Author丨Wu Bin Chen Zhi, 21st Century Business Herald

Editor丨Bao Fangming Zhang Mingxin

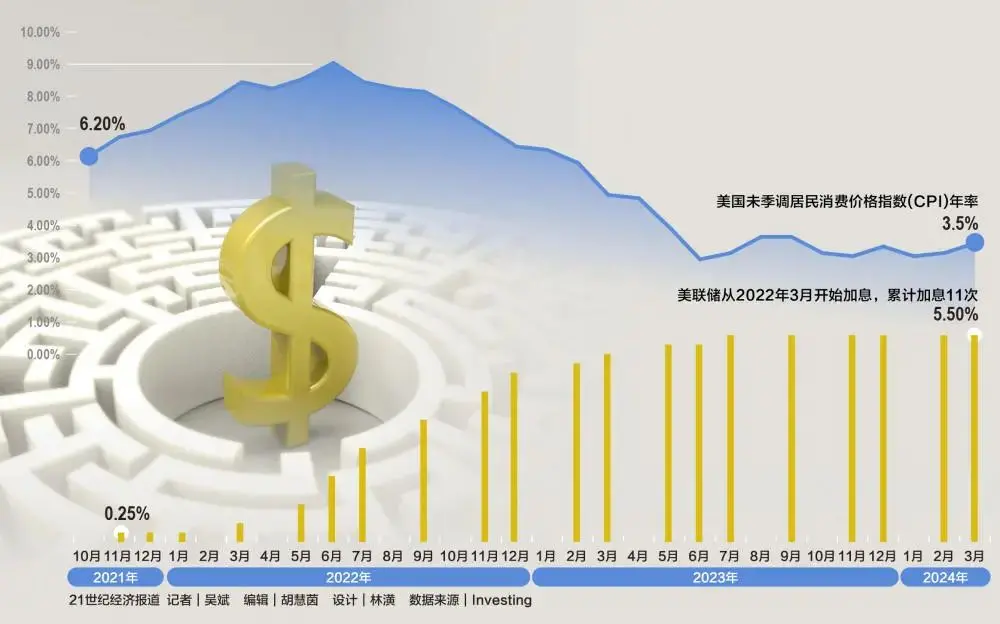

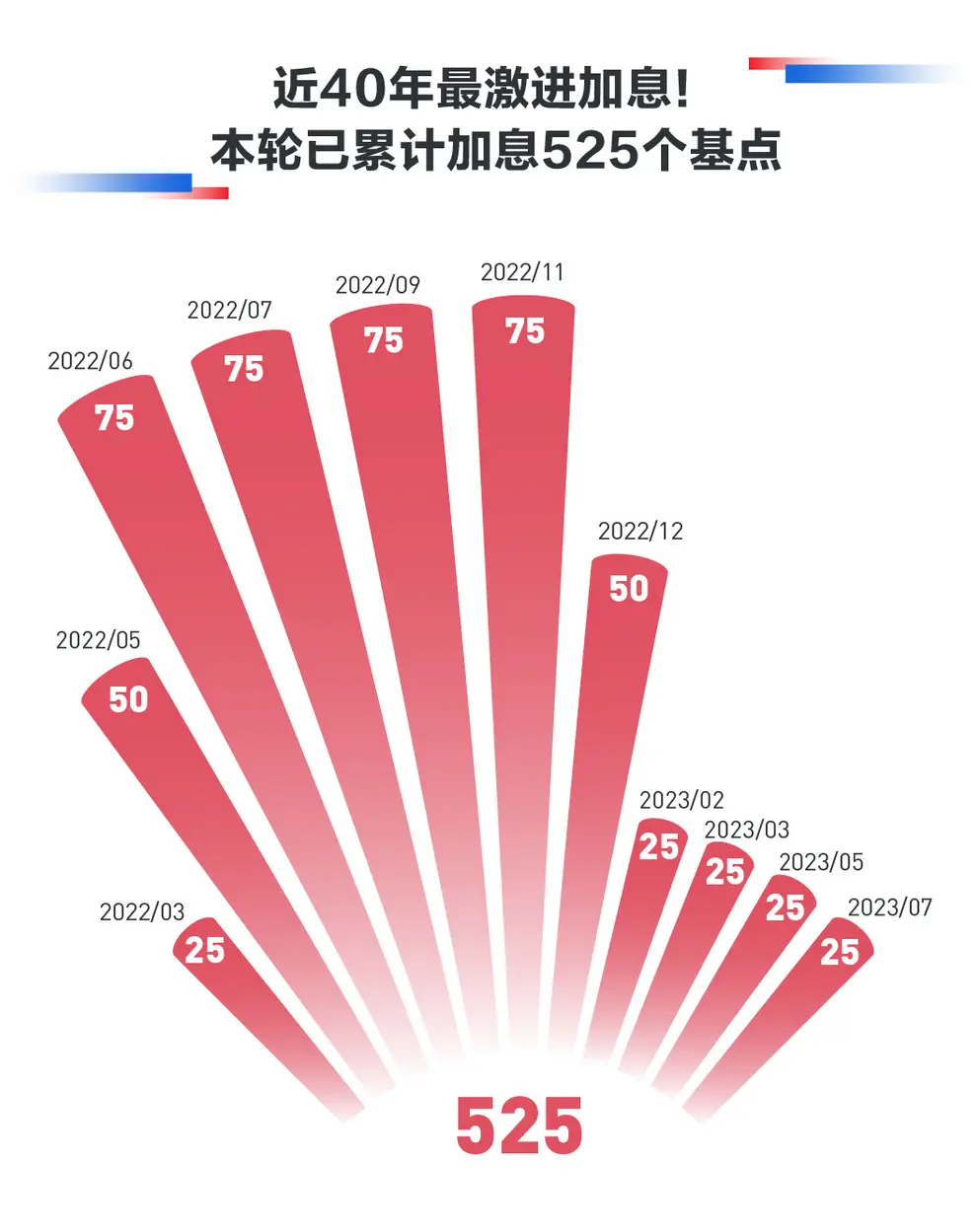

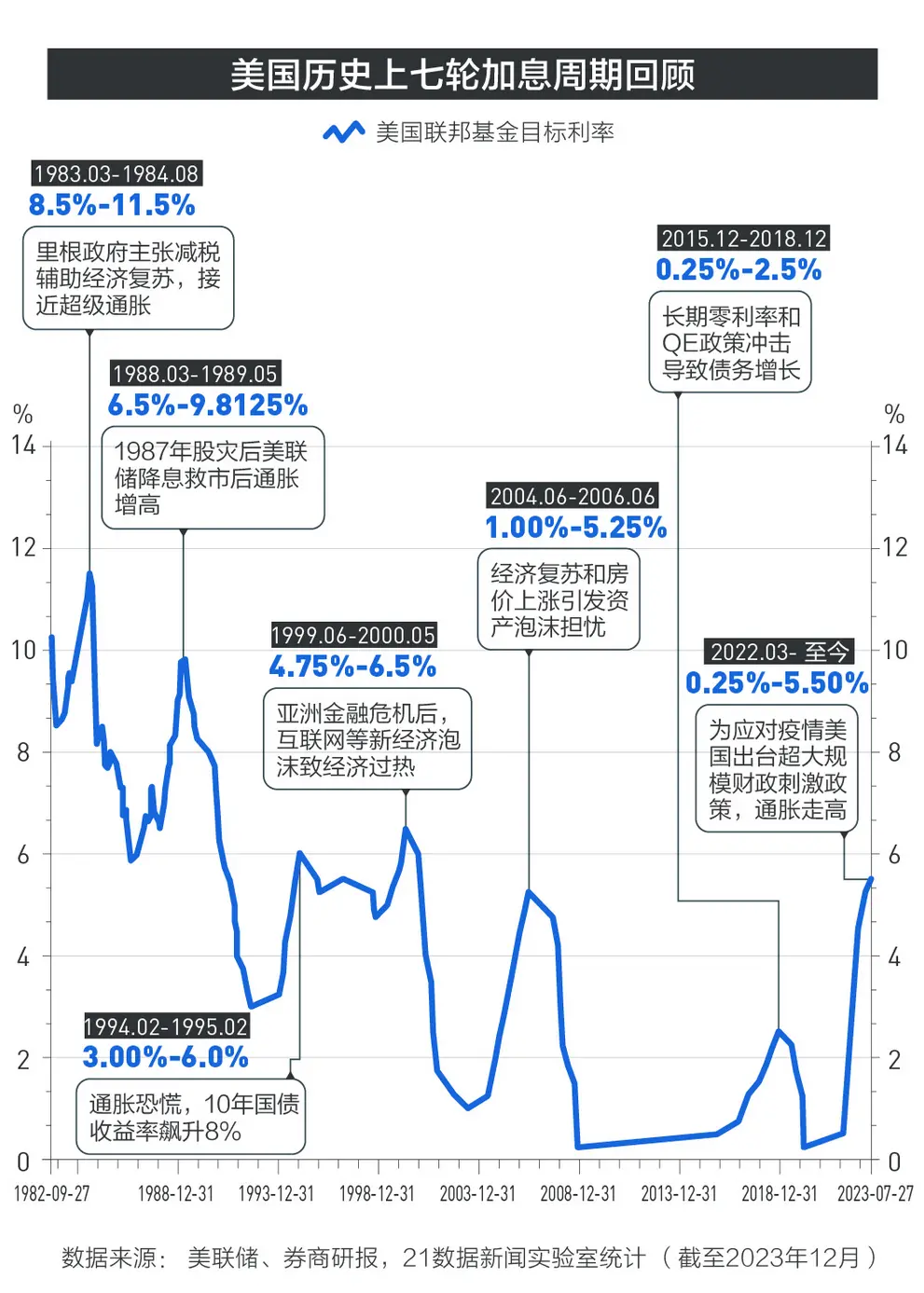

From the evening of April 18th to the early morning of April 19th, Beijing time, several senior officials of the Federal Reserve made intensive statements, releasing significant signals! They even mentioned the possibility of raising interest rates, which is rare.

Intensive Statements from Federal Reserve Officials!

In the early morning of April 19th, Atlanta Federal Reserve President Bostic stated that if inflation remains stagnant, there will be no choice but to respond. If inflation stagnates or moves in the opposite direction, there must be an open attitude to raise interest rates, controlling inflation is very important. If the speed of inflation decline exceeds expectations, there may be an early rate cut, and the overall risk outlook is balanced.

William, the President of the New York Federal Reserve, known as the "third in command of the Federal Reserve," warned that if the data shows that the Federal Reserve needs to raise interest rates to achieve its target, then it will do so.

