The reversal of the Federal Reserve's interest rate cut expectations has led to significant fluctuations in BTC prices, with the market experiencing extreme fear for 12 consecutive days. ETF funds continue to flow out, the altcoin market is sluggish, and investor trading enthusiasm has declined.

Author: Yuuki, Deep Tide TechFlow

I. Overall Performance

1. Macroeconomic Events:

Last week, the market was significantly affected by macro liquidity events, with BTC prices fluctuating sharply around the Federal Reserve's interest rate cut expectations.

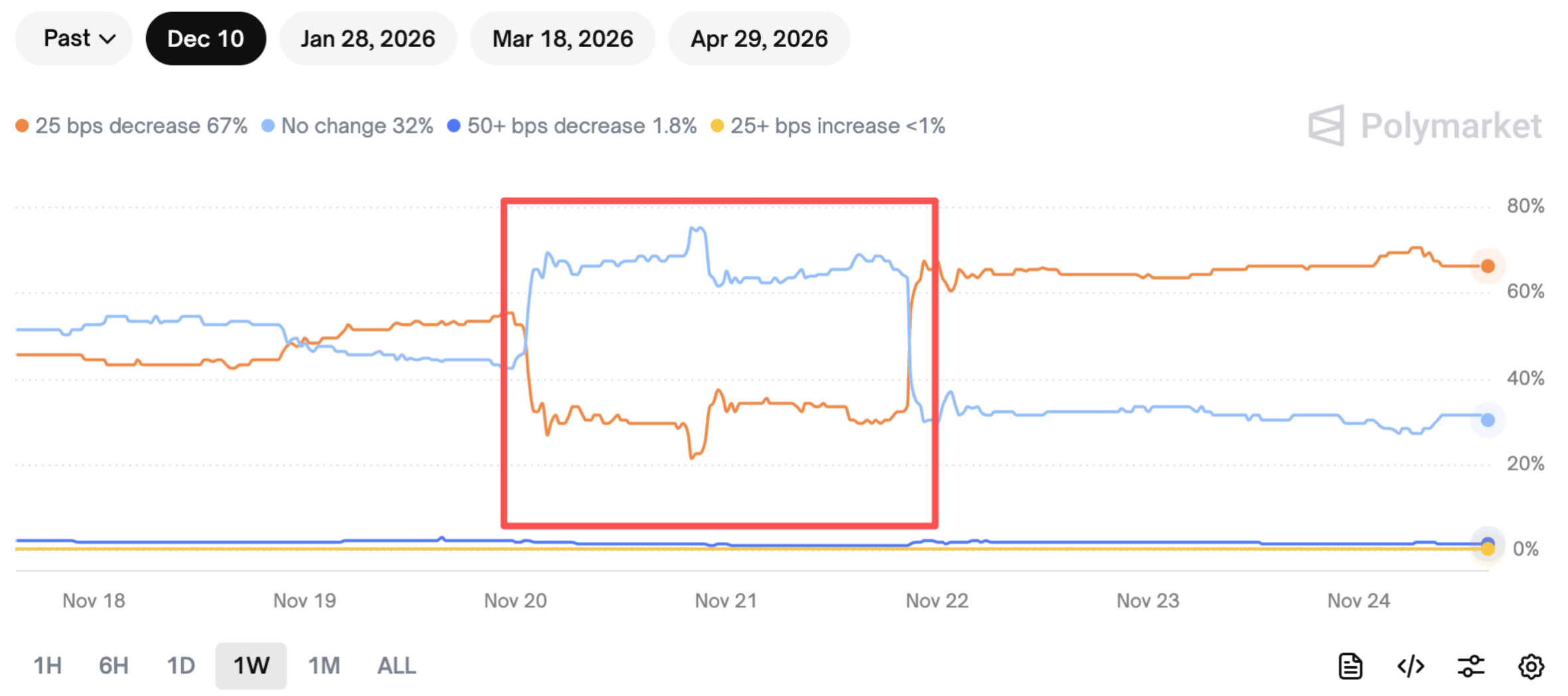

On November 20, Beijing time, the minutes from the Federal Reserve's October meeting were released, containing hawkish language; subsequently, JPMorgan released a viewpoint stating that the Federal Reserve would not cut rates in December. As a result, the market continuously lowered its expectations for a December rate cut to as low as 22%; BTC saw a maximum drop of 13% over two days, reaching a weekly low of 80,600.

