2025 年第三季度对加密市场而言具有承上启下的关键意义:它承接了 7 月以来的风险资产反弹,并在 9 月降息落地后进一步确认宏观转折点。然而,进入第四季度,市场同时遭受了宏观面的不确定性冲击和加密市场自身的结构性风险爆发,市场节奏急剧反转,原有的乐观预期被打破。

随着通胀回落的节奏放缓,叠加10 月份美国联邦政府爆发史上最长停摆、财政争议不断升级,最新的FOMC会议纪要明确释放“警惕过早降息”信号,使得市场对政策路径的判断出现剧烈摇摆。原本明确的“降息周期已开启”叙事被迅速削弱,投资者开始重新定价“高利率更持久”“财政不确定性飙升”等潜在风险,降息预期的反复推演显著抬高风险资产波动。在此背景下,美联储也刻意压制市场过度预期,以避免金融条件过早放松。

在政策不确定性上升的同时,政府长时间停摆进一步加剧了宏观面的压力,对经济活动与金融流动性造成双重挤压:

- GDP 增长显著被拖累:国会预算办公室估测,政府停摆将使 2025 年 Q4 实际 GDP 年化增速下调 1.0% - 2.0%,相当于数十亿美元的经济损失。

- 关键数据缺失与流动性收缩:停摆导致非农、CPI、PPI 等关键数据无法按期发布,市场陷入“数据盲区”,增加了政策和经济判断的难度;同时联邦开支中断,使短期流动性被动收紧,风险资产普遍承压。

进入 11 月,美股市场内部关于AI 板块是否出现阶段性估值过高的讨论持续升温,高估值科技股的波动率有所抬升,整体风险偏好受到一定影响,使加密资产难以获得来自美股 Beta 端的外溢支撑。尽管第三季度金融市场对降息的提前定价曾显著提升风险偏好,但这类“流动性乐观”在第四季度受到政府停摆与政策不确定性反复的影响而明显弱化,风险资产普遍进入新一轮的再定价阶段。

在宏观不确定性上升的同时,加密市场也面临自身的结构性冲击。7–8 月间,比特币与以太坊分别突破历史高位(比特币上探至 $120,000 以上;以太坊于 8 月末触及约 $4,956),市场情绪阶段性趋于积极。

然而,10 月 11 日币安的大规模清算事件成为加密行业最严重的系统性冲击:

- 截至 11 月 20 日,比特币和以太坊均从高位出现较大幅度回调,市场深度受到削弱,多空分歧随之扩大。

- 清算引发的流动性缺口削弱了整体市场信心,Q4 初期的市场深度明显下降,同时清算溢出效应加剧了价格波动,并推升了交易对手风险。

与此同时,现货ETF与币股 DAT 的资金流入在第四季度明显放缓,机构买盘力度不足,难以对冲清算带来的抛压,导致加密市场自 8 月下旬起逐步进入高位换手与震荡阶段,并最终演化为更明显的调整行情。

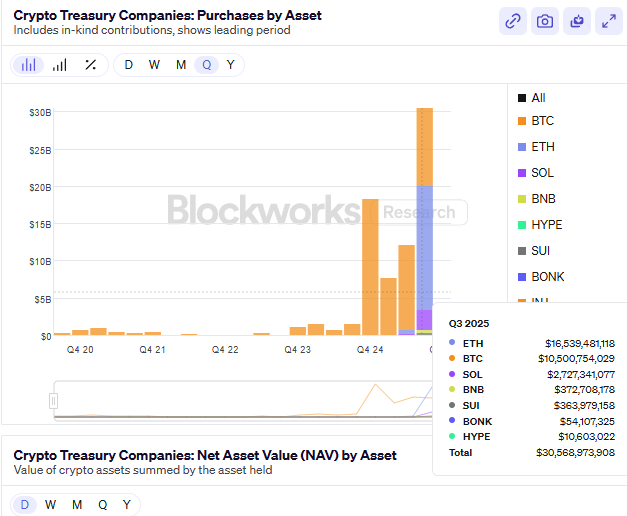

回顾第三季度,加密市场上涨一方面来源于整体风险偏好回升,另一方面受到上市公司推动 DAT(Digital Asset Treasury / 数字资产财库)策略的积极影响。该类策略提升了机构对加密资产配置的接受度,改善了部分资产的流动性结构,成为当季的核心叙事之一。然而,随着第四季度流动性环境趋紧与价格回调加剧,DAT 相关买盘的持续性开始减弱。

DAT 策略的本质在于企业将部分代币资产纳入资产负债表,通过链上流动性、收益聚合与质押工具提升资本效率。随着更多上市公司与基金尝试与稳定币发行方、流动性协议或代币化平台合作,该模式正从概念探索阶段逐步进入实操阶段。在此过程中,ETH、SOL、BNB、ENA、HYPE 等资产在不同维度上展现出“代币—股权—资产”边界融合的趋势,体现出数字资产财库在宏观流动性周期中的一定桥梁作用。

