Author: zhou, ChainCatcher

Do you remember the explosive prediction event on Polymarket last October?

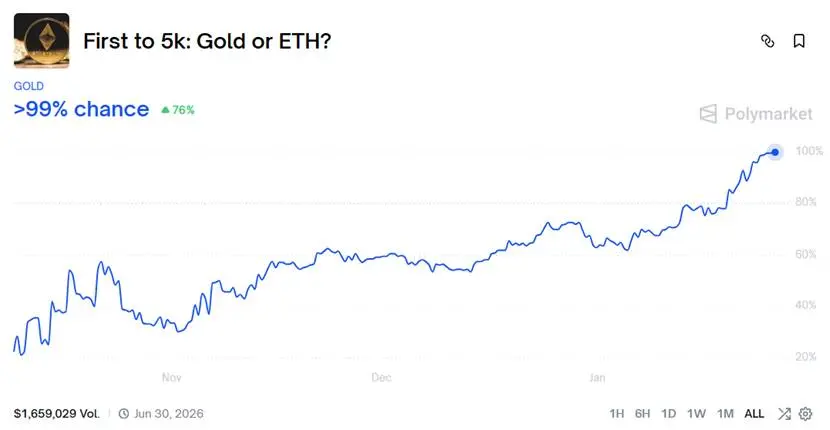

“First to $5,000: Gold or ETH?”

At that time, the price of Ethereum surged to around $4,800, and the market gave it an 80% probability of breaking through $5,000, with many believing that the era of digital gold had arrived.

Three months later, the market has provided an answer.

On January 26, spot gold broke through $5,100 per ounce, while Ethereum remained fluctuating between $2,800 and $3,000, with the overall cryptocurrency market in a slump.

In the face of extreme uncertainty in the macro environment, capital has collectively turned to the most traditional safe-haven assets, while cryptocurrencies, as high-volatility risk assets, were the first to be sold off.

Gold Soars, Cryptocurrency Market Votes with Its Feet

The rise in gold is driven by multiple macro factors.

First, the signals of hedging against U.S. dollar credit risk are becoming increasingly evident. The Danish academic pension fund AkademikerPension announced it would liquidate about $100 million in U.S. Treasury bonds by the end of the month, citing serious concerns about the U.S. fiscal situation. Sweden's largest private pension fund Alecta also disclosed that it has significantly reduced its holdings of U.S. Treasury bonds since early 2025, amounting to about $7.7 billion to $8.8 billion. Institutions view U.S. policy uncertainty and ongoing debt expansion as core reasons.

Second, geopolitical risks have intensified. Just a month into 2026, several significant global events have occurred, including the U.S. proposing to "strong buy" Greenland, a raid to capture the Venezuelan president, imposing a 25% tariff on countries trading with Iran, and further chaos within Iran. Coupled with the prolonged stalemate of the Russia-Ukraine conflict, geopolitical issues have not eased in the new year but rather show signs of worsening.

Additionally, inflation and currency devaluation pressures continue. With central banks engaging in massive monetary easing and the monetization of fiscal deficits, the purchasing power of paper currency is being continuously diluted. Gold and silver, as hard assets, naturally become the preferred choice for capital seeking safety.

Against this backdrop, institutional views on gold are rapidly turning optimistic. OCBC Bank has raised its gold price target for the end of 2026 to $5,600 per ounce; Goldman Sachs has also significantly adjusted its expectations, raising its year-end target from $4,900 to $5,400.

They emphasize that the continued buying by private investors and emerging market central banks is squeezing the limited supply of gold. Data shows that global central bank net gold purchases exceeded 1,100 tons in 2025, and it is expected to maintain a pace of over 60 tons per month in 2026. With the Federal Reserve possibly restarting interest rate cuts, gold ETF holdings have also begun to rebound.

In the cryptocurrency market, the investment enthusiasm for on-chain gold has also reached new heights. According to Coingecko data, the total market capitalization of tokenized gold has surpassed $525 million, and tokenized silver has also set a historical record. According to Lookonchain monitoring, a certain whale has incurred a loss of $18.8 million on ETH in a short period and is now doubling down on gold. It spent $36.04 million to buy 7,536 XAUT at an average price of $4,786, currently showing an unrealized profit of $2.3 million.

