Daily market key data review and trend analysis, produced by PANews.

1. Market Observation

At the beginning of February, global assets experienced a significant decline. The news of Trump nominating Kevin Warsh as the Federal Reserve Chairman became the trigger point, raising market concerns that his hawkish stance would end the expansion of the balance sheet, leading to the "Warsh Shock" sweeping the globe. Meanwhile, geopolitical risks intensified, with Iran's Supreme Leader Khamenei warning of the risk of "regional war," and the U.S. deploying aircraft carrier strike groups. Although Trump expressed a willingness to reach an agreement, he threatened to see if Khamenei's warning would come true if no results were achieved.

As a result, the U.S. dollar strengthened, precious metals and commodities faced severe setbacks, with spot gold dropping below $4,450, plunging 9% in a single day, and retreating over $1,100 from its historical high of $5,596; spot silver once plummeted over 14% and fell below the $73 mark, dropping to the third position among global assets. Copper prices on the London Metal Exchange plummeted over 5%, and nickel fell 6% in a single day. The main contract for domestic lithium carbonate even hit the daily limit down, reported at 132,440 yuan/ton, while WTI crude oil fell to around $62. Copper prices on the London Metal Exchange plummeted over 5%. Nickel fell 6.00% in a single day, currently reported at $16,496.20/ton.

In response to market volatility, the Thailand Futures Exchange temporarily limited the daily price fluctuation range of online silver futures to ±30% of the latest settlement price and announced the suspension of online gold futures trading. Pepperstone strategist Michael Brown analyzed that the decline in the metal market is similar to the previous rise, exhibiting characteristics of "too rapid and too steep" declines. He believes the market may see a "dead cat bounce," but in the long term, the bullish logic for precious metals remains solid due to strong demand from central banks and retail, and precious metals remain a better safe-haven choice than the U.S. dollar or U.S. Treasuries amid geopolitical risks. The key for the market going forward is whether the bubble has been completely squeezed and speculative positions cleared, allowing fundamentals to reassert control over price movements.

In the stock market, influenced by concerns over interest rate prospects and the sustainability of AI capital expenditures, South Korea's KOSPI index plummeted 5.26%, marking the largest single-day drop in 14 months. Samsung and SK Hynix fell over 4%, and Nvidia CEO Jensen Huang clarified that previous rumors about a $100 billion investment in OpenAI "were never a commitment," further undermining market confidence in the AI sector.

The sentiment in the Bitcoin market is extremely low, with prices briefly falling below $75,000, hitting a low of $74,612, marking the fifth consecutive month of decline and reaching a new 10-month low, just about $100 away from the recent support line of $74,501. It also fell below the average purchase price of approximately $76,000 held by Michael Saylor's Strategy, which currently holds 712,647 Bitcoins facing over $900 million in unrealized losses. Several analysts, including Ardi, Greeny, and ERROR, pointed out that the $70,000 to $75,000 range is a key support level; if breached, the next target could be $69,000 or even $54,000. Caroline Mauron, co-founder of Orbit Markets, warned that if Bitcoin falls further below $70,000, it would severely damage long-term market confidence. Astronomer believes that $74,300 will be breached, stating that the "last line of defense" is usually a trap, maintaining an overall bearish or neutral bias. Crypto analyst Doctor Profit believes that Bitcoin's drop below the key MA100 weekly line confirms the start of a bear market and predicts a new cycle bottom between $54,000 and $44,000. Analyst Ali Charts also stated that if Bitcoin loses key levels, it could drop to $42,256. Crypto Chase believes that Bitcoin prices in the $60,000 to $65,000 range will see a strong rebound. Analyst Rekt Capital also noted that history is repeating itself, with the bearish crossover of the 21-week and 50-week EMA indicating further downside.

However, some analysts see the possibility of a short-term rebound. Trader Killa predicts that the CME futures gap around $84,000 will be filled in the coming weeks, while AlphaBTC expects a rebound to the $87,000-$88,000 range in February, followed by another deep dive later in the month. Macro analyst Raoul Pal linked Bitcoin's decline to the performance of SaaS stocks, believing it is driven by macro liquidity rather than issues within the crypto market itself.

Ethereum is also facing severe tests, with prices dropping alongside the market, briefly falling below $2,200. Ali Charts stated that the $2,100-$2,250 range is a key support area from the past two years, but he plans to "sell the house to buy the dip" around $1,800; CJ analysis believes that the $2,100 support is not safe, expecting the market to plunge to $1,800-$2,000 to build a bottom, advising caution until it recovers above $2,100; Michaël van de Poppe pointed out that Ethereum and most tokens' daily RSI has fallen below 30, signaling a market bottom, and compared to historical data, although ETH is currently down 31%, it may see a rise of over 300% against Bitcoin afterward. Altcoins generally followed the market's plunge, with mainstream projects like SOL, BNB, and XRP falling between 4% and 6%.

2. Key Data (as of February 2, 13:00 HKT)

(Data source: CoinAnk, Upbit, SoSoValue, CoinMarketCap)

Bitcoin: $76,524 (YTD -12.69%), daily spot trading volume $76.87 billion

Ethereum: $2,228 (YTD -25.1%), daily spot trading volume $53.71 billion

Fear and Greed Index: 14 (Extreme Fear)

Average GAS: BTC: 1.75 sat/vB, ETH: 0.02 Gwei

Market share: BTC 59.2%, ETH 11.8%

Upbit 24-hour trading volume ranking: BTC, XRP, ETH, SENT, AXS

24-hour BTC long-short ratio: 48.80% / 51.20%

Sector performance: The crypto market sector saw a significant decline, with only the SocialFi sector remaining relatively strong.

