Author: Arthur Hayes

Translation: Joyce, BlockBeats

Editor's note: After the approval of the Bitcoin ETF, both the cryptocurrency community and traditional financial institutions are closely watching the impact of this event on the global financial market.

In this article, Arthur Hayes analyzes the reasons for the approval of the Bitcoin ETF. The anti-inflation properties of Bitcoin make it an ideal asset in the current global inflationary environment. The Bitcoin ETF provides an opportunity for those who want to avoid the impact of inflation but cannot leave the traditional government-controlled financial system. Then, Arthur Hayes provides a detailed analysis of the potential market impact of the Bitcoin spot ETF and explains in detail the creation and redemption process of ETFs, as well as the arbitrage opportunities that may exist in the operation of the Bitcoin ETF.

BlockBeats has translated the original article as follows:

Why Now?

The final moments of life are the most expensive from a medical perspective. We are willing to spend unlimited funds on treatments that can delay the inevitable death. Similarly, the elites responsible for maintaining the current world order, led by the US hegemony and its vassal states, are willing to spare no effort to protect this order because they benefit the most from it. However, since 2008, when the improper mortgage loans to penniless Americans triggered a global economic crisis, the severity of which rivaled the Great Depression of the 1930s, the US hegemony has been lying on its deathbed. And what prescription have the medieval neo-Keynesian barbers who blindly follow Ben Bernanke prescribed? The same as the dying empire… "the printing press hums."

The United States, Europe, and some vassal states, competitors, and allies in other regions have all resorted to printing money to address different symptoms of the same problem: a severely imbalanced global economic and political system. The United States, led by the Federal Reserve (Fed), prints money to purchase US government bonds and mortgage-backed securities. Europe, led by the European Central Bank (ECB), prints money to purchase government bonds of eurozone member countries to maintain the survival of a flawed monetary (but not fiscal) union. Japan, led by the Bank of Japan (BOJ), continues to print money in pursuit of the illusory inflation that disappeared after the real estate collapse in 1989.

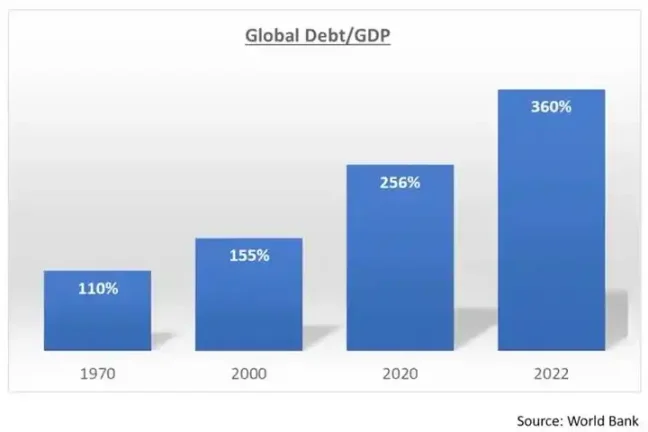

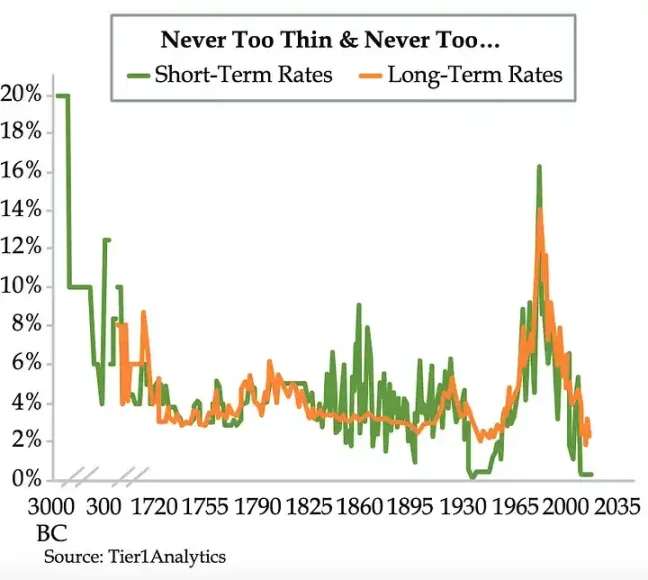

This rampant money printing has led to an accelerated increase in the global debt-to-GDP ratio. Global interest rates have reached their lowest levels in 5000 years. At its peak, nearly $20 trillion in corporate and government bonds had negative yields. Since interest is compensation for the time value of money, if interest is negative, are we implying that time no longer has value?

