With the rapid development of the digital economy, artificial intelligence is undoubtedly one of the most innovative and promising fields today. Many AI entrepreneurs and programmers are diving into it, filled with enthusiasm and technical dreams. However, seemingly innovative business models may also harbor many unnoticed legal risks.

This case will analyze the legal risks that AI entrepreneurs, programmers, and technical teams may face when engaging in financial technology, quantitative trading, and other fields through the first case in Shanghai involving the illegal recommendation of stocks using an "AI stock trading robot," and will provide compliance suggestions.

I Author of this article: Lawyer Shao Shiwei

1. Shanghai's First Case of Illegal Operation of AI Stock Trading Software: Company Controller Sentenced to Seven Years and Nine Months

Case Overview:

Company S, without approval from the competent authority, operated the "Xundong Quantitative" online platform to promote stock trading products such as "Interval Arbitrage" and "DIY Stock Trading Robot" to customers, providing securities consulting services such as timing for buying and selling individual stocks and recommending specific stocks. The total profit amounted to over 30 million RMB[i].

After trial by two levels of courts, the actual controller of Company S, Mr. Zhong, was sentenced to seven years and nine months in prison.

2. Is Selling AI Robot Stock Trading Quantitative Trading Software Illegal?

In this case, the owner of the technology company, Mr. Zhong, believed[ii]:

The DIY stock trading robot he developed helps customers filter and buy the stocks they want based on plans set by the customers themselves. In Mr. Zhong's view, the purchasing strategies are all formulated by the customers, and the software merely serves the role of data analysis, thus the company does not require corresponding qualifications for operation.

However, this viewpoint was not accepted by the court. Many practitioners in the AI industry, including programmers, may hold similar views:

AI stock trading software is merely an information filtering tool, not an investment recommendation. The software automates the collection and organization of publicly available market data (such as capital flow, trading volume, etc.), helping users improve information processing efficiency. The final decision-making power is entirely in the hands of the users, which is fundamentally different from providing specific buy and sell recommendations or promising returns, known as "stock recommendations." Therefore, they believe that such software falls under "neutral information technology services," rather than "illegal securities investment consulting business," and should not constitute illegal securities business as defined in Article 225 of the Criminal Law.

In this viewpoint, "factors" (such as capital movements, sector movements) and "interval arbitrage" models are calculated and presented based on publicly available, objective data. What the software does is merely simplify the information processing process without making subjective "value judgments" or "investment decisions." Users trade based on their own settings, and the software only executes automatically when conditions are triggered, serving as a tool for user-driven decision-making rather than making decisions on behalf of the users.

If merely using data analysis and automation technology constitutes a crime, then all AI software or financial data terminals on the market that provide similar information filtering and quantitative tools (such as certain functions of Tonghuashun and Dongfang Caifu) could also be deemed illegal operations, which is clearly unreasonable.

So, why was the business of Company S identified as illegal operation?

3. Why the Court Found Illegal Operation: Dissecting Company S's Business Model

From the business model of Company S, the actual situation far exceeds merely selling AI stock trading software. The company not only provided strategy services such as "interval arbitrage," but also divided its stock trading robot software into different tiers of membership services, priced at 8,800 RMB and 28,800 RMB for VIP members. Through these membership services, Company S charged customers "interface usage service fees," which amounted to "illegally accessing the trading channels of brokers," ultimately accumulating profits of over 3 million RMB.

Specifically, members at the 8,800 RMB tier would receive services such as "interval arbitrage." The so-called "interval arbitrage" refers to the software analyzing the rise and fall of stocks over several days, calculating reference values, recommending timing for buying and selling individual stocks to customers, or directly providing trading strategies to assist customers in quantitative investment. If customers are dissatisfied with the software's preset algorithms and trading strategies, they can obtain further analysis and recommendations through customer service personnel.

Members at the 28,800 RMB tier can set their own investment "tracks" and capital allocation plans based on the data, models, and parameters provided by the company. Once preset conditions are triggered, the software automatically assists customers in executing buy and sell operations.

