精选要闻

1、Vitalik「量子计算 2028 年破解加密算法」警告引发社区激烈争论

3、ZEC 短时突破 700 美元,24 小时涨幅达 15.38%

4、ZORA 突破 0.06 美元,24 小时涨幅 18.9%

5、Binance Alpha 将于今日 20:00 进行空投,积分门槛 240 分

精选文章

1.《比特币还需要什么条件才能涨?》

昨晚英伟达交出了一份华丽的成绩单。第三季度营收 570 亿美元,同比暴涨 62%,净利润飙升 65% 至 319 亿美元。这已经是英伟达连续第十二次超预期了。财报发布后,股价盘后大涨 4-6%,第二天盘前继续上涨 5.1%,直接给公司增加了约 220 亿美元市值,还顺带拉动纳斯达克期货上涨 1.5-2%。按理说,市场情绪这么好,比特币这个数字黄金也该跟着沾点光吧?结果现实给了我们一记耳光——比特币不涨反跌,价格滑落至 91,363 美元,跌幅约 3%。

2.《DeFi 都不敢玩了,看看这四个稳妥年化 10% 的理财》

牛熊难辨,大家都不敢炒币了。把钱放在 DeFi 理财,没想到 DeFi 也爆雷了。所以这次不谈那些动辄百分之几十上百的收益,也不鼓励做什么花哨的策略,律动 BlockBeats 挑了几个在当前市场下相对稳健、APY 都在 10% 上下、且经过时间验证链上和链下交易平台的池子,这些都是当前市场中可选择的方向之一。整体比较下来,Binance 上的 BFUSD 目前的综合优势还是相对突出的,在收益率、机制设计、用途扩展以及风险结构上都比同类产品更稳妥。

链上数据

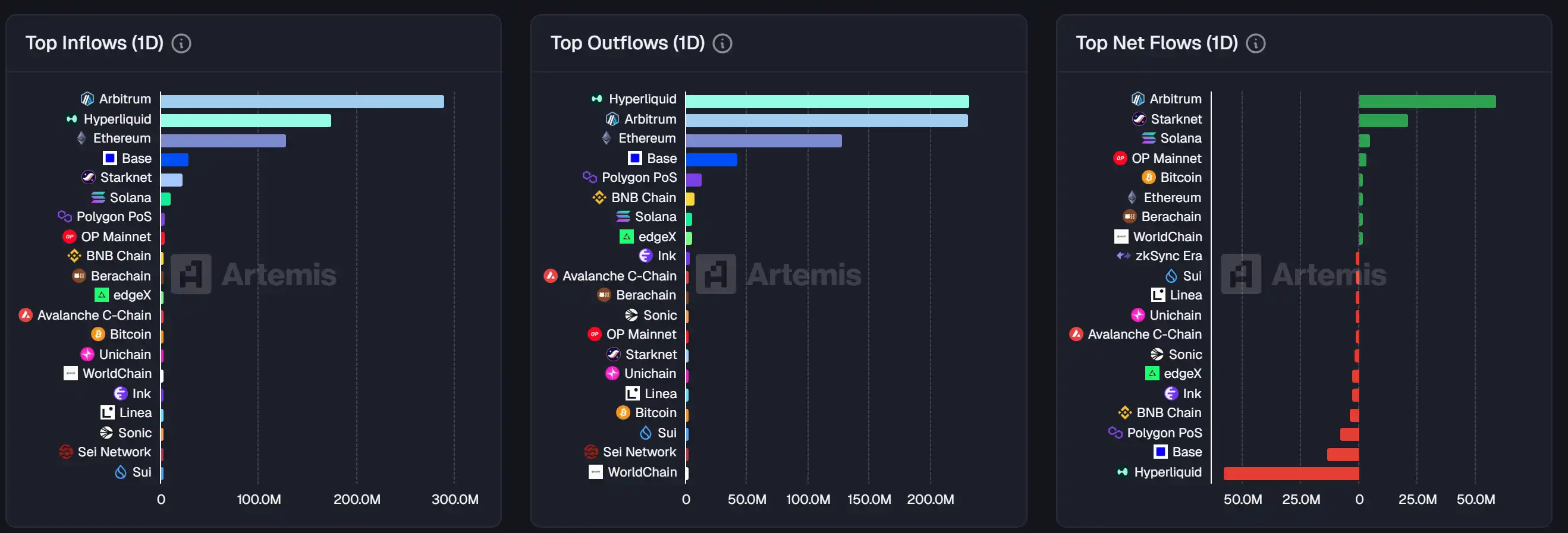

11 月 20 日上周链上资金流动情况

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。