Written by: imToken

Recently, the most discussed topic in the Ethereum community is undoubtedly Vitalik Buterin's public reflection on the scalability roadmap.

It can be said that Vitalik's attitude is quite "sharp," bluntly stating that with the increase in Ethereum mainnet's (L1) own scalability, the roadmap established five years ago, which deemed L2 as the primary scaling solution, is already ineffective.

This statement was once negatively interpreted by the market as a "bearish" or even "denying" sentiment towards L2. However, if we carefully organize Vitalik's core viewpoints, combined with the series of mainnet scaling progress, the decentralization process evaluation framework, and recent technical discussions around Native/Based Rollup, we will find that Vitalik is not entirely dismissing the existence value of L2, but is more inclined towards a kind of "correcting the chaos":

Ethereum does not intend to abandon L2, but to redefine the division of labor—L1 returns to the safest settlement layer position, L2 pursues differentiation and specialization, thus allowing the strategic focus to return to the mainnet itself.

1. Has L2 Completed Its Historical Mission?

Objectively speaking, in the previous cycle, L2 was indeed viewed as Ethereum's lifeline.

In the initial Rollup-Centric roadmap, the division of labor was also very clear: L1 is responsible for security and data availability, L2 is responsible for extreme scalability and low Gas; during that era when Gas fees could reach tens of dollars, this was almost the only feasible answer.

However, the developments in reality are far more complex than expected.