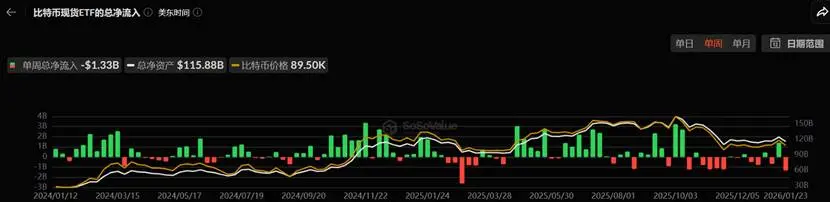

However, the cryptocurrency market presents a starkly different picture, with Bitcoin down 30% from last year's peak and Ethereum down about 40%. Last week, both Bitcoin and Ethereum spot ETFs recorded massive net outflows: Bitcoin ETF saw a net outflow of $1.33 billion (the second-highest weekly outflow in history), while Ethereum ETF had a net outflow of $611 million.

As of January 20, the earnings of the two largest cryptocurrency treasury companies varied. Bitcoin treasury company Strategy (MSTR) holds a total of 709,715 BTC at an average cost of $75,979, with an unrealized profit of $10.813 billion. Ethereum treasury company Bitmine (BMNR) holds a total of 4,203,036 ETH at an average cost of $3,857, with an unrealized loss of $3.232 billion.

Market sentiment is clearly leaning bearish. The famous trader and chart analyst Peter Brandt, who successfully predicted the Bitcoin crash in 2018, stated that the Bitcoin bear market channel has been completed and has issued another sell signal. He pointed out that Bitcoin's price needs to rise to $93,000 to offset the sell signal. Bloomberg analysts even believe that Ethereum has a higher likelihood of falling below $2,000 in the short term than returning to $4,000.

Capital Rotation: The Day Gold Stops Rising Will Be the Day Crypto Reverses?

However, the slump in the cryptocurrency market is more of a phase of capital rotation. In extreme risk-averse periods, the flow of funds typically first rushes into zero credit risk assets like U.S. Treasuries and gold, and only gradually returns to the stock market and cryptocurrency market after the peak of risk has passed.

Currently, the collective rise of gold, silver, and some commodities represents a concentrated phase of defensive allocation. Once gold approaches institutional target price levels and momentum weakens, or if a major macro risk shows signs of easing, profit-taking may begin to seek the next high-return opportunity. At that time, deeply corrected and fully washed-out leveraged crypto assets will become the most natural recipients.

Specifically for Bitcoin and Ethereum, the signals for bottoming are becoming increasingly clear.

For Bitcoin, large realized losses on-chain are often a classic bottom characteristic. CryptoQuant data shows that Bitcoin's realized losses have reached $4.5 billion, the highest level in three years. The last time this occurred, Bitcoin's price was trading at $28,000 after a brief adjustment period of about a year.

On the institutional side, Bitcoin treasury companies are continuously increasing their BTC holdings through financing schemes, especially since MSCI decided not to temporarily remove DAT from the index, prompting passive funds like Vanguard to follow up and buy MSTR stock. Arthur Hayes publicly stated that the core trading strategy for this quarter is to go long on MSTR and Metaplanet.

Ethereum's situation is similar. On one hand, over 36 million ETH are currently staked, accounting for nearly 30% of the circulating supply, with the exit queue close to zero, as validators express their long-term confidence in the network through their actions. On the other hand, BitMine recently received shareholder approval to increase the cap on the company's issued stock to enhance future financing flexibility, and it is highly likely to continue increasing its Ethereum holdings.

It is worth mentioning that currently, the probability of BlackRock executive Rieder succeeding the Federal Reserve chair is close to 50%, clearly leading over competitors. Market analysis suggests that if this event comes to fruition, his friendly stance towards RWA and the crypto ecosystem will bring significant momentum to the cryptocurrency market.

However, history has proven countless times that when precious metals go crazy, they are completely unreasonable.

How high can gold rise next? No one knows. What needs to be done now is not to guess where the top is, and certainly not to short it. In an era of inflation cycles and credit reassessment, it is difficult to say that gold has reached its peak.

Loyal cryptocurrency investors may have to patiently wait for the rotation signal to appear. Hopefully, that day will come sooner than we imagine.

Click to learn about job openings at ChainCatcher

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。