Author: @BlazingKevin_, the Researcher at Movemaker

1 Research Summary

Figure Technology Solutions (hereinafter referred to as "Figure") is at the forefront of the transformation in the financial services industry, committed to reshaping traditional lending and capital markets through blockchain technology. As a vertically integrated fintech company, Figure is not only the largest non-bank home equity line of credit (HELOC) originator in the United States but also a key infrastructure provider in the tokenization of real-world assets (RWA). By December 2025, Figure has successfully completed its IPO, with a market capitalization stabilizing between $7.5 billion and $9 billion.

The core argument of this report is that Figure represents the third phase of fintech development: from "online" (like Rocket Mortgage) to "platform" (like SoFi), and now to "on-chain." Figure utilizes its public blockchain, Provenance Blockchain, developed on the Cosmos SDK, to successfully address the most challenging "back-office efficiency" issues in traditional finance. By minting, registering, and trading assets (such as mortgages and ownership records) directly on-chain, Figure is able to reduce the costs of loan origination and securitization by over 100 basis points and shorten processing times from the traditional 30-45 days to under 5 days.

2025 is a pivotal year for Figure. The company not only achieved GAAP profitability, with a net profit of nearly $90 million in Q3, but also completed a strategic merger with Figure Markets, reintegrating its lending business with the digital asset trading platform. This initiative has built a closed-loop ecosystem: consumers can mortgage properties to obtain funds, which are issued in the form of interest-bearing stablecoins ($YLDS), and can be directly invested in the Figure Markets exchange or re-staked in the Democratized Prime protocol. This integration of the "asset side" and "funding side" showcases the ultimate vision of the RWA sector.

This report will analyze Figure's Q3 financial report and assess whether its "blockchain-native" strategy constitutes a true moat based on recent updates to its revenue sources and business model, as well as its long-term investment value in the increasingly crowded RWA sector.