然而,在当前市场环境下,与 DAT 相关的创新型资产估值框架(如 mNAV)普遍跌破 1,显示出市场对链上资产净值的折价。该现象反映了投资者对于相关资产的流动性、收益稳定性以及估值可持续性的担忧,也意味着资产代币化进程在短期内面临一定的调整压力。

在赛道层面,多个板块展现出持续的增长势能:

- 稳定币板块市值持续扩容,总市值突破 $2970 亿,其在宏观不确定性环境中的资金锚定作用进一步强化。

- Perp 板块以 HYPE、ASTER 为代表,借助交易结构创新(如链上撮合、资金费率优化与分层流动性机制)实现了显著的活跃度提升,成为季度内资金轮动的主要受益者。

- 预测市场板块在宏观预期波动下重新活跃,Polymarket 与 Kalshi 成交量屡创新高,成为市场情绪与风险偏好的即时指标。

这类板块的崛起表明,资金正从单一价格博弈转向围绕“流动性效率—收益生成—信息定价”三大核心逻辑的结构化配置。

总体来看,2025 年第三季度加密与美股市场的节奏错位,在第四季度转化为结构性风险的集中暴露与流动性压力的全面上升。政府停摆导致关键宏观数据延迟发布,并加剧财政不确定性,削弱了整体市场信心;美股围绕 AI 估值的争论推升波动,而加密市场则在币安清算事件后面临更直接的流动性与深度冲击。与此同时,DAT 策略资金流入放缓、mNAV 普遍跌破 1,显示市场在机构化过程中对流动性环境仍高度敏感,脆弱性明显。后续能否企稳,将主要取决于清算事件影响的消化速度,以及市场能否在多空分歧加大的环境下逐步恢复流动性与情绪稳定。

降息预期兑现,市场进入再定价阶段

2025 年第三季度,全球宏观环境的关键变量并非“降息”这一事件本身,而是降息预期的生成、交易与消耗。市场对流动性拐点的定价从 7 月即已启动,真正的政策行动反而成为验证既有共识的节点。

在经历两个季度的博弈后,美联储在 9 月 FOMC 会议 将联邦基金利率目标区间下调 25 个基点 至 4.00%–4.25%,随后在 10 月会议中再次小幅降息。然而,由于前期市场对降息的押注已高度一致,政策动作本身对风险资产的边际推动有限,降息的信号效应在此前已基本计入价格。与此同时,随着通胀下行速度放缓和经济韧性超预期,美联储开始明确表达对“市场提前定价明年连续降息”的担忧,导致12 月进一步降息的概率自 10 月后显著下降。这一沟通姿态成为拖累市场风险偏好的新变量。

宏观数据在第三季度内呈现出“温和降温”的特征:

- 核心 CPI 年率从 5 月的 3.3% 降至 8 月的 2.8%,通胀下行趋势得到确认;

- 非农新增就业连续三个月低于 20 万人;

- 职位空缺率回落至 4.5%,为 2021 年以来最低水平。

这组数据表明美国经济并未陷入衰退,而是进入温和放缓区间,为美联储提供了“可控降息”的政策空间。由此,市场在 7 月初即已形成“确定性降息”的共识。

根据 CME FedWatch 工具,投资者对 9 月降息 25 个基点的概率在 8 月底已超过 95%,意味着市场几乎提前完成了预期兑现。债券市场亦反映出这一信号:

- 10 年期美债收益率自季度初的 4.4% 降至季度末的 4.1%;

- 2 年期收益率降幅更大,约 50bps,显示出市场对政策转向的交易押注更为集中。

第三季度的宏观转折更多体现为“预期的消化”而非“政策的变动”。流动性修复的定价在 7–8 月间已基本完成,9 月的实际降息只是对既有共识的正式确认。对于风险资产而言,新的边际变量已从“是否降息”转向“降息节奏与持续性”。

然而,当降息真正落地时,预期的边际效应已被完全消耗,市场迅速进入“无新增催化”的真空阶段。

自 9 月中旬起,宏观指标与资产价格的变动呈现明显钝化:

- 美债收益率曲线趋平:截至 9 月末,10 年–3 个月国债利差仅约 14 个基点,表明期限溢价虽仍存在,但倒挂风险已解除。

- 美元指数回落至 98–99 区间,较年初高点(107)显著走弱,但美元融资成本在季度末结算期仍显偏紧。

- 美股资金面边际收缩:纳斯达克指数继续上行,但 ETF 流入放缓、成交量增长乏力,显示机构在高位已开始调整风险敞口。

这种“预期兑现后的真空期”成为季度内最具代表性的宏观现象。市场在前半程交易“降息确定性”,后半程则开始定价“增长放缓的现实”。

美联储 9 月会议公布的点阵图(SEP)显示,决策层内部对于未来利率路径的判断存在明显分歧:

