Original: David Lin

Compiled & Organized by: Yuliya, PaNews

History does not simply repeat itself, but it is always remarkably similar. In this episode of the well-known YouTube host David Lin, we witness Gareth Soloway, a seasoned trader with 27 years of experience in the internet bubble and the 2008 financial crisis, interpreting the similarities between the current market and historical peaks. He believes that driven by the AI concept, market valuations have become extremely overextended into the future, and a critical turning point has arrived, with a 10% to 15% correction merely being the beginning. Gareth not only issues a warning for the stock market but also holds a cautious attitude towards the short-term trends of Bitcoin and gold, systematically explaining from multiple dimensions, including macroeconomics, industry insights, and technical charts, why he believes investors need to prepare for the impending market turbulence.

The Relationship Between the AI Bubble, Labor Market, and Monetary Policy

Host: There is no doubt that the current market is in a very interesting period. I noticed an article where former senior economic advisor to Trump, Kevin Hassett, made a point that artificial intelligence may be causing a "calm period" in the labor market. He mentioned that despite strong GDP growth in the second quarter of 2025, companies may reduce the demand for hiring college graduates because AI has increased the productivity of existing employees. I have seen some reports that large consulting firms like McKinsey have also lost some business as clients turn to cheaper, more streamlined AI consulting firms. Do you think AI is the main reason driving the stock market up while simultaneously causing a slowdown in the labor market?

Gareth: First of all, AI has undoubtedly played a role in driving the stock market up. Data shows that 75% of the S&P 500's gains over the past two years are directly related to AI concept stocks, and AI stocks have been leading the market higher. However, I do not agree that the current partial weakness in the labor market is due to the boom in AI. AI will eventually have an increasing impact on employment, but the real reason at the moment is the enormous uncertainty in the business sector.

Of course, the stock market seems to be continuously rising, but the reality is that people are still suffering from the pain of inflation, and I believe that actual inflation is higher than reported, which has led consumers to start slowing down their spending (for example, the performance of Cava and Chipotle). The reduction in consumer spending forces these companies to pause hiring.

Host: The Federal Reserve is about to stop quantitative tightening (QT) and may inject more liquidity through continued interest rate cuts. Do you think this will further push the entire stock market higher, in other words, will the AI bubble get bigger?

Gareth: I believe the AI bubble is at a turning point. I think the stock market has peaked and will at least see a 10% to 15% correction. In fact, I mentioned earlier that a 10% correction might start in October, and the market indeed peaked at the end of October. Although the current decline from historical highs is not large, I do believe that the downward trend has already begun. I want to discuss some of the reasons for this, as they are very noteworthy.

First is the valuation metrics. The current valuations are pricing in future earnings for the next five years (until 2030) or even further out, which means the prices are front-loading unrealized earnings, and the risks are very apparent.

Secondly, we must talk about how capital is flowing back and forth. For example, AMD received billions of dollars in investment from OpenAI, but in return, AMD gave OpenAI warrants to purchase 100 million shares of AMD stock. Nvidia also gave OpenAI some money so that OpenAI could purchase or borrow chips from Nvidia. This is somewhat of a typical "Ponzi scheme," aimed at maintaining this positive momentum, while the reality is that this ecosystem is not as solid as it appears. Many companies also admit that "AI is great, but it's currently hard to monetize."

I truly believe AI is the future, but the question is, at this current juncture, is it really worth such a high valuation?

Another important issue is data centers. The construction of data centers is currently being put on hold. Remember, the surge in AI stocks was largely due to the need to build all these data centers, which require chips. But the key point is that Microsoft has paused the construction of two data centers, and Micron has also paused one. Why? Because there is not enough power. They need to secure power, and they cannot simply draw from the existing grid, as doing so could triple the electricity bills for residents. So, if you divert all the energy to these data centers, it will actually crush the average consumer.

Finally, those massive data center companies are using a depreciation period of up to seven years to calculate the value of chips. This is absurd. Data shows that due to rapid technological advancements and the high load of chips running for two consecutive years, a chip purchased at full price is worth only 10% of its original value after two years. When you spread the depreciation over seven years, the annual depreciation amount becomes very small, making their financial reports appear more profitable. But in reality, these massive companies are severely overestimating their profits.

