This article analyzes the data of liquidity staking and L2 in 2023, and looks back and looks forward to the development of Ethereum.

Author: Carol, PANews

In 2023, Ethereum had two main storylines.

The first storyline is related to liquidity staking. In April, Ethereum completed the Shanghai upgrade and officially opened staking withdrawals, entering the "interest rate control" era. Contrary to earlier market concerns, the Ethereum upgrade not only did not cause large-scale selling pressure, but instead attracted more deposits as the coin price rose, making LSD the hottest DeFi track.

The second storyline is related to Layer2 (hereinafter referred to as L2). Arbitrum's airdrop not only continued the "wealth creation myth" once again, but also raised expectations for other L2 airdrops. In addition, with the rise of Base and the upcoming Cancun upgrade, keywords such as modularization, parallel EVM, data availability (DA), and decentralized sequencers are becoming increasingly visible. L2's rapid development, the rapid rise in the prices of representative assets such as OP, make L2 the most anticipated area in 2024.

PANews' data news column PAData analyzed the data of liquidity staking and L2 in 2023, to review and look forward to the development of Ethereum:

- From the Shanghai upgrade to the end of the year, the total amount of Ethereum deposits was approximately 17.3061 million ETH, and the total amount of redemptions was approximately 8.1135 million ETH. The cumulative staking total increased by 10.8242 million ETH, with a growth rate of about 60%, but the staking growth rate rapidly declined. This means that people are no longer as enthusiastic about staking deposits as they used to be.

- Will Ethereum's staking deposits squeeze other DeFi activities? The correlation analysis results show that in the short term, when the price clearly declines, more funds flow from DeFi to staking deposits, indicating a "siphoning" effect of Ethereum staking activity. When the price clearly rises, funds flow out of both staking and DeFi activities, and there is no reverse "siphoning" effect.

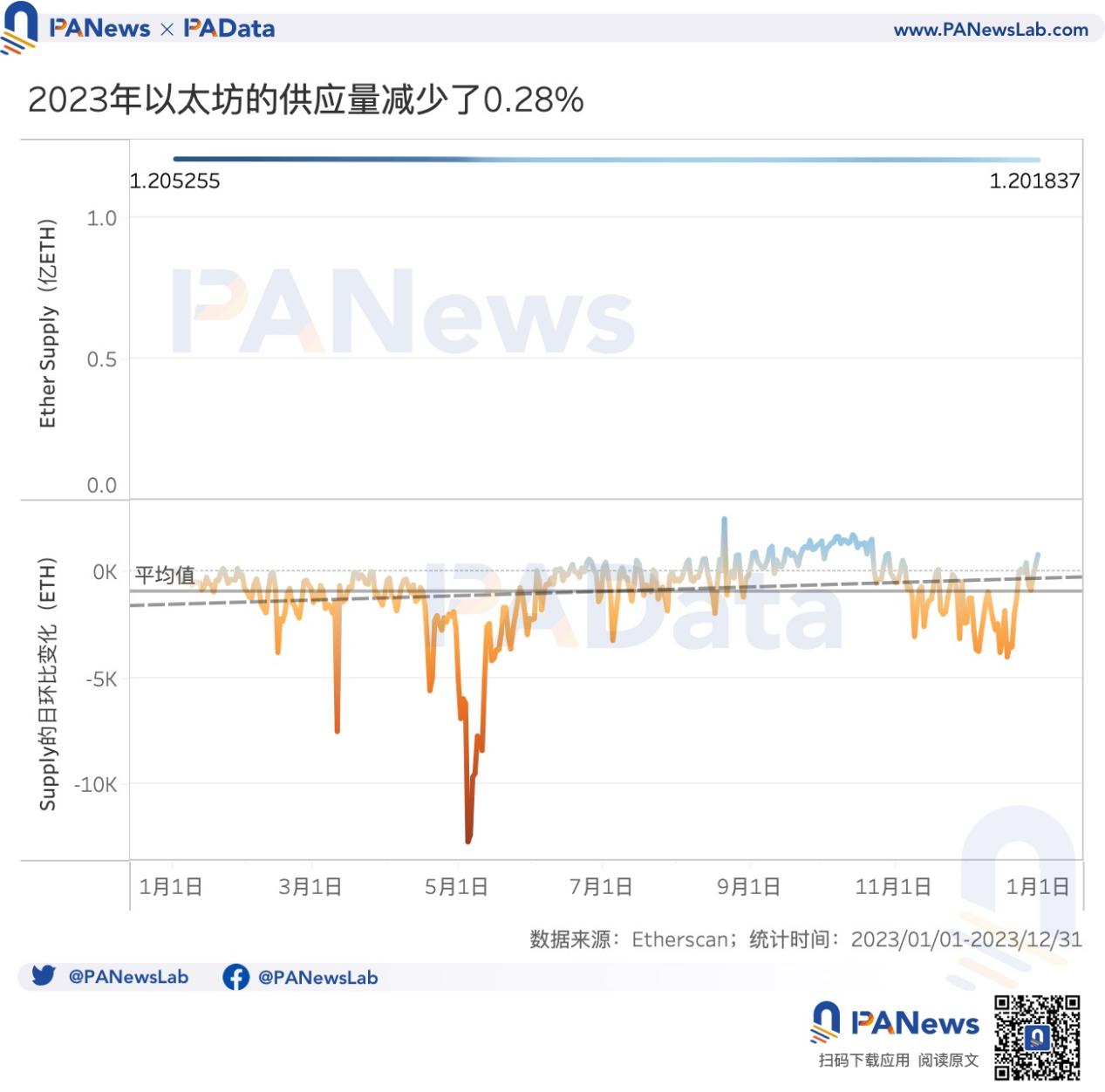

- In 2023, the total amount of fees burned by Ethereum amounted to approximately 1.0935 million ETH. The supply decreased by about 341.8 thousand ETH, a decrease of about 0.28%. ETH overall achieved a slight deflation, but the magnitude and trend of deflation are not significant.