2 Business Segments and Product Lines

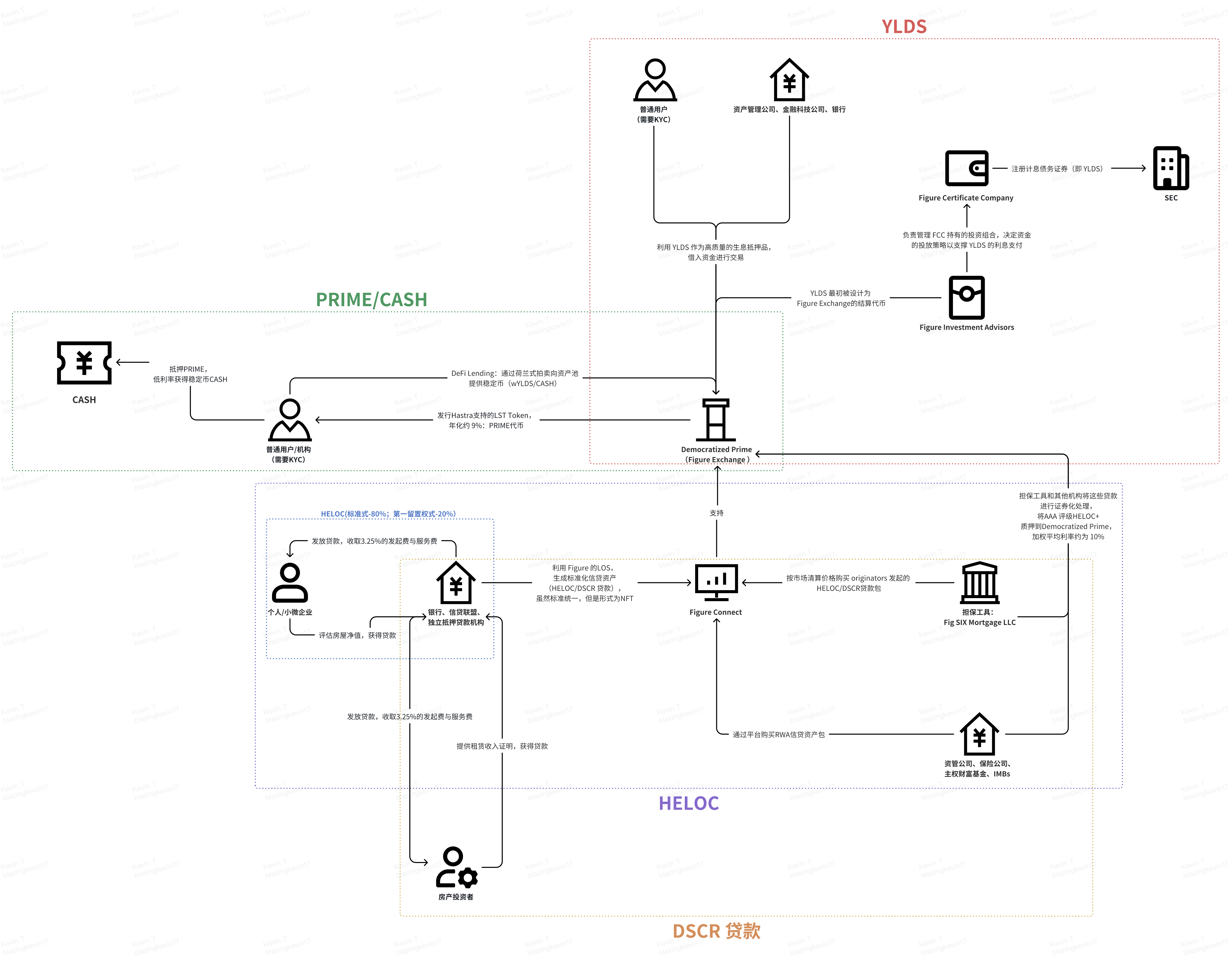

After completing the merger with Figure Markets in July 2025, Figure's business structure has become more cohesive and vertically integrated. Figure's core competitiveness lies in digitizing the entire lifecycle of assets (origination, registration, trading, financing, settlement) through the Provenance blockchain. Based on this, we have organized Figure's four core business models: RWA asset origination and distribution, capital protection and securitization, DeFi financing and lending, interest-bearing stablecoins and payment settlement. As shown in the figure below, we connect these four business areas to clarify Figure's complete business model.

2.1 RWA Asset Origination and Distribution

2.1.1 HELOC

This is Figure's "foundation," aimed at addressing the pain points of manual operations, paper reliance, and high costs (industry average of $11,230) in the traditional credit market. Focusing on HELOC, it is noteworthy that the trading volume of DSCR loans surged significantly in Q3. First, HELOC is Figure's flagship product.

Product Mechanism and User Experience: Traditional banks typically require 30 to 45 days to process HELOCs, involving cumbersome offline assessments and notarizations. Figure leverages automated valuation models (AVM) and immutable records on the blockchain to achieve an exceptional experience of "5-minute approval, 5-day funding." This speed advantage directly addresses market pain points, especially in a high-interest environment where homeowners prefer to obtain liquidity through HELOCs rather than selling their homes, thus avoiding the loss of their existing low-rate mortgages.

Market Position: Since its inception, Figure has issued over $19 billion in loans, becoming the largest non-bank HELOC originator in the United States. Its market share among non-bank institutions is overwhelmingly dominant.

HELOC+ is the highest tier premium loan pool within this protocol. Its underlying collateral consists of HELOC asset packages originated by Figure and its partners, which have been tokenized on the Provenance chain, with credit quality comparable to assets rated AAA by S&P.

From another perspective, regarding the HELOC business, the stakeholders involved from loan origination to the final securitization of RWA assets and their behavioral objectives are as follows:

Borrowers (individuals/small businesses):

◦ Apply for home equity lines of credit (HELOC) or small business loans (SMB) through Figure's 100% digital process.

