Author: CoinFound

The contention over the CLARITY Act is fundamentally not a confrontation between the crypto industry and regulation, but a redistribution of the underlying interests in the financial system. Traditional banks rely on low-cost deposits to maintain their net interest margins, while interest-generating stablecoins directly reach users through Treasury yields, reshaping the flow of funds and the transmission channels of the dollar system. The focus of regulation has shifted from "whether to allow innovation" to "how to quantify residual risks and systemic stability." Within this framework, the real watershed will no longer be CeFi or DeFi, but rather who can establish a new balance between transparency, compliance structure, and capital efficiency. The direction of CLARITY may determine the foundational rules for digital dollars and institution-level RWAs in the next decade.

CLARITY: (May 2025 - December 2025)

While the GENIUS Act is dedicated to resolving security issues related to the infrastructure of stablecoins, the CLARITY Act (H.R. 3633) looks towards the more grand and complex structure of the secondary cryptocurrency market, token taxonomy, and the delineation of regulatory jurisdiction.

Breakthrough in the House and Restructuring of Jurisdictional Boundaries

On May 29, 2025, Chairman of the House Financial Services Committee French Hill, along with the House Agriculture Committee and several bipartisan legislators, officially proposed the "Digital Asset Market Clarification Act" (CLARITY Act). The fundamental purpose of this act is to eliminate the long-standing "regulation by enforcement" phenomenon faced by the U.S. crypto market, providing predictable legal certainty for entrepreneurs, investors, and the market.

The CLARITY Act boldly implements jurisdictional delineation in its structure. The act explicitly grants the Commodity Futures Trading Commission (CFTC) "exclusive jurisdiction" over the spot market for "digital commodities," while retaining the jurisdiction of the U.S. Securities and Exchange Commission (SEC) over digital assets classified as Investment Contracts. To accommodate this massive emerging market, the act instructs the CFTC to establish a comprehensive registration mechanism specifically for digital commodity exchanges, brokers, and dealers, introducing a "Provisional Status" to allow existing market participants to continue operating legally during the compliance transition period.

At the House level, the act gained significant bipartisan support. On July 17, 2025, a day before the GENIUS Act was signed by the President, the CLARITY Act passed the House with an overwhelming majority of 294 votes in favor and 134 votes against. This victory at this stage overshadowed the underlying conflicts of interest within the act, and the market generally held an optimistic view regarding the establishment of a comprehensive crypto regulatory framework in the U.S. by the end of 2025.

Ripple Effects: Expansion of Commodity Pool Definitions and Compliance Challenges for DeFi

Notably, when amending the Commodity Exchange Act (CEA), the CLARITY Act introduced a provision with far-reaching implications. The act classifies the spot trading of "digital commodities" as a form of "Commodity Interest Activity." Under traditional financial regulatory frameworks, only derivatives (such as futures, options, and swaps) would trigger regulatory recognition of a "Commodity Pool"; spot market transactions (such as buying and selling physical gold or oil) are exempt from this restriction.

The CLARITY Act breaks this boundary. This means that any investment fund or collective investment tool engaged in spot digital asset trading, or even liquidity pools and corporate treasury management companies in decentralized financial protocols, that involve centralized management and trading of "digital commodities," may be legally classified as a "Commodity Pool." The direct consequence is that operators and advisors of such entities must register with the CFTC as Commodity Pool Operators (CPO) or Commodity Trading Advisors (CTA), and comply with the extremely strict disclosure, compliance, auditing, and margin requirements of the National Futures Association (NFA). This harsh additional compliance cost signals that the native asset management model of crypto will face a forced assimilation process towards aligning with traditional Wall Street financial standards.

Parallel Legislative Tracks and Under Currents in the Senate

As the House bill moved to the Senate, the complexity of the legislation increased exponentially. The Senate did not directly adopt the House's text but began internal power and interest restructuring. In the second half of 2025, the Senate formed two parallel legislative tracks:

On one hand, the Senate Agriculture, Nutrition, and Forestry Committee, under Chairman John Boozman, drafted and advanced the Digital Commodity Intermediaries Act based on the jurisdictional portions of the House CLARITY Act. This draft focuses on establishing a regulatory system for CFTC oversight of spot market digital commodity intermediaries, emphasizing client fund segregation requirements and conflict of interest protections, and received preliminary approval from the committee by the end of January 2026.

