WLFI's investment is seen as an endorsement of Vaulta's potential, which may drive EOS's short-term rise.

Written by: Luke, Mars Finance

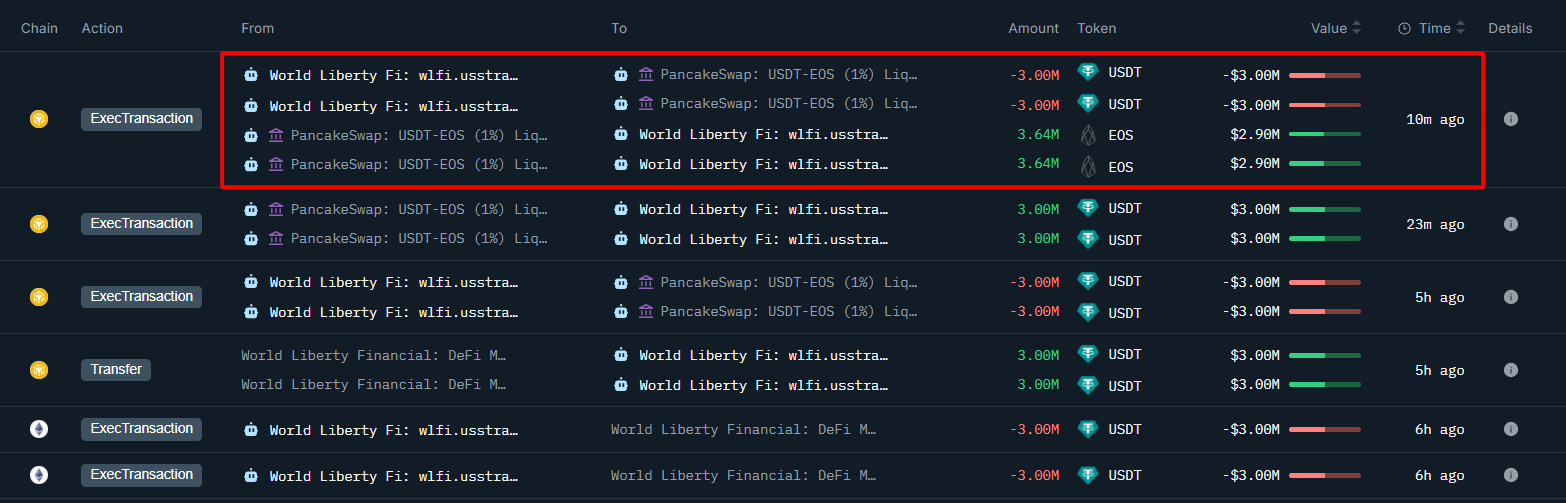

On May 16, 2025, blockchain data monitoring platform Onchain Lens revealed a significant piece of news: the decentralized finance (DeFi) project World Liberty Financial (WLFI), backed by the Trump family, purchased 3.63 million EOS for 3 million USDT (approximately 3 million USD) at a unit price of $0.825 just 10 minutes ago. Some exclaimed, "The Trump family is making a big move again, is EOS about to take off?" while others scoffed, "It's just another round of hype."

This transaction is not an isolated event. Just over a month ago, on April 1, the crypto market was in despair, with altcoins generally plummeting by 20%-50%, while EOS, under its new identity as "Web3 Bank" Vaulta, rose over 30% against the trend, breaking the $0.8 mark. Now, WLFI's high-profile entry adds fuel to the narrative of EOS's recovery. What exactly is causing this "old horse" of blockchain to stir up waves in the trough? Why did WLFI choose EOS as its investment target? Let’s trace the ups and downs of EOS, dissect Vaulta's transformation logic, and explore the deeper meaning behind this $3 million transaction.

The Twisted Seven Years of EOS: From ICO Frenzy to Lingering in the Trough

The story of EOS began in 2017, a time when the crypto world was filled with gold. The cheers of Bitcoin breaking $10,000 had not yet faded when EOS burst into the market with claims of "one million TPS (transactions per second)" and "zero fees." Founder Dan Larimer was hailed as a "technical prophet," and Block.one raised $4.2 billion through a year-long ICO, setting the most extravagant fundraising record in blockchain history. In the spring of 2018, EOS's price soared from $5 to $23, briefly placing its market cap in the top five, with 21 supernodes competing vigorously, and the community was fervent, as if the future of blockchain had been rewritten.