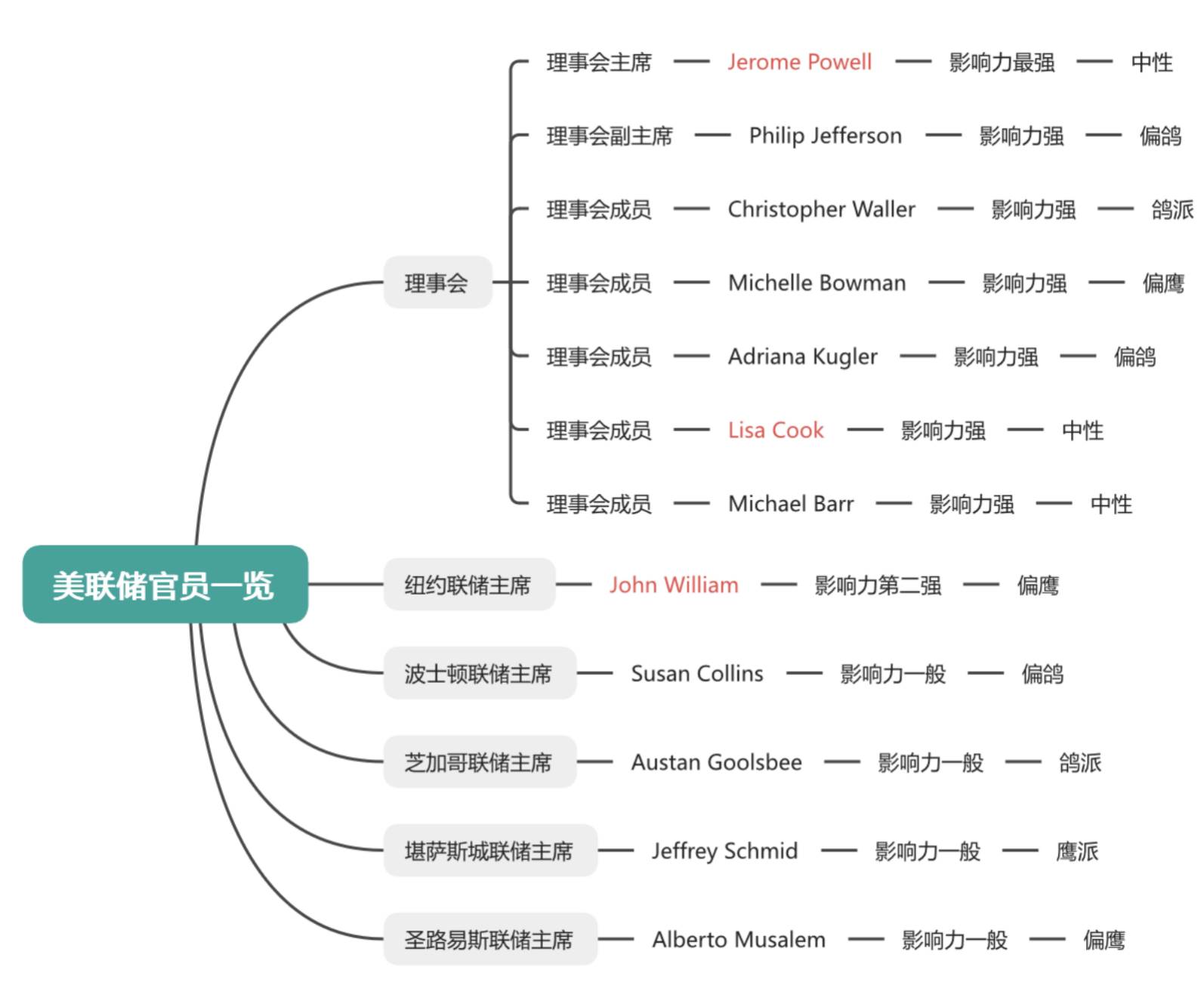

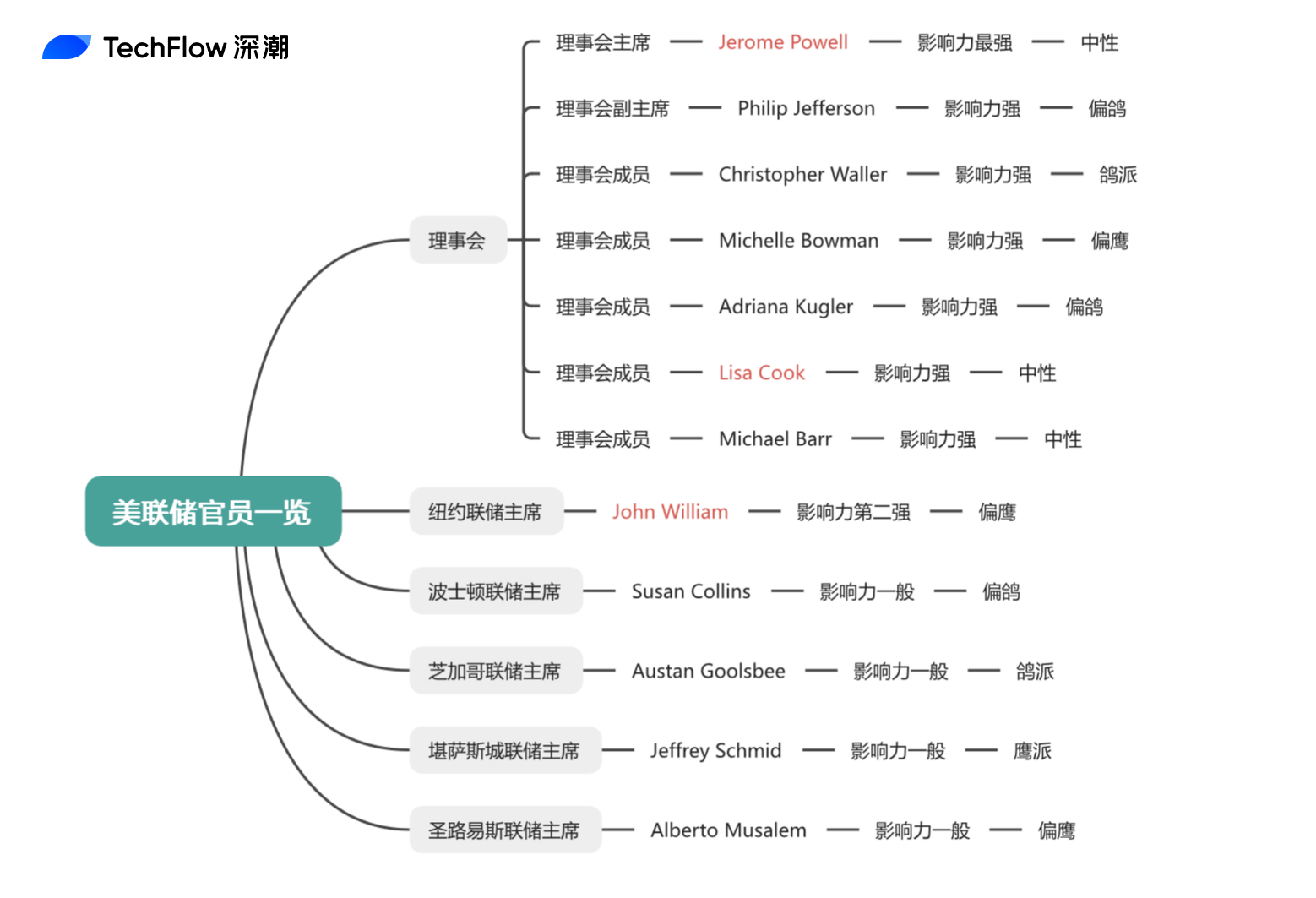

However, following the dovish remarks from Federal Reserve official John Williams on the evening of November 21, expectations for a December rate cut dramatically reversed (John Williams is the President of the New York Fed and the only local Fed president with permanent voting rights, considered the de facto second-in-command of the Federal Reserve, and has historically held a hawkish stance, suddenly turning dovish and breaking market expectations).

