Author: @clairegu1, @MorrisSHYang and Hubble Research Team

Polymarket's trading volume has reached new heights, becoming the liquidity center of global prediction markets. However, an unavoidable question for traders is: out of the hundreds of millions of dollars in trading volume, how much is genuine human intelligence at play, and how much is algorithms silently battling it out? When most retail investors look for smart money based on trading volume rankings, they may be walking straight into the meat grinder of robots.

The Hidden Bot Zone: A Very Few Create the Vast Majority of "Prosperity"

In a comprehensive analysis of all addresses, Hubble discovered a group of abnormal accounts in the "Bot Zone":

A game of a very few: This group of accounts accounts for only 3.7% of the total number (about 54,000 addresses).

Absolute voice: These 3.7% of accounts contribute 37.44% of the total trading volume across the platform.

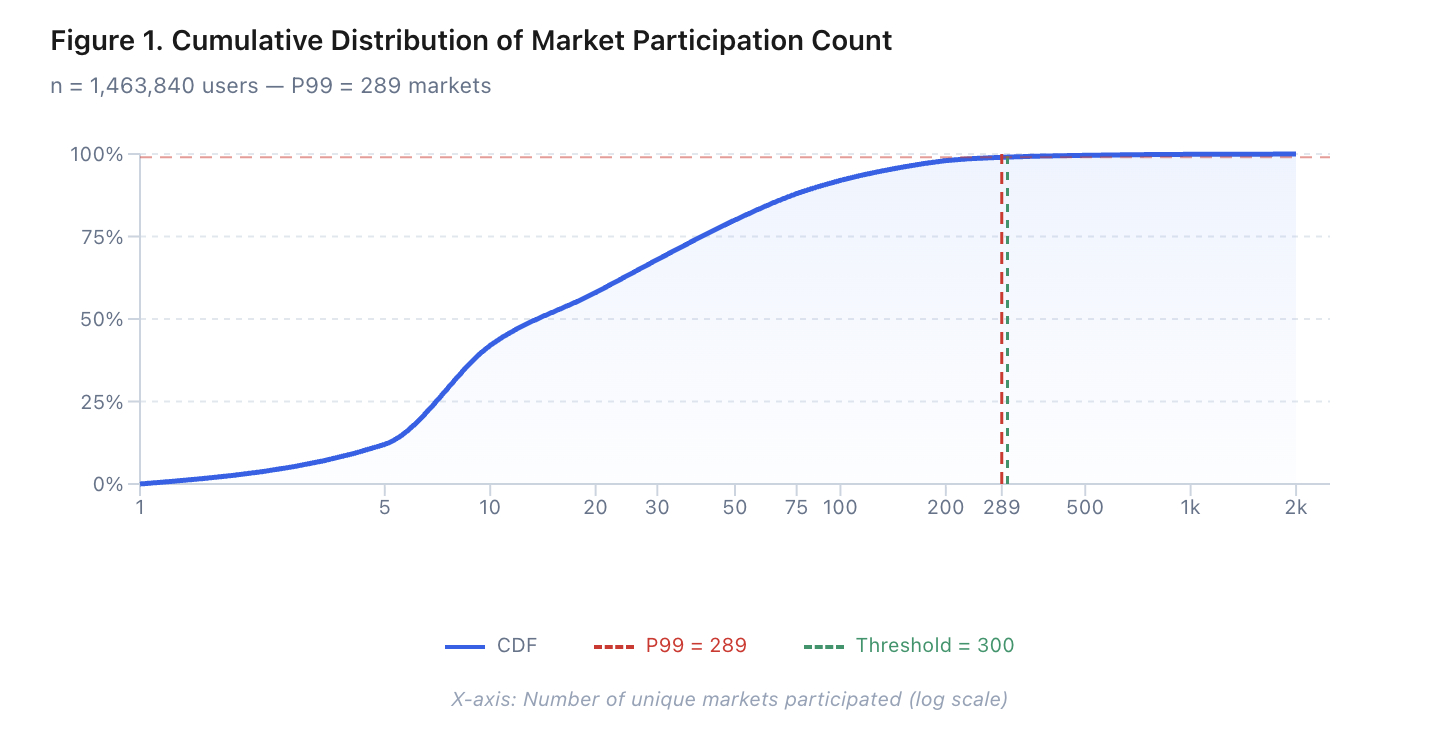

The lie of perception: Statistics show that 99% of real users participate in fewer than 289 markets in their lifetime. However, accounts in the "Bot Zone" generally participate in more than 500 markets.

For traders, this means that nearly 40% of the "market sentiment" you see is actually just the fluctuations of code.

If your

decision is based on trading volume, you are likely just providing liquidity for a hedging script that has no viewpoint (refer to previous articles:

How Hubble Identifies Algorithms

To accurately identify these "machine predators," Hubble developed a filtering logic based on the "XY-axis quadrant analysis."

