Author: Ying Ying, CITIC Construction Securities Research

Hong Kong's "Stablecoin Ordinance" has officially become law, and the dominance of digital currency "minting rights" may become a global competitive focus. On May 30, the Hong Kong Special Administrative Region government published the "Stablecoin Ordinance" in the Gazette, marking the official implementation of this epoch-making digital financial regulatory legislation. Hong Kong has officially become the world's first jurisdiction to establish a comprehensive regulatory framework for fiat-backed stablecoins. This groundbreaking legislative initiative is seen as another significant breakthrough in financial technology regulation following Hong Kong's introduction of the virtual banking license system in 2017. It will not only further consolidate Hong Kong's position as an international financial center but also set an "Eastern standard" in the global digital financial governance arena.

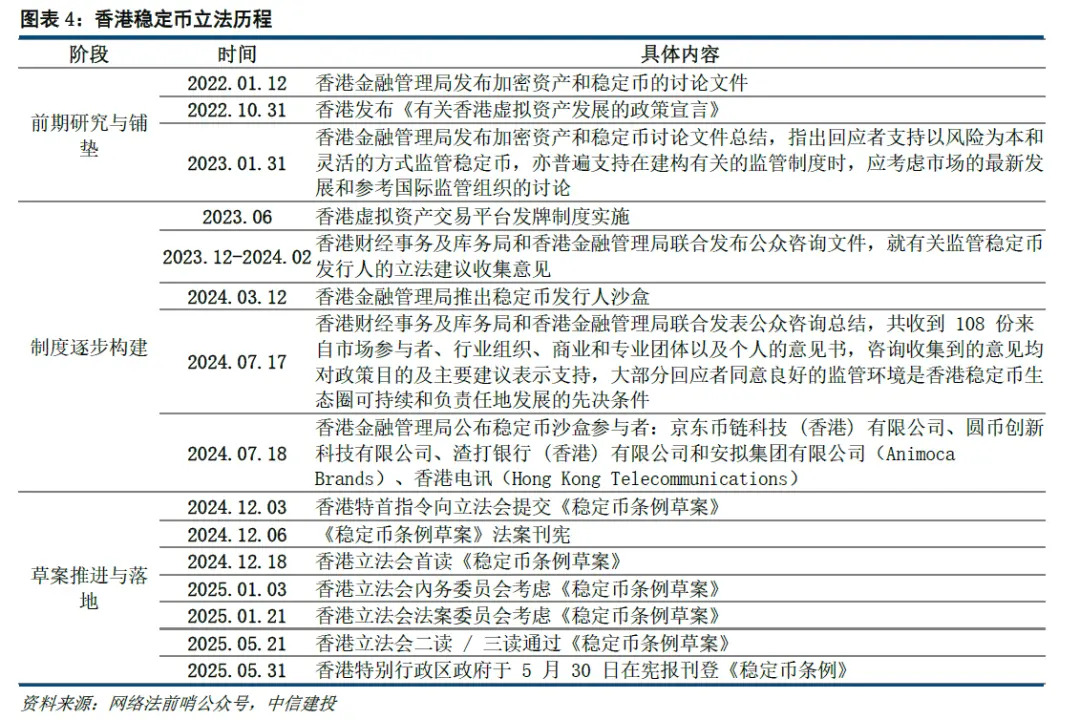

1) From the legislative process, it fully reflects a prudent and gradual approach. The formation of the Ordinance was not achieved overnight; in 2022, the Hong Kong Monetary Authority released a discussion paper on crypto assets and stablecoins, marking the official launch of the Ordinance. The Ordinance went through three stages: preliminary research and groundwork, gradual system construction, and the advancement and implementation of the draft, continuously adjusting and optimizing, and officially came into effect on May 30, 2025, ultimately establishing a comprehensive and systematic regulatory framework for stablecoins.

