Landing on the US stock market with a premium of over 30%, what gives CoinShares the confidence?

Written by: Eric, Foresight News

Following Coinbase, Galaxy Digital, Circle, Bullish, and Gemini, another company from the Web3 industry is set to enter the US stock market.

On September 8, European crypto asset management company CoinShares announced its merger with the special purpose acquisition company Vine Hill Capital Investment Corp, which is listed on the NASDAQ, and the newly established Jersey company Odysseus Holdings Limited. After the merger, CoinShares will be listed on the NASDAQ (or another US exchange) and will delist from NASDAQ Stockholm. Following the listing of several domestic US Web3 companies, the first European-based Web3 enterprise will also enter the US capital market.

CoinShares originated from the commodity investment company Global Advisors, founded in 1998 by Russell Newton and Danny Masters. Russell Newton worked in crude oil trading for eight years at companies including Shell Oil, and joined JPMorgan in July 1994 as a commodity strategist. Co-founder Danny Masters, who is also the current chairman of CoinShares, was the global head of energy trading at JPMorgan before co-founding Global Advisors with Russell Newton.

The current CEO of CoinShares, economist JM Mognetti, joined Global Advisors in 2012. Just a year after his arrival, global macro investors began to withdraw significantly from commodities, shifting their investments to stocks and fixed income. For the three of them, the company urgently needed to find new investment directions, and at that moment, Bitcoin, priced at only a few hundred dollars, came into their view.

Without any hesitation, Global Advisors fully pivoted to the digital asset space in 2014, later rebranding as CoinShares in 2016, and gradually developing into a comprehensive crypto asset management company that integrates asset management, capital market operations, and proprietary investments.

In 2014, Global Advisors launched the first regulated Bitcoin investment fund in Europe. After rebranding, CoinShares acquired XBT Provider, which launched the first Bitcoin-based security listed on a regulated exchange, with its Bitcoin Tracker One ETP listed in Sweden in 2015.

At the beginning of 2021, CoinShares began launching ETPs (exchange-traded products) backed by physical assets, covering not only Bitcoin and Ethereum but also tokens like LTC, XRP, LINK, and UNI. In March of the same year, CoinShares was listed in Sweden, becoming the second publicly listed Web3 company globally, following Galaxy Digital (which was already listed on the Toronto Stock Exchange in Canada). According to data provided by CoinShares, as of February 19, 2021, CoinShares had assets under management of $4.56 billion, including 70,185 Bitcoins and 655,211 Ethers, making it the largest crypto asset management company in Europe and the second largest globally (after Grayscale).

In comparison, as of February 24, 2021, Grayscale had total assets under management of $39.3 billion, Bitwise had just surpassed $1 billion, and Galaxy Digital had assets under management of $834.7 million as of January 31, 2021.

At the beginning of 2024, after the SEC approved several institutional applications for Bitcoin spot ETFs, CoinShares acquired one of the issuers of Bitcoin spot ETFs, Valkyrie. As of the time of writing, Valkyrie's Bitcoin spot ETF had assets under management exceeding $650 million.

In addition to asset management, investment is also an important business for CoinShares. At the time of its listing, CoinShares disclosed its investment in Canadian crypto asset management company 3IQ Corp and the parent company of the US qualified trust institution Kingdom Trust at the end of 2020. In 2021 and 2022, CoinShares invested twice in the Swiss online bank FlowBank, holding nearly 30% of the shares, but FlowBank went bankrupt in 2022 due to insolvency.

Having discussed the development history of CoinShares, let's talk about its financial situation.

