I. Outlook

1. Summary of Macroeconomic Aspects and Future Predictions

Last week, the core feature of the U.S. macro environment was the release of inflation data and the market's recalibration of interest rate cut expectations. The inflation-related data for December released during the week showed a generally mild performance without a significant rebound, but the service items and wage-related components still exhibited some stickiness, making the path for inflation to decline appear "slow and not smooth."

Looking ahead, the market's focus will shift from "whether to cut interest rates" to whether the pace of rate cuts will be delayed. With inflation not quickly returning to target and employment only moderately cooling, the Federal Reserve is likely to maintain a wait-and-see approach in the short term, awaiting more data to confirm whether the economic slowdown is sustainable.

2. Market Changes and Warnings in the Cryptocurrency Industry

Last week, the core feature of the cryptocurrency market was a noticeable weakening after repeated resistance at key pressure points. Bitcoin attempted to rise multiple times but failed to effectively break through and stabilize, with selling pressure continuing to concentrate and ultimately triggering a price drop, returning to the previous range of fluctuations. During the decline, trading volume increased, indicating that it was not merely a volume-reducing pullback, but rather that funds were actively reducing positions at the pressure points. Mainstream coins faced overall pressure, with altcoins experiencing more significant declines, especially the MEME and high-volatility sectors that had previously seen large gains, which quickly retraced after being blocked at pressure points, leading to a rapid cooling of market risk appetite.

From a risk perspective, the failure at the pressure points reinforces the judgment of "a rebound rather than a reversal." As long as Bitcoin cannot effectively break through and stabilize at the critical threshold of $100,000, the market may continue to maintain a weak oscillating structure, or even continue to test support levels downward. Coupled with the fact that the macro data verification period has not yet ended, if liquidity expectations change unfavorably, further attempts near the pressure points may continue to evolve into selling triggers. Overall, the cryptocurrency market remains in a defensive phase below the pressure points in the short term, and caution is warranted regarding the emotional and price exhaustion caused by repeated resistance.

3. Industry and Sector Hotspots

Total funding of $15.93 million, led by A16z and Paradigm, with participation from Hashkey—Aztec, a privacy-focused Ethereum Layer 2 network based on zero-knowledge proofs; total funding of $2.2 million, led by Robot Ventures, with participation from Solana—Asgard aims to become the "Credit Layer" of Solana DeFi, releasing DeFi capital efficiency through on-chain credit.

II. Market Hotspot Sectors and Potential Projects of the Week

1. Overview of Potential Projects

1.1. Brief Analysis of Total Funding of $15.93 Million, Led by A16z and Paradigm, with Participation from Hashkey—Aztec, a Privacy-Focused Ethereum Layer 2 Based on Zero-Knowledge Proofs

Introduction

Aztec is a privacy-focused Ethereum Layer 2 network that combines zero-knowledge rollups with programmable privacy to enable encrypted smart contracts. It allows developers to build applications with default privacy, ensuring that data—including balances, transactions, and business logic—inherits Ethereum's security while maintaining privacy.

Aztec employs a hybrid execution model that supports the simultaneous operation of public and private functions within the same contract, unlocking numerous use cases such as privacy DeFi, confidential payments, secure identity processes, and compliance-friendly privacy applications. Its innovative zk architecture significantly reduces gas costs while achieving end-to-end encryption, providing infrastructure-level support for the large-scale implementation of privacy applications.

Core Mechanism Overview

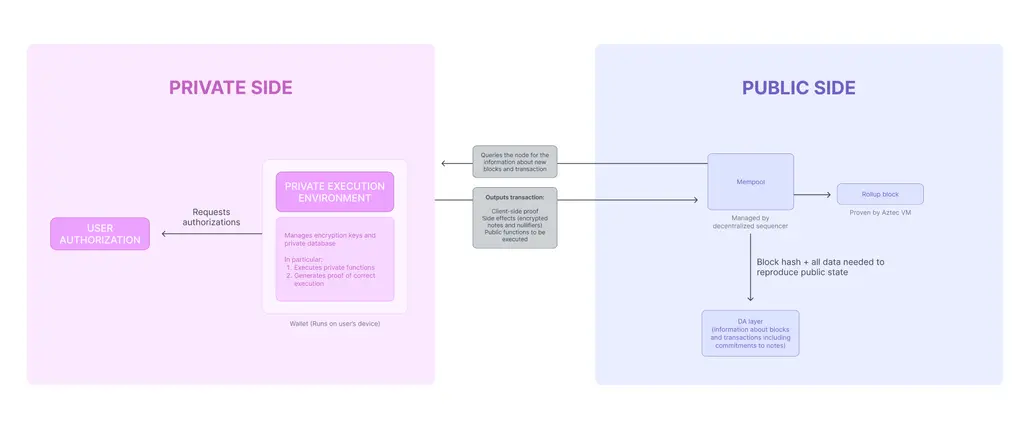

Aztec adopts a dual execution environment architecture of "private first, public last": private computations are completed locally by users and generate zero-knowledge proofs, while public computations are executed by network nodes, ultimately packaged and verified on Ethereum.

