Original Title: False Narratives….and Other Thoughts

Original Author: @RaoulGMI

Translated by: Peggy, BlockBeats

Editor's Note: As market sentiment continues to weaken, crypto assets are repeatedly labeled as "the end of the cycle." However, this article argues that the price decline is not due to a failure of fundamentals, but rather a result of a temporary liquidity contraction. The rebuilding of the U.S. Treasury account, the exhaustion of reverse repo tools, government shutdowns, and the strengthening of gold have collectively siphoned off funds that should have flowed into long-duration assets, putting pressure on Bitcoin and assets like SaaS.

At the same time, the "false narratives" surrounding monetary policy are also worth noting. The market generally views Kevin Warsh as a hawk, but statements from Druckenmiller indicate that his policy thinking is closer to the Greenspan era: allowing the economy to run hot and betting on productivity gains to alleviate inflation. Within this framework, what is more likely to occur in the future is a combination of interest rate cuts and fiscal measures to release liquidity.

From a complete cycle perspective, time is often more important than price. In the short term, risk assets may continue to be under pressure; however, as liquidity constraints gradually ease, the current pessimistic narrative may be repriced.

Here is the original text:

False Narratives… and Some Disjointed Thoughts

I want to share some insights I gained while writing GMI this weekend, hoping to help you stabilize your emotions and regain some confidence. Sit back, pour a glass of red wine or make a cup of coffee… I originally intended to reserve this content for GMI and Pro Macro, but I know you really need some reassurance right now.

"The Grand Narrative"

The prevailing grand narrative is that Bitcoin and the entire crypto market are broken. The cycle is over, everything is doomed, and we can never have anything good again. It has completely decoupled from other assets—blame CZ, blame BlackRock, or blame someone else.

To be honest, this is indeed a very tempting narrative trap… especially when you wake up every day to see prices plummeting again and again.

But yesterday, a hedge fund client from GMI sent me a brief message asking: Is it time to buy SaaS stocks? They have dropped to very cheap levels; or, as the current narrative suggests, has Claude Code "killed" SaaS?

So I decided to take a closer look. What I found directly dismantled the narrative that "BTC is done" and the narrative that "SaaS has been terminated."

Because the charts for SaaS and BTC are identical.

UBS SaaS Index vs Bitcoin

This means there is another factor that we have all overlooked at play…

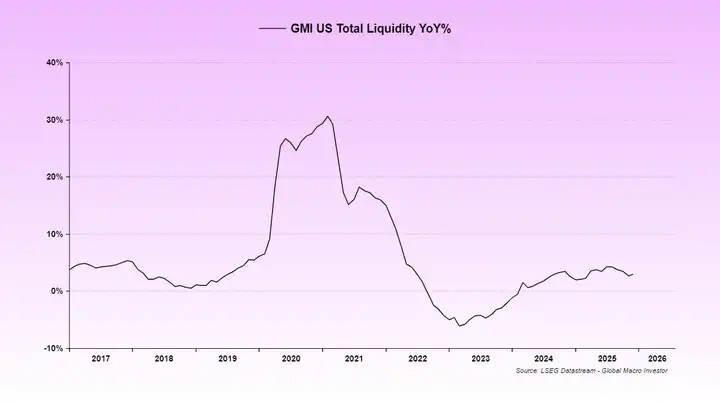

This factor is: due to two shutdowns and issues at the "pipeline" level of the U.S. financial system, U.S. liquidity has been suppressed. (The "liquidity injection" process of reverse repos has essentially been completed by 2024.)

As a result, the rebuilding of the TGA (U.S. Treasury General Account) in July and August did not have a corresponding monetary hedging mechanism.

The result is that market liquidity has been directly siphoned away.

