Author: Vijay Boyapati (@real_vijay)

Translation: czgsws, 0x711, BlockBeats

As early as June 2022, after the collapse of SanJian Capital, there were rumors that DCG was also "unable to hold on." In January of this year, Genesis could no longer hold on in the aftermath of the FTX collapse and officially submitted its 11th chapter bankruptcy application. SanJian Capital founder Zhu Su had previously revealed DCG's fraudulent behavior, feeling unjustly blamed as a "scapegoat."

In August of this year, Bloomberg reported that the New York Attorney General's Office, the SEC, and other regulatory agencies are investigating Genesis and its parent company DCG. In September, it was again revealed that "federal investigators are conducting a thorough investigation into DCG and its subsidiary Genesis" in the news. However, to this day, there is still no definitive conclusion on what DCG and its CEO Barry Silbert have done and whether they should face legal judgment.

On November 6, crypto KOL Vijay Boyapati (@real_vijay) accused DCG and its CEO Barry Silbert of fraudulent behavior on social media, calling it "a more important fraud case in 2022 than the SBF corruption case." So, whether the Bitcoin trust created by DCG is a Noah's Ark or a fraudulent scheme, Vijay, from his perspective, peels back the layers and analyzes the company.

BlockBeats has compiled and translated the original text as follows:

To fully understand DCG's fraudulent behavior and its impact, we must go back to 2013, when Barry Silbert founded Grayscale, which provided the first trust that allowed investors to purchase Bitcoin from their brokerage accounts. For many years, GBTC was the only way for stock market capital to gain exposure to Bitcoin, and due to its trust structure (lacking a redemption mechanism similar to an ETF), GBTC's trading price always remained higher than its NAV (net asset value) in its early trading history. This means that the fund's value in the market was higher than its actual underlying assets (Bitcoin). Stock investors had little choice but to pay a premium for GBTC just to gain exposure to Bitcoin.

GBTC shares were created by paying Bitcoin to Grayscale, and six months later, users could receive equivalent GBTC shares. The existence of a premium for GBTC (which at one point exceeded 40%) made arbitrage trading possible and increasingly profitable. Investors could engage in arbitrage trading by shorting a certain amount (let's say x) of Bitcoin while providing an equivalent amount of Bitcoin to Grayscale. Six months later, arbitrageurs could close their positions by selling GBTC (trading at a higher price than x Bitcoin) and earn the premium. This is a common GBTC premium arbitrage trading strategy.

Some market participants realized that this trading was "very promising" and seemingly risk-free (because the premium for GBTC always existed), and began to pour in large numbers. Two of these participants were hedge fund SanJian Capital and lending platform BlockFi (both of which are now bankrupt). SanJian Capital not only earned the GBTC premium but also engaged in arbitrage trading with leverage. They borrowed a large amount of Bitcoin to increase their returns. But who did they borrow from? Genesis.

Like Grayscale, Genesis is also a subsidiary of DCG. This corporate structure was intentionally modeled by Barry Silbert after Berkshire Hathaway's corporate structure and applied to the crypto market. Genesis is the largest, most important, and essentially the primary brokerage service provider in the cryptocurrency market. It has both a trading/derivatives department (GGT) and a lending department (GGC), but to outsiders, it is just one entity, as the two departments share office space and even employees.

Genesis obtains Bitcoin from holders (regardless of size) by offering Bitcoin deposit rates, then lends out these Bitcoin at higher rates and profits from the interest spread. Who does Genesis lend to? SanJian, BlockFi, Alameda, and others.

At this point, it should be noted that DCG directly controls GGT (Silbert served as its chairman from 2013 to July 2022) and controls GGC through GGT. GGC did not establish a board of directors until June 2022, when a board was appointed, two-thirds of whose members were from DCG.

