Author: Ceteris

Translation: Luffy, Foresight News

Last year, in the "Annual Infrastructure Outlook" report, I specifically wrote a "L2 War" chapter, which outlined my views on the Rollup field and the trends for the coming year. The main points are as follows:

Blast is a hybrid of the Rollup architecture and will lead to the end of the "kumbaya" period.

The L2 ecosystem will become more fragmented and isolated, and each L2 will launch its own cross-chain/interoperability standards and SDKs to initiate new chains/L3.

Rollup needs to use alternative data availability layers (DA) to scale.

DA as a source of value accumulation will disappear. DA will undergo disruptive innovation, and charging a premium for DA will no longer be feasible.

The new bull market theme for Ethereum is "global proof verification layer and currency."

The value accumulation of the DA layer will be limited.

If all value is concentrated in the sorting layer, then the value accumulation of L2 tokens is theoretically positive.

The views in this article are outdated. Ethereum has experienced multiple crises, and these views have now been repeatedly mentioned and discussed. In fact, you can see that a large part of the Ethereum community has shifted its focus to how to scale L1, rather than ceding value to Rollup.

https://twitter.com/ChainLinkGod/status/1832198208287863174

However, when everyone is paying attention to and discussing this point, it is no longer a true "alpha" or contrarian view. So, what are we seeing today, and what should we do next?

