Introduction

Ether.fi is dedicated to Ethereum staking and liquidity restaking. The current pain point in the Ethereum staking and restaking field is that users lose control of their Ethereum after staking it. Therefore, Ether.fi aims to help users enjoy staking and restaking rewards while retaining control of their Ethereum by developing a non-custodial staking solution.

Project Strength

Core Team

Mike Silagadze: Founder & CEO. Graduated from the University of Waterloo, Mike Silagadze has been involved in the cryptocurrency industry since 2010. He previously founded Gadze Finance and served as CEO, and also founded Top Hat.

Chuck Morris: Chief Engineer. Holds a graduate degree from the University of Chicago with a major in computer science. He has extensive experience in cryptocurrency development engineering teams.

Partners

Kiln: Provides infrastructure services for Ethereum.

DSRV: A company providing blockchain infrastructure support, including node services and other technical support.

Chainnodes: A blockchain service provider focusing on node operation and management.

Obol: A company specializing in distributed trust protocols or decentralized technologies related to blockchain.

From the team and partner information disclosed by Ether.fi, it is evident that its development team has extensive experience in cryptocurrency industry investment and development. Additionally, they have established partnerships with multiple cryptocurrency infrastructure companies, receiving strong support in infrastructure construction.

Financial Strength

Ether.fi has raised approximately $32.3 million through two rounds of financing.

Seed Round: In February 2023, Version One Ventures led the investment, with participation from Purpose Investments, North Island Ventures, Node Capital, Maelstrom, Kommune.one, Chapter One Ventures, and Arrington XRP Capital. The amount was $5.3 million.

Series A: In February 2024, Version One Ventures and OKX Ventures led the investment, with participation from White Star Capital, White Loop Capital, Stani Kulechov, Selini Capital, Sandeep Nailwal, North Island Ventures, Node Capital, and Matthew Howells-Barby. The amount was $27 million.

Version One Ventures and OKX Ventures are top investment institutions in the crypto industry. The founder of AAVE, Stani Kulechov, the founder of Polygon, Sandeep Nailwal, and the founder of Kraken, Matthew Howells-Barby, also participated in Ether.fi's financing, indicating a high level of recognition from top professionals in the industry.

Operating Model

Based on the amount of ETH and its LST tokens deposited by users, there are two categories: multiples of 32 ETH and its LST; other amounts of ETH and its LST tokens.

- When the amount of ETH and its LST tokens deposited by users is a multiple of 32

Validator operators submit bids to obtain the allocated validator node for operation. Trusted validator operators can submit a nominal bid to be marked as available. Untrusted validator operators participate in the auction mechanism and are allocated a validator based on the marked price. Depositors deposit 32 ETH into the Ether.fi deposit contract, triggering the auction mechanism and allocating a validator operator to run the validator. This also creates a withdrawal vault and two NFTs (T-NFT, B-NFT), granting ownership of the withdrawal vault. T-NFT represents 30 ETH, which is transferable at any time. B-NFT represents 2 ETH and is mandatory. The only way to withdraw 2 ETH is to exit the validator or fully exit. The validator uses the public key of the winning validator operator to encrypt the validator key and then submits it as an on-chain transaction. The validator operator uses the decrypted validator key to start the validator. Subscribers (or validator operators) can submit an exit command to exit the validator and deposit the subscribed ETH into the withdrawal vault. Then, subscribers can burn the NFTs and reclaim the ETH after deducting fees.

B-NFT is used to provide a deductible amount for price drop insurance (in the event of a price drop) and represents the responsibility of monitoring the performance of the validator node. Due to the increased risk and responsibility, the yield of B-NFT is higher than that of T-NFT.

