Once merely a tool for cryptocurrency traders to store profits, it has now become the trading layer for emerging economies, a settlement tool within the fintech stack, and a strategic currency extension of U.S. monetary policy.

Written by: Castle Labs

Translated by: AididiaoJP, Foresight News

Over the past 12 months, stablecoins have gradually transitioned from a marginal role in the crypto space to a more prominent position in broader financial markets. The data speaks for itself: the supply of stablecoins has more than doubled, with a significant increase in usage by traditional payment networks and institutional participants, indicating a growing market interest in these assets. But more fundamentally, there is a structural transformation; what was once just a tool for crypto traders to store profits has now become the trading layer for emerging economies, a settlement tool in the fintech stack, and a strategic currency extension of U.S. monetary policy.

This report compares the usage of stablecoins from mid-2024 to mid-2025, tracking the growth in adoption, regional changes, and the current status of stablecoins as both products and concepts.

Global Trends: From Liquidity Tools to Functional Infrastructure

Market Capitalization and Usage Growth

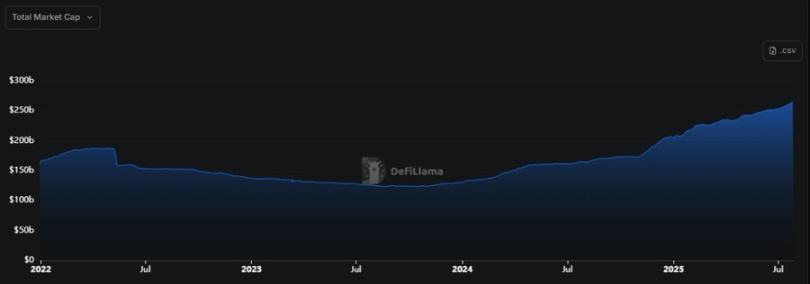

The market capitalization of stablecoins rebounded from approximately $160 billion in mid-2024 to over $260 billion by July 2025, an increase of more than 60%, pushing the total supply of stablecoins in circulation beyond the peak of 2022, with liquidity reaching new records.

On-chain transaction volumes further illustrate the situation. In 2024, the settlement volume of stablecoins exceeded the combined total of Visa and Mastercard, reaching $27.6 trillion. Monthly transaction volumes doubled year-on-year, growing from $1.9 trillion in February 2024 to $4.1 trillion in February 2025. A peak of $5.1 trillion was reached in December 2024, indicating that these funds are no longer confined to the crypto-native space; in certain ecosystems, stablecoins account for more than half of all transaction value.

Expansion of User Base

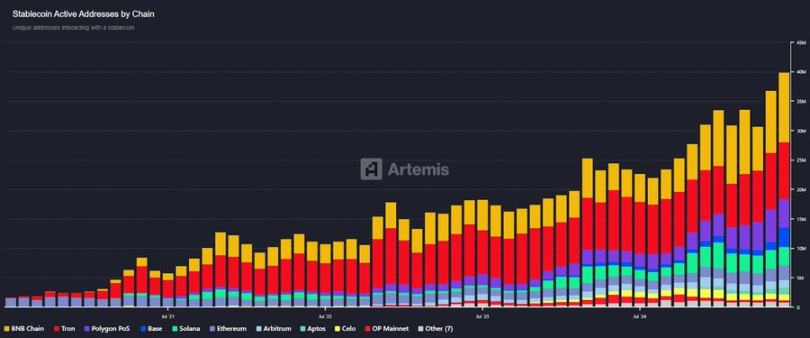

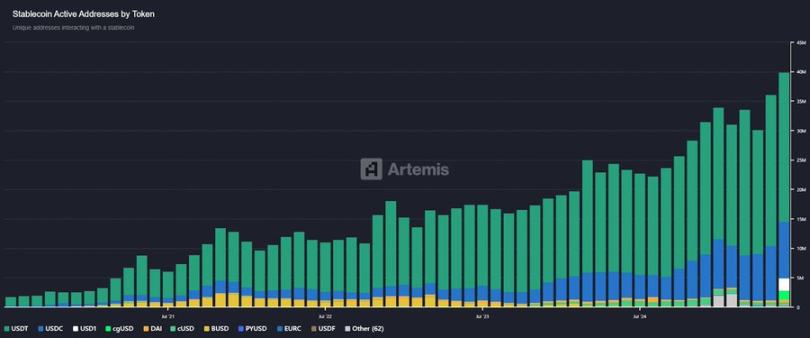

The number of active wallets grew from about 20 million in mid-2024 to around 40 million by mid-2025. The total number of addresses holding stablecoin balances has surpassed 120 million. This growth is not only quantitative but also reflects diversity. An increasing number of small businesses, freelancers, and remittance users are transferring funds via stablecoins, often without directly participating in the broader crypto market.

