This article comes from:arise

Compiled by|Odaily Planet Daily(@OdailyChina);Translator|Azuma(@azuma_eth)

The core content of this article is just one thing — how to prepare for the potential largest airdrop in the prediction market track.

Data Issues That Must Be Declared

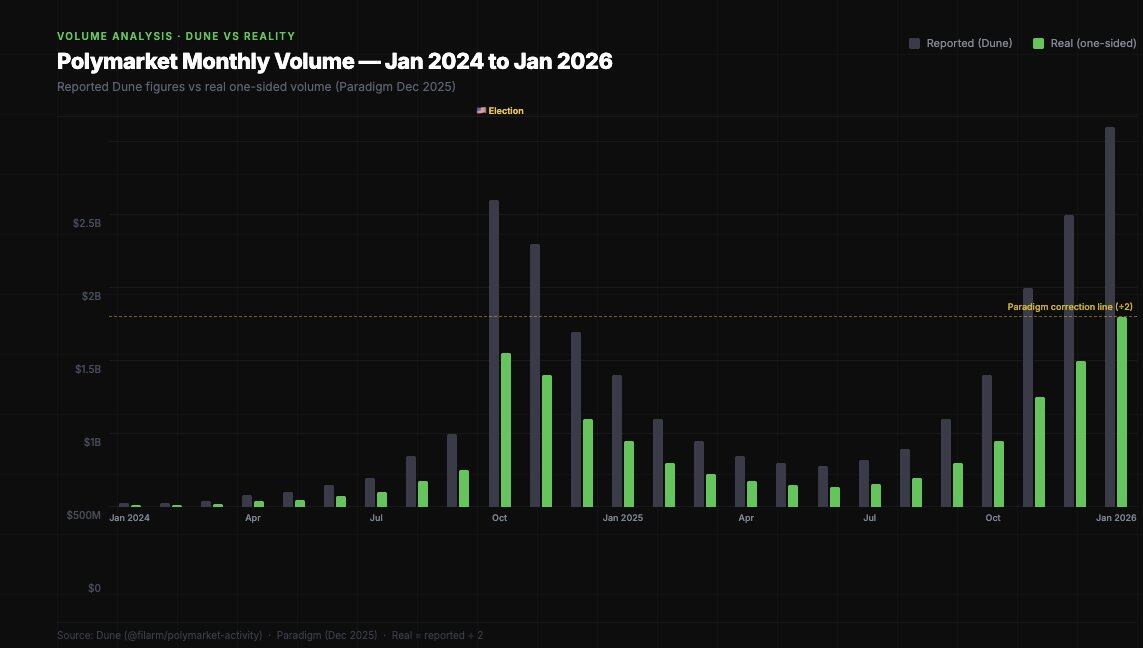

Before building any model, we need real and reliable data. The trading volume data from Polymarket has been widely misreported.

In December 2025, Paradigm released a key finding of a study: most Polymarket dashboards calculate trading volume by accumulating all “OrderFilled” events, but that event is triggered on both sides of the same transaction, resulting in double counting. The real trading volume is about half of the number presented on the dashboard.

Dashboard trading volume vs. unilateral trading volume — the latter is the truly important number in airdrop modeling.

This is crucial for airdrop modeling; if Polymarket treats trading volume as a metric, they will only use internal data and not various statistics on Dune. Your actual trading volume "score" is likely only half of what tools like Polycool display.

User Distribution

Regarding airdrop speculation, the most important dataset comes from a study by IMDEA Networks Institute, covering over 86 million transactions (April 2024 – April 2025).

- Only 0.51% of addresses made more than $1000 in profit;

- Only 1.74% of addresses (estimated) traded over $50000;

- The top three arbitrage addresses individually extracted $4.2 million in "risk-free profit";

- The top traders can earn over ten million dollars.

In terms of LP rewards, the stratification phenomenon is even more pronounced.

79% of traders have never earned even $1 in LP rewards — this is currently the most overlooked interaction behavior. Among 314,000 traders, only 66,567 wallets have ever received LP rewards. This means only 21% of traders have ever provided liquidity. Compared to overall participation, this reward mechanism is significantly overlooked.

