Compiled by: Jerry, ChainCatcher

Performance of Crypto Spot ETFs Last Week

Net Outflow of $1.487 Billion from U.S. Bitcoin Spot ETFs

Last week, U.S. Bitcoin spot ETFs experienced a net outflow over four days, totaling $1.487 billion, with a total net asset value of $106.96 billion.

Eight ETFs were in a net outflow state last week, with the outflows primarily coming from IBIT, FBTC, and GBTC, which saw outflows of $963 million, $191 million, and $119 million, respectively.

Data Source: Farside Investors

Net Outflow of $327 Million from U.S. Ethereum Spot ETFs

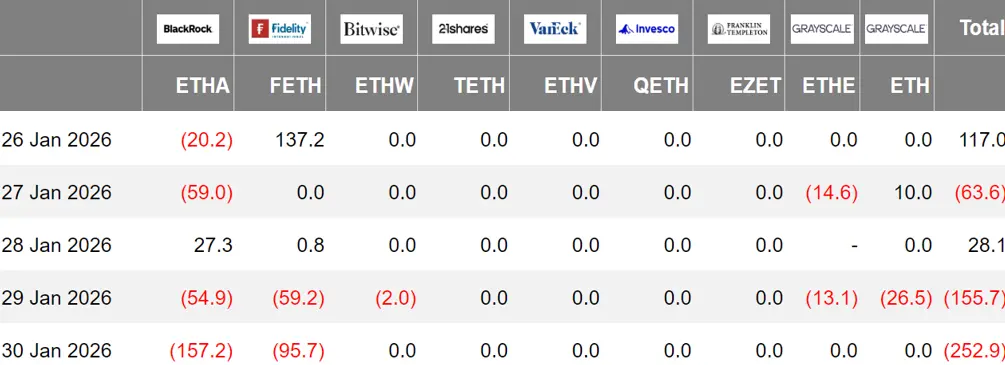

Last week, U.S. Ethereum spot ETFs had a net outflow over three days, totaling $327 million, with a total net asset value of $15.86 billion.

The outflow last week mainly came from BlackRock's ETHA, which had a net outflow of $264 million. Five Ethereum spot ETFs were in a net outflow state.

Data Source: Farside Investors

No Fund Inflows for Hong Kong Bitcoin Spot ETFs

Last week, Hong Kong Bitcoin spot ETFs had no fund inflows, with a net asset value of $33.9 million. The holdings of the issuer, Harvest Bitcoin, decreased to 290.72 BTC, while Huaxia maintained 2390 BTC.

Hong Kong Ethereum spot ETFs also had no fund inflows, with a net asset value of $8.627 million.

Data Source: SoSoValue

Performance of Crypto Spot ETF Options

As of January 30, the nominal total trading volume of U.S. Bitcoin spot ETF options was $2.3 billion, with a nominal total long-short ratio of 2.35.

As of January 29, the nominal total open interest of U.S. Bitcoin spot ETF options reached $24.52 billion, with a nominal total open interest long-short ratio of 1.56.

The trading activity of Bitcoin spot ETF options has increased in the short term, with overall sentiment leaning bullish.

Additionally, the implied volatility was 45.13%.

Data Source: SoSoValue

Overview of Crypto ETF Developments Last Week

Bitwise Registers "Bitwise Uniswap ETF" in Delaware

According to market news, cryptocurrency asset management company Bitwise has registered the "Bitwise Uniswap ETF" statutory trust entity in Delaware, preparing for potential future applications related to the decentralized trading protocol Uniswap.

Such state-level registrations typically occur months before a formal application to the U.S. Securities and Exchange Commission (SEC), and most do not progress to subsequent stages. Analysts point out that this move is a strategic step by Bitwise to retain optionality and does not indicate that it has entered SEC review or established a clear listing timeline.

Grayscale Bitcoin Mini Trust ETF Now Live on Morgan Stanley Platform

Grayscale CEO Peter Mintzberg announced, "The Grayscale Bitcoin Mini Trust ETF (Ticker: BTC) is now live on the Morgan Stanley platform, opening investment channels for over $7.4 trillion in assets under management (AUM)."

Hang Seng Gold ETF to Issue Tokenized Fund Units Based on Ethereum

Hang Seng Investment announced the issuance of the gold exchange-traded fund "Hang Seng Gold ETF," expected to be listed on the Hong Kong Stock Exchange. This ETF will have tokenized non-listed class fund units, with HSBC acting as the tokenization agent, initially planning to use Ethereum as the primary blockchain, with the possibility of adopting other public blockchains with equivalent security resilience and distributed ledger technology in the future.

It is reported that fund unit holders can subscribe or redeem tokenized fund units in token form through qualified distributors.

First AVAX Spot ETF in the U.S. Launched with No Net Inflows on First Day

The first AVAX single-token spot ETF in the U.S.—VanEck Avalanche ETF (Ticker: VAVX)—was officially listed for trading on Nasdaq.