Rollup Status

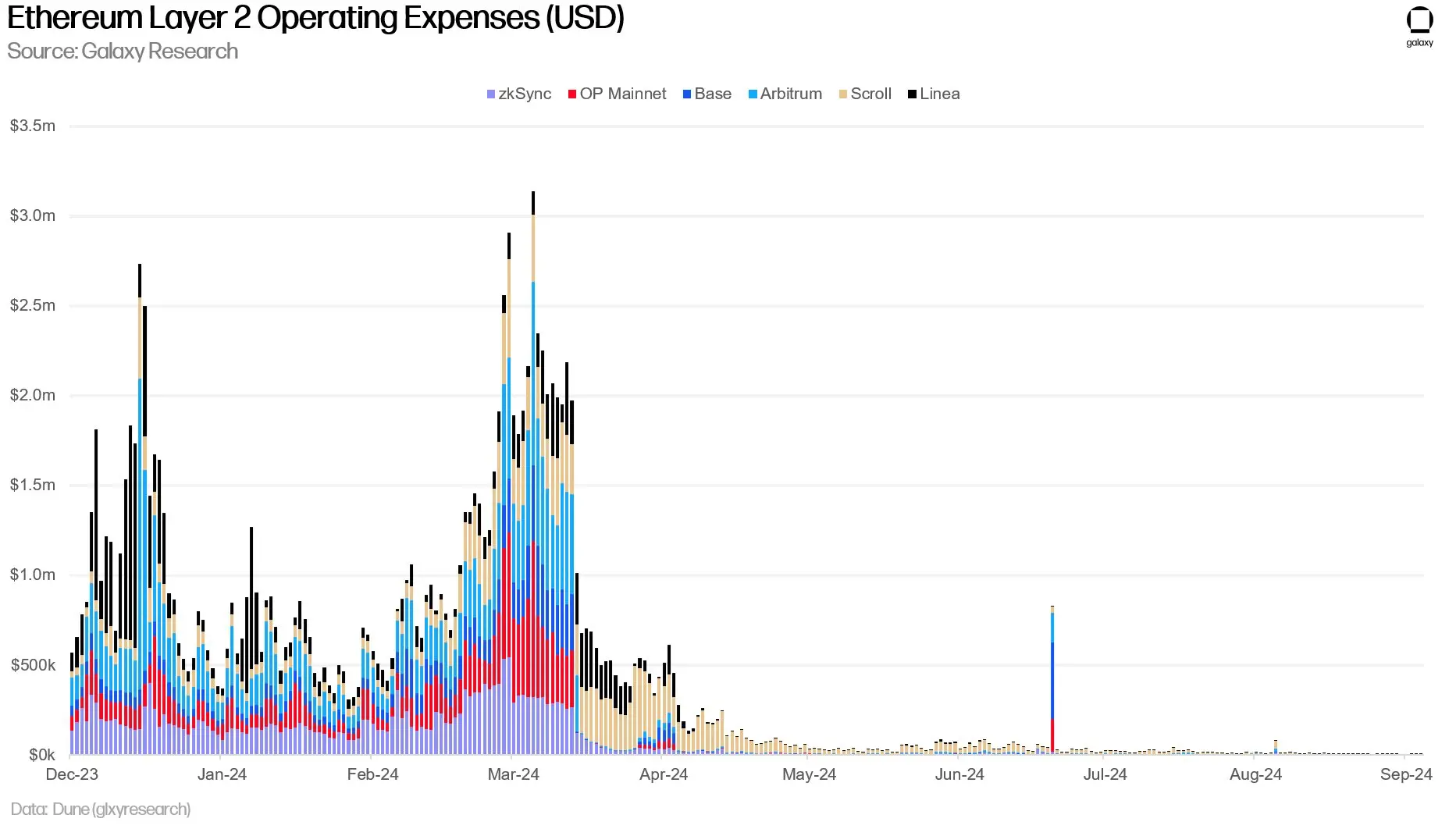

First is the revenue. What changes have occurred in Ethereum's revenue after EIP-4844? The chart below from Galaxy provides an intuitive answer: DA is no longer a significant value driver for the Ethereum economy.

Is this completely a bad thing? No! Ethereum has no choice. As we have emphasized, DA has undergone "disruptive innovation," which means that charging a premium has become more challenging. Although we are confident that Ethereum can still charge higher fees than other DA layers so that Rollup can inherit the complete security of Ethereum, it is still unclear to what extent Rollup will do so. The main benefit of sharing the DA layer is interoperability. By sharing the DA layer, cross-chain becomes more secure, and economies of scale can be achieved in this way. Similarly, although this is a key benefit, no one really knows how much this benefit is worth. Will Rollup pay 10 times the fees of other DA layers? Or 100 times? There is an exact answer to this question, it's just that we don't know what it is.

Therefore, the decrease in Ethereum DA fee revenue is natural, and it has no choice. Now, some people are starting to question Ethereum's Rollup roadmap, represented by Max Resnick and Doug Colkitt.

