This is an investment guide for altcoin crypto treasury reserve companies.

Author: Timothée

Translation: Deep Tide TechFlow

“I will make him an offer he can't refuse.” — Altcoin crypto treasury reserve companies offer discounted mNAV entry tickets to PIPE investors and unlock them as soon as possible.

How to invest in crypto treasury reserve companies (or not invest).

Current DAT (crypto treasury reserve companies) market will be driven by Alt DAT (altcoin crypto treasury reserve companies) issued through PIPE by the fourth quarter, as these altcoin crypto treasury reserve companies are listing the fastest and will immediately impact the scale of the underlying tokens. Currently, the BTC and ETH markets are saturated, while SOL is about to reach a critical moment. Altcoins are on the rise.

TL;DR

Key elements of crypto treasury reserve companies -> Please refer to the detailed bank comparison table

Additional questions -> Ask yourself, who is the ultimate owner?

FUD (Fear, Uncertainty, Doubt) regarding crypto treasury reserve companies -> Some concerns are valid, most are not; do your own research (DYOR) and read the relevant documents!

Fourth quarter outlook -> The press conference ends, and the real winners will emerge

If you are building projects in this field, please DM me>

Why are altcoin crypto treasury reserve companies doing DAT? The reason is simple:

New listing method: No longer Binance, but NASDAQ!

Buyback + burn… but can be monetized!

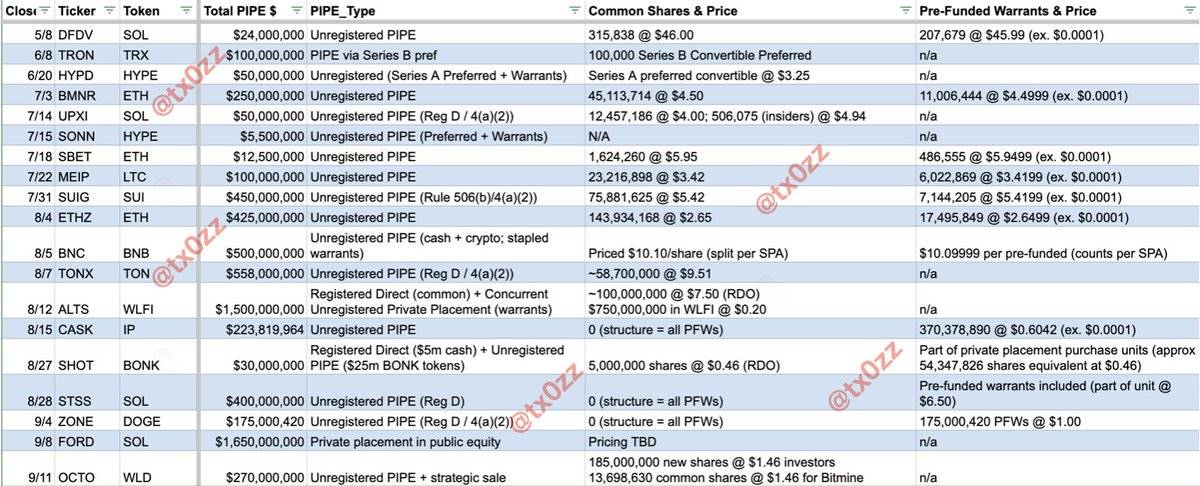

Here are some data on altcoin crypto treasury reserve companies that I have collected, ignoring the following:

Some Alt SPACs (Deep Tide Note: a type of altcoin special purpose acquisition company, also known as a "blank check company." This is a publicly listed shell company created to acquire or merge with an existing company), such as $TLGY (the SPAC company "TLGY Acquisition Corporation" serving the $ENA project) and $ETHM (the SPAC company "The Ether Machine" serving $ETH related businesses), as they are expected to go live by the end of the year. While I am optimistic about $TLGY, these projects cannot use funds until the deSPAC is completed by the end of the year (Deep Tide Note: refers to the process of a SPAC completing a merger with a target company. This is a critical stage in the SPAC lifecycle, marking the transition from a "blank check company" to a company with actual business operations), and promoting media coverage before that is meaningless.

Listing operating companies that increase BTC strategies, as they are not purely cryptocurrency projects. These companies (e.g., $SMLR) may trade at a premium between Q3 2024 and Q3 2025, but I believe they will trade at a discount to net asset value (NAV) in the long run, as investors have more and better options to express exposure to the market.

