Author: David Han, David Duong

Translation: DAOSquare

Key Highlights

- The rebound in the crypto market this week was supported by a large influx of funds into the US spot Bitcoin ETF and the short squeeze in leveraged derivative positions. Open interest in futures reached the highest level since January 2022, and the funding rate soared to the highest level since April 2021 (annualized at 109%).

- The proposal put forward by the Uniswap Foundation on February 23 laid the technical foundation for implementing a mechanism to pay UNI stakers and delegates (participating in governance) with wETH.

- We believe that the discussion on blockchain adoption will shift from scalability to creating a smooth user experience, which not only means the abstraction of the underlying blockchain, but also addresses pain points such as mnemonic phrases and wallet management.

Market Observations

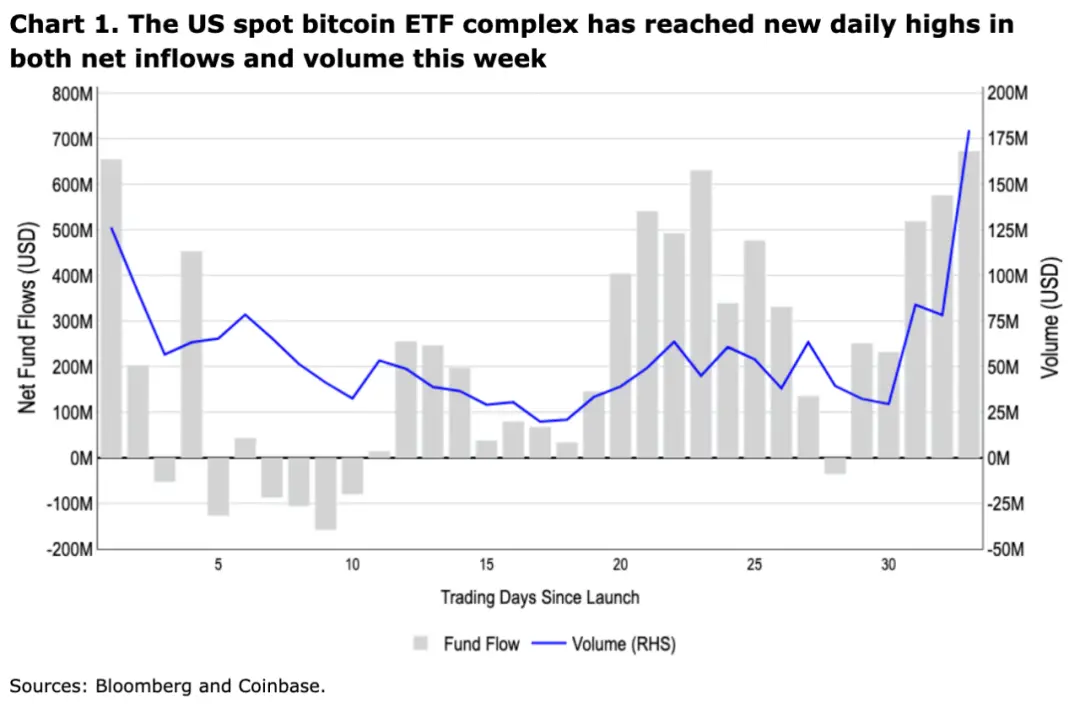

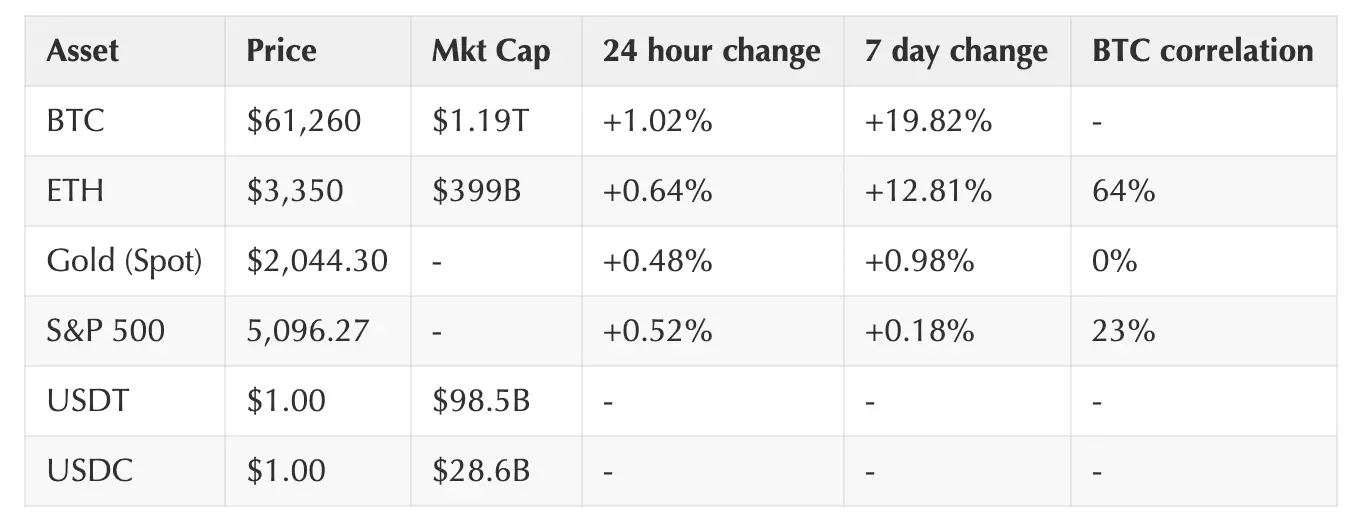

The impressive rebound in the crypto market this week was supported by a large influx of funds into the US spot Bitcoin ETF and the comprehensive support from the short squeeze in leveraged derivative positions. The US spot Bitcoin ETF saw nearly $1.8 billion in net inflows in the first three days of this week, with BlackRock's iShares Bitcoin ETF (IBIT) alone accounting for 70% of it (see Chart 1). Despite many major brokerage firms such as Morgan Stanley still conducting due diligence on these products (a prerequisite for offering these products to clients), the performance this week was undoubtedly encouraging.

In recent days, the momentum of the Bitcoin price has driven a short squeeze, with open interest in BTC perpetual futures reaching the highest level since January 2022 ($14.2 billion). According to Glassnode data, the weighted average annualized funding rate for open interest reached 109% on February 28, the highest level since April 2021. Subsequently, the rate dropped to around 70% (see Chart 2). Between February 25 and 28, nearly $750 million in shorts were liquidated, setting new highs for the number of shorts liquidated since the beginning of the year. At the same time, we believe that the short covering based on the futures long/short ratio may be coming to an end, but it is not yet complete.