- 2025 年底政策利率中值预期下调至 3.9%;

- 委员预测区间落在 3.4%–4.4%,反映决策层对通胀黏性、经济韧性和政策空间的意见分化。

在 9 月降息与 10 月再次小幅降息之后,美联储的沟通逐渐转向更为谨慎的基调,以避免金融条件提前宽松。受此影响,原本在被高度押注的12 月再降息概率现已显著回落,政策路径重新回到“数据依赖”而非“预设节奏”的框架下。

与前几轮“危机式宽松”不同,本轮降息属于节奏可控的政策调整。美联储在降息的同时继续推进缩表,释放出“稳资本成本、抑通胀预期”的信号,强调平衡增长与物价,而非主动扩张流动性。换言之,利率拐点已确立,但流动性拐点尚未到来。

在此背景下,市场表现出明显的分化特征。融资成本下行为部分高质量资产提供估值支撑,但广义流动性并未显著扩张,资金配置趋于审慎。

- 具备稳健现金流与盈利支撑的板块(AI、科技蓝筹、部分 DAT 类美股)延续了估值修复趋势;

- 高杠杆、高估值或缺乏现金流支撑的资产(包括部分成长股与加密非主流代币)则在预期兑现后动能减弱,交易活跃度明显下降。

总体而言,2025 年第三季度是“预期兑现期”,而非“流动性释放期”。市场在前半程定价降息确定性,在后半程转向对增长放缓的再评估。预期的提前消耗使风险资产虽维持高位,却缺乏持续上行动能。这种宏观格局为随后的结构性分化奠定了基础,也解释了加密市场在 Q3 呈现的“突破—回落—高位震荡”走势:资金流向相对稳健、现金流可验证的资产,而非系统性风险资产。

非比特币资产的 DAT 爆发与结构转折

2025 年第三季度,数字资产财库(Digital Asset Treasury, DAT)从加密行业的边缘概念跃升为全球资本市场扩散速度最快的新主题。这一季度首次出现了公开市场资金在规模与机制层面同步进入加密资产的局面:通过 PIPE、ATM 与可转债等传统融资工具,数十亿美元的法币流动性直接进入加密市场,形成了“币股联动”的结构化趋势。

DAT 模式的起点可追溯至传统市场的先行者MicroStrategy(NASDAQ: MSTR)。自 2020 年起,该公司率先将比特币纳入企业资产负债表,并在 2020–2025 年间通过多轮可转债与 ATM 发行累计购入约 64 万枚比特币,总投入超过470 亿美元。这一战略举措不仅重塑了企业的资产结构,也创造了传统股票成为加密资产“二级载体”的范式。

由于股权市场与链上资产的估值逻辑存在体系性差异,MicroStrategy 的股价长期高于其比特币净值,mNAV(市值 / 链上资产净值)常年维持在 1.2–1.4 倍 区间。这一“结构性溢价”揭示了 DAT 的核心机制:

- 企业通过公开市场融资持有加密资产,使法币资本与加密资产在公司层面形成双向互通与估值反馈。

从机制上看,MicroStrategy 的实验奠定了 DAT 模型的三大支柱:

- 融资通道:通过 PIPE、ATM 或可转债引入法币流动性,为企业提供链上资产配置资金;

- 资产储备逻辑:将加密资产纳入财报体系,形成企业级“数字金库(On-Chain Treasury)”;

- 投资者入口:让传统资本市场投资者通过股票获得加密资产的间接敞口,降低合规与托管壁垒。

这三者共同构成了 DAT 的“结构循环”:融资—持仓—估值反馈。企业利用传统金融工具吸纳流动性,形成加密资产储备,再通过股权市场的溢价形成资本增厚,实现资本与代币之间的动态再平衡。

这一结构的意义在于,它首次实现了数字资产以合规方式进入传统金融体系的资产负债表,并赋予资本市场一种全新的资产形态——“可交易的链上资产映射”。换言之,企业不再只是链上参与者,而成为法币资本与加密资产之间的结构性中介。

随着这一模式被市场验证并快速复制,2025 年第三季度标志着 DAT 理念的第二阶段扩散:从以比特币为核心的“储值型财库”,延展至以太坊(ETH)与 Solana(SOL)等生产性资产(PoS 收益或DeFi 收益)。这种新一代 DAT 模型以 mNAV(市值 / 链上资产净值)定价体系为核心,将收益性资产纳入企业现金流与估值逻辑中,形成“收益驱动型财库化周期”。与早期的比特币财库不同,ETH、SOL 等具备可持续的 Staking 收益和链上经济活动,使其财库资产不仅具备储值属性,还具备现金流特征。这一变化标志着 DAT 从单纯的资产持有,迈向以生产性收益为核心的资本结构创新阶段,成为连接生产性加密资产价值与传统资本市场估值体系的关键桥梁。

