Written by: Chris, Techub News

When it comes to leaving a significant mark on the history of Bitcoin, Mt. Gox is definitely one of them. This exchange platform, which once held over 70% of the global Bitcoin trading market, has gone through a journey from glory to bankruptcy, full of drama and profound lessons.

The story of Mt. Gox began in 2010, founded by a programmer named Jed McCaleb. Initially, Mt. Gox was a trading platform for "Magic: The Gathering" cards, named after the abbreviation of "Magic: The Gathering Online Exchange." In July 2010, McCaleb keenly recognized the potential of Bitcoin and transformed the platform into a Bitcoin exchange. This decision provided a new trading platform for Bitcoin, making digital currency trading more convenient. McCaleb's foresight and innovative spirit laid the foundation for the Bitcoin trading market, but it also marked the beginning of Mt. Gox's tumultuous history.

2011 was a year of rapid rise for Mt. Gox. During this year, it quickly became one of the largest Bitcoin exchange platforms globally, accounting for 70% to 80% of the global Bitcoin trading volume. During this time, the Bitcoin market was booming, attracting a large number of investors, with Mt. Gox becoming their preferred platform. In the same year, McCaleb decided to sell the exchange to a Frenchman named Mark Karpeles. Karpeles not only became the largest shareholder of Mt. Gox but also served as the CEO, leading the platform's operations.

Karpeles was highly sensitive to technology, continuously improving the platform's technical architecture to increase trading speed and enhance user experience. Under his leadership, Mt. Gox continued to expand and rapidly became a major platform for Bitcoin trading. However, behind the rapid development lay significant hidden risks. While Karpeles' management drove the rapid growth of Mt. Gox, his attention to security and regulation was clearly insufficient.

In June 2011, Mt. Gox experienced a thrilling storm. This storm was caused by a hacker who, using an auditor's credentials, stealthily infiltrated the exchange's system. The hacker meticulously planned a price manipulation, instantly driving the price of Bitcoin from several dollars to just 1 cent per coin.

One can imagine the traders' feelings as they witnessed the frantic flashing numbers on the screen, plummeting from several dollars to 1 cent. Their emotions were akin to riding a roller coaster, filled with fear and panic. In the chaotic few minutes, the hacker successfully transferred around 2,000 Bitcoins.

Following the incident, Mt. Gox's management team immediately realized the severity of the situation. Although only a relatively small amount of Bitcoin, valued at just over 2,000 dollars at the time, was transferred, it served as a wake-up call for Mt. Gox. They swiftly took action, transferring a large amount of remaining Bitcoin to cold wallets. Cold wallets are a storage method not connected to the internet, greatly enhancing the security of Bitcoin and effectively preventing further theft by hackers.

While this incident exposed vulnerabilities in Mt. Gox's security management, it also demonstrated their rapid crisis response capability. This event served as an important warning, prompting Mt. Gox and other exchanges to recognize that only by continuously enhancing security measures could they stand firm in the ever-changing world of cryptocurrency. Mt. Gox's swift response not only saved a significant amount of Bitcoin but also laid a solid foundation for future security measures.