The recent performance is consistent with the constructive outlook we released in early February, but we remain cautious about some potential negative seasonal factors that may arise in March. For example, traditional assets are often affected by tax-related factors, which may lead to temporary downward pressure. If the funding rate and the liquidation behavior of open interest lead to a series of long liquidations, the significant and sustained positive fluctuations in the funding rate and open interest may also impact the market. Nevertheless, we maintain a constructive outlook for the coming months overall, as many wealth management companies will continue to incorporate spot ETFs, which will absorb liquidity at a faster pace than the speed at which Bitcoin miners produce.

On-chain: Uniswap Fee Switching

On February 23, the Uniswap Foundation (UF) announced an upgrade proposal for the Uniswap V3 protocol governance to implement a mechanism to reward UNI token delegates and stakers with a portion of trading fees using wETH. However, it is important to note that the proposal itself did not activate fee switching but laid the technical groundwork for its implementation. If the proposal is approved, the initial fee parameters will be set at 0, but future proposals may allocate 10% to 20% of trading fees for the reward program.

In our view, the greatest concern about enabling protocol fees is the impact on liquidity providers, as any such fees will be deducted from their income. This could lead to a decrease in total value locked (TVL) and MEV-based traffic. Detailed analysis by Gauntlet (in which UF is involved) addressed this issue and indicated that the impact on the core non-MEV amount may be minimal, with estimated annual revenues ranging from a conservative $10 million to an optimistic $72 million based on historical activity. If the initial proposal is approved, the Gauntlet team will also be responsible for proposing the fee rollout plan.

We believe that since the proposal has been put forward by UF's governance lead and has received broad support in the forum, it is likely to be implemented. In fact, in the fee proposal rejected in June 2023, most participants expressed support, but the voting split between different fee levels ultimately led to "no fee" prevailing. Given that this proposal does not change any revenue structure and does not present the same voting allocation issues, we do not see any significant obstacles. Interestingly, the proposal also links revenue to governance (through staking and delegation), which we believe can incentivize UNI holders to participate more actively in the community. The voting period for this proposal is expected to take place between March 1 and 7.

