Author: White55, Mars Finance

I. The "Watershed" of Regulation: Why Did the SEC Yield to Liquid Staking?

Excerpt from SEC staff statement on certain cryptocurrency liquid staking activities. Source: SEC

On August 6, 2025, the U.S. Securities and Exchange Commission (SEC) quietly released a groundbreaking "Liquid Staking Activities Guide," which for the first time clearly states that liquid staking tokens (LST) do not constitute a securities offering in specific scenarios, and related service providers are not required to register under the Securities Act. The underlying message of this guide is that the staking ecosystem of mainstream public chains like Ethereum and Solana has finally received a "compliance passport."

The core logic of the SEC lies in the separation of economic substance:

- Staking receipt tokens (such as stETH, mSOL) serve merely as "proof of ownership," and their issuance and trading do not involve the attributes of an "investment contract." As long as the user's deposit of crypto assets is independent of any promise to "profit from the efforts of others," it does not trigger the Howey Test.

- Clarification of regulatory boundaries: The SEC specifically named protocols like Lido, Marinade Finance, and JitoSOL as meeting exemption criteria, as their functions are limited to "administrative services" (such as token minting and reward distribution), rather than active management or profit guarantees.

This shift is driven by a dual game of politics and market dynamics:

- SEC Chairman Paul Atkins has shifted from the previous administration's "enforcement regulation" style to promote the "Project Crypto" initiative, viewing staking as a "network security service" rather than a speculative tool.

- The pressure from the "CLARITY Act": Congress intends to exclude node operation, staking, and self-custody wallets from the definition of "securities broker," forcing the SEC to rush to establish rule-making authority.

II. Dissecting Liquid Staking: Why Is It the "Liquidity Engine" of DeFi?

1. Mechanism: From Asset Locking to Capital Splitting

Liquid staking allows stakers to use alternative tokens to maintain the liquidity of their staked tokens and earn additional yields through DeFi protocols using these alternative tokens.

Before delving into liquid staking, let's first understand staking and its related issues. Staking refers to locking cryptocurrency in a blockchain network to maintain its operation, allowing stakers to earn rewards. However, staked assets typically become illiquid during the staking period, as they cannot be redeemed or transferred.

Liquid staking enables cryptocurrency holders to participate in staking without relinquishing control over their held assets. This fundamentally changes the way users stake. Projects like Lido have introduced liquid staking, providing a tokenized representation of staked assets in the form of tokens and derivatives.

It allows users to enjoy the benefits of staking while retaining trading flexibility, enabling them to trade these tokens in decentralized finance (DeFi) applications or transfer them to other users.

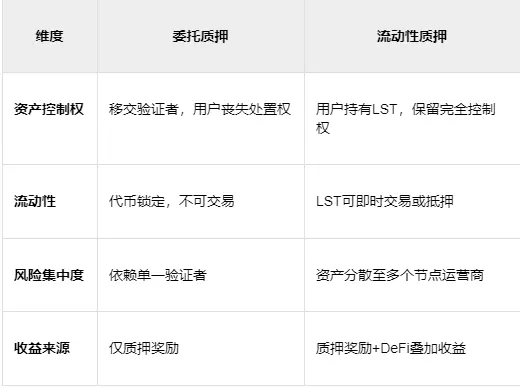

2. The "Power Struggle" with Delegated Staking

In Delegated Proof of Stake (DPoS) networks, users vote to elect their preferred representatives. However, the purpose of liquid staking is to allow stakers to bypass minimum staking thresholds and token locking mechanisms.

While the basic concept of DPoS draws from Proof of Stake (PoS), its execution differs. In DPoS, network users have the right to elect representatives, known as "witnesses" or "block producers," responsible for block validation. The number of representatives participating in the consensus process is limited and can be adjusted through voting. Users in DPoS can pool their tokens into a stake pool and use their combined voting power to elect their preferred representatives.

On the other hand, liquid staking aims to lower investment thresholds and provide stakers with a way to circumvent token locking mechanisms. Blockchains typically have minimum requirements for staking. For example, Ethereum requires anyone wishing to establish a validator node to stake at least 32 Ether. It also requires specific computer hardware, software, time, and expertise, which also necessitates significant investment.