Thanks to Danielle DiMartino Booth of Quill Intelligence for providing this chart.

As you can see, in response to the 2008 global financial crisis (GFC), interest rates were pushed to their lowest point in 5000 years.

This is the Bloomberg index of global negative-yielding debt. From virtually zero before the 2008 global financial crisis, it reached a high of $17.76 trillion in 2020. This is the result of global central banks lowering interest rates to 0% and below.

The majority of the world's population does not have enough financial assets to benefit from the devaluation of global fiat currencies. Inflation of various commodities has sprung up around the world like mushrooms after rain. Do you remember the Arab Spring of 2011? Do you remember when a serving of avocado toast in every major global financial center cost less than $20? Do you remember when a median-income family could afford a house at the median price without the help of the "Bank of Mom and Dad"?

The only barely feasible way out is to own some gold. But owning gold in physical form is impractical. Gold is heavy and difficult to hide in large quantities, and it is hard to evade the watchful eye of greedy government regulation. Therefore, ordinary people can only silently endure, while the elites continue to revel in Davos as if time had stood still since 2007.

However, like a lotus blooming in a cesspool, Satoshi Nakamoto released the Bitcoin whitepaper in an empire that had morally, politically, and economically bankrupted. This whitepaper outlined a system where, for the first time in human history, currency could be separated from the nation-state in a globally scalable manner through interconnected machines and cryptographic proof. I say "globally scalable" because Bitcoin is weightless. Whether you hold 1 satoshi or 1 million bitcoins, the weight is the same: 0. Furthermore, you can protect your bitcoins using only the mnemonic phrase to unlock your bitcoin wallet, using your mind. Bitcoin provides a complete financial system for everyone, free from the constraints of the old system, requiring only a device connected to the internet.

People finally had a way to escape the global fiat currency devaluation frenzy. However, after the 2008 financial crisis, Bitcoin was not mature enough to provide a credible escape route for believers. Bitcoin, and the entire crypto market, had to grow in user numbers and prove that they could withstand a severe crisis.

We, the loyal believers, faced a severe test in 2022. The Federal Reserve, following most central banks globally, began tightening financial conditions at the fastest pace since the 1980s. The banking system and bond market of the US hegemony could not withstand the onslaught of the Federal Reserve. In March 2023, three US banks (Silvergate, Silicon Valley Bank, and Signature Bank) collapsed within a mere two weeks. If valued at market prices, the US banking system was bankrupt, a situation that still exists, especially considering the US government bonds and mortgage-backed securities they hold. Therefore, US Treasury Secretary Janet Yellen created the Bank Term Funding Program (BTFP) as a secret way to rescue the entire US banking system.

Cryptocurrencies were not immune to the disruptions caused by high interest rates. Centralized lending platforms like BlockFi, Celsius, and Genesis went bankrupt due to loans granted to overleveraged trading firms (such as Three Arrows Capital). Terra Luna, a stablecoin pegged to the US dollar, also went bankrupt due to the decline in the price of its governance token Luna, which supported the issuance of the UST stablecoin. This event wiped out over $40 billion in imaginary value in just two days. Then, centralized exchanges also began to go bankrupt, with FTX being the largest. Operated by the "right" type of white American hegemony, Sam Bankman-Fried, FTX embezzled over $10 billion of customer funds, and his scam was exposed as cryptocurrency prices plummeted.

What happened to Bitcoin, Ethereum, and DeFi projects like Uniswap, Compound, Aave, GMX, and dYdX? Did they fail? Did they call the central crypto banks and get rescued? Absolutely not. Overleveraged positions were liquidated, prices fell, people lost a lot of money, centralized companies ceased to exist, but the Bitcoin blocks still produced on average once every 10 minutes. DeFi platforms did not go bankrupt on their own. In short, there was no bailout because crypto cannot be bailed out. We suffered, but we persevered.

