Author: Zuo Ye

When I run out of money, I can only try to capture your attention.

At six in the evening, I finish the stream and change out of my OK outfit, heading to drink a few bottles of beer after Binance's big liquidation.

In the Meme counter's crazy Perp market, I earn a little commission using my mom's KYC.

The grand show of 2026 begins, witnessing the collapse of the exchange towers, unlike previous direct explosions, such as major liquidations or pinning to ignite public opinion, but rather the public no longer pays attention to exchanges, manifested in the inability to attract new users to Binance Square and OKX Planet.

When even the inspirational stories of beautiful dealers go unnoticed, exchanges have to come out and shout, "Look at the kids, you get paid just for watching!"

This article is dedicated to commemorating the one-year anniversary of Chuan Bao's ascension, a presidential-level performance that gives us a wealth of emotional value.

Lying Down to Make Money

If you don't explode in silence, you will perish in silence.

The exchanges did nothing wrong in 2025, embracing Perp DEX and actively going on-chain, aggressively complying and hitting back at mom's hospitalized commission son. Just a couple of days ago, Binance Wallet even had a Meme trading competition, responding to OKX Wallet's smart account system.

In 2026, exchanges will fail to produce any good products, as retail investors' attention affects capital flow. BNB Chain's monthly active users of 2 million are merely a numbers game, akin to Twitter's million-dollar competitions, where success stories lose their warmth within a day.

The wealth effect is changing its spokesperson, as people care about a $1000 creative reward, destined to ignore the $1000x wealth stories.

These facts emphasize one thing: exchanges need people, not shiny VIPs, but scruffy contract traders.

When you place an order to open a contract, you are a VIP; when you get liquidated, you are just a nobody on the street.

A rough calculation shows that an outsider's survival cycle after entering the circle is about 6 months, while a crypto KOL's trading account has a lifecycle of about 18 months. Regardless of the path taken, it is essentially a competition for retail investors' attention.

Unfortunately, exchanges' understanding of attention is still stuck in the pre-AI era, focused on KOLs. In the Vibe Coding era, the value of code and media is decreasing exponentially; not only is product realization worthless, but even creativity is undervalued. Engineering trial and error can combine everything for A/B testing.

The ability to spread has commercial value, but recommendation algorithms are not divine. Elon Musk's 100 million exposure is a liability for X; only content that tames algorithms is the cash flow of the new era, capable of increasing platform daily active users and attracting advertisers.

In short, poetry cannot diminish Li Bai's value, and algorithms cannot iterate to infinity.

Yet exchanges still treat retail investors as appendages to KOLs and media. Adults, the times have changed; the era where retail investors advocate for themselves has arrived.

Analyzing the role of content creators, they are always stuck between exchanges and retail investors, psychologically massaging retail trading behavior and helping the exchange's branding department meet KPIs, collectively completing the slaughter and exploitation of batches of retail investors.

This does not mean that retail investors do not have awakening moments; the "refined leeks" that remain after each cycle will remember the past, becoming beacons in the dark forest, evolving from the anti-fraud track to the troll track. No one can record the crypto circle, but the crypto circle grows memories.

Retail investors do not spend money; rather, they realize that their attention is the most valuable. This reasoning is very simple. Domestic social media like Xiaohongshu are crazily banning crypto content to make way for digital RMB, while Twitter significantly reduces crypto weight to reshape user experience. Agencies that only know how to scroll have already walked into a dead end with Kaito.

Image description: CZ responds

Image source: @cz_binance

Under the wonderful internal and external siege, CZ can still comfort himself by saying, "I am a small shareholder of Twitter." This $500 million past is still used to comfort retail investors, creating the illusion that Binance is very strong, while in reality, Binance Square's new user acquisition has gone crazy.

If Binance does it, then OKX will do it too. If the leader does it, then Bitget and Gate will follow. If KOLs do not settle in, they will directly pull content to pretend the ecosystem is thriving, and then report to the boss Leader, claiming success in attracting people.

But all of this is fake. Retail investors' attention is an infinite mercy for KOLs, media, and exchanges. KOLs and media need to exchange this for the traffic necessary to survive, while exchanges need the number of retail investors to maintain decent momentum. The park is a gold mine, and the platform's price is worth a fortune.