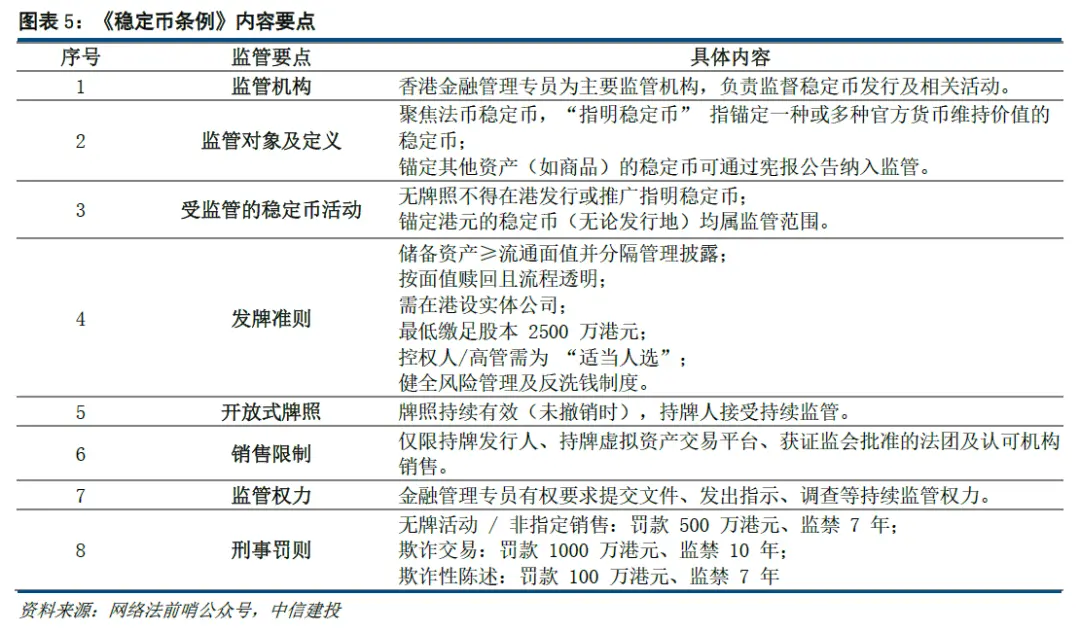

2) From the legislative content, the core innovations lie in strict access, strong reserves, and guaranteed redemption. The Ordinance adopts the principle of "value anchoring regulation," innovatively constructing a full-chain regulatory system for stablecoins around regulatory agencies, regulated entities and definitions, regulated stablecoin activities, licensing criteria, license duration, sales restrictions, and regulatory penalty mechanisms. The core innovations of the Ordinance are mainly reflected in strict access systems, transparent reserve management, and investor protection. 1) Strict access system: Issuers need to apply for a license, with a minimum registered capital of 25 million HKD, and must demonstrate reserve management capabilities and risk response abilities. 2) Transparent reserve management: The Ordinance implements a regulatory mechanism of "100% fiat reserve + independent custody + monthly audits." 3) Comprehensive investor protection: An unconditional redemption system allows users to redeem stablecoins at face value at any time, and issuers must process this within a reasonable time, or face severe penalties.

3) From the legislative impact, it emphasizes both regulated development and seizing opportunities. As the world's first special legislation for fiat-backed stablecoins, the Ordinance fills the regulatory gap for fiat stablecoins and helps promote the compliant development of stablecoins. 1) Raising compliance thresholds. Implementing a high-standard licensing system (such as a minimum of 25 million in paid-in capital, strict reserve asset requirements, etc.) is beneficial for raising market entry barriers for stablecoins, limiting the entry of small or emerging stablecoin issuers, and filtering out financially sound and technically reliable participants, promoting the stablecoin market towards specialization and transparency. 2) Enhancing investor confidence. The Ordinance effectively reduces fraud and market risks through strict licensing, reserve asset management, and penalty mechanisms. For example, only licensed institutions are allowed to offer stablecoins to retail investors. 3) Seizing opportunities for the globalization of stablecoins. With the improvement of the regulatory framework, stablecoins are transitioning from niche tools in the crypto world to the mainstream financial stage, expected to become the infrastructure of the next generation financial system. The introduction of the Ordinance indicates Hong Kong's intention to occupy an important position in the global stablecoin market and seize opportunities for the globalization of stablecoins.

