Compiled by: Luan Peng, ChainCatcher

Important News:

- Musk supports putting U.S. Treasury trades on the blockchain

- MicroStrategy rebranded as Strategy

- Sun Yuchen: CEXs are welcome to contact for cooperation, offering a 20% annualized USDD reward

- Coinbase International has launched AXS, XTZ, and EGLD perpetual contracts

- U.S. CFTC to review prediction markets in public roundtable

- Eric Trump: Now is a good time to buy BTC

- Jupiter founder: Project X account accessed by an Android phone in the U.S., one employee missing

- South Korean police arrest 90 people for drug trafficking using cryptocurrency

“What important events have occurred in the past 24 hours”

Musk supports putting U.S. Treasury trades on the blockchain

According to Watcher.Guru on the X platform, Musk supports putting U.S. Treasury trades on the blockchain for complete transparency.

MicroStrategy rebranded as Strategy

According to an official announcement, MicroStrategy has changed its company name to Strategy.

The announcement states that Strategy is the world's first and largest Bitcoin financial company and a component of the NASDAQ 100 index. This brand simplification is a natural evolution for the company, reflecting its focus and broad appeal. The new logo includes a stylized "B," representing the company's Bitcoin strategy and its unique position as a Bitcoin financial company. The primary color of the brand is now orange, symbolizing energy, wisdom, and Bitcoin.

Sun Yuchen: CEXs are welcome to contact for cooperation, offering a 20% annualized USDD reward

Sun Yuchen posted on the X platform, welcoming CEXs to contact for cooperation, offering a 20% annualized USDD reward, with USDT/USDD being mutually exchangeable at a 1:1 ratio without loss.

Previously, Sun Yuchen stated that USDD has zero exchange support and relies solely on on-chain traffic, with supply exceeding 100 million within three days of launch.

Coinbase International has launched AXS, XTZ, and EGLD perpetual contracts

According to an announcement from Coinbase International, the AXS-PERP, XTZ-PERP, and EGLD-PERP perpetual contract markets are now open for full trading on the Coinbase International Exchange and Coinbase Advanced platforms.

Users can now trade using various order types, including limit orders, market orders, stop-loss orders, and limit stop-loss orders.

U.S. CFTC to review prediction markets in public roundtable

The U.S. Commodity Futures Trading Commission will hold a public roundtable in the coming weeks to review its regulatory approach to prediction markets, which may affect platforms like Kalshi and Polymarket.

This roundtable will take place following the agency's information gathering on contracts related to sports events, aimed at collecting opinions from market participants, legal experts, and industry stakeholders.

Eric Trump: Now is a good time to buy BTC

Eric Trump, the son of former President Trump, stated on his social media platform: "I feel now is a good time to buy BTC."

Jupiter founder: Project X account accessed by an Android phone in the U.S., one employee missing

Jupiter founder Meow posted on social media: "As far as I know, Jupiter employee @9yointern is returning to Singapore from Mountain Dao due to an emergency at home.

What I know next is that our X account was accessed by an Android phone from the U.S., and we have completely lost contact with her.

If you can find her or know what happened, please let us know."

Previous reports indicated that the Jupiter X account was hacked and suspicious token information was released.

South Korean police arrest 90 people for drug trafficking using cryptocurrency

Recently, South Korean police arrested 90 Vietnamese suspects for allegedly using cryptocurrency to sell drugs in various bars and clubs across the country. The police stated that these suspects smuggled drugs into the country disguised as coffee and vitamin packages and distributed them in Vietnamese-operated bars and clubs in multiple cities.

The police initially estimated that the gang smuggled drugs worth 1.04 billion won (approximately $721,000), of which about 710 million won (nearly $500,000) had been successfully sold. Some suspects are illegal residents, and currently, 18 suspects have been detained, with the case still under further investigation.

MicroStrategy Q4 financial report: net loss of $670.8 million, purchased over 210,000 BTC

According to The Block, MicroStrategy (now "Strategy") reported its fourth-quarter financial performance, with its Bitcoin holdings nearly doubling. The operating expenses for the quarter reached $1.103 billion, a 693% year-on-year increase. The company reported a net loss of $670.8 million, with total revenue of $120.7 million, approximately $3 million below general expectations, and a 3% decrease from the previous year. As of December 31, 2024, the company's cash and cash equivalents stood at $38.1 million, down from $46.8 million in the same period last year.

Strategy currently holds 471,107 Bitcoins, valued at approximately $4.4 billion. The fourth quarter saw the largest increase in the company's quarterly Bitcoin holdings, ultimately acquiring 218,887 BTC for $20.5 billion. The company reported a BTC yield of 74.3% year-to-date.

Additionally, Strategy announced a new KPI, the annual "BTC yield" and "BTC dollar yield," with a target of $10 billion for the annual "BTC dollar yield" by 2025.