Host: The issues you raised have indeed persisted for some time, but no one knows how long this situation will last or when it will stop. So as a trader, how do you make actual investment decisions based on this information? After all, most people might agree with your views but would also say, "We don't know when the music will stop."

Gareth: That is precisely the scary part. If you ask the average person, most would say we are in a bubble, but they are still buying in because they don't want to miss out on the upside and believe they can successfully exit before the market turns. This mentality was particularly evident when the cryptocurrency market and other assets peaked in 2021.

Look at the weekly chart of SMH (VanEck Semiconductor ETF), which basically covers all the major semiconductor companies like Broadcom, Nvidia, and AMD; the yellow line is the 200-week moving average. Looking back to 2020 and 2021, we see a pattern of deviation from the relative 200-week moving average: in the past, at peaks, it deviated as much as 102% from the 200-week moving average, followed by a significant 45% correction.

And in the data for 2024, the deviation also reached 102%, followed by a 40% correction in the industry. Recently, SMH again reached a deviation of 102% a few weeks ago, indicating that the market may face new adjustment pressure. The 200-week moving average acts as the market's "base camp"; when stock prices deviate too far, they will eventually return. Based on current data, the semiconductor industry may be facing a significant correction.

Market Correction and Bitcoin Analysis

Host: This is indeed concerning because, as you mentioned earlier, the semiconductor industry is closely linked to other tech stocks and the broader economy, creating a phenomenon of circular financing. I suspect that if any large semiconductor stock drops, it could drag down the entire market. Do you agree?

Gareth: 100% agree. When 75% of the S&P 500's gains over the past two years have come from AI stocks, if these stocks drop, they will inevitably drag down the entire market. Additionally, you have to consider other factors. Currently, 90% of GDP growth expectations come from the capital expenditures of these large tech companies. Now imagine if these big companies slightly cut back on capital expenditures, the U.S. economy could fall into recession. So, we are on the brink of a potential correction that could be larger than expected. This precariousness in the stock market, especially in the tech sector, has already begun in the past few weeks. You have seen several very bad sell-offs; just last Friday, we experienced the largest single-day sell-off since April.

Host: The 10% to 15% drop expectation you mentioned earlier has also been echoed by leaders of some major banks. Goldman Sachs CEO David Solomon stated a few weeks ago in Hong Kong that the stock market is likely to see a 10% to 20% correction in the next 12 to 24 months. Morgan Stanley's CEO also agreed and believes we should welcome this possibility, as a 10% to 15% correction is a natural part of the cycle and not driven by some macro cliff effect. They seem to think that even in a bull market, such a magnitude of correction is quite common. So, structurally, do you still hold a bullish outlook?

Gareth: As a short-term trader, I am currently more bearish; I have been shorting some stocks like Nvidia and SanDisk.