In the aftermath of 2023, it became apparent that the US hegemony and its vassal states could not continue to implement a tightening monetary policy. Doing so would bankrupt the entire system because leverage and debt had piled up too high. An interesting thing happened: as US long-term bond yields began to gradually rise, Bitcoin and cryptocurrencies rebounded, while bond prices fell.

Bitcoin (white) vs. US 10-year Treasury Yield (yellow)

As you can see in the chart above, when interest rates rise, Bitcoin, like all other long-term assets, shows a decline.

After the Bank Term Funding Program (BTFP), this relationship reversed. Bitcoin and yields rose in sync. Especially in the steep acceleration of the bear market, the rising yields indicate investor lack of confidence in the "system." In response, they sold off the safest government bonds of the empire, namely US Treasuries. This capital mainly flowed into the "Magnificent Seven" AI tech stocks (Apple, Google parent Alphabet, Microsoft, Amazon, Meta, Tesla, Nvidia), and to some extent, into cryptocurrencies. After nearly 15 years, Bitcoin finally showed its true colors, becoming "the people's currency," not just a derivative of empire risk assets. This poses a very tricky problem for traditional finance.

Capital must stay within the system to eliminate a large amount of non-productive debt through inflation. Bitcoin is outside the system and now shows zero to slightly negative correlation with bonds (remember, when yields rise, bond prices fall). If bond vigilantes express dissatisfaction with government bonds by selling them and buying Bitcoin and other cryptocurrencies, the global financial system will collapse. Its collapse is because the inherent losses within the system are finally recognized, and large financial firms and governments will have to drastically downsize. Bitcoin is outside the system and now shows zero to slightly negative correlation with bonds (remember, when yields rise, bond prices fall).

To avoid this reckoning, the elite must financialize Bitcoin by creating a highly liquid exchange-traded fund (ETF). This is the same trick they played in the gold market, when the US Securities and Exchange Commission (SEC) approved ETFs like SPDR GLD in 2004, claiming these ETFs held gold bars in global vaults. If all the capital wanting to escape a collapse of the global government bond market buys Bitcoin ETFs managed by large traditional financial firms like BlackRock, then capital remains safely within the system.

As it is evident, to protect the global bond market, the Federal Reserve and all other major central banks must once again turn to money printing. BlackRock officially applied for a Bitcoin ETF in June 2023. A spot Bitcoin ETF was approved in the United States. However, by 2023, the US SEC finally seemed to accept such applications. I bring up these points to emphasize the strangeness surrounding the current events around the ETF approval process. The Winklevoss brothers applied for a spot Bitcoin ETF in 2013, but the SEC rejected their application for over a decade. BlackRock applied and was approved within six months. It makes one wonder, "Hmm…"

As I wrote in my previous article "Expression," a spot Bitcoin ETF is a trading product. You buy it with fiat currency to earn more fiat currency. It is not Bitcoin. It is not a path to financial freedom. It does not break free from the traditional financial system. If you want to escape, you must buy Bitcoin and withdraw it from the exchange for self-custody.

I wrote this lengthy preface to explain "Why Now?" Why has a spot Bitcoin ETF finally been approved at this crucial moment for the empire and its financial system? I hope you can appreciate the significance of this development. The estimated size of the global bond market is $133 trillion; imagine if bond prices continue to fall, even as the Fed may start cutting rates in March, funds will flow into Bitcoin ETFs. If inflation bottoms out and starts rising again, bond prices may continue to fall. Remember, war leads to inflation, and the empire's peripheral regions are definitely experiencing war.

Market Impact of Spot Bitcoin ETF

The rest of this article will discuss the market impact of the spot Bitcoin ETF. I will focus solely on BlackRock's ETF, as BlackRock is the world's largest asset management company. They have the best ETF distribution platform globally. They can sell products to family offices, retail wealth advisory firms, retirement and pension plans, sovereign wealth funds, and even central banks. All other companies will do their best, but in managing assets, BlackRock's ETF will undoubtedly be the winner. Whether this prediction is correct or not, the following strategies will work for any issuer with large ETF trading volume.