- Looking at the basic situation of 34 L2s, 11 of them adopted Optimistic Rollup and ZK Rollup. Most of them are still in the early stages of technology, with 17 of them only achieving the functionality of STAGE 0. This includes popular ones such as OP Mainnet, Base, zkSync Era, and Starknet.

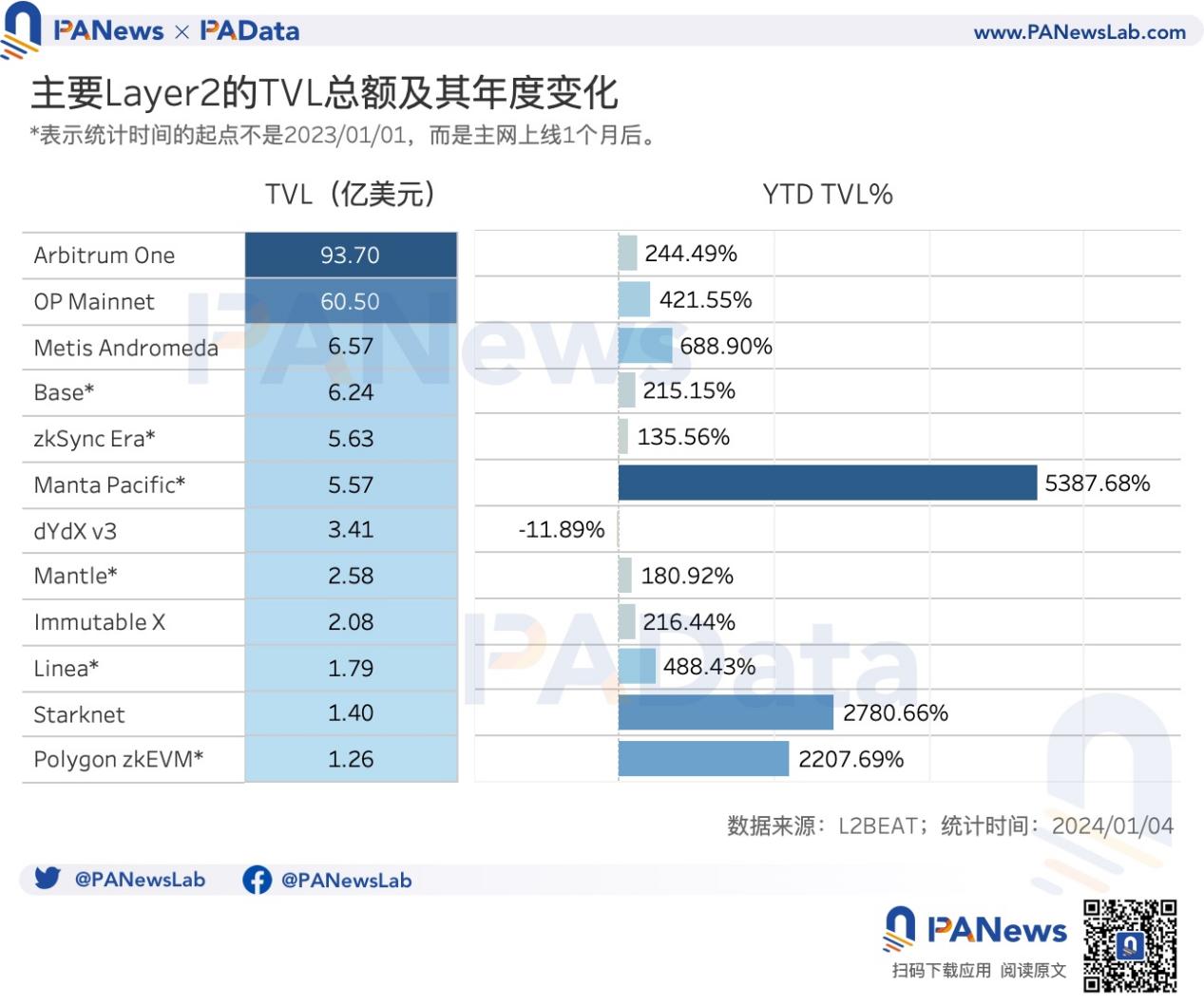

- The L2 with the highest TVL is Arbitrum One, reaching 9.37 billion USD, followed by OP Mainnet, reaching 6.05 billion USD. Those with a high TVL increase during the year include Manta Pacific, Starknet, and Polygon zk EVM.