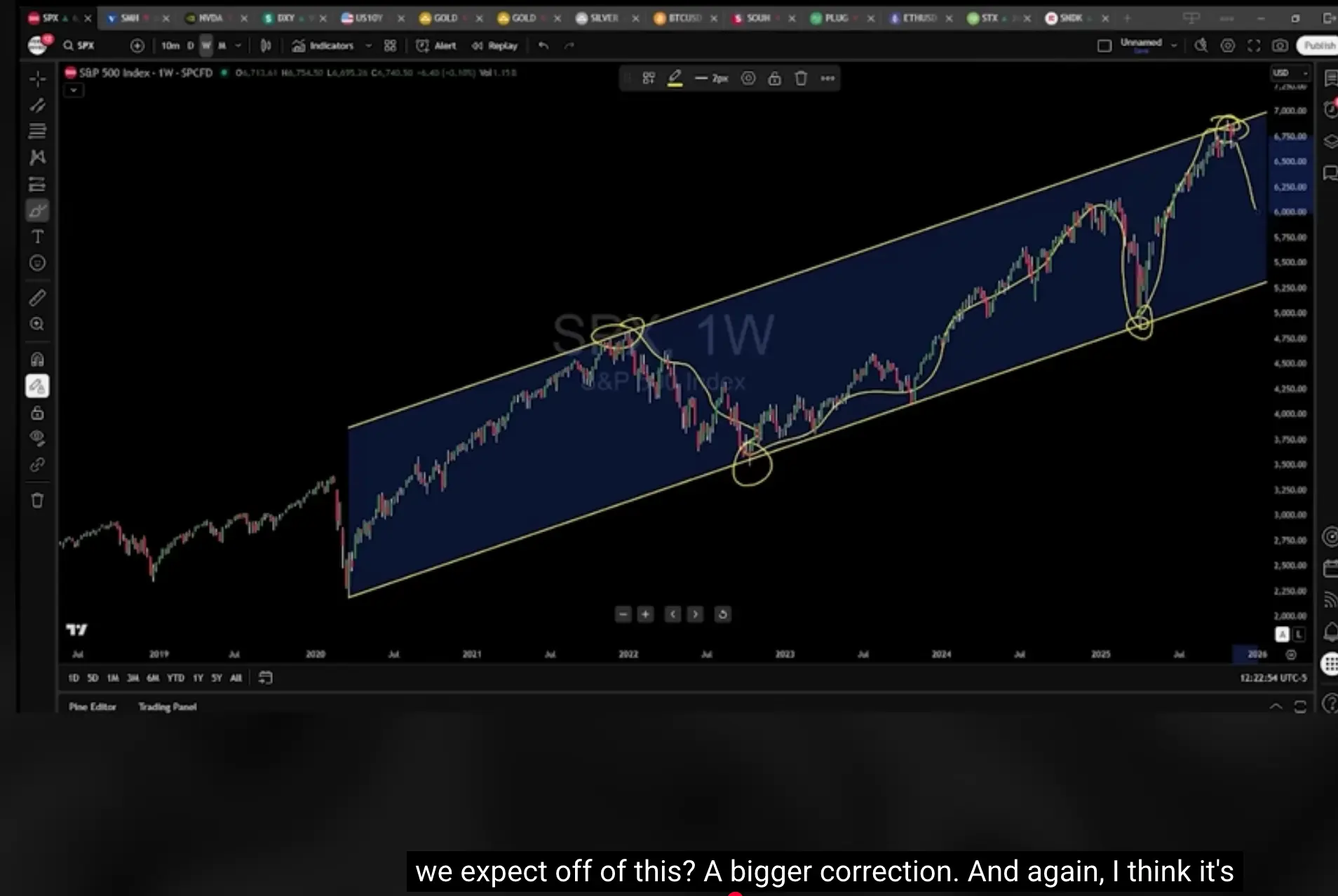

Let me show you this chart of the S&P 500, and I will demonstrate why we are likely at a peak. From the low of the COVID-19 pandemic in 2020 to the low of the bear market in 2022, a clear trend line was formed, and the S&P 500 has now reached the upper boundary parallel to the bull market peak in 2021. Historical data shows that when the market touches the upper boundary of this channel, bear market-level corrections have occurred.

Based on this, I believe the correction has already begun, and the top of the S&P 500 has formed. The reason the market is currently volatile is that those "buying the dip" investors have been brainwashed by large institutions, governments, etc., to believe that the market will never drop more than 2% to 3%. When a 10% to 15% correction actually arrives, they will be very surprised.

Host: Which tech stock do you think is the most severely overvalued? You mentioned you are shorting Nvidia.

Gareth: I tend to short the semiconductor industry broadly. I think shorting Nvidia ahead of its earnings report is a bit risky because it could always rise by $10 or $20 after the report and then drop again. There is a significant risk of a pullback based on valuation and technical factors in the long term.

I am also shorting and watching stocks like SanDisk, which have moved very vertically last year/this year—these weekly charts suggest a pullback of 20% to 30% would be reasonable. I am not denying the fundamentals of these companies, but the technicals, valuations, and market structure make their short-term risks very high.