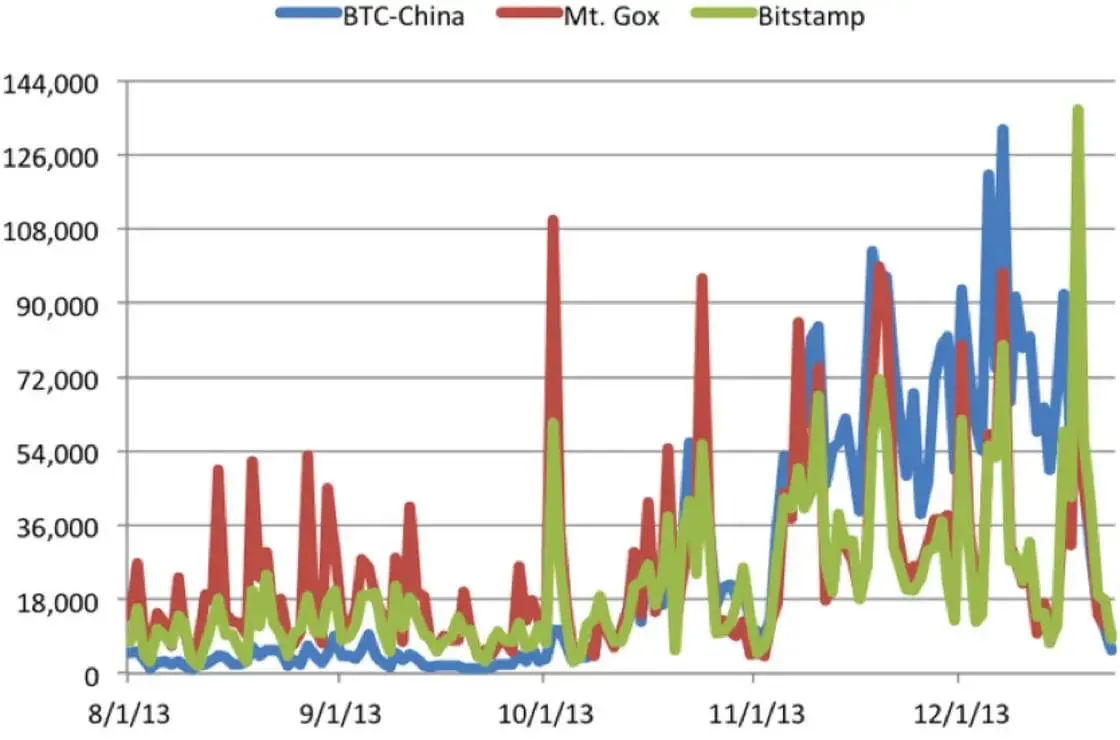

In 2013, Mt. Gox reached its peak period. At that time, almost 7 out of every 10 Bitcoin transactions were completed on Mt. Gox. This once inconspicuous small exchange had become the largest Bitcoin trading platform globally. However, amidst this prosperity, a long-simmering storm was quietly brewing.

One day in May, the U.S. Department of Homeland Security (DHS) quietly took action, seizing the accounts of Mt. Gox's U.S. subsidiary on the grounds of being an unregistered money transmitter. When this news broke, the senior management of Mt. Gox felt as if lightning had struck. This action not only led to the freezing of Mt. Gox's funds in the United States but also placed it in an unprecedented cash flow crisis.

Imagine the tense atmosphere in Mt. Gox's headquarters at that time. Employees anxiously made phone calls, attempting to seek solutions from all sides. In the meeting room, the management team held emergency meetings, their faces filled with worry. Perhaps the founder of Mt. Gox was gazing into the distance from the office window, contemplating the sudden predicament.

The DHS's action was like a sharp knife, deeply cutting into Mt. Gox's compliance wounds. Mt. Gox had been busy expanding its business and had failed to promptly pay attention to and comply with the strict financial regulations in the United States. This event not only exposed its shortcomings in compliance but also foreshadowed facing more regulatory challenges in the future.

This seizure caught Mt. Gox off guard, but it also taught them an important lesson. The management of Mt. Gox began to realize that only by steadily moving forward on the path of compliance could they truly ensure the long-term development of the exchange. In this globalized cryptocurrency market, compliance and security are equally important and indispensable.

On February 7, 2014, Mt. Gox announced the suspension of all Bitcoin withdrawals, citing the discovery of suspicious activity, pointing out that this issue was due to a transaction malleability vulnerability in the Bitcoin software, making transactions appear incomplete, thereby causing Bitcoin to be potentially sent repeatedly. However, just seventeen days later, on February 24, things took a turn for the worse. Mt. Gox once again issued an announcement, this time declaring the permanent cessation of Bitcoin trading. This news was like a heavy blow, completely shattering the confidence of the users. Four days later, Mt. Gox filed for bankruptcy. This once glorious exchange had now reached the brink of bankruptcy. Karpeles admitted to losing 744,408 customer-owned Bitcoins and 100,000 Bitcoins owned by the exchange itself. This hacker attack left Mt. Gox unable to pay customers' Bitcoins, leading to the declaration of bankruptcy. At this moment, Mt. Gox's reputation completely collapsed, and user confidence crumbled along with it.