DCG has a huge incentive to encourage Genesis to issue Bitcoin loans for GBTC arbitrage trading, as this Bitcoin will flow into Grayscale (another gem in DCG's crown), and then the liquidity will be trapped in Grayscale (because there is no ETF redemption mechanism). Grayscale uses these "locked" Bitcoin to charge a high 2% fee annually for "fund management" (in other words, doing nothing). Currently, GBTC holds over 620,000 Bitcoins, which means Grayscale will collect over 12,000 Bitcoins annually as management fees.

The profits from Grayscale flow to its parent company DCG. At this point, you will find that there are some important conflicts of interest between DCG, Grayscale, and Genesis. In fact, Grayscale even knew about the loans provided by Genesis to drive funds into GBTC. Documents show that the CEO of Grayscale signed off on the loan provided by Genesis to SanJian Capital. It is clear that Barry Silbert's idea of these family businesses operating with "a certain distance" is laughable.

As time passed, new methods for gaining exposure to Bitcoin in the stock market emerged (such as Microstrategy's stock, futures ETFs, and foreign spot ETFs). New competition, coupled with a large number of GBTC shares generated by arbitrage trading, began to erode the premium for GBTC.

On February 23, 2021, the GBTC premium turned negative for the first time (i.e., it became a discount). Since then, it has never returned to a positive premium, and the discount has reached as high as 49%—meaning that the fund was only worth half of its underlying asset value. The arbitrage trading was over.

With the end of GBTC premium arbitrage trading, SanJian Capital lost its most reliable and profitable way of making money. Then, it turned to another highly risky trade: TerraUSD arbitrage trading. At the same time, Genesis continued to provide them with loans.

On May 7, 2022, the Terra Luna ecosystem began to collapse, and the LUNA and UST tokens basically went to zero within a few days. Given its leverage, the collapse of LUNA&UST became the final straw that broke SanJian Capital, leaving it heavily indebted.

SanJian's bankruptcy created a huge loophole for the companies that provided it with loans, the largest of which was Genesis, which had provided $2.3 billion in loans to SanJian. While such risks can be managed through proper risk management and the use of collateral, Genesis's risk management was very poor.

In mid-June 2022, SanJian defaulted on the Bitcoin loans provided by Genesis. After liquidating the very small amount of collateral it owned, Genesis was left with a $1.2 billion shortfall on its balance sheet, and now it was also heavily indebted.

At this point, if the lenders of Bitcoin to Genesis tried to withdraw their Bitcoin, Genesis would be unable to fulfill its obligations. At this point, Genesis CEO Michael Moro announced that bankruptcy was the correct course of action.

But Michael Moro did not announce bankruptcy, instead, he and his parent company CEO Barry Silbert devised a plan to cover up the losses on Genesis's balance sheet. By doing so, they were able to alleviate the concerns of Genesis's lenders and minimize withdrawal behavior.

In exchange for Genesis's bankruptcy claim against SanJian Capital (which was almost worthless due to 3AC's complete collapse), DCG would provide Genesis with an $11 billion "note." Michael Moro assured the market that they had "carefully mitigated the losses."

In fact, this note was a complete scam. Barry Silbert did not inject actual capital to fill the gap on Genesis's balance sheet, but provided a note with a below-market interest rate and a ten-year lock-up period.