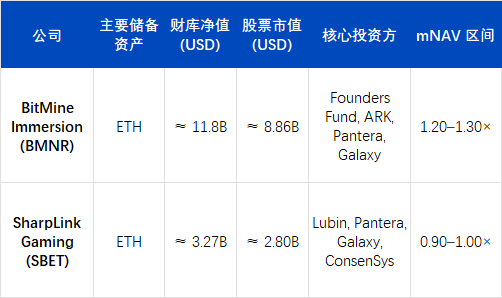

注:进入 2025 年 11 月,新一轮加密市场下跌引发了 DAT 板块自诞生以来最系统性的一次估值重定价。随着 ETH、SOL、BTC 等核心资产在 10–11 月出现 25–35% 的快速回撤,以及部分 DAT 公司通过 ATM 加速扩表所带来的短期稀释效应,主流 DAT 企业的 mNAV 普遍跌破 1。BMNR、SBET、FORD 等均出现不同程度的“折价交易”(mNAV≈0.82–0.98),甚至连长期保持结构性溢价的 MicroStrategy(MSTR) 也在 11 月出现 mNAV 短暂跌破 1 的情况,为 2020 年比特币财库战略启动以来首次。该现象标志着市场从此前的结构性溢价期进入“资产主导、估值贴现”的防御阶段。机构投资者普遍将此视为 DAT 行业的首次全面“压力测试”,也反映资本市场正在重新评估链上资产收益的可持续性、财库扩表的节奏合理性以及融资结构对股权价值的长期影响。

SBET 与 BMNR 引领以太坊财库化浪潮

在2025 年第三季度,以太坊财库化(ETH DAT)的市场格局初步确立。其中,SharpLink Gaming(NASDAQ: SBET) 与 BitMine Immersion Technologies(NASDAQ: BMNR)成为两家定义行业范式的龙头公司。它们不仅复制了 MicroStrategy 的资产负债表策略,更在融资结构、机构参与度与信息披露标准上,实现了“从概念到制度”的跃迁,构建了 ETH 财库周期的双重支柱。

BMNR:以太坊财库化的资本工程

截至2025年9月底,BitMine Immersion Technologies(BMNR) 已确立其作为全球最大以太坊财库(Ethereum Treasury)的地位。根据公司最新披露,其持有约 3,030,000 枚 ETH,按 10 月 1 日收盘价 $4,150/ETH 计算,对应链上净资产约 $12.58 B(约 125.8 亿美元)。若计入公司账面现金与其他流动资产,BMNR 的总加密及现金持仓约 $12.9 B(约 129 亿美元)。

按此估算,BMNR 持有量约占以太坊流通量的 2.4–2.6%,为市场上首个单一持有超 300 万枚 ETH 的上市机构。对应股票市值约 $11.2–11.8 B(约 112–118 亿美元),推算 mNAV ≈ 1.27×,为当前所有数字资产财库(DAT)类上市公司中估值最高者。

BMNR 的战略跃升与其组织重构密切相关。公司董事长 Tom Lee(前 Fundstrat 联合创始人)在 2025 年中全面接管资本运营后,提出核心论断:“ETH 是未来的机构主权资产。”在其主导下,公司完成从传统矿业企业向“以 ETH 为唯一储备资产、以 PoS 收益为现金流核心”的结构性转型,成为首家将以太坊质押收益作为主要经营现金流的美国上市公司。

融资方面,BMNR展现出罕见的融资强度与执行效率。公司在公开市场与私募渠道同步扩充资金来源,为其以太坊财库战略提供了长期弹药。这一季度,BMNR 不仅刷新了传统资本市场的融资节奏,也奠定了“链上资产证券化”的制度化雏形。

7月9日,BMNR 通过 Form S-3 注册声明,与 Cantor Fitzgerald 和 ThinkEquity 签署 “At-the-Market(ATM)” 发行协议,初始授权额度为 20 亿美元。仅两周后,7 月 24 日,公司在 SEC 8-K 文件中披露将该额度上调至 45 亿美元,以应对市场对其 ETH 财库模式的积极响应。8 月 12 日,公司再次向 SEC 提交补充说明,将 ATM 总额度提升至 245 亿美元(新增 200 亿美元),并明确资金用途为购入 ETH 及扩展 PoS 质押资产组合。

这些额度代表 BMNR获得的 经 SEC 批准可持续市价发行股票的上限,并不等同于实际募集现金。

在落地资金层面,公司已完成多笔确切交易:

- 2025 年 7 月上旬,完成 2.5 亿美元 PIPE 私募,为初期 ETH 建仓提供资金;

- ARK Invest(Cathie Wood) 于 7 月 22 日披露购入 约 1.82 亿美元 BMNR 普通股,其中 1.77 亿美元净募资 由公司直接用于增持 ETH;

