Highlights of This Issue

This week's newsletter covers the statistical period from August 15 to August 21, 2025. The total on-chain market capitalization of RWA continues to rise, with the number of holders expanding by 13.75%, but the activity in the tokenized stock market has noticeably cooled; on the regulatory front, the U.S. Treasury is publicly soliciting innovative proposals for stablecoin monitoring under the "GENIUS Act," and the Federal Reserve's meeting minutes repeatedly discuss the impact of stablecoins on U.S. Treasury demand and the financial system, indicating a deepening regulatory framework; traditional giants like S&P, Toyota, and DBS Bank are actively positioning themselves to apply RWA in financial products, physical assets, and consumer goods, signaling an accelerated trend of RWA tokenization penetration.

Data Insights

RWA Sector Overview

According to the latest data from RWA.xyz, as of August 22, 2025, the total on-chain market capitalization of RWA is $26.44 billion, an increase of 4.21% compared to the same period last month, with steady growth; the total number of asset holders is approximately 366,200, up 13.75% from the same period last month, indicating continuous growth in the overall user base; the total number of asset issuers is 263.

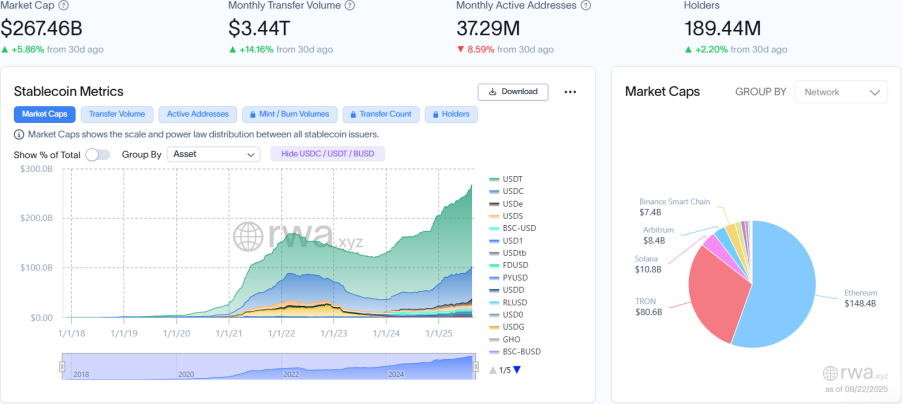

Stablecoin Market

The total market capitalization of stablecoins is $267.46 billion, an increase of 5.86% compared to the same period last month; the monthly transfer volume is $3.44 trillion, a significant increase of 14.16% compared to the same period last month, with the growth rate of transfer volume significantly outpacing that of market capitalization, indicating an increase in the unit currency turnover rate; the total number of monthly active addresses is approximately 37.29 million, down 8.59% from the same period last month; the total number of holders is approximately 189 million, a slight increase of 2.20% compared to the same period last month. The leading stablecoins are USDT, USDC, and USDe, with USDT and USDC's market capitalizations increasing by 3.17% and 4.35%, respectively, while USDe's market capitalization surged by 84.21%.

Tokenized Stock Market

The total market capitalization of the tokenized stock sector is approximately $356 million, a decrease of 13.03% compared to the same period last month; the monthly transfer volume is approximately $25.4 million, down 26.67% from the same period last month; the total number of monthly active addresses is approximately 32,500, a significant drop of 55.61% from the same period last month, indicating a cooling market sentiment; the total number of holders is approximately 61,160, with an increase of 7.47% compared to the same period last month. The stock with the highest issuance scale is EXOD (self-custody platform Exodus Movement), with a volume of approximately $244 million.

Regulatory News

U.S. Treasury Solicits Innovative Stablecoin Regulation Proposals under the GENIUS Act

The U.S. Treasury is publicly soliciting innovative methods from financial institutions for detecting illegal activities related to digital assets under the GENIUS Act, including APIs, artificial intelligence, digital identity verification, and blockchain monitoring. The public is required to submit comments by October 17 (within 60 days), which will be used to assess the effectiveness, cost, privacy, and cybersecurity of the tools.

The Federal Reserve released the minutes from its July meeting, mentioning that many participants discussed recent and future developments related to payment stablecoins and their potential impact on the financial system. These participants noted that with the recent passage of the GENIUS Act (the U.S. Stablecoin Guidance and National Innovation Act), the use of payment stablecoins may increase. They stated that payment stablecoins could help improve the efficiency of payment systems and observed that such stablecoins might increase demand for the underlying assets (including U.S. Treasuries). Additionally, participants expressed concerns that stablecoins could have broader implications for banks and the financial system, as well as for the implementation of monetary policy, warranting close monitoring, including oversight of the various assets used to back stablecoins.