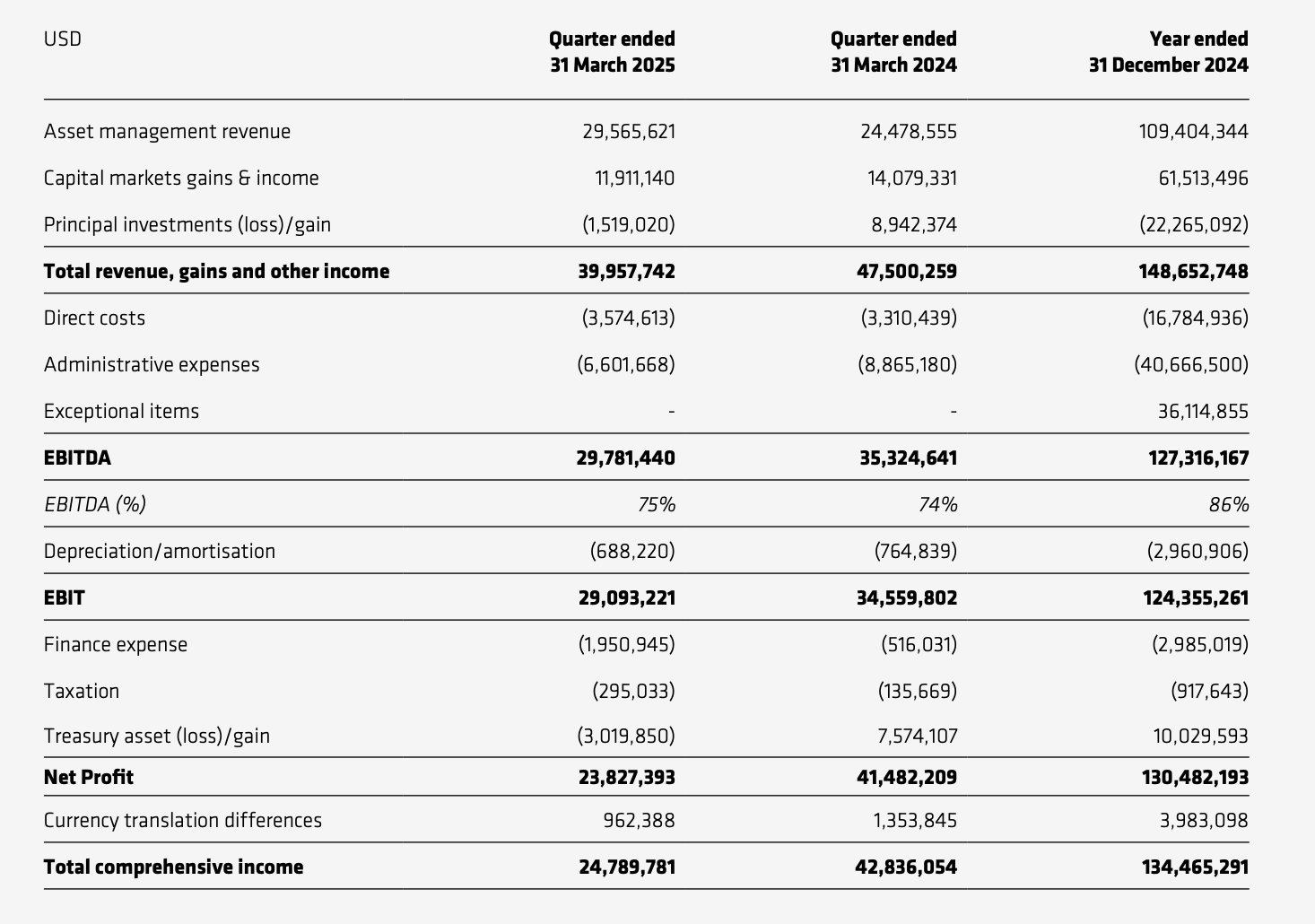

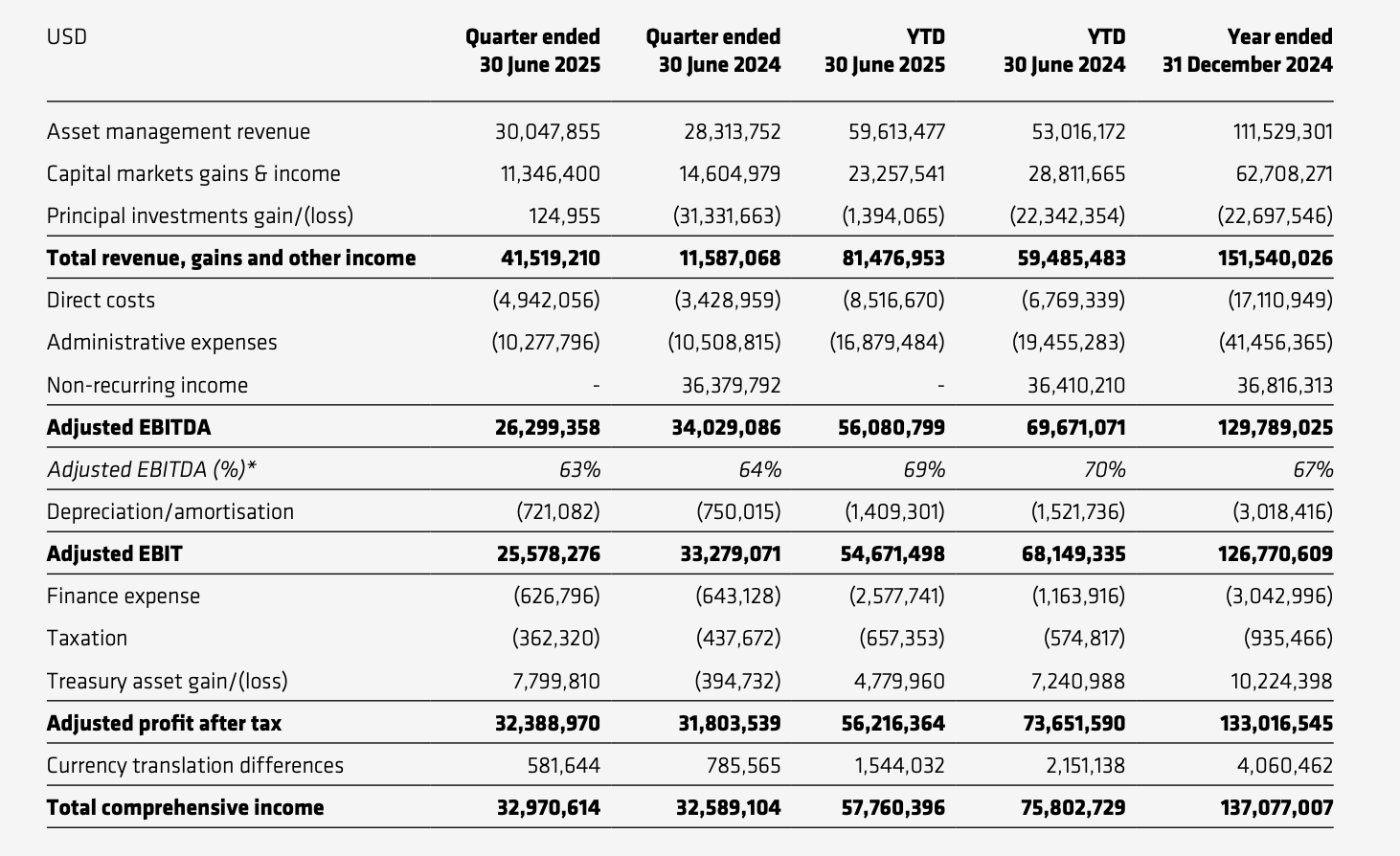

Comparing CoinShares' first and second quarter financial reports released this year, CoinShares reported first-quarter revenue of $39.958 million, a year-on-year decrease of approximately 15.88%, with earnings before interest, taxes, depreciation, and amortization (EBITDA) of $29.781 million, a year-on-year decrease of approximately 15.7%, but the profit margin reached 75%, slightly up year-on-year. Considering the fluctuations in the prices of the company's held crypto assets, taxes, and other factors, CoinShares' comprehensive income for the first quarter was approximately $24.79 million, a year-on-year decrease of 42.1%.