- Founders Fund(Peter Thiel) 于 7 月 16 日向 SEC 申报持股 9.1%,虽非新增融资,但在市场层面强化了机构共识。

此外,BMNR 在其早期 ATM 授权下已累计售出约 45 亿美元等值股票,实际募资规模显著超过最初 PIPE 金额。截至 2025 年 9 月,公司通过 PIPE + ATM 等多渠道累计动用资金已达数十亿美元,并在 245 亿美元总授权框架下继续推进长期扩张计划。

BMNR 的融资体系呈现出清晰的三层架构:

- 确定性资金落地层—— 已完成的 PIPE 与机构定向认购,规模约 4.5–5 亿美元;

- 市场化扩张层—— 通过 ATM 机制分阶段出售股票,实际募资已达 数十亿美元级别;

- 潜在弹药层—— 已获 SEC 批准的 245 亿美元 ATM 总额度,为后续 ETH 财库扩张提供上限弹性。

凭借这一分层资本结构,BMNR 在短时间内建立起约 3.03 百万枚 ETH(价值约 125.8 亿美元) 的储备规模,实现了财库战略从“单一持仓实验”向“制度化机构资产配置”转型。

BMNR 的估值溢价来源主要包括两层逻辑:

- 资产层溢价:PoS 质押收益率维持在 3.4–3.8% 年化,形成稳定现金流锚;

- 资本层溢价:作为“合规 ETH 杠杆通道”,其股价通常领先 ETH 现货 3–5 个交易日,成为机构跟踪 ETH 市场的前瞻指标。

在市场行为上,BMNR 股价于第三季度与 ETH 同步创下历史新高,并多次带动板块轮动。其高换手率与流通股流转速度表明,DAT 模型正逐步演化为资本市场可交易的“链上资产映射机制”。

SBET:制度化财库的透明化样本

相较于 BitMine Immersion Technologies(BMNR) 激进的扩表策略,SharpLink Gaming(NASDAQ: SBET) 在 2025 年第三季度选择了一条更加稳健、制度化的财库化路径。其核心竞争力并非资金规模,而在于治理结构、披露标准与审计体系的透明化建设,为 DAT 行业建立了可复制的“机构级模板”。

截至 2025 年 9 月,SBET 持有约 840,000 枚 ETH,按季度末均价估算,链上资产约 32.7 亿美元,对应股票市值约 28 亿美元,mNAV ≈ 0.95×。尽管估值略低于净资产,但公司季度 EPS 增长高达 98%,显示其在ETH 收益化与成本控制方面具备极强的经营杠杆与执行效率。

SBET 的核心价值不在于激进的仓位扩张,而在于建立了 DAT 行业首个合规、可审计的治理框架:

- 战略顾问 Joseph Lubin(以太坊联合创始人、ConsenSys 创始人)于 Q2 加入公司战略委员会,推动将质押收益、DeFi 衍生品及流动性挖矿策略纳入企业财库组合;

- Pantera Capital 与 Galaxy Digital 分别参与 PIPE 融资与二级市场持股,为公司提供机构流动性与链上资产配置顾问;

- Ledger Prime 提供链上风险对冲与波动率管理模型;

- Grant Thornton 作为独立审计机构,负责验证链上资产、收益与质押账户的真实性。

这一治理体系构成了 DAT 行业首个“链上可验证 + 传统审计并行”的披露机制。

在 2025 年第三季度的 10-Q 报告 中,SBET 首次完整公开:

- 公司主要钱包地址及链上资产结构;

- 质押收益曲线与节点分布;

- 抵押与再质押(restaking)头寸的风险限额。

该报告使 SBET 成为首家在 SEC 文件中同步披露链上数据的上市公司,显著提高了机构投资者的信任度与财务可比性。市场普遍将 SBET 视为 “合规型 ETH 指数成分股”:其 mNAV 接近 1×,价格与 ETH 市场保持高相关性,却因信息透明、风险结构稳健而具备相对低波动特征。

ETH 财库化的双主线:资产驱动与治理驱动

BMNR 与 SBET 的分化路径,构成了 2025 年第三季度 ETH DAT 生态发展的两条核心主干:

- BMNR:资产驱动型—— 以融资扩表、机构持股与资本溢价为核心逻辑。BMNR 借助 PIPE 与 ATM 融资工具快速积累 ETH 头寸,并通过 mNAV 定价形成市场化杠杆通道,推动法币资本与链上资产的直接耦合。

- SBET:治理驱动型—— 以透明合规、财库收益结构化与风险控制为主线。SBET 将链上资产纳入审计与信息披露体系,通过链上验证与传统会计并行的治理架构,确立了 DAT 的制度化边界。

两者代表了 ETH 财库化从“储备逻辑”向“制度化资产形态”转变的两极:前者扩展了资本规模与市场深度,后者奠定了治理信任与机构合规基础。在此过程中,ETH DAT 的功能属性已超越“链上储备资产”,演化为兼具 现金流生成、流动性定价与资产负债表管理的复合结构。