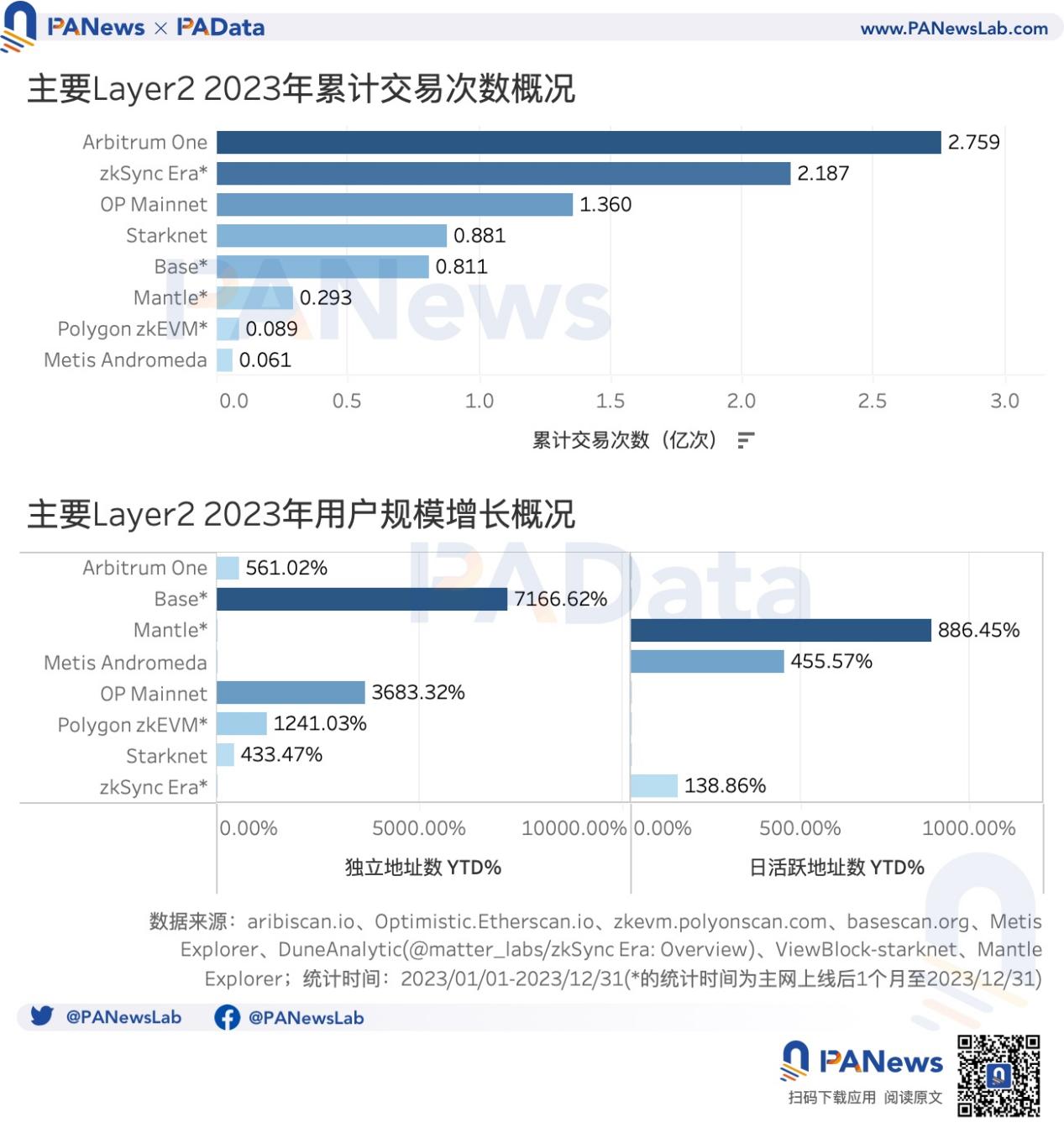

- Arbitrum One had the highest number of total transactions in 2023, exceeding 275 million times. Next is zkSync Era, exceeding 218 million times. Both of them briefly exceeded Ethereum's TPS at the end of the year.

- The number of independent addresses and daily active addresses of L2 in 2023 increased significantly. The L2 with the highest increase in independent addresses is Base, with an increase of over 7166%. The L2 with the highest increase in daily active addresses is Mantle, with an increase of over 886%.

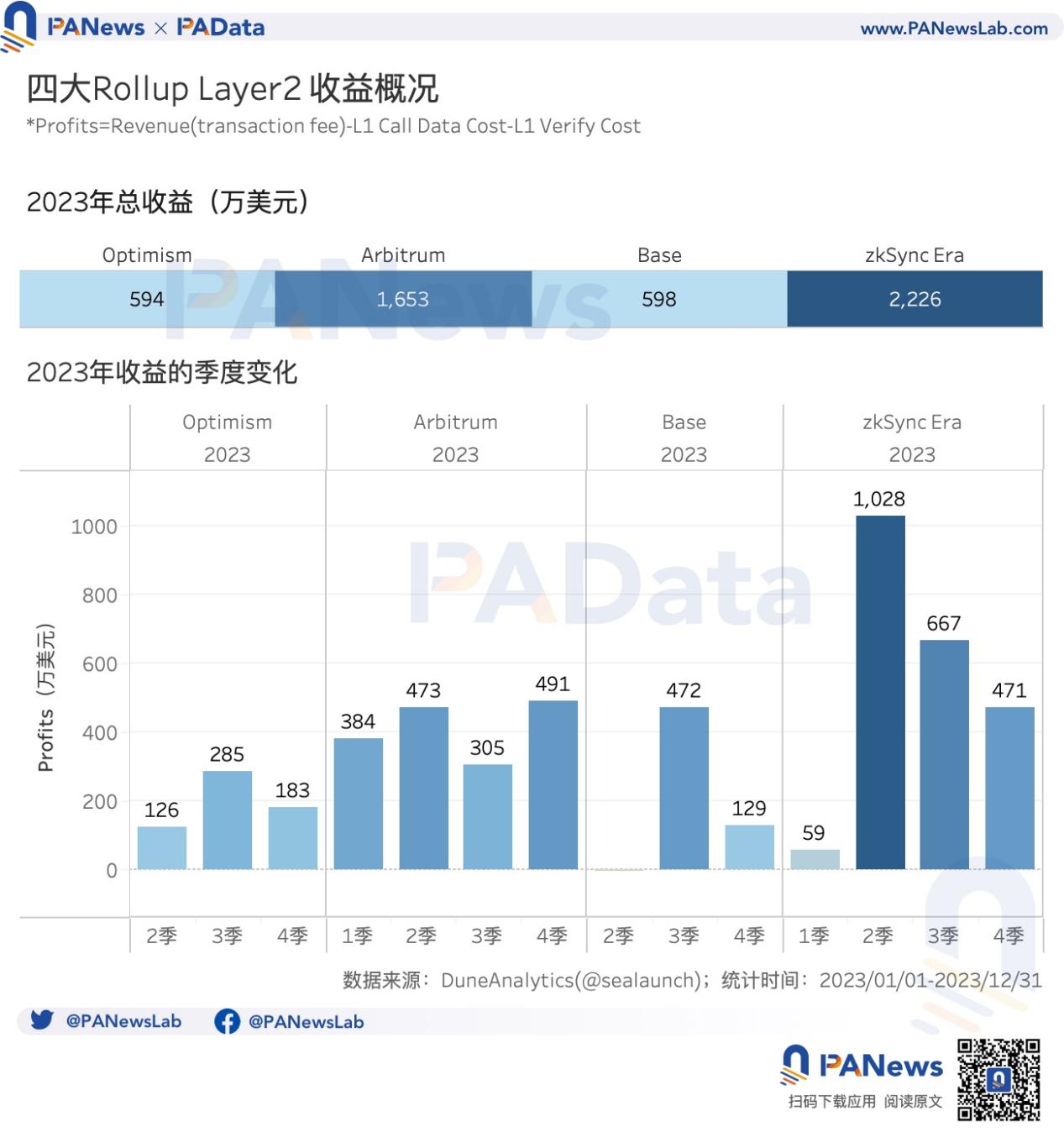

- Among the 4 major Rollup-type L2s, zkSync Era had the highest annual revenue, reaching 22.26 million USD, followed by Arbitrum, reaching 16.53 million USD. Base and Optimism were both below 6 million USD.