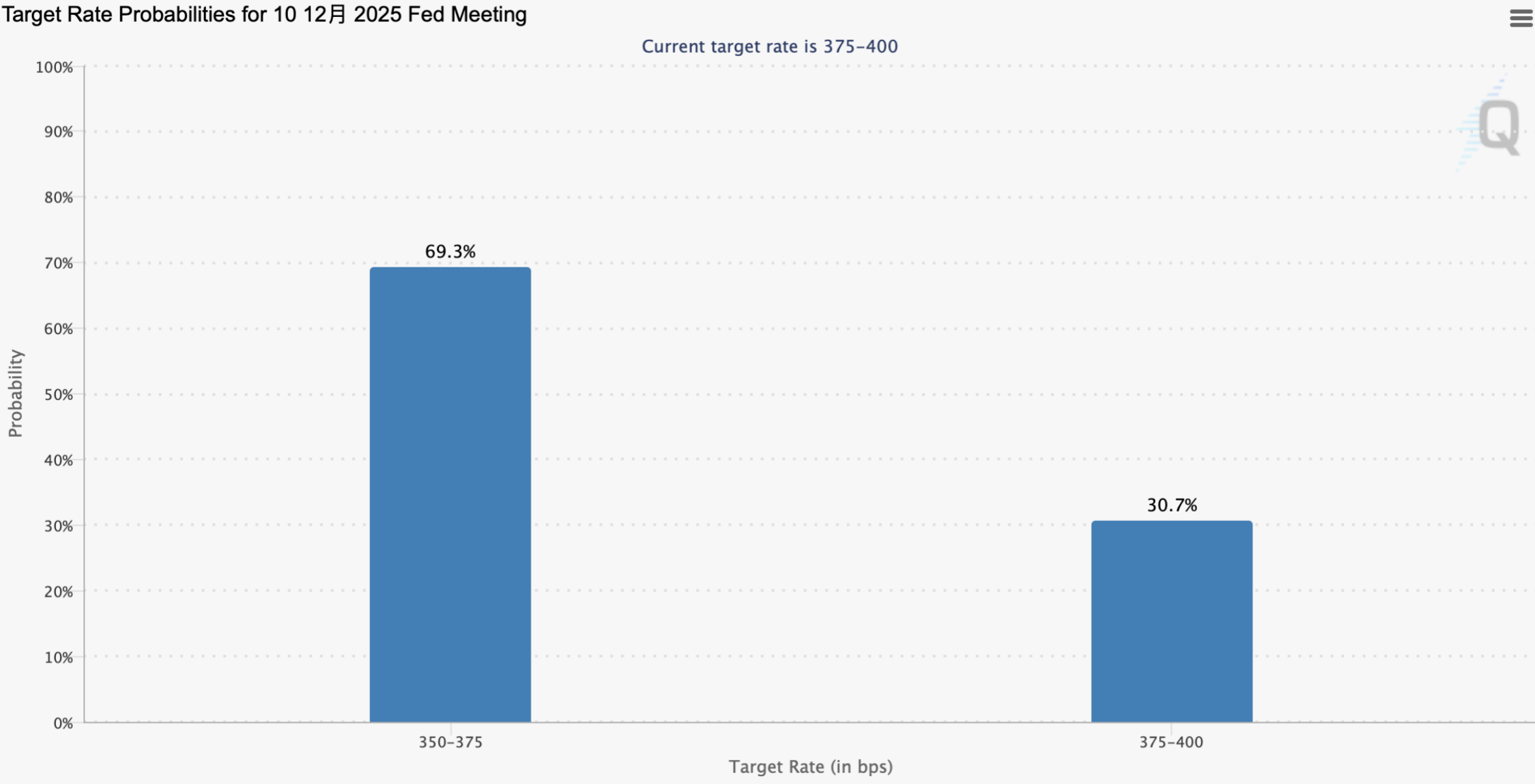

Currently, according to CME data, the probability of a 25 basis point rate cut in December is 69.3%; BTC and U.S. stocks have begun to recover. Next week, on December 29, the Federal Reserve will enter a quiet period before the rate cut, and macro indicators such as Japanese government bond yields, private credit default rates, the end of QT on December 1, and TGA spending rates will continue to be monitored.

NVIDIA released its earnings report last Thursday, showing better-than-expected growth but failing to stabilize its stock price, with investor sentiment towards U.S. stocks becoming increasingly bearish, focusing on the downside risks of the U.S. stock market.

Figure: Probability of a 25 basis point rate cut by the Federal Reserve in December rises to 69.3%

Data Source: CME Group

Figure: Dramatic reversal of rate cut expectations from November 20-21, with BTC prices fluctuating in sync

Data Source: Polymarket

The following chart summarizes the influence of current Federal Reserve officials and their historical hawkish-dovish positions, with Powell and Williams having the strongest influence. Additionally, based on the current statements from Federal Reserve officials, Cook's vote may become the key vote for whether the Federal Reserve cuts rates in December.

Figure: Summary of the influence and hawkish-dovish positions of current Federal Reserve officials

Data Source: TechFlow Compilation

The yield on 10-year Japanese government bonds has risen to 1.78%. If it continues to rise, along with an increase in the yen exchange rate, caution is needed regarding the liquidity tightening of dollar assets caused by the unwinding of yen carry trades; the narrow arbitrage scale of the yen (short-term foreign debt of the Bank of Japan) is about $350 billion, while the broad yen arbitrage trading scale, including institutional overseas investments, exceeds $1 trillion.