The widespread attention to this proposal has prompted several other projects to consider following suit, such as Frax. If this trend develops in other mature DeFi protocols, we believe it may begin to bring speculative token valuations into a clear and substantiated valuation model, especially for tokens and protocols that can generate sustainable fees. This shift also represents a change in the protocol value accrual mechanism, as it directly rewards delegates and stakers with wETH (the current proposed payment token), in contrast to mechanisms adopted by other protocols such as MakerDAO, which use native token buybacks and burns.

On-chain: Surge in Application Chains

Additionally, we would like to discuss the growing rollup field on Ethereum, which has given rise to a new type of rollup-as-a-service (RaaS) product that allows for the creation and deployment of rollups with a simple click. The development of modular blockchains has accelerated with the emergence of various technologies used for deploying Layer2 (L2) and other application-specific chains. The previously mentioned Frax protocol plans to launch its own L2 Fraxtal, which will make it part of the Optimism superchain. Other major protocols, such as the decentralized perpetual contract exchange GMX, currently a top TVL protocol on Arbitrum, are also considering deploying their own chains (it is currently known that the GMX protocol will remain on Arbitrum and Avalanche C-Chain).

As more L2s emerge, we believe there will be more scrutiny in the cross-chain bridge and interoperability space, and the complexity of the entire ecosystem will increase. Different solutions have their own considerations in terms of security assumptions, confirmation time, development schedules, and costs, which may also pose certain barriers for non-technical end users. Additionally, the fixed costs of Rollups (gas costs for Layer1 infrastructure) are also a factor to consider. In a world of increasing L2s, profitability may become more challenging, and it is likely to further push applications towards Layer3, leading to a reshuffling of profitable L2 chains. The fragmentation of this execution environment has led some critics to believe that a single or integrated blockchain providing shared state can achieve more use cases and better cross-application security.

In the discussion of these two scalability approaches, both the arguments for and against demonstrate far-reaching implications, although we believe that these technical trade-offs are secondary to building a smooth user experience. In our view, widespread adoption of any application ultimately requires abstracting technical complexity from consumers, just as the underlying technology stack (and design trade-offs) of large web2 platforms is largely irrelevant to users. Therefore, we believe that enabling users to protect their wallets with passkeys (such as Coinbase's wallet solution) is more important for expanding the crypto market. Although these tools are often overlooked in the scalability debate, we believe that these innovations may ultimately have a significant impact on user adoption and acquisition, especially if scalability solutions tend to have similar performance in the long term.

Performance in Crypto and Traditional Fields

(As of 4:00 PM Eastern Time on February 29)

