Author: Zhou, ChainCatcher

On the evening of January 30, Beijing time, Trump officially announced the nomination of former Federal Reserve Governor Kevin Warsh as the next chairman of the Federal Reserve, succeeding Jerome Powell, whose term will end on May 15, 2026.

Trump had previously stated in public events that his chosen candidate is well-known and respected in the financial community, and should have received this position years ago.

This statement quickly shifted the market's focus to Warsh, as he was on the final shortlist during the selection process in 2017 but ultimately lost to Powell.

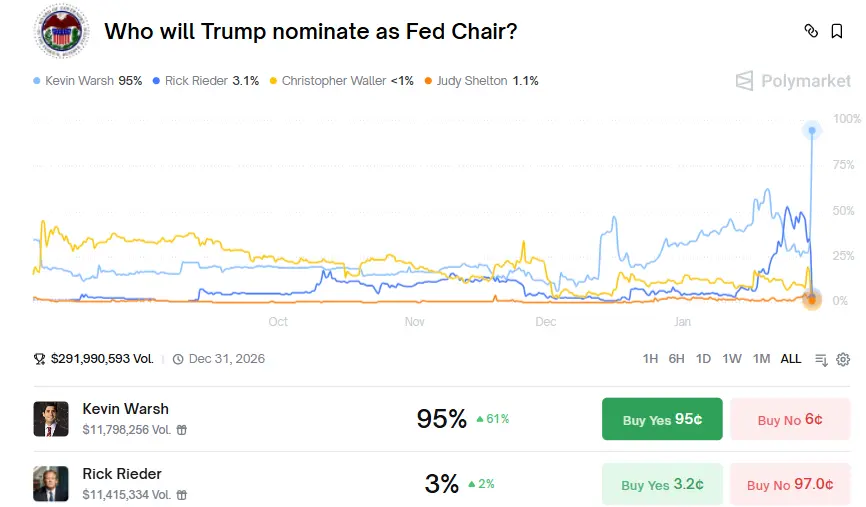

In the hours leading up to the announcement, Polymarket's prediction market odds showed Warsh's chances skyrocketing to over 95%, while BlackRock executive Rick Rieder's probability plummeted from a previous peak of nearly 50% to 3%.

Due to Warsh's long-standing reputation for hawkish views, this expectation rapidly boosted the dollar and U.S. Treasury yields, while putting pressure on commodity prices, leading to a sharp decline in international gold and silver prices.

Among them, spot gold plummeted by 8%, evaporating $4 trillion in market value, and silver dropped by as much as 18%; the yield on the U.S. 30-year Treasury bond rose to 4.91%, the highest in over a week.

Simultaneous Rate Cuts and Balance Sheet Reduction: Structural Hawkish vs. Tactical Dovish?

This nomination occurs in a politically tense environment within the Federal Reserve's leadership. Current Chairman Powell has faced multiple public criticisms from Trump regarding high interest rates and is currently under investigation by the Department of Justice concerning the renovation costs and audit issues of the Federal Reserve headquarters.

According to public information, the professional background of the nominated Kevin Warsh aligns closely with Trump's economic vision. He has a legal background and served as a Federal Reserve Governor from 2006 to 2011, playing a key role in market communication during the global financial crisis.

Currently, Warsh holds multiple positions, including professor at Stanford University and partner at the Druckenmiller family office. His monetary policy advocacy is not simply dovish or hawkish, but emphasizes the need for a complete systemic reform of the Federal Reserve. He believes the outdated inflation framework should be abandoned in favor of a more transparent price stability target.

One of the most notable features is the logic of simultaneous rate cuts and balance sheet reduction.

In Warsh's view, the main error of the Federal Reserve over the past decade has been the excessive expansion of its balance sheet, which he sees as a form of indirect subsidy to Wall Street. He advocates for a significant and rapid reduction of the current approximately $7 trillion balance sheet, to offset inflationary pressures by withdrawing market liquidity.

Warsh believes that as long as the balance sheet can be significantly reduced, the Federal Reserve will have the room to safely lower nominal interest rates, thereby meeting Trump's demands for a low-interest-rate environment and housing market affordability without triggering uncontrollable price increases.

Additionally, Warsh acknowledges the deflationary effects brought about by technological advancements (AI), arguing that increased productivity provides a realistic basis for substantial rate cuts.

Deutsche Bank analysts believe that Warsh may adopt a strategy of simultaneous rate cuts and balance sheet reduction, lowering interest rates while tightening liquidity. However, this combination is contingent on regulatory reforms that reduce banks' reserve requirements, raising doubts about its short-term feasibility. Historically, he has shown strong hawkish instincts, expressing concerns about inflation risks even during the 2008 crisis when the economy was on the brink of deflation.

Some observers also worry that his dovish stance may merely be a political expedient, and that Trump risks being misled. If inflation rises, he may revert to the stringent monetary discipline he maintained during the 2008 crisis.

Negative Attitude Towards Crypto Assets

The latest FOMC meeting, which kept interest rates unchanged, has already disappointed the market, and Warsh's succession news seems unable to alleviate anxiety in the crypto market.

Warsh's attitude towards Bitcoin and cryptocurrencies is neutral to negative. While he views Bitcoin as a sustainable store of value, similar to gold, he does not consider it worthless like Powell. However, he has strongly opposed private cryptocurrencies, advocating for the U.S. to quickly launch a central bank digital currency to counter China's digital yuan.

Markus Thielen, founder of 10x Research, points out that the market generally views Kevin Warsh's regained policy influence as a bearish factor for Bitcoin, as he has long emphasized monetary discipline, higher real interest rates, and tighter liquidity. His policy framework tends to regard crypto assets as "speculative products in a loose monetary environment," rather than tools for hedging against currency depreciation. Higher real interest rates mean that the true cost of financing rises after accounting for inflation, which typically suppresses demand for risk assets, including Bitcoin.

Moreover, several observers believe that a hawkish stance and underestimation of deflation risks may have exacerbated economic downward pressure in the past. If similar thinking is applied, it could lead to higher unemployment rates, slower recovery, and greater deflation risks.

Damien Boy, portfolio strategist at Wilson Asset Management, stated that the market is contemplating what the world will look like if the Federal Reserve's balance sheet shrinks. Once discussions about withdrawing support begin, assets like gold, cryptocurrencies, and bonds will face sell-offs.

Overall, if Warsh is ultimately allowed to take the helm, he will face unprecedented challenges: how to meet Trump's demand for the lowest global interest rates while maintaining the Federal Reserve's independence as a global monetary beacon. Warsh has previously advocated a return to "rules-based" monetary policy, and whether this can be compatible with Trump's "intuition-based" approach will be one of the uncertainties for the global market in 2026.

Welcome to join the official ChainCatcher community

Telegram subscription: https://t.me/chaincatcher;

Official Twitter account: https://x.com/ChainCatcher_

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。