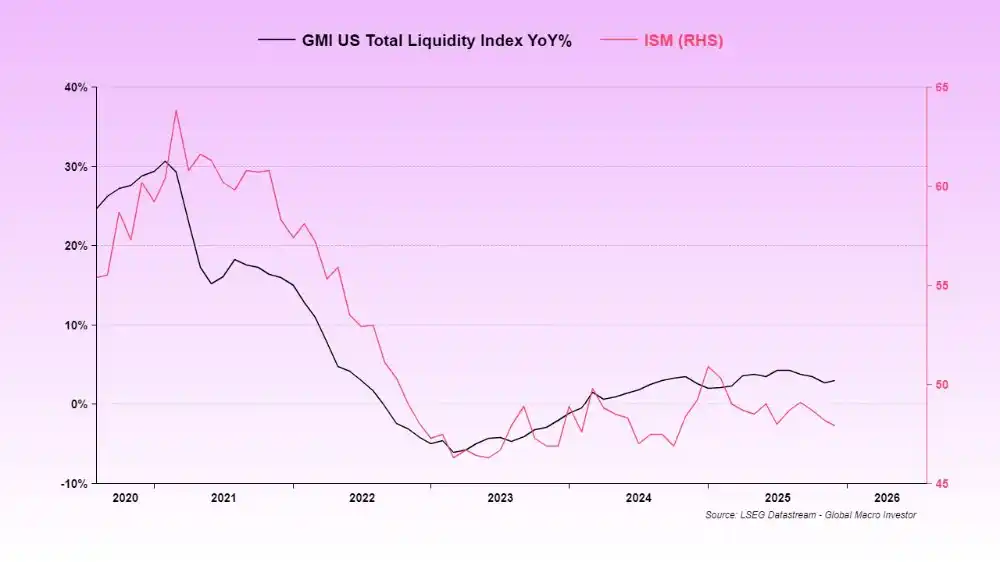

The persistently weak liquidity so far is the reason why the ISM index remains low.

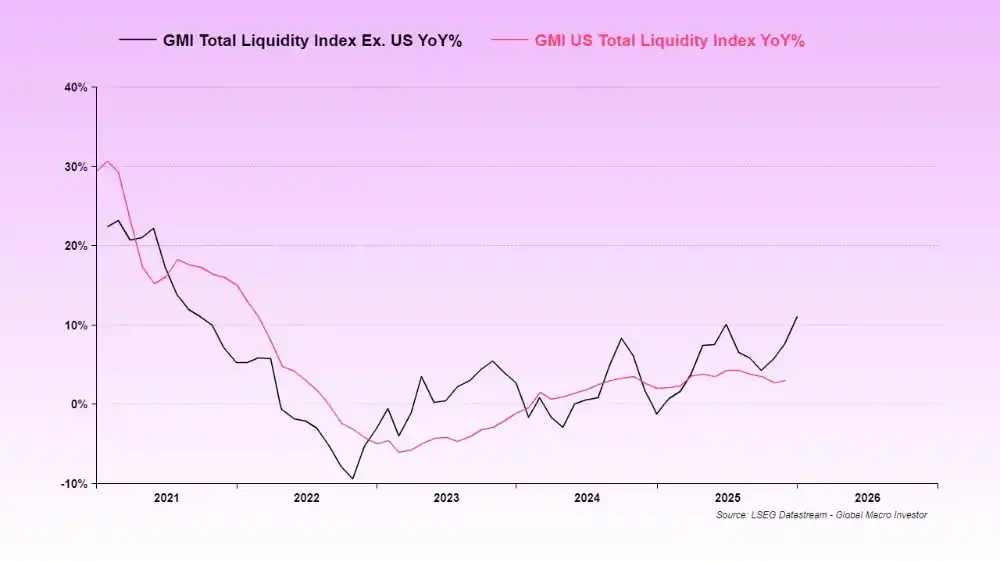

We usually use Global Total Liquidity (GTL) because, in the long run, it has the highest correlation with BTC and the Nasdaq Index (NDX).

However, at this stage, U.S. Total Liquidity (USTL) is clearly more dominant—because the U.S. remains the core supplier of global liquidity.

In this cycle, Global Total Liquidity (GTL) has changed ahead of U.S. Total Liquidity (USTL), and the upcoming liquidity rebound is approaching—ISM will also warm up accordingly.

And this is the key reason affecting SaaS and BTC.

Both asset classes are essentially the longest-duration assets; when liquidity experiences a temporary pullback, they will naturally be revalued at a discount.

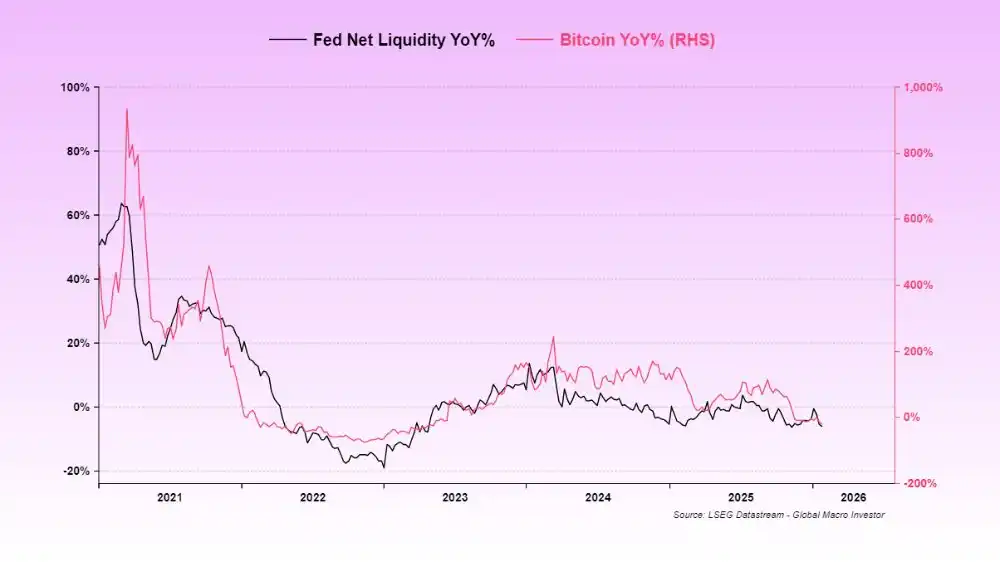

At the same time, the rise in gold has almost absorbed all marginal liquidity in the system—those funds that could have flowed into BTC and SaaS have been "intercepted" by gold.