The Federal Reserve meeting minutes indicate that officials are closely monitoring the growth of stablecoins and the associated risks following the passage of the GENIUS Act.

According to financial blog Zero Hedge, the term "stablecoin" was mentioned eight times in this Federal Reserve meeting minutes.

Local Developments

OSL Group and Zhongchou Game Reach Strategic Cooperation on Stablecoin Ecosystem

OSL Group announced on August 15 that it has reached a strategic cooperation agreement with Zhongchou Game to integrate OSL's compliant virtual asset financial infrastructure with Zhongchou Game's global IP game ecosystem, promoting the application of stablecoins in game payments and the real economy. The two parties will connect OSL's stablecoin service network for financial institutions with Zhongchou Game's payment scenarios, accelerating the promotion of compliant stablecoins in the digital entertainment and industrial sectors.

Shenzhen Longgang District Data Co., Ltd. Partners with Hong Kong Web3.0 Standardization Association

According to the Science and Technology Innovation Board Daily, as the only strategic partner of the Hong Kong Web3.0 Standardization Association in mainland China, Shenzhen Longgang District Data Co., Ltd. has signed a strategic cooperation agreement with the association to deeply participate in the ecological construction of the world's first RWA asset registration platform released by the association on August 7 in Hong Kong. The two parties plan to jointly build a cross-border data compliance recognition mechanism, creating a full-cycle service platform covering asset confirmation, trusted storage, and compliant circulation, relying on "Shenzhen's industrial foundation + Hong Kong's international hub" to explore a model of "mainland asset digitization, Hong Kong digital financialization, and global circulation compliance," supporting domestic and international dual circulation.

Project Progress

According to Cointelegraph, S&P Dow Jones Indices is discussing collaborations with major exchanges, custodians, and decentralized finance protocols to launch tokenized versions of benchmark index products. Earlier this year, the company partnered with Centrifuge to authorize the tokenization of the S&P 500 index. According to S&P Dow Jones Indices director Stephanie Rowton, this move aims to establish a robust infrastructure to support index tokenization trading. The plan primarily considers factors such as transparency, security, and regulatory compliance, and may extend to the tokenization of other flagship indices like the Dow Jones Industrial Average.

Orama Labs Launches PYTHIA-based LaunchPad and Partners with Kingnet Capital HK

Orama Labs is set to launch its first product, LaunchPad, which aims to build the next-generation asset tokenization protocol to address the inefficiencies in traditional research funding and resource allocation. Meanwhile, Kingnet Capital HK will provide core technological support in the AI field for Orama Labs.

The platform aims to create a closed-loop ecosystem from research to commercialization by funding research experiments, securing intellectual property rights, addressing information silos, and community governance, promoting innovative development in on-chain research.

PYTHIA serves as the core governance token of the platform, incentivizing research contributors, funding high-quality research projects, and driving on-chain governance.

Scottish Distillery Bowmore and Avalanche Launch First Tokenized Whiskey Series

The Scottish distillery Bowmore has partnered with the blockchain platform Avalanche to release the first tokenized whiskey series, combining rare spirits with digital ownership. This series will officially debut at the TOKEN2049 event in Singapore on September 30, with pre-sales now open. The launch includes the Bowmore 30-Year Collector’s Edition valued at $5,500 (limited to 8 bottles) and the Bowmore 12-Year (limited to 150 bottles) priced at $180. Each bottle of whiskey is linked to a uniquely numbered NFT, providing verifiable ownership and tamper-proof certification.

Decentralized RWA Platform MyStonks Launches ETF U.S. Stock Token MSTX.M

The MyStonks platform has simultaneously launched the ETF U.S. stock token $MSTX.M, following the earlier launch of the leveraged inverse ETF $MSTZ.M.

$MSTX.M is based on the leveraged ETF MSTX launched by Defiance ETFs, which tracks approximately 2x the daily performance of MicroStrategy (MSTR) stock. Through tokenization, investors can conveniently participate in high-volatility investment opportunities related to MicroStrategy and its Bitcoin assets on-chain.

NASDAQ-listed VCI Global Limited (NASDAQ: VCIG) has announced a $2 billion partnership with a digital asset holder to establish a sovereign-level crypto infrastructure joint venture project backed by 18,000 BTC (currently valued at approximately $2.16 billion).

VCI Global holds a 70% stake and is responsible for commercialization and infrastructure management, while the partner retains custody of the BTC assets. The project will promote the institutional application of cryptocurrencies, including BTC-backed real asset tokenization, crypto storage monetization, and AI computing integration.