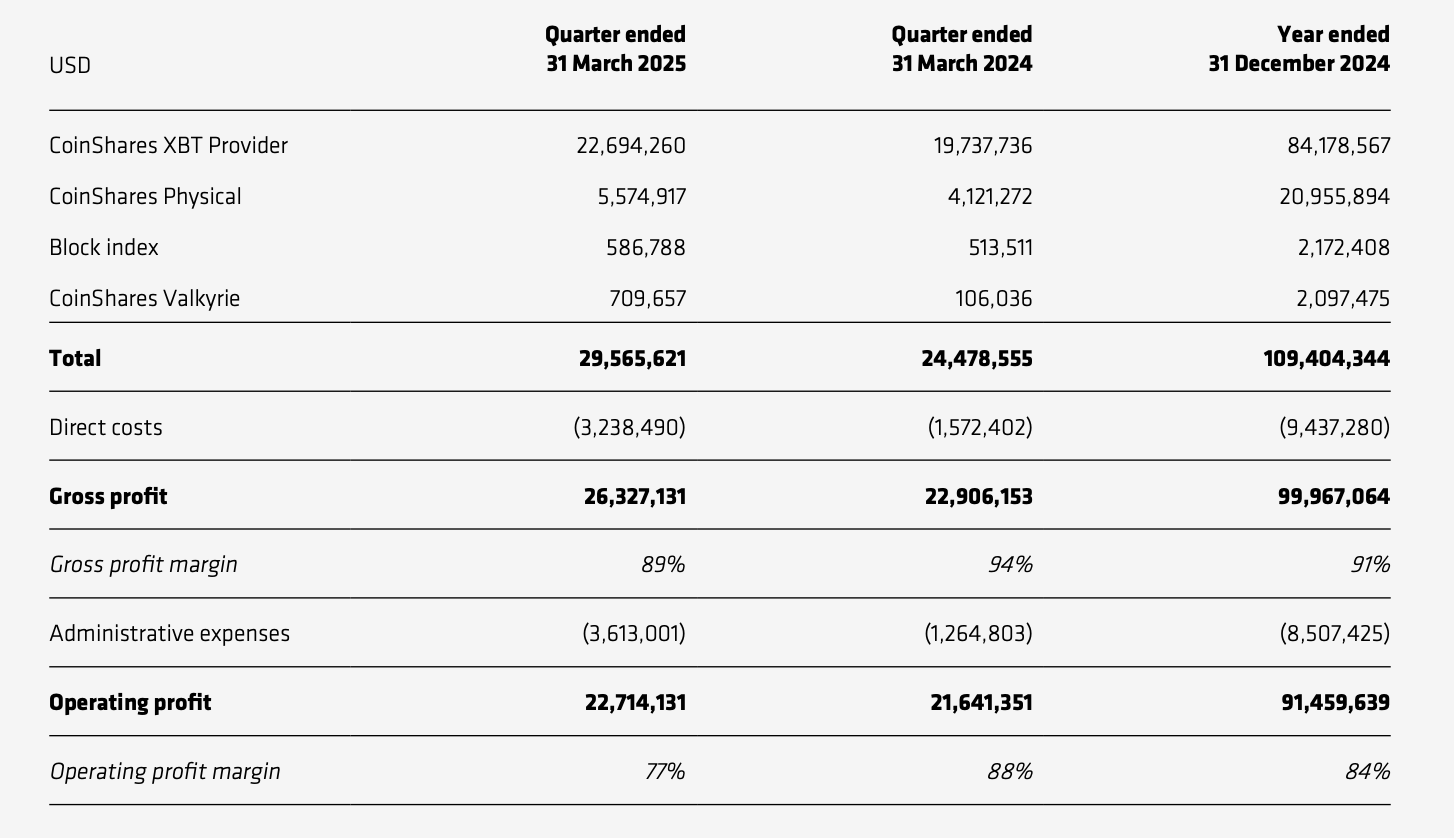

In the asset management business, which accounts for the largest share, CoinShares recorded first-quarter revenue of $29.566 million, accounting for about 74% of total revenue, a year-on-year increase of approximately 20.8%. After deducting direct costs and administrative expenses, the profit was approximately $22.714 million, a slight year-on-year increase of about 5%.