Figure: 10-year Japanese government bond yield rises to 1.78%

Data Source: TradingView

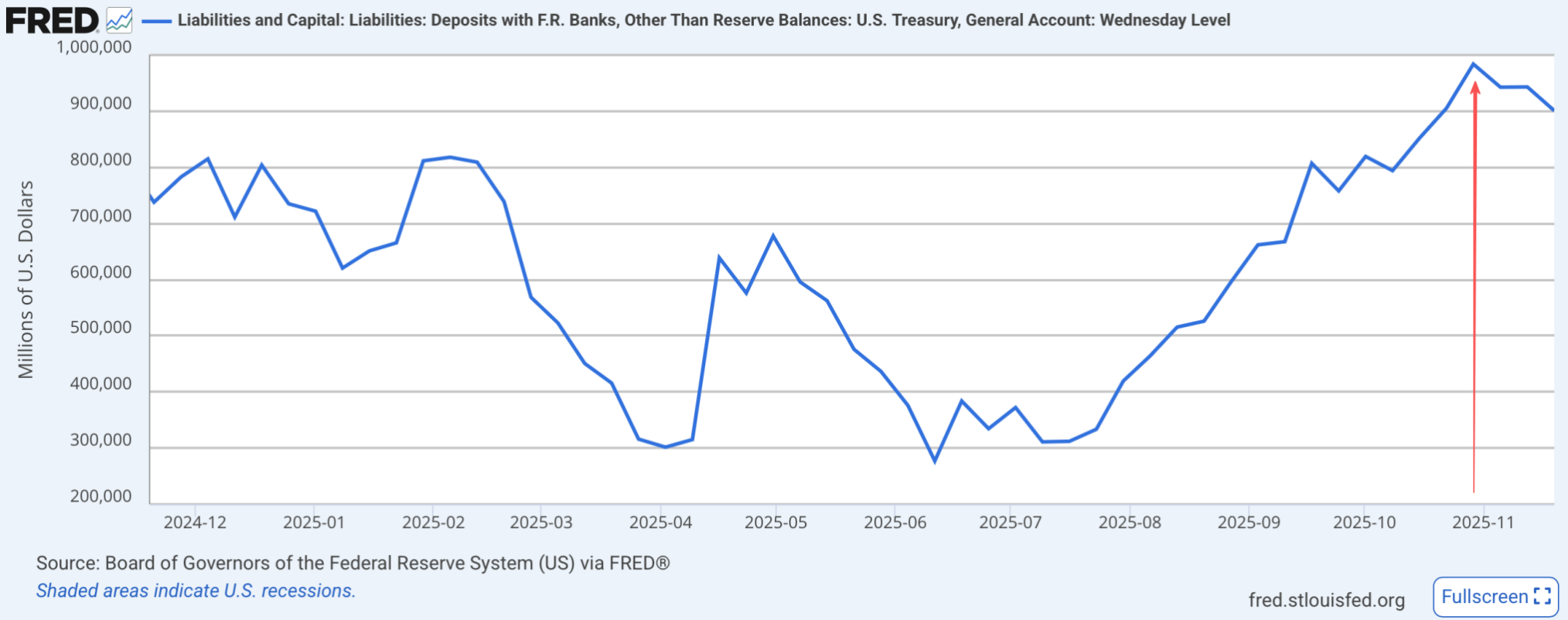

After the government shutdown ended, the TGA account balance has not shown a significant decline, and liquidity has yet to be injected into the market.

Figure: TGA account balance

Data Source: FRED

2. Market Sentiment:

For the past seven days, market sentiment has remained in a state of extreme fear. After BTC broke down to 80,600 on November 21, it began to recover, and the fear and greed index has also risen somewhat, but it has not yet exited the extreme fear zone. The market has now been in the extreme fear zone for 12 consecutive days, the first time since July 2022; the last time this occurred was due to the bankruptcy of the FTX exchange, which caused the market to remain in extreme fear for two months from May to July 2022.