On the other hand, the Senate Banking, Housing, and Urban Affairs Committee began drafting a more comprehensive amendment that includes banking innovation and consumer protection. It was within the closed-door negotiations of this committee that the lobbying power of traditional banking began to fully exert itself, with the aim of obstructing the establishment of "interest-earning stablecoins" as their non-negotiable core strategic objective. This laid the groundwork for a legislative crisis that erupted in early 2026.

Senate Stalemate and Full Collision of Interest Groups (January 2026)

Entering 2026, U.S. crypto legislation faced a dramatically turning point. On January 12, the Senate Banking Committee officially released a 278-page revision draft of the CLARITY Act (Title I referred to as the "2026 Lummis-Gillibrand Responsible Financial Innovation Act"). This draft in Chapter Four "Responsible Banking Innovation" set extremely strict definitions and limits on the rewards mechanism for stablecoin holders. The Banking Committee sought to close loopholes left by the GENIUS Act through legislation, proposing to prohibit digital asset service providers from offering interest or returns to users for "passive holdings" of stablecoins.

Systemic Defensive Logic and Macroeconomic Anxiety of Traditional Banking

Traditional financial lobbying groups, represented by the American Bankers Association (ABA), the Bank Policy Institute (BPI), the Consumer Bankers Association (CBA), the Independent Community Bankers of America (ICBA), and U.S. credit unions, have shown unprecedented vigilance and hostility toward interest-earning stablecoins. Their core argument is not merely about profit competition, but a systematic defense based on macro-financial stability and the credit transmission mechanics of the real economy.

The table below compares in detail the core arguments and deeper logic of the traditional banking industry and the crypto industry regarding interest-earning stablecoins:

| Interest Group | Core Demands and Policy Propositions | Deep Economic Logic and Data Supporting Their Claims |

|---|---|---|

| Traditional Banking Industry (ABA, BPI, ICBA, Credit Unions) | Demand the inclusion of a "comprehensive prohibition" against third-party platforms offering yield on stablecoins in the CLARITY Act and implement strict anti-evasion measures. | 1. Deposit Drain and Credit Drought Crisis: The net interest margin (NIM) model that banks rely on survives by low-cost, high-stickiness retail deposits. If stablecoin platforms offer high interest (4%-10%), it will trigger structural deposit outflow. According to the Treasury, traditional deposits worth up to $6.6 trillion are at risk of loss. 2. Break in the Transmission of Community Economies: Every deposit retained in community banks translates, through the multiplier effect, into housing loans, small business loans, or agricultural credit. Legalizing stablecoin yields will drain this grassroots liquidity, severely damaging the blood supply mechanism of local real economies. 3. Regulatory Arbitrage and Moral Hazard: Stablecoins are advertised as extremely safe, but their high yields do not have the rigid backing of federal deposit insurance (FDIC), potentially triggering contagion during extreme market scenarios. |

| Crypto Asset Industry (Coinbase, Ripple, Blockchain Association) | Strongly oppose the expansion of yield prohibitions, arguing that yields derived from underlying real assets' risk-free rates or on-chain economic activities should be legally returned to token holders. | 1. Capital Efficiency and Value Reversion: Stablecoins are 100% supported by U.S. Treasury securities or cash, which in themselves generate substantial interest. Prohibiting platforms from returning yields to users essentially deprives consumers of their property gains, protecting the monopolistic profits of traditional banks. 2. Outflow of Innovation and Geopolitical Financial Risk: A comprehensive ban would not only stifle the competitiveness of centralized exchanges but directly destroy complex business models in decentralized finance (DeFi) that allocate returns via smart contracts. This would force hundreds of billions of dollars in crypto capital along with top developers to migrate to jurisdictions with more favorable regulations, weakening the U.S. position in the new generation of financial infrastructure. |

Coinbase's Strong Counteraction and Standstill of Legislative Process

Faced with the devastating yield prohibition in the Senate Banking Committee draft, the crypto industry's reaction was exceptionally fierce. The largest cryptocurrency exchange in the U.S., Coinbase, took extreme countermeasures in mid-January, with its CEO Brian Armstrong publicly announcing the withdrawal of support for the CLARITY Act, bluntly stating that the current revision draft is "worse than maintaining the status quo (no clear legislation at all)."

