Original: 《 Why Institutions Aren't Coming On-Chain 》

Translation: Ken, Chaincatcher

Introduction: Current money market protocols (such as Aave, Morpho, Kamino, Euler) serve lenders well, but they fail to cater to a broader group of borrowers, especially institutional borrowers, due to the lack of fixed borrowing costs. Since only lenders are well served, market growth has stagnated.

From the perspective of money market protocols, P2P fixed rates are a natural solution, while interest rate markets provide an alternative that is 240-500 times more capital efficient.

P2P fixed rates and interest rate markets are complementary and crucial for each other's prosperity.

Insights from Leading Protocols: Everyone Wants to Offer Fixed Rates to Borrowers

The roadmaps of various teams at the beginning of the year often set the tone for upcoming developments.

Morpho, Kamino, and Euler Finance are leading on-chain money markets with a total locked value of $10 billion. Browsing their 2026 roadmaps, one obvious theme stands out: fixed rates.

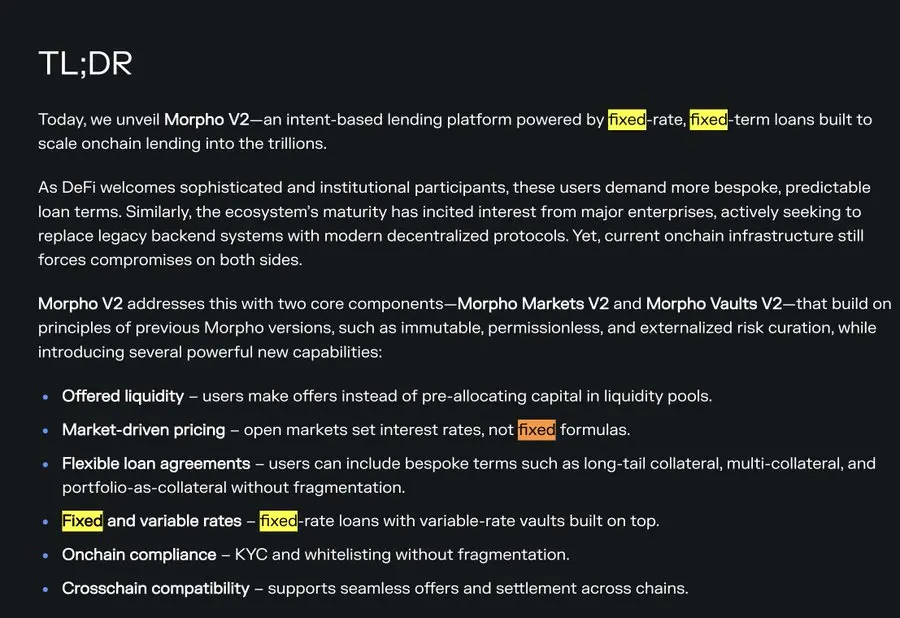

Morpho:

[1] Morpho V2 Briefing

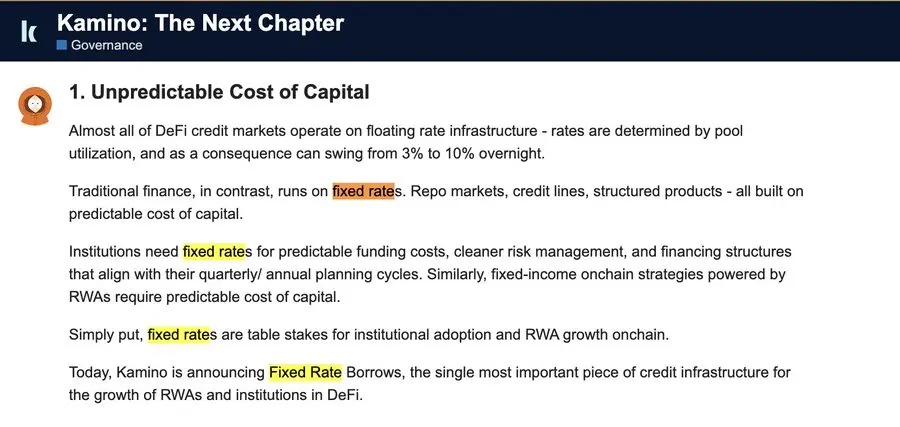

Kamino:

[2] Kamino's 2026 Plan

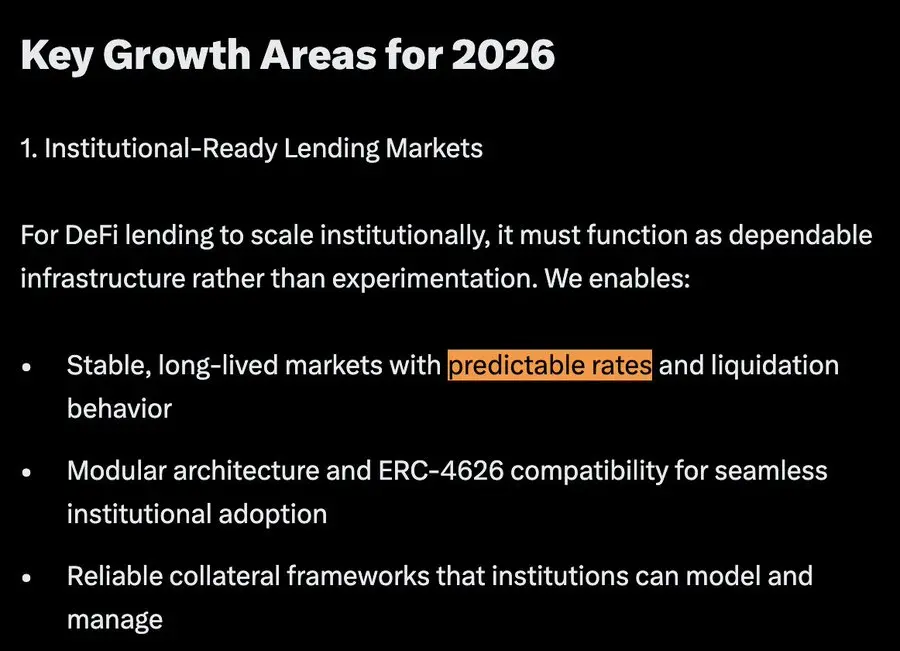

Euler:

[3] Euler's 2026 Roadmap

[3] Euler's 2026 Roadmap

The term "fixed rate" or "predictable rate" appears 37 times in the 2026 announcements of Morpho, Kamino, and Euler Finance. Excluding irrelevant vocabulary, this is the most frequently mentioned term in the announcements and appears as a top priority in all three roadmaps.

Other keywords include: institutions, real-world assets, and credit.

What's going on?

Early Decentralized Finance: Fixed Rates for Borrowers "Don't Matter at All"

For builders, early decentralized finance was fun and experimental. But for users, early decentralized finance can be summarized in two words: absurd speculation and terrible hacks.

Absurd Speculation

From 2018 to 2024, decentralized finance resembled a "Mars casino" disconnected from the real world. Liquidity was primarily driven by early retail and speculative behavior. Everyone was chasing four-digit annualized returns. No one cared about borrowing at fixed rates.

The market was highly volatile and full of uncertainties. Liquidity lacked stickiness. The overall collateralization rate fluctuated wildly with market sentiment. With virtually no demand for fixed-rate borrowing, the demand for fixed-rate lending was even lower.

Lenders preferred the flexibility of withdrawing funds at any time. No one wanted their funds locked for a month—because in a nascent and rapidly changing market, a month felt like a lifetime.

Terrible Hacks

Between 2020 and 2022, hacks were rampant. Even blue-chip protocols were not spared: Compound suffered a major governance exploit in 2021, resulting in losses of tens of millions of dollars. Overall, vulnerabilities in decentralized finance during this period caused losses amounting to billions of dollars, deepening institutions' skepticism about the risks of smart contracts.

Institutions and high-net-worth capital had limited trust in the security of smart contracts. As a result, participation from more conservative capital pools remained extremely low.

In contrast, institutions and high-net-worth individuals borrowed from off-chain platforms like Celsius, BlockFi, Genesis, and Maple Finance to avoid smart contract risks.

At that time, there was no saying "just use Aave," as Aave's status as the safest decentralized finance protocol had not yet been established.

Catalysts for Change

I'm not sure if this is intentional or coincidental, but we often refer to platforms like Aave and Morpho as "lending protocols"—despite both lenders and borrowers using them, there is certainly something noteworthy here.

The term "lending protocol" is actually very fitting: these platforms excel at serving lenders but are clearly lacking in serving borrowers.

Borrowers seek fixed borrowing costs, while lenders want the ability to withdraw funds at any time and earn floating rates. Current protocols serve lenders well but fail to serve borrowers. Without fixed-rate borrowing options, institutions will not borrow on-chain, and the bilateral market cannot grow—this is why these platforms are currently actively working to build fixed-rate features.