Lower usage is generally seen as a "undervalued" signal in airdrop models.

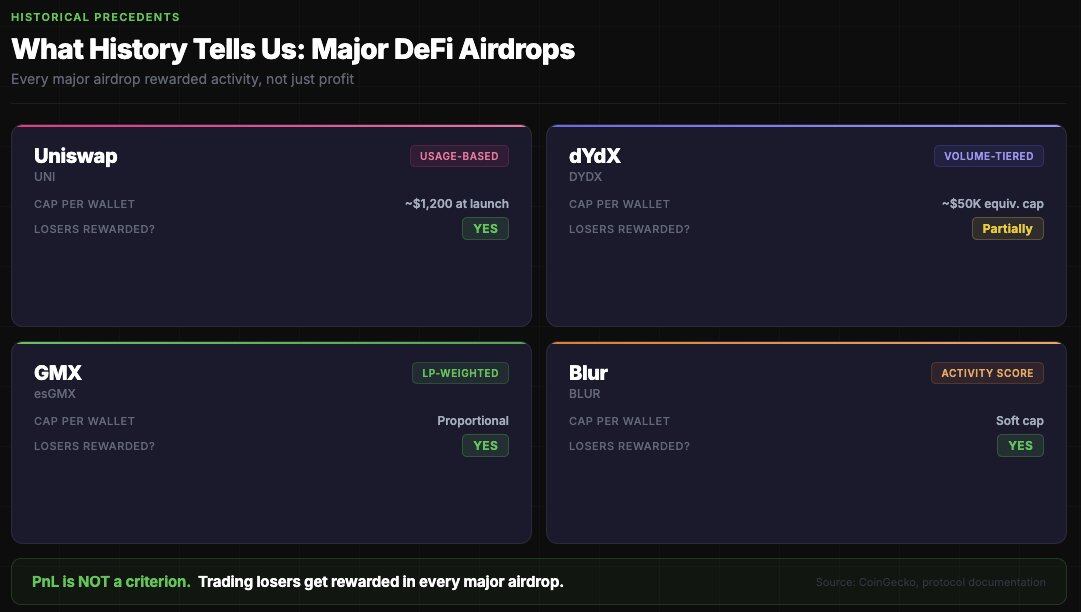

Airdrop Precedents: What Does History Tell Us?

All major DeFi airdrops reward "active behavior," rather than "profit status." Polymarket will follow the same logic.

The common points of all large-scale airdrops include:

- Pure average distribution can be exploited by witch attacks (Polymarket will not evenly distribute);

- Pure volume-based distribution will lead to an airdrop overly concentrated on whales (PR risk + SEC risk);

- Best strategy: tiered leveling + reward limits + multiple dimensions (volume + LP + diversity + duration of activity);

- In all major airdrops, losers are also rewarded — profit and loss (PnL) is not the standard.

The last point is very critical: if you trade $100,000 and lose $20,000, you are more likely to be rewarded than someone who traded $1,000 and made $500. The platform does not want to incentivize only profitable trades — that makes it easier to filter out insiders.