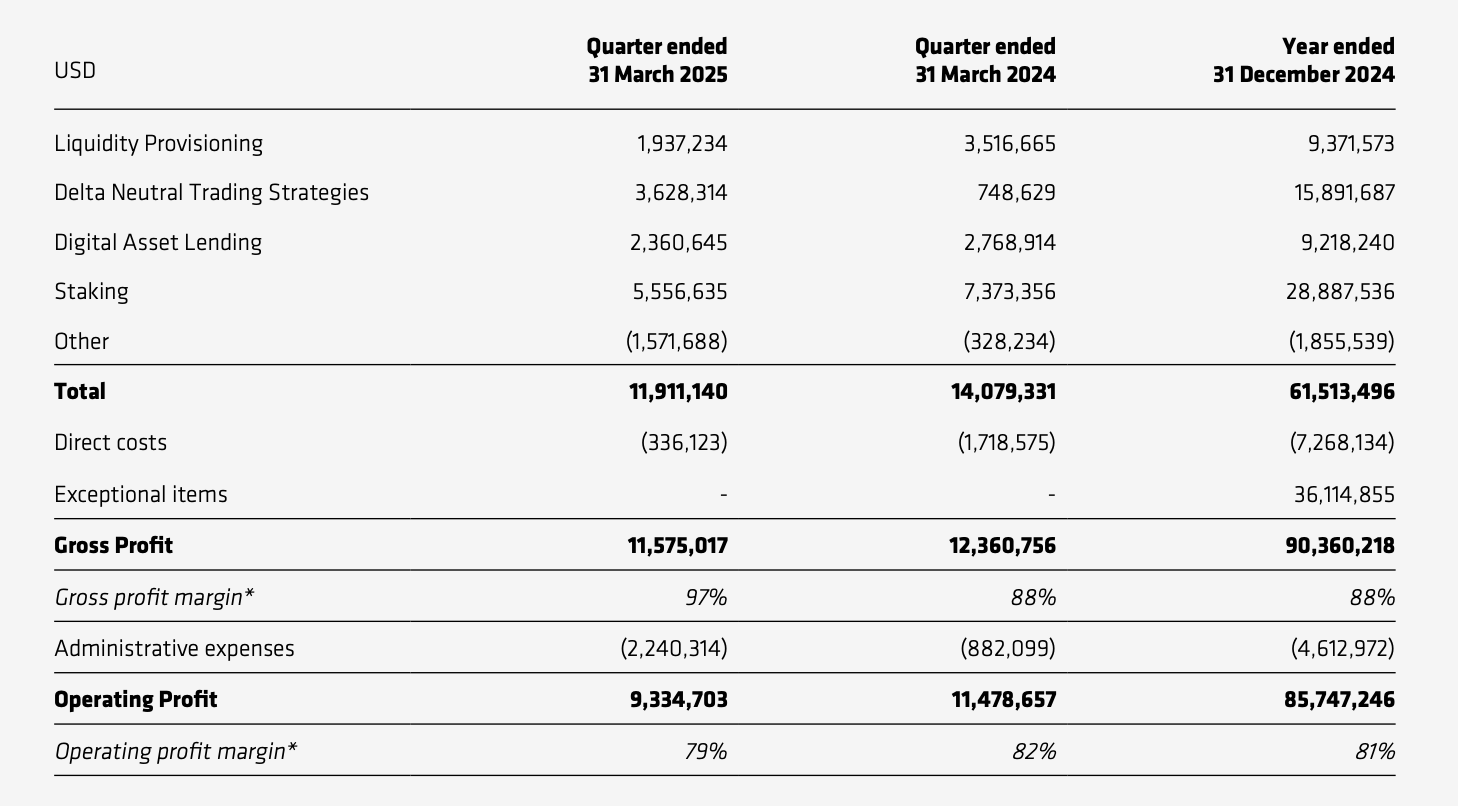

In the capital market infrastructure business, CoinShares recorded approximately $11.911 million in revenue for the first quarter, a year-on-year decline of about 15.4%. CoinShares' so-called capital market infrastructure business includes providing liquidity income, delta-neutral trading strategy income, digital asset lending, and staking income. After deducting direct costs and administrative expenses, the profit was approximately $9.335 million, a year-on-year decline of about 18.7%.

