原文标题:The Genesis Story : How Crypto Found Me

原文作者:@hmalviya9

原文编译:zhouzhou,BlockBeats

编者按:当前 RWA 永续产品(如 Ostium)虽然使用量激增,但 GLP 式流动性模式不可持续,因资金费率高、交易者与 LP 零和博弈、缺乏对冲机制,限制了平台扩展。相比之下,HyperLiquid 采用更灵活的 HLP 模式表现更优。未来,Ostium 若转向订单簿模式,降低费用并提升市场效率,才有可能实现长期健康发展。

以下为原文内容(为便于阅读理解,原内容有所整编):

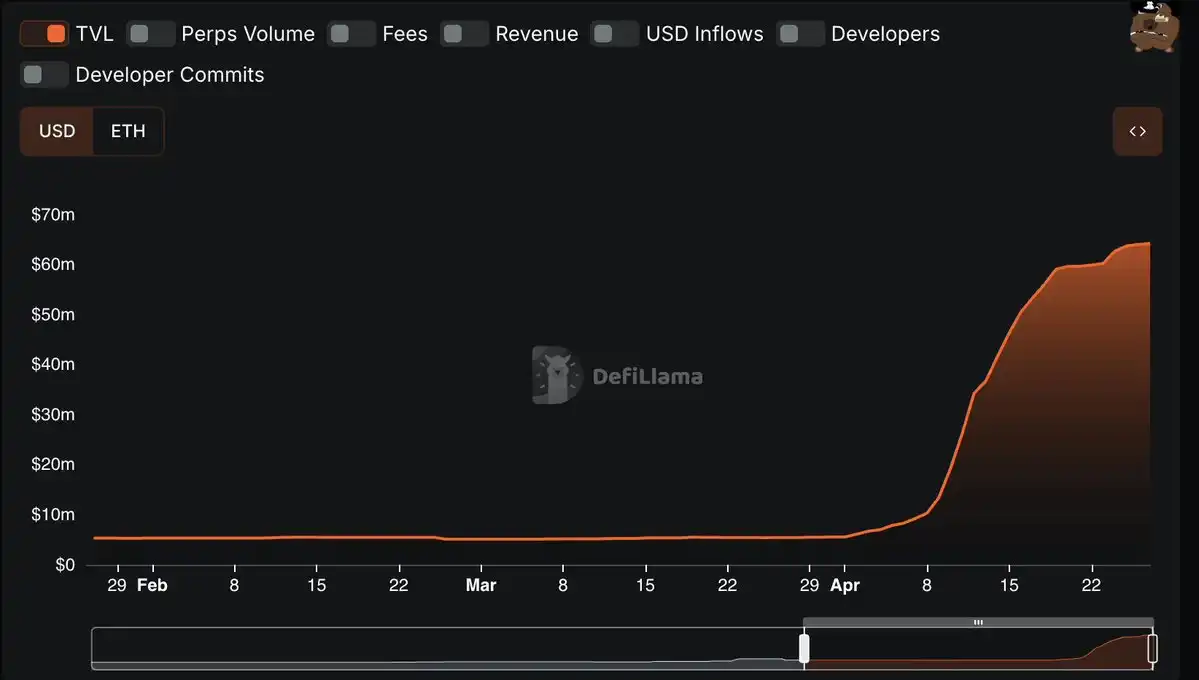

过去一个月,随着关税危机临近、货币市场震荡、股市像心电图一样波动,RWA 永续合约的使用量出现了惊人的增长。@OstiumLabs 的总存款量从原本稳定的不到 600 万美元,在短短一个月内飙升到了超过 6000 万美元。交易量也大幅上升。HyperLiquid 也上线了 @Paxos 的 PAXG 永续合约市场。

对于用加密衍生品做多或做空 RWA 的需求已经非常明显了。问题在于,目前的解决方案到底够不够好?如果不够,又该如何改进?

为什么说这些解决方案可能并不好?