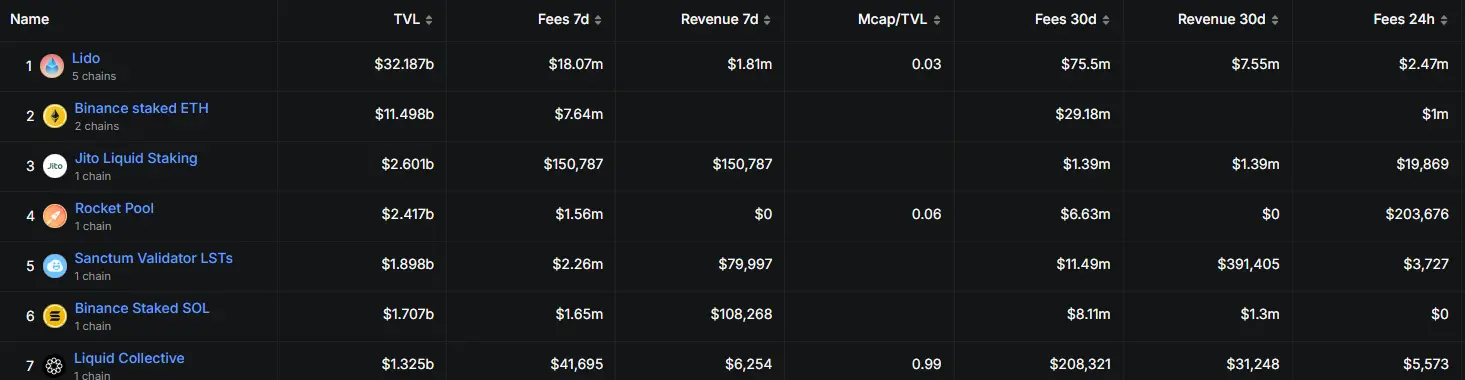

This model has sparked market growth: the total value locked (TVL) in liquid staking protocols has surpassed $67 billion, with Ethereum accounting for 76% ($51 billion), and Lido alone holding a 31% market share.

III. How Liquid Staking Works

Liquid staking aims to eliminate staking thresholds, allowing holders to profit using liquidity tokens.

Stake pools allow users to combine multiple small stakes into a larger stake using smart contracts, which provide corresponding liquid tokens (representing their share in the pool) to each stake holder.

This mechanism removes the barrier to becoming a staker. Liquid staking goes a step further, enabling stakers to earn dual rewards. On one hand, they can profit from the staked tokens; on the other hand, they can utilize liquidity tokens to earn profits through trading, lending, or any other financial activities without affecting their original staking position.