Additionally, remember that capital does not completely exit the market at the top. In the early stages of a top formation, like in 2007, we see a correction, followed by a strong rebound, then another correction, and then another rebound, because buyers have been trained to buy the dip. The largest declines occur at the end of the cycle when everyone gives up and panics. So, the initial formation of a top is usually slow because there are still buyers, but as prices drop, the speed of the decline will accelerate.

Host: Alright, let's turn to Bitcoin. We'll come back later to ask Gareth for his year-end prediction for the S&P 500. Bitcoin has now seen a significant pullback, dropping below $100,000 and currently sitting under $95,000. What are your thoughts on Bitcoin now and the key support levels ahead?

Gareth: From a professional standpoint, this recent high was actually quite easy to identify. We discussed a few months ago that if you connect the 2017 bull market peak and the first peak in 2021, this trend line perfectly predicted every recent top.

So it's clear that the white line here is a resistance level. If we can rise again and break through this line, then the views of those calling for absurdly high prices may become valid.

If the stock market drops and triggers panic, people will unfortunately still sell Bitcoin. The key support for Bitcoin is currently around $73,000 to $75,000 (many tops/breakout points support this area). If the bears win the battle, Bitcoin could return to $73,000 to $75,000, or even lower. If the bulls can hold this line, we could return to $127,000, $128,000, or even $130,000.

Host: You mentioned the risks in the semiconductor sector, and we know that Bitcoin and tech stocks are interconnected. Why do you think Bitcoin has underperformed many semiconductor stocks and the entire tech sector this year? Bitcoin has been basically flat this year, while the Nasdaq index continues to rise.

Gareth: There are several reasons:

- Bitcoin has recently become a "boring" asset. I know this sounds crazy, but when you see some chip stocks rising by 30%, 40%, or even 100%, they look like the new "altcoins" with ridiculous gains. In contrast, Bitcoin seems less "sexy."

- Another factor is that we are starting to see institutional buying power is not as aggressive as before. Some crypto companies that had built Bitcoin reserves are now struggling to raise funds, leading to reduced buying. We even see this with MicroStrategy. Due to changes in loan conditions, MicroStrategy cannot borrow the same level of funds for large-scale purchases as it did in the past. So MicroStrategy is still buying, but the orders are much smaller than before.

- The final factor is de-risking. If you look back, risk assets tend to peak before the stock market does. Bitcoin peaked in December 2017, and the stock market peaked in January 2018. Bitcoin peaked in November 2021, and the stock market peaked at the end of December that same year. When people start to de-risk, at least for large institutional funds, they first focus on the highest-risk assets, which are cryptocurrencies. So the de-risking process starts there and then spreads to the stock market like a cold. I think we are on the verge of seeing this happen.

Host: If Bitcoin and tech stocks have historically had a very close correlation and Bitcoin has outperformed the stock market in past bull cycles, but not this time, does that mean Bitcoin is undervalued?

Gareth: I still believe Bitcoin will ultimately outperform the stock market because it remains a reserve digital gold asset. So when panic strikes and de-risking begins, prices will be impacted. But once the dust settles, people will realize that the stock market needs to drop more, and Bitcoin can become a recipient of some of that capital flow. I want to be clear that I still believe Bitcoin could drop to $73,000-$75,000, or even lower, but I will gradually buy in during the decline to build a long-term holding position.

Host: Are you more optimistic or pessimistic about the altcoin market?

Gareth: I am cautious about altcoins. They are always changing, and there is always a new hot technology emerging. Ethereum, in my view, needs to drop a bit more; I have set a swing trading buy price for ETH between $2,800 and $2,700, which is an important support level.

Gold, Risk Comparison, and Long-Term Outlook

Host: Let's talk about gold. Gold is currently still firmly above $4,000 and is undergoing consolidation. Interestingly, I noticed that videos about gold on my channel have started to lose traction. A month and a half ago, when gold prices soared above $4,000, people were very excited. Now it has basically formed a bottom around $4,000, and my interpretation is that people have accepted this as the "new normal." Is this the new normal? Is $4,000 now the bottom price?

