Author: Nancy, PANews

In the world of anime, Astro Boy never has just one ending. He is both the hero who merges with the sun, remembered by the times; and he is also the scrap metal that, after his energy is depleted, becomes forgotten in a corner.

In the crypto world, Cosmos, phonetically referred to as Astro Boy in the Chinese community due to its token ATOM, once appeared as a hero cloaked in the mantle of the Internet of Everything. However, it has gradually failed its script amid the tug-of-war of technology, ecology, and interests. Now, this once-popular project is facing ecological blood loss, asset migration, and narrative reassessment.

The Ace Product Noble, Once a Pillar, Chooses to Depart

On January 20, Noble officially announced its separation from the Cosmos SDK, migrating to an independent high-performance EVM L1, with plans to launch its mainnet on March 18.

This decision sparked heated discussions in the Cosmos community. In the eyes of many, Noble is one of the key forces in the history of Cosmos DeFi development and serves as the central stablecoin hub in the Cosmos IBC (Inter-Blockchain Communication) ecosystem.

For a long time, the development of DeFi in Cosmos was hindered by the lack of native, high-liquidity stablecoins. This directly led to highly fragmented ecological liquidity, which had to rely on cross-chain bridges for capital allocation, while the bridges themselves came with trust costs and security risks. More critically, the algorithmic stablecoin UST, which the Cosmos ecosystem heavily relied on, also collapsed in 2022, causing a significant impact on its ecosystem.

The real turning point came in 2023. At that time, Noble reached a partnership with Circle, positioning itself as a general asset issuance chain built specifically for the IBC ecosystem, and became the first platform to issue native USDC within the IBC ecosystem.

With the introduction of native stablecoins, Cosmos finally gained the ability to compete for liquidity with other mainstream public chains, and DeFi TVL quickly rebounded from its lows, with trading volume and user activity amplifying in tandem.

As the Cosmos ecosystem revived, Noble itself also experienced rapid growth. It has raised over $18 million in cumulative financing and has gradually become one of the core infrastructures of the IBC ecosystem.

As of now, Noble has processed over $22 billion in transaction volume and has become the main liquidity layer for more than 50 blockchains. Meanwhile, Noble's ecological partners have issued over $250 million in assets, including various stablecoins such as USDC, EURe, USDN, and USDY, with approximately 30,000 active users globally each month.

From the recent actual operation data of IBC, Noble's importance is even more apparent.

According to the Map of Zones, in the past 30 days, Noble's IBC transaction volume reached $93.84 million, firmly holding the top position among the 110 Zones connected by IBC, with a scale more than 1.8 times that of the second-place Osmosis. Meanwhile, many other chains are either nearly stagnant or have low monthly transaction volumes. To some extent, the current activity level of the IBC ecosystem is largely supported by Noble.

However, more noteworthy than the transaction volume is the nature of the funds. In the past 30 days, the average transaction amount for the top-ranked Noble was about $1,272, while Osmosis followed closely with only $56, and dYdX around $28. At the same time, Noble had fewer than 48,000 transaction addresses during the same period, yet contributed a far higher scale of funds than other chains. This indicates that Noble does not rely on a large number of retail transactions to maintain its data but is the main channel for significant capital entering Cosmos.

The departure of a core liquidity infrastructure is undoubtedly a heavy blow to the Cosmos ecosystem.

Although Noble's reasons for this migration are somewhat euphemistic, they hit the nail on the head. They believe that the toolchain of the EVM ecosystem is more mature, developer resources are more concentrated, which helps them deliver functions more efficiently and serve mainstream applications and institutional needs; in contrast, the Cosmos ecosystem has gradually become a limiting factor in product iteration and functional expansion.

The Severed Arm of Astro Boy, Saying Goodbye to "Selling Tractors in a Toy Store"

Noble's escape is not an isolated case but a microcosm of the crisis in the Cosmos ecosystem.