4) From a global competition perspective, mastering the rule-making power is expected to gain an advantage in the reshuffling of future monetary systems. Since Hong Kong, countries and regions such as the United States, the European Union, and Africa are also fiercely competing for dominance in stablecoins. The U.S. "GENIUS Act" attempts to incorporate stablecoins into the national strategic framework to consolidate the dollar's dominance in the global monetary system, requiring stablecoin legislation to be deeply tied to national debt demand. The EU's "Crypto Asset Market Regulation Act" seeks to redefine the digital financial order with a unified regulatory framework. African stablecoins are primarily positioned as "financial equality tools" to help the public combat inflation and currency devaluation. In the future, mastering the rule-making power of digital currency "minting rights" is expected to gain an advantage in the reshuffling of future monetary systems.

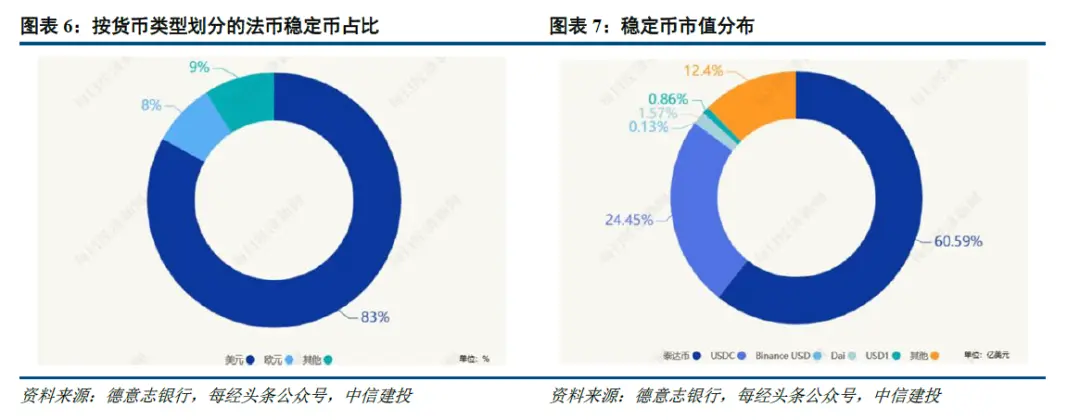

The stablecoin market is experiencing rapid growth, and the activity level of cross-border payment application scenarios is continuously rising. 1) From the market size perspective, the stablecoin market is growing rapidly, with an increase of over 1100% in five years. According to Deutsche Bank data, in 2020, the total market value of stablecoins was approximately $20 billion, and by May 30, 2025, the total market value of stablecoins had soared to $249.7 billion, with an increase of over 1100% in about five years. Among them, Tether's USDT (pegged 1:1 to the U.S. dollar), launched in 2014, accounts for over 60% of the stablecoin market, followed by USDC (over 24%). Additionally, stablecoins dominate trading flows, with stablecoin trading volume reaching $28 trillion in 2024, surpassing the combined total of Visa and Mastercard, and supporting over one-third of cryptocurrency trading. 2) From the market competition landscape, the stablecoin market shows a highly concentrated situation, mainly dominated by fiat-backed stablecoins such as USDT, USDC, TUSD, and BUSD, which account for over 90% of the market share. Among them, USDT, with an issuance volume of $144.6 billion, ranks first with a share of 59%; USDC has an issuance volume of $60.6 billion, accounting for 25%, with a significant growth rate (35%). The concentration of the stablecoin market continues to rise, with a significant head effect. 3) From the application scenarios, the activity level of stablecoins in cross-border payment settlements is continuously increasing. The application scenarios for stablecoins are expanding, mainly including crypto asset trading, cross-border payments, DeFi innovation scenarios, and value storage. Among them, the activity level of stablecoins in cross-border payment settlements is continuously rising. According to estimates by Castle Island Ventures and Brevan Howard Digital (2024), the payment settlement volume of stablecoins reached approximately $2.5 trillion in the 12 months prior to May 2024, which is ten times its payment settlement volume in 2020.

