Highlights of This Issue

This week's newsletter covers the statistical period from January 24, 2026, to January 30, 2026.

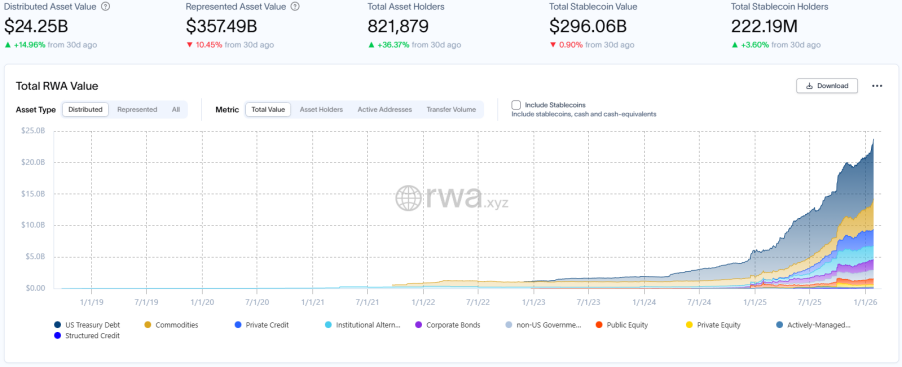

This week, the total market capitalization of on-chain RWA surged by 14.96% to $24.25 billion, with the number of holders skyrocketing by 36.37% to over 820,000, indicating a rapid increase in market participation; the total market capitalization of stablecoins slightly decreased, but the monthly transfer volume soared to $9.31 trillion, with a turnover rate of 31.4 times, highlighting the high-frequency circulation of funds within the system and insufficient ecological expansion momentum.

On the regulatory front: The U.S. SEC clarified the classification of tokenized securities and their legal applicability, South Korea finalized the "Basic Law on Digital Assets" setting minimum capital requirements for stablecoin issuers, the UK launched a regulatory investigation into stablecoins, and the global compliance path is becoming increasingly clear.

On the institutional side: Binance is considering restarting stock tokenization trading, R3 announced a transformation to a Solana-based tokenized capital market, Fidelity will launch a stablecoin FIDD compliant with GENIUS standards, and Tether introduced USA₮ for the U.S. market, showing that mainstream institutions are actively incorporating traditional assets into the on-chain realm. Payment scenarios continue to deepen, with the OKX Card launching in Europe to promote the daily payment application of stablecoins.

Data Insights

RWA Track Overview

According to the latest data from RWA.xyz, as of January 30, 2026, the total on-chain market capitalization of RWA reached $24.25 billion, an increase of 14.96% compared to the same period last month, marking a recent high in growth rate; the total number of asset holders rose to approximately 821,900, a significant increase of 36.37% compared to the same period last month, reflecting a rapid increase in market participation.

Data from Coingecko shows that the total market capitalization of tokenized gold and silver briefly surpassed $6 billion, setting a new historical high, currently around $5.906 billion. Among them, the total market capitalization of tokenized gold is approximately $5.462 billion, while that of tokenized silver is about $444 million.

Stablecoin Market

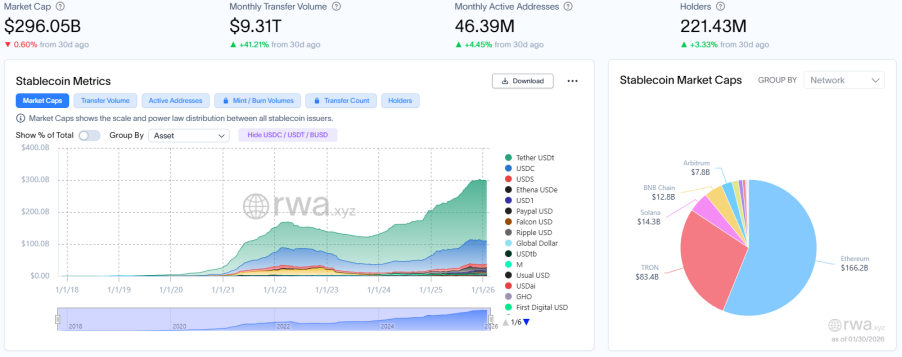

The total market capitalization of stablecoins contracted to $296.05 billion, a slight decrease of 0.6% compared to the same period last month, reflecting a continued shrinkage in fund size; the monthly transfer volume soared to $9.31 trillion, a dramatic increase of 41.21% compared to the same period last month, with the turnover rate (transfer volume/market capitalization) climbing to 31.4 times.