- When the amount of ETH and its LST tokens deposited by users is other than multiples of 32

When the amount of ETH and its LST tokens deposited by users is other than multiples of 32, or when users do not want to take on the responsibility of monitoring the validator node, they can participate in Ether.fi's staking by minting eETH in the NFT liquidity pool. The liquidity pool contract contains a hybrid asset composed of ETH and T-NFT. When users deposit ETH into the pool, the pool mints eETH tokens and transfers them to the users. The minter of T-NFT can deposit the T-NFT into the liquidity pool and mint eETH equivalent to the value of the T-NFT. Liquidity providers holding eETH can convert it to ETH in the pool at a 1:1 ratio, provided that there is sufficient liquidity. If liquidity is insufficient, the conversion will trigger a validator exit. Users staking with B-NFT deposit their ETH into the pool and enter the queue for B-NFT allocation. When the amount of ETH in the liquidity pool exceeds the threshold, the next holder in the queue will be allocated. During this process, a private key is generated and the staking process is triggered, with 32 ETH staked into the pool, and two NFTs minted: T-NFT into the pool and B-NFT to the bond holder. When the amount of ETH in the liquidity pool falls below the threshold, the earliest minted T-NFT triggers an exit request. This exit request records a timestamp and starts a countdown. If the countdown expires and the validator has not exited, the value of the B-NFT holder will be gradually reduced. Validator operators receive rewards when exiting expired validators. When the validator exits, T-NFT and B-NFT are burned, and ETH (minus fees) is deposited into the liquidity pool.

Additionally, to increase stakers' earnings, Ether.fi has established a node service market in the project's design, allowing stakers and node operators to register nodes, provide infrastructure services, and share service income. While users deposit funds into Ether.fi and receive staking rewards, Ether.fi automatically restakes the users' deposits with Eigenlayer to earn additional income. Eigenlayer uses staked Ethereum to support various AVS and increase stakers' earnings by establishing an economic security layer. The total amount of staking rewards will be distributed to stakers, node operators, and the protocol, accounting for 90%, 5%, and 5% respectively. Users can earn Ethereum staking rewards, Ether.fi loyalty points, restaking rewards (including EigenLayer points), and rewards for providing liquidity to DeFi protocols.

Distributed Validator Technology (DVT)

In Ether.fi's whitepaper, Distributed Validator Technology (DVT) is introduced to address the centralization of validators in Ethereum staking. DVT's purpose is to allow multiple independent entities to collectively manage a single validator, thereby dispersing the risk of a single point of failure.

DVT Technology Implementation

The implementation of DVT technology mainly involves upgrades and improvements in two aspects:

Firstly, in DVT, the keys are split, no longer controlled by a single key, but by splitting the validator's key into multiple parts, with each entity participating in the validator management having only a portion of the key. Consensus from the majority of entities is required for any operation, effectively reducing the risk previously posed by a single node controlling the key.

Secondly, clear contracts and agreements must exist among DVT participants to regulate the responsibilities and rights of each participating entity, ensuring fairness and transparency of the entire system.

In summary, Ether.fi has significantly reduced the centralization risk of the original nodes by introducing DVT technology, ensuring the security and fairness of stakers and participants.

Validator Management NFTization

In Ether.fi's design, two NFTs, T-NFT and B-NFT, are created for each validator. T-NFT represents 30 ETH and is transferable at any time. B-NFT represents 2 ETH and is mandatory, with the 2 ETH only refundable upon complete withdrawal. The minted NFTs not only represent ownership of funds staked on the validator but also contain all the key data required for managing and operating the validator. The content of the NFT includes detailed information about the created validator, such as the running node, physical location, node operator, and detailed information about node services. NFT holders have control over the validator.

Ether.fi's NFT design is an upgraded version of LST in previous projects, allowing stakers to manage their validators in a more flexible and decentralized manner through NFT ownership. This approach also reduces the trust issue of stakers having to transfer their ETH to a third party.

Innovation Compared to Similar Projects

Ether.fi is compared to other Restaking projects.

Security: Ether.fi's most significant advantage over traditional staking projects is security. In traditional staking projects, users directly stake their ETH in nodes, losing control of the keys in the process. If a node behaves maliciously or is attacked, stakers may suffer corresponding losses. Ether.fi aims to allow stakers to control their keys and retain custody of their ETH while delegating the staking to node operators, effectively reducing the risk of participating in Ethereum staking.

Withdrawal Mechanism: In other Restaking projects, users need to wait 7 days to redeem their staked ETH or LST. However, Ether.fi provides a unique withdrawal mechanism, allowing users to unstake eETH back to ETH. This means users can not only swap back to ETH through DEX but also choose to unstake 1:1 for a shorter waiting time. Additionally, Ether.fi is the only protocol that supports direct LRT withdrawal, while other protocols such as Curve and Balancer require LP pool redemption, with withdrawal times varying based on liquidity reserves.