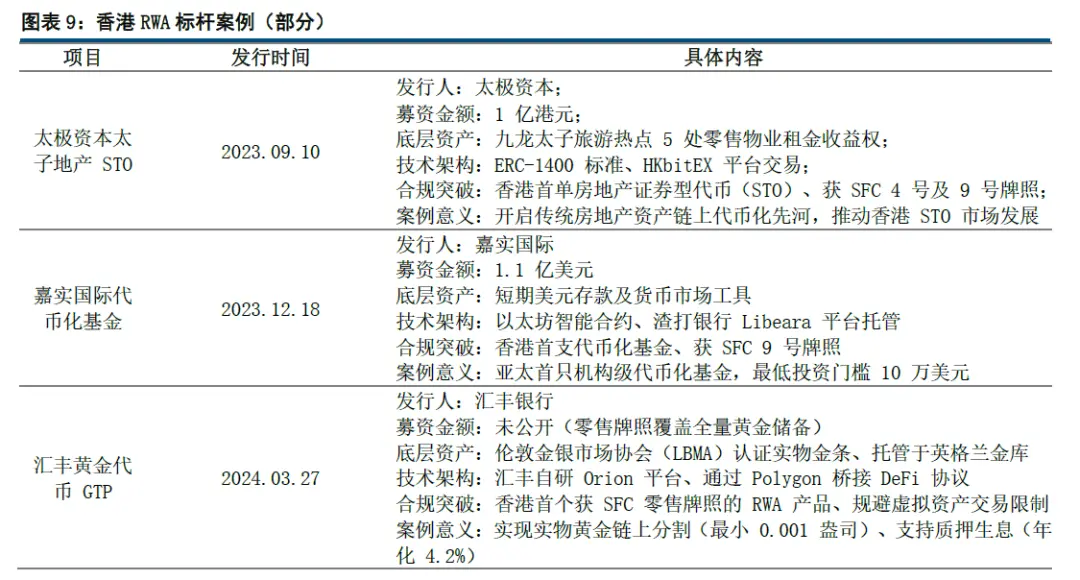

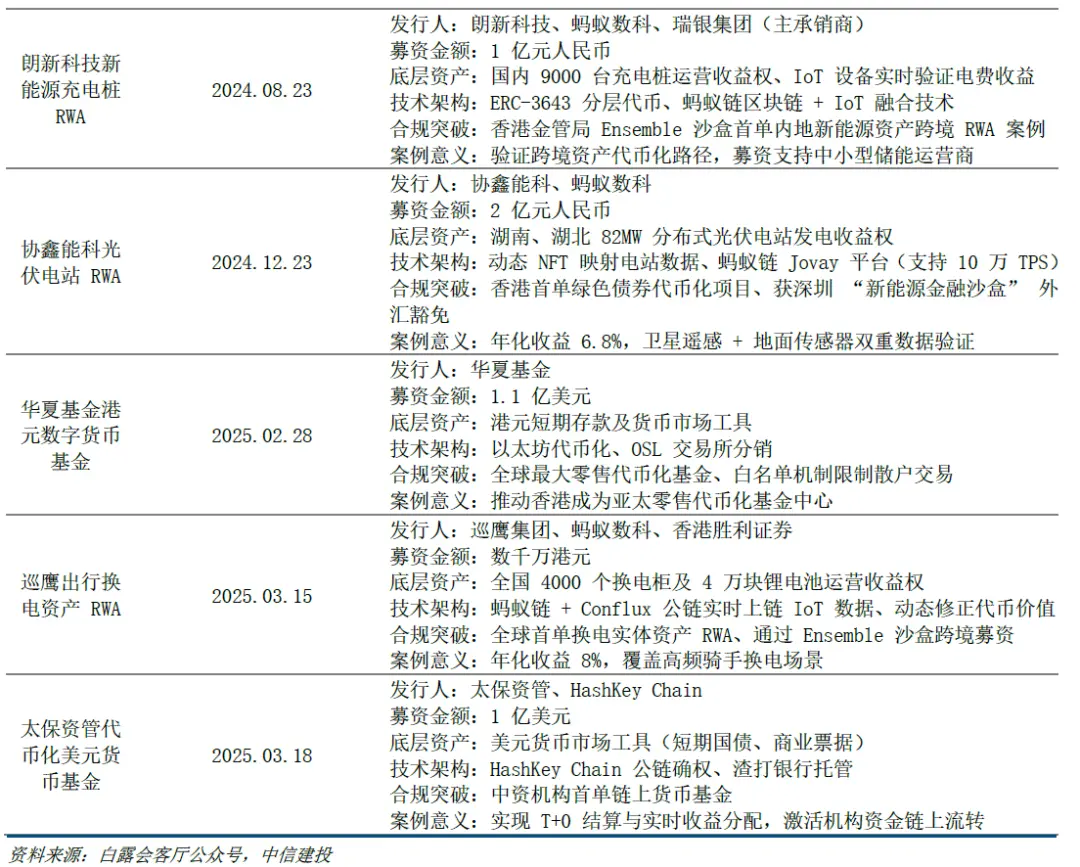

The implementation of stablecoin legislation is conducive to accelerating the large-scale application of RWA, with the RWA market size expected to soar to $16 trillion by 2030. Compliant and transparent stablecoins are expected to play an indispensable role as an "engine" and "cornerstone" in the RWA ecosystem, building a foundation of compliance and trust for RWA financing, while significantly reducing costs and improving efficiency, which will accelerate the process of converting various real assets into digital tokens through blockchain technology, supporting the large-scale application of RWA. In recent years, many countries around the world, including the United States, Japan, and Singapore, have been actively exploring innovative applications of RWA, with giants such as Goldman Sachs, BlackRock, Ant Group, and JD.com entering the field to seize RWA development opportunities. In October 2022, Hong Kong released the "Virtual Asset Policy Declaration," establishing the strategic position of RWA; in March 2024, the Hong Kong Monetary Authority launched the Ensemble project, covering four major themes: fixed income and investment funds, liquidity management, green and sustainable finance, and trade and supply chain finance, and has formed numerous benchmark cases for RWA. For example, in August 2024, Longxin Group, in collaboration with Ant Group and UBS (the main underwriter), successfully executed a domestic cross-border RWA case for new energy assets, with the underlying assets anchored to the operating income rights of 9,000 charging piles in China, raising 100 million RMB.