Strategy's convertible preferred stock STRK to be listed on NASDAQ this Thursday

According to CoinDesk, Strategy (formerly MicroStrategy) announced during its fourth-quarter earnings call on February 6 that its convertible preferred stock STRK will be listed on NASDAQ this Thursday.

The earnings report showed that the company had a loss of $3.03 per share in the fourth quarter, due to a $1 billion impairment loss from not adopting FASB accounting standards. The company stated it would begin adopting the new standards this quarter. In the newly set performance metrics, Strategy plans to achieve $10 billion in Bitcoin yield by 2025, having already completed $1.24 billion; it also set a Bitcoin yield target of 15%, with the current yield at 2.9%.

In terms of financing, the company has utilized $17 billion of its $21 billion ATM (at-the-market) stock issuance capacity, with its stock issuance accounting for only 2.9% of the cumulative trading volume, with the highest proportion during the week of November 11-15, reaching 7%.

U.S. CFTC fines EmpiresX founder $130 million for cryptocurrency fraud

The U.S. Commodity Futures Trading Commission (CFTC) announced that a U.S. federal court has ordered the Brazilian founder of the illegal cryptocurrency investment platform EmpiresX to pay over $130 million in fines and restitution.

On February 4, U.S. District Court Judge Cecilia Altonaga imposed a permanent injunction, economic penalties, and other legal actions against EmpiresX founders Emerson Pires, Flavio Goncalves, and their partner Joshua Nicholas.

According to court documents, Empires Consulting operated a fraudulent investment scheme called EmpiresX, which falsely promised high returns to investors. Pires and Goncalves are accused of obtaining at least $40 million from victims through false cryptocurrency advertisements.

Arthur Hayes published a blog post today stating that the Bitcoin strategic reserve policy is terrible, noting, "The fundamental problem with governments hoarding any asset is that they buy and sell assets primarily for political gain, not financial gain." This policy may change with shifts in the political landscape, altering Bitcoin's original trajectory.

Regarding the upcoming cryptocurrency legislation, Arthur Hayes also holds a pessimistic view: "Those building truly decentralized technologies and applications do not have enough financial resources to manipulate politics at this critical moment in the cycle. Therefore, the desire for cryptocurrency regulation may be realized, and if it does, it will manifest in overly complex and prescriptive forms that only large, wealthy centralized companies can afford."

Thus, Arthur Hayes still believes Bitcoin will retest the $70,000 to $75,000 range. Only if the Federal Reserve, U.S. Treasury, Japan, and others print money in some form or enact specific legislation allowing permissionless cryptocurrency innovation can the current market conditions improve.

“What important events have occurred in the past 24 hours”

At the beginning of the new year, the PENGU token has been online for over a month, and the Abstract mainnet has just launched. As a crypto media outlet closely following Pudgy Penguins, the Abstract ecosystem, and its parent company Igloo.Inc, Odaily Planet Daily conducted an in-depth interview with Pudgy Penguins CEO Luca Netz, discussing topics such as the PENGU token, the Abstract ecosystem, the competitive landscape of L1 & L2 networks, and the vision dispute between Ethereum and Solana, aiming to gain more insights into the crypto industry from Luca's perspective.

Sun Yuchen's 8 Years in the Crypto Space: A Tale of Two Cities

In recent years, Sun Yuchen has almost become the "last survivor" in the crypto space. Whether facing regulatory crackdowns, market crashes, or the downfall of crypto moguls, he has consistently navigated through it all, firmly standing at the center of the industry. Recently, his name has once again become a topic of discussion, still filled with drama.

Arthur Hayes' New Article: Beyond Bitcoin National Reserves, U.S. Crypto Hegemony Has Other Aims

The Pax Americana Make-A-Wish Corporation located at Mar-a-Lago hosts a large number of "wishers" daily. People in the cryptocurrency field, like others, line up trying to seize the opportunity to fulfill one or more wishes. This capricious "genie"—the master known as the "orange man"—holds "court" weekly in his private club, which combines country and nightclub styles in the swamps of South Florida, accompanied by classic pop songs from the 1980s, surrounded by a group of sycophantic followers.

The genie itself is neither good nor evil; what we truly need to judge is whether the wishes of the wishers are reasonable. Every culture in the world has moral stories about "wrong wishes," where those attempting to achieve success, wealth, or personal happiness through shortcuts often face unexpected consequences.

Beijing Youth Daily: Can "Digital Assets" Become a Major Asset Class Like Houses, Stocks, and Funds?

On February 5, 2025, Beijing Youth Daily prominently featured "digital assets" on the front page and a full-page report on A4. From the perspective of young people, the report covered the development of the "digital assets" industry, investment stories, and the participation of social forces.

The article explored whether "digital assets" have the potential to become a major asset class like houses, stocks, funds, and gold; it also mentioned that China's "digital asset" market is gradually building a circulation environment from the perspective of industry collaboration and autonomy, with the hope of forming a standardized market. Banks and large enterprises, such as Industrial and Commercial Bank of China, Ant Group, and GCL-Poly Energy, have begun to venture into the digital asset field, releasing digital collectibles or launching RWA projects.