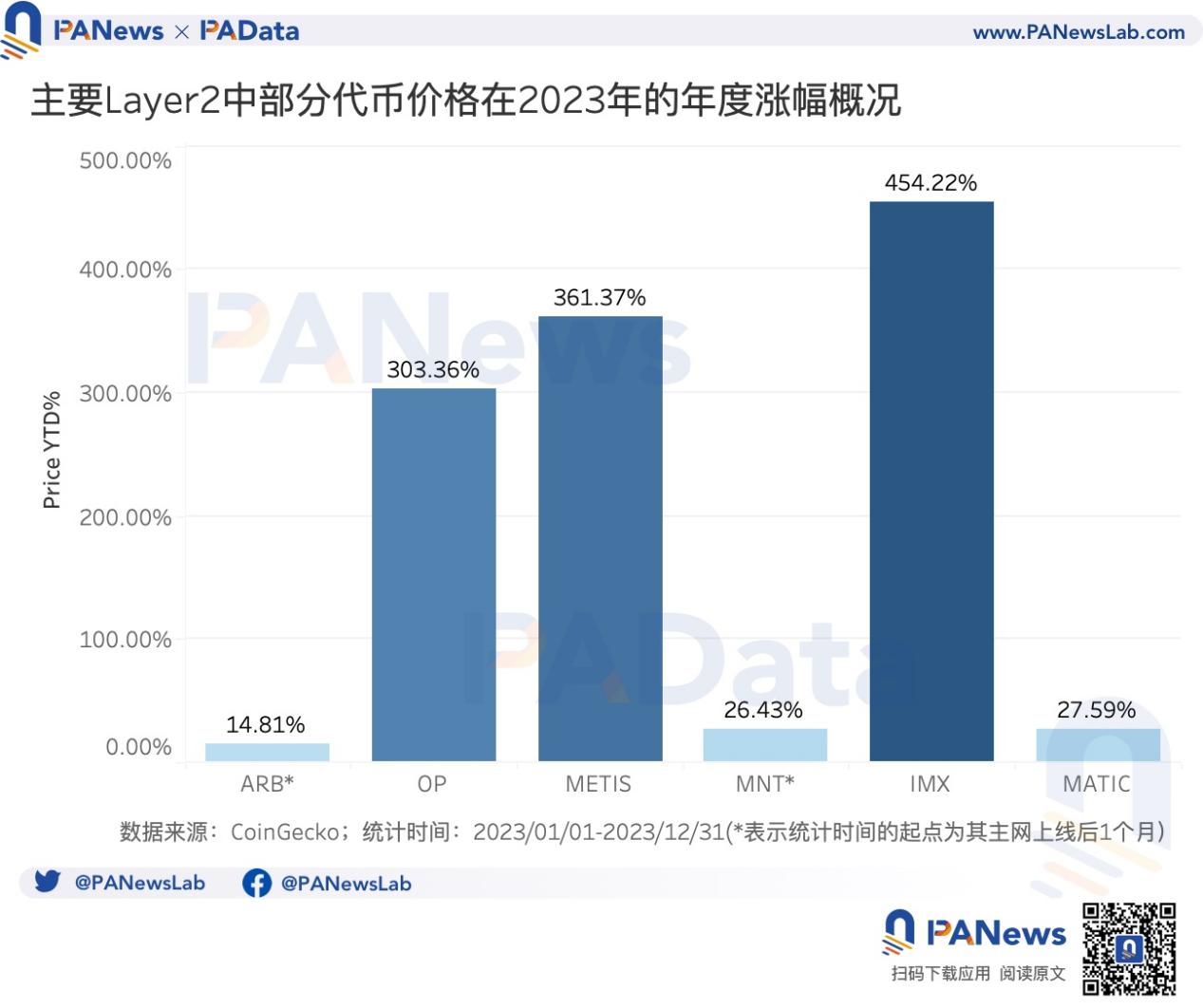

- The highest price increase in 2023 was IMX, with an increase of over 454%, followed by METIS and OP, both with an increase of over 300%. The price of ARB performed flat, with only a 14.81% increase throughout the year.

01. After the Shanghai upgrade, the total staking amount increased by nearly 60%, but the growth rate declined, and the total burned amount exceeded 1.09 million ETH to achieve deflation