Even if this structure is extremely favorable to lenders, change often stems from user pain points or product advancements. Over the past year and a half, decentralized finance has accumulated significant experience in both areas.

In terms of pain points, fixed income looping strategies have been continuously harmed by fluctuations in borrowing costs, while the price difference between off-chain fixed rates and on-chain floating rates has been widening.

User Pain Point 1: Fixed Income Looping Strategies

Traditional finance offers a wealth of fixed income products. It wasn't until 2024, when Pendle and liquid staking protocols began to split the yields of ETH liquid staking, that decentralized finance had nearly any such products.

When looping fixed income tokens, the pain caused by fluctuations in borrowing rates becomes evident—looping strategies promising 30-50% APY are often completely consumed by rate volatility.

I personally tried to automate the opening and closing of these strategies based on rate changes, but each adjustment incurred costs at multiple levels: underlying yield sources, Pendle, money markets, and gas fees. Clearly, volatile borrowing rates are unsustainable—they often lead to my yields turning negative. Pricing borrowing costs based on on-chain liquidity dynamics introduces volatility far beyond acceptable limits.

This growing pain is merely the prologue to private credit moving on-chain. The vast majority of private credit tends to favor fixed-rate borrowing because real-world business activities require certainty. If decentralized finance wants to evolve, no longer just being a "Mars casino" disconnected from real economic activities, and truly support meaningful business activities (like GPU mortgages and credit borrowing for trading firms), then fixed rates are inevitable.

User Pain Point 2: Widening Spread Between Fixed/Floating Rates

As lending protocols provide excellent service to lenders—flexible withdrawals, no KYC, and easy programmability—on-chain lending liquidity has been steadily increasing.

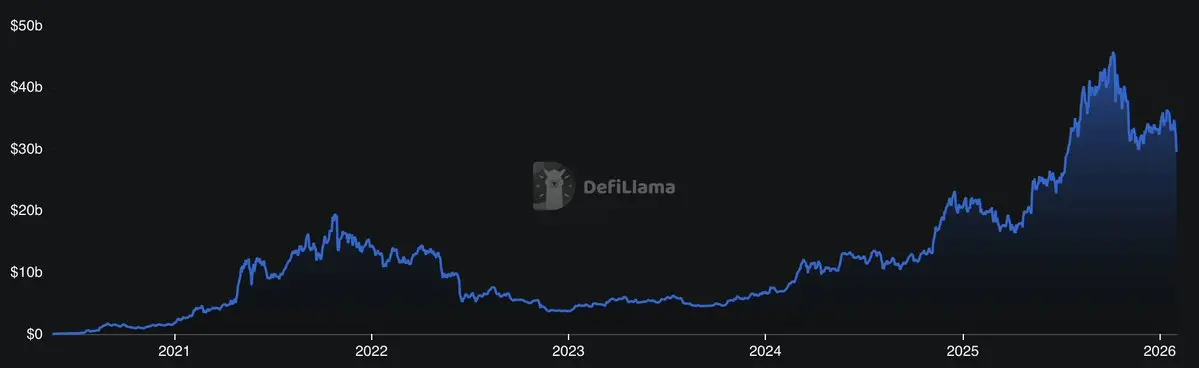

[5] Aave TVL Historical Chart. The growth rate of this chart is about twice that of Bitcoin's price increase.

As lending liquidity increases, the floating borrowing rates of these protocols decrease. While this seems beneficial for borrowers, it is largely irrelevant for institutional borrowers—they prefer fixed-rate loans and are obtaining them through off-chain channels.