In addition, the New York Federal Reserve released a signal on its monetary policy, predicting that the Federal Reserve may not stop shrinking its balance sheet until 2025.

According to the analysis by Nick Timiraos, a journalist from The Wall Street Journal, known as the "New Federal Reserve News Agency," the mention of a rate hike scenario by the "third in command of the Federal Reserve" is relatively more impactful on the market compared to the speech by Federal Reserve Chairman Powell.

Under the pressure of the "hawkish" statements from the Federal Reserve, the U.S. stock market collectively plunged again.

As of the close, both the S&P and Nasdaq fell for five consecutive days, with the S&P falling by 0.22%, marking the longest consecutive decline since October last year; the Nasdaq fell by 0.52%, hitting the lowest closing level since February 21 for the fourth consecutive day; the Dow barely closed up by 0.06%.

The latest situation of U.S. Treasury yields for various maturities

On Thursday (April 18th), U.S. Treasury yields collectively rose, with the 2-year Treasury yield rising by 5 basis points to 4.993%, the 3-year Treasury yield rising by 5.5 basis points to 4.828%, the 5-year Treasury yield rising by 5.5 basis points to 4.679%, the 10-year Treasury yield rising by 4.2 basis points to 4.636%, and the 30-year Treasury yield rising by 2.5 basis points to 4.73%.

More Signals Needed for U.S. Rate Cuts

According to CME's "FedWatch," the probability of the Fed maintaining interest rates in May is 98.7%, and the probability of a 25 basis point rate hike is 1.3%. The probability of the Fed maintaining interest rates in June is 79.9%, with a cumulative probability of a 25 basis point rate cut at 16.3%. Nancy Vanden Houten, an economist at Oxford Economics, told 21st Century Business Herald that about half of the indicators we track show that the labor market tightened in March, which runs counter to the Fed's efforts to lower inflation. A strong labor market means that the Fed needs to maintain higher interest rates for a longer period to ensure sustainable inflation decline.