Figure: Market sentiment was extremely fearful last week

Data Source: Coinglass

3. Specific Data:

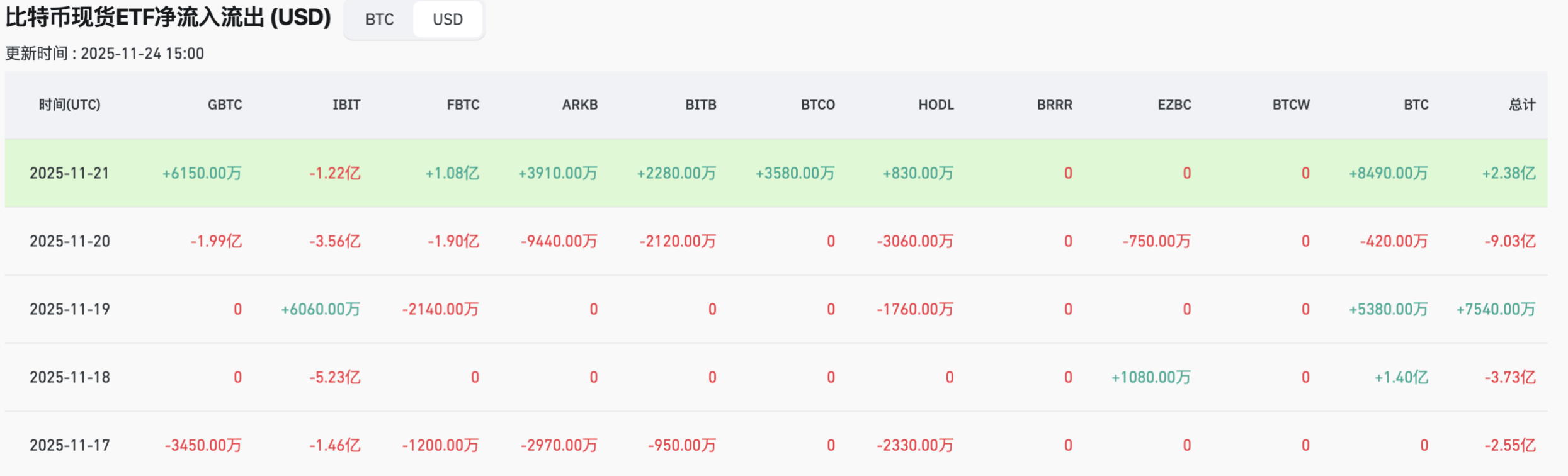

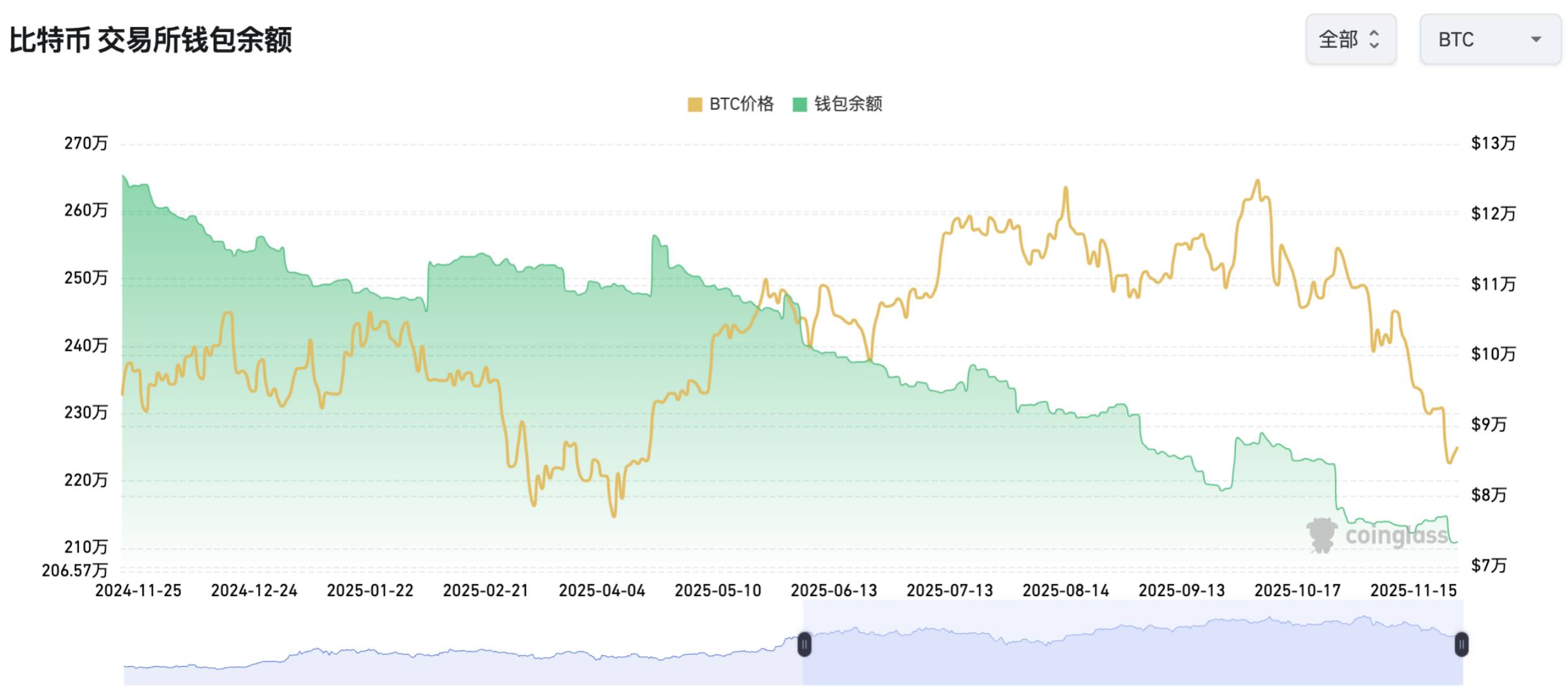

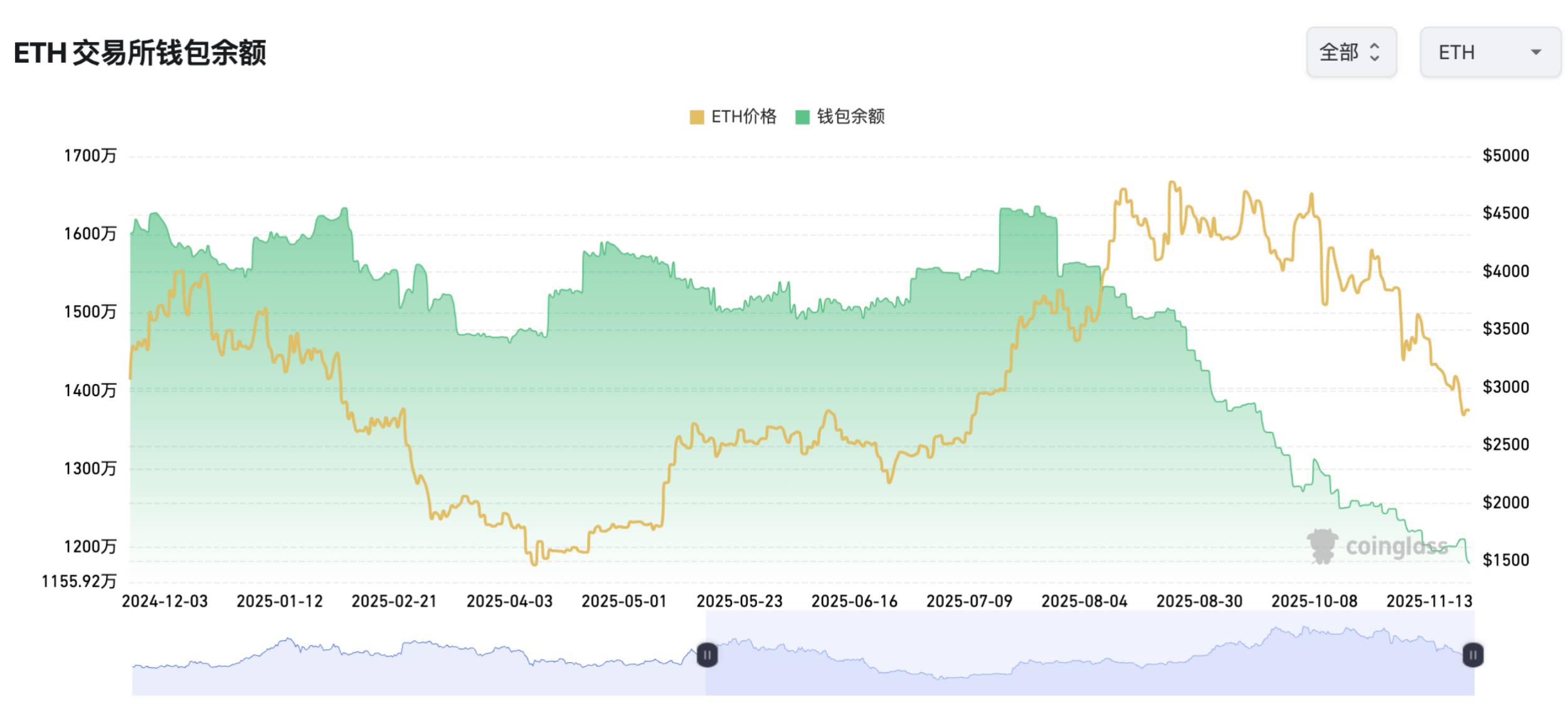

Last week, BTC ETF outflows totaled $1.218 billion, a week-on-week increase of 9.5%; ETH ETF outflows were $500 million, a week-on-week decrease of 31.3%. Currently, the BTC exchange balance is 2.1095 million coins, a week-on-week decrease of 1.3%; the ETH exchange balance is 11.7951 million coins, a week-on-week decrease of 1.76%. Data is as of November 16, with the market capitalization of stablecoins at $264.824 billion, a week-on-week decrease of 0.1%.

Figure: BTC ETF outflows of $1.218 billion, a week-on-week increase of 9.5%

Data Source: Coinglass

Figure: ETH ETF outflows of $500 million, a week-on-week decrease of 31.3%

Data Source: Coinglass

Figure: BTC exchange balance decreased by 1.3% week-on-week

Data Source: Coinglass

Figure: ETH exchange balance decreased by 1.76% week-on-week

Data Source: Coinglass

Figure: Stablecoin market capitalization decreased by 0.1% week-on-week

Data Source: Coinglass

II. Local Hotspots

- Last week, the overall market was sluggish, and the privacy sector also began to decline, with ZEC dropping 18% over the week, showing a high-level consolidation; STRK plummeted 31% over the week, essentially falling back to its starting point; HYPE faced a large unlock, dropping 18% over the week; the PUMP team continued to sell coins for cashing out, with the coin price dropping 26% over the week; the small coin TNSR surged, increasing 250% over the week, with a peak increase of 800% during the week. The Tensor Foundation acquired the Tensor marketplace from Tensor Labs, destroying 22% of the TNSR tokens held by Tensor Labs.

Figure: Price and trading volume performance of popular assets

Data Source: Rootdata

Last Friday, Base founder Jesse issued his eponymous token "jesse" on the Base chain through the Zora platform, with a peak market capitalization of $30 million, corresponding to an opening sniper profit of about 2-3 times. Currently, the market capitalization of the jesse token has dropped to $13 million, equal to the opening price available to most investors.