However, the glory was short-lived. EOS's DPoS (Delegated Proof of Stake) mechanism, while improving transaction efficiency, faced criticism for its high centralization. The 21 nodes were controlled by exchanges, making retail voting virtually meaningless, and the farce of on-chain arbitration freezing accounts further eroded trust. On the technical side, "one million TPS" became a joke, with the peak on the mainnet reaching only over 4,000, far below the promotional target. The RAM and CPU resource model was complex, with high transfer costs, and the developer experience was disastrous. By 2022, EOS's DApp ecosystem was nearly extinct, with fewer than 50,000 active users and a total locked value (TVL) of only $174 million, overshadowed by Ethereum ($60 billion) and Solana ($12 billion).

Block.one's actions further extinguished the community's hopes. The $4.2 billion ICO funds were invested in assets like Bitcoin (currently holding 160,000 BTC, worth about $16 billion) and U.S. Treasury bonds, with almost no relation to the EOS ecosystem. In 2019, Block.one was fined $24 million by the SEC for illegal ICO practices but did not provide substantial compensation to the community. On the X platform, the community angrily dubbed it: "Block.one is not a blockchain company; it's the Buffett of the crypto world." EOS's market cap plummeted from $18 billion to less than $800 million by 2025, falling out of the top 100, and the once "Ethereum killer" became a market fringe player.

Vaulta's Transformation: Ambitions and Controversies of a Web3 Bank

Just as EOS seemed to be heading towards its end, the community's counterattack brought a turning point. In 2021, the EOS Foundation (ENF), led by Yves La Rose, took over the project, marginalizing Block.one with the support of 17 nodes, and began a path of self-rescue. On March 18, 2025, EOS announced its rebranding to Vaulta, positioning itself as a "Web3 banking operating system," aiming to reshape wealth management, consumer payments, investment portfolios, and insurance through blockchain. This transformation not only allowed EOS to rise 30% against the bear market on April 1, breaking the $0.8 mark, but also laid the groundwork for WLFI's investment.

Vaulta's core architecture retains EOS's C++ smart contracts and decentralized RAM database, supplemented by cross-chain interoperability (IBC), attempting to connect traditional finance with DeFi. ENF injected vitality into the ecosystem through a series of innovations:

The rebirth of the RAM market: EOS's RAM (memory resources) became an invisible pillar of the ecosystem due to its scarcity. Vaulta optimized resource allocation, launching the XRAM mechanism, allowing users to stake tokens for RAM and share gas fees priced in BTC. As of March 2025, RAM demand surged due to new projects, with some users earning substantial BTC shares through XRAM staking, leading to comments on the X platform like, "RAM is more like an asset than EOS tokens."

The Bitcoin narrative of exSat: The exSat project launched in 2024 stores Bitcoin UTXO data using EOS's RAM, aiming to enhance BTC transaction speed and support DeFi applications. As of March 2025, exSat locked 5,413 BTC, with a TVL of $587 million, far exceeding EOS's mainnet's $174 million, becoming the "new engine" of the ecosystem. However, the technical stability and compliance of exSat remain in question, with the community doubting whether it is merely "promising big things for BTC."

The layout of 1DEX and RWA: 1DEX is Vaulta's decentralized exchange, attempting to fill the gaps in DeFi, but its lack of EVM compatibility and missing documentation have led to criticism as a "work in progress." Vaulta also plans to provide investment opportunities in real estate, stocks, and other assets through tokenization of real-world assets (RWA) to attract institutional funds.

Vaulta's transformation has sparked polarized reactions. Optimists believe that the Web3 bank aligns with the regulatory trend in the crypto market, and the innovations in RAM and exSat inject new vitality into EOS; pessimists question whether Vaulta's technical foundation can compete with Ethereum and Solana, suggesting that the transformation blueprint may just be "a name change to harvest retail investors." On the X platform, some joked, "EOS has gone from being an Ethereum killer to a Bitcoin little brother, and now wants to be a bank teller; what a versatile chain."

Why Did WLFI Bet on EOS? The Interplay of Strategy and Speculation

WLFI's transaction of purchasing 3.63 million EOS for 3 million USDT occurred amid the excitement of Vaulta's transformation, combining its DeFi strategy and the brand effect of the Trump family, indicating multiple considerations behind this decision.