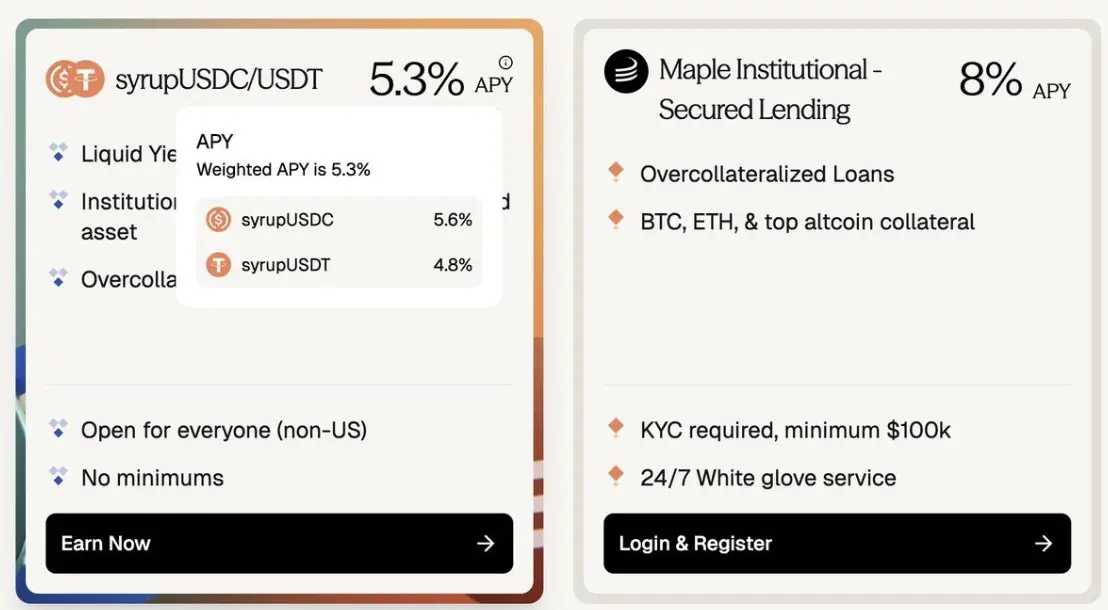

The real pain point in the market is the widening gap between off-chain fixed-rate borrowing costs and on-chain floating rates. This gap is quite significant. Institutions pay an average premium of 250 basis points (bps) for fixed-rate borrowing, and for blue-chip altcoin collateral, the premium can be as high as 400 bps. At a 4% Aave benchmark rate, this represents a premium of 60-100%.

[6] Aave ~3.5% vs Maple ~8%: Fixed-rate loans collateralized by crypto assets have a premium of about 180-400 bps.

On the flip side of this gap is the compression of on-chain yields. Since the current lending market is structurally biased towards lenders, there are more lenders attracted than borrowers—this ultimately harms lenders' returns and leads to a ceiling on protocol growth.

Product Progress: Decentralized Finance Becomes the Default Choice for Lending

In terms of development, Morpho has been integrated into Coinbase as its primary source of yield, while Aave has become a pillar for protocol treasury management, retail stablecoin savings applications, and new types of stablecoin banks. Decentralized finance lending protocols provide the most convenient way to access stablecoin yields, with liquidity continuously flowing on-chain.

As TVL increases and yields decrease, these lending protocols are actively iterating, thinking about how they can also become excellent "borrowing protocols" to serve borrowers and balance the bilateral market.

Meanwhile, decentralized finance protocols are becoming increasingly modular—this is a natural evolution from Aave's "one-size-fits-all" funding pool model (note: although I believe the funding pool model will still have long-term, sustained demand—this is a topic for future articles). With Morpho, Kamino, and Euler leading the modular lending market, loans can now be more precisely customized based on collateral, LTV (loan-to-value), and other parameters. The concept of independent credit markets has emerged. Even Aave v4 is upgrading to a hub-and-spoke modular market structure.

The modular market structure paves the way for new types of collateral (Pendle PTs, fixed income products, private credit, RWA) to move on-chain, further amplifying the demand for fixed-rate borrowing.

Mature Decentralized Finance: Money Markets Thrive Through Interest Rate Markets

Market Gap:

Borrowers strongly prefer fixed rates (well-served off-chain) > Lenders strongly prefer floating rates and the flexibility to withdraw funds at any time (well-served on-chain)

If this market gap is not bridged, on-chain money markets will stagnate at their current scale and will not expand into broader money and credit markets. Bridging this gap has two clear paths, which are not mutually exclusive but are highly complementary, even symbiotic.

Path 1: P2P Fixed Rates Managed by Administrators

The P2P fixed rate model is very intuitive: for every fixed-rate borrowing demand, an equal amount of funds is locked for fixed-rate lending. While this model is simple and elegant, it requires a 1:1 liquidity match.

According to the 2026 announcements, all major lending protocols are building towards P2P fixed rates. However, retail users do not lend directly to these P2P fixed rate markets for two main reasons:

They value withdrawal flexibility;

They face too many independent markets that need to be assessed and selected.

As a result, only the liquidity currently deployed in the treasury of risk management institutions can be lent to these fixed rate markets—and even then, only a portion can be lent. Risk management institutions must retain sufficient liquidity to meet the immediate withdrawal demands of depositors.