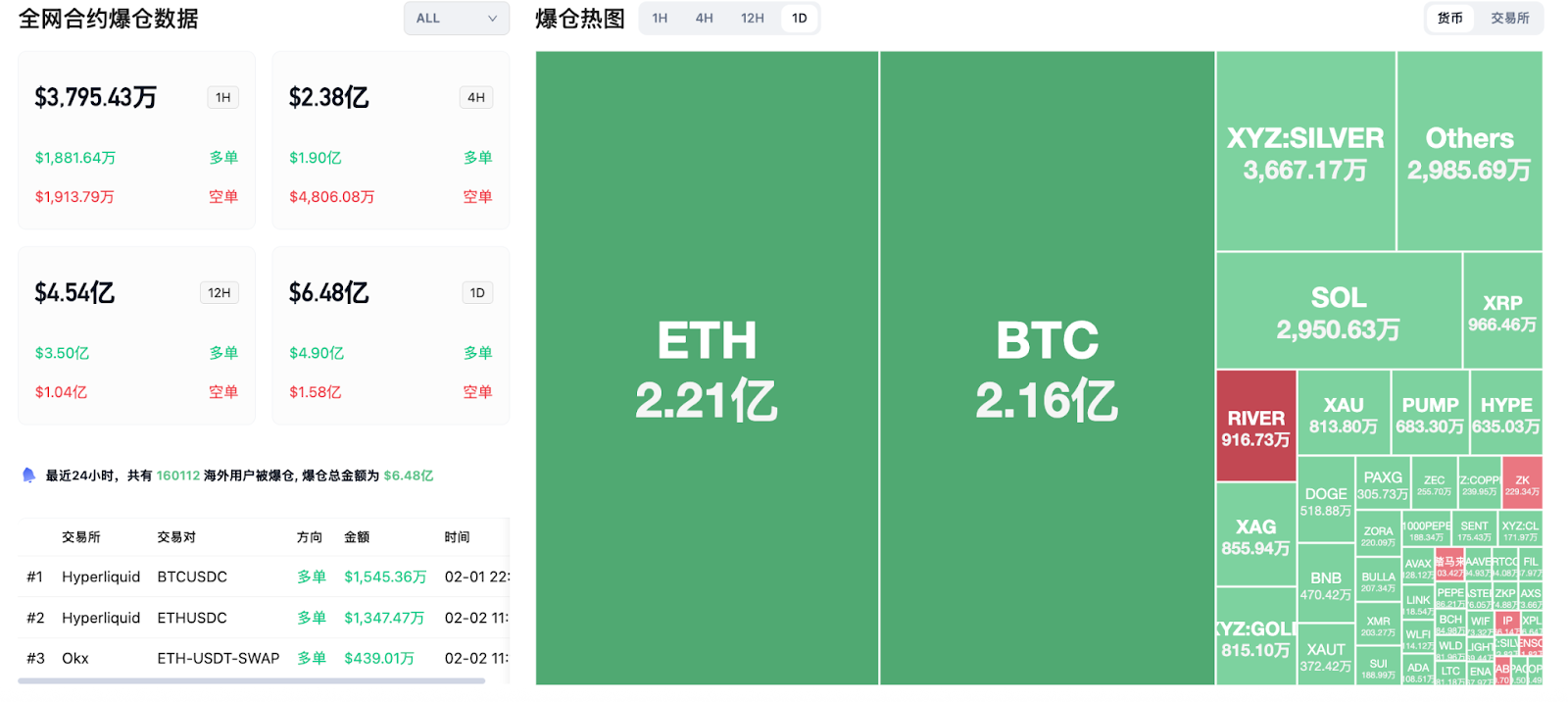

24-hour liquidation data: A total of 160,112 people were liquidated globally, with a total liquidation amount of $648 million, including $216 million in BTC liquidations, $221 million in ETH liquidations, and $29.5 million in SOL liquidations.

3. ETF Flows (as of January 30)

Bitcoin ETF: Net outflow of $1.49 billion this week, the second-highest in history

Ethereum ETF: Net outflow of $327 million this week

XRP ETF: Net outflow of $52.26 million this week

SOL ETF: Net outflow of $2.45 million this week

4. Today's Outlook

Crypto wallet Rainbow releases auction details for RNBW token, starting price $0.1

Aster will launch the sixth phase of airdrop on February 2, distributing 0.8% of the total supply

Binance: ZAMA token will be listed for circulation on February 2 at 20:00

Ongoing geopolitical events in Iran (week-long event)

Shanghai Futures Exchange: Adjusting the price fluctuation limit for silver futures to 17%, and the margin ratio for maintaining positions to 18% (February 3)

Federal Reserve Governor Bowman to speak (February 3, 22:40)

The largest gains among the top 100 cryptocurrencies today: Stable up 12.5%, MYX Finance up 12.1%, Jupiter up 6%, MemeCore up 5.4%, Canton Network up 4.3%.

5. Hot News

Spot gold falls below $4,500, retreating nearly $1,100 from its historical high

A whale transfers 2,819 BTC after being dormant for 8 years, with 1,500 BTC deposited into Paxos

Jupiter receives a $35 million strategic investment from ParaFi Capital

CNBC host Jim Cramer: Bitcoin buyers may concentrate, and the price could rebound to $82,000

Meme coin KOL Murad's portfolio plummets nearly 86%, losing $58 million in six months

Rich Dad Poor Dad author: Prepare to buy during the crash of gold, silver, and Bitcoin markets

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。