在开头部分,我提到了两个看似矛盾的观点:一方面,交易者确实在使用 RWA 产品;另一方面,我又质疑现有解决方案是否足够好。

有人可能会想,既然用户正在选择这些平台,难道不说明目前的 RWA 永续合约已经足够好吗?但事实并非如此,让我通过一些数据来解释一下。

如果我们看看 Ostium 上的资金费率,可以发现黄金交易对(XAU/USD)的资金费率曾高达 30%,现在也还有 13%。

相比之下,目前 Bybit 上 BTC 的资金费率大约是 Ostium 的一半,而 Binance 和 OKX 上的 BTC 资金费率只有 Ostium 的四分之一左右。有人可能会认为,这是因为黄金表现更好,但其实未必。

黄金今年迄今上涨了大约 50%,而比特币涨幅也差不多。

而且,当我们把加密市场和传统金融市场(比如 CME)做比较时,差距就更明显了。如果你在 CME 做多黄金,并且滚动持仓,年化成本大约是 6%,只有 Ostium 最低资金费率的一半,相差 600 个基点。

看到这么大的价差,做 delta neutral(无方向性风险)交易的读者可能会觉得有巨大套利空间:比如在 Ostium 做空,收取 13% 的资金费率,同时在 CME 做多,付出 6% 的年化成本。但实际上并不是这样。

因为 Ostium 采用类似 GLP(GMX 的流动性池)模式,目前如果你在 Ostium 做空,反而要支付 13% 的资金费率。

这就导致无论是 delta neutral 交易者还是做市商,都没有动力来提供流动性。而这并非偶然,而是 Ostium 设计上的一个根本性问题。

GLP 模式的不可持续性

Ostium 和 @GainsNetwork_io 使用的 GLP 模式,简单来说,是无法规模化发展的。

GLP 模式本质上是所有交易者都在和协议的资金池对赌。最早由 GMX 推出,他们的资金池叫 GLP。到了 Ostium,叫 OLP;在 Gains 上则是各种 g(asset) 金库。

需要特别注意的是,GLP/OLP 模式和 @HyperliquidX 的 HLP 模式其实非常不同。HLP 的定价模型是隐藏且动态变化的,而 GLP 的定价是固定且静态的。

这意味着,虽然 HyperLiquid 也有基础流动性提供者,但基础 LP 不是唯一的对手方,资金费率机制还能继续激励市场走向更高效。而在 Ostium 的 OLP 模式下,交易者必须亏损,OLP 的流动性提供者才能赚钱。这就是一个彻头彻尾的零和博弈。

而且不同于 HLP 模式可以在链上部分对冲敞口,OLP 模式下没有稳定机制去对冲 RWA 的风险暴露。

虽然 OLP 模式帮助 Ostium 在早期快速拉起了流动性,但现在反而成了他们继续增长的障碍。就像 HyperLiquid 最后也不得不放开 HLP 对用户交易的绝对对手方控制一样,Ostium 未来也需要松绑 OLP 对定价的主导权,才能实现更大的扩展。

一个警示案例已经出现:在黄金市场的相对份额上,目前 Ostium 在黄金市场的持仓量只有 400 万美元,而 HyperLiquid 新开的 PAXG 市场持仓量已经达到 1500 万美元(而且资金费率和开仓成本也更低)。

此外,Ostium 目前的总锁仓量是 6500 万美元,其中 5700 万美元,也就是 86% 的资金,都集中在 OLP 里。而 HyperLiquid 虽然也高,但占比大约是 60% 左右,相比之下要更健康一些。

总结一句话,这种模式是不可持续的。

未来的可能方向

虽然上述问题如果放任不管会很严重,但理论上它们都可以通过改变模式来解决。

如果 Ostium 能转向订单簿模式,就能降低手续费,资金费率也会因为市场效率提高而下降,同时平台依然可以靠收取交易费用盈利。

OLP 也可以继续存在,但应该以更加动态灵活的形式运作。

在我个人看来,作为一个热爱 RWA 永续概念的人,这才是 RWA 永续产品唯一可持续的长期模式,不仅是对 Ostium,对 Gains,以及所有相关项目都是如此。

GLP/"赌场式"模式只能用于冷启动阶段,长期发展是不现实的,这已经被多次验证了。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。