Coinbase's hardline stance was not mere bluster, but a necessary choice to defend the cornerstone of its survival. Financial reports indicate that in the third quarter of 2025, Coinbase's net revenue from stablecoins (primarily through USDC issued in collaboration with Circle's Centre Alliance) reached $243 million, accounting for 56% of its total net revenue for that quarter. This profit-sharing model, based on zero-risk returns from underlying dollar assets, has become the core cash flow for crypto exchanges to withstand cyclical fluctuations in transaction volumes. If the CLARITY Act forcibly cuts this financial artery, it would not only severely impact the valuations of publicly traded crypto companies but completely overturn the existing competitive landscape in the industry.

Coinbase's public breakup triggered a political domino effect. Because the digital asset legislation highly relies on fragile bipartisan consensus, the internal division within the crypto industry directly undermined the political foundation for the bill's passage. Facing continuous opposition from key Democrats and a reassessment of community bank interests by some Republicans, Senate Banking Committee Chairman Tim Scott (Republican from South Carolina) was compelled to indefinitely cancel the markup meeting and voting procedure for the CLARITY Act that had been scheduled for late January, choosing to pause progress to avoid the embarrassment of the bill being defeated at the committee stage. Thus, comprehensive digital asset legislation in the U.S. fell into a deep paralysis.

Emergency Mediation by the White House and High-Pressure Negotiation Record (February 1 to 20, 2026)