Crypto treasury reserve companies using ELOCs (Equity Line of Credit) instead of PIPE (no immediate cash flow).

If you find any inaccuracies, please DM me, and I will update the content.

Key points to note

RDO (Rapid Unlock): The unregistered portion will unlock after registration becomes effective, expected to take 30-45 days, but if the PIPE portion is completed in physical form, it may now require a NASDAQ shareholder vote (specific guidance pending).

Pre-financing warrants: Typically used to avoid exceeding a certain ownership threshold to meet reporting requirements.

Warrants as incentives: While warrants are usually a sweetener for investments, they help DAT lock in future financing prices to prevent mNAV from turning into a discount.

Behavior of PIPE investors: It can be assumed that 99% of PIPE investors will sell upon unlocking.

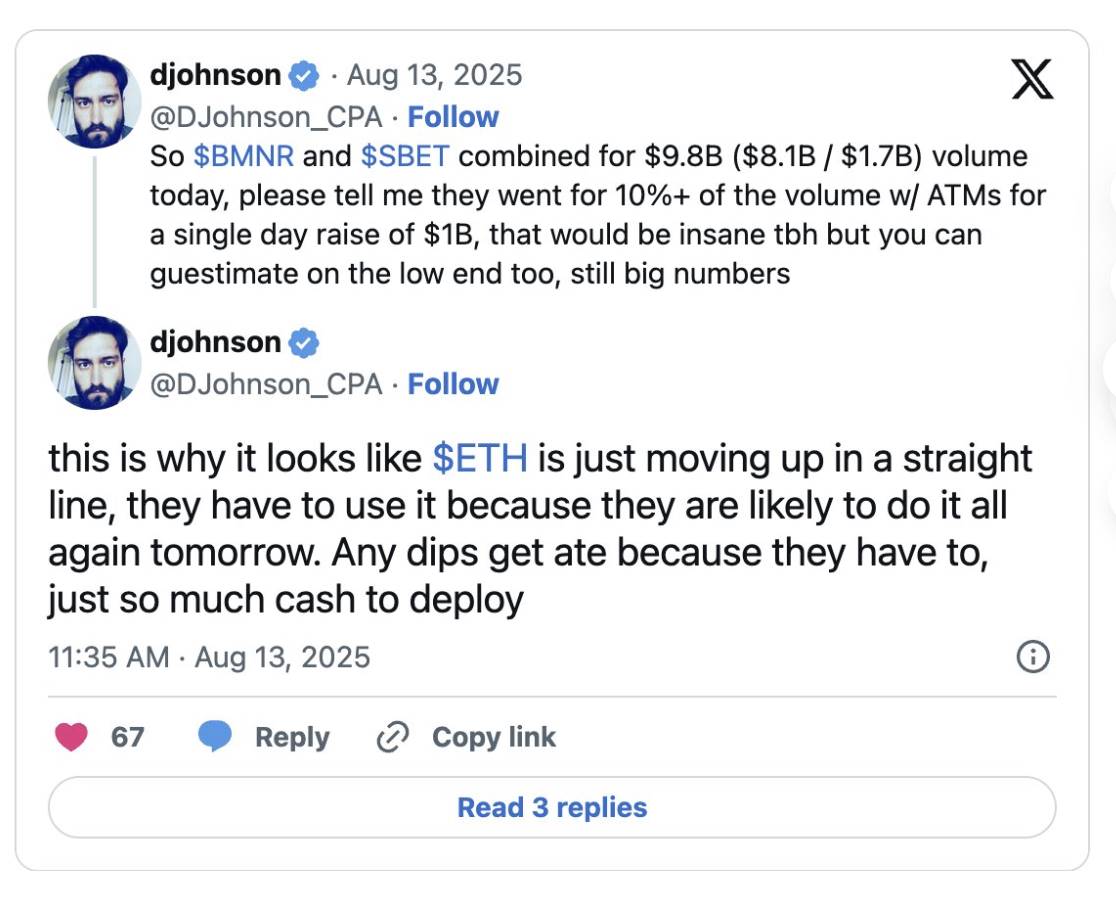

Large-scale fundraising strategy: Some players achieve WKSI (Well-Known Seasoned Issuer) status through large-scale fundraising and high circulation, thus immediately launching ATM (At-The-Market) and monetizing premiums (we have seen this strategy in $BMNR, $SBET, and possibly $OCTO).