In the crypto industry, especially for active on-chain users, the security of their assets is the most important concern, followed by the rate of return. Ether.fi significantly reduces the security concerns of users' assets by using DVT technology and NFT-based validator management. It also provides a user-friendly mechanism for stakers to withdraw their staking, reducing many concerns for users participating in the project.

Project Model

Business Model

Ether.fi's economic model consists of three roles: node operators, stakers, and Active Validator Service Providers (AVS).

Node Operators: Node operators play a crucial role in Ether.fi's economic model, utilizing Ether.fi's infrastructure to provide high-quality services to stakers and other network participants. They are responsible for staking users' ETH or LST, minting NFTs for stakers, and restaking the staked ETH to Eigenlayer for earnings. Node operators also provide services to AVS integrated into Ether.fi to earn income.

Stakers: Stakers deposit their ETH into Ether.fi and receive Ethereum staking rewards. They also restake their ETH to Eigenlayer for additional earnings and provide services to AVS to earn income. 5% of stakers' earnings are allocated to nodes, and 5% to the Ether.fi project, contributing to Ether.fi's revenue.

Active Validator Service Providers (AVS): As a Restaking project, Ether.fi involves AVS. While most Restaking projects integrate their staked ETH into Eigenlayer to earn additional rewards, Ether.fi's future plan includes establishing its own AVS ecosystem, providing an additional source of income for stakers.

Token Model

According to the whitepaper, ETHFI has a total supply of 1 billion tokens, with an initial supply of 115.2 million tokens, resulting in a circulation rate of 11.52%.

ETHFI Allocation:

Investors and Advisors: 325 million tokens, 32.5%, locked for 2 years, linear unlocking

Core Team Contributors: 232.6 million tokens, 23.26%, locked for 3 years, linear unlocking

DAO Treasury: 272.4 million tokens, 27.24%

Airdrop: 110 million tokens, 11%

Liquidity Provision: 30 million tokens, 3%

Binance Launchpool: 20 million tokens, 2%

Protocol Guild: 10 million tokens, 1%

Token Empowerment

According to the whitepaper, ETHFI in Ether.fi is used for:

Paying protocol fees: Users need to use ETHFI for operations and transactions within Ether.fi.

Project incentives: Rewarding users who participate in staking and node operation.

Governance participation: Holding ETHFI tokens allows participation in project governance.

ETHFI Valuation

According to the whitepaper, there are no scenarios of centralized or periodic destruction of ETHFI in the Ether.fi project.

The limited empowerment of ETHFI is a significant drawback in the Ether.fi project, as it does not include a staking mechanism, reducing a key point for increasing the project's value through locked ETHFI tokens. However, based on the token allocation in the whitepaper, the most significant impact on the market comes from investors and advisors, and core team contributors, which together account for 55.76% of the total supply. Although this percentage is relatively high, the majority of the tokens will not be released until after March 2026, so it will not affect the circulation rate for the time being.

The future trend of ETHFI depends more on whether the price of ETH can continue to rise after the launch of the spot ETF for ETH, and whether Ether.fi can integrate more AVS in the future to bring additional staking rewards to Ether.fi's stakers.