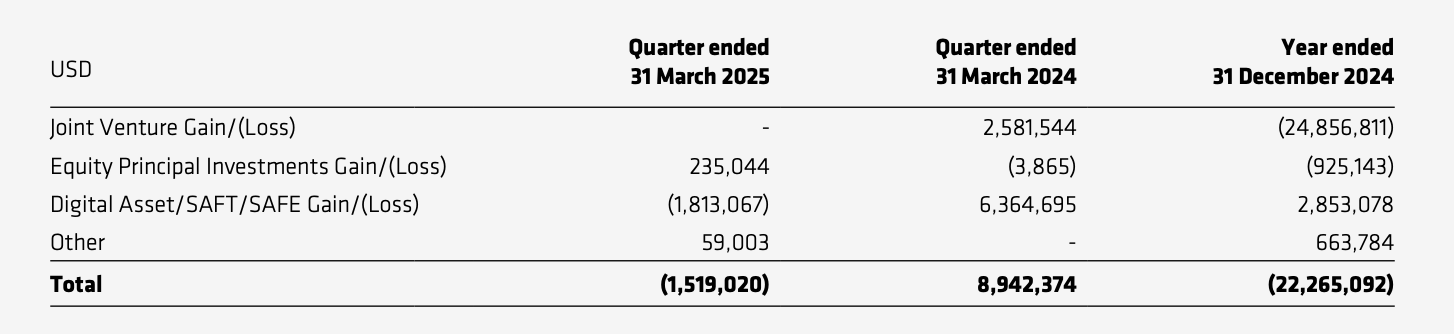

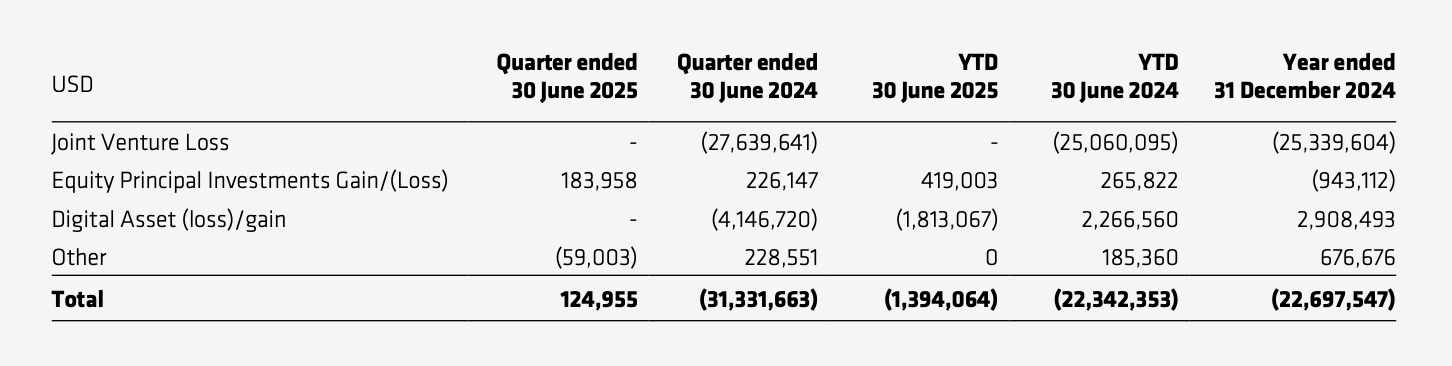

In proprietary investment, CoinShares reported a loss of approximately $1.519 million in the first quarter, compared to a profit of approximately $8.942 million in the same period last year, a year-on-year drop of about 117%.

In the first quarter, due to the overall decline in cryptocurrency prices, aside from the asset management business, which was less affected by price fluctuations, other business conditions saw a decline. A closer look at the financial report shows that in the capital market infrastructure business, income from providing liquidity, lending, and staking was significantly impacted by price declines and low trading activity, but delta-neutral strategy trading compensated for some losses, while the investment business was mainly dragged down by the overall market price decline. Overall, CoinShares did not see a decline in its core business and is actively adjusting its investment strategies.

In the second quarter, although cryptocurrency prices rose overall, CoinShares' business did not experience significant growth.

In the second quarter, CoinShares recorded revenue of $41.519 million, a quarter-on-quarter increase of approximately 3.8% and a year-on-year increase of 258.3%. EBITDA was $26.299 million, a quarter-on-quarter decrease of 11.7% and a year-on-year decrease of approximately 22.7%, with the profit margin also dropping to 63%. CoinShares' comprehensive income for the second quarter was approximately $25.578 million, a slight quarter-on-quarter increase of about 3.2% and a year-on-year increase of 1.1%.

For the entire first half of the year, due to the inclusion of losses from FlowBank's bankruptcy and income from the sale of FTX claims in 2024, the data appears somewhat distorted (the significant year-on-year increase in revenue is also due to this anomaly). Excluding this data, CoinShares' performance in the first half of this year is not significantly different from the same period last year.