The total number of monthly active addresses increased to 46.39 million, up 4.45% compared to the same period last month; the total number of holders reached 221 million, an increase of 3.33% compared to the same period last month, indicating a slow expansion of the user base, but both growth rates are far below the increase in transfer volume.

The sharp divergence between market capitalization contraction and explosive transfer volume indicates that funds are not being used for ecological expansion but are circulating frequently within the system.

The leading stablecoins are USDT, USDC, and USDS, with USDT's market capitalization slightly declining by 0.58% compared to the same period last month; USDC's market capitalization decreased by 5.97% compared to the same period last month; USDS's market capitalization increased slightly by 3.66% compared to the same period last month.

Regulatory News

U.S. SEC Issues Statement on Tokenized Securities, Clarifying Classification and Legal Applicability

The U.S. Securities and Exchange Commission (SEC) issued a statement providing an official explanation regarding the classification and legal applicability of tokenized securities to clarify the applicability of federal securities laws to crypto assets. The statement defines "tokenized securities" as financial instruments that are represented in the form of crypto assets, with ownership records maintained entirely or partially through a crypto network. The core classification includes issuer-initiated tokenized securities and third-party initiated tokenized securities.

For issuer-initiated tokenized securities, the issuer integrates blockchain into its shareholder registry system, allowing on-chain asset transfers to directly correspond to changes in equity. The SEC emphasizes that the form of issuance does not affect the applicability of securities laws, and all offerings and sales must be registered or exempted. Third-party initiated tokenized securities are primarily divided into two model types. One is custodial tokenized securities, where a third party issues crypto assets representing the underlying securities, which represent the holder's rights to the underlying securities held in custody. The other is synthetic tokenized securities, where a third party issues crypto assets of its own securities to provide synthetic exposure; such assets may belong to linked securities or securities-like swaps. The SEC emphasizes that third-party tokenized products may introduce additional counterparty and bankruptcy risks and may be subject to stricter regulatory rules for securities-like swaps in some cases.

The SEC specifically points out that offering crypto assets representing securities-like swaps to non-qualified contract participants must be registered under securities laws and traded on national securities exchanges. Whether a crypto asset financial instrument falls under securities-like swaps should be based on its economic substance rather than its name. The SEC states it is ready to communicate with market participants on related issues.

According to South Korean media reports, the ruling Democratic Party of Korea has finalized the name of its bill aimed at regulating the virtual asset market as the "Basic Law on Digital Assets" and plans to submit it before the New Year holiday (Korean Lunar New Year). They also agreed to set the minimum statutory capital requirement for stablecoin issuers at 5 billion won (approximately $3.5 million). However, sensitive issues such as the scope of the central bank's authority and major shareholder ownership restrictions will be finalized after further coordination with the policy committee.

UK Financial Services Regulatory Committee Launches Investigation into Stablecoin Regulation

According to the UK House of Lords Financial Services Regulatory Committee, the committee announced today the launch of an investigation into the growth of stablecoins and proposed regulations, currently soliciting relevant opinions and evidence. The investigation will focus on the development of the global stablecoin market, future trends of pound-denominated stablecoins, the potential impact of stablecoins on the UK economy and financial services, and the applicability of the proposed regulatory framework by the Bank of England and the Financial Conduct Authority (FCA).

Committee Chair Baroness Noakes DBE stated that the purpose of this investigation is to assess the opportunities and risks brought by the growth of stablecoins and to explore whether the regulatory framework proposed by the Bank of England and the FCA can effectively respond to these changes. Experts and interested parties in the relevant fields are welcome to submit their opinions.

Local Developments

Hong Kong's "Hang Seng Gold ETF" Listed on January 29, Covering Ethereum-Based Tokenized Fund Units

The first ETF in Hong Kong issued by Hang Seng, which supports the exchange of physical gold at banks, was listed on January 29.

AASTOCKS previously reported that Hang Seng Investment's newly issued gold ETF "Hang Seng Gold ETF" holds physical gold, with all gold bars stored in designated vaults in Hong Kong; the ETF also plans to establish tokenized non-listed class fund units, with HSBC acting as the tokenization agent. Initially, Ethereum is intended to be used as the main blockchain, with potential future expansion to other public blockchains that have equivalent security and distributed ledger technology. Fund unit holders can only subscribe or redeem tokenized fund units through qualified distributors, and these tokenized shares will not have secondary market trading.