◦ Authorize the system to automatically verify income, assets (AVM automated valuation), and credit scores, achieving "5-minute approval, 5-day funding."

Originating Partners (banks, credit unions, independent mortgage lenders):

◦ Utilize Figure's white-label loan origination system (LOS) to produce standardized credit assets according to unified underwriting standards.

◦ Pay Figure a transaction-based processing fee.

◦ Place the produced credit asset packages on the Figure Connect marketplace for bidding or sale based on forward commitments, achieving rapid capital turnover without long-term balance sheet occupation.

Figure Connect Platform (intermediary):

◦ Convert credit assets into "digital twin" tokens on the Provenance chain, ensuring the uniqueness and immutability of ownership, composition, and performance history.

◦ Facilitate transactions between originating banks and capital market buyers (institutions), providing real-time, atomic on-chain settlement services.

Institutional Buyers (asset management companies, insurance companies, sovereign wealth funds):

◦ Purchase homogeneous credit asset packages with AAA rating potential through the platform, gaining transparent, data-rich credit exposure.

◦ Enjoy settlement speeds several times faster than traditional secondary markets (from months reduced to days/seconds).

2.1.2 First Lien HELOC

In Figure's business model, the cash-out refinancing business is being reshaped through its innovative "First Lien HELOC" product. This business has grown rapidly, with trading volume in the first half of 2025 increasing nearly threefold year-on-year. Next, we will explain the core differences between cash-out refinancing and HELOC business.

In traditional finance and Figure's blockchain-native credit model, while both are means for homeowners to extract home equity, there are significant differences in loan nature, lien priority, and capital market performance.

1. Loan Nature and Credit Structure: Start and Revolving

- HELOC: Under legal and regulatory frameworks (such as the Truth in Lending Act TILA), HELOC is defined as "open-end credit." Its core feature is that homeowners can repeatedly withdraw and repay funds within a specified draw period (usually 2 to 5 years). Figure's HELOC product allows borrowers to withdraw multiple times as needed without incurring additional out-of-pocket costs or payoff fees.

- Cash-out Refinancing: This typically falls under "closed-end credit." Homeowners apply for a new loan larger than the original mortgage amount, pay off the old loan, and receive the remaining cash difference in one lump sum. It is not a revolving credit line but a one-time debt restructuring action.

2. Differences in Lien Priority

HELOC: Typically exists as a "second lien." This means it is an additional liability on top of the homeowner's existing first mortgage. In liquidation, its repayment order is after the first mortgage, thus carrying a higher risk weight.

Refinancing Business: Necessarily involves "first lien." Since it replaces the old loan with a new loan, the new lender will obtain the primary lien on the property. One of Figure's fastest-growing products in recent years is the "First Lien HELOC," which is essentially designed as an alternative to traditional cash-out refinancing.

3. Efficiency and Cost Differences under Figure's Model

According to Figure's business data, it has achieved a disruptive cost reduction in these two types of businesses through blockchain technology:

- Cost Comparison: Figure's cost for processing first lien loans (refinancing alternatives) is only $1,000, while the industry average cost is as high as $12,000. For traditional HELOCs, Figure's average production cost is only $730, far below the mortgage industry's average cost of $11,230.

- Funding Time: Whether refinancing or HELOC, through Figure's automated loan origination system (LOS), homeowners can typically receive approval within 5 minutes, with a median funding time of 10 days, while the traditional industry median time is about 42 days.

4. Capital Market and Securitization Logic

- HELOC Securitization: Figure has successfully issued multiple asset-backed securities (ABS) supported by HELOCs, with senior debt repeatedly receiving AAA ratings from S&P and Moody's. Since HELOCs are often second liens, rating agencies typically assume their default loss rates are higher than those of first lien assets.

- Refinancing (First Lien) Performance: Due to the first lien nature of the refinancing business, its assets are more attractive in the capital markets, and risk pricing is usually more favorable. Figure's first lien business volume grew nearly threefold in Q3 2025.