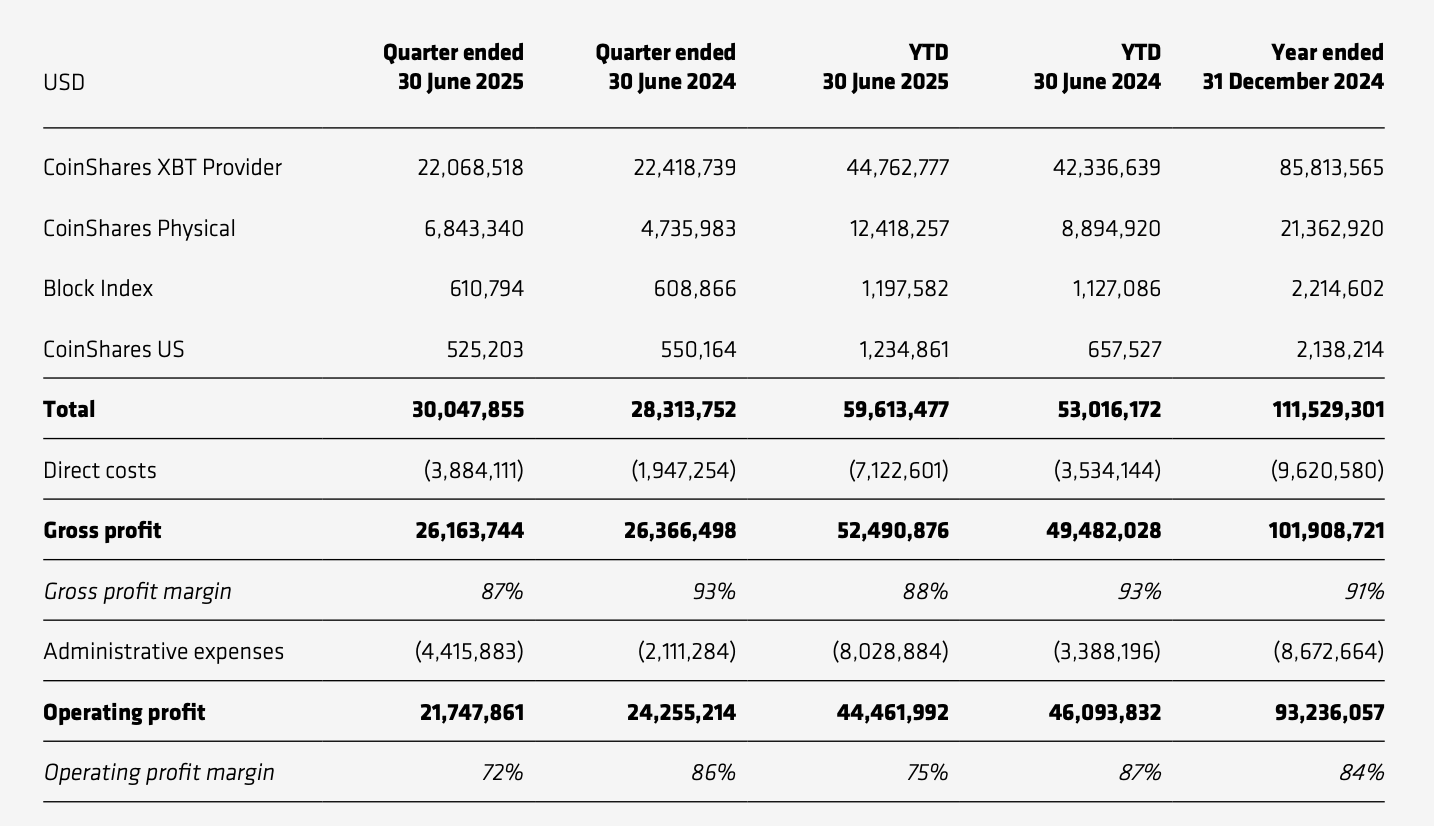

In the asset management business, CoinShares' second-quarter revenue slightly exceeded $30 million, with a quarter-on-quarter increase of 1.6% and a year-on-year increase of 6.1%. Operating profit was $21.748 million, a quarter-on-quarter decline of approximately 4.3% and a year-on-year decline of approximately 10.3%. In the first half of the year, CoinShares' total revenue from asset management was approximately $59.613 million, a year-on-year increase of 12.4%, with operating profit of $44.462 million, a year-on-year decrease of 3.5%.

CoinShares stated that in the second quarter, the products launched by XBT experienced a net outflow of $126 million, coupled with the company allocating more expenses and costs to the asset management department, resulting in an increase in asset management revenue but a continuous decline in profit.

In the capital market infrastructure business, CoinShares recorded approximately $11.346 million in revenue for the second quarter, a quarter-on-quarter decrease of 2% and a year-on-year decrease of 22.3%. In terms of profit, excluding the additional income generated from the sale of FTX claims, both profit amount and profit margin have declined.

In the proprietary investment business, CoinShares reported a profit of only about $125,000 in the second quarter. Although this represents some growth compared to the approximately $1.519 million loss in the first quarter, the losses and profits from investments exhibit some randomness over time, making them less reliable. It is noteworthy that CoinShares has been in a state of loss in investments throughout 2024 and up to now in 2025, while in 2023, CoinShares achieved nearly $3.7 million in profits from investments.