https://twitter.com/0xdoug/status/1831898285130330367

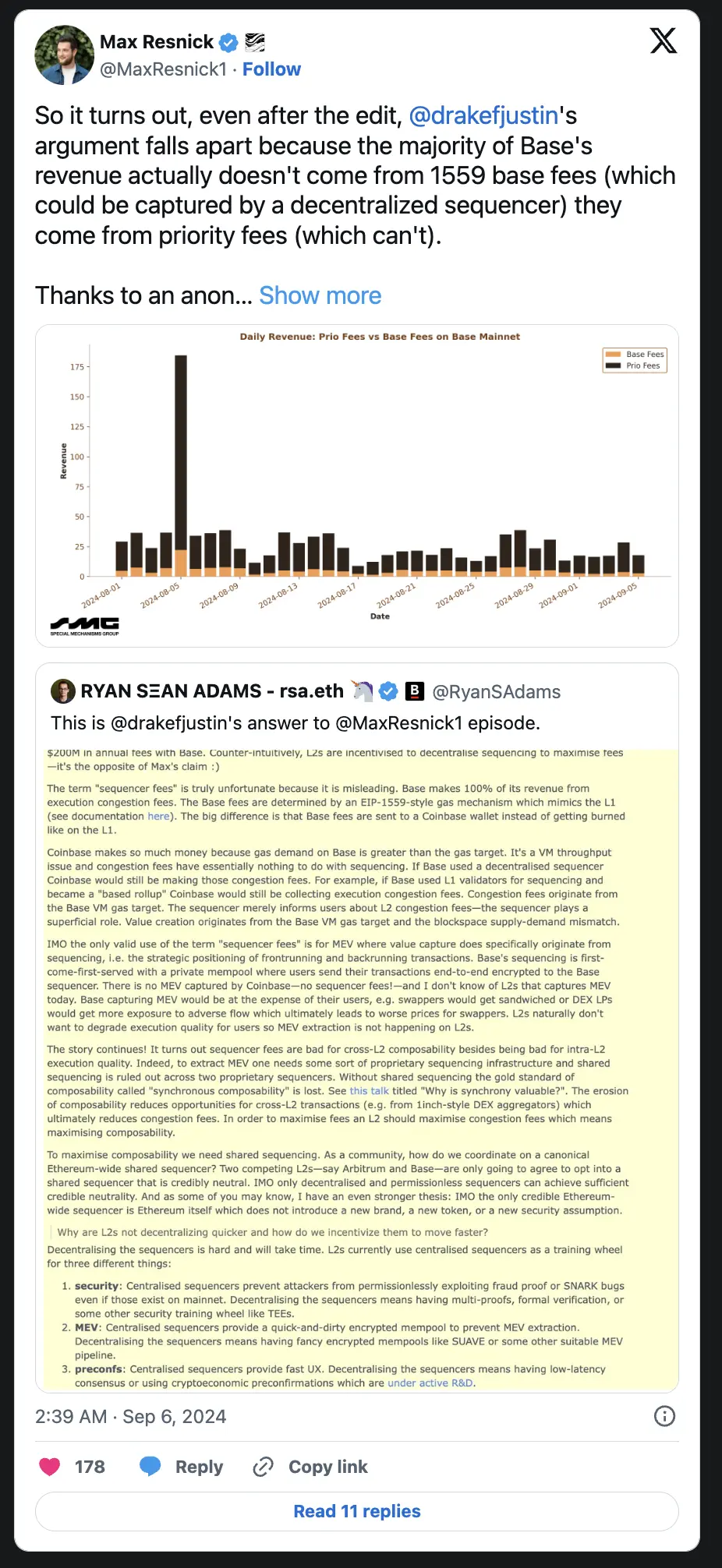

https://twitter.com/MaxResnick1/status/1831764059664085461

Now that everyone agrees on the view that DA's disruptive innovation has impacted the Ethereum economy, is it destined to fail?

Ethereum's Path Forward

As we said in the annual outlook report, the theme of Ethereum now boils down to "global proof verification layer and currency." What does this really mean?

Well, this is not entirely correct, but we do know what this means. Ethereum is the most decentralized and longest-standing base layer, which gives it a competitive advantage over all other blockchains in terms of asset issuance and proof verification. Even if the economic benefits are not so strong, Ethereum is still a high-quality asset. However, after all the execution work is removed, Ethereum will return to the economic model before EIP-1559, where most of the ETH will be recycled.

https://twitter.com/ceterispar1bus/status/1815855290577031247

This is why we are starting to see many people refocusing on L1 scaling and bringing applications back to Ethereum L1. We know that execution on L1 incurs costs. What we don't know is whether the world will adopt ETH as a currency. If every Rollup uses ETH as a currency, then it will become a non-sovereign currency used worldwide, like BTC. For me, this is an optimistic and possible outcome, and the challenge is whether Vitalik, Justin Drake, you, or I think that ETH as a currency is largely irrelevant.

Will ETH Become a World Currency?

We return to the previous question: Why are people trying to scale L1 again and increase L1 fees? Is this correct? Felipe from Theia believes that if we only value L1 tokens based on MEV and fees, they will go to zero anyway, so the only thing that can prove their valuation reasonable is to become a "reserve asset in emerging markets," i.e., "currency." I support this view.

https://twitter.com/TheiaResearch/status/1829508309696786700

Finally, Wei Dai believes that for the Rollup-centric roadmap to be economically viable, Ethereum needs to provide network effects for L2 in two ways:

Provide composability and resistance to censorship based on sorting.

Stronger shared settlement, where assets issued by L2 can also be used on other L2s to eliminate fragmentation.

This is the only way for Ethereum to have a long-term impact.

https://twitter.com/_weidai/status/1830488020556083533

I think all of the above views are feasible, but I don't know what the real answer is. There is a view that if Ethereum focuses on scaling L1 again, it will only become a "worse Solana" because Ethereum can never compete with Solana in L1 execution. I think no one really knows the result, people just believe in different things. Ultimately, the market will determine what is valuable.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。