In Houten's view, a resilient labor market, strong consumer spending, and higher-than-expected inflation data have weakened the Fed's confidence in reaching 2% inflation, and the Fed's first rate cut may be delayed until September.

Zhao Wei, Chief Economist of Guojin Securities, told 21st Century Business Herald that the urgency of a rate cut by the Fed is not high, but the resistance is not as great as imagined. A timely rate cut in 2024 is still the Fed's baseline assumption, and the "window" for rate cuts is from June to September, with the timing of rate cuts being pushed back, with about two rate cuts throughout the year. However, this is not unconditional. Excessively loose financial conditions will increase uncertainty about subsequent inflation, thereby compressing the Fed's room for rate cuts.

Source of the images/21 Data News Lab statistics

Overall, optimism about the U.S. economy currently dominates, and the urgency of a rate cut by the Fed has decreased. Traders now expect the Fed to cut rates only once or twice this year, far fewer than the approximately 6 times expected at the beginning of 2024, and lower than the 3 times predicted by the Fed's March dot plot. Some investors and economists even believe that the Fed may not cut rates at all this year. 【See details →】

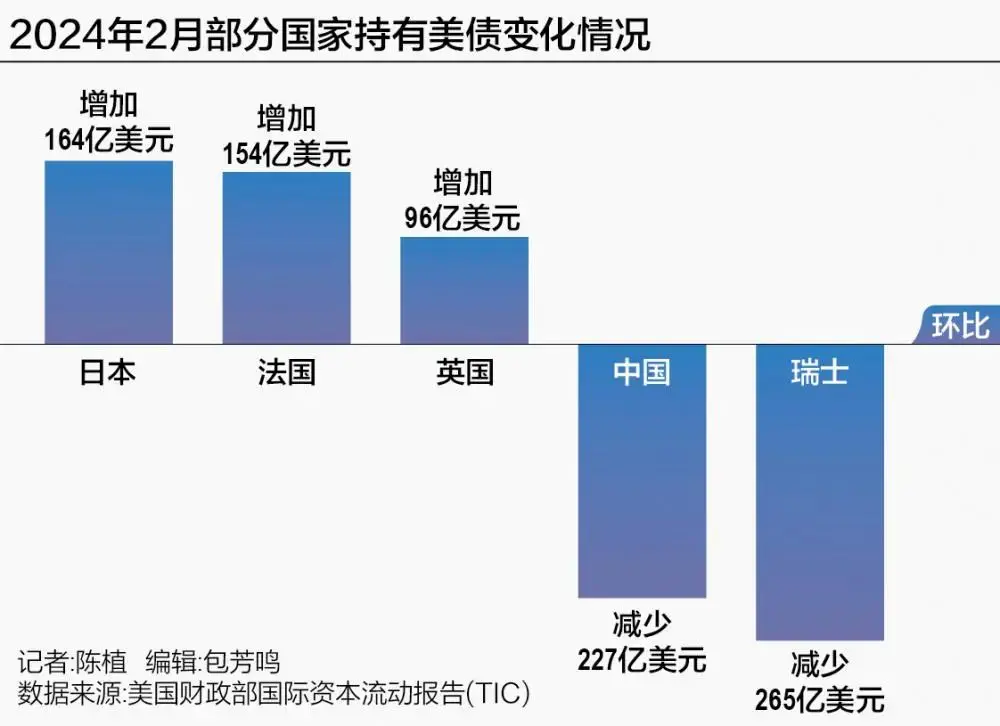

China Reduced its Holdings of U.S. Treasuries by $22.7 Billion in February

Influenced by the expectation of a delayed pace of rate cuts by the Fed, the global central banks' strategies for trading U.S. Treasuries diverged again in February.

In the early morning of April 18th, the U.S. Department of the Treasury released the latest Treasury International Capital (TIC) report, showing that in February, Japan, France, and the UK increased their holdings of U.S. Treasuries by $16.4 billion, $15.4 billion, and $9.6 billion respectively. By the end of February, Japan's holdings of U.S. Treasuries reached $1.1679 trillion, the highest level since August 2022.