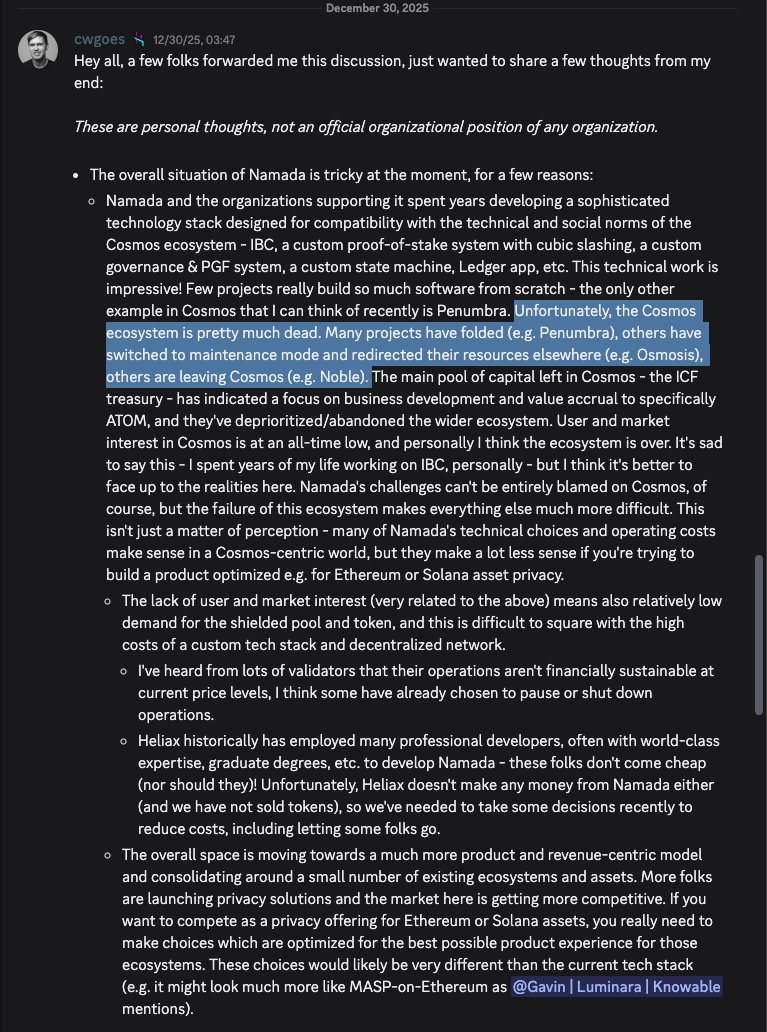

"The Cosmos ecosystem is almost on the brink of death; many projects have already shut down (such as Penumbra), some have switched to maintenance mode and redirected resources elsewhere (such as Osmosis), and others are in the process of withdrawing (such as Noble). User and market interest in Cosmos has dropped to historic lows," pointed out Christopher Goes, co-founder of the ecological project Anoma, in a recent post.

In fact, over the past year, dozens of projects in the Cosmos ecosystem have chosen to shut down or migrate, covering various sectors such as stablecoins, privacy, lending, DEX, and NFTs, with almost none escaping unscathed. Some projects have reached their end due to sluggish growth, unsustainable revenue models, and continuous loss of developers; others have gradually bled out due to security incidents, liquidity exhaustion, or shocks from macro market changes, ultimately choosing to abandon the Cosmos route. Migrating to other ecosystems like Base, Arbitrum, Solana, and Sei, or even directly building independent blockchains, is becoming an increasingly realistic and common choice.

Christopher Goes further pointed out that the ICF Foundation (Interchain Foundation) has clearly stated that it will shift its funding focus to business development and the value capture of ATOM, lowering its priority on the broader ecosystem, and even choosing to abandon it. The entire industry is shifting towards a more product and revenue-centric model, concentrating on a few existing ecosystems and assets.

This marginalization crisis stems from both internal and external environmental changes.

As a core narrative, Cosmos's Appchain model faces challenges in reality. The investment required to independently launch and maintain a blockchain long-term far exceeds early expectations. This economic model is nearly unsustainable in a bear market environment, especially for most small and medium-sized projects. More importantly, compared to the smooth experiences of other ecosystems, Cosmos's fragmentation issue has never been fundamentally alleviated.

Moreover, the token economics of ATOM have also exacerbated the predicament. Long-term high inflation did help incentivize staking and security in the early days, but in the absence of an effective value absorption mechanism, it continuously dilutes holders. Furthermore, application chains built on the SDK hardly need to rely on ATOM itself; they have their own native tokens for Gas, staking, and governance, and the fees and value generated from ecological growth do not flow back to ATOM, failing to form an effective value capture closed loop. The end result is that application chains are becoming increasingly "fat," while ATOM continues to "thin."

Additionally, internal governance conflicts are believed to further weaken Cosmos's execution power. From early disagreements among co-founders to intense debates over adjustments to ATOM's inflation rate, and even threats of forks; subsequently, the ICF, responsible for ecological oversight, was accused of issues such as lack of transparency in fund management and insufficient developer support, leading to a gradual loss of community trust.

Last year, Cosmos Labs (formerly Interchain Labs) also faced centralization controversies. The Cosmos network validator POSTHUMAN publicly pointed out that Cosmos Labs does not represent the entire Cosmos community, its voting power is lower than that of Cosmostation, and it has close ties with the ICF. Its advocacy for a survival-of-the-fittest approach, halting EVM implementation, freezing ISC-related payments, and promoting private chain paths led to project departures and harmed the reputation of Cosmos and the interests of ATOM holders, calling for community and builders to lead development.

External competition cannot be ignored either. Between 2023 and 2025, L2 and high-performance public chains like Solana rapidly occupy the minds of developers and users, offering lower barriers and stronger liquidity aggregation capabilities. In contrast, the complexity of Cosmos is gradually becoming a disadvantage rather than a moat.

In response to recent bearish market sentiments, RoboMcGobo, head of growth for the Cosmos ecosystem, recently stated that the so-called wave of project shutdowns is not unique to Cosmos but is a systemic deflation across the entire industry. Whether it’s Solana, Arbitrum, or Base, activity levels are significantly declining, and the era of "crypto serving crypto" has come to an end.

In his view, the past issue with Cosmos was that it "has been selling tractors in a toy store." The Cosmos SDK is essentially an industrial-grade heavy tool, yet it has been widely used to build simple DeFi or NFT applications, mismatching the scenarios and capabilities. Its programmable interoperability, immutable ledger, protocol customization, and compliance tools remain advantages that other blockchain solutions find hard to match. At the same time, a frequently overlooked fact is that some of the world's largest banks and governments are using Cosmos to drive their next phase of growth.

RoboMcGobo also stated that next year, the growth focus for Cosmos will be to hand the SDK over to clients who can truly create real value. As the crypto industry matures, more projects that remain in the "toy store era" will leave or shut down, and abandoning childhood products and use cases is a natural law.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。