Thus, the reason Company S constituted illegal operation is that:

The 8,800 RMB tier service essentially provides customers with specific investment advice—recommending timing for buying and selling individual stocks, providing strategic trading, and customer service making recommendations based on experience analysis. This service directly points to "telling customers what to buy and when to buy," with the core being the provision of investment advice, which has completely exceeded the scope of information intermediary.

The 28,800 RMB tier service, on the other hand, directly replaces customers in executing trades by combining the data and models provided by the company. The software's automatic execution function essentially plays the role of a trading channel and instruction execution, which is the core of brokerage business.

The combination of these two aspects allowed Company S to bypass the role of licensed brokers and directly complete the core securities trading and investment consulting business that should be conducted by licensed institutions such as securities companies and investment consulting companies.

4. Compliance Boundaries of AI Stock Trading Software: Standards for Distinguishing Crime from Non-Crime

So, based on the above case, does it mean that relevant individuals or companies selling AI stock trading software without obtaining qualifications such as the "Securities and Futures Business License" or "Securities Investment Fund Sales Qualification" are engaging in legally prohibited behavior? Of course not.

In practice, the core of the dispute does not lie in whether AI is used or whether quantification is done, but rather in: what the product and service ultimately output—data and tools, or "investment advice and trading execution." In other words, whether it has crossed the boundary from neutral technical services to securities investment consulting or securities business operation.

Combining the business model of Company S, the comparison can be explained from the following three levels:

1. Functional Output Level:

In Company S's services, the "interval arbitrage" model and customer service recommendations output clear instructions on "when to buy and sell which stock." This completes the transition from "what is" (data facts) to "how to do" (investment decisions), which is the essence of investment consulting business.

According to Article 1 of the "Interim Regulations on Strengthening the Supervision of Securities Investment Consulting Business Using 'Stock Recommendation Software' (2020 Second Revision)": Software products, software tools, or terminal devices that have the function of summarizing securities information or historical data statistics of securities investment varieties but do not have the function of "providing specific investment analysis opinions, predicting price trends, suggesting variety selection, or actual buy and sell recommendations" do not belong to "stock recommendation software."

Therefore, if an AI tool only provides securities information summaries, historical data statistics, capital flows, or sector movements as objective data displays, and does not provide specific analysis opinions, trend predictions, variety selection suggestions, or buy and sell recommendations, it is closer to a neutral information tool.

2. Business Logic Level:

Company S's business model involves charging high, tiered membership service fees, with the basis for these fees being "providing profitable investment advice and trading convenience." From the user's perspective, they are paying for "who can quickly complete profitable operations for me." This is essentially selling investment consulting services and trading channel services.

In contrast, if the product is sold as software only once, or charges a data subscription fee, with the main value being the information tool itself and not using "profitability" as the core selling point, it is usually closer to the business logic of technical services or information services.

3. Operational Closed Loop Level:

In Company S's services, especially at the 28,800 RMB tier, after users set conditions, the software fully automates the entire process from decision trigger to order execution. This has partially replaced the roles of investors and brokerage agents.

In contrast, if the product only provides analysis tools, and users still need to make their own judgments and place orders themselves, with the decision and execution phases not being replaced by the platform, then its overall risk boundary is relatively controllable.

5. The Impact of "Black Technology" Leading to Multiple Punishments

The reason Company S's software could quickly assist customers in automated stock trading is that it purchased an external program from hacker Han, who developed the external program into its company software and deployed it on the company's server, allowing Company S's account to bypass the relevant technical protection measures of Tongdazhin software (market data terminal provider), illegally accessing the broker's server to conduct automated stock trading, thus charging customers for interface usage service fees.

In this regard, Han was sentenced to three years for providing programs that intrude into computer information systems. Mr. Zhong, the actual controller of Company S, and Mr. Kong, the company's technical head, were both punished for illegal operation and copyright infringement.