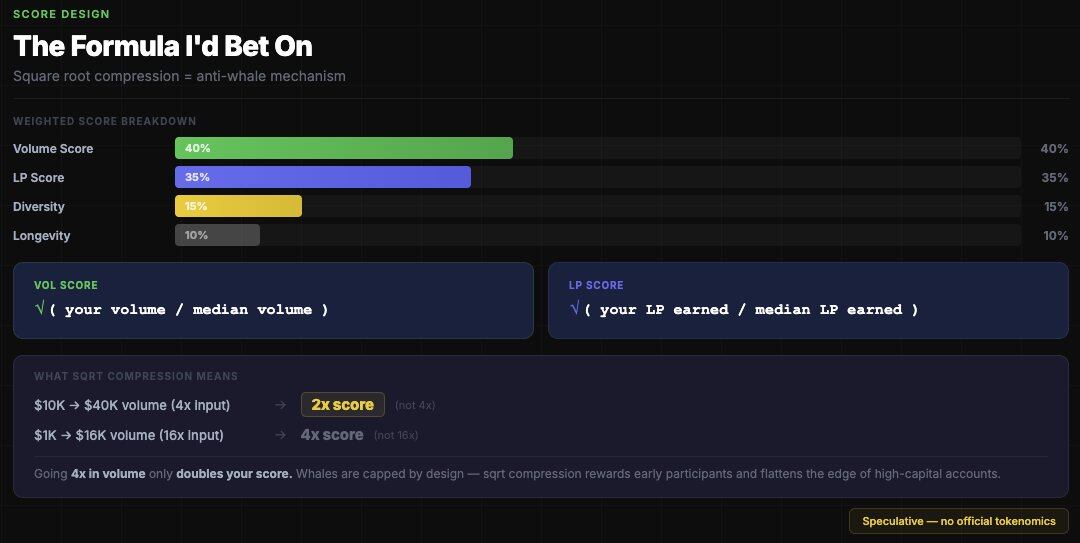

Reverse Thinking: How to Limit Whales?

Some airdrop calculators on the market use the simplest trading volume ratio model: airdrop share = personal trading volume / total trading volume × airdrop amount.

This is wrong because mainstream airdrops consistently employ a "decreasing curve."

I prefer to bet on a model where Polymarket limits the airdrop scale for whales through square root compression — for example, if trading volume increases fourfold, the score only increases twofold, which will fundamentally change the airdrop outcomes aimed at whale groups.