Firstly, Vaulta's technical characteristics align closely with WLFI's USD-pegged stablecoin USD1. USD1 aims to provide low-cost, high-efficiency DeFi services, and Vaulta's high throughput (block time of 1 second), nearly zero transaction fees, and EVM compatibility make it an ideal operating platform. Compared to Ethereum's high gas fees and Solana's network volatility, Vaulta's stability supports USD1's cross-chain transactions and liquidity pools. Vaulta's RAM market can also provide efficient solutions for USD1's smart contracts and data storage. Analysts on the X platform speculate that WLFI may plan to deploy lending or payment protocols related to USD1 on exSat, expanding the use cases for the stablecoin.

Secondly, EOS's undervaluation provides a speculative opportunity. In May 2025, EOS's price was around $0.825, at a historical low with a low price-to-earnings ratio. The 30% rise triggered by Vaulta's transformation and the growth of exSat's TVL ($587 million) injected upward momentum into EOS, with WLFI's transaction price aligning with the market, indicating a cautious layout through public markets or over-the-counter transactions. If Vaulta's Web3 bank narrative continues to gain traction, EOS could return to $1.4 or even higher, yielding considerable returns. The brand effect of the Trump family further amplifies the market impact of this investment, similar to the "market rescue" trend of EOS in 2018, with users on the X platform already predicting, "WLFI's entry may ignite retail FOMO, and EOS could surge to $1 in the short term."

Additionally, Vaulta's exSat and RWA plans provide ecological synergy opportunities for WLFI. exSat supports Bitcoin DeFi through EOS's RAM, aligning with USD1's cross-chain goals; the tokenization of real estate and stocks through RWA offers WLFI a point of entry for its wealth management strategy. WLFI may gain priority subscription rights for RWA by investing in EOS or collaborate with Vaulta to develop new products. WLFI's recent $2 billion deal with Abu Dhabi investment firm MGX also indicates its search for partners globally, and Vaulta's international community may provide emerging market opportunities.

The policy backdrop of Trump's second term (starting in 2025) adds confidence to WLFI's investment. The stablecoin legislation promoted by the Trump administration (such as the GENIUS Act) and the "strategic crypto reserve" plan may create a favorable environment for Vaulta's Web3 banking model. As the flagship project of the Trump family, WLFI's investment in EOS not only strengthens its market layout but also reinforces the brand image of "American-made" blockchain through Vaulta's transformation narrative. Users on the X platform commented, "WLFI buying EOS is like Trump endorsing Vaulta, a dual signal of politics and market."

Market Impact and Concerns

WLFI's investment in EOS may trigger a short-term market frenzy. Although the transaction scale of 3 million USDT is not huge, the attention from the Trump family could push EOS to between 1.0 and 1.4 USD, further amplifying trading volume and FOMO sentiment. In the long term, if WLFI and Vaulta achieve deep cooperation in the areas of USD1, exSat, or RWA, it could inject new vitality into the EOS ecosystem, attracting developers and users back. However, the challenges of Vaulta's implementation (technical stability, compliance) and competitive pressure (from Ethereum and Solana) are unavoidable. EOS's historical baggage (the trust crisis of Block.one) and the controversy over WLFI's conflicts of interest (the family profiting about 400 million USD) may also trigger regulatory scrutiny, increasing investment risks.

For investors, EOS's undervaluation and Vaulta's narrative provide short-term speculative opportunities, with BTC shares from XRAM and the growth of exSat adding highlights to the ecosystem. However, caution is needed regarding the long-term outlook; Vaulta's execution capability and the rebuilding of market trust will be key.

Conclusion

The seven-year journey of EOS, from the glory of a 4.2 billion USD ICO to a 90% reduction in market cap, is a history of rise and fall in the blockchain era. Vaulta's transformation into a Web3 bank has injected new life into this "old horse," with innovations in the RAM market, exSat, and RWA allowing EOS to rise against the trend in the bear market of 2025. WLFI's purchase of EOS for 3 million USD is both an acknowledgment of Vaulta's technical potential and a high-profile move by the Trump family in the crypto market. This investment may drive EOS's short-term rise and pave the way for the expansion of the USD1 ecosystem, but its long-term success depends on Vaulta's implementation capability and trust rebuilding.

The crypto space has always been dramatic. EOS, once the "Ethereum killer," is now returning to the stage under the identity of Vaulta, and WLFI's entry acts like a signal flare, igniting market imagination. Will the endpoint be the revival of the Web3 bank, or yet another echo of speculation? Time will reveal the answer. For investors, facing this "old horse," the choice is between following the trend or maintaining rationality, perhaps requiring a heart strong enough to endure.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。