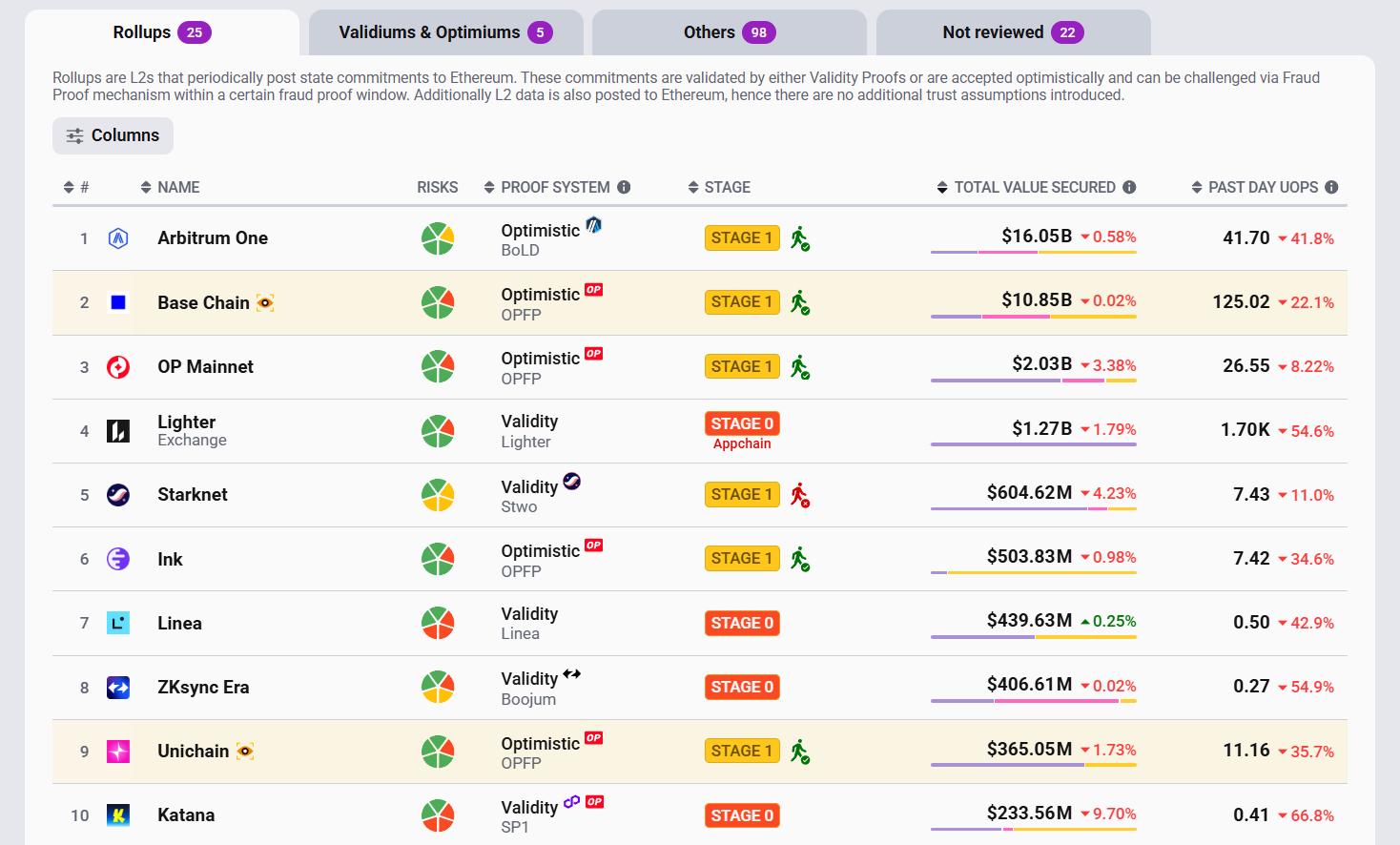

According to the latest statistics from L2BEAT, the broad category of L2 has currently surpassed hundreds, but the expansion of numbers does not equate to structural maturity; the vast majority are slow in their decentralization processes.

Here, it is important to add some foundational knowledge: as early as 2022, Vitalik criticized the majority of Rollup's Training Wheels architecture in his blog, stating that it relies on centralized operations and human intervention to ensure security. Users frequently using L2Beat should be very familiar with this; its homepage shows a related key indicator—Stage:

This is an evaluation framework that divides Rollup into three decentralization stages: completely reliant on centralized control "Stage 0," limited reliance "Stage 1," and fully decentralized "Stage 2," which also reflects the degree of reliance on human intervention for rollups.

In a recent reflection, Vitalik pointed out that some L2s may for regulatory or business needs, forever remain in "Stage 1," relying on a security council to control upgradability; this means that such L2s are essentially a "secondary L1" with cross-chain bridging attributes, rather than the originally envisioned "branded sharding."

To put it more bluntly, if the rights to ordering, upgrades, and final decisions are concentrated in the hands of a few entities, it not only contradicts Ethereum's original intention of decentralization but L2 itself also resembles a parasitic entity that leeches off the Ethereum mainnet.

At the same time, the expansion of L2s has also brought about another structural problem that many have deeply felt over the past few years, namely liquidity fragmentation.

This caused the traffic originally centralized on Ethereum to be gradually divided, forming fragmented value islands. With the increase in the number of public chains and L2s, the degree of liquidity fragmentation is further exacerbated, which is not the original intention of scaling.

From this perspective, one can understand why Vitalik emphasizes that the next step for L2 is not more chains, but deeper integration. Ultimately, this is actually a timely correction—through institutionalized scaling and an internal security mechanism, reinforcing L1 as the world's most trusted settlement layer.

In this context, scaling is no longer the only goal; security, neutrality, and predictability have regained their status as core assets of Ethereum, while the future of L2 lies not in quantity, but in deeper integration with the mainnet and more specialized innovations in segmented scenarios.

For example, providing unique additional functions, such as privacy-specific virtual machines, extreme scalability, or dedicated environments designed for non-financial applications like AI agents.

Hsiao-Wei Wang, Co-Executive Director of the Ethereum Foundation, expressed a similar view at the Consensus 2026 conference, stating that L1 should serve as the safest settlement layer, accommodating the most critical activities; while L2 should pursue differentiation and specialization, handling activities that aim for an extreme user experience.

2. Native Rollup: The Future of Based Rollup + Pre-confirmations?

Amid this wave of reflection on the L2 narrative, the concept of Based Rollup is expected to shine brightly in 2026.

If the keyword of the past five years was "Rollup-Centric," the core of current discussions is shifting to a more specific question: Can Rollups "grow within Ethereum" rather than "hang outside of Ethereum"?