Institutional Integration

In 2024, stablecoins became not only financial tools for crypto companies but were also gradually adopted by fintech firms, asset management companies, and some enterprises. The reason is simple: they provide a fast, programmable, dollar-denominated asset that can be transferred across platforms without relying on traditional banking channels. For companies operating across multiple countries or time zones, this means improved liquidity management, faster internal transfers, and reduced settlement delays.

With interest rates remaining high for most of 2024, depositing idle cash into stablecoins like USDC has also become more attractive. Many stablecoins are backed by short-term government bonds; although users cannot directly earn yields, their reserve structures instill confidence that the underlying assets are high-quality and income-generating. For companies seeking a reliable dollar-denominated digital alternative, stablecoins have become a viable option.

This year, stablecoins have further integrated into fintech architectures. Visa expanded USDC settlements to Ethereum and Solana. Stripe and PayPal introduced stablecoin payments into consumer channels. Even banks have begun testing local stablecoins, such as Standard Chartered's HKD coin, to explore faster cross-border settlements.

Tether achieved a profit of $13 billion in 2024, more than double that of BlackRock, highlighting the financial significance of the reserve model. This not only proves that stablecoin issuers support infrastructure but also indicates that they operate highly profitable businesses. This profitability translates into sustainability, enhancing user trust and accelerating adoption across the financial sector.

Evolution of Stablecoin Types

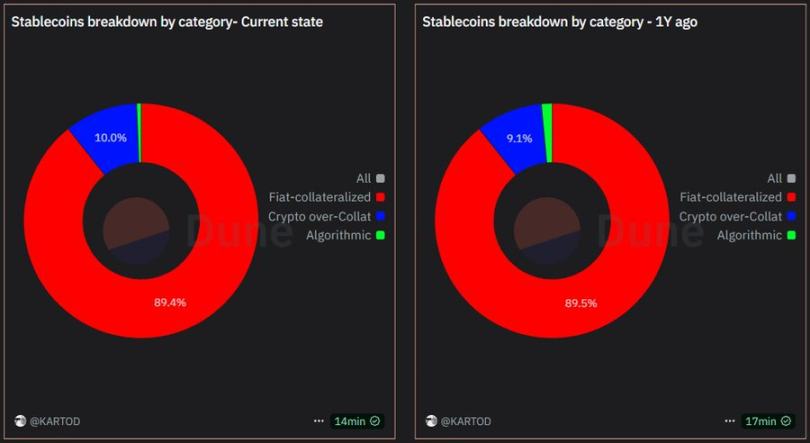

Fiat-backed Stablecoins Dominate

The market share of fiat-backed stablecoins (fully backed by cash or short-term government bonds) has grown from about 85% in 2024 to over 90% currently. The supply of Tether (USDT) increased from about $83 billion to approximately $150 billion. USDC recovered from a low of around $59 billion in 2023, regaining favor among institutions.

The adoption of stablecoins like PayPal's PYUSD and Paxos' USDP has been more moderate, but real growth is concentrated in leading products. User preference for fully backed and transparent reserves has become a common expectation, although this also brings trade-offs related to centralized custody and regulatory risks.

Decline of Crypto-Collateralized and Algorithmic Stablecoins

Crypto-collateralized stablecoins (like DAI) have seen slight growth in absolute numbers (around $5 billion) but a decline in market share. Protocols like Aave (GHO) and Curve Finance (crvUSD) have added hundreds of millions in circulation, but crypto-backed stablecoins have not truly broken through and have not collapsed either.

On the other hand, algorithmic models have nearly disappeared. After the collapse of Terra, designs that were not over-collateralized lost trust, and many projects, including Frax Finance, shifted to fully fiat-backed models in 2023. Since then, no new algorithmic stablecoins have gained significant attention.

Today, fiat-backed stablecoins dominate in both use cases and consensus. Crypto-backed stablecoins represent a small and practical niche market. What was once considered a mainstream algorithmic approach has essentially exited the market.