The various measures extensively mentioned by domestic media signify that the application of digital assets is gradually expanding, penetrating into broader industries and fields; it also suggests that the "wind direction" of domestic regulation may accelerate changes, and in the near future, more noteworthy opportunities may emerge in China.

Berachain Launches Airdrop Query, Drowned in Complaints: Who Actually Received the Tokens?

A large number of users who actively participated in the testnet interactions and made deposits on the first day did not qualify for the airdrop.

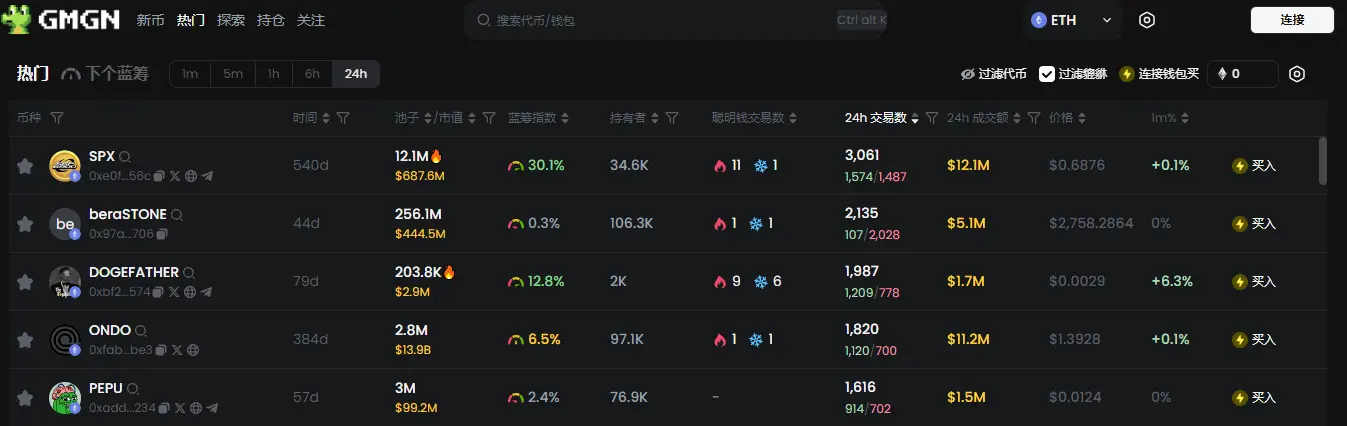

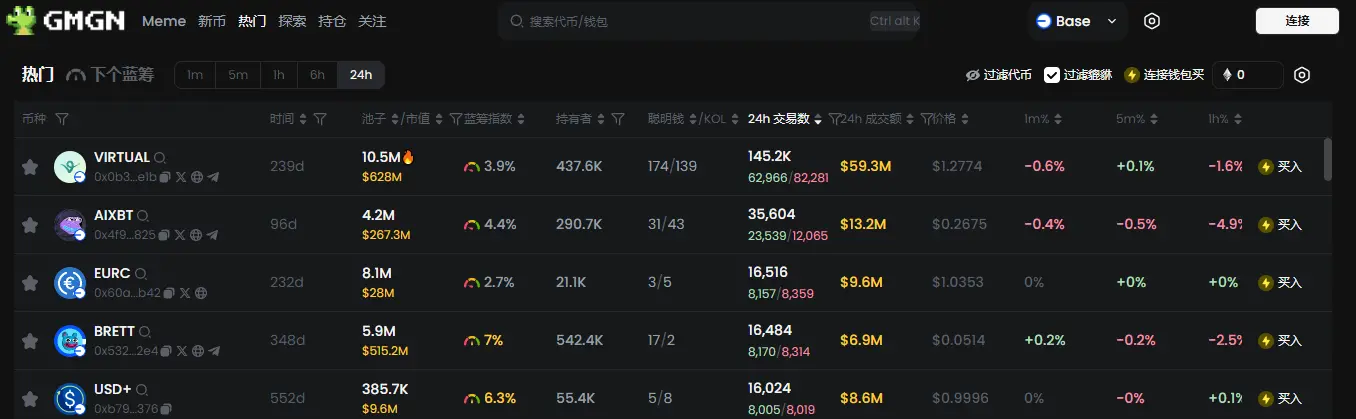

Meme Popularity Rankings

According to the meme token tracking and analysis platform GMGN, as of February 6, 19:50:

In the past 24 hours, the top five popular tokens on Ethereum are: SPX, beraSTONE, DOGEFATHER, ONDO, PEPU

In the past 24 hours, the top five popular tokens on Solana are: YODA, $JOGE, CROCIM, SSE, DCOIN

In the past 24 hours, the top five popular tokens on Base are: VIRTUAL, AIXBT, EURC, BRETT, USD+

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。