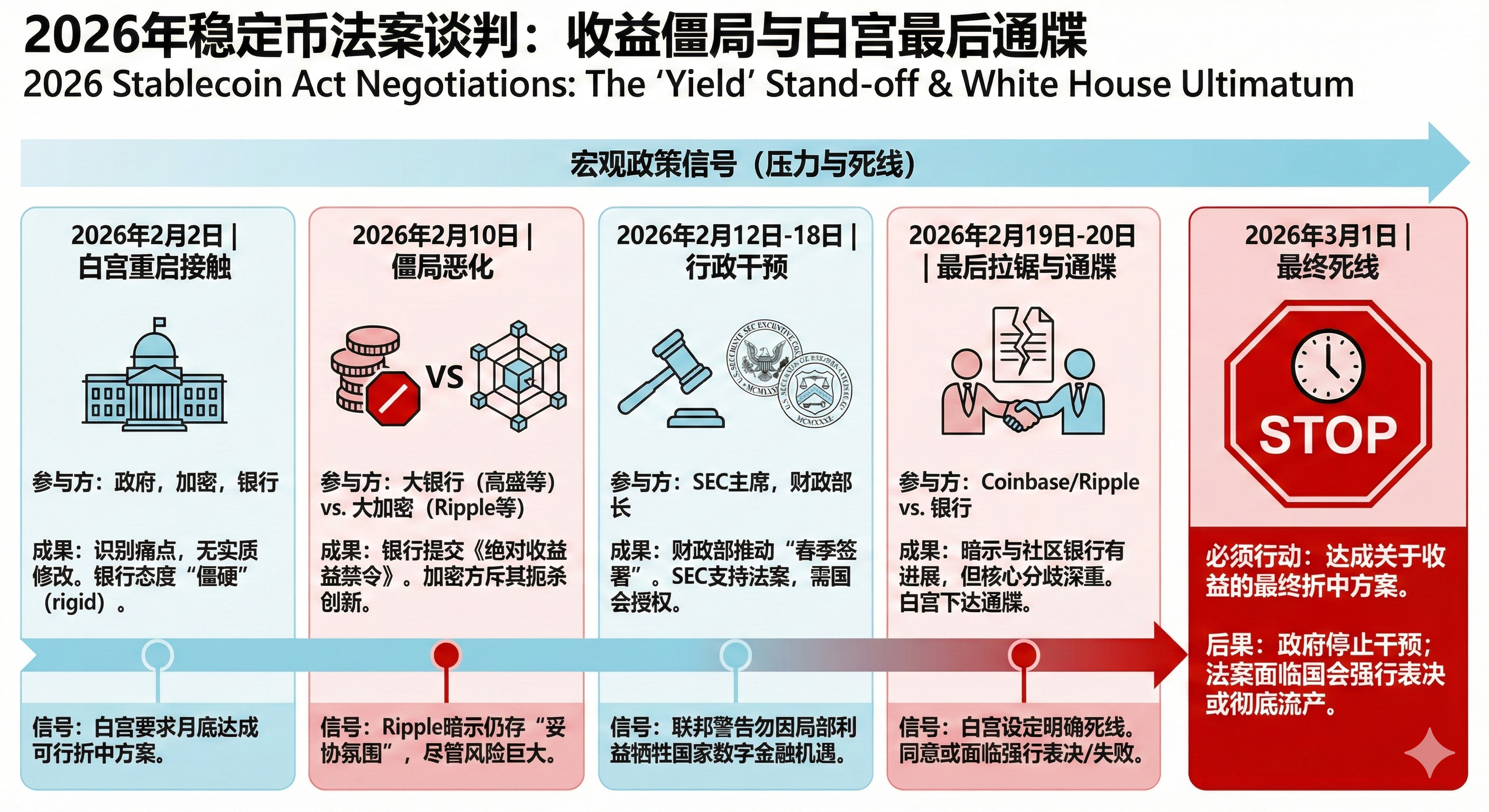

Faced with the threat of collapse due to a single issue impacting major technology and financial strategic legislation, the White House took unprecedented direct intervention in February 2026. With the mid-term elections approaching in November 2026, the Biden administration and the Treasury were keenly aware that if a bill could not be signed before Congress recess in spring, this legislative agenda would likely come to a complete standstill amidst the political polarization of the election cycle. In this context, Patrick Witt, Executive Director of the President's Digital Asset Advisory Council, took on the challenging role of mediator, beginning intense shuttle diplomacy between traditional finance and crypto newcomers.

The following is a timeline and insider details of the White House mediation based on disclosures from various parties in February 2026:

| Key Time Node | Participants and Nature of Events | Core Negotiation Details and Phase Achievements | Macroeconomic Policy Signals |

|---|---|---|---|

| February 2, 2026 | First Round of White House Closed-Door Meetings. Representatives from the White House, crypto industry (Coinbase, Blockchain Association, etc.), and banking sector (ABA, BPI, ICBA, etc.) attended. | Aimed at rebooting the bill derailed by yield disputes. Both parties identified "pain points" and potential compromise areas but did not make substantial changes to the legislative text (no redlining). Crypto advocacy groups called this "an important step," but attending insiders pointed out that banking representatives' attitudes were "extremely rigid," lacking flexibility for substantial concessions representing their member banks. | The White House clearly stated that both sides must reach a feasible compromise by the end of this month (i.e., by the end of February) to clear obstacles for the bill's resumption in the Senate. |

| February 10, 2026 | Second Round of White House Closed-Door Meetings. Streamlined high-level negotiations, where executives from Goldman Sachs, Citigroup, and JPMorgan faced off against executives from Ripple, Coinbase, and the Crypto Innovation Committee. | The atmosphere of the meeting sharply deteriorated, falling into a serious deadlock. Banking representatives not only did not compromise but adopted a harder stance, submitting a document titled "Principles for Yield and Interest Prohibitions," demanding an "absolute comprehensive ban" on any financial or non-financial gains derived from holding payment stablecoins, accompanied by extremely strict anti-evasion clauses. The crypto industry reacted extremely negatively to this document, viewing it as an attempt to stifle financial innovation. | Despite the risk of rupture, Ripple's Chief Legal Officer Stuart Alderoty still released optimistic signals to the outside, suggesting that amidst strong momentum for bipartisan promotion of market structure legislation, "the atmosphere for compromise remains." |

| February 12-18, 2026 | Congressional Hearings and Administrative Interventions. SEC Chairman Paul Atkins and Treasury Secretary Scott Bessent spoke in both houses and publicly. | Treasury Secretary Bessent emphasized the necessity to aim for "spring signing," leveraging the political pressure of the mid-term elections to compel compromise. SEC Chairman Atkins endorsed the CLARITY Act at the hearing, reiterating that the SEC is implementing "Project Crypto" for token classification, clearly stating that "most crypto tokens are not securities." He also warned that merely relying on SEC's No-Action Letters cannot achieve "future-proof" regulation and that Congress must provide solid statutory authority. | The coordinated statements from the SEC and the Treasury sent a clear signal to the banking sector: the highest level of federal supervision does not want to sacrifice the historic opportunity to establish a national-level digital financial infrastructure due to local profit disputes. |

| February 19-20, 2026 | Third Round of White House Talks and Ultimatums. Coinbase and Ripple's Chief Legal Officers met again with banking representatives. | After arduous negotiations, Coinbase CEO Brian Armstrong publicly hinted on social media that progress had been made regarding "exchanges and compromises with community bank interests," but did not disclose whether the core policy differences had been completely resolved. Due to ongoing deep divisions, the White House issued a clear deadline. | The White House officially set March 1, 2026 as the "deadline" for reaching a final agreement on stablecoin yields. If no joint compromise proposal can be made by then, the government may cease intervention and the bill's fate will be left to a forced vote in Congress or face complete abandonment. |

As of February 20, 2026, with the March 1 deadline approaching, the success or failure of U.S. crypto regulatory legislation hinges entirely on whether traditional bank capital and emerging crypto capital can design a profit balance model in the next ten days that protects grassroots deposits from devastating siphoning while maintaining the innovative vitality of the crypto ecosystem.