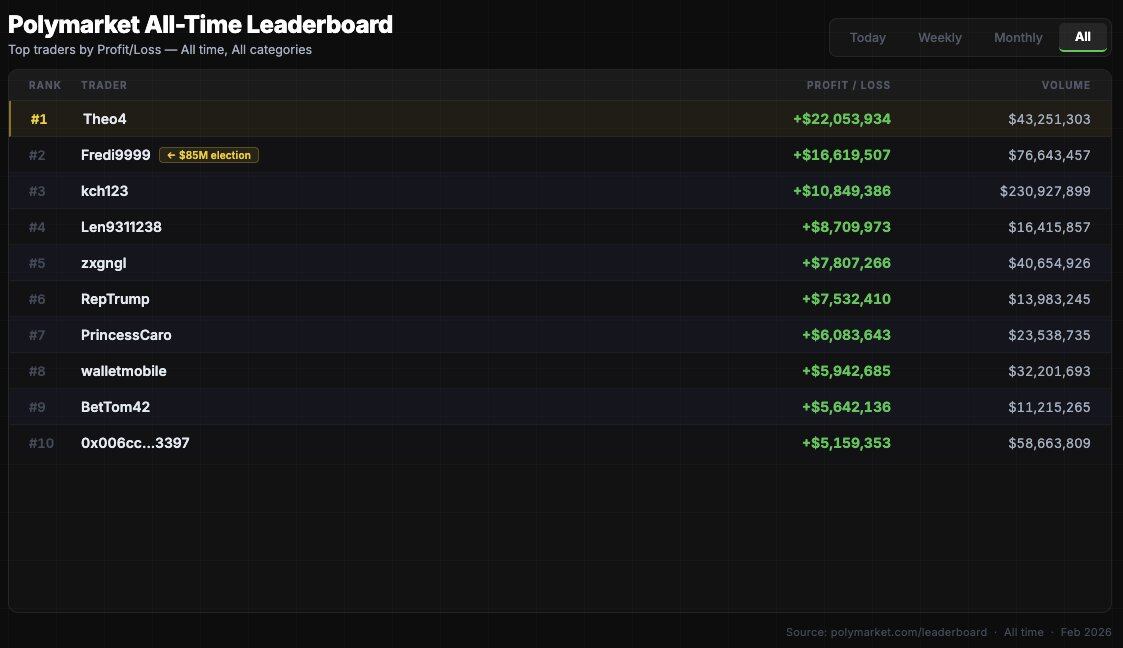

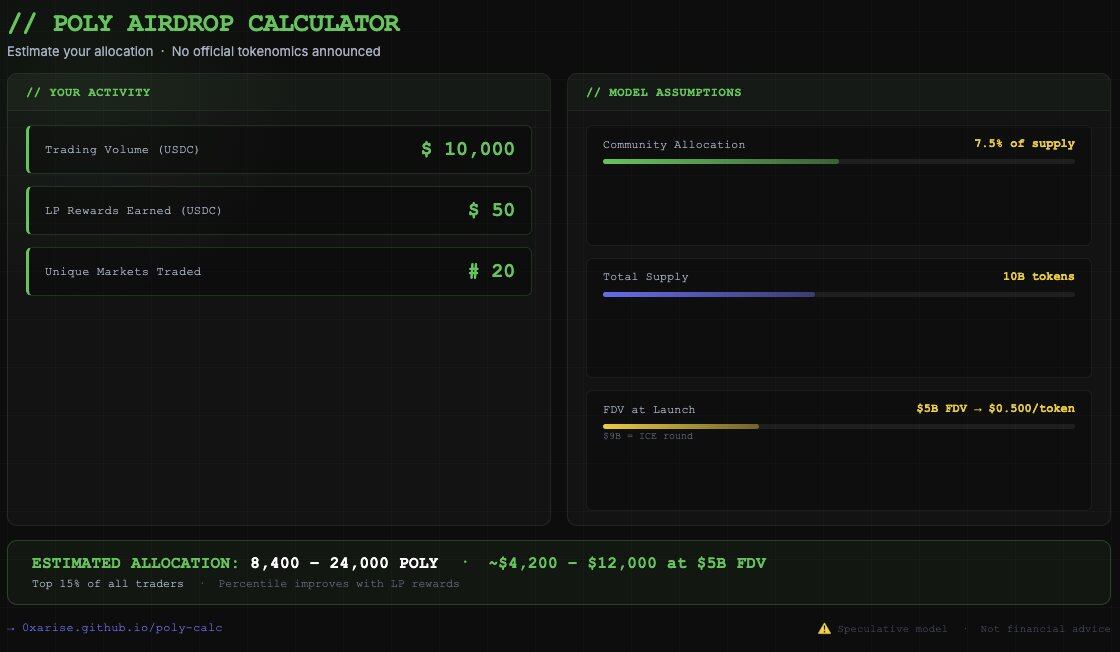

So how much will top wallets receive? Suppose the total supply of POLY is 10 billion, with 7.5% allocated for community airdrops (750 million POLY), the FDV at TGE is $3-9 billion.

If there is no limit on the airdrop amount for a single address, and if the trading volume is $85 million (using top trader fredi999 as an example), the model estimates that approximately 3-5 million POLY could be obtained. At a $9 billion FDV, this amounts to $3-4.5 million. Theoretically feasible, but with very poor PR effects.

A more realistic scenario is to set a limit on the airdrop amount for a single address, such as a cap of 500,000 to 2 million POLY; under a $5 billion FDV, a top address could receive about $450,000 to $1 million.

"LP" and "Volume": Where Are the Current Opportunities?