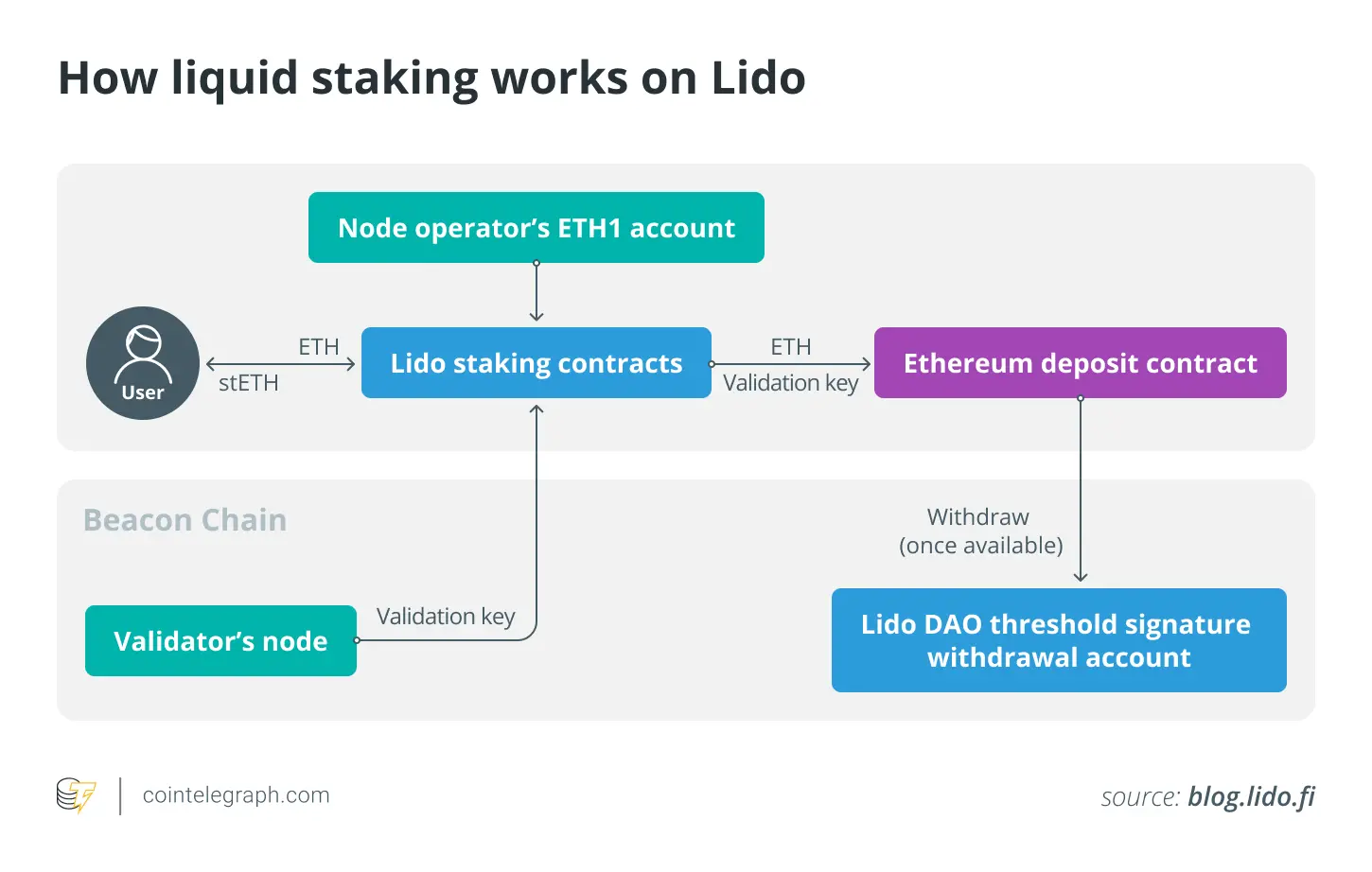

Using Lido as an example will help us better understand how liquid staking operates. Lido is a liquid staking solution for PoS currencies, supporting multiple PoS blockchains, including Ethereum, Solana, Kusama, Polkadot, and Polygon. Lido provides an innovative solution to the barriers posed by traditional PoS staking by effectively lowering entry thresholds and the associated costs of locking assets in a single protocol.

Lido is a staking pool based on smart contracts. Users deposit assets into the platform and can stake them on the Lido blockchain through the protocol. Lido allows ETH holders to stake a small portion of the minimum threshold (32 ETH) to earn block rewards. After depositing funds into Lido's staking pool smart contract, users receive Lido Staked ETH (stETH), an ERC-20 compatible token that is generated upon deposit and destroyed upon withdrawal.

The protocol allocates the staked ETH to validators (node operators) within the Lido network, which is then deposited into the Ethereum Beacon Chain for validation. These funds are subsequently held in a smart contract that validators cannot access. The ETH deposited through the Lido staking protocol is divided into collections of 32 ETH, managed by active node operators on the network.

These operators use public validation keys to verify transactions involving users' staked assets. This mechanism allows users' staked assets to be distributed across multiple validators, thereby reducing the risks associated with single points of failure and individual validator staking.

Stakers can deposit tokens such as Solana's SOL, MATIC, DOT, KSM into Lido's smart contract and receive stSOL, stMATIC, stDOT, and stKSM respectively. stTokens can be used for DeFi yield earning, providing liquidity, trading on decentralized exchanges (DEX), and many other use cases.

IV. The "Domino Effect" of the SEC Guidelines: Who Is Celebrating? Who Is Cautious?

1. Institutions: From Bystanders to "Staking Whales"

The staking revolution of ETF issuers: Rex Shares has launched the first Solana staking ETF in the U.S., holding SOL through a Cayman subsidiary and staking at least 50% of its position; BlackRock, VanEck, and other Ethereum ETF applicants are urgently revising their proposals to include staking clauses—analysts predict a probability of approval exceeding 95%.

The trend of public companies "hoarding coins for interest":

- Bitcoin mining company Bit Digital has liquidated its mining rigs and shifted to Ethereum staking;

- SharpLink Gaming has staked all 198,000 ETH (approximately $500 million), earning 102 ETH in a single week;

- BitMine has raised $250 million to establish an ETH staking fund, managed by Wall Street veteran Tom Lee.

Wall Street's new calculation: With treasury yields at only 4%, staking ETH can yield 5% returns + asset appreciation potential—this is the "fixed income +" version of crypto.

2. The Compliance Turning Point for DeFi

The explosion of the "secondary market" for LST: Institutions can include tokens like stETH in their balance sheets or use them as collateral for derivatives. Alluvial's CEO predicts, "The exemption of staking tokens from securities will give rise to a trillion-dollar on-chain treasury market."

The retail entry revolution: Robinhood has opened ETH and SOL staking to U.S. users; Kraken has achieved non-custodial Bitcoin staking through the Babylon protocol (user BTC remains on the mainnet, earning yields through Tapscript locking).

The Endgame: When Wall Street Takes Over the Staking Empire

The SEC's green light is essentially the prologue to institutional compliance:

- Staking as a Service (StaaS) will replace retail mining, becoming standard configuration for asset management giants like BlackRock and Fidelity;

- LST derivatives (such as futures and options) will land on CME and ICE, attracting hedge funds to hedge against staking yield volatility;

- The entry of sovereign funds: Funds from the UAE and others are testing staking ETFs, viewing them as "digital sovereign bonds."

The ultimate goal of all this is to transform PoS chains like Ethereum and Solana into a "digital bond market" for global capital—where staking yields are the new treasury yields, LSTs are the new T-Bills, and the SEC's stamp is merely the key for Wall Street to unlock the treasury.

History never repeats itself, but it rhymes: In 1688, underwriters in London coffeehouses used wealth to guarantee ocean-going merchant ships; in 2025, the SEC guarantees the navigational safety of the sea of code with a single guideline.

Click to learn about job openings at ChainCatcher

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。