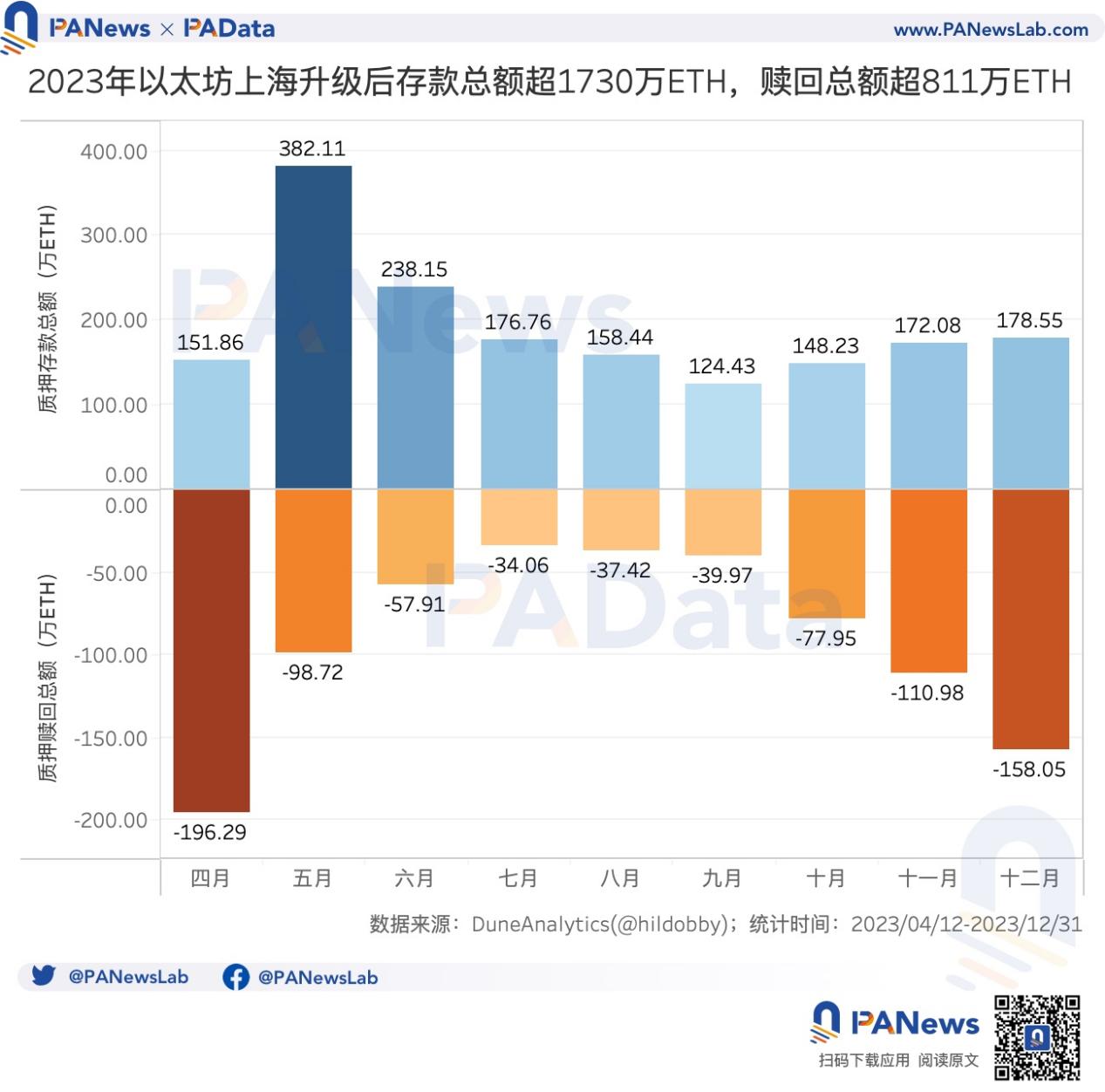

From the successful completion of the Shanghai upgrade on April 12th to the end of the year, the total deposit amount of Ethereum was approximately 17.3061 million ETH, and the redemption amount (including Principal and Rewards redemption) was approximately 8.1135 million ETH. The redemption amount showed a inverted "U" shape, with higher amounts in April and December, exceeding 1.96 million ETH and 1.58 million ETH, respectively. The total deposit amount remained relatively stable, with the exception of attracting 3.82 million ETH in May, the total deposit amount for each month was approximately 1.68 million ETH.

After the Shanghai upgrade, the cumulative staking total increased from 18.1659 million ETH to 28.9901 million ETH, with an increase of 10.8242 million ETH, a growth rate of about 60%.