Project Progress

OpenEden, FalconX, and Monarq Jointly Launch Tokenized Yield Investment Portfolio PRISM

According to the official blog, OpenEden, FalconX, and Monarq jointly announced the upcoming launch of the tokenized yield investment portfolio PRISM. This product aims to seek stable returns during market cycles through a multi-strategy quantitative model actively managed by Monarq, while maintaining a low correlation with cryptocurrency prices.

PRISM's investment strategy includes cash-and-carry arbitrage, over-collateralized lending to institutional trading counterparts, participation in mature on-chain yield platforms, and allocation of regulated tokenized real-world assets, including U.S. Treasury-backed assets. Returns will be distributed through a staking mechanism, allowing users to stake PRISM to obtain value accumulation certificates xPRISM that reflect the portfolio's performance over time. This product is currently based on the Ethereum network and will gradually expand to more networks. PRISM has a limited pre-deposit activity before its launch.

According to Coindesk, Binance is considering restarting stock tokenization trading. Stock tokens are digital representations of stocks, allowing investors to purchase partial shares of companies like Apple or Microsoft (these shares are held and settled on the blockchain) without needing to own the entire share, reflecting the price of the underlying asset in real-time. Previously, Binance closed similar products in 2021 due to regulatory pressure.

Additionally, OKX, Coinbase, and traditional exchanges like the New York Stock Exchange and Nasdaq are also exploring stock tokenization issuance, indicating a revival of interest in stock tokenization across the financial industry.

However, there are still many legal and regulatory hurdles, as pending cryptocurrency market structure legislation in the U.S. and existing securities regulations may slow down or restrict the launch of stock tokenization products.

R3 Announces Plans to Transform into a Solana-Based Tokenized and On-Chain Capital Market

According to CoinDesk, blockchain technology developer R3 announced plans to reposition itself as a Solana-based tokenized and on-chain capital market, focusing on high-yield institutional assets such as private credit and trade finance, and packaging them into DeFi-native structures, aiming to bring Wall Street-level assets on-chain and massively introduce off-chain capital into on-chain markets. It is reported that R3 currently supports assets exceeding $10 billion through its Corda blockchain platform and has established partnerships with HSBC, Bank of America, Italian Bank, Monetary Authority of Singapore, Swiss National Bank, European Clearing Bank, SDX, and SBI.

WisdomTree Expands Its Tokenized Funds to the Solana Blockchain

According to Coindesk, New York-based asset management company WisdomTree is expanding its tokenized funds to the Solana blockchain, promoting multi-chain development. Both institutional and individual investors can issue, trade, and hold tokenized funds on Solana through WisdomTree Connect and WisdomTree Prime.

Fidelity to Launch GENIUS-Compliant Stablecoin FIDD on Ethereum

According to Bloomberg, Fidelity will launch the GENIUS-compliant stablecoin FIDD on Ethereum. The Fidelity Digital Dollar (FIDD) will be issued by the Fidelity Digital Assets National Association, a national trust bank that received a conditional operating license from the Office of the Comptroller of the Currency last December.

UAE Central Bank Approves Universal Digital to Issue USD-Pegged Stablecoin USDU

According to CoinDesk, the UAE Central Bank has approved the country's first USD-backed stablecoin, USDU, under its Payment Token Services Regulations. The stablecoin is issued and managed by Universal Digital, a crypto company regulated by the Abu Dhabi Global Market Financial Services Regulatory Authority.

USDU is pegged to the US dollar at a 1:1 ratio, with the related funds held in safeguarded accounts at onshore banks such as the UAE National Bank and Mashreq Bank. This marks the first time a USD stablecoin operates officially under a central bank payment regulatory framework. Aquanow has been appointed as the global distribution partner to provide access to USDU for institutions outside the UAE in licensed regions.