Why are more and more American homeowners choosing First Lien HELOCs, and what benefits can they gain?

◦ Extreme Cost Savings: Figure's first lien production cost is about $1,000, while the industry average cost is as high as $12,000, saving users a disruptive payoff cost.

◦ Time Efficiency: Approval takes only 5 minutes, with median funding time reduced from the industry average of 42 days to 10 days.

◦ Flexibility: Obtaining lower rates than personal loans, with the flexibility to extract equity again in the future.

From the data released in the Q3 financial report:

In the third quarter of 2025, Figure's total transaction volume in the consumer credit market reached $2.5 billion, a year-on-year increase of 70%.

First Lien HELOC Performance:

◦ Q3 2025: The transaction volume of First Lien HELOC accounted for 17% of the total consumer credit volume. Based on this, the transaction amount for the quarter was approximately $425 million. This share increased by 650 basis points from 10.5% in the same period of 2024.

◦ Performance in the First Half of 2025: Its transaction volume accounted for 15% of the total origination amount, corresponding to a transaction amount of approximately $480 million.

◦ Growth Rate: This business has shown exponential growth, with transaction volume in Q3 2025 nearly tripling year-on-year.

Open/Standard HELOC (typically a second lien):

◦ Since HELOCs account for 99% of the total, the vast majority, excluding first liens, belong to this category.

◦ Despite the rapid growth of first liens, Figure's balance sheet shows that as of September 30, 2025, 80% of the HELOC assets it holds are still in non-first lien positions (i.e., existing as second or third liens).

2.1.3 DSCR Loans

Designed specifically for real estate investors, this product does not consider the borrower's personal income but is approved based on the property's rental yield (DSCR).

DSCR loans are one of the core pathways for Figure to expand its successful model in the HELOC space to a broader category of consumer credit assets.

In Q3 2025, the new product category, including DSCR loans, contributed over $80 million in transaction volume, demonstrating strong growth momentum.

The participant structure, behavioral patterns, and revenue distribution logic are highly consistent with HELOC, but with a greater focus on the cash flow of investment properties in terms of underlying asset attributes. From the stakeholder profile perspective, it remains largely consistent with HELOC, aside from the borrowers.

Metric Dimensions

Core Data / Metrics

Market Significance

Growth Momentum

Q2 (0.02%) → Q3 (> $80 million)

Explosive Growth: Despite a very low share in Q2, in Q3, with the push from DSCR and new products like crypto mortgages, transaction volume rapidly climbed.

Single Loan Metrics

Average Balance: $174,000 Loan Limit: $1 million

Precise Coverage: This limit accurately targets the mainstream financing range for single-family rental (SFR) investors.

Market Potential (TAM)

> $20 billion / year (securitization scale)

Stock Replacement: DSCR is at the core of the U.S. non-qualified mortgage (Non-QM) market, and Figure aims to address its "low transparency and long cycles" through blockchain technology.

System Support (LOS)

> $16 billion

Horizontal Expansion: Utilizing the automated system (LOS) that has already been successfully run in the HELOC space and has accumulated $16 billion in loans, Figure aims for rapid scaling of DSCR products.

Core Competitive Advantage

75% RWA Private Credit Market Share

Industry Pricing Power: With overwhelming market share, Figure is establishing "real-time, atomic settlement" as the industry benchmark for the DSCR sub-market.

DSCR loan borrowers primarily seek financing for rental properties. Borrowers submit applications through Figure or its partners' portals. The uniqueness of DSCR loans lies in the requirement for borrowers to provide proof of rental income (usually a lease) in addition to the standard credit assessment to calculate the debt service coverage ratio.

The core logic of DSCR loans is to "replace trust with facts (data)." Similar to HELOC, it achieves "Pareto optimization" between the asset side and funding side by converting extremely illiquid real estate debt into standardized, homogeneous tokens on-chain: borrowers receive funds, institutions reduce friction costs, and ordinary DeFi users, who were previously on the financial periphery, become co-beneficiaries of these high-quality RWA assets.

