Original|Odaily Planet Daily (@OdailyChina)

“Do you know how I've been getting through these 3 years?” This may be the voice of many users who have participated in Linea interactions.

After a long wait of 3 years, the "orthodox faction of Ethereum," the L2 network Linea under Consensys, is finally about to welcome its TGE moment. However, judging by the current airdrop amount and the pre-market price of LINEA, it may be difficult to satisfy the many users who have invested heavily. Some claim to have invested hundreds of thousands of dollars, only to find that the value of the airdropped tokens may be just a few thousand dollars, or even less. As a result, after experiencing a vigorous phase of "L2 being the talk of the town," the Ethereum network may have entered a phase of "L2 losing public trust."

After several years of development, the "L2 technical route" once endorsed by Ethereum founder Vitalik may have become a detour in the development history of the Ethereum ecosystem. Odaily Planet Daily will explore this viewpoint in conjunction with Linea's token issuance and the current state of mainstream L2 networks, inviting readers to critique and discuss.

The Place Where Dreams Begin

According to the original vision of Ethereum founder Vitalik, L2 networks are built on the foundation of inheriting the security of the Ethereum mainnet, aimed at expanding the Ethereum ecosystem and reducing usage costs.

In October 2020, Vitalik elaborated on the technical vision of the L2 route in the article “Rollup-centric Ethereum Roadmap”. Its core purpose is to simplify Ethereum's long-term expansion strategy by moving computation execution primarily to L2 solutions (such as Rollup), thereby quickly achieving network scalability while alleviating the high gas fees and congestion issues of the mainnet at that time.

Additionally, he mentioned the short-term actions and potential impacts of this technical route: “We need to do more work on cross-L2 transfers to make the experience of moving assets between different L2s as close to instant and seamless as possible.” “Launching L2 projects with their own tokens is essential—of course, provided that the tokens have real economic value (i.e., the future fees estimated to be captured by L2). As a result, these L2 network-related protocols will have the ability to earn fees/MEV, thus directly or indirectly (through supporting development funding tokens) providing funding for their development. In the long run, this is a strategic move beneficial to the long-term economic sustainability of Ethereum.”

Linea is about to issue tokens, but L2 activity has significantly declined

Currently, among the major L2 networks, only Arbitrum and Base are performing well in terms of value capture, with the former's token price showing a lackluster performance like other L2 tokens; the latter has no intention of releasing a native token, mainly relying on sequencer revenue to generate income, earning network development fees to support Coinbase behind it.