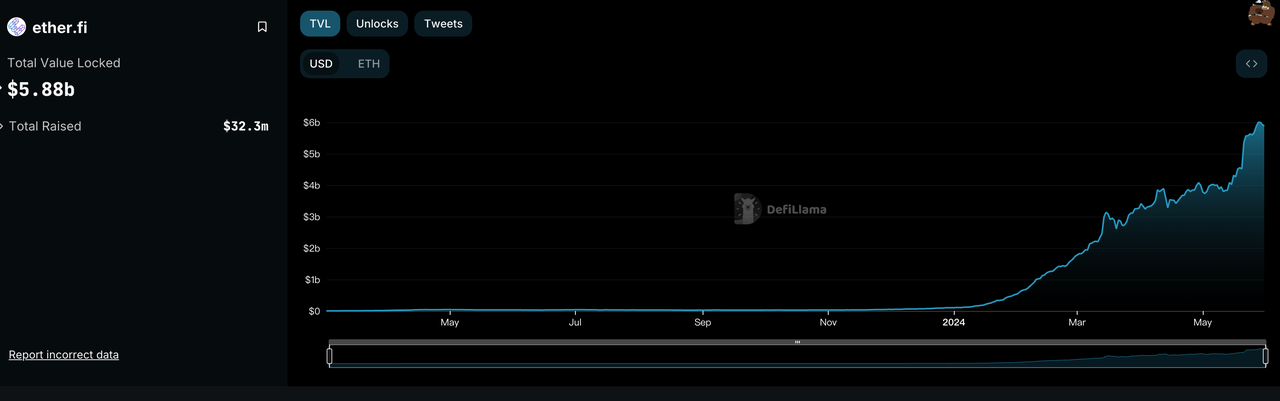

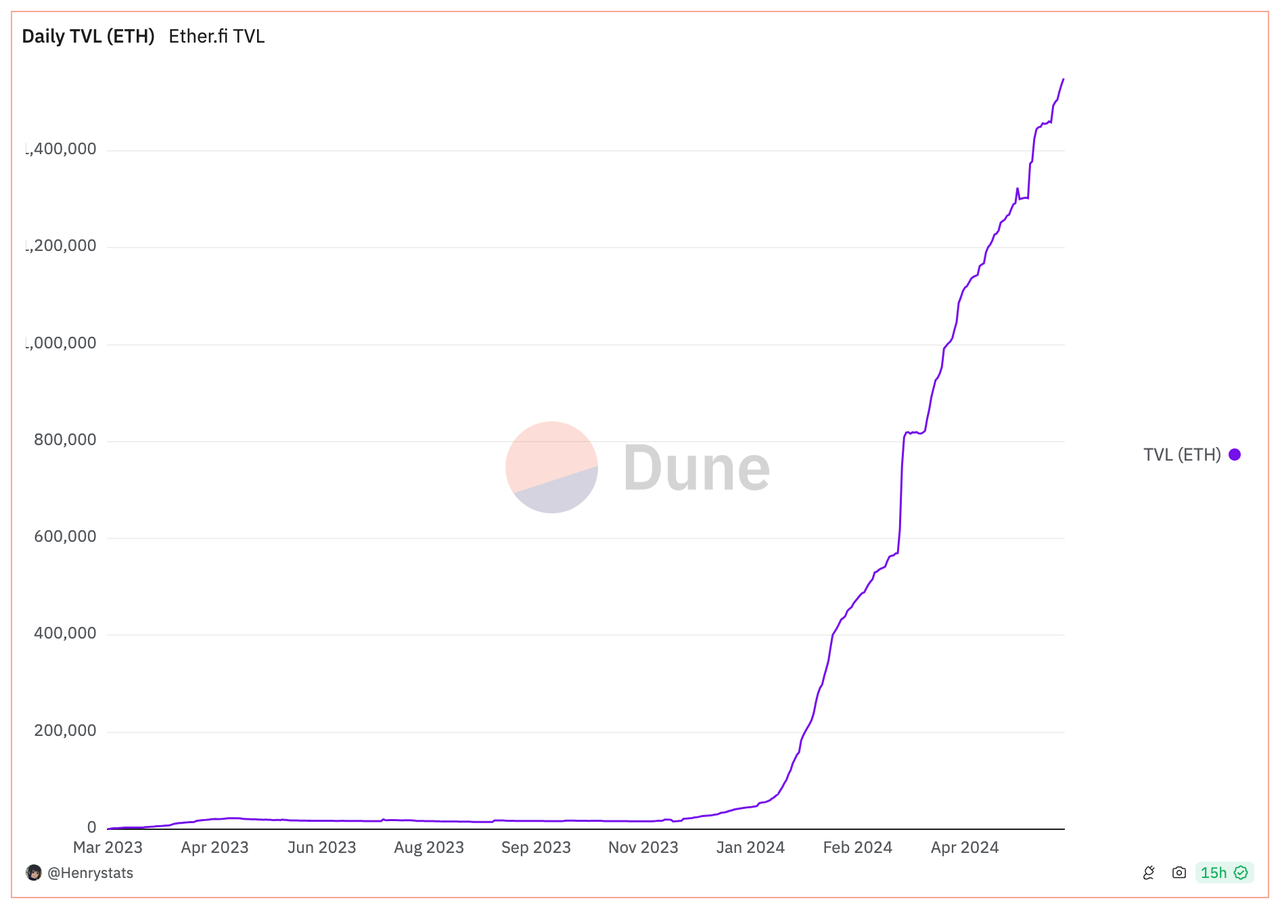

TVL

https://defillama.com/protocol/ether.fi#information

https://dune.com/ether_fi/etherfi

From the charts, it can be seen that Ether.fi's TVL has reached $5.88 billion, currently ranking