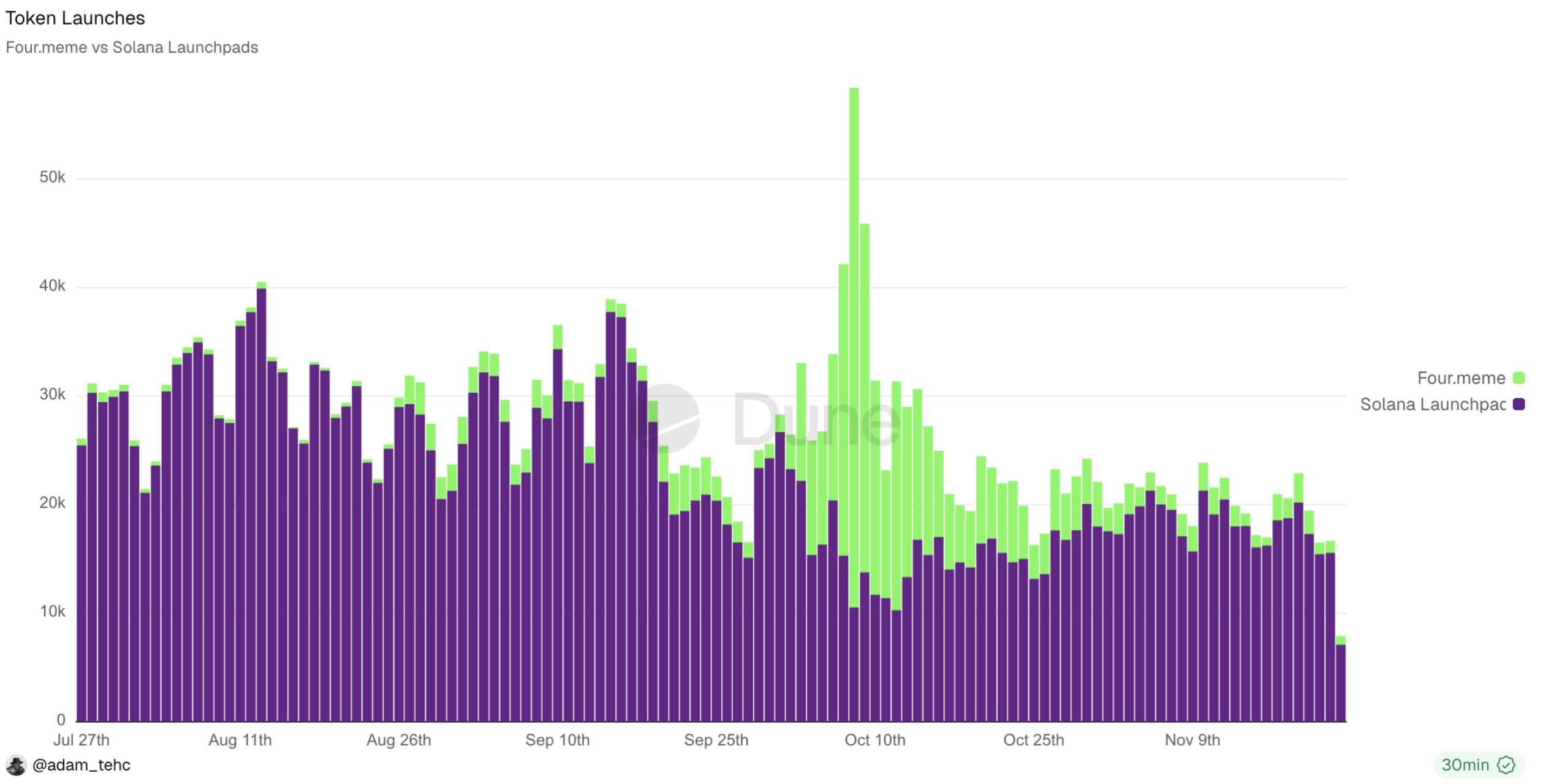

Last week, the open interest and trading volume of altcoin contracts on exchanges continued to decline, with investor trading enthusiasm waning; the number of tokens minted on the Solana and BSC chains remained low. Solana's official Twitter hinted that something significant is about to happen, but the market still lacks hotspots.

Figure: Open interest and trading volume of altcoin contracts continued to decline

Data Source: Coinglass

Figure: Token issuance on Solana and BSC chains remains low

Data Source: Dune

- Important news from last week:

Federal Reserve's Williams: The Federal Reserve may still cut rates in the short term;

MSCI considers excluding companies with over 50% exposure to digital assets from major indices;

CryptoSlate reported that several Wall Street institutions sold Strategy stocks in Q3, with a total value of approximately $5.38 billion;

Franklin Templeton's XRP ETF received approval for listing on the NYSE Arca, trading under the ticker XRPZ;

U.S. Treasury Secretary Yellen: Interest rate-sensitive sectors are in a painful period, expecting improvement by 2026, and the overall economy is not facing recession risks;

U.S. Congressman proposed the "Bitcoin for America" bill, aiming to enshrine strategic Bitcoin reserves into law;

Mt. Gox transferred 10,608 BTC, valued at $954 million;

Base co-founder Jesse launched the jesse token on November 21.

III. This Week's Focus

1. Macroeconomic Events:

November 25: U.S. September retail sales month-on-month; U.S. September PPI data;

November 26: U.S. initial jobless claims for the week;

November 28: Japan's October unemployment rate;

December 1: Speech by Bank of Japan Governor Ueda Kazuo.

2. Token Unlocks:

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。