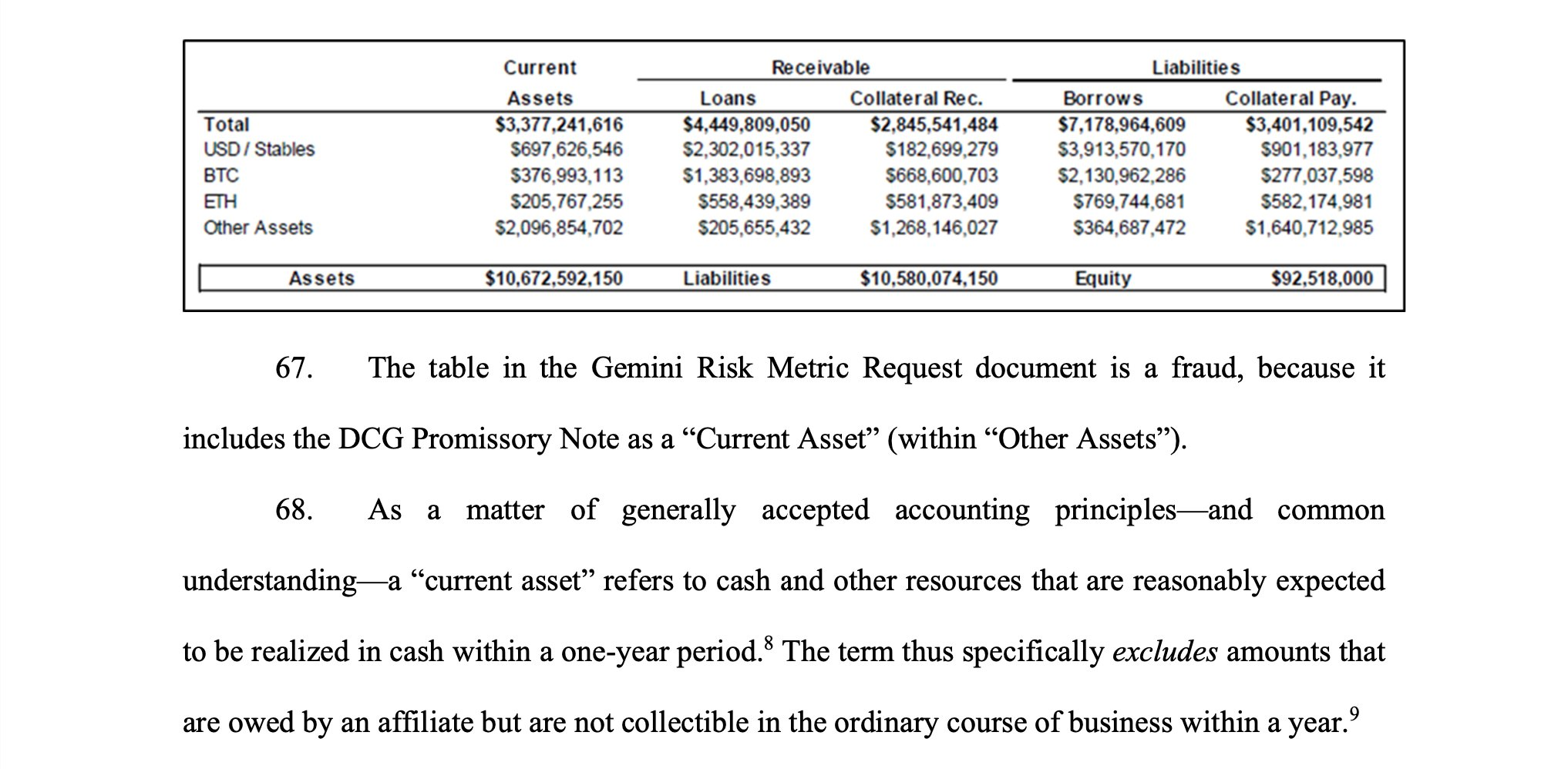

It is clear that Barry Silbert knew that this note could not solve Genesis's bankruptcy problem, as in the subsequent bankruptcy of Genesis, he valued the same note at only a small fraction of the $11 billion claimed by Genesis. The loophole in the balance sheet still existed. After implementing this financial fraud, Genesis's executives went all out to convince clients of their solvency, falsely claiming that the note received was a liquid asset (equivalent to cash).

This raises the question, "Why did DCG intervene?" When they could have let Genesis go bankrupt, why take the risk of engaging in criminal fraud? The answer is:

DCG is one of Genesis's largest borrowers, treating the investment company Genesis as its piggy bank.

In fact, just after the collapse of SanJian caused a loophole in Genesis's balance sheet, DCG borrowed a huge loan of 18,697 Bitcoins from the bankrupt Genesis on June 18. DCG was also running GBTC arbitrage trading, but is now trapped by piles of underwater GBTC.