The "Diagonal Law" of real users

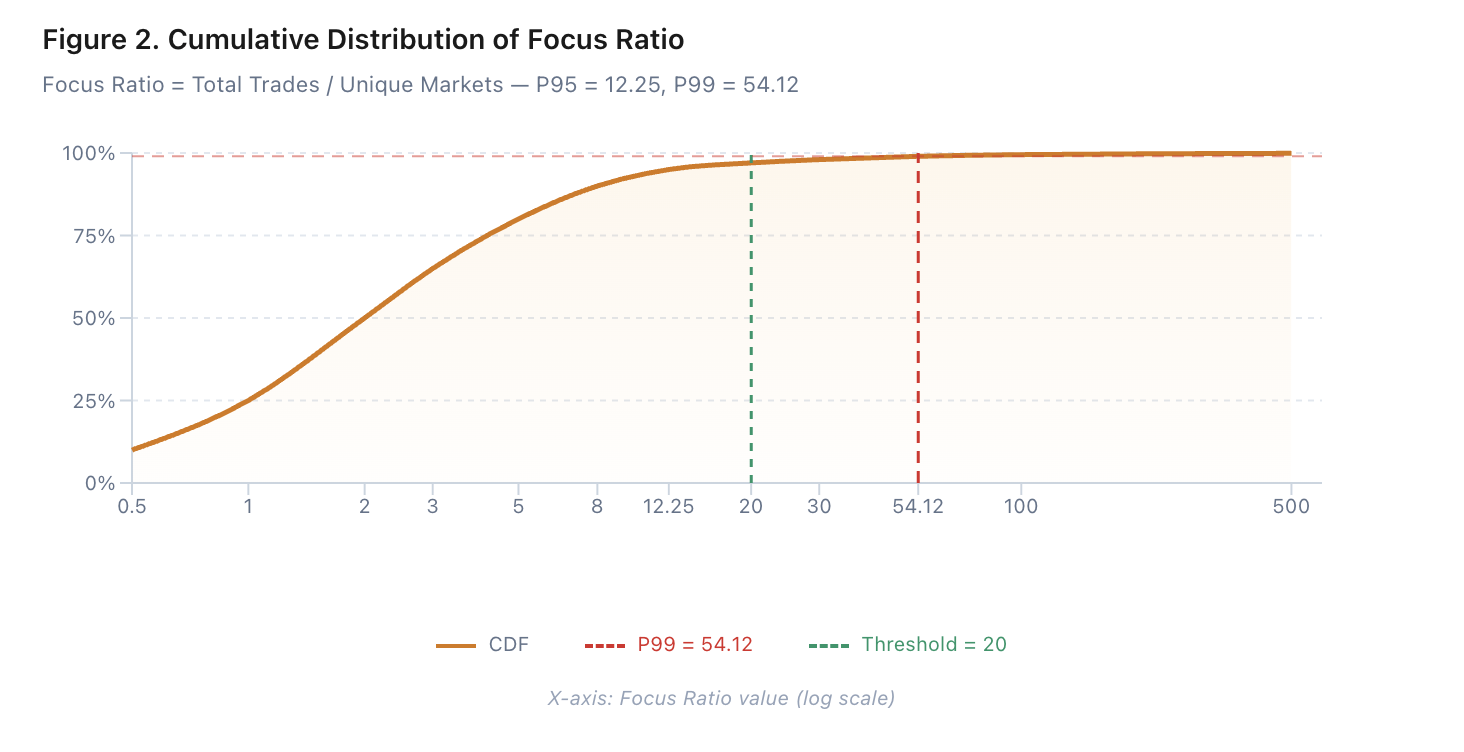

For real users, the number of markets participated in and the total number of trades show a positive logarithmic linear relationship. As the number of markets studied increases, the number of trades increases moderately, and their Focus Ratio (total trades / number of markets participated) remains within a reasonable range of 2 to 10.

- Judgment benchmark: Data shows that 95% of users have a Focus Ratio below 12.25.

The "Edge Distribution" of robots

Robots break this linear relationship and are distributed at the edges of the coordinate axes:

Vertical anomaly (deep cultivation type): Very few markets, but a lot of trades. These addresses are usually market-making scripts, with Focus Ratio peaks reaching as high as 39,394.

Horizontal anomaly (distribution type): Many markets, but very few trades per market. These addresses are often arbitrageurs or bulk snipers.

Our research team found that true "prediction masters" usually focus deeply on specific fields.

Those "jack-of-all-trades" who jump around hundreds of markets often base their logic on arbitrage from odds deviations rather than true insights into event outcomes. Following such signals makes it difficult to learn genuine gaming logic.

Holding Duration is the Only Truth

In addition to static counts, we identified the essence of Bot "fast capital turnover" by tracking the Inventory Curve:

HFT/MEV Bot: Average holding duration of 60 seconds. Only machines can complete a full risk hedging loop in just a few seconds.

Grid Bot/Market Maker: Holding duration within 10 minutes.

Real traders: Active traders usually hold positions for more than 1 hour, while trend holders can hold for over 1 day.

This indicates that algorithms can simulate trading frequency, but it is difficult to simulate human "hesitation" and "determination."

Signals with a holding duration of less than 10 minutes are essentially noise, as they do not predict outcomes but rather harvest volatility.

Summary: The Survival Principles of Polymarket

Based on the real distribution behind 1.46 million addresses, we summarize three core principles for following traders:

Trading volume does not equal consensus, and liquidity does not equal profit: 37% of the trading volume in the market is just "algorithms dancing." If you enter a high-volume market, you may not be entering a hotspot but rather stepping into a high-frequency robot's "meat grinder."

"All-round players" are likely "assembly line workers": Statistics have shown that humans cannot deeply engage in 300 topics simultaneously. True Smart Money often focuses on a few specific areas.

Time is the only golden standard for identifying real people: Algorithms can simulate trading frequency, but it is difficult to simulate human "time exposure." True value signals are often hidden in addresses willing to bear risk exposure for over 1 hour.

PolyHub: Born for "Signal Dehydration"

In the current market environment, blindly following Polymarket's original signals is dangerous. To address this pain point, we have built the PolyHub tool.

We aim to assist traders in penetrating algorithmic noise and finding those who truly grasp trends with "human wisdom."

If you are interested in penetrating market fog and locking in true smart money, feel free to join our exploration program:

Follow @PolyHub: Get in-depth data analysis and algorithm model updates on prediction markets in real-time.

Join interactively: Like/retweet the original tweet and comment "Waitlist," and we will reserve the first batch of internal testing seats for PolyHub.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。