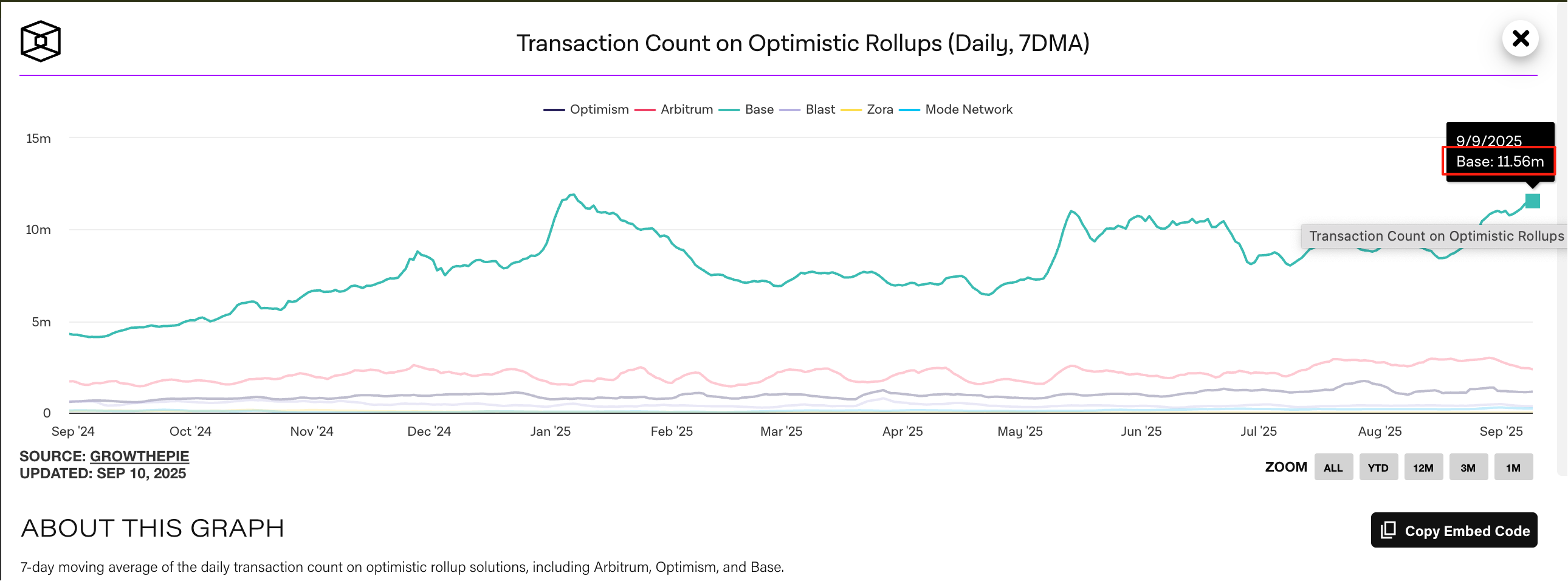

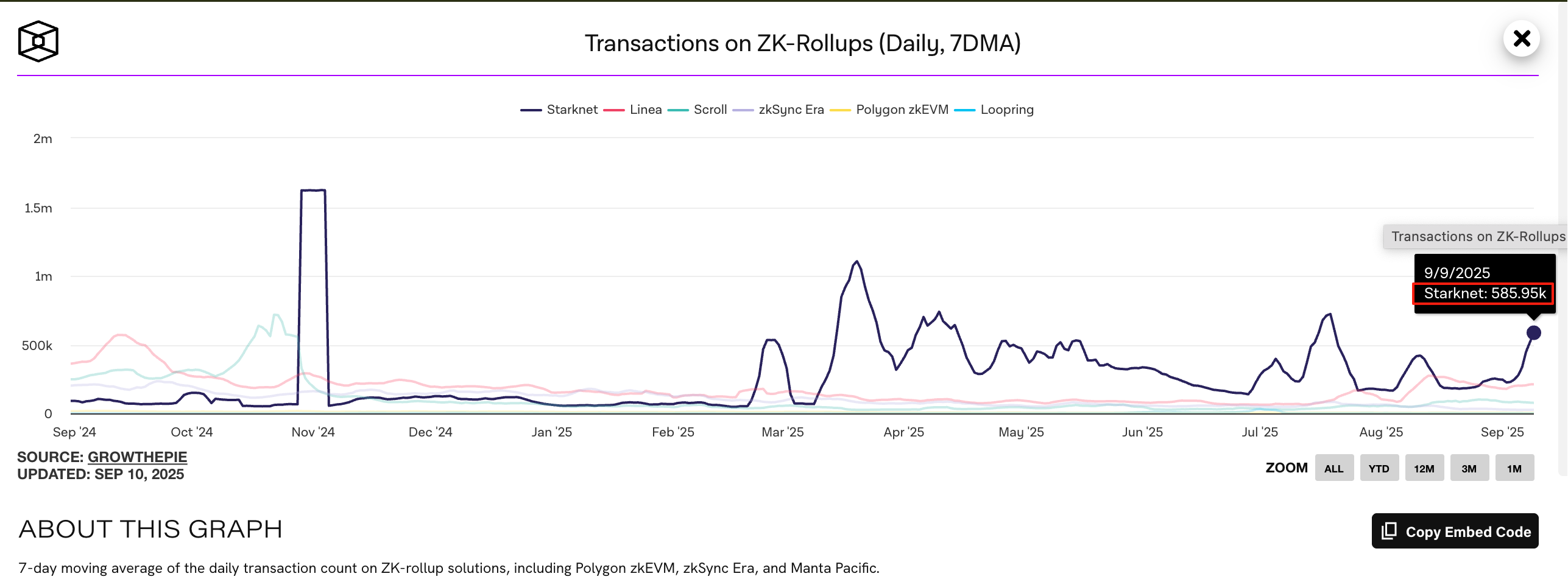

According to TheBlock data, on September 9, the number of transactions for Base (seven-day average) reached 11.56 million, while Arbitrum had 2.36 million transactions, Optimism had 1.15 million transactions, Blast had only 344,000 transactions, and Mode Network had just 233,000 transactions. Among ZK-based L2 networks, Starknet had the highest transaction count (585,000), followed