This article will discuss the following, and how the internal operation of the ETF will create amazing trading opportunities for those who can trade in both traditional finance and the crypto market: the creation and redemption process of the ETF, spot trading arbitrage and time series analysis of trading, ETF derivatives such as listed options, and the impact of ETF financing trades.

Setting all that aside, let's make some money!

Cash Rules Everything Around Me

Problem solved. Inflows (creation) and outflows (redemption) of funds can only be done in cash. The most concerning aspect of this ETF is that it allows ordinary people to buy the ETF with fiat currency and choose to redeem the ETF in the form of Bitcoin. The purpose of this product is to store fiat currency, not to provide an easy way for retirement accounts to buy Bitcoin.

Creation

To create ETF shares, authorized participants (APs) must send the dollar value of the creation basket (a certain number of ETF shares) to the fund before a specific time each day.

APs are large traditional financial trading firms. Some important institutions in traditional finance have registered as APs for various ETFs. Even companies that once called for a ban on cryptocurrencies, such as the company where JP Morgan's CEO Jamie Dimon is located, will also participate. This surprises me ;)

Example:

The value of each ETF share is 0.001 BTC. The creation basket contains 10,000 shares, and at 4 pm Eastern Time, the value of these bitcoins is $1,000,000. The AP must wire this amount to the fund. The fund will then instruct its counterparty to purchase 10 bitcoins. Once the bitcoins are purchased, the fund will allocate the ETF shares to the AP.

1 basket = 0.001 BTC * 10,000 shares = 10 BTC

10 BTC * 100,000 BTC/USD = $1,000,000

Redemption

To redeem ETF shares, APs must send the shares of the ETF to the fund before 4 pm Eastern Time. The fund will then instruct its counterparty to sell 10 bitcoins. Once the bitcoins are sold, the fund will pay out $1,000,000 to the AP.

1 basket = 0.001 BTC * 10,000 shares = 10 BTC

10 BTC * 100,000 BTC/USD = $1,000,000

For us traders, we want to know where Bitcoin must be traded. Of course, the counterparties helping the fund buy and sell Bitcoin can trade on any exchange they prefer, but to minimize slippage, they must match the fund's net asset value (NAV).

The fund's NAV is based on the BTC/USD price from CF Benchmark at 4 pm Eastern Time. CF Benchmark obtains prices from Bitstamp, Coinbase, itBit, Kraken, Gemini, and LMAX between 3-4 pm Eastern Time. Any trader wishing to perfectly match the NAV and reduce execution risk by trading directly on all these exchanges can do so.

The Bitcoin market is global, and price discovery primarily takes place on Binance (I assume located in Abu Dhabi). CF Benchmark excludes another large Asian exchange, OKX. This will be the first time in a long time that the Bitcoin market has seen predictable and persistent arbitrage opportunities. It is expected that billions of dollars in trading volume will gather within an hour on exchanges with lower liquidity, following the prices of their larger Asian competitors. I anticipate there will be some attractive spot arbitrage opportunities available.

Obviously, if the ETF is hugely successful, price discovery may shift from the East to the West. But don't forget about Hong Kong and its mimicked ETF products. Hong Kong only allows its listed ETFs to trade on regulated exchanges in Hong Kong. Binance and OKX may serve this market, but new exchanges will also emerge.

Regardless of what happens in New York or Hong Kong, neither city will allow fund managers to trade Bitcoin at the best prices; they may only trade on "selected" exchanges. This unnatural competitive state will only lead to lower market efficiency, and we as arbitrageurs can profit from it.

Here's a simple arbitrage example:

Average Daily Volume Days (ADV) = (Exchange CF Benchmark Weight * Daily Closing Market Price (MOC) in USD) / CF Benchmark Exchange USD ADV

Choose the least liquid exchange in the CF Benchmark, i.e., the exchange with the highest ADV days. If there is increased buying pressure, the Bitcoin price on the CF Benchmark exchange will be higher than on Binance. If there is increased selling pressure, the Bitcoin price on the CF Benchmark exchange will be lower than on Binance. Then, sell Bitcoin on the expensive exchange and buy Bitcoin on the cheaper exchange. You can estimate the direction of creation/redemption flow by trading ETFs with their Intraday Net Asset Value (INAV) premium or discount. If the ETF is trading at a premium, there will be a creation flow. Authorized Participants (APs) short the expensive ETF and then create at the cheaper NAV. If the ETF is trading at a discount, there will be a redemption flow. APs buy the ETF at a lower price in the secondary market and redeem at a higher NAV.