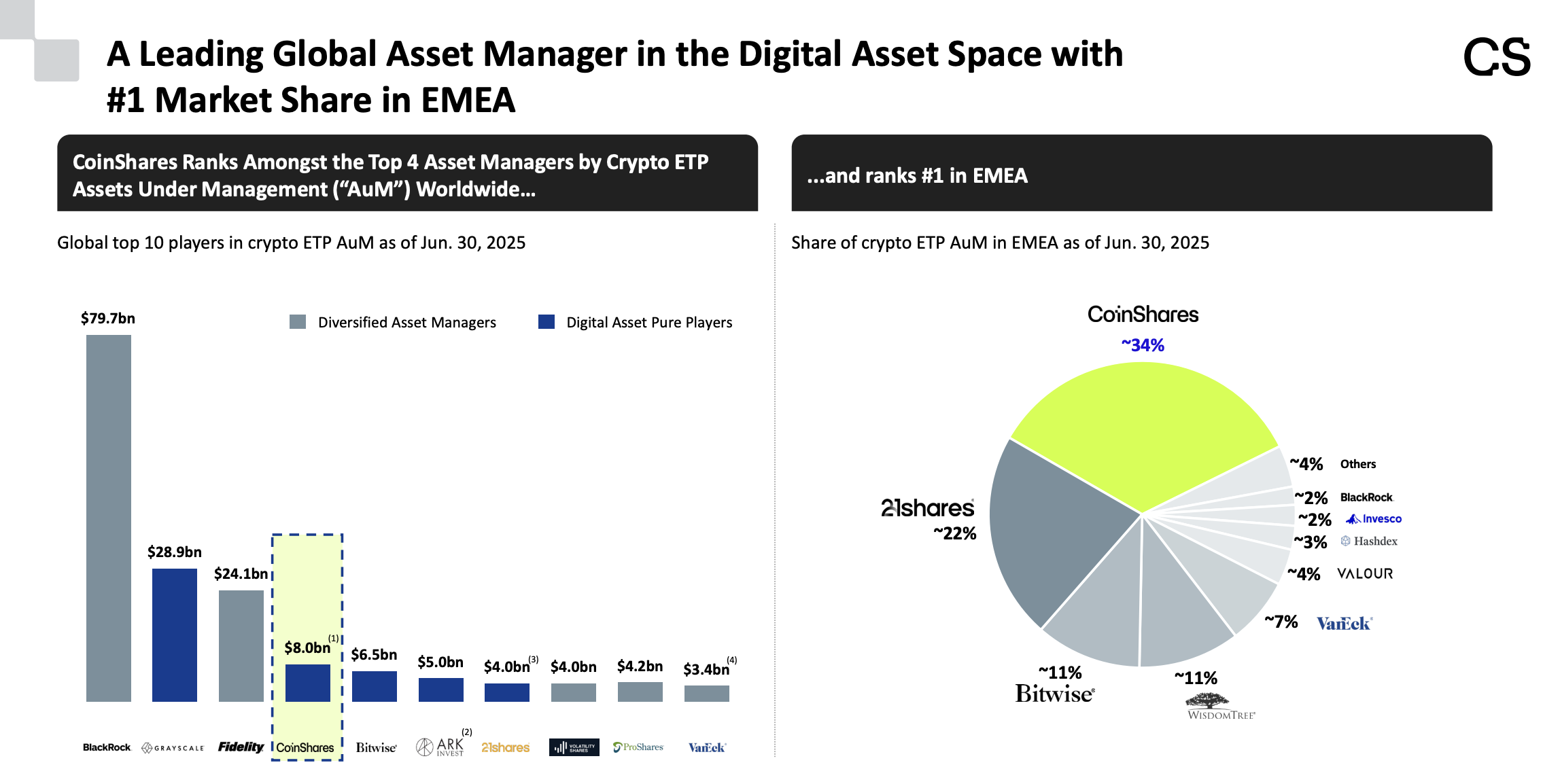

Although CoinShares stated in its roadshow materials that its total assets under management have exceeded $8 billion, making it the fourth largest crypto asset management institution globally after BlackRock, Grayscale, and Fidelity, and the largest in the EMEA (Europe, Middle East, and Africa) region, accounting for about 34% of the market share, the overall data suggests that CoinShares' growth is relatively slow. Aside from the steady, modest growth in its asset management business, the performance of its other businesses fluctuates significantly. CoinShares' acquisition of Valkyrie and its listing in the US are essentially aimed at expanding its business in the US, but its home base seems to lack a unique competitive advantage.

According to ISS Market Intelligence data, as of the end of May this year, the asset management scale of American fund companies in Europe has increased from $2.2 trillion a decade ago to $4.9 trillion. If US asset management giants intend to expand their crypto asset management business into Europe, CoinShares will have to face strong competitors.

Assuming that the SEC approves more cryptocurrency ETFs in the future, CoinShares' current advantages may gradually be eroded. Based on the closing price of European stocks yesterday, CoinShares has a market capitalization of approximately 8.228 billion Swedish Krona, equivalent to about $877 million, with a price-to-earnings ratio of about 7.97. However, its "reverse merger" valuation has reached $1.2 billion, with a premium rate close to 37%.

In comparison to the world's largest asset management company, BlackRock, which had an asset management scale of $12.5 trillion as of the end of the second quarter, CoinShares far exceeds BlackRock in the ratio of asset management scale to market capitalization, but its price-to-earnings ratio is significantly lower than BlackRock's by nearly 27. This creates a somewhat contradictory valuation for CoinShares. While crypto asset management will remain highly sought after for a considerable time in the future, whether CoinShares' market capitalization can see significant growth will likely depend on whether its asset management business can achieve better-than-expected growth, whether it can establish a competitive moat in non-US regions, and whether it can capture a share of the market in the US.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。