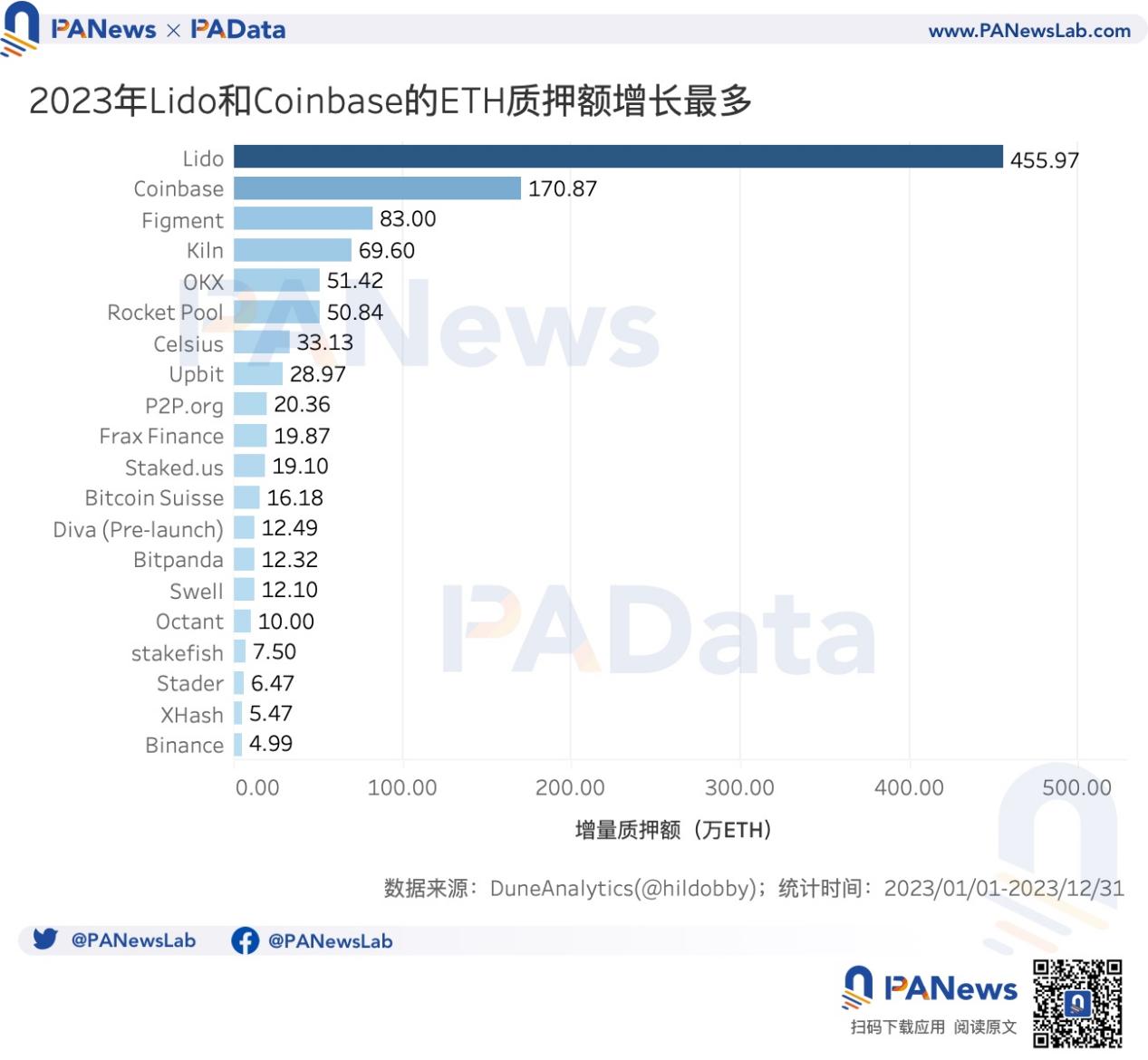

Looking at the staking entities, Lido and Coinbase were the two entities with the largest increase in staking total in 2023, increasing by 4.5597 million ETH and 1.7087 million ETH, respectively, while the increase of other entities was less than a million ETH. Among them, Figment, Kiln, OKX, and Rocket Pool's staking total increased by over 500,000 ETH, showing significant growth.

However, looking at the data for the whole year, the growth rate of Ethereum's staking total is rapidly declining. In May, the average daily chain-on-chain growth rate of the cumulative staking total reached its peak at 0.48%, but it has been declining month by month, and by December, it had dropped to 0.03%, showing a clear downward trend. This means that people are no longer as enthusiastic about staking deposits as they used to be.

According to DuneAnalytics data, although Ethereum's staking interest rate has dropped from 4.18% at the beginning of the year to 3.09% at the end of the year, this is still a stable financial income. There has always been a belief that Ethereum's high staking interest rate may attract more deposits, thereby squeezing other on-chain activities and affecting the long-term development of the Ethereum ecosystem. So, does this assumption hold true based on the data performance?

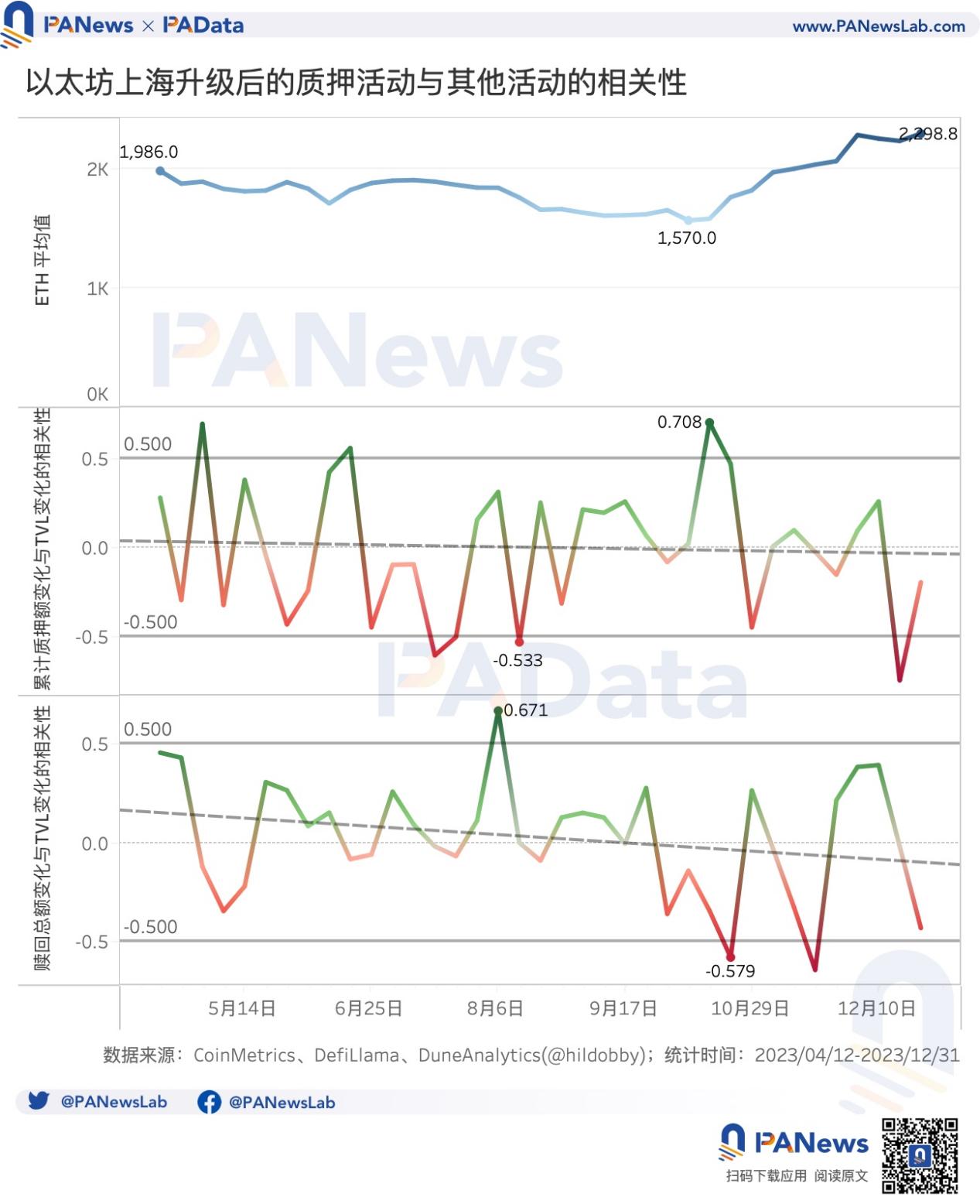

PAData has statistically analyzed the day-on-day changes in the cumulative staking total and TVL, as well as the day-on-day changes in the redemption total and TVL after the Shanghai upgrade. Here, TVL is priced in ETH, and according to DefiLlama's definition, TVL does not include the lock-up amount of liquidity staking protocols.