As of June 2, 2025, the total on-chain value of RWA was $23.1 billion (excluding stablecoins), a year-on-year increase of over 110%. Among them, private credit accounted for $13.4 billion, U.S. Treasury bonds $7.2 billion, and commodities $1.5 billion. According to BlackRock's forecast, the RWA market size is expected to soar to $16 trillion by 2030. As RWA continues to deepen its development, issuers, custodial banks, investors, and blockchain entities in the RWA ecosystem are expected to grow rapidly, and investment opportunities may arise in areas such as RWA asset operations, banking IT, and cross-border payments.

Summary:

The official implementation of Hong Kong's "Stablecoin Ordinance" is expected to accelerate the rapid development of stablecoins and RWA into a new phase. On May 30, the "Stablecoin Ordinance" in Hong Kong, as the world's first special legislation for fiat-backed stablecoins, officially came into effect, effectively filling the regulatory gap for fiat stablecoins and accelerating the compliant development of stablecoins. Hong Kong has officially become the world's first jurisdiction to establish a comprehensive regulatory framework for fiat-backed stablecoins, while countries and regions such as the United States, the European Union, and Africa are also fiercely competing for dominance in stablecoins, aiming to gain an advantage in the reshuffling of future monetary systems. The stablecoin market is experiencing rapid growth, with an increase of over 1100% in five years, and the activity level of cross-border payment application scenarios is continuously rising. At the same time, the implementation of stablecoin legislation is conducive to accelerating the large-scale application of RWA, with the RWA market size expected to soar to $16 trillion by 2030. As RWA continues to deepen its development, issuers, custodial banks, investors, and blockchain entities in the RWA ecosystem are expected to grow rapidly, and investment opportunities may arise in areas such as RWA asset operations, banking IT, and cross-border payments.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。