PoS 收益、治理权与估值溢价的制度化逻辑

ETH等PoS加密资产财库的核心竞争力,来自于可生息资产结构、网络层话语权与市场估值机制的三重结合。

高质押收益率:现金流锚的确立

与比特币的“非生产性持仓”不同,ETH 作为 PoS 网络资产,可通过质押获得 3–4% 年化收益率,并在 DeFi 市场上形成复合收益结构(Staking + LST + Restaking)。这使得 DAT 公司能够以企业形式捕获链上真实现金流,将数字资产从“静态储备”转变为“收益性资产”,具备稳定的内生现金流特征。

PoS 机制下的话语权与资源稀缺性

ETH 财库公司在质押规模扩大后,会获得网络层级的治理权与排序权。BMNR 与 SBET 当前合计控制的 ETH 质押规模约占全网 3.5–4%,已进入协议治理的边际影响区间。这类控制力具备类似“系统性地位”的溢价逻辑,市场愿意给予高于资产净值的估值乘数。

mNAV 溢价的形成机制

DAT 公司估值不仅反映其所持链上资产的净值(NAV),还叠加了两类预期:

- 现金流溢价:质押收益与链上策略带来的可分配利润预期;

- 结构性溢价:企业股权为传统机构提供了合规的 ETH 敞口渠道,从而形成制度化稀缺性。

在 7–8 月的市场高点,ETH DAT 平均 mNAV 维持在 1.2–1.3 倍区间,个别公司(BMNR)一度触及 1.5 倍。这种估值逻辑类似于黄金 ETF 溢价或封闭式基金的 NAV 折溢价结构,是机构资金进入链上资产的重要“定价中介”。

换言之,DAT 的溢价并非情绪驱动,而是基于真实收益、网络权力与资本通道的复合结构形成。这也解释了为何 ETH 财库在短短一个季度内即获得比特币财库(MSTR 模式)更高的资金密度与交易活跃度。

从 ETH 向多山寨资产财库化的结构演进

进入 8–9 月,非以太坊系 DAT 的扩张速度显著加快。以 Solana 财库化 为代表的新一轮机构配置潮,标志着市场主题从“单一资产储备”转向“多链资产分层”。这一趋势意味着 DAT 模式正从 ETH 核心向多生态复制,形成更具系统性的跨链资本结构。

FORD:Solana 财库的制度化样本

Forward Industries(NASDAQ: FORD) 成为本阶段最具代表性的案例。公司于第三季度完成 16.5 亿美元 PIPE 融资,资金全部用于 Solana 现货建仓与生态协作投资。截至 2025 年 9 月,FORD 持有约 6.82 百万枚 SOL,按季度末均价 $248–$252 计,链上财库净值约 16.9 亿美元,对应股票市值约 20.9 亿美元,mNAV ≈ 1.24×,位列非 ETH 财库企业之首。

与早期 ETH DAT 不同,FORD 的崛起并非单一资产驱动,而是 多方资本与生态共振的产物:

- 投资方包括 Multicoin Capital、Galaxy Digital 与 Jump Crypto,三者均为 Solana 生态长期核心投资机构;

- 治理结构中引入 Solana Foundation 顾问委员会成员,确立“链上资产即企业生产资料”的战略框架;

- 所持 SOL 资产保持完全流动状态,暂未进行质押或 DeFi 配置,以保留后续 再质押(Restaking)与RWA资产联动 的战略弹性。

这种“高流动性 + 可配置财库” 模型,使 FORD 成为 Solana 生态的资本中枢,也体现出市场对高性能公链资产的结构性溢价预期。

全球 DAT 版图的结构变化

截至 2025 年第三季度末,全球公开披露的非比特币 DAT 财库总规模已突破 240 亿美元,环比 Q2 增长约 65%。结构分布如下:

- 以太坊(ETH)仍占主导地位,约占总规模 52%;

- Solana(SOL)占比约 25%,成为机构资金第二大配置方向;

- 其余资金主要分布于 BNB、SUI、HYPE 等新兴资产,构成 DAT 模式的横向扩展层。

ETH DAT 的估值锚在于PoS 收益率与治理权价值,代表长期现金流与网络控制力的组合逻辑;SOL DAT 则以 生态成长性与质押效率 为核心溢价来源,强调资本效率与扩展性。BMNR 与 SBET 在 ETH 阶段确立了制度与资产基础,FORD 的出现则推动 DAT 模式进入多链化与生态化的第二阶段。

与此同时,部分新进入者开始探索 DAT 的功能延展:

- Ethena(ENA) 推出的 StablecoinX 模型,将国债收益率与链上对冲结构相结合,尝试构建“收益型稳定币财库”,以创造稳定但具现金流的储备资产;