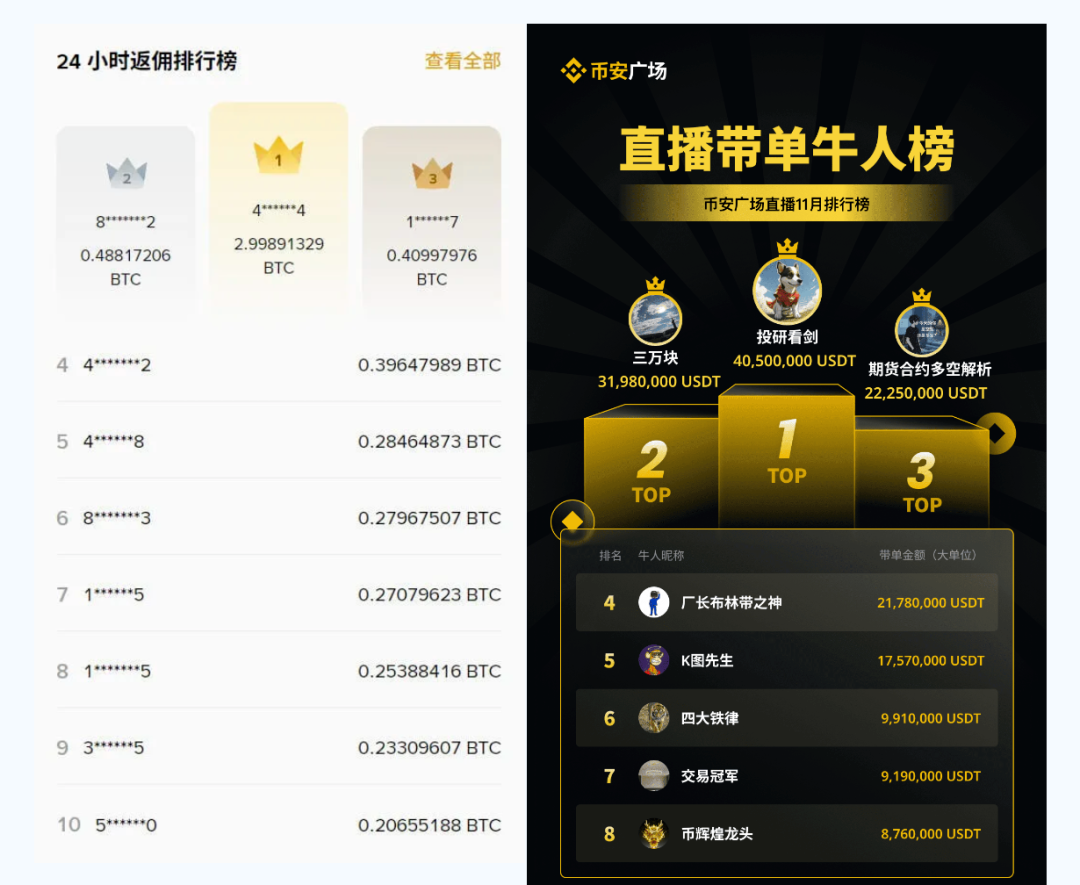

Image description: Commission ends, live streaming begins

Image source: @binancezh

Outside of Twitter, on Douyin, lies the public domain traffic that exchanges yearn for. They are also among the earliest to awaken, with countless comment sections emphasizing that viewers are not passive numbers but living souls.

In the cute cat video comment section, users know that the view count of cat videos is crucial, determining the quality and grade of tonight's cat food. They know to actively lie down to become cat food;

In the domineering egg comment section, users appreciate the difficulty of perfecting eggs, determining the success and effort of their accounts over the years. They know to actively lie down to become hens;

In the lonely and solitary comment section, users actively like and push for live streaming good deeds, determining the positive cycle of discussing actions rather than intentions. They know to actively lie down to become rice and flour.

Under the high-intensity "internet sense" education, everyone is an internet user, and everyone participates in the arena of creating and destroying gods. Everyone knows that their attention can be aggregated into money by algorithms, and everyone knows that their attention to a token is real gold and silver.

Only in the crypto industry do exchanges always treat retail investors as passive fools, even attempting to tier price KOLs based on their attention and follower counts. This situation will no longer exist; the awakening of retail investors will completely change the operational model of the entire industry.