If the day-on-day change in the cumulative staking total is negatively correlated with the day-on-day change in TVL (≤-0.5), or the day-on-day change in the redemption total is positively correlated with the day-on-day change in TVL (≥0.5), that is, when a higher day-on-day growth rate of the staking total coincides with a lower day-on-day growth rate of TVL, or a higher day-on-day growth rate of the redemption total coincides with a higher day-on-day growth rate of TVL, it can be considered that there is a "siphoning effect" in Ethereum's staking activity, and vice versa.

The correlation analysis results show that overall, it cannot be proven that there is a "siphoning effect" in Ethereum's staking activity.

However, when the time period is shortened to a weekly basis, it is possible that there is a "siphoning effect" in Ethereum's staking activity during certain time periods. For example, in mid-August (around August 6th to August 19th), the correlation coefficient between the day-on-day change in redemption total and the day-on-day change in TVL was 0.671, and the correlation coefficient between the day-on-day change in cumulative staking total and the day-on-day change in TVL was -0.533, when the weekly average price of ETH dropped from $1844 to $1659. This indicates that when the price clearly declines, more funds flow from DeFi to staking deposits, suggesting a "siphoning" effect in Ethereum's staking activity.

Another typical time period occurred in late October (around October 15th to October 28th), where the correlation coefficient between the day-on-day change in cumulative staking total and the day-on-day change in TVL was 0.708, and the correlation coefficient between the day-on-day change in redemption total and the day-on-day change in TVL was -0.579, when the weekly average price of ETH rose from $1583 to $1765. This indicates that when the price clearly rises, funds flow out of both staking and DeFi activities, and there is no reverse "siphoning" effect.

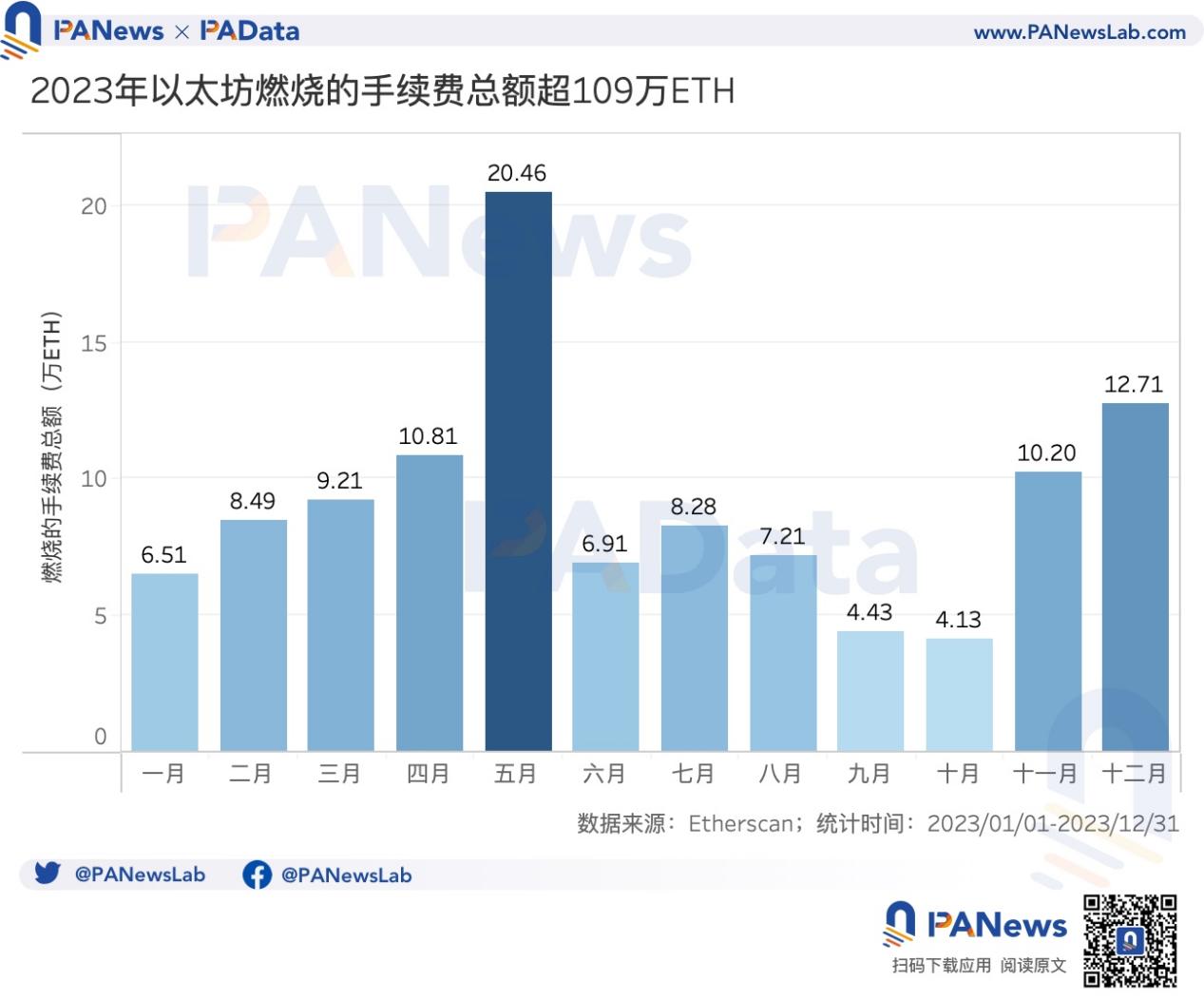

One of the important pre-reform changes of the Shanghai upgrade is the implementation of EIP1559, which made it possible for Ethereum to achieve deflation. In 2023, the total amount of fees burned by Ethereum amounted to approximately 1.0935 million ETH. Among them, 20.46 thousand ETH was burned in May, the highest monthly burn of the year, and 4.13 thousand ETH was burned in October, the lowest monthly burn of the year. At the end of the year, the burn amount rose again to over 100 thousand ETH.