first in the Restaking space. It is evident that Ether.fi's TVL has been rapidly increasing since 2024.

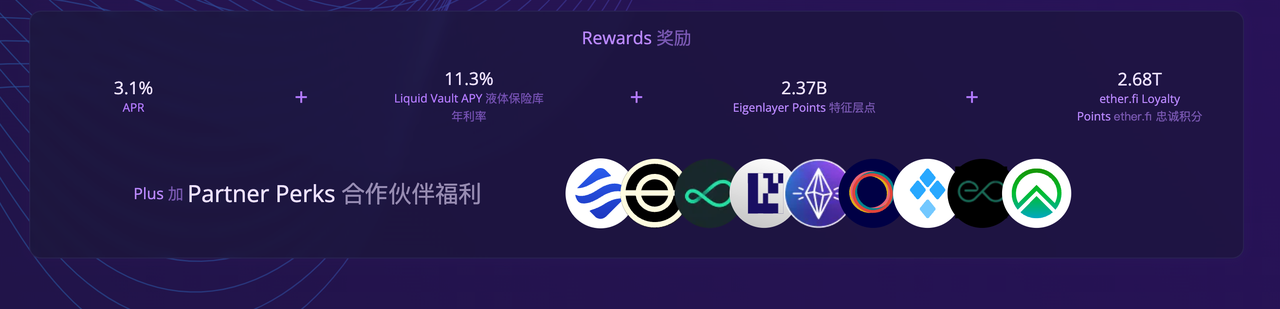

APY

https://www.ether.fi/

From Ether.fi's official website, the APY has reached 14.4%, making it very attractive to stakers.