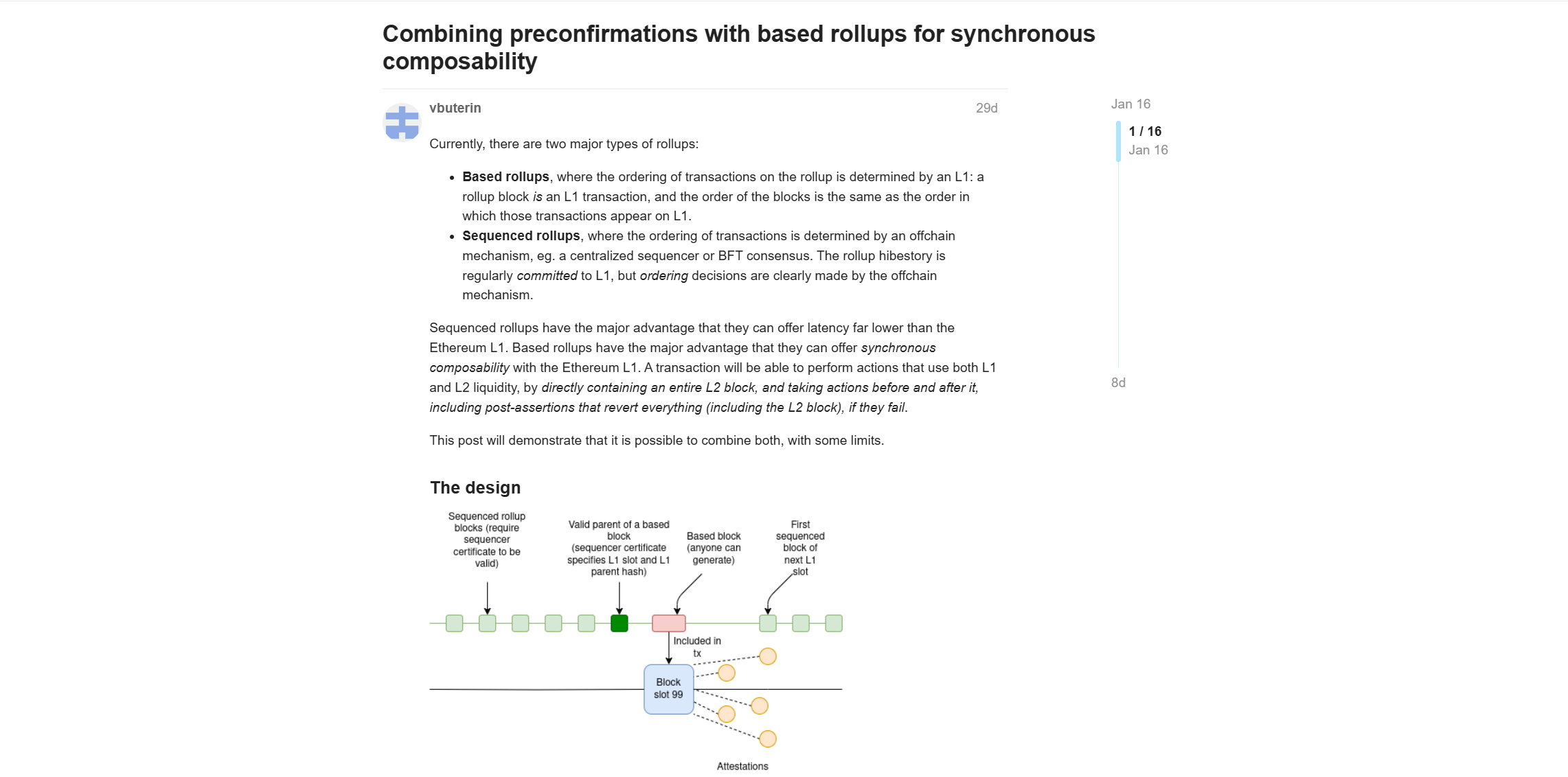

Thus, the "Native Rollup" currently hotly debated in the Ethereum community can be understood to some extent as an extension of the Based Rollup concept—if Native Rollup is the ultimate ideal, then Based Rollup is the most viable path towards that ideal.

It is well known that the main difference between Based Rollup and traditional L2s like Arbitrum and Optimism lies in entirely abandoning independent or even centralized sequencer layers, but rather sorting directly by Ethereum L1 nodes. In other words, the verification logic similar to Rollups is integrated at the L1 level by the Ethereum protocol itself, unifying the previously separate extreme performance optimization and protocol-level security between L2 and Ethereum mainnet.

This design gives users the most intuitive feeling that Rollups seem to be embedded within Ethereum, inheriting L1's resistance to censorship and activity. More importantly, it solves L2's most severe pain point—synchronous composability. In a Based Rollup block, you can directly call L1 liquidity, achieving atomic cross-layer transactions.

However, Based Rollup faces a practical challenge: if it completely follows L1's rhythm (one slot every 12 seconds), the user experience could appear cumbersome. After all, under the current Ethereum architecture, even when transactions are packed into blocks, the system still needs to wait approximately 13 minutes (2 epochs) to achieve finality, which is too slow for financial scenarios.