- BNB DAT 由交易所体系主导,依托生态企业的资产抵押与储备代币化扩展流动性池,形成“封闭型财库体系”。

估值透支后的阶段性停滞与风险再定价

经历了 7–8 月的集中上行后,DAT 板块在 9 月进入估值透支后的再平衡阶段。二线财库股一度推高板块整体溢价,mNAV 中位数突破 1.2×,但随着监管收紧与融资趋缓,估值支撑在季度末快速回落,板块热度明显降温。

从结构上看,DAT 行业正从“资产创新”向“制度整合”过渡。ETH 与 SOL 财库确立了“双核心估值体系”,但扩张性资产的流动性、合规性与真实收益率仍处在验证阶段。换言之,市场驱动力已由“溢价预期”切换至“收益兑现”,行业进入再定价周期。

进入 9 月后,核心指标同步走弱:

- ETH 质押收益率自季度初的 3.8% 回落至 3.1%,SOL 质押收益率 环比下降逾 25%;

- 多家二线 DAT公司 mNAV 已跌破 1,资本效率边际递减;

- PIPE 与 ATM 融资总额环比下滑约 40%,ARK、VanEck、Pantera 等机构暂停新增 DAT 配置;

- ETF 层面,资金净流入转为负值,部分基金将 ETH 财库仓位替换为短久期国债 ETF,以降低估值波动风险。

这种回调暴露出一个核心问题:DAT 模型的资本效率在短期内被透支。早期的估值溢价源于结构创新与制度稀缺,但当链上收益下滑、融资成本上升后,企业扩表速度高于收益增长,陷入“负向稀释循环”——即市值增长依赖融资,而非现金流。

从宏观层面看,DAT 板块正步入“估值内化期”:

- 核心公司(BMNR、SBET、FORD)依托稳健财库与信息透明维持结构稳定;

- 边缘项目因资本结构单一与披露不足,面临去杠杆与流动性收缩;

- 监管方面,SEC 要求企业公开主要钱包地址与质押收益披露标准,进一步压缩“高频扩表”空间。

短期风险主要来自流动性反身性导致的估值压缩。当 mNAV 持续下行、PoS 收益率难以覆盖融资成本时,市场对“链上储备 + 股权定价”模型的信心将受损,出现类似 2021 年 DeFi 夏季后的系统性估值回调。尽管如此,DAT 行业并未进入衰退,而是从“扩表驱动”过渡至“收益驱动”阶段。未来几个季度内,ETH 与 SOL 财库预计仍将保持制度化优势,其估值核心将更多依赖:

- 质押与再质押收益效率;

- 链上透明度与合规披露标准。

换言之,DAT 热潮的第一阶段已结束,行业进入“整固与验证期”。未来估值回归的关键变量在于 PoS 收益的稳定性、再质押的整合效率,以及监管政策的明晰程度。

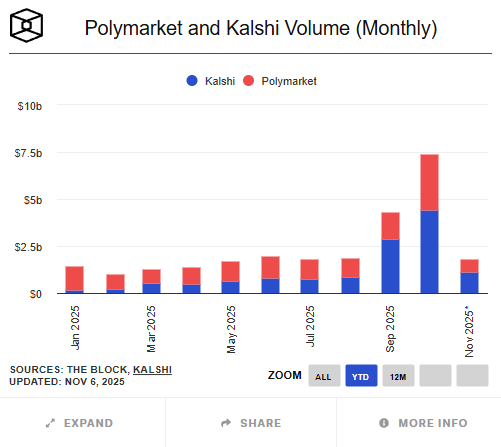

预测市场:宏观叙事的“晴雨表”与注意力经济的崛起

2025 年第三季度,预测市场从“加密原生边缘玩法”跃升为“链上与合规金融交汇的新型市场基础设施”。在宏观政策频繁变动、通胀与利率预期剧烈波动的环境下,预测市场逐渐成为捕捉市场情绪、对冲政策风险与发现叙事价格的重要场所。宏观与链上叙事的融合,使其从投机工具演化为兼具信息聚合与价格信号功能的市场层。

从历史表现看,加密原生预测市场在多次宏观与政治事件中均展现出显著的前瞻性。2024 年美国总统选举期间,Polymarket 的总交易量超过 5 亿美元,其中仅“谁将赢得总统选举”一项合约即达 2.5 亿美元,单日成交峰值突破 2000 万美元,创下链上预测市场纪录。在“美联储是否会于 2024 年 9 月降息”等宏观事件中,合约价格的变化明显领先于 CME FedWatch 利率期货的预期调整,显示出预测市场在部分时间段已具备领先指标价值。

尽管如此,链上预测市场的整体体量仍远小于传统同类市场。2025 年以来,全球加密预测市场(以 Polymarket、Kalshi 等为代表)累计成交约 241 亿美元,而传统合规平台如 Betfair、Flutter Entertainment 的年度交易量则在数千亿美元级别。链上市场规模尚不足传统市场的 5 %,但在用户增速、主题覆盖与交易活跃度方面,均展现出高于传统金融产品的成长性。