Psychological Analysis of Ineffective Behavior

The madness of exchanges is not new, but their anxiety over "content" is a first.

However, this anxiety only leaves a thirst for emotional value, which cannot be truly converted into trading value. The current problem is that retail investors know the value of their attention, KOLs need to cater to changes in Twitter's algorithm, but exchanges are still playing straight balls.

After Musk announced the Feed algorithm as promised, "human feel" became the most valuable action. Mechanical interactions and matrixes have been limited in the short term, and now the auditors have become the tireless Grok Transformers.

Image description: X interaction weight

Data source: @elonmusk

Then exchanges are still bidding for promotional rankings for OKX Planet based on KOL follower counts. To be honest, Xu Mingxing should prepare market training for new employees; simple employee benefits cannot attract retail trading. The OKX wallet is a thousand times better than the Binance wallet, yet retail investors have not surpassed Binance.

If they cannot enhance the wealth effect, they should at least reduce signs of flaunting wealth.

Retail investors live so hard, while exchange bosses live comfortably. This battle has already declared its end before it even started; OK cannot catch up with Binance, and the square cannot surpass Twitter, leaving only the deserted planet singing "wrong, wrong, wrong."

Binance is anxious about OK's poor performance, while Musk strikes from both sides.

If exchanges cannot provide emotional value to retail investors, then retail investors will not provide trading value to exchanges. KOLs are merely a link in the value transmission chain, thinking of what retail investors think and urgently addressing CEX's needs.

This process is very simple. Everyone knows that KOLs who shoot videos and write articles can exchange traffic for real money. The more retail investors watch, comment, and stay longer, the stronger the creators' profitability towards the platform, allowing KOLs to provide users with a better reading experience.

Then exchanges take action, demanding KOLs sell traffic to them and dumping retail investors into the market. This is the process of the market's microstructure completely collapsing.

Binance claims 300 million users, even exceeding Twitter's 2021 monetized monthly active mDAU by 100 million, but this is meaningless. It can be clearly stated that this traffic anxiety can be quantified.

Twitter's monthly active users should be declining; users' daily usage time on X/Twitter has decreased from 34 minutes to 28 minutes. Nikita Bier states that X users read only about 30 posts daily, confirming no significant growth.

The US and Japan are Twitter's largest user groups, with around 100 million users in the US and about 20 million in Hong Kong and Singapore. Considering that mainland users cannot access directly and need to go through other means, it can be estimated that the number of Chinese Twitter crypto users is at most in the millions.

So why do Binance and OKX seek growth from a group of a few million and expect conversion to their platforms to exponentially decline? One conclusion can be drawn: the attention of tens of thousands or hundreds of thousands can support Binance's total user count of 300 million.

In interpersonal relationship theory, the six degrees of separation theory refers to the difficulty of information dissemination, where information can be transmitted to a maximum of 6 people, and there is also a three-degree influence index, indicating that each person can influence the behavior of "friends of friends." Assuming a KOL has 20 friends, their maximum influence is 20X20X20 = 8000 people. This is not the upper limit of dissemination power, but it is the upper limit of leading ability.

Unfortunately, Dunbar's number still limits the exertion of influence; 150 people are the contacts we can reach. Because crypto users are highly overlapping, you can see similar KOLs and exchange operations in every group. Trust me, the retail investors in each group are roughly the same bunch.

Image description: In the vast mountains and fields, you are my joy hidden in the breeze.

Under repeated cross-influences, OKX Planet can at most attract third-rate wed3 KOLs that Binance Square cannot reach, while Dragon Mom at least goes to BNB Chain.

Do you remember the lifecycle of retail investors and KOLs? At least the NFT group I joined is now completely inactive.

Conclusion

Humility is a life attitude, while ascension is a life choice.

Broadcasting to the entire universe, each of our attentions to exchanges is a grace to them, especially during difficult times in the industry. This is not a way for exchanges to take advantage of users.

Exchanges now need to consider one thing: whether to monetize the last bit of attention, allowing flaunting employees to report to bosses and shareholders, or to take care of retail investors' survival with a service-oriented attitude, improving content and allowing traffic to grow naturally.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。