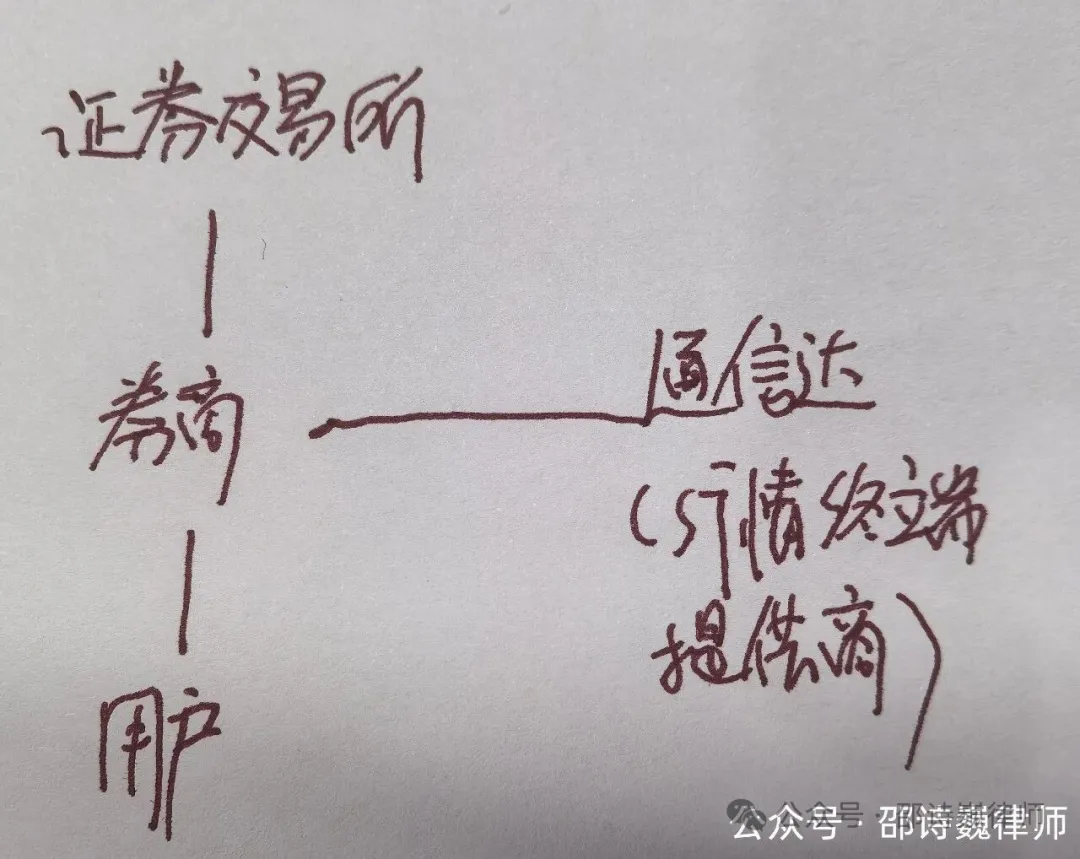

The reason lies in that, under the compliance framework, the basic structure of securities trading should be:

(I still prefer the most original way of drawing)

The exchange is responsible for trading rules and matching mechanisms, brokers establish customer relationships with investors as the only legal operating entity, and investors participate in securities trading through brokers. Communication and trading terminal service providers like Tongdazhin provide technical tool support for brokers and investors, and do not participate in securities business operations or establish securities service relationships with investors.