In March of the same year, Mt. Gox found itself at a crossroads of fate. They filed for bankruptcy protection in the Tokyo District Court in Japan, officially entering the bankruptcy liquidation process. For the once-largest Bitcoin exchange globally, this was undoubtedly a bleak moment.

Just when everyone thought hope was dim, Mt. Gox brought unexpected news. They claimed to have recovered 200,000 Bitcoins. These Bitcoins were found in the company's old wallets, a message akin to a beam of light in the darkness, bringing a glimmer of hope to the desperate victims.

However, the recovery of 200,000 Bitcoins was just the tip of the iceberg, with a large amount of Bitcoins still unaccounted for. This discovery was not only a spark of hope but also a mirror, reflecting the chaos and loopholes in Mt. Gox's management system. How were these Bitcoins lost? How did the hacker breach the system? These questions remain unanswered, and behind each question, there could be management negligence.

In 2015, Mark Karpeles was arrested in Japan on suspicion of data manipulation and embezzlement of customer funds, facing multiple charges.

In court, he repeatedly insisted on his innocence. He detailed the operation process of the exchange and attempted to prove that the lost Bitcoins were due to a hacker attack rather than his own negligence. Inside and outside the courtroom, voices of supporters and opponents were heard, with intense emotions. Supporters believed he was innocent and unfairly accused, while opponents believed he should be held responsible for the collapse of Mt. Gox and should face legal sanctions.

In July 2016, after a year of trial and detention, Karpeles was finally granted bail. Karpeles' arrest and trial became a global focus.

In 2018, the Tokyo District Court approved the transition of Mt. Gox from bankruptcy liquidation to civil rehabilitation, compensating victims by selling the remaining Bitcoins.

According to this decision, Mt. Gox will compensate victims by selling the remaining Bitcoins. These Bitcoins were previously locked in the exchange's wallets and will now be used to compensate for the significant losses caused by hacker attacks and management chaos. Although the value of these Bitcoins cannot fully compensate for all the losses, this decision undoubtedly brought new hope to the victims.

In 2019, Mark Karpeles was found guilty of data manipulation but acquitted of embezzlement charges, receiving a suspended sentence of two and a half years. Although Karpeles escaped the harshest punishment, his reputation was already damaged.

In November 2021, the Japanese court and Mt. Gox's creditors reached a compensation agreement, establishing a registration and compensation process. Approved creditors can submit compensation claims through an online system.

Trustee Nobuaki Kobayashi announced at a press conference that victims could begin submitting compensation claims. This announcement once again sparked strong reactions among the victims. Kobayashi detailed the application process and assured that the entire process would be strictly executed according to the agreement, ensuring that every victim receives the compensation they deserve.

By September 2023, Kobayashi issued another statement, announcing an extension of the deadline for repaying creditors to October 31, 2024. This decision was made to ensure that all victims have sufficient time to submit their claims, avoiding any omissions or missed opportunities. Kobayashi stated, "We hope that every victim receives the compensation they deserve, and no one's rights should be overlooked." The plan includes the payment of 142,000 Bitcoins, 143,000 BCH (Bitcoin Cash), and 6.9 billion yen. In May 2024, some of the Bitcoins in Mt. Gox's wallets were transferred out, marking further progress in the repayment plan.

The story of Mt. Gox not only revealed many risks and challenges in the early development of Bitcoin but also provided important lessons for the future development of the entire cryptocurrency industry. Through these events, Mt. Gox's journey from glory to decline demonstrated the risks and opportunities in the cryptocurrency industry. This history reminds us that while technology and markets continue to evolve, security and compliance are always the cornerstones of ensuring the industry's healthy development.

Looking back on this history, we see that the progress of technology and the development of the market cannot replace the importance of security and compliance. The rise and fall of Mt. Gox sounded the alarm for us, reminding us not to overlook basic security measures and regulatory requirements while pursuing innovation and growth. This is not only a reflection on the past but also an inspiration for the future.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。