SkyBridge Capital Plans to Tokenize $300 Million in Assets on Avalanche

Anthony Scaramucci's investment firm SkyBridge Capital has announced plans to tokenize approximately $300 million in assets and deploy them on the Avalanche blockchain. This funding represents about 10% of SkyBridge's managed assets, including funds focused on non-security cryptocurrencies like Bitcoin and other portfolio funds. The tokenization will be completed in partnership with Tokeny.

This move by SkyBridge aligns with the recent trend of asset tokenization on blockchain by financial giants such as BlackRock and Franklin Templeton.

The Avalanche network currently holds nearly $2 billion in assets, and SkyBridge hopes to promote the integration of traditional finance with blockchain technology through this tokenization, while also showcasing the cost-saving advantages of blockchain.

Stellar Development Foundation Invests in UK Archax to Promote RWA Asset Tokenization

According to CoinDesk, the Stellar Development Foundation has announced an investment in the UK digital asset platform Archax, aimed at promoting the tokenization of real-world assets (RWA) based on the Stellar blockchain. Archax has integrated Stellar into its own tokenization tools and has launched the Aberdeen Money Market Fund token on the network. The specific investment amount has not been disclosed. The current RWA market size has reached $26 billion and is expected to grow to the trillion-dollar level by 2030.

Bitget Launches First RWA Index Perpetual Contract, Initial Assets Include TSLA, NVDA, and CRCL

Bitget has officially launched the industry's first RWA index perpetual contract. The initial assets include AAPL/USDT (RWA), NVDA/USDT (RWA), and CRCL/USDT (RWA).

The RWA contract underlying assets are composed of tokenized RWA indices of stocks that are already circulating in the market, with each index containing multiple RWA tokens to track the prices of different third-party issuers. Its pricing mechanism references the crypto perpetual contract model, dynamically adjusting the index sources based on market activity, trading volume, liquidity, and other factors, while regularly disclosing weights to ensure pricing flexibility and fairness.

In terms of trading rules, the RWA index perpetual contract adopts a 5×24 hour trading system, with prices frozen during weekends and stock market holidays to avoid liquidation, supporting order cancellations but pausing new order submissions, and funding fee settlements resuming with trading. The product continues the existing trading mechanisms and clearing processes of crypto perpetual contracts, with an initial leverage limit set at 10 times, supporting only isolated margin mode and setting a platform-wide position limit to control risk.

The initial pricing of this product will be based on stock tokens from the xStocks platform, with plans to incorporate more credible issuers soon and expand the RWA perpetual contract categories this quarter.

According to official news from StableStock, the TraDeFi platform has completed a seed round of financing involving YZi Labs, MPCi (formerly known as Matrix Partners China), and Vertex Ventures, while successfully completing the YZi Labs Easy Residency project.

StableStock focuses on the on-chain stock ecosystem, aiming to bring trillions of dollars in equity liquidity into DeFi. The platform has officially entered the public testing phase, open to all users.

Kraken and Backed have announced a strategic partnership with TRON DAO to integrate xStocks into the TRON blockchain, further expanding the application of stock tokenization. xStocks is an industry-standard stock token jointly launched by Backed and Kraken, and in the future, Kraken users in eligible regions will be able to directly access xStocks via the TRON blockchain. The token will be deployed in TRC-20 format, ensuring that each token asset is fully backed 1:1.

On-chain RWA Exchange DigiFT Completes Strategic Financing, Total Financing Reaches $25 Million

On-chain RWA exchange DigiFT announced that it completed a new round of strategic financing in August 2025, led by Japan's largest financial group, SBI Holdings, with participation from Mirana Ventures, Offchain Labs (Arbitrum), Yunqi Capital, and executives from the global fintech sector. After this round of financing, DigiFT's total financing has reached $25 million, which will be used to expand tokenized products, enhance RWA secondary market liquidity, broaden on-chain application scenarios, and build compliant smart contract infrastructure.

DBS Bank in Singapore Launches Tokenized Structured Notes on Ethereum

According to CoinDesk, Singapore's largest bank, DBS (Development Bank of Singapore), has announced the issuance of tokenized structured notes on the Ethereum public chain, open to qualified and institutional investors on local exchanges ADDX, DigiFT, and HydraX. The first product is a participation note linked to crypto assets, cash-settled on price increases and limiting losses on price decreases. The note unit has been reduced from the traditional $100,000 to $1,000, enhancing liquidity and trading convenience. In the first half of 2025, the trading volume of related products exceeded $1 billion, with a nearly 60% quarter-on-quarter growth in Q2. DBS plans to expand into stock and credit notes in the future.