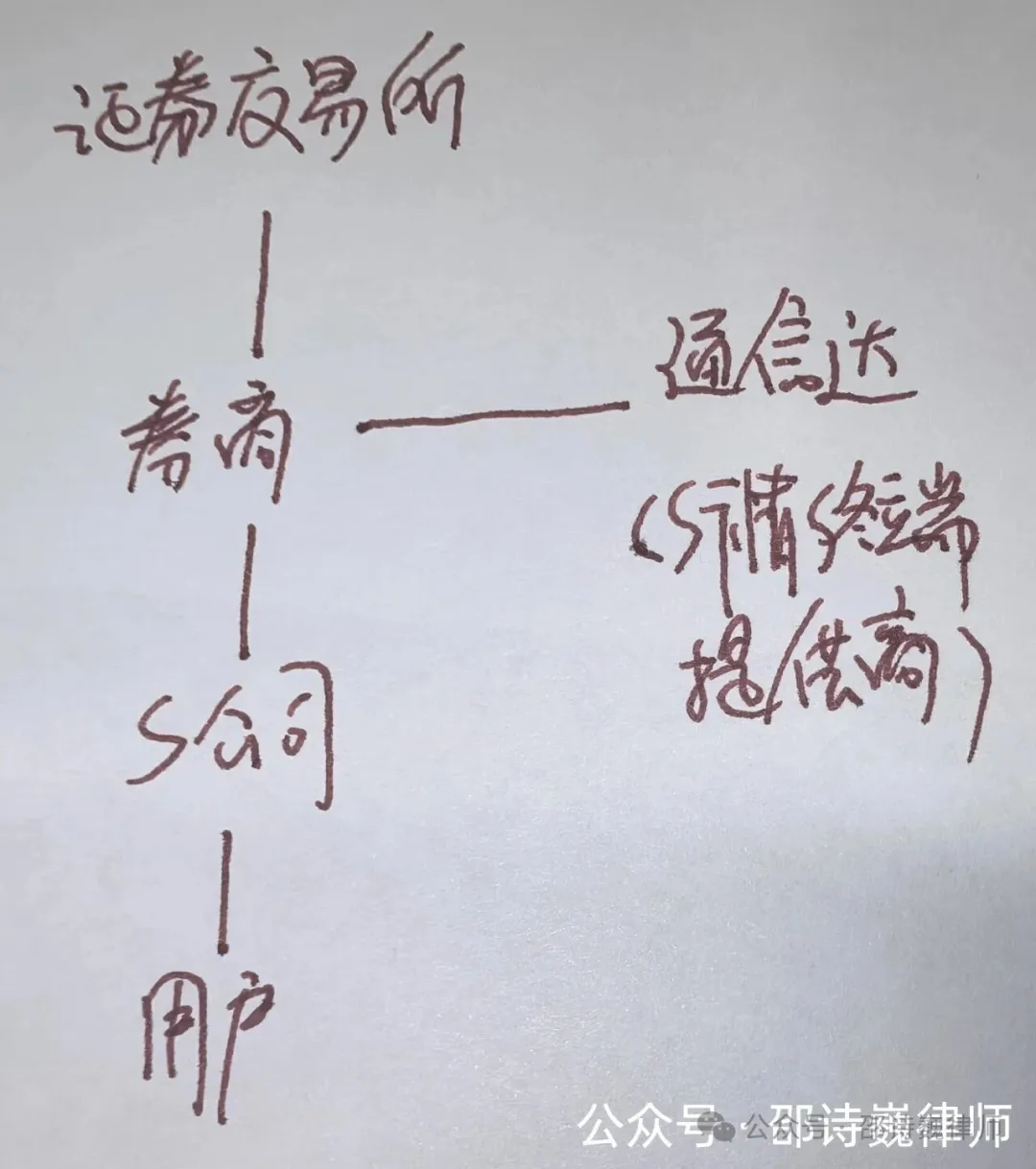

However, in this case, due to the involvement of Company S, the structure evolved into:

Investors first establish a trading relationship with Company S, purchasing so-called "interval arbitrage" and "stock trading robot" products and services. Company S then illegally accesses the broker's trading channel by cracking the Tongdazhin interface program and bypassing normal technical protection measures, completing automated trading operations, and continuously charging investors for profits.

In this structure, brokers and Tongdazhin are not the organizers or beneficiaries of the business, but are passively utilized as "objects" in its technical path. The entity that truly builds the business model, controls the trading path, forms a charging closed loop, and profits from it is always Company S itself.

6. Risk Warning for AI Entrepreneurs and Programmers:

This case of a technology company being sentenced for "AI stock trading software" essentially exposes the blurred boundaries of compliance for many AI entrepreneurial projects, quantitative trading products, and financial technology tools.

For AI entrepreneurs, company leaders, technical partners, programmers, and even product managers, if you are engaged in or plan to enter related fields, it is advisable to carefully evaluate your products and business models to ensure they do not touch the regulatory boundaries of securities business, avoiding being misjudged as investment consulting or disguised operation of securities business.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。