Theoretical and Legal Framework for Breaking the Deadlock: Yield Neutrality Principle and Residual Risk Assessment Model

As the White House mediation bogged down, an internal discussion draft leaked from the SEC crypto task force and related interdepartmental drafting committee in late January 2026—the "Digital Markets Restructure Act of 2026"—provided a profound new regulatory paradigm for unraveling the deadlock of interest-earning stablecoins, highly coherent in both legal and operational aspects. The "yield neutrality" and "residual risk assessment" theories proposed in this draft fundamentally overturn nearly a century of financial product classification logic in the U.S.

Foundation for Breaking Monopoly: Yield Neutrality Principle (Yield Neutrality for Stable Value Instruments)

Article 205 of the draft aims to fundamentally break the outdated thinking that "any payment of interest inevitably equates to bank deposits or securities." This provision establishes a landmark "yield neutrality" legal principle:

- Decoupling Privileges from Bank Licensing: The draft clearly states that the act of providing returns, interest, or economic benefits by digital assets or stable value instruments is legally regarded as "neutral." Such returns "must not be limited, conditioned, or exclusively retained for depository institutions (i.e., traditional commercial banks) or their affiliates." This directly nullifies the banking industry's core appeal for the monopoly of yield rights at a statutory level.

- Strict Conditional Licensing Mechanism: Granting yield rights to non-bank entities does not mean a free-for-all. Non-bank entities holding the proposed "Unified Registration Certificate" (URC) are allowed to provide or facilitate yields on stablecoins, but must strictly meet four irrefutable compliance preconditions:

- Extreme Transparency: The underlying logic of stablecoins and their yield mechanisms must be comprehensively and publicly disclosed in the "Unified Digital Market Registry."

- Legitimate Source Tracing: The true physical or code sources of the yields must be clearly delineated and shown to the public. Yields must arise from clearly legitimate mechanisms, such as risk-free interest rates managed by the federal reserve, values underpinning compliant licensed assets, actual secondary market transaction fees, or transparent operational methods of underlying blockchain protocols (like staking yields).

- Controlled Risk Classification: The yield-generating instrument and its transmission mechanism must be subject to classification and dynamic supervision by the "residual risk assessment model" established by the act.

- Absolute Prohibition of False Endorsements: Any marketing language suggesting or implying that the yields of this stablecoin are guaranteed by the "full faith and credit" of the U.S. government or are backed by the Federal Deposit Insurance (FDIC) system (unless it is actually connected to such insurance plans) is strictly prohibited.

- Statutory Priority and Preemption Effect: This clause, through the form of federal legislation, explicitly declares its efficacy to exceed and take precedence over any prior laws that might be interpreted as reserving yield distribution rights exclusively to banks (directly targeting potential restrictive clauses in the GENIUS Act), achieving a complete unbinding of legal applications.

Disrupting the Howey Test: Residual Risk Assessment Model

If the "yield neutrality principle" resolves the eligibility question of "who is qualified to allocate yields," then the "residual risk assessment model" detailed in Articles 103 and 202 fundamentally addresses the technical dilemma of "how regulators should scientifically evaluate and quantify the management of these yield-generating instruments."

For a long time, the SEC has excessively relied on the "Howey Test," established in 1946, to determine whether crypto assets fall under securities, leading to endless litigation. In contrast, the "Restructure Act" completely abandons static assessments based on "technical labels" (like stablecoins, smart contracts, tokens), moving towards a modular and dynamically responsive regulatory mechanism based on underlying risk vectors.