2.2 Capital Protection and Securitization

To enhance market liquidity and act as a "last buyer," Figure has established strategic partnerships with top investment institutions.

Sixth Street (Strategic Joint Venture Partner):

◦ Provides $200 million in equity capital to the joint venture entity Fig SIX Mortgage LLC.

Fig SIX Mortgage LLC (Guarantee Vehicle):

The jointly established entity Fig SIX Mortgage LLC is defined within the Figure ecosystem as a key "guarantee vehicle" and has received a commitment of $200 million in recoverable equity capital from Sixth Street.

In terms of business operations, Fig SIX plays a critical role as a "permanent buyer" in the Figure Connect electronic trading market. This mechanism alleviates the asset distribution concerns for originating partners such as banks, credit unions, and independent mortgage lenders, ensuring that the blockchain-native assets they generate can achieve certain transaction execution and more competitive market pricing. This "always present" bidding mechanism effectively transforms previously fragmented and opaque private credit transactions into a standardized market with efficient price discovery capabilities.

In the structured design of securitized products, Fig SIX's risk hedging function is more pronounced. This vehicle actively retains and holds the "residual equity" or "first loss piece" in the asset package when initiating securitization transactions. This arrangement makes Fig SIX the "chief absorber" of credit risk, taking the first losses when underlying HELOC loans default, thereby protecting the interests of senior creditors.

2.3 DeFi Financing and Lending

This model democratizes the flow of funds by eliminating traditional prime brokerage and warehouse financing intermediaries.

Asset Holders:

Typically banks or lending institutions, they deposit tokenized credit assets (such as HELOC asset packages) or crypto assets generated through the LOS system into smart contracts as collateral. This model allows institutions to obtain real-time liquidity against their held RWA assets, often at financing costs lower than those provided by traditional banks' warehouse lines.

The protocol employs hourly Dutch auctions to determine the clearing rate. Borrowers set their maximum acceptable rate, while lenders bid for their target returns, with all incoming funds being interest-accrued at a uniform market clearing rate. This mechanism ensures the immediacy and fairness of price discovery, allowing the market to dynamically adjust within a wide interest rate range of 1% to 30%.

Liquidity Providers:

Figure has successfully "granularized" the private credit market, which was previously limited to top financial institutions.

Ordinary DeFi users can participate in the financing of global credit assets with just $100 through this protocol, which is unimaginable in the traditional financial system.

As of mid-2025, lenders earned an annualized return of nearly 9% through this protocol, significantly higher than the returns from holding YLDS stablecoins or in traditional money market funds. This attractiveness has prompted Figure to further expand this model to Layer 1 ecosystems like Solana and Sui, amplifying the RWA yield leverage by introducing liquidity-staking tokens like PRIME.

Democratized Prime Protocol:

To ensure the safety of lender funds, the Democratized Prime establishes a robust risk management system based on code.

- Asset Rights Confirmation: Utilizes DART technology to achieve perfect collateral rights, ensuring lenders have indisputable legal and technical recourse to the underlying RWA assets.

- Clearing Logic: The protocol monitors LTV in real-time. When the LTV triggers the 90% threshold, the smart contract automatically initiates on-chain liquidation processes, auctioning off credit assets through weekly BWIC to realize funds, which are prioritized for repaying lender principal. Additionally, if market liquidity is insufficient to meet redemptions, interest rates will automatically jump to 30% to force borrowers to deleverage or attract new capital into the market.

2.4 Interest-Bearing Stablecoins and Payment Settlement

Figure leverages its SEC-registered compliant status to bring traditional money market yields into the on-chain payment system.

Figure Certificate Company (FCC) (Issuer):

Unlike most stablecoins on the market that are based on offshore entities, the core advantage of $YLDS lies in the transparency of its legal identity.