by Linea (211,000), Scroll (76,000), ZKSync Era (25,000), Polygon zkEVM (4,000), and Loopring (250).

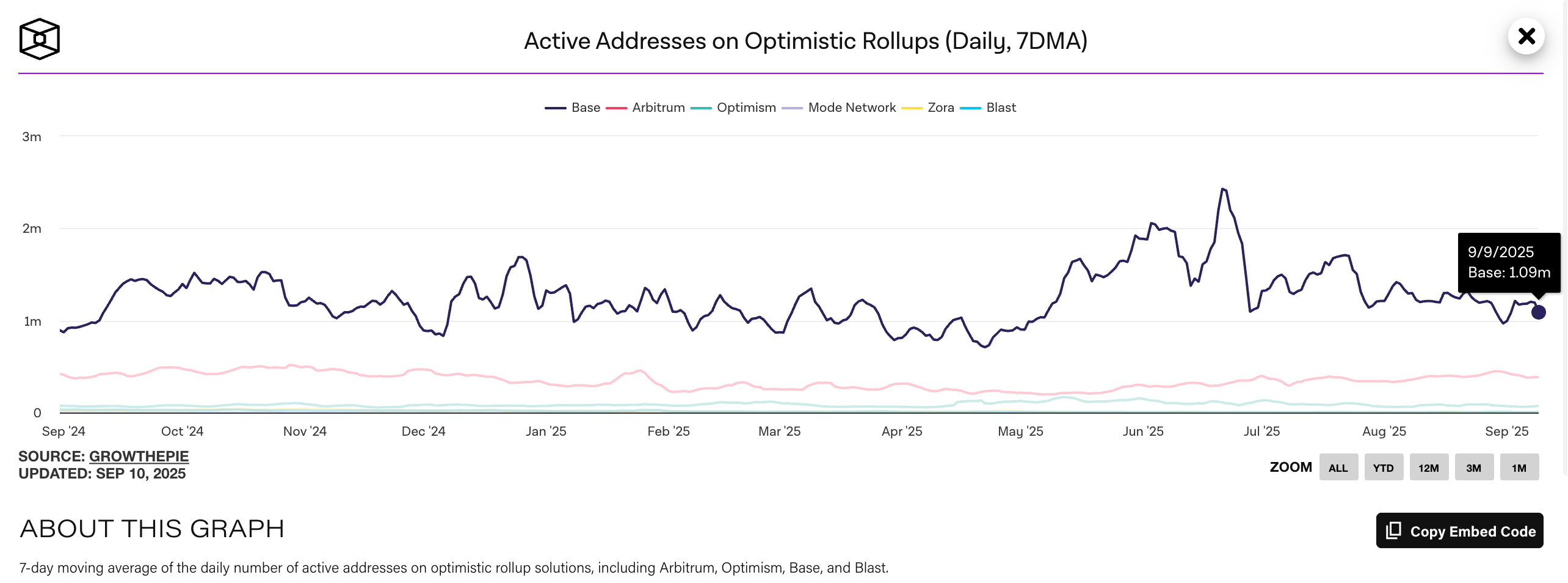

In terms of daily active addresses, taking September 9 as an example, Base (seven-day average) led the Optimism-based L2 networks with 1.09 million addresses, while the other networks and their corresponding address counts were: Arbitrum (384,000); Optimism (72,000); Mode Network (3,450); Zora (3,440); Blast (2,800).