The core idea of the model is to measure "residual risk"—that is, the investment risks, leverage risks, or market integrity risks that still exist after thoroughly applying mitigating measures such as blockchain cryptographic validation, immutable smart contracts, and rigorous legal structures. The model precisely divides these residual risks into three independent but quantifiable dimensions:

| Risk Category | Risk Source and Core Definition | Examples of Digital Asset Scenarios Triggering This Risk | Corresponding Main Regulatory Jurisdiction |

|---|---|---|---|

| Enterprise Risk | Originating from identifiable corporate entities, core developers, or intermediaries having agents, information asymmetry, or discretion from management. | The issuer uses pooled user stablecoins to invest in high-risk corporate bonds or alternative assets through discretionary decision-making to obtain high yields. The high dependence on the manager's "efforts and decisions" results in extremely high residual enterprise risk. | U.S. Securities and Exchange Commission (SEC), classified as high-risk investment funds or securities. |

| Exposure Risk | Stemming from synthetic and leveraged exposure to reference assets, volatility, interest rates, or complex indices. | Users deposit stablecoins into decentralized derivatives protocols, with the protocol offering excess annualized yields through high leverage, exposing them to risks of liquidation and bad debts during extreme market volatility. | Commodity Futures Trading Commission (CFTC), classified as derivatives or commodity pool operations. |

| Market and System Integrity Risk | Involves asset physical and logical custodial security, system integrity, market manipulation, or operational failures of trading and settlement facilities. | Typical daily liquidity management offered by centralized exchanges, even though returns entirely stem from underlying risk-free Treasury bonds, may still face risks such as misappropriation of user asset pools, hacking, or internal data tampering. | Prudential Regulatory Agencies / Joint Market Supervision by SEC and CFTC, focusing on auditing, asset isolation, and cybersecurity. |

The operational mechanism of this assessment model is vividly likened by the bill's drafters to a dynamic "smart thermostat." Its core regulatory logic is "measuring economic abstraction": that is, assessing to what extent the economic risk exposure of the asset is detached from the actual control rights or legal recourse of the users. The intervention of regulatory intensity scales proportionally—when the residual risks of a yield-generating asset are inflated due to manipulation or opaque operations, regulatory authority and information disclosure requirements will automatically and rigorously expand; conversely, when decentralized technology or automated smart contracts are mathematically and cryptographically proven to perfectly neutralize, or even eliminate, human management risks and counterparty credit risks, regulatory intervention will contract and recede proportionately. To ensure that the SEC, CFTC, and prudential banking regulators can seamlessly share data and execute this model, the bill also proposes the establishment of a "Market Structure Coordination System" (MSCS).

Applying this theoretical framework to the current deadlock of interest-earning stablecoins, a clearly logical path to breaking through emerges: if third-party platforms like Coinbase merely serve as transparent "pipelines," storing 100% in the Federal Reserve or in forms of short-term U.S. Treasury securities as "risk-free yields," and transparently distributing them proportionately and automatically to end users while strictly executing asset isolation, with no mismatches in funding pool terms, leverage amplification, or proactive credit risk degradation occurring. Then, according to the "residual risk assessment model," the "residual enterprise risk" and "exposure risk" of such business conduct will be deemed extremely low. In this case, regulators' responsibility should not be to directly ban or classify as illegal the money market funds based on the outdated dogma of maintaining traditional banking interests, but merely to continuously verify the absolute safety and disclosure authenticity of its custodians through technical means. This categorization method, based on technical facts and objective risk characteristics rather than based on institutional identity and historical licenses, provides a solid technical and legal backing for bridging political divides on Capitol Hill.

Impact of the Success or Failure of the CLARITY Act:

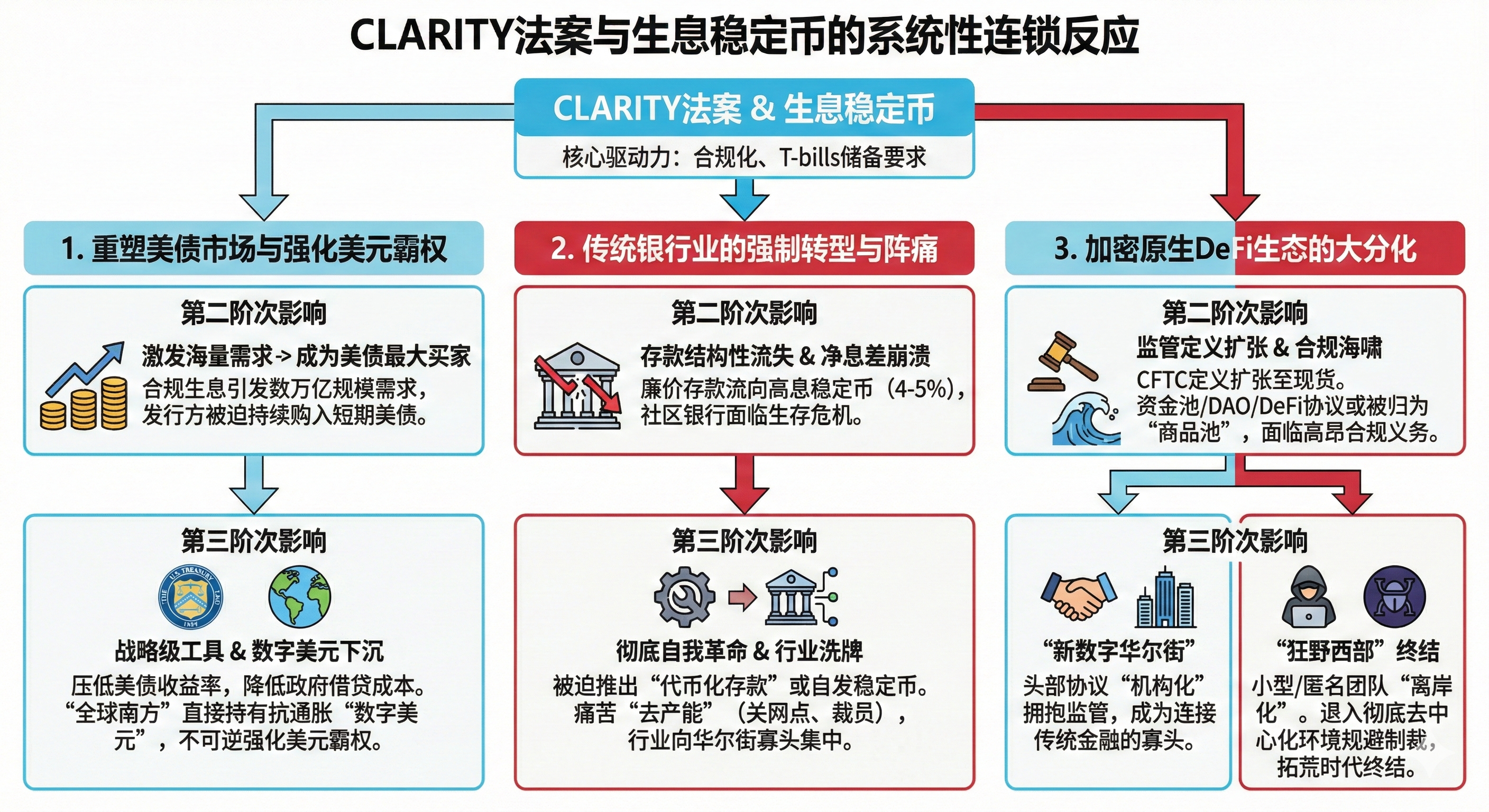

The success or failure of the CLARITY Act, as well as the ultimate attribution of yield rights from interest-earning stablecoins, is by no means a simple redistribution of industry profits. The spillover effects of this legislation will penetrate the crypto circles, producing far-reaching systemic ripple effects on U.S. macro debt financing, the global hegemony of the dollar, and the evolution of the traditional financial system.

1. Deep Integration and Reshaping of the U.S. Treasury Market, Strengthening Digital Dollar Hegemony

By the end of 2025, the total market value of stablecoins with various interest-earning attributes has exceeded $15 billion, and the overall market size of broad payment stablecoins approaches hundreds of billions of dollars. According to the compliance requirements of the GENIUS Act, all future dollar stablecoins must primarily be backed by U.S. short-term Treasury securities (T-bills) and U.S. dollar cash as reserve assets.

- Second-Order Impact: If the CLARITY Act ultimately adopts the "yield neutrality" principle, allowing for the regulated operation of earning mechanisms under strong regulatory guardrails, it will significantly stimulate massive demand from institutional investors (like corporate treasury management) and global retail users for dollar stablecoins. According to macroeconomic think tank predictions, a compliant and interest-bearing stablecoin ecosystem could rapidly expand to an astonishing scale of trillions of dollars in a short time. To maintain a 1:1 reserve line, compliant issuers of stablecoins (such as major non-bank trusts and asset management companies) will be forced to become one of the largest and most stable institutional buyers of U.S. short-term Treasury bonds in the public market, continuously injecting astronomical liquidity into the Treasury market.