Tether Launches New Stablecoin USA₮ for the U.S. Market

Tether announced the official launch of the USD-pegged stablecoin USA₮, issued by Anchorage Digital Bank, N.A., operating under the newly passed GENIUS Act federal stablecoin framework in the U.S. USA₮ is backed by reserve assets held by Cantor Fitzgerald and is issued for U.S. domestic institutions and platforms, with initial listings on Bybit, Crypto.com, Kraken, OKX, and Moonpay. Tether stated that the globally circulating USD₮ will continue to comply with GENIUS Act requirements, while USA₮ is designed specifically for the highly regulated U.S. environment, issued through federally regulated banks. Tether Operations also emphasized that USA₮ is not legal tender and does not enjoy government insurance protections such as those from the FDIC or SIPC.

Coinbase Testing Flipcash's Developing Stablecoin USDF on Its Backend

According to Cointelegraph, Coinbase is testing the stablecoin USDF developed by Flipcash, which is part of its "Coinbase Custom Stablecoin" feature. This feature was launched last December, allowing businesses to create their own branded USD stablecoins, collateralized by Circle's USDC, and supporting seamless fund transfers across Coinbase-compatible chains.

Coinbase stated on the X platform that USDF is currently enabled for operational testing on the backend of the Coinbase exchange, but trading, deposit, and withdrawal functions are not yet open. Custom stablecoins can provide businesses with greater flexibility in payroll payments, B2B transactions, cross-border settlements, and fund management. In addition to Flipcash, Solana-focused self-custody wallet Solflare and decentralized finance platform R2 are also collaborating with Coinbase to develop their own custom stablecoin solutions.

OKX Card Officially Launches in Europe, Promoting Stablecoin Payments in Daily Scenarios

According to official news, the OKX Card has officially launched in Europe. This product aims to integrate on-chain payments into daily life within a compliant framework, allowing users to spend using stablecoins and achieve real-time conversion, simplifying traditional payment processes and enhancing payment efficiency.

OKX stated that the OKX Card is centered around stablecoins, designed for real-world payment scenarios, aiming to promote a more convenient and efficient payment experience while further exploring the practical application value of stablecoins in the global financial system.

ZK Technology-Driven Bitcoin Layer 2 Network Citrea Launches Mainnet and Issues Stablecoin

According to The Block, the Bitcoin Layer 2 project Citrea, supported by Founders Fund and Galaxy, has officially launched its mainnet and introduced the native stablecoin ctUSD, supported by M0 infrastructure. Citrea uses zkEVM to process transactions and writes zero-knowledge proofs onto the Bitcoin main chain, supporting financial applications such as BTC collateralized lending and structured products, aiming to build a native Bitcoin financial market.

Theo Launches Yield-Generating Gold Token thGOLD, Achieving DeFi Native Functionality

According to The Block, Theo has launched the innovative gold token thGOLD, combining physical gold collateral with a yield mechanism, distinguishing it from traditional tokens that only track gold prices. This product is based on a gold lending fund involving Singapore's Mustafa Gold, with partners including Standard Chartered-backed Libeara and FundBridge Capital. thGOLD will be launched on multiple DeFi platforms such as Uniswap, Morpho, and Pendle, marking the first time physical gold assets achieve on-chain yield and collateral functionality.

Gold and Forex Tokenization Market Tenbin Labs Completes $7 Million Financing, Led by Galaxy Digital

According to CoinDesk, Galaxy Digital led a $7 million financing round for Tenbin Labs, aimed at building a tokenized gold and forex market. The project focuses on bringing traditional financial assets on-chain, expanding the practical application of crypto assets in the global market.

Token Creation Platform Doppler Completes $9 Million Seed Round Financing, Led by Pantera Capital

According to The Block, the token creation and issuance protocol platform Doppler has completed a $9 million seed round financing, led by Pantera Capital, with participation from Variant, Figment Capital, and Coinbase Ventures. The team revealed that the financing was completed in the form of a simple agreement for future equity with token rights in the second quarter of 2025.

Doppler is one of two major products under Whetstone Research, the other being Pure Markets. Doppler compresses processes such as token deployment, liquidity initiation, and governance through integrated interfaces, employing a price discovery auction mechanism designed to limit sniping and generate protocol-owned liquidity on the first day. The Doppler platform creates over 40,000 assets daily, with a cumulative value exceeding $1.5 billion and a cumulative trading volume exceeding $1 billion.