This creates a tricky dynamic game for risk management institutions that need to satisfy immediate withdrawal demands:

When there is a surge in deposit withdrawals, and the treasury lacks liquidity due to funds being locked in fixed rate loans, the treasury lacks mechanisms to suppress withdrawals or encourage deposits. Unlike money markets that have utilization curves, treasuries are not structurally designed to maintain withdrawal liquidity. More withdrawals do not yield higher returns for the treasury. If the treasury is forced to sell its fixed rate loans in the secondary market, these loans are likely to trade at a discount—potentially leading to insolvency for the treasury (similar to the dynamics of Silicon Valley Bank in March 2023).

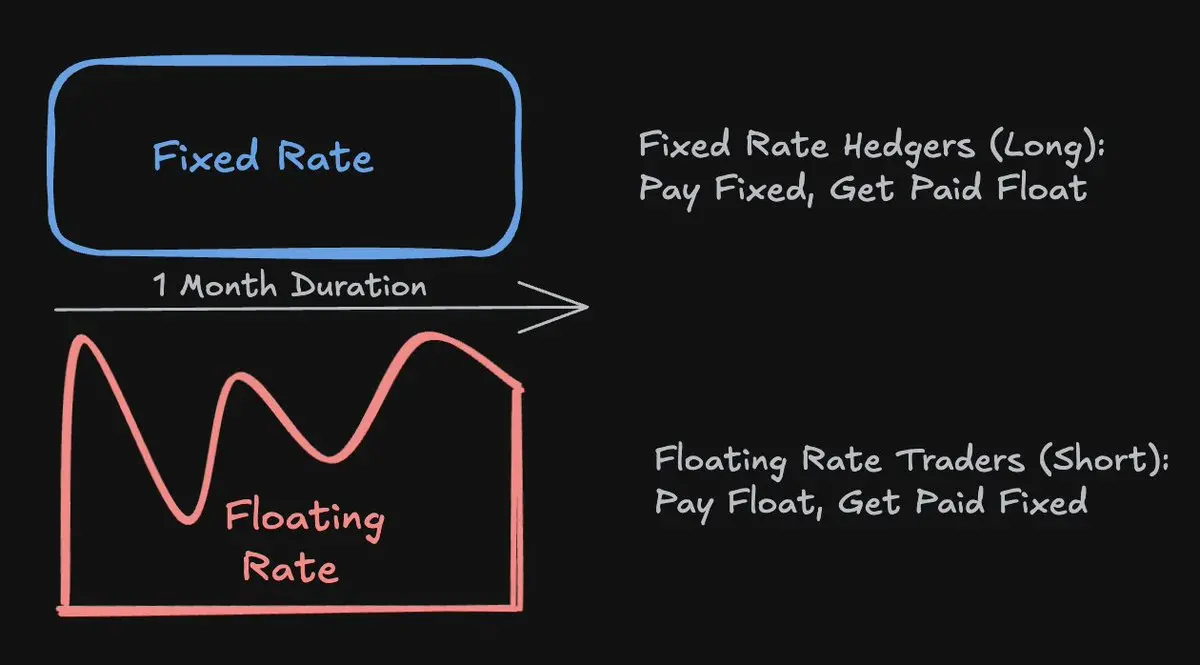

To alleviate this tricky dynamic, risk management institutions prefer to do what traditional lending institutions typically do: convert fixed rate loans into floating rates through interest rate swaps.

They pay a fixed rate to the swap market and receive a floating rate in return, thus avoiding the risk of being locked into low fixed rates when floating rates rise and withdrawals increase.

In this scenario, institutional lenders and risk management institutions utilize the interest rate market to better provide fixed rate liquidity.

Path 2: Interest Rate Markets Based on Money Markets

Interest rate markets do not directly match fixed rate lenders and borrowers. Instead, they match borrowers with funds willing to compensate for the difference between the "agreed fixed rate" and the "floating rate generated by the money market utilization curve." This approach provides capital efficiency that is 240 to 400 times higher than the 1:1 liquidity matching required by P2P markets.

The calculation logic for capital efficiency is as follows:

Borrow 100 million (100m) at a floating rate from Aave's existing liquidity; the borrower wishes to convert this floating rate loan into a one-month fixed rate loan. Assuming the fixed rate is priced at an APR of 5%; 100m * 5% / 12 = 416k; the interest rate swap achieves an inherent leverage of 100m / 416k ≈ 240 times.

Morpho

Interest rate exchanges help hedgers and traders price and swap fixed and floating rates.

Interest rate exchanges built on money markets cannot provide completely pure fixed rate loans like the P2P model—if rates spike 10 times and remain high for an extended period, theoretically, hedgers may face automatic deleveraging (ADL) risk.