Gareth: Personally, I believe gold has a bit more downside potential because the "weak hands" haven't been shaken out yet. The market typically tends to wash out these uncertain holders before starting the next bull market. Comparing the gold price movements in 1979 with those in 2025 shows a nearly similar pattern: first a wave of increase, then sideways consolidation, followed by several weeks of consecutive increases (in 1979, there were 9 consecutive weekly bullish candles, and the same occurred in 2025). Historically, the 1979 consolidation pulled back to key support before launching into a new round of increases.

By analogy, I believe gold could pull back to $3,600–$3,500 before starting the next major rise. But importantly, this time is different from 1979. In 1979 and the 1980s, then-Fed Chairman Volcker was raising interest rates. Now, Powell is cutting rates. In 1979, the debt-to-GDP ratio was 32%, and now it is 130%. The government is continuously spending recklessly. So the difference is that in 1979, it took 20 to 30 years to see new historical highs again. This time, I believe we will return to historical highs by next year. Reaching $5,000 next year is, for me, a foregone conclusion.

Host: In the short term, which asset has greater downside risk: gold, Bitcoin, or stocks? If calculated by percentage, which one should drop more?

Gareth: In terms of percentage, Bitcoin has the highest volatility and the greatest short-term downside risk. If Bitcoin drops to my target price of $75,000 or $73,000, that would be about a 23% drop from current levels. If gold drops to around the $3,600 level I set, that would be about a 12% decline. For the stock market, we discussed a 10% to 15% correction. This correction would bring us back to around the 6,100 level, which is the previous pivot high that has now become technical support. The stock market is the most uncertain for me; it may be at a cyclical peak, and we could see declines of up to 30% to 40% in the coming years, although I believe there will be a rebound after a 10% to 15% correction. If I were to allocate, I would lean more towards gold at the target prices mentioned, as it is relatively the least risky, followed by Bitcoin.

Host: You are structurally more bullish on gold than Bitcoin; why is that?

Gareth: The main issue with Bitcoin is that there is a lot of leverage in the system.** People can invest with a significant amount of capital. When entities like MicroStrategy hold so much Bitcoin and also use leverage, it makes me concerned. As someone who makes a living analyzing trading risks, this does make me a bit nervous. If they get into trouble and are forced to liquidate, they could cause a Bitcoin crash that exceeds anything we have seen before.

Gold, on the other hand, is more diversified. Central banks around the world hold it, and they won't panic sell; central banks can print their own money anyway. So ultimately, at least for me, gold has more safety in its price.

Host: I want to share a post by Ray Dalio that echoes what you said earlier about "stimulus in a bubble." He mentioned that the Federal Reserve announced it would stop quantitative tightening (QT) and begin quantitative easing (QE); however you describe it, this is a form of easing. How do you think this will affect the market?

Gareth: I agree with Dalio's point: the Fed's technical shift in operations (stopping balance sheet reduction and implementing quantitative easing or similar actions) is injecting liquidity into a system that already has a bubble. Historically, the pattern of increasing debt during expansion and de-leveraging during recession has not occurred in this cycle—we have been continuously accumulating debt, which has created a larger bubble, and a larger bubble means a larger crash. The current situation may be even worse than during the financial crisis; I think many people struggle to fully grasp its scale. The U.S. is approaching or entering a century-level problem, which will educate many young investors who have never experienced a major crash. People often say that someone in every generation must go through one. Most of those who experienced the Great Depression are no longer around, and we seem to have forgotten those lessons—be prudent with finances, avoid overspending, and do not accumulate massive debt.

Host: What warning advice would you give to young traders who have not yet experienced a significant downturn or bubble burst?

Gareth: Stay vigilant. Many new investors entered the market after the COVID-19 pandemic, and since then, we have only experienced V-shaped recoveries, with the market hitting new highs within a month; they may think the market only goes up. I started trading in 1999, and I remember the Nasdaq took over 15 years to reach new highs again. But history is not like that; the market may take much longer to recover. Protecting capital is key—trade with discipline, control risk, and be aware of the systemic risks posed by the current monetary and debt situation. At least 60% to 70% of American households may already be in a state of economic recession; the market's rise masks this reality; once the stock market drops, high-end consumption will slow down. In my view, regardless of how much AI capital expenditure there is, the economy will decline.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。