第三季度中,Polymarket 成为现象级增长案例。与年中传闻的“10 亿美元估值融资”不同,10 月上旬最新消息显示:纽交所母公司 ICE 拟投资最高 20 亿美元、持股约 20%,对应 Polymarket 估值约 80–90 亿美元。这意味着其数据与商业模式已获得华尔街层面的认可。截至 10 月底,Polymarket 年度累计成交额约 132 亿美元,9 月单月交易量达到 14–15 亿美元,较二季度显著提升,并且10月单月交易量更是创历史新高达到 30 亿美元。交易主题集中在“美联储是否会在 9 月 FOMC 会议降息”、“SEC 是否会于年底前批准以太坊 ETF”、“美国总统选举关键州胜率”及“Circle(CIR)上市后股价表现”等宏观与监管事件。部分研究者指出,这些合约的价格波动在多数情况下领先美债收益率及 FedWatch 概率曲线约 12–24 小时,成为具有前瞻性的市场情绪指标。

与此同时,Kalshi 在合规路径上实现了制度化突破。作为美国商品期货交易委员会(CFTC)注册的预测市场交易所,Kalshi 于 2025 年 6 月完成 1.85 亿美元 C 轮融资(由 Paradigm 领投),估值约 20 亿美元;10 月最新披露估值已升至 50 亿美元,年化交易量增速超过 200%。该平台在第三季度推出了与加密资产相关的合约,如“比特币是否将在本月底收于 $80,000 以上”与“以太坊 ETF 是否会在年底前获批”,标志着传统机构正式进入“加密叙事化事件”的投机与对冲市场。据 Investopedia 报道,其加密相关合约上线两个月内成交额已超过 5 亿美元,为机构投资者提供了在合规框架内表达宏观预期的新渠道。由此,预测市场形成了“链上自由 + 合规严谨”的双轨格局。

与早期偏向娱乐与政治主题的预测平台不同,2025 年第三季度的主流市场重心已显著转向宏观政策、金融监管及币股联动事件。宏观与监管类合约在 Polymarket 平台上的累计成交额超过 5 亿美元,占季度总交易量的 40% 以上。投资者对“ETH 现货 ETF 是否将在 Q4 前获批”及“Circle 上市后股价是否突破关键位”等主题保持高度参与。这类合约的价格走势在部分时间段甚至领先传统媒体舆情与衍生品市场预期,逐渐演化为“市场共识的定价机制”。

链上预测市场的核心创新在于其通过代币化机制实现事件的流动性定价。每个预测事件都以代币形式进行二元化或连续化定价(如 YES/NO Token),并借助自动做市商(AMM)维持流动性,从而在无需撮合的条件下实现高效价格发现。结算则依赖去中心化预言机(如 UMA、Chainlink)上链执行,保证透明与可审计性。这一结构使得几乎所有社会与金融事件——从选举结果到利率决议——都能以链上资产形式被量化和交易,构成了“信息金融化”的新范式。

但快速发展的同时,风险亦不容忽视。首先,预言机风险仍是链上预测市场的核心技术瓶颈,任何外部数据延迟或被操纵都可能引发合约结算争议。其次,合规边界不明仍制约市场扩张,美国与欧盟对事件类衍生品的监管口径尚未完全统一。第三,部分平台仍缺乏 KYC/AML 流程,潜在引发资金来源合规风险。最后,流动性过度集中于头部平台(Polymarket 市场占比超 90%),在极端行情下可能导致价格偏离与市场波动放大。

总体而言,第三季度的预测市场表现显示其已不再是边缘化的“加密玩法”,而正在成为宏观叙事的重要承载层。它既是市场情绪的即时反射,也是信息聚合与风险定价的中介工具。展望第四季度,预测市场有望沿“链上 × 合规”的双循环结构继续演进:链上部分的 Polymarket 将依托 DeFi 流动性与宏观叙事交易实现外延扩张;合规路径的 Kalshi 则借助监管认可与美元计价机制加速吸引机构资本。随着数据驱动型金融叙事的普及,预测市场正从注意力经济走向决策基础设施,成为金融体系中少有的、既能反映群体情绪又具备前瞻定价功能的新型资产层。

参考链接

https://www.strategicethreserve.xyz/

https://blockworks.com/analytics/treasury-companies

https://www.theblock.co/data/decentralized-finance/prediction-markets-and-betting

ArkStream Capital是由原生加密货币人士创立的加密基金,包含一级市场与流动性策略,投资web3原生与前沿的创新,致力于推动web3创始人与独角兽成长。ArkStream Capital团队从2015年开始进入加密货币领域,来自MIT,Stanford, UBS, 埃森哲,腾讯,谷歌等高校与公司。投资组合包含超过100家区块链公司,包括Aave, Sei, Manta, Flow, Fhenix, Merlin, Avail, Space and Time等。

Website:https://arkstream.capital/

Medium: https://arkstreamcapital.medium.com/

Twitter: https://twitter.com/ark_stream

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。