- Third-Order Impact: This structurally certain purchasing power of Treasury securities driven by global digitalization demand will become a strategic tool for the Federal Reserve and the U.S. Treasury to manage the sovereign debt curve. The continued huge buying will effectively lower the yields of U.S. short-term Treasury securities (i.e., lower the yield curve front), thereby substantially reducing the overall borrowing costs for the U.S. government and significantly improving the worsening national fiscal situation and deficit pressures. More profoundly, in countries of the "Global South" that have long suffered from high inflation and fiat currency devaluation, legally generating anti-inflation yields from "digital dollars" will become the ultimate wealth hedge asset. Hundreds of millions of people overseas will be able to directly convert their local wealth into digital assets backed by U.S. Treasury credit without going through cumbersome offshore bank account procedures. This will not only be a devastating blow to other weak sovereign currencies but will also allow the U.S. to achieve global dollar hegemony downward into the bottom layers of society without establishing any physical offshore bank branches, further and irreversibly reinforcing the dollar's status as the sole core reserve currency globally.

2. Forced Transformation and Growing Pains of Traditional Commercial Banking

The banking industry mobilizing its highest level of political lobbying power to attempt to strangle interest-bearing stablecoins arises from their clear foreseeability that this emerging financial infrastructure will deliver a devastating blow to their survival-dependent net interest margin (NIM) model.

- Second-Order Impact: If the attempts to comprehensively ban third-party provision of interest-earning stablecoins fail, the structural outflow of low-cost deposits from the traditional banking system—especially from small and medium-sized community banks with weak risk resilience—will become an irreversible historical tide. Capital has a natural and ruthless pursuit of profit. In the face of compliant digital dollars that support 24/7 global real-time cross-border settlement with annualized yields stabilizing around 4% to 5% and no minimum threshold, traditional banks’ zero-interest checking accounts or low-interest savings accounts will instantly lose all market appeal.

- Third-Order Impact: To avoid being eliminated in this brutal battle for liquidity, traditional commercial banks will be forced to undergo a thorough self-revolution, shifting their strategic focus from policy defense to a full-scale technological offense. In the foreseeable future, we will witness mainstream banks launching large-scale "tokenized deposits" based on consortium chains or public chains, or issuing compliance high-yield stablecoins at the bank level leveraging their vast balance sheets. To absorb the cost pressure from paying higher deposit interest, the banking industry will have to go through painful "capacity reduction," massively scaling down physical branches and redundant human resources to drastically lower overall operating costs through extreme digitization. This process will trigger a reshuffling of cost structures and profit expectations in the U.S. and even global banking sectors, with industry concentration further shifting toward Wall Street oligarchs possessing top-tier financial technology capabilities.

3. "Institutionalization" Watershed and Major Differentiation of the Crypto Native DeFi Ecosystem

The CLARITY Act not only redistributes interests but fundamentally reshapes the ecological structure of the crypto industry. The act designates the CFTC as the direct regulator of "digital commodities" and expands the traditional definition of "commodity pools" to directly cover the spot digital commodity market.

- Second-Order Impact: This minor change in legal definition will trigger a tsunami in the crypto asset management sector. Any investment fund conducting capital pool aggregation operations in the spot digital asset space, or providing users with complex structured earning strategies, decentralized autonomous organization (DAO) treasury management bodies, or even DeFi protocols characterized by liquidity aggregation, are highly likely to be legally classified as "commodity pools." Their operators will be forced to fully register with the CFTC under the law and bear high auditing and compliance obligations.

- Third-Order Impact: The decentralized finance (DeFi) ecosystem will inevitably face severe polarization. Capital-rich head DeFi protocols and major centralized exchanges capable of bearing high legal compliance costs will actively embrace regulation, further consolidating their oligopolistic positions in the market and transforming into "super compliance nodes" that connect traditional Wall Street liquidity with crypto assets. Meanwhile, those small protocols, startup development teams, or fundamentalist anonymous developers unable to meet stringent registration requirements will retreat from mainstream U.S. scrutiny using the limited protections and exemptions retained for "non-controlling blockchain developers" in the act, fully exiting into more thoroughly decentralized, permissionless, or even dark web offshore environments. This means that the crypto industry's wild west pioneering era will be thoroughly ended in 2026, replaced by a highly institutionalized "new digital Wall Street" dominated by Wall Street capital, licensed compliance giants, and federal regulatory agencies.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。