To execute this trade in a price-neutral manner, you need to deploy USD and Bitcoin on the CF Benchmark exchange and Binance. However, as a risk-neutral arbitrage trader, your Bitcoin needs to be hedged. To do this, buy Bitcoin with USD and short the Bitcoin/USD perpetual swap contract on BitMEX. Place some Bitcoin collateral on BitMEX, and the rest of the Bitcoin can be spread across relevant exchanges.

ETF Options

To truly get the ETF casino running, we need leveraged derivatives. In the US, the zero-date (0DTE) options market has exploded. One-day expiry options are like lottery tickets, especially when you buy them out of the money (OTM). Now, 0DTE options have become the most traded options instrument in the US. Of course, people love to gamble.

After the ETF has been listed for a while, options will start appearing on US exchanges. Now, the real fun begins.

It's hard to get 100x leverage in TradFi. They don't have a place like BitMEX to solve the problem. But the premiums on short-dated OTM options are very low, which results in high leverage or gearing. To understand why, refresh your theoretical option pricing knowledge by studying the Black-Scholes theory.

Degen traders with brokerage accounts that can trade on US options exchanges will now be able to make highly leveraged bets on the Bitcoin price in a fluid way through these new high-leverage ETF options products. The underlying of these options will be the ETF.

Here's a simple example:

ETF = 0.001 BTC per share

BTC/USD = $100,000 ETF share price = $100

You believe that by the end of the week, the price of Bitcoin will rise by 25%, so you buy a $125 strike call option. The option is out of the money because the current ETF price is 25% lower than the current strike price. The volatility is high, but not extremely high, so the premium is relatively low at $1. You can lose a maximum of $1, and if the option quickly goes into the money (above $125), you can earn more profit through the change in option premium, and if you just bought the option, you can earn a 25% profit by selling the ETF shares yourself. This is a very rough way to explain leverage.

In the US capital markets, these fervent traders are a serious bunch. With these new high-leverage ETF options products, they will cause some chaos in the implied volatility and forward structure of Bitcoin.

Forward Arbitrage

Call option price - Put option price = Long forward contract

As traders buying lottery tickets push up the prices of ETF options, the prices of out-of-the-money options will rise. This provides an opportunity to achieve arbitrage between BTC/USD perpetual contracts (such as those on BitMEX) and ATM forward contracts derived from ETF option prices.

Futures basis = Futures price - Spot price

I expect the trading price of the ETF ATM forward basis to be higher than the BitMEX futures basis. Here's the trading method.

Short the ETF ATM forward by selling ATM call options and buying ATM put options.

Simultaneously buy Bitcoin/USD fixed-term futures contracts on BitMEX with a similar expiration date to the ETF options.

Wait for the prices to converge near the expiration. This won't be a perfect arbitrage because BitMEX and the ETF use different trading prices to construct the spot index price of Bitcoin.

Volatility (Vol) Arbitrage

To a large extent, when you trade options, you are trading volatility. Traders currently trading Bitcoin options on non-US exchanges native to crypto have different preferences in terms of tenor and strike prices compared to traders trading ETF options. I predict that the trading volume of ETF options will dominate the global flow of Bitcoin options. Due to these two groups of traders, i.e., US-based dollar-denominated traders and non-dollar-denominated traders, not being able to interact on the same exchange, arbitrage opportunities will arise.

When options with the same tenor and strike price trade at different prices, there is a direct arbitrage opportunity. Additionally, there will be more general volatility arbitrage opportunities, i.e., certain parts of the ETF options volatility surface in non-US regions will differ significantly from the Bitcoin volatility surface. Discovering and exploiting these opportunities will require more trading experience, but I know there will be plenty of speculators in these markets looking to arbitrage.