According to SoSoValue data, there were no net inflows on the first day of VAVX's listing, with a trading volume of $330,000 and a total net asset value of $2.41 million.

The VanEck Avalanche ETF supports cash/physical redemptions, has a management fee rate of 0.30%, and supports staking.

As of the time of publication, the total net asset value of the AVAX spot ETF was $2.41 million, with an AVAX net asset ratio of 0.05%.

According to Bloomberg's senior ETF analyst Eric Balchunas on platform X, BlackRock has just released the official S-1 application for the upcoming iShares Bitcoin Quality Yield ETF, but has not yet disclosed fee or ticker information.

The strategy of this ETF is to track Bitcoin price movements and provide quality yield through an actively managed covered call strategy, primarily targeting IBIT stocks and occasionally targeting ETP indices.

SBI Holdings Plans to Launch Dual-Asset Crypto ETF Combining BTC and XRP

Japan's financial group SBI Holdings has submitted an application to launch a dual-asset crypto ETF that combines BTC and XRP into a single regulated product.

Views and Analysis on Crypto ETFs

Glassnode published a weekly report stating that Bitcoin continues to consolidate near structurally important price levels on-chain, with the balance between holder confidence and marginal demand remaining very delicate. The condition of short-term holders remains weak, with the lower limit of the current compression range (-1 standard deviation) at $83,400. This level is a recent key support level, and if breached, it could lead to further price retracement towards the real market average near $80,700. However, the overall capital flow pattern has stabilized.

The selling pressure from ETFs has eased, and initial signs of improvement in spot market positions have emerged, especially in offshore markets, indicating that buyer interest is beginning to rebuild. Meanwhile, the derivatives market remains restrained, with neutral financing indicating low market leverage levels, and prices are less affected by speculative momentum. Adjustments in options positions have reinforced this cautious attitude. The skew has turned bearish, short-term protection pricing has increased, and dealer gamma has fallen below zero, increasing the likelihood of significant price fluctuations during periods of market volatility.

Moving forward, the key to market trends lies in whether the demand from spot and ETF channels can be sustained. Continued positive capital inflows and stronger spot buying will support the continuation of the trend, while ongoing weakness and rising downside hedging demand will make the market susceptible to further consolidation or deeper retracements.

Analysis: Bitcoin Spot ETF Investors Facing Stress Test as Market Fluctuates Near Entry Price

According to Cointelegraph, the average entry price for U.S. Bitcoin spot ETF investors is currently around $86,000. As the market fluctuates near this entry price, ETF investors are facing a "test of faith," deciding whether to take on the risk of holding or to take profits to avoid the possibility of turning gains into losses.

CryptoQuant analyst Moreno stated, "Historically, the entry price range serves as a psychological pivot; prices above this level enhance investor confidence and stabilize capital flows, while prices consistently below this range accelerate redemptions as investors lose their profit buffer."

Since October of last year, the holdings of U.S. Bitcoin spot ETFs have decreased by 8.4%, with cumulative capital inflows dropping from approximately $72.6 billion to about $66.5 billion. The performance of ETFs in the second half of January has also been poor, with net outflows on six out of seven trading days, and only achieving a mere $6.8 million in net inflows on January 26.

Wintermute: Bitcoin Trapped in 60-Day Range, Record ETF Outflows Indicate U.S. Selling Pressure

According to market news, Bitcoin's price has been trapped in the $85,000 to $94,000 range for 60 days, with recent selling pressure in the U.S. market becoming a key factor in the dominant direction.

Although Bitcoin attempted to rise to $97,000 in early January, it lacked subsequent buying support and retreated to the mid-range of the interval. Market momentum is closely related to ETF capital flows: the strong performance in January was accompanied by robust ETF inflows, while the subsequent pullback corresponded to record outflows from BTC and ETH ETFs. Meanwhile, the Coinbase premium has turned into a discount, further confirming that U.S. counterparties are net sellers, indicating that institutional capital inflows (through ETFs, corporate treasuries, etc.) have turned negative, putting pressure on the market.

Analysts believe that to effectively break the range, it is necessary to observe whether ETF capital flows and the Coinbase premium can turn positive. Only when both indicators reverse can the market truly break through the mid-level of $90,000. This week's dense macro events may serve as catalysts to break the deadlock, including: the Federal Reserve's interest rate decision and Powell's speech, earnings reports from tech giants (Microsoft, Meta, Tesla, Apple), progress in tariff negotiations, and potential dollar/yen intervention and government shutdown risks.

Gold continues to set historical highs, while Bitcoin's "digital gold" narrative has yet to show the same safe-haven appeal in the current market environment. In summary, before the range is effectively broken, close attention should be paid to the $85,000 support level and the direction of ETF capital flows. The prolonged 60-day consolidation coinciding with dense macro risk events suggests that the market is about to choose a direction.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。