Compiled by: Jerry, ChainCatcher

Performance of Crypto Spot ETFs Last Week

Net Inflow of $1.416 Billion for U.S. Bitcoin Spot ETFs

Last week, U.S. Bitcoin spot ETFs saw a net inflow over four days, totaling $1.416 billion, with total assets under management reaching $124.56 billion.

Nine ETFs experienced net inflows last week, primarily from IBIT, FBTC, and BITB, which saw inflows of $1.034 billion, $194 million, and $79.6 million, respectively.

Data Source: Farside Investors

Net Inflow of $479 Million for U.S. Ethereum Spot ETFs

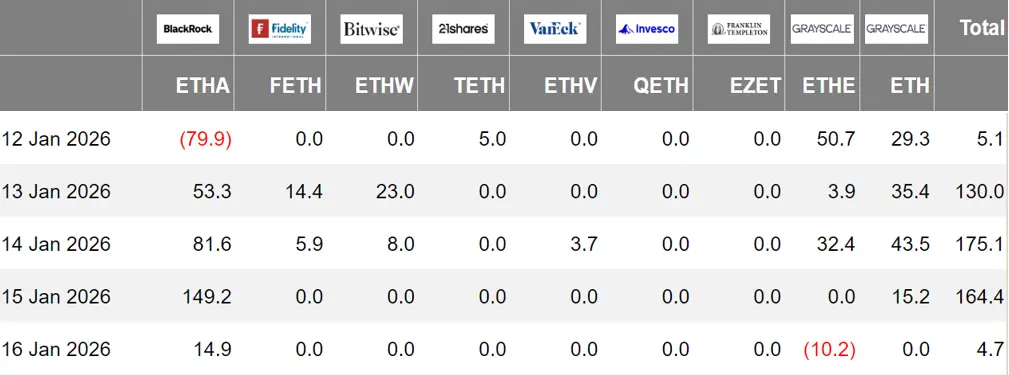

Last week, U.S. Ethereum spot ETFs had a net inflow over five days, totaling $479 million, with total assets under management reaching $20.42 billion.

The inflow was mainly from Grayscale ETHE, which had a net inflow of $219 million. Seven Ethereum spot ETFs were in a net inflow state.

Data Source: Farside Investors

No Fund Inflows for Hong Kong Bitcoin Spot ETFs

Last week, Hong Kong Bitcoin spot ETFs had no fund inflows, with total assets under management reaching $36.4 million. The holdings of the issuer, Harvest Bitcoin, decreased to 290.85 BTC, while Huaxia maintained 2390 BTC.

Hong Kong Ethereum spot ETFs saw a net outflow of 0.02 ETH, with total assets under management at $10.6 million.

Data Source: SoSoValue

Performance of Crypto Spot ETF Options

As of January 16, the nominal total trading volume of U.S. Bitcoin spot ETF options was $848 million, with a total long-short ratio of 2.89.

As of January 15, the nominal total open interest of U.S. Bitcoin spot ETF options reached $33.67 billion, with a total long-short ratio of 1.71.

The market's short-term trading activity for Bitcoin spot ETF options has decreased, with overall sentiment leaning bullish.

Additionally, the implied volatility is at 42.60%.

Data Source: SoSoValue

Overview of Crypto ETF Dynamics Last Week

Defiance to Close and Liquidate Nasdaq-Listed Ethereum ETF

According to Globenewire, Defiance has announced its decision to close and liquidate its Nasdaq-listed Ethereum exchange-traded fund: Defiance Leveraged Long and Yield Ethereum ETF (ETHI).

Additionally, Defiance will close and liquidate another seven leveraged long and yield ETFs, namely: PLT, HOOI, SMCC, AMDU, HIMY, TRIL, LLYZ.

Data: Bitwise LINK Spot ETF Listed, U.S. LINK Spot ETF Sees $2.59 Million Net Inflow in a Day

The Bitwise Chainlink ETF (ticker CLNK) has officially listed on the NYSE, bringing the total number of LINK spot ETFs to two.