However, the likelihood of this happening is extremely low, and it has never occurred in the three-year history of Aave or Morpho. Interest rate exchanges can never completely eliminate ADL risk, but they can implement multi-layered protective measures—such as conservative margin requirements, insurance funds, and other safeguards—to reduce it to negligible levels. This trade-off is very appealing: borrowers can obtain fixed rate loans from established, high TVL money markets like Aave, Morpho, Euler, and Kamino while benefiting from capital efficiency that is 240-500 times higher than P2P markets.

Path 2 mirrors the operation of traditional finance—daily interest rate swap trading volumes of $180 trillion facilitate credit, fixed income products, and real economic activities.

This combination of proven money market security, existing liquidity of $30 billion in lending protocols, appropriate risk mitigation measures, and excellent capital efficiency makes interest rate exchanges a pragmatic path for expanding fixed rate lending on-chain.

Exciting Future: Connecting Markets and Expanding Credit

If you stuck with the previous section's dry mechanisms and market microstructures, I hope this section sparks your imagination about future development paths!

Some predictions:

1. Interest rate markets will become as important as existing lending protocols

Since borrowing primarily occurs off-chain while lending mainly happens on-chain, the market remains incomplete. Interest rate markets connect borrowing demand by catering to the different preferences of both lenders and borrowers, greatly expanding the potential of existing money market protocols and becoming an indispensable part of on-chain money markets.

In traditional finance, interest rate markets and money markets are highly complementary. We will see the same dynamics play out on-chain.

2. Institutional Credit: Interest Rate Markets Become Pillars of Credit Expansion

Disclaimer: The "credit" here refers to money markets that are either unsecured or under-collateralized, not over-collateralized modular markets (e.g., Morpho Blue market).

The credit market's reliance on interest rate markets is even greater than that of over-collateralized loans. When institutions finance real-world activities (such as GPU clusters, acquisitions, or trading operations) through credit, predictable funding costs are crucial. Therefore, as on-chain private credit and RWA expand, interest rate markets will develop accordingly.

To connect off-chain real-world yield opportunities with on-chain stablecoin capital, interest rate markets are a more critical pillar for on-chain credit expansion. @capmoney_ is a leading team in the field of institutional credit lending, and I closely follow them to understand the future direction of the industry. If you are interested in this topic, I recommend you follow them as well.

3. Consumer Credit: Everyone Can "Borrow to Consume"

Selling assets triggers capital gains tax, which is why ultra-high-net-worth individuals (Ultra-HNW) almost never sell assets; they choose to borrow to consume. I can imagine that in the near future, everyone will have the privilege of "borrowing to consume" rather than "selling to consume"—a privilege currently reserved for the super-rich.

Asset issuers, custodians, and exchanges will have strong incentives to issue credit cards that allow people to collateralize assets for borrowing and direct consumption. To make this system operate on a fully self-custodied stack, decentralized interest rate markets are essential.

@EtherFi's credit card leads the collateral-based consumer credit model, with its credit card business growing 525% last year, processing up to $1.2 million in payments in a single day. If you don't have an EtherFi card yet, I highly recommend you try it out and explore "borrowing to consume"!

Finally, I want to point out that fixed rates are far from the only catalyst for growth in money markets. There are many issues that only money markets can solve—such as supporting off-chain collateral and oracle mechanisms based on RWA for looping strategies, etc. There are many challenges ahead, and I am genuinely curious and hopeful to contribute to the evolution of this market.

If you've read this far, thank you for diving deep into the details of this fascinating market with me!

At @SupernovaLabs_, we are captivated by the nuances of this market's evolution every day. We hope to become a pillar for existing lending protocols, helping them better serve the borrowing side of the market. We believe this will unleash borrowing demand, drive credit expansion, and become an indispensable part of the on-chain economy. The opportunity is at hand, and the time is now. We will have more announcements about product launches next week.

[1] Morpho v2:https://morpho.org/blog/morpho-v2-liberating-the-potential-of-onchain-loans/

[2] Kamino The Next Chapter:https://gov.kamino.finance/t/kamino-the-next-chapter/864

[3] Euler's 2026 Roadmap:https://x.com/0xJHan/status/2014754594253848955

[4] Casino on Mars:https://www.paradigm.xyz/2023/09/casino-on-mars

[5] DefiLlama: Aave TVLhttps://defillama.com/protocol/aave

[6] Maple Finance Yield:https://maple.finance/app

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。