Rise of Yield-bearing Stablecoins

One emerging category to watch in 2025 is yield-bearing stablecoins, which are not only used for value preservation but also for appreciation. Unlike traditional fiat-backed or over-collateralized models, these tokens explicitly integrate yields from real-world or on-chain strategies into their structure. Two typical examples are Ethena's USDe and Resolv's USR.

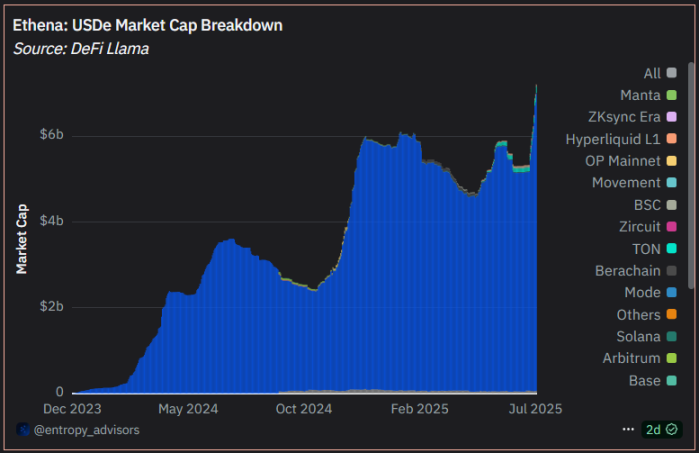

Ethena Labs' USDe employs a delta-neutral strategy, maintaining its peg by pairing staked ETH collateral with perpetual short positions while generating synthetic yields. This yield is passed on to holders through an additional token, sUSDe. This model has garnered early attention due to its composability, transparent yield mechanism, and ability to generate income without relying on centralized reserves. As of mid-2025, the supply of USDe remains far below that of major stablecoins, but it is one of the few projects to achieve significant adoption and stability in the post-Terra experiment.

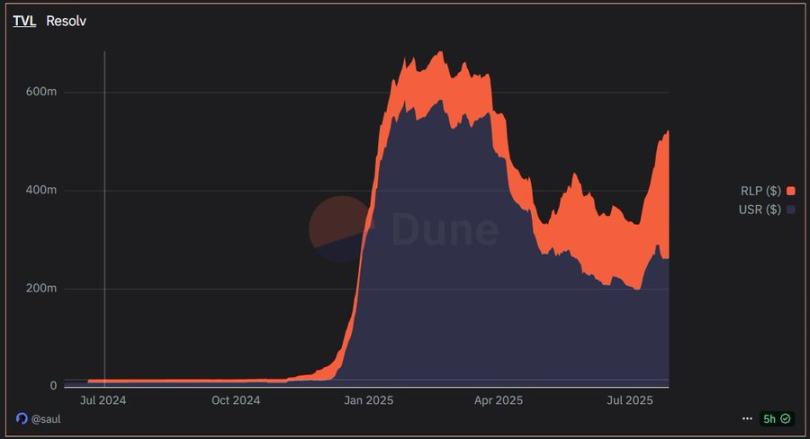

In contrast, Resolv Labs links yields to real-world income-generating assets, creating a structure that is closer to tokenized government bonds but exists in stablecoin form. USR aims to maintain its peg while providing users with stable yields through partnerships with off-chain credit and structured products. This is a more institutional approach, with adoption primarily concentrated in DeFi protocols and early lending platforms.

These models are still in the experimental stage, with adoption rates far below those of fiat-backed stablecoins. However, they represent a clear trend: users not only need stability but also seek passive income. The challenge remains to maintain transparency, peg stability, and regulatory clarity. If any of these aspects falter, confidence will quickly erode.

Currently, yield-bearing stablecoins have carved out a niche. They have not replaced USDT or USDC but have expanded the design space, offering capital-efficient options for users willing to accept different risk preferences. Whether they can scale without inheriting the vulnerabilities of previous algorithmic stablecoins remains to be seen. But for now, they are regarded with more importance than any attempts made after the collapse of UST.

