The key to HIP-4 lies in integrating outcome contracts into the same margin framework as perpetual futures, allowing event trading to enter the same environment as other crypto derivatives.

Author: Predictefy

Translation: Deep Tide TechFlow

Deep Tide Introduction: In January 2026, prediction markets processed over $23 billion in nominal trading volume. Hyperliquid alone processed over $225 billion in the same month. Outcome trading could bring billions of dollars in new trading volume to prediction markets.

Predictefy's analysis points out that the key to HIP-4 is integrating outcome contracts into the same margin framework as perpetual futures, allowing event trading to enter the same environment as other crypto derivatives.

This could bring billions of dollars in new trading volume and open interest to prediction markets in a short time. A conservative estimate suggests partial adoption could reach a monthly trading volume of $28 billion, moderate adoption $33 billion, and strong integration could exceed $40 billion.

The full text is as follows:

Prediction markets processed over $23 billion in nominal trading volume in January 2026. Hyperliquid alone processed over $225 billion in the same month. Outcome trading could bring billions of dollars in new trading volume to prediction markets.

Prediction markets are growing rapidly, but they primarily operate independently. You can trade event outcomes, but these positions are not within the same system that traders use to manage broader market risks.

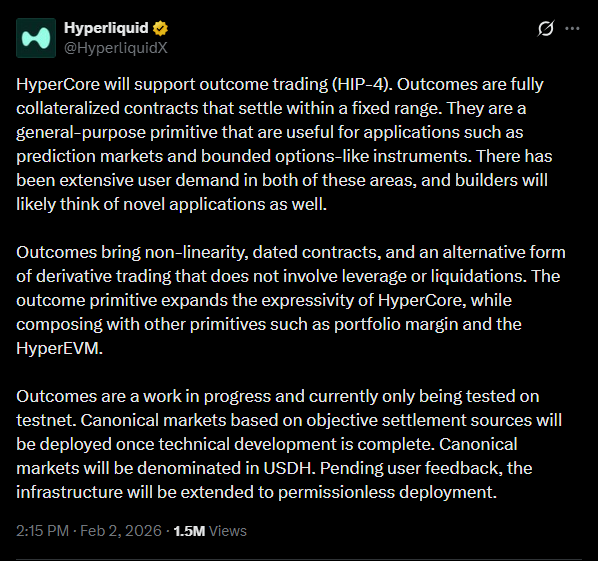

HIP-4 changes this. On Hyperliquid, outcome contracts share the same margin framework as perpetual futures, bringing event trading into the same environment as other crypto derivatives.

This could bring billions of dollars in new trading volume and open interest to prediction markets in a short time. Here’s how it works.

Prediction markets have reached a considerable scale

In the past year, prediction markets have surpassed niche activities.

- Weekly trading volume on major platforms has repeatedly exceeded $6 billion

- The last month recorded approximately $23.8 billion in nominal trading volume

- Market share remains concentrated, with platforms like Polymarket, Opinion, and Kalshi accounting for most of the activity

Despite this growth, prediction markets still primarily operate as independent venues. Event exposure, directional crypto exposure, and volatility exposure typically require separate platforms, collateral pools, and risk systems. This fragmentation limits capital efficiency and constrains the types of strategies traders can implement.

Outcome contracts bring risk into core infrastructure

The outcome contracts introduced by HIP-4 have several defining features:

- Positions are fully collateralized

- Settlements occur within a fixed and bounded payment range

- No clearing mechanism

- Contracts are event-based or time-based

- Positions are integrated into the same margin framework as perpetual futures

Binary contracts themselves are not new. The structural change lies in their integration into a unified derivatives engine. Event exposure can now share collateral with perpetual positions, allowing risk to be managed at the portfolio level rather than at the individual market level.

Enhancing capital efficiency

Previously, implementing event-driven strategies typically required traders to:

- Deposit collateral on prediction market platforms

- Deposit separate collateral on perpetual futures venues for hedging

- Independently manage risk and margin across venues

This setup increased capital requirements and operational complexity.

With outcome contracts in a shared trading environment, event exposure and directional hedges can be managed together. A portfolio margin system can identify offsetting risks, reducing overall margin usage. This aligns event trading with established derivatives risk management practices.

Current market size and trading volume growth potential

Prediction markets processed approximately $20-25 billion in monthly trading volume in January 2026 under today's isolated structure, with event trading positioned outside the broader derivatives stack.

In contrast, Hyperliquid recorded over $225 billion in perpetual futures trading volume in the same month, with daily perpetual trading volume reaching the billions. Derivatives liquidity pools are already much deeper than independent prediction market activities.

If HIP-4 improves capital efficiency and makes it easier to hedge event positions within the same system, trading activity could expand through structural turnover—more strategies operating on the same capital.

Conservative scenario suggestions:

- Partial adoption → $28 billion monthly prediction market trading volume

- Moderate adoption → $33 billion

- Strong integration → Over $40 billion

These estimates reflect strategic integration rather than speculative cycles and do not include the ongoing monthly growth already seen in prediction market trading volume, which could push the total higher.

Prediction markets begin to resemble options infrastructure

Outcome contracts introduce:

- Non-linear payments

- Event-driven settlements

- Bounded risk characteristics

These features overlap with options-style exposures. This creates a foundation for:

- Event volatility strategies

- Structured products containing outcome positions

- Systematic portfolios combining event and market risks

- Protocols for building new products on top of outcome primitives

Prediction markets are transitioning from being primarily narrative-driven to becoming components available within broader financial strategies.

Competitive landscape

Independent prediction market platforms retain advantages in brand recognition, liquidity depth, and simplicity. However, platforms that integrate event risk with perpetual contracts and other derivatives offer:

- Shared collateral pools

- Instant hedging within the same environment

- Net settlement of risk at the portfolio level

Even a partial migration of more advanced trading flows could impact the concentration of capital-efficient and hedge-intensive activities.

Signals of adoption

Structural adoption will be reflected in trading behavior, not just headline trading volume:

- Pairing outcome positions with perpetual hedges

- Growth in open interest for macro and policy events

- Emergence of vaults or structured strategies built on outcome exposure

- Narrowing spreads relative to independent prediction market venues

These signals indicate that outcomes are being used as financial instruments rather than isolated event trades.

Conclusion

Prediction markets have achieved scale but have remained structurally separate from the broader derivatives stack until now.

HIP-4 introduces a framework where event risk can coexist with perpetual futures within shared trading infrastructure. As this model develops, prediction markets may increasingly operate as components of diversified risk portfolios rather than as independent betting venues.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。