In this context, the supply of ETH in 2023 decreased from 120.53 million ETH to 120.18 million ETH, a decrease of about 341.8 thousand ETH, or about 0.28%. In other words, ETH achieved a slight deflation overall in 2023.

Looking at the day-on-day changes, the average daily decrease in supply in 2023 was 939 ETH. In terms of trends, the magnitude of the day-on-day change in supply is decreasing. This means that the trend of deflation is very weak and not significant.

02. 12 L2s had an average TVL growth of over 333% throughout the year, and zkSync Era had a total revenue of 22.26 million USD

2023 was a year of rapid development in the L2 field, with OP Stack "staking a claim" to most of the market and various new technological trends such as modular development, parallel EVM, decentralized sequencers, and third-party DA solutions emerging. The blueprint seems to be emerging, so what is the actual development situation of L2?

Looking at the basic situation of the 34 L2s as per L2BEAT statistics, 11 of them adopted Optimistic Rollup and ZK Rollup, with an equal number of both. Additionally, 8 adopted Validium, and 4 adopted Optimium. The main difference in different technological architectures lies in the combination of different data availability (DA) and proof systems.

Most of these L2s are general-purpose, with only a few dedicated to exchanges or NFTs, such as dYdX v3 and Immutable X.

Most of these L2s are still in the early stages of technology. 17 L2s are in STAGE 0, including popular ones like OP Mainnet, Base, zkSync Era, and Starknet. Only 3 L2s have reached STAGE 1, including Arbitrum One, dYdX v3, and zkSync Lite.

From a technical perspective, the main difference between STAGE 1 and STAGE 0 is that STAGE 1 has achieved state submission to L1 and partially implemented proof systems, including the ability for users to exit based on a certain review process, and the ability to exit within 7 days after an unnecessary upgrade by participants more centralized than the Security Council.

In addition, 2 L2s have reached the higher STAGE 2, with the main technical difference from STAGE 1 being the further improvement of the proof system, including fraud proof submission only open to whitelisted participants, and providing less than 30 days for exit unrelated to provable vulnerabilities on-chain, and the actions of the Security Council are not limited to provable vulnerabilities on-chain.

Currently, the L2 with the highest TVL (the total value locked in Ethereum custody contracts, which may include externally bridged and locally created assets) is Arbitrum One, reaching 9.37 billion USD, followed by OP Mainnet, reaching 6.05 billion USD. Apart from these two, the TVL of other L2s does not exceed 700 million USD. The market share of L2 is mainly shared by Arbitrum One and OP Mainnet.

However, in 2023, many "new faces" appeared in the L2 market outside of the top two. Among the top 12 L2s with the highest TVL, 6 of them were launched in 2023, accounting for half of the total. These new L2s gained momentum and achieved high TVL growth during the year, such as Manta Pacific with a TVL growth of over 5387%, and Starknet and Polygon zk EVM with TVL growth of over 2000%.

Other L2s with high TVL growth include Metis Andromeda and Linea, with growth rates exceeding 688% and 488% respectively. In addition, L2s that went live earlier, such as Arbitrum One, OP Mainnet, and Immutable X, also achieved over 200% TVL growth.

Due to data availability, the analysis of on-chain data for the following will be limited to L2s with relatively high TVL. In terms of transaction volume, Arbitrum One had the highest total transaction volume in 2023, exceeding 275 million times. Next was zkSync Era, exceeding 218 million times. OP Mainnet also exceeded 136 million times, while the total transaction volume of other L2s within the scope of the statistics was less than 100 million times, and some were even less than 10 million times.

It is worth noting that influenced by the craze for inscriptions, Arbitrum One and zkSync Era's TPS surpassed Ethereum at the end of the year, withstanding the test of high-frequency interactions.

From the perspective of user scale, all L2s within the scope of the statistics achieved significant growth in 2023. The independent address with the highest annual growth rate is Base, with a growth of over 7166%, followed by OP Mainnet, with a growth of over 3683%. The L2 with the highest annual growth rate in daily active addresses is Mantle, with a growth of over 886%, followed by Metis Andromeda, with a growth of over 455%. Overall, this means that not only more people are starting to use L2, but they are also using it more frequently.

Despite the bright prospects for L2 development, at present, its capital and user scale are still relatively limited, which is reflected in the fact that L2's revenue is not high. After analyzing the revenue of the 4 main Rollup-type L2s, it was found that zkSync Era had the highest annual revenue, reaching 22.26 million USD, followed by Arbitrum, reaching 16.53 million USD. Base and Optimism both had revenue of less than 6 million USD.

Furthermore, L2's revenue does not synchronize with its transaction volume, as an increase in transaction volume usually means an increase in costs in terms of DA. For example, zkSync Era's high revenue mainly came from the second quarter, not the fourth quarter of the inscription craze. Balancing fee income and DA costs may become an important issue for the future development of L2.

If the rapid development of L2 is reflected in the price performance, there are still some differentiation and misalignment. Among the high TVL L2s, there are still not many issued tokens. Among them, the token with the highest price increase in 2023 was IMX, with an increase of over 454%, followed by METIS and OP, both with an increase of over 300%. However, despite ARB's impressive performance in other data, its price performance was mediocre, with only a 14.81% increase for the whole year, even lower than MNT and MATIC.

In 2024, more L2 projects may issue tokens, and how to balance fee income and DA costs, as well as providing value support for tokens, will continue to be important issues that L2 needs to address in the future.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。