Regional Behavioral Shifts

Emerging Markets: Latin America, Africa

Motivation: Stability and Access to Dollar Exposure

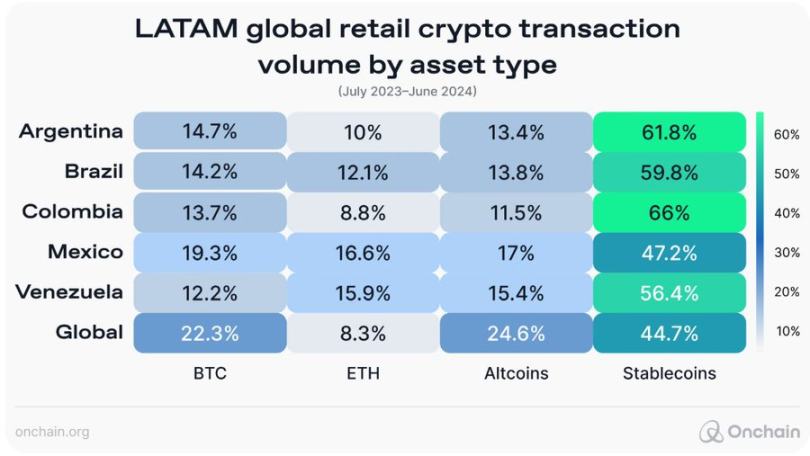

In countries facing inflation and currency volatility, stablecoins are increasingly becoming an alternative to digital dollars. Argentina, Venezuela, and Nigeria are examples. In 2024, demand for USDT surged as local currencies depreciated. By 2025, holding digital dollars has become a common practice for individuals and merchants.

In Africa, foreign exchange shortages affect over 70% of countries, and stablecoins have now become a bridge connecting local economies to global capital. Nigerian exchanges typically quote prices in USDT. When banks cannot provide dollars, businesses use stablecoins to pay overseas suppliers.

Remittances and Payments

The migration of remittance pathways to stablecoins is significant. In 2024, cryptocurrency-based cross-border transfers in Latin America grew by over 40%. By 2025, applications like Binance P2P and Airtm have become the primary remittance tools for the entire community.

The average cost of sending $200 through stablecoins in Sub-Saharan Africa is about 60% lower than traditional remittance channels. This is not just a marginal improvement but a transformative impact and a reflection of product-market fit.

Preferred Platforms and Tokens

Tron has become the dominant public chain for stablecoin activity in emerging markets due to its low fees, with most niche and P2P markets using USDT on Tron. The BSC chain and Solana have also gained market share, but in many regions, Tron remains the default choice.

USDC is gradually penetrating traditional financial payment channels, especially when regulatory scrutiny or institutional relationships become focal points. However, for ordinary users, USDT still holds an absolute advantage.

Regulatory Attitudes

Governments remain cautious. Brazil has introduced regulations for digital assets and is exploring central bank digital currencies (CBDCs). South Africa is developing guidelines for stablecoins. Most other emerging markets are still observing. While they recognize their utility, there are concerns about dollarization and capital flight. Currently, basic usage is tolerated, especially in the absence of alternatives.