Role of FCC: FCC is registered as an investment company under the U.S. Investment Company Act of 1940, specifically issuing face value certificates, of which $YLDS is the digital representation.

Underlying Asset Guarantee: $YLDS is 100% backed by a high-quality, low-risk asset portfolio held by FCC (primarily U.S. Treasury securities and similar securities held by prime money market funds). This structure ensures asset stability and regulatory traceability, allowing it to serve as institutional-grade interest-bearing collateral.

YLDS Holders (Primarily Institutions):

$YLDS provides holders with a "Pareto improvement" between traditional financial markets and DeFi.

- Yield Model: Holders can earn a yield equivalent to SOFR (Secured Overnight Financing Rate) minus 50 basis points. In a macro high-interest rate environment, this makes $YLDS a superior asset choice compared to traditional non-interest-bearing stablecoins.

- Payments and Settlements: $YLDS supports 24/7 on-chain peer-to-peer transfers and serves as the default settlement currency for Figure Exchange, allowing users to complete asset exchanges in seconds. For example, users can directly use $YLDS to purchase Bitcoin, with the system automatically handling the underlying currency hedging and settlement.

Figure Payments Corporation (Funding Channel):

Due to regulatory constraints, FCC cannot directly hold universal crypto assets like USDC or USDT, so Figure introduced Figure Payments Corporation (FPC) as a key funding channel.

- Mirror Order Mechanism: When users purchase crypto assets using $YLDS on the exchange, FPC runs a mirror order process in the background. The system matches $YLDS holders with counterparties holding USDC through FPC's own liquidity pool, thereby bridging the gap between compliant security tokens and the public crypto market.

- Ecosystem Scale: This compliant structure saw significant growth in 2025, with its balance rising from approximately $4 million in Q2 2025 to nearly $100 million by November, and has expanded to Layer 1 ecosystems like Solana and Sui.