In comparison, China reduced its holdings of U.S. Treasuries by $22.7 billion in February, with the total holdings dropping to $775 billion, approaching the lowest level since 2009.

However, China was not the country with the largest reduction in holdings of U.S. Treasuries in February. Switzerland reduced its holdings of U.S. Treasuries by $26.5 billion in February.

"Currency War" is Imminent! Central Banks' Trading Diverges

A hedge fund manager on Wall Street analyzed that the divergence in the U.S. Treasury trading strategies of various countries is largely related to their respective trends in monetary policy and the security requirements of reserve asset allocation.

Currently, the strong U.S. dollar is causing a comprehensive storm for Asian currencies.

As of the morning of April 19th, the latest situation of the U.S. dollar index

As the appreciation of the U.S. dollar brings depreciation pressure on Asian currencies, government officials in South Korea and Japan have rarely intervened together in the foreign exchange market.

The currency defense battle in Asia is imminent!

Specifically, although Japan has entered a period of tightening monetary policy, the Bank of Japan is hesitant to aggressively raise interest rates, and market expectations for the Fed to continue delaying the pace of rate cuts have led to the historical high maintenance of the yield spread disadvantage between the Japanese yen and the U.S. dollar for a longer period, resulting in a large amount of Japanese funds investing in U.S. Treasuries to earn risk-free yield differentials.

A similar situation has also occurred in the UK and some European countries. Due to market expectations that the rate cut pace of the Bank of England and the European Central Bank is faster than that of the Fed, capital from the UK and Europe has been reducing their holdings of local government bonds with declining yields and turning to U.S. Treasuries with relatively higher yields.

In comparison, countries such as China "take the lead" in their monetary policies and pay more attention to the risk of the decline in U.S. Treasury prices (high U.S. Treasury yields) brought about by the Fed's delayed pace of rate cuts, and accordingly reduce some of their U.S. Treasury holdings to enhance the value preservation effect of reserve assets.

In the view of the hedge fund manager, influenced by the expectation of a delayed pace of rate cuts by the Federal Reserve, multiple central banks may reduce their holdings of short-term U.S. Treasuries, as their prices are more susceptible to the impact of the Fed's delayed pace of rate cuts. Correspondingly, these countries will increase their holdings of medium and long-term U.S. Treasuries to achieve a higher yield from their U.S. Treasury asset allocation.

On April 18th, the U.S. Department of the Treasury issued $13 billion in 20-year Treasury bonds. As an indicator of overseas demand, the allocation ratio for the Indirect Bidders, who participate in the bidding through primary dealers or brokers on behalf of foreign central banks and other institutions, reached 74.7%, the highest since February 2023, and only slightly below the historical record. The reason for this is that the bid yield for the 20-year U.S. Treasury bonds reached 4.818%, the second-highest in history, showing a high yield for the hold-to-maturity strategy.

Several industry insiders pointed out that in the future, the U.S. Treasury trading strategies of multiple central banks will continue to diverge, as the recent sharp rise in the U.S. dollar has led to a significant decline in non-U.S. currencies, forcing some countries to reduce their holdings of U.S. Treasuries to raise dollars for intervening in the foreign exchange market to stabilize their own currency exchange rates.

"Even Japan, which has been increasing its holdings of U.S. Treasuries for the past five months, may join the camp of reducing its holdings of U.S. Treasuries," said a hedge fund manager in emerging markets. In addition, influenced by the continuous escalation of international geopolitical risks, the future trend of U.S. Treasury allocations by different types of countries will continue to diverge—Western countries may still continue to increase their holdings of U.S. Treasuries, but an increasing number of emerging market countries will accelerate the diversification of their foreign exchange reserve asset allocations.

"If the proportion of U.S. Treasuries and other U.S. dollar assets in the foreign exchange reserves of an emerging market country is higher, it indicates a higher dependence of the country's currency exchange rate on the U.S. dollar," he stated. "Once the U.S. dollar strengthens and leads to a significant depreciation of its currency exchange rate, it will actually exacerbate the capital outflow pressure on this country, which is not conducive to its financial stability."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。