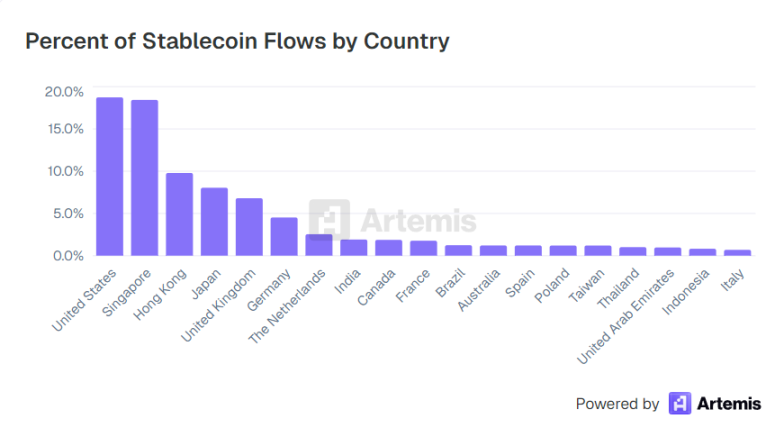

Asia: Regional Differences Are Pronounced

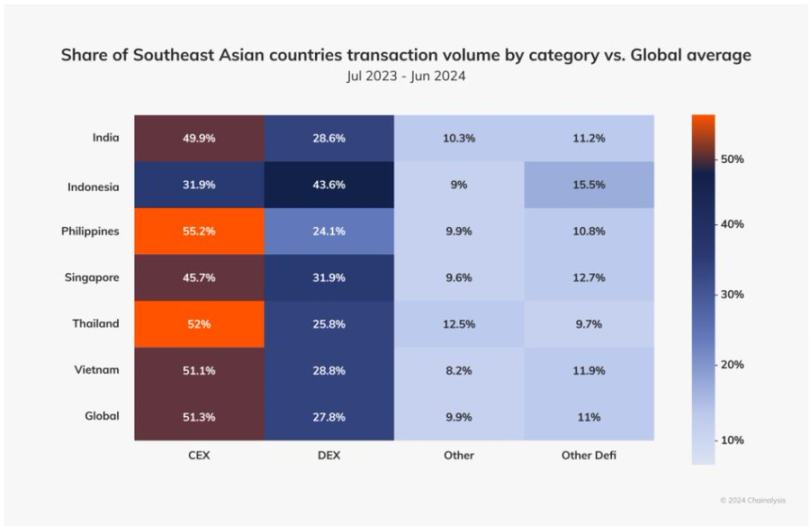

Southeast Asia and South Asia

In Southeast Asia, the use of stablecoins is more related to access channels rather than inflation. In countries like the Philippines and Vietnam, remittances are the main driver. Overseas workers send USDT or USDC back home through applications like Coins.ph or BloomX. In India, traders and freelancers use stablecoins to transfer funds between platforms to reduce slippage.

Vietnam stands out in retail crypto adoption. Singapore, on the other hand, is taking a more institutional approach, granting licenses for stablecoins and encouraging regulated issuance.

East Asia and Financial Hubs

Hong Kong and Singapore position themselves as regulated financial centers for stablecoins. The Monetary Authority of Singapore (MAS) implemented clear guidelines (reserve support, redemption terms) by the end of 2024. By 2025, USDC and regional stablecoin issuers are applying for licenses in Singapore.

Japan allows banks to issue stablecoins under a legal framework established in 2023. Several yen-pegged stablecoins are already in existence, but they remain niche. In South Korea, due to strict regulations, the use of stablecoins is still concentrated in trading.

Mainland China officially prohibits cryptocurrency-related activities, but USDT is widely used through over-the-counter channels. Reports indicate that significant capital flight and trade activities occur through Tether on the Tron network. This is a persistent but unofficial norm.

Developed Markets: Integration Rather Than Replacement

Usage Patterns

In the U.S. and Europe, stablecoins are rarely used for everyday consumption; instead, they are embedded in the backend of fintech stacks, corporate finance, and cross-border settlements.

Companies use stablecoins to transfer funds between subsidiaries. Freelancers accept USDC as payment for international work. Following the bank failures in 2023, crypto companies now rely on stablecoins rather than ACH or SWIFT for fiat transactions.

Franklin Templeton's on-chain money market fund settles in USDC. Mastercard and Western Union have launched stablecoin-based services. These integrations indicate the complementary expansion of stablecoins in fintech rather than complete replacement.

Regulatory Trends

The EU's MiCA framework will take effect in mid-2024. By mid-2025, non-euro stablecoins will face daily limits, and issuers will need to apply for licenses. The UK has also passed legislation recognizing stablecoins as digital settlement assets.

In the U.S., the recently passed GENIUS Act has yet to show its impact. Previous enforcement actions (such as the decline of BUSD) and market behaviors (concentrated around USDC/USDT) indicate that regulators are indirectly shaping this space, and this situation is changing. Stablecoins now account for over 1% of the M2 money supply, and Federal Reserve officials have begun to publicly acknowledge this.

Conclusion: From Parallel Assets to Embedded Layers

Between July 2024 and July 2025, stablecoins transitioned from being primarily crypto-native tools to an independent parallel financial system. In emerging markets, they have become a solution to bypass currency collapse and expensive banking services; in developed markets, they are integrated into regulated, compliant workflows.

The market structure reflects this evolution. Fiat-backed stablecoins dominate, with a market share exceeding 90%. Algorithmic and unsupported models, once seen as the core of "decentralization," have largely disappeared. Today, the use of stablecoins is driven more by practicality and trust than by ideology.

The regulatory environment has not fully caught up but is progressing. Institutions, banks, fintech companies, and payment giants are gradually adopting them. At this stage, the question surrounding stablecoins is no longer whether they will be regulated, but how they will be regulated and integrated by existing organizations, and how much value they will hold and where that value will flow.

Stablecoins are unlikely to completely replace fiat currencies, but they are filling gaps in areas where traditional currencies fail (such as non-working hours, cross-border scenarios, or economies with weak infrastructure).

Future developments will depend on continued practicality, clear rules, and the ability to scale yields without compromising stability or transparency. However, looking back over the past year, the trends are quite clear. Stablecoins have found their role, and this role is more significant than most people expected.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。