Toyota Releases MON Blockchain Framework Based on Avalanche to Promote Vehicle Asset Tokenization

According to BeInCrypto, Toyota Blockchain Lab has released a white paper for the Mobility Orchestration Network (MON), based on the Avalanche multi-chain architecture, to convert vehicles into tradable digital assets. MON establishes a digital identity for vehicles through NFTs, integrating legal, technical, and economic proofs to achieve fleet asset securitization. This framework supports electric vehicle fleets, autonomous taxis, and logistics, covering data related to registration, insurance, and operations, and manages securities issuance, ownership, operations, and payment settlements through four Avalanche L1 chains. MON aims to facilitate cross-industry and cross-border compliance and asset circulation and is currently in the proof-of-concept stage.

Insights Highlights

PANews Overview: This article points out that the focus of competition in cryptocurrency is shifting from general Layer 2 (L2) solutions to dedicated blockchains tailored for stablecoin payments. Existing public chains (such as Ethereum and Solana) cannot fully meet the core needs of massive transactions, low latency, predictable low costs, and built-in fiat channels for payment scenarios. The article details seven dedicated chains launched by giants like Tether, Circle, and Stripe (such as Plasma, Arc, Tempo), which share common features: using stablecoins themselves to pay gas fees, sub-second finality, extremely low transfer costs, native integration of fiat on- and off-ramps, and end-to-end optimization for specific financial use cases (payments, foreign exchange, settlement). The essence of this competition is the struggle for dominance in the infrastructure of future global capital flows, with the ultimate winners likely to be those platforms that can "invisibly" embed themselves into everyday payment scenarios (such as checkout, payroll, and cross-border remittances).

PANews Overview: This article depicts the explosive growth of the stablecoin market in Latin America, where practicality reigns. In the context of high inflation and capital controls in the region, stablecoins are widely used as "digital dollars" for savings, payments, cross-border remittances, and hedging against local currency depreciation, far surpassing the utility of other cryptocurrencies. Brazil and Mexico are the leaders, with Brazil having the most diversified ecosystem of local currency (real) stablecoins, with trading volume surging 230 times from 2021 to 2025, primarily used for B2B payments and on-chain settlements; the Mexican market is dominated by two main peso stablecoins, MXNB (for small retail payments) and MXNe (for large institutional settlements). These local stablecoins have successfully bridged the gap between local fiat and on-chain dollars by integrating with local instant payment systems (such as Brazil's PIX) and establishing liquidity pools on global DEXs, creating a vibrant localized financial ecosystem.

PANews Overview: This article reveals the intense conflict of interest between traditional banks and emerging stablecoin issuers. The American Bankers Association (ABA) has joined forces with 52 institutions to oppose Section 16(d) of the GENIUS Act, which allows state-chartered institutions not participating in federal insurance to operate stablecoin businesses across state lines, creating "regulatory arbitrage." The fundamental concern of the banking industry is that payment giants (like Stripe) and stablecoin issuers (such as Tether and Circle) may attract users by offering yield rewards, leading to massive outflows of bank deposits (estimated to be in the trillions of dollars), which would directly increase banks' funding costs and weaken their lending capabilities. Meanwhile, stablecoin issuers have become significant buyers in the U.S. Treasury market (with Tether being the seventh-largest holder), increasing their influence. Despite the competition between the two sides, the article also points out the potential for a "co-opetition" relationship in the future, where banks could act as custodians and service providers for stablecoins, with giants like JPMorgan already exploring their own "tokenized deposit" businesses.

PANews Overview: This article analyzes the three main models currently being used to tokenize U.S. stocks. Robinhood adopts a "derivative contract" approach, where users purchase not the stocks themselves but a financial contract that tracks stock prices. Its advantage lies in leveraging existing brokerage licenses and a large user base, but the ecosystem is closed and cannot interact with external DeFi. xStocks takes an open route of "real assets on-chain," holding real stocks 1:1 through a Swiss legal framework and SPV (Special Purpose Vehicle), allowing tokens to be freely traded on the Solana chain and combined with DeFi protocols. However, its success depends on establishing sufficient liquidity and gaining long-term regulatory tolerance. StableStocks represents a "hybrid model," where stocks are actually held by partner brokerages, and users act as beneficiaries, issuing tokens on the BNB chain. Its feature is to provide a "DeFi-lite" yield enhancement function within its own platform, balancing experience and complexity. The article concludes that the key to winning this competition lies not in technology but in who can first create irreplaceable value for users (such as an exceptional experience, a rich ecosystem, or a large user base).

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。