Interestingly, in a tweet reflecting on L2, Vitalik recommended a community proposal from January titled "Combining preconfirmations with based rollups for synchronous composability." The core of this proposal is not merely pushing for Based Rollup but rather proposing a hybrid structure:

Retain low-latency sequenced blocks, generate based blocks at the end of slots, submit based blocks to L1, and finally combine with a preconfirmation mechanism to achieve synchronous composability.

In Based Rollup, preconfirmation is a commitment by specific roles (such as L1 proposers) that a transaction will be included before it is formally submitted to L1, which is also the task clarified in Ethereum's Interop roadmap Project #4: Fast L1 Confirmation Rule.

The core aim is very direct; to allow applications and cross-chain systems to gain a "strong and verifiable" L1 confirmation signal within 15 to 30 seconds, without waiting for the full finality required of 13 minutes.

Mechanically, the fast confirmation rule does not introduce a new consensus process but rather reuses the voting of attestants that occurs in every slot under Ethereum's PoS system. When a block has already accumulated enough distributed validator votes in early slots, even if it has not yet entered the finality phase, it can still be viewed as "extremely unlikely to be rolled back under a reasonable attack model."

In short, this level of confirmation does not replace finality but provides a strong confirmation explicitly recognized by the protocol before finality, which is especially critical for interop: cross-chain systems, intent solvers, and wallets no longer need to wait blindly for finality; rather, they can securely advance their next logic based on protocol-level confirmation signals within 15 to 30 seconds.

Through this layered confirmation logic, Ethereum delicately delineates different trust levels between "security" and "perceived speed," potentially constructing an extremely smooth interoperability experience (see also: Ethereum's "Second-Level" Evolution: From Fast Confirmation to Settlement Compression, How Can Interop Eliminate Wait Times?).

3. What is the Future of Ethereum?

Looking back at the 2026 milestone, the main theme of Ethereum is quietly shifting, gradually moving from a pursuit of extreme "scalability" to a pursuit of "unity, layering, and endogenous security."

Last month, several executives from Ethereum L2 solutions expressed their willingness to explore and embrace the Native Rollup path to enhance the consistency and synergy of the entire network. This attitude itself is an important signal: the Ethereum ecosystem is undergoing a painful but necessary deflation, returning from a pursuit of "the number of chains" to a pursuit of "protocol unity."

However, as the underlying roadmap of Ethereum is recalibrated and advanced, especially when L1 continues to strengthen, and Based Rollups with preconfirmations gradually land, a more realistic issue begins to emerge—the biggest bottleneck is no longer chains, but wallets and access thresholds.

This corroborates imToken's repeated emphasis in 2025: when infrastructures become nearly invisible, what truly determines the limits of scaling will be the entry-level interactive experience.

Overall, beyond scaling at the base level, the future breakout and scaling development of the Ethereum ecosystem will not focus solely on TPS or the number of Blobs but will unfold around three more structurally significant directions:

- Account Abstraction and Access Threshold Reduction: Ethereum is promoting native account abstraction (Native AA); future smart contract wallets will become the default choice, completely replacing obscure mnemonic phrases and EOA addresses. For users of wallets like imToken, this means that entering the crypto world will be as simple as registering a social account (see also: From EOA to Account Abstraction: Will Web3's Next Leap Happen in the "Account System"?);

- Privacy and ZK-EVM: Privacy features are no longer a fringe demand. With the maturity of ZK-EVM technology, Ethereum will provide necessary on-chain privacy protection for commercial applications while maintaining transparency, which will be its core competitive advantage in the public chain arena (see also: ZK Roadmap "Dawn Moment": Is Ethereum's Ultimate Roadmap Accelerating Holistically?);

- On-chain Sovereignty of AI Agents: In 2026, the initiators of transactions may no longer be humans, but AI agents. The future challenge lies in establishing trustless interaction standards: how to ensure that AI agents are executing the will of users rather than being manipulated by third parties? Ethereum's decentralized settlement layer will become the most reliable rule enforcer in the AI economy (see also: The New Ticket of the AI Agent Era: Pushing for ERC-8004, What is Ethereum Betting On?);

Returning to the initial question, has Vitalik really "denied" L2?

A more accurate understanding is that he denies an oversaturated, disconnected, and fragmented narrative. This is not the end but a new beginning. Returning from the grand illusion of "branded sharding" to the meticulous crafting of Based Rollup and preconfirmation, in essence, helps reinforce Ethereum L1 as the absolute foundation of global trust.

However, this also means that in this return to technological pragmatism, only those innovations truly rooted in the new foundational principles of Ethereum and sharing the same breath and fate with the mainnet will survive and thrive in the next era of great voyages.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。