In a situation where liquidity is insufficient to support all assets simultaneously, the riskiest portion is hit first.

This is the reality of the market.

Now, the U.S. government has shut down once again.

The Treasury has actually hedged against this: after the last shutdown, it did not use the funds from the TGA (Treasury General Account), but instead continued to add money to it—this further siphoned off market liquidity.

This is precisely the "liquidity vacuum period" we are facing now, and it is why price movements are so brutal. Currently, there is no liquidity flowing into our beloved crypto market.

However, signs indicate that this shutdown is likely to be resolved this week, which will be the last liquidity obstacle to cross.

I have mentioned the risks of this shutdown multiple times before. Soon, it will become a thing of the past in the rearview mirror, and we can truly enter the next phase—a liquidity flood driven by eSLR adjustments, partial releases of TGA, fiscal stimulus, and interest rate cuts.

Ultimately, all of this revolves around the midterm elections.

In complete cycle trading, many times, "time" is more important than "price." Yes, prices may be beaten down; but as time extends and the cycle continues to advance, everything will self-correct, and the "crocodile mouth" will eventually close.

This is also why I repeatedly emphasize "patience."

Things take time to unfold, and staring at P&L every day will only harm your mental health, not improve your portfolio performance.

On the Fed's "False Narrative"

Speaking of interest rate cuts, there is another widely circulated false narrative in the market: that Kevin Warsh is a hawk.

This is complete nonsense.

These claims are mainly based on some statements from 18 years ago. Warsh's role and mission are to replicate the operational script of the Greenspan era. Trump has mentioned this, and Bessent has too.

The details are too lengthy to elaborate, but the core meaning is simple: cut interest rates, let the economy run hotter, while assuming that productivity gains from AI will suppress core CPI. Just like the phase from 1995 to 2000.

Warsh indeed does not like balance sheet expansion, but the system has now reached reserve constraints, so he is almost unable to change the current path. If he tries to force a change, the credit market would be directly blown apart.

So the conclusion is simple: Warsh will cut rates, but won't do anything else.

He will make way for Trump and Bessent, allowing them to push liquidity through the banking system. And Miran will likely forcibly advance a comprehensive reduction of eSLR, further accelerating the process.

If you don't believe me, then believe Druck.

Warsh holds a very open and approving attitude towards the monetary policy ideas of former Fed Chairman Alan Greenspan, and he firmly believes that economic growth can be achieved without triggering inflation.

I know that when everything seems so bleak, listening to any bullish narrative can feel jarring. Our Sui position now looks like a pile of dog shit, and we are starting to lose track of what to believe and who to trust.

But first, it should be said: we have been through this many times before.

When BTC drops 30%, it is not uncommon for small coins to drop 70%; and if they are high-quality assets, they often rebound faster.

Mea Culpa

Our mistake at GMI was not realizing in time that "U.S. liquidity" is the true dominant variable at this stage.

In past complete cycles, global total liquidity usually dominated, but this time it is not the case. Now everything is clear—the "Everything Code" is still in effect. There is no "decoupling."

It’s just that we did not anticipate, or rather underestimated, the cumulative effects of a series of events: Reverse Repo being drained → TGA rebuilding → government shutdown → gold soaring → shutdown again.

This set of combinations is very difficult to predict in advance, and we indeed underestimated its impact.

But all of this is nearing its end. Finally. Soon, we can return to a "normal operating" state.

We cannot hit every variable perfectly, but now our understanding of the situation is clearer,

and we remain extremely bullish on 2026—because we are very clear about the operational scripts of Trump / Bessent / Warsh.

They have repeatedly told us. All we need to do is listen and then be patient.

In complete cycle investing, what truly matters is time, not price.

If you are not a complete cycle investor, or you cannot withstand this level of volatility, that’s perfectly fine.

Everyone has their own style.

But Julien and I have never been short-term traders, and to be honest, we are quite bad at it (we do not care about the ups and downs within the cycle).

However, in the matter of complete cycle investing, our verifiable, retraceable long-term track record over the past 21 years ranks among the best in history.

Of course, a disclaimer: we can also make mistakes. 2009 was a painfully extreme example.

So now is not the time to give up.

Good luck, and let’s welcome a fucking epic 2026 together.

The cavalry of liquidity is on its way.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。