If DCG let Genesis go bankrupt, it would also be forced into bankruptcy proceedings and be required to repay the huge loan it received from its subsidiary. Instead, Barry Silbert and DCG chose to "pretend to be ignorant and linger on."

The bankruptcy issue of Genesis was finally exposed in November 2022, when FTX collapsed and clients in the field began to withdraw Bitcoin. Genesis was unable to meet client withdrawal requests and froze withdrawals on November 16, 2022.

At the time, DCG/Genesis argued that it was the collapse of FTX and the resulting market turmoil that "temporarily" froze its client funds. In fact, Genesis has been insolvent since June of that year (the collapse of SanJian).

Even after freezing withdrawals, Genesis claimed that it was not insolvent, just facing a "duration mismatch" issue. In other words, it had enough funds to meet withdrawal requests, but they were not immediately available. This was deeply misleading.

On January 19, 2023, Genesis was forced to declare bankruptcy and slowly began to reveal the severity of its fraudulent behavior to creditors. Creditors painfully realized that DCG had never truly addressed Genesis's bankruptcy issue.

On October 19, 2023, the New York Attorney General filed a civil lawsuit against Genesis, DCG, and Barry Silbert and Michael Moro personally. The complaint is detailed and substantive, accusing them of a large-scale conspiracy to defraud hundreds of thousands of investors.

While the NYAG's lawsuit against Silbert and others is a civil case, the Southern or Eastern District of New York is likely to consider this a criminal case. Many ordinary investors have lost their life savings, and DCG/Genesis has become the core of the 2022 market collapse.

The Genesis collapse has many astonishing similarities to the FTX fraud:

- Deceptive balance sheets

- False public statements to appease investors

- Financial fraud perpetrated by a small group of insiders

- Financial media that is too credulous to ask probing questions

This story is just as significant and important as the FTX collapse, but has received little public attention. The outcome of the story may be just as dramatic—Barry Silbert and Michael Moro may become SBF's cellmates.

As the American lawyer pointed out in the trial of FTX, "Any false or fraudulent statements made to obtain or retain legitimately acquired assets are felonies."

For those closely following, warning signs exist. Michael Moro was forced to leave or switch jobs shortly after committing note fraud. Lawrence H. Summers also resigned from his advisory position at DCG, possibly sensing some very suspicious internal developments.

When the fraud is exposed and prosecuted, the small core circle of people who knew what happened at DCG/Genesis will become cooperating witnesses, just as SBF's core circle did against him.

From the lawsuits filed, the New York Attorney General already has a cooperating witness who served as a director at Genesis during the note fraud.

Unfortunately, financial media (Bloomberg/Reuters/CNBC) has been extremely negligent in both the Genesis and the previous FTX cases. When faced with important questions, they have shown embarrassingly credulousness (for example, SBF claimed there was no conflict of interest between FTX and Alameda).

Non-corporate journalists like @coffeebreak_YT and @laurashin have been asking tough questions and maintaining a rational skepticism when receiving nonsensical or untenable answers.

When DCG says "there is no basis for this case," it strongly leans towards corporate double speak. The complaint is detailed, substantive, and supported by an experienced, knowledgeable witness. DCG has yet to provide a meaningful rebuttal to any of the charges brought by the New York Attorney General.

So who will step up to break the deadlock? Hundreds of thousands of investors have suffered losses, many of whom have been severely affected, yet Barry Silbert still sits on his throne. Here, I will quote the words of the American prosecutor who sued SBF:

"When I became a U.S. prosecutor, I promised that we would spare no effort to eradicate corruption in the financial markets. This is what is meant by sparing no effort. This case is moving at lightning speed—it's not a coincidence, it's a choice. This case is also a warning to every fraudster who thinks they are untouchable, that their crimes are too complex for us to arrest, that their power is too great to prosecute, or that they can talk their way out of being arrested. Those people should rethink and stop their actions. If they don't, I guarantee our handcuffs are enough to arrest all of them."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。