The performance of ZK-based L2 networks is also unsatisfactory. On September 9, perhaps benefiting from the upcoming TGE, the daily active addresses on the Linea network grew to 56,000, a decline of over 90% compared to the peak of around 750,000 daily active addresses in July 2024; the daily active addresses of other L2 networks remained below 50,000: Starknet (around 40,000); ZKSync Era (around 9,200); Scroll (around 6,300); Polygon zkEVM (around 1,200); and Loopring had a dismal 18 active addresses.

Moreover, while the explosion of L2 networks has somewhat improved the operational efficiency of the Ethereum ecosystem, it has also provided a breeding ground for frequent protocol security incidents within the ecosystem. Additionally, after the implementation of EIP-1559, EIP-7999, and other proposals aimed at optimizing gas fees, the gas costs on the Ethereum mainnet have significantly decreased, and the efficiency of transfers and transactions has far exceeded previous levels.

Thus, after several years of L2 development, people are increasingly recognizing that the core questions for the Ethereum ecosystem today are—

First, does the Ethereum ecosystem have a purpose for user retention and activity?

Second, can Ethereum L2 network tokens achieve value capture?

Currently, the situation regarding both aspects is not optimistic.

The Path to Value Breakthrough in the Ethereum Ecosystem: Stablecoins and ETH Treasury Reserves

In terms of results, the L2 route has still made a significant contribution to the development of the Ethereum ecosystem. Aside from the substantial gas fee savings, the strategic value of L2 mainly manifests in two aspects:

First is the value of TVL (Total Value Locked). According to l2beat website data, as of September 10, the total TVL of Ethereum L2 networks has grown to $54.7 billion. Although this represents a decline of over $10 billion compared to the peak of $65.5 billion in December last year, it still brings more liquidity retention to the Ethereum ecosystem and provides ample funding for many protocols and projects within the ecosystem.

Second is the seamless integration with traditional financial assets. In addition to crypto-native networks like Arbitrum and Optimism, traditional tech companies have launched L2 public chains such as Soneium by Sony, RWA L2 public chain Jovay by Ant Group under Alibaba, and Robinhood's L2 public chain based on Arbitrum for stock tokenization product trading, among others. As a mature blockchain ecosystem that has been operating stably for ten years, Ethereum remains the best choice for traditional companies targeting the RWA sector, while L2 networks provide a relatively smooth entry window and channel bridge.

Looking ahead, the path to value breakthroughs in the Ethereum ecosystem may still rely on connections with the traditional financial sector and broader asset coupling—the former primarily involves stablecoins, with future development routes covering PayFi, DePIN, cross-border trade, etc.; the latter mainly relies on numerous listed companies promoting ETH treasury reserves to achieve tokenization and assetization of stocks and other RWA assets.

As we stand at the 10th anniversary of the Ethereum mainnet launch in 2025, although most L2 networks have gradually become mere pebbles in the long journey of crypto history in the "financing-token issuance-disappearance" vicious cycle, they have also become the soil and nutrients for nurturing new innovative products while becoming part of the "crypto bubble."

Including Linea, which has not issued tokens for a long time, many L2 networks may have few ecological projects and lackluster token market performance, but they have also provided numerous technical updates and project products for the narrative boom in the crypto market. This may be seen as an "industry bubble" at a certain stage of the crypto industry's development, but it is by no means a so-called "black history of the industry."

As for whether the Ethereum ecosystem can further develop, it may still require the test of time.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。