3 Q3 Revenue Breakdown

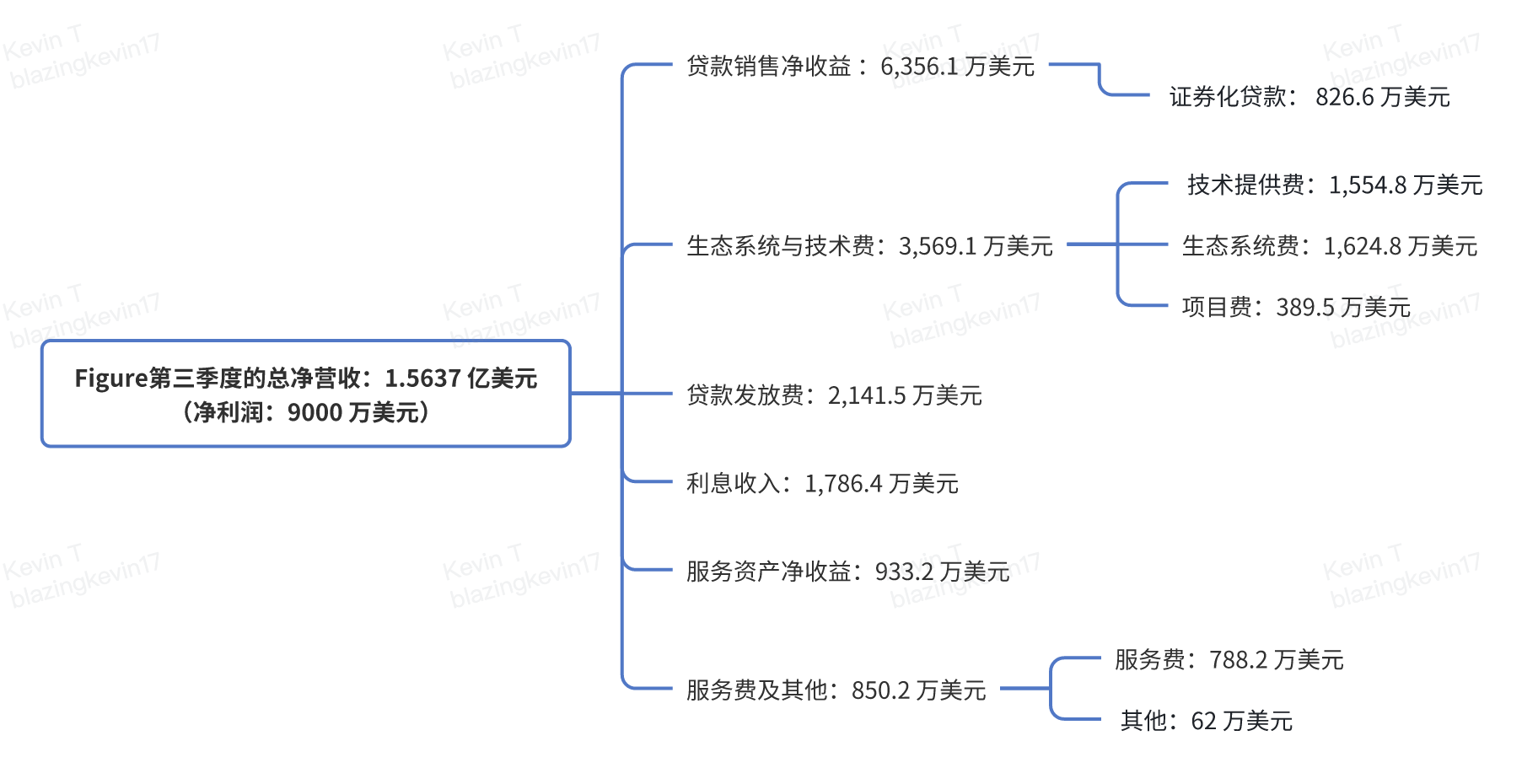

Figure's performance this quarter is impressive, with total net revenue reaching $156.37 million and net profit soaring to $90 million, resulting in a net profit margin of nearly 57%, which is extremely rare among traditional financial institutions. This clearly demonstrates the efficiency reconstruction of traditional lending businesses through blockchain infrastructure. Behind this profitability is a highly diversified and complementary revenue structure, primarily composed of loan sales, technology fees, loan origination, and ongoing service fees and interest.

Net revenue from loan sales, as its largest revenue engine, contributed $63.561 million, showcasing Figure's strong asset liquidity in the secondary market. Among this, full loan sales accounted for $51.72 million, allowing Figure to achieve rapid capital recovery by fully transferring ownership, risk, and cash flow of Home Equity Lines of Credit (HELOC) to institutional buyers. Notably, the $8.266 million in securitized loan revenue was generated by injecting standardized loans through special purpose entities (SPE) and issuing bonds rated from AAA to B-. Figure's ability to assist these securitized products in obtaining AAA ratings from agencies like S&P and Moody's is no small feat, entirely thanks to the data integrity provided by its LOS system and the traceability of the Provenance blockchain, which offers institutional investors a level of underlying transparency that is hard to achieve in traditional financial markets.

Technology and ecosystem fees contributed $35.691 million this quarter, which is the core differentiator of Figure from ordinary financial companies. Of this, $15.548 million came from technology service fees, while $16.248 million was derived from ecosystem fees, which essentially represent a "market access" or "matching" premium. Figure leverages blockchain technology to shorten traditional settlement cycles, which can last for months, to just days or even seconds. This real-time settlement capability is a core asset that attracts ecosystem partners. Through standardized underwriting and document processing, previously non-standard loans are transformed into highly homogeneous, easily tradable digital assets, marking Figure's successful transition from a loan origination institution to a financial infrastructure provider.