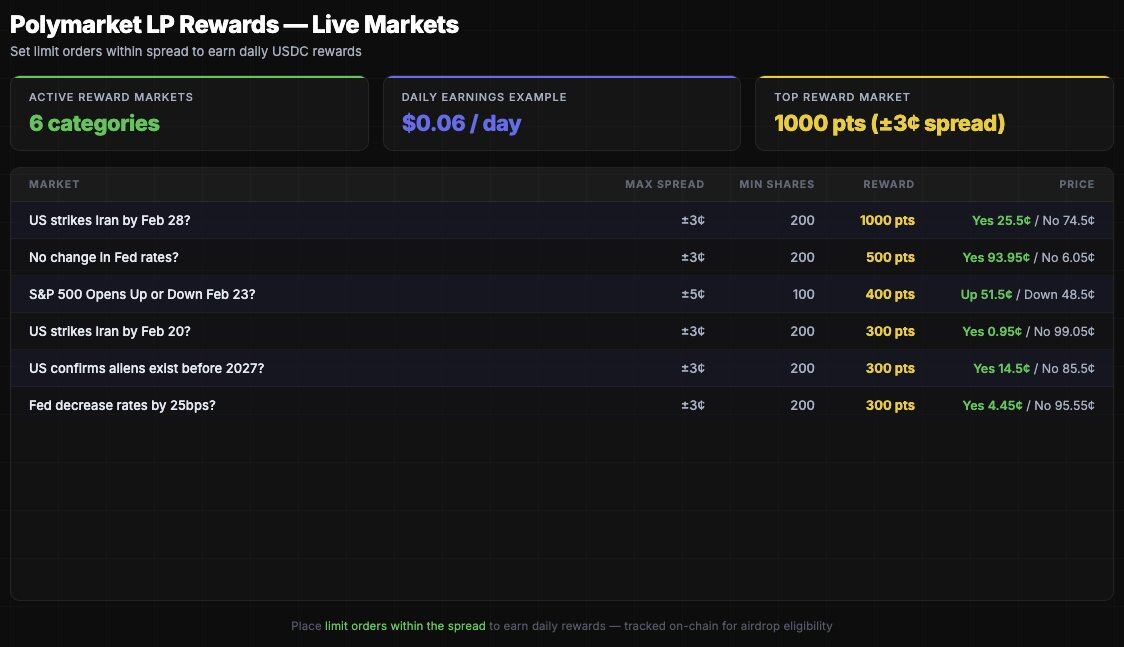

If participating in Polymarket starting with a principal of $5,000 in February 2026, the mathematically more favorable option for new participants is deploying LP.

- To earn $49 in LP rewards (top 10%), you need to consistently place limit orders in a high-reward market. If using $500-$1,000, this can be achieved within 30-60 days.

- To earn $1,563 in LP rewards (top 1%), you will need higher capital or sustained high-frequency participation.

As for trading volume, you need to focus on accumulating real trading volume without wash trading:

- Trade in more than 5 different category markets (politics, crypto, sports, science, culture);

- Hold positions for at least 1-24 hours before closing;

- Do not wash trade for the same market across different addresses;

- Accept moderate losses — this is proof of "real participation";

- Target market trading volume > $500,000 (Polymarket may filter out tiny markets);

- Single bet size: $50-$500.

Airdrop Model Speculation

Airdrops will not happen as most people expect.

Most airdrop speculations are based on the simplest volume-weighted distribution, but Polymarket will do it smarter and more interestingly. They have on-chain LP data that is clean, verifiable, and all measured in dollar terms. They also have trading volume data that can filter out witch patterns. They also have wallet age, market diversity, and geographical distribution data.

This is my model — Polymarket has not confirmed anything, so this is just my speculation.

- Volume weight is 40%: a square root compression formula will be used, with a minimum threshold of about $500;

- LP reward weight is 35%: on-chain verifiable, combating witch attacks;

- Market diversity weight is 15%: the number of independent markets participated in;

- Activity duration weight is 10%: the number of active months before the snapshot.

Furthermore, Polymarket will impose limits on rewards for a single address (possibly at $500,000), otherwise, the top 50 addresses will receive too large a share, undermining the community narrative. Losers will receive the same rewards as profitable peers with equal trading volume; profit is not the standard — this cannot be rationalized philosophically and creates distorted incentives.

79% of traders have never received a single dollar in LP rewards. If the LP weight accounts for 35% of the airdrop formula, the most capital-efficient behavior currently is to offer limit orders in high-volume markets and start accumulating on-chain traceable contribution proofs.

In short, POLY could become the largest airdrop in the history of prediction markets. Based on a $9 billion FDV, the total value of the community airdrop could reach $450 million to $900 million. Even capturing just 0.1% of that is $450,000. That’s why optimizing LP data now is much more important than most people realize.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。