Importance of structure: Focus on the price of net asset value (NAV) per share, and whether there is future hanging pressure from warrants, etc.

Pay attention to the spending of crypto treasury reserve companies on banking fees. Currently, crypto treasury reserve companies with a scale below $100 million often pay excessively high fees during the startup phase. The performance of banks varies; some excel in branding, some in structural design, and others in finding shell companies, etc.

Future data to supplement / questions to ask during due diligence:

- Key spokespersons (attention return): Who can drive market attention? Distributing content is important, but telling a good story is equally crucial. While not everyone can become an industry leader like Tom Lee (@fundstrat), you don't need a spokesperson of that level to drive grassroots development. For example, the crypto treasury reserve company $SHOT of $BONK has core contributor @theonlynom.

Ideally, spokespersons should frequently appear in the news, such as Bloomberg.

Financial management: What are the expenditures of the crypto treasury reserve company? Do they burden cash flow?

Liquidity: What percentage of circulation and trading volume accounts for the fundraising scale?

Buying pressure: What percentage of net new funds raised accounts for the circulating market value of the tokens—how much is too much? How much is meaningful? 10%? 20%?

Target company business: Before the crypto treasury reserve company completely divests traditional business, does the target company have liabilities or long-term risks?

Foundation involvement: Is the crypto treasury reserve company supported by a foundation, or is it just one of many crypto treasury reserve companies?

Buyback: Does the crypto treasury reserve company use part of the raised funds for defensive buybacks? Has it raised warrants or convertible bonds to establish a separate funding pool?

Future strategy: If the crypto treasury reserve company raises funds through PIPE at once, this is just a one-time cash acquisition. Attention should be paid to proactive communication from the target company or new team (or foundation). This is not the cryptocurrency field; there will be real-world consequences.

PR/IR targeting retail investors: If the crypto treasury reserve company puts data before narrative, their strategy is wrong. Check their tweets—who do you think is writing these tweets? Who is the target audience? Altcoin crypto treasury reserve companies need to build awareness among retail investors first.

Key concerns (FUD) and countermeasures:

mNAV is compressing! -> Yes, it is for crypto treasury reserve companies that cannot compete to be market leaders. For example, in the case of ETH, mNAV compression is caused by excessive dilution from ATM and overall market dynamics. But you should ask yourself whether a certain crypto treasury reserve company can enhance its per-share value within months instead of holding spot. If the answer is yes, then this discounted mNAV is your opportunity. Not all crypto treasury reserve companies are the same; there should be a top winner in each field (such as BTC/ETH/SOL and Altcoin), depending on their storytelling ability.

This is a Ponzi scheme! -> We have not yet seen crazy leverage behavior among these crypto treasury reserve companies, as most are financed through equity. If leverage does occur, it will not create a crazy chain reaction but is more likely to result in a larger market slowdown, such as indigestion. Inefficient crypto treasury reserve companies may need to sell tokens to buy back shares, thus putting some pressure on token prices.

They are dumping on retail! -> You must believe that NASDAQ has stricter listing requirements. Companies that lock tokens in physical form will not perform well. The market has already noticed this (thanks for your attention!), and I believe the market will become the price arbitrator upon listing.

My outlook for the fourth quarter:

The market for BTC/ETH/SOL has basically completed its layout, and there will not be many new competitors entering the market unless they are regional projects.

We may see a small number of top 50 crypto treasury reserve companies supported by foundations, with a total fundraising scale of about $250 million, including physical contributions.

mNAV compression and potential obstacles to physical contributions mean that traditional VCs may no longer participate in these deals, leading to a depletion of funds. This also means that the prices of shell companies may decline.

Structure is crucial—we will soon see whether the crypto treasury reserve companies launched in July/August can lay the foundation for long-term success in the fourth quarter, namely whether they can gain meaningful media attention and effectively operate their capital structure after unlocking.

I am not optimistic about SPACs unless you have a star team and tell a very differentiated story. You can refer to the development of the ETH crypto treasury reserve company sector, such as the leading performance of $BMNR, and assume that BTC projects will be similar—if you choose to challenge the king (like $MSTR), you must ensure success.

I still believe that crypto treasury reserve companies have a net positive impact on the crypto industry, as long as they can raise net new capital from the equity market and use it to drive the flywheel effect of their ecosystem.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。