According to SoSoValue data, CLNK had a net inflow of $2.59 million on its first day of trading, with a trading volume of $3.24 million and total assets under management of $5.18 million.

Yesterday, the Grayscale Chainlink Trust ETF had no net inflow, with a historical total net inflow of $63.78 million.

The Bitwise Chainlink ETF supports cash/physical redemptions, with a management fee of 0.34%, and does not currently support staking.

As of the time of writing, the total assets under management of LINK spot ETFs are $95.87 million, with a LINK net asset ratio of 0.95%, and a historical cumulative net inflow of $66.38 million.

U.S. SEC Delays Decision on PENGU and T. Rowe Crypto ETFs

According to Cointelegraph, the U.S. Securities and Exchange Commission (SEC) has extended the decision deadline for two crypto-related exchange-traded funds (ETFs) while opening public commentary on a third crypto fund option.

The SEC stated in a Federal Register notice that it will extend the consideration period for allowing the listing of the Canary Pudgy Penguins (PENGU) ETF on Cboe BZX and the T. Rowe Price Active Crypto ETF on NYSE Arca. Both applications follow the SEC's standard 19b-4 process, allowing regulators to extend the initial decision window by up to 45 days.

Views and Analysis on Crypto ETFs

Bloomberg ETF analyst Eric Balchunas stated, "Bitcoin ETFs recorded a strong performance yesterday with a net inflow of $843 million, bringing the total net inflow for the past week to $1 billion, and the cumulative net inflow year-to-date to about $1.5 billion. In terms of price, Bitcoin is currently around $97,000, after seemingly oscillating around $88,000 for nearly half a year. The overall feeling is that buying pressure may have gradually absorbed, or even exhausted, selling pressure, but we will need to continue to observe how it unfolds."

Bitwise CIO: If ETFs Continue to Accumulate, Bitcoin May Repeat Gold's Parabolic Surge in 2025

Bitwise Chief Investment Officer Matt Hougan stated on X that Bitcoin's price is expected to repeat gold's trajectory in 2025, as ETFs continue to absorb all new supply. He pointed out that gold initially reacted slowly after central banks doubled their purchases in 2022, only to surge 65% in 2025 once selling pressure was exhausted. Currently, Bitcoin ETFs have been buying over 100% of new supply since their launch in January 2024, and if this demand continues, a significant price increase may occur after long-term sellers are exhausted.

According to Cointelegraph, Bitcoin briefly rose above $92,000 on Monday due to a criminal investigation into Federal Reserve Chairman Powell by U.S. federal prosecutors. Analysts questioned whether the independence of the Federal Reserve might be impacted, which could benefit alternative assets like Bitcoin that are seen as scarce.

Despite this news causing a temporary spike, traders remain cautious overall, primarily due to continuous fund outflows from Bitcoin ETFs and weak demand for leveraged positions. Even with recent rebounds, Bitcoin is still down about 23% from its October 2025 peak, while gold and silver reached historical highs in 2026. This divergence in trends has led traders to begin questioning whether the narrative of "Bitcoin as a digital store of value" is weakening.

The annualized premium of Bitcoin futures (i.e., basis) remains at a neutral bearish level of about 5%. Generally, when market sentiment truly turns bullish, the premium of Bitcoin futures relative to spot often reaches or exceeds 10%. More importantly, Bitcoin spot ETFs recorded a total net outflow of $1.38 billion over four consecutive trading days.

Even more concerning is that despite Strategy increasing its Bitcoin holdings by approximately $1.25 billion over the past month, the Bitcoin price has still failed to effectively hold above $94,000. Overall, the attractiveness of Bitcoin and cryptocurrencies remains low, as reflected in ETF fund flows and weak demand for Bitcoin leveraged long positions. This indicates that the probability of an unexpected surge to $105,000 in the short term is relatively low.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。