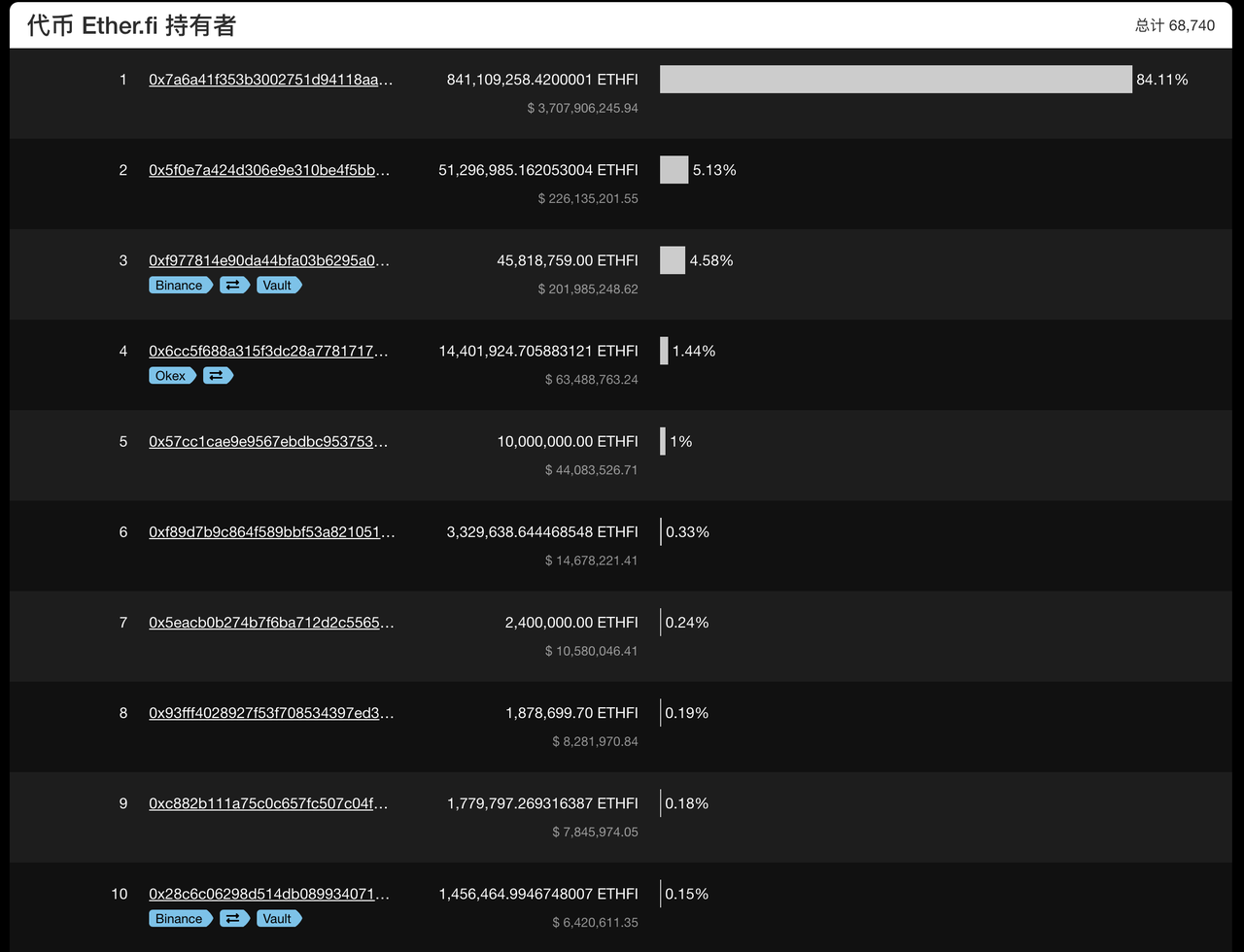

Top Ten Holders

https://ethplorer.io/zh/address/0xfe0c30065b384f05761f15d0cc899d4f9f9cc0eb#pageTab=holders&tab=tab-holders

Among the top ten holders, it includes Ether.fi's DAO Treasury, as well as the official addresses of Binance and OKEX. The remaining holders account for 7.07%, with 77.07 million ETHFI tokens. The current circulating supply is 115.2 million, representing 66.91% of the circulating supply, indicating that a majority of tokens are concentrated in the hands of whales.

Project Risks

Besides serving as the governance token for Ether.fi, the main function of the ETHFI token is to pay fees for using the project and distribute rewards to stakers and node operators. Although the current unlock amount of ETHFI tokens is not high, and the lock-up time for the largest proportion held by investors and advisors, as well as core team contributors, is reasonable, there is no buyback or staking mechanism for ETHFI, leading to a continuous increase in the circulating supply. This lack of a mechanism for deflation indirectly affects the price increase of the token to a certain extent.

While Ether.fi has addressed the advantage of stakers retaining ownership of their assets and being able to unstake promptly compared to other Restaking projects, the main focus for a project in the Restaking space is to increase the additional real income for stakers. Currently, Ether.fi, like other Restaking projects, relies on Eigenlayer to integrate staked tokens for AVS active validation services. Although Ether.fi plans to launch its own AVS active validation services this year, the uncertainty of whether other projects will use Ether.fi is significant. If this is not achieved, it will have a significant impact on the token price.

Conclusion

Ether.fi is dedicated to Ethereum staking and liquidity restaking. By adopting DVT technology and NFT-based validator management, it has addressed the common issue in Ethereum staking and liquidity restaking where stakers lose control of their ETH after staking. The LRT withdrawal mechanism is also very reasonable and has gained recognition from users. It has addressed users' concerns and the industry's common problems regarding security. Additionally, with the approval of Ethereum's spot ETF, if ETH can experience a significant increase in the upcoming bull market, Ether.fi, based on Ethereum, is likely to perform very well.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。