At the front end of the business, Figure's loan issuance fees reached $21.415 million, which includes direct fees for processing loan services, miscellaneous fees at the time of disbursement, and income from loan discounts. The explosive growth of this revenue segment is attributed to its highly automated operational processes. Figure has completely abandoned the inefficiencies of traditional finance by connecting borrowers' bank accounts for automatic income verification and utilizing automated valuation models (AVM) to replace time-consuming on-site property appraisals. Combined with digital lien matching, automated title searches, and remote online notarization, Figure has significantly reduced customer acquisition costs and enhanced user experience. All loan data, stripped of personal privacy, is stored as hashed values on the Provenance blockchain, ensuring that assets possess immutable credit attributes from the moment of their inception.

In addition to profiting through a "fast in, fast out" sales model, Figure also demonstrates strong asset management capabilities. Its interest income recorded $17.864 million, sourced from core HELOC portfolio yields, digital asset-backed personal loans, and approximately 5% of risk share income retained during the asset securitization process. Furthermore, Figure has shown a crypto-native sharpness in cash flow management, optimizing capital efficiency through YLDS stablecoin interest and cash equivalents returns. This combination of "light asset operation" and "strategic risk retention" allows the company to maintain liquidity while also sharing in the long-term appreciation dividends of high-quality assets.

The performance of service assets and fees reflects the "long tail effect" of Figure's profit model. This quarter, net revenue from service assets was $9.332 million, reflecting the fair value of the servicing rights retained after loan sales. Although this value is subject to fluctuations based on internal model valuation assumptions, the cash flow it generates is tangible. Service fees and other income totaled $8.502 million, of which $7.882 million came from managing loan portfolios for banks, insurance companies, or securitization trusts, including handling monthly repayments, account maintenance, and investor reporting. In the third quarter, its weighted average service fee rate remained around 30 basis points (0.30%), providing the company with a stable recurring revenue pillar.

Finally, Figure's investment layout also reflects its role as a deeply engaged participant in the crypto space. In the "other" income for this quarter, it recorded $620,000, primarily related to minority equity investments in unconsolidated entities. Notably, its holdings in the Domestic Solana Fund, which acquired SOL tokens through the FTX bankruptcy auction, are worth mentioning. Additionally, the joint venture Fig SIX established with Sixth Street and the revenue from the compliance investment advisory firm Reflow have built a complete financial ecosystem covering credit, investment banking, and compliance consulting.

In summary, Figure's Q3 financial report not only showcases strong financial data but also proves to the market that blockchain in finance is not just a gimmick, but a productivity tool that can effectively reduce costs, shorten settlement cycles, and enhance asset ratings. By hashing underlying loans for proof of existence and batch-changing asset package ownership on the Provenance blockchain, Figure has established a complete digital standard chain from asset origination, automated review, real-time settlement to post-service. This model not only enhances the efficiency of traditional finance but also paves the way for a broader on-chain future for RWA assets.

About Movemaker

Movemaker is the first official community organization authorized by the Aptos Foundation and jointly initiated by Ankaa and BlockBooster, focusing on promoting the construction and development of the Aptos ecosystem in the Chinese-speaking region. As the official representative of Aptos in the Chinese-speaking area, Movemaker is committed to building a diverse, open, and prosperous Aptos ecosystem by connecting developers, users, capital, and numerous ecosystem partners.

Disclaimer:

This article/blog is for reference only, representing the author's personal views and does not reflect the position of Movemaker. This article does not intend to provide: (i) investment advice or recommendations; (ii) offers or solicitations to buy, sell, or hold digital assets; or (iii) financial, accounting, legal, or tax advice. Holding digital assets, including stablecoins and NFTs, carries high risks, significant price volatility, and may even become worthless. You should carefully consider whether trading or holding digital assets is suitable for you based on your financial situation. For specific issues, please consult your legal, tax, or investment advisor. The information provided in this article (including market data and statistics, if any) is for general reference only. Reasonable care has been taken in compiling this data and charts, but no responsibility is accepted for any factual errors or omissions expressed therein.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。