MOC (Market on Close) Liquidity

As the ETF will lead to a surge in trading volume of US-listed ETF derivatives, the 4 pm closing price of the CF Benchmark index will become very important. The value of derivatives comes from their underlying assets. With the upcoming billions of dollars in notional amount options and futures expiring every day, matching the closing trade price of the ETF is crucial to ensure Net Asset Value (NAV) consistency.

This will generate statistically significant trading behavior around 4 pm Eastern Time on trading days and other times. Those who are good at handling datasets and have excellent trading bots will make huge profits by arbitraging these market inefficiencies.

ETF Financing (Creation Loans)

Centralized lending platforms such as Blockfi, Celsius, and Genesis are very popular among Bitcoin holders who want to borrow fiat currency using their Bitcoin as collateral. However, the dream of an end-to-end Bitcoin economy has not yet been realized. Devout Bitcoin supporters still need fiat currency to pay for necessities using the not-so-clean fiat currency.

All the centralized lending platforms I just mentioned have collapsed, and many others have as well. It has become more difficult and expensive to borrow fiat currency using Bitcoin as collateral. Traditional finance is very accustomed to using liquid ETFs as collateral for borrowing. Now, it will be possible to obtain large-scale fiat currency loans at competitive rates by pledging Bitcoin ETF shares. For those who believe in financial freedom, the issue is to maintain control of Bitcoin and take advantage of this cheaper capital.

The solution to this problem is to exchange Bitcoin for ETF. Here's how it works.

APs who can borrow in the interbank market will create ETF shares and hedge Bitcoin/USD price risk. This is the creation lending business. In Delta-One terms, it's the repo value of the ETF shares.

Here's the process:

Borrow USD in the interbank market and create ETF shares in cash.

Sell ATM call options on the ETF and buy ATM put options on the ETF to create a synthetic short forward contract.

The creation of ETF units will generate a positive interest rate differential, i.e., forward basis > interbank USD interest rate.

Lend out ETF shares in exchange for Bitcoin collateral.

Let's bring in Chad to discuss how he needs to handle his Bitcoin:

Chad is a holder of 10 Bitcoins, and he needs to pay his AMEX bill in USD for those expensive champagne bottles at the bars. Chad contacted his friend Jerome, a cunning Frenchman working at SocGen, who used to be a major financial back-office alternative due to aggressive futures trading and ended up in jail, but got his job back (you can't fire anyone in France), now in charge of running a crypto trading desk. Chad asked Jerome about an exchange of Bitcoin for ETF for 30 days. Jerome offered a quote of -0.1%. This means Chad will exchange 10 Bitcoins for 10,000 shares of ETF, assuming each share is worth 0.001 Bitcoin. After 30 days, Chad will receive back 9.99 Bitcoins.

Within the 30 days that Chad has 10,000 shares of ETF instead of 10 Bitcoins, he will pledge the ETF shares to his traditional financial stockbroker to obtain very cheap USD loans.

Everyone is happy. Chad can continue to show off at the club without having to sell his Bitcoins. And Jerome earns the financing spread.

ETF financing business will gradually become very important and impact Bitcoin rates. As this market develops, I will focus on attractive ETF, physical Bitcoin, and Bitcoin derivative financing trades.

Your Size is My Size

In order to sustain these trading opportunities for a long time and allow arbitrageurs to execute them at a sufficient scale, the complex structure of Bitcoin spot ETFs must trade shares worth billions of dollars every day. On Friday, January 12th, the total daily trading volume reached $3.1 billion. This is very encouraging, and as various fund managers begin to activate their vast global distribution networks, the trading volume will only increase. There is a way to trade the financial version of Bitcoin within the traditional financial system, and fund managers will be able to escape the dilemma of poor returns offered in the current global inflation environment.

We are in the early stages of a period of sustained global inflation. There is a lot of noise, but over time, managers who run stock-bond correlations will realize that things have changed. With interest rates at or below zero, especially when inflation persists, bonds cease to play a role in investment portfolios. The market will slowly realize this, and the selling off of the over $100 trillion bond market will devastate nations. Then, these managers must look for another asset class that has no substantial correlation with stocks or any traditional financial asset category. Bitcoin has accomplished this task.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。