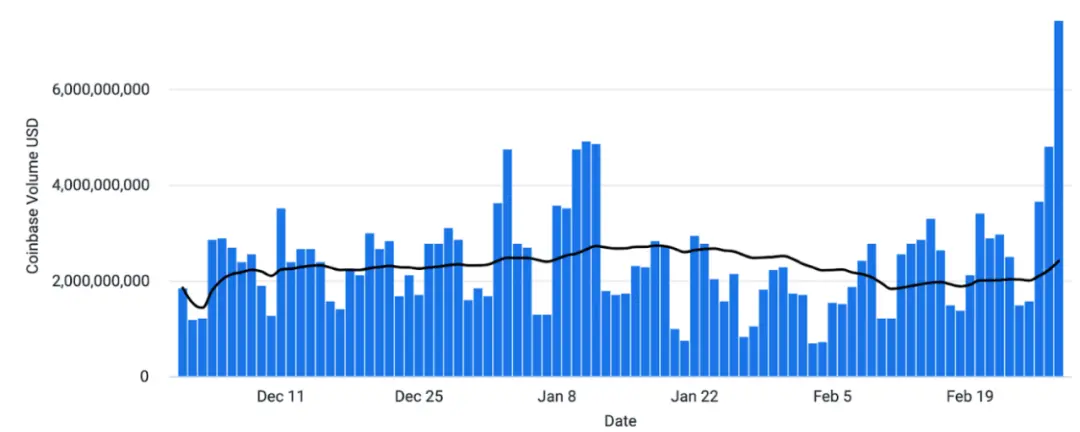

Coinbase Exchange and CES Insights

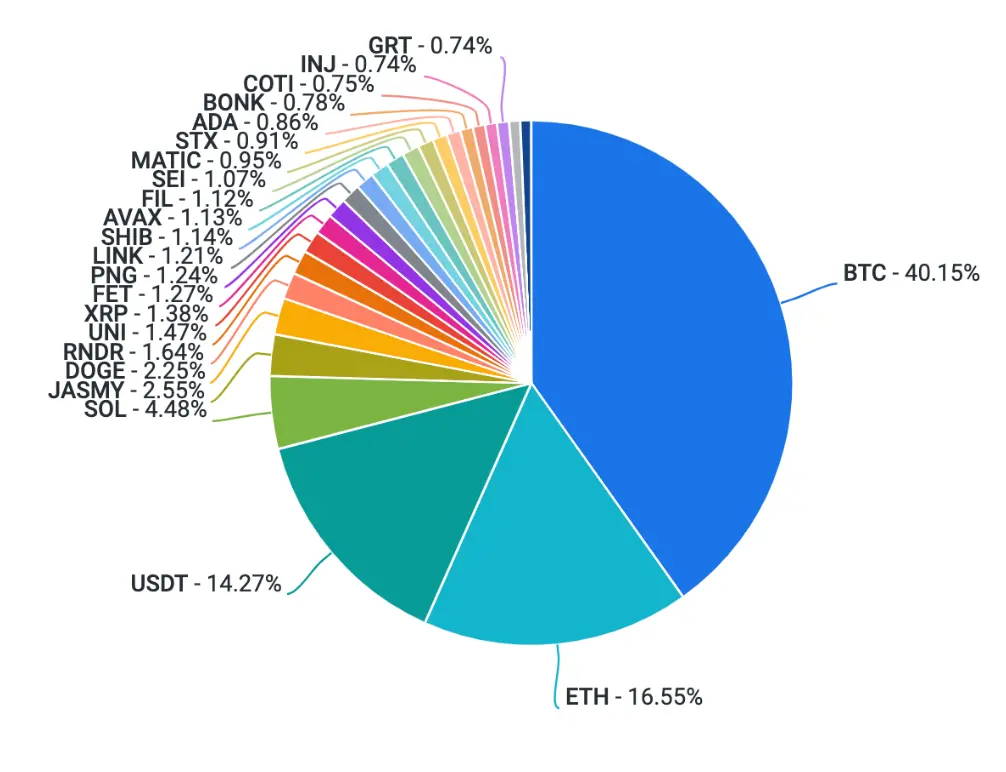

The rebound of BTC continues to surprise many market participants with its strong momentum. Long holders have benefited from this momentum, as over $2 billion in new funds have entered ETF products in the past week. However, high funding rates and the increase in open interest in perpetual futures products may pose risks to the rebound. Over the past 7 days, the average funding rate has exceeded 30%, making the cost of holding long positions high. The performance of altcoins shows a closer correlation with investor trading behavior around themes and narratives.

Coinbase Platform Trading Volume (USD)

Coinbase Platform Trading Volume (Asset Proportion)

Funding Rate

Notable Crypto News

Institutions

- VanEck launches NFT platform, to offer tokenized ownership of watches and wines before March (The Block)

- Ledn launches Ethereum-backed lending business, onboards former Celsius users (The Block)

Regulation

- Elizabeth Warren willing to "work with" crypto industry (but reiterates the need to follow traditional financial rules) (The Block)

- Hong Kong ends licensing activity for cryptocurrency exchanges (Cointelegraph)

General

- Ethereum NFT card game "Gods Unchained" launches on iOS and Android (Decrypt)

Coinbase

- Coinbase announces support for asset recovery on BNB Smart Chain and Polygon (Coinbase Blog)

- Coinbase Cloud adds support for Nethermind and Erigon to enhance diversity of Ethereum execution clients (Coinbase Blog)

- Evolving wallet industry will help onboard a billion users to the blockchain (Coinbase Blog)

Global Perspectives

Europe

- European Central Bank official says fair value of Bitcoin remains zero (ECB blog) (Decrypt)

- Paris Saint-Germain becomes the first football team to verify on the blockchain (CoinDesk)

- English Law Commission seeks views on legislation to classify cryptocurrencies as property (CoinDesk)

Asia

- Major Japanese companies Mitsubishi UFJ, Rakuten, and Sumitomo to launch security token offerings (Cryptonews)

- Hong Kong Monetary Authority issues circular on the sale and distribution of tokenized products (HKMA)

- Hong Kong Financial Secretary says Hong Kong will introduce regulatory sandbox for stablecoin issuers (The Block)

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。