RWA Trading Platform MSX Launches Spot and Contract Targets Across Multiple Tracks

According to official news, MSX has simultaneously launched spot and contract trading for American Rare Earth Company $USAR.M, North America's major silver producer $CDE.M, semiconductor equipment manufacturer $LRCX.M, semiconductor quality inspection leader $KLAC.M, process control supplier $MKSI.M, and uranium fuel supplier $CCJ.M.

Insights Highlights

According to Coindesk, a new report from consulting firm McKinsey and blockchain data company Artemis Analytics shows that over $35 trillion in funds were transferred on the blockchain using stablecoins last year, but only about 1% of that was for real-world payments. The analysis estimates that only $380 billion of the activity reflected actual payments, such as payments to suppliers, remittances, or payroll. This accounts for approximately 0.02% of the total global payment volume, while McKinsey estimates that the total global payment volume exceeds $20 trillion annually.

Standard Chartered Warns Stablecoins Could Withdraw $500 Billion from U.S. Bank Deposits by 2028

According to The Block, Standard Chartered released a report stating that the accelerated adoption of stablecoins could withdraw up to $500 billion in deposits from the U.S. banking system by 2028, posing the greatest threat to U.S. regional banks that rely on deposit interest margins. The bank expects that by then, the market capitalization of stablecoins will reach $2 trillion, with one-third coming from developed markets. Regulatory uncertainty and legislative delays are also seen as amplifying risk factors.

PANews Overview: The U.S. Securities and Exchange Commission (SEC) originally planned to launch an "exemption mechanism" in January this year to provide a fast track for crypto products such as tokenized securities, but it faced strong opposition from Wall Street institutions represented by JPMorgan and Citadel.

In a closed-door meeting, Wall Street argued that such a broad exemption would bypass established securities laws, weaken investor protection, and introduce market risks, advocating that "the same business should follow the same rules," and calling for tokenized assets to be included in the existing regulatory framework.

Under pressure, the SEC chairman has withdrawn the original timeline, delaying the policy's implementation. At the same time, the SEC released guidance clarifying that tokenized securities, regardless of their form, are subject to securities laws as long as their essence is that of a security, categorizing them into two types: those directly issued by issuers and those held by third parties.

The crux of this debate lies in the conflict between traditional finance's "stability first" approach and the crypto industry's "speed and innovation" demand, resulting in a stalemate for innovative policies, with the market awaiting clearer rules.

Surpassing PayPal, Entering the Top Five in Six Months: Trump's Stablecoin "Game of Power"

PANews Overview: The stablecoin USD1 has seen its market value soar to $4.9 billion within six months, surpassing PayPal and entering the global top five.

Its issuer, World Liberty Financial, has deep ties to the Trump family, and its rapid success is not solely based on technology or market factors, but rather through three main strategies: first, collaborating with exchanges like Binance to launch high-yield subsidy programs (such as an initial annualized rate of 20%) to attract massive users and funds; second, actively expanding "national-level" application scenarios, such as exploring cross-border payments in partnership with the Central Bank of Pakistan, attempting to upgrade from a commercial product to digital financial infrastructure; third, building a network of interests centered around political influence, allowing crypto giants supporting the project (like Binance and Justin Sun) to potentially exchange for reduced regulatory pressure, while the Trump family could share up to 75% of the project's profits.

However, this "power-driven" model also brings significant concerns: the lack of transparency in USD1's reserves and excessive concentration of liquidity mean that market confidence is heavily reliant on Trump's personal political status. Should the political environment change, it could face a run or severe scrutiny, exposing the underlying vulnerabilities of its business model and high political risks.

Afghanistan's Stablecoin: An Unexpected Crypto Innovation Hub

PANews Overview: An Afghan startup named HesabPay has developed a blockchain-based remittance platform that uses digital wallets and stablecoins pegged to local currencies or the U.S. dollar to provide humanitarian aid in conflict areas.

The platform has received a license from the Afghan government and has been adopted by organizations such as the UN Refugee Agency to efficiently distribute aid funds to hundreds of thousands of families in Afghanistan, Syria, and other regions. Its core advantage lies in significantly reducing transfer costs, achieving near-instantaneous fund arrival, and utilizing blockchain transparency to ensure that the flow of funds is traceable and monitorable, helping to rebuild donor trust.

Despite the risks of being technically blocked due to political issues or sanctions, and the fact that digital currencies cannot be completely "invisible" like cash, the platform employs real-time dashboards and automated compliance checks to guard against fraud and illegal activities.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。