Crypto Market Plunges as Elon Trump War Shakes Investor Confidence

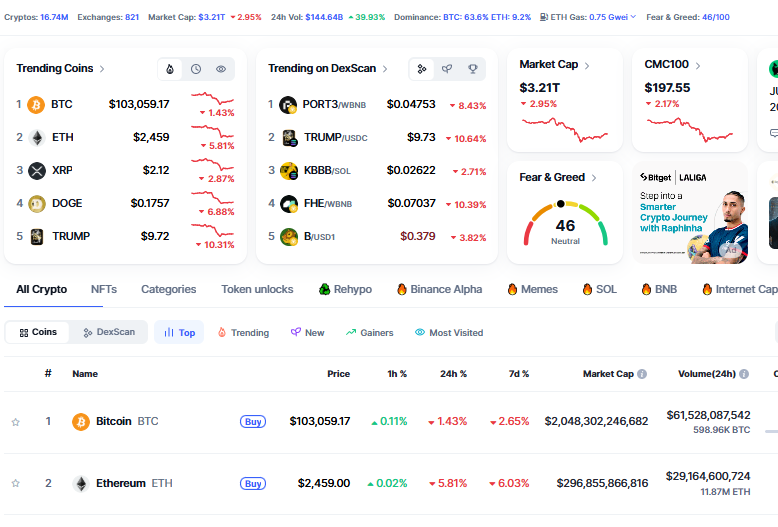

The crypto market and Tesla stock both saw major drops after a public feud between Elon Musk and Donald Trump sparked panic. it led to over $1 billion in crypto liquidations. Tesla stock price is down by 14.26% within a day, it lost $153 billion in market value. The market cap of the crypto market is down by 2.95% currently stands at $3.21Trillion, increasing trading volume by almost 40%. All the prominent currencies like Bitcoin, Ethereum, and other Altcoins have experienced decrease.

Rising Political Tensions Between Musk and Trump

A heated public fight between Elon and the U.S. President has caused panic in global markets. The drama started on June 5, when Musk posted on X (formerly Twitter) that Trump’s plan to impose worldwide tariffs would “cause a recession in the second half of this year.” He also stepped down from the Department of Government Efficiency (DOGE) .

Elon is blaming Trump’s new spending bill, called the “ Big Beautiful Bill ” , for worsening the national debt, which has now reached $36.9 trillion . Musk repeated his warning: “Real growth comes from making useful things, not printing money.”

Trump Hits Back, Musk Escalates

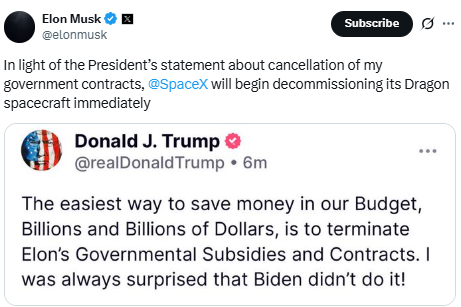

In response, Trump posted that the easiest way to save billions of dollars would be by cutting Elon Musk’s federal subsidies and contracts. That statement caused further market panic.

Musk didn’t stay silent. He hit back by announcing that SpaceX would start decommissioning its Dragon spacecraft. Then he went even further, accusing Trump of links to the Jeffrey Epstein files and publicly supporting calls for Trump’s impeachment.

Source: Elon Musk X

This back-and-forth quickly became more than just a political spat, it sent shockwaves through Wall Street and the crypto market.

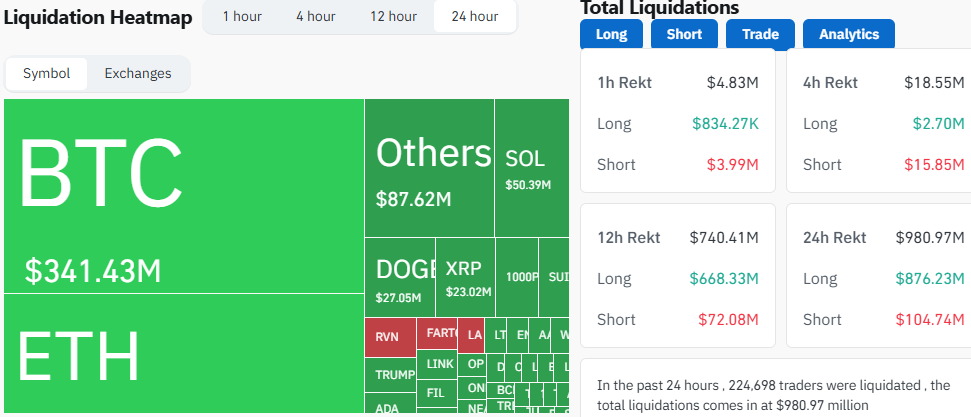

Crypto Bloodbath: $1 Billion Lost

According to data from Coinglass, more than $980 million was liquidated in the crypto market, In total, 224,666 traders were liquidated, within just 24 hours. Out of which $876.22 million came from long positions and $104.74 million came short, bets that prices would go up. A single largest liquidation occurred on Bitmex XBTUSD valued at $10.00 million.

Source: Coinglass

Bitcoin (BTC) dropped almost 4%, falling from $105,915 to $100,500 , before making a slight recovery to $102,180 . Ethereum (ETH) plunged over 7%. The timing couldn’t have been worse. The crash happened alongside the expiry of $3.8 billion in BTC and ETH options , adding even more volatility. At the same time, Bitcoin price broke below its key support at $105K, shaking investor confidence. Currently BTC is trading at $103,059.17 with a decrease of 1.43% within and Eth is trading at $2459 with a decrease of about 5.59% within the last 24 hours.

Source: CoinMarketCap

Analysts Weigh In: Musk-Trump Feud or Market Cycle?

Experts say this crash is a clear case of political Feud , fear, uncertainty, and doubt triggered by public drama. Whale wallets started dumping assets, and bearish signals appeared on both the MACD and RSI indicators.

Some traders, however, believe this drop is just part of Bitcoin’s normal cycle. “It will touch $99,400 before reaching a new all-time high, no matter what Elon or Trump do,” one user posted.

What’s Next for Crypto?

This feud has caused more than just headlines, it created real losses for investors. With Tesla stock falling 14% and altcoins slipping further, the industry is under stress. ETF outflows and whale behavior are signs of a larger risk-off trend.

Traders now face a key question: Is this a dip worth buying, or the start of a longer decline? Oversold conditions may attract short-term buyers, but as long as Elon and the president continue their war of words, uncertainty will remain.

For now, caution is the best strategy.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。