1. Aztec Transaction Process (From User to Ethereum)

Users initiate transactions through aztec.js

Similar to web3.js / ethers.js, but supports both private and public logic.Private functions are executed locally (PXE)

Completed on the user's device

Generates zero-knowledge proofs locally

Private data does not leave the device

Proof + state updates are submitted to the public execution layer (AVM)

Does not expose private data

Only verifies "you calculated correctly"

Public functions are executed in AVM

Handles public state

Can execute DeFi, settlement, bridging, and other logic

AVM packages blocks and submits them to Ethereum

Includes state changes

Includes zk proofs

Ethereum only verifies, does not view private content

Final Effect:

Ethereum ensures security, Aztec ensures privacy.

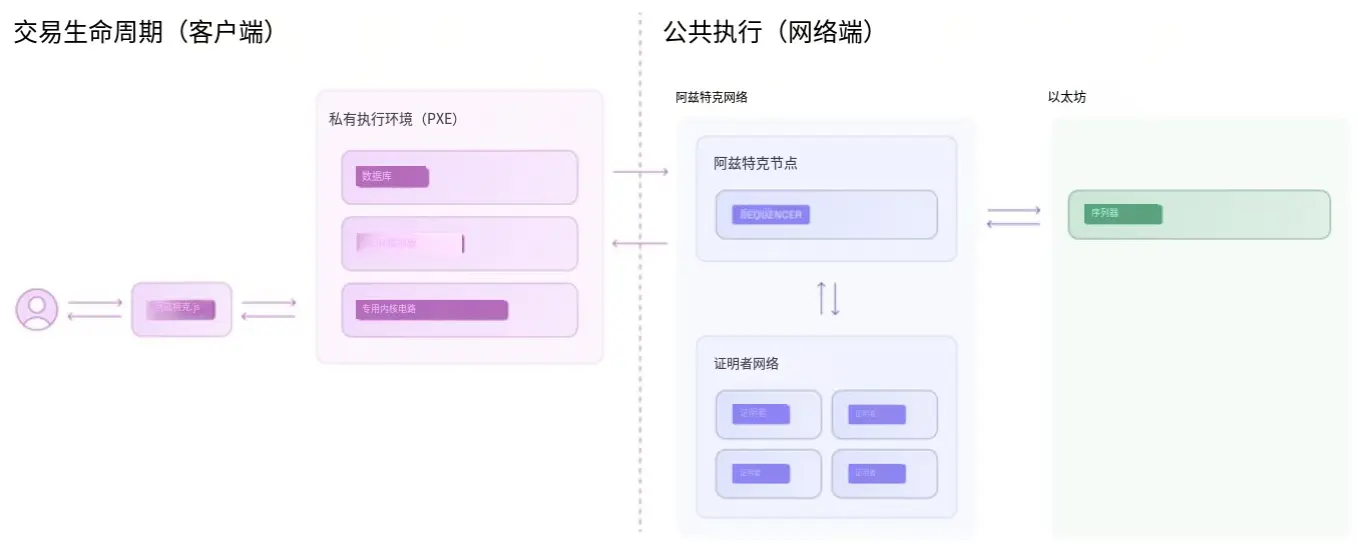

- Dual Execution Environment: Why Split into "Private + Public"

a. Private Execution Environment (PXE, Client)

Core Role: Privacy + Local Computation

Execution Location: User device (browser / local node)

Execution Content:

Private functions

Private state updates

Zero-knowledge proof generation

Management Content:

User keys

Private assets (Notes)

Nullifier (anti-double spending)

Benefits

Private data is never uploaded

No issue of "nodes spying on transactions"

True end-to-end encrypted execution

Costs

Poorly written private logic can make "proofs expensive"

High requirements for developers (Noir optimization is crucial)

b. Public Execution Environment (AVM, Network)

Core Role: Consensus + Composability

Execution Location: Aztec node network

Similar to: EVM

Execution Content:

Public functions

Public state changes

Rollup packaging

Key Rules (Very Important)

Private functions → can call public functions

Public functions → cannot call private functions

Reason:

To prevent private data from being reverse-engineered

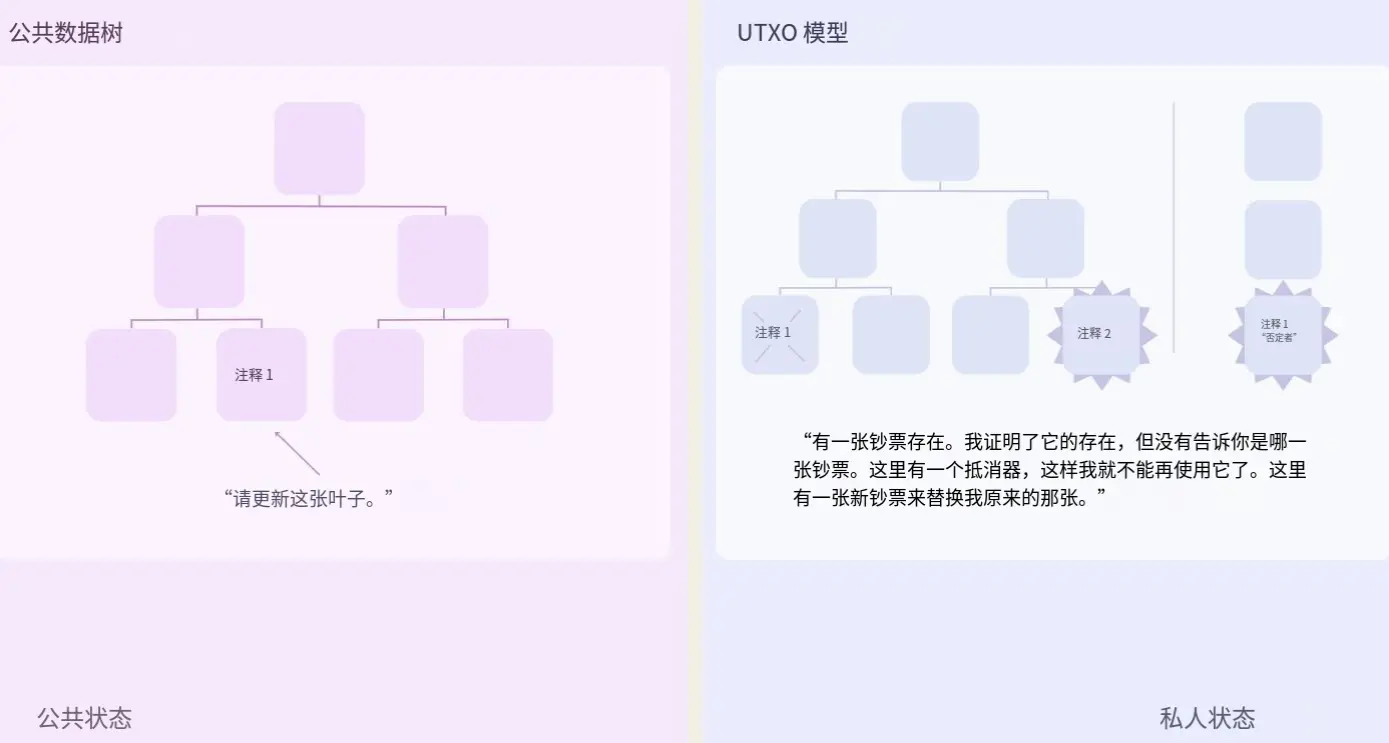

- Private State vs Public State (Essential Differences)

a. Private State (UTXO / Notes Model)

Data Form: Notes (similar to UTXO)

Storage Structure:

Note Tree (append-only)

Nullifier Tree (cancellation markers)

Operation Method:

Create commitments

Generate nullifiers upon cancellation

Characteristics

Strong privacy

Not directly queryable

More like "encrypted asset certificates"

b. Public State (Account Model)

Similar to Ethereum

Direct read/write

Stored in Public Data Tree

Characteristics

High composability

Easy integration with DeFi

No privacy protection

- Account and Key System

a. Native Account Abstraction (AA)

Each account is a smart contract

Customizable:

Signature logic

Nonce management

Gas payment methods

Multi-signature / social recovery

No "default EOA private key."

b. Three Sets of Keys (For Privacy Services)

Each account has three sets of keys:

- Nullifier Key

Prevents double spending

Incoming Viewing Key

Used for receiving assets

Outgoing Viewing Key

Allows self-viewing of outgoing records

Implementation:

Others cannot see you

You can still keep accounts

Compliance can choose to disclose selectively

- Noir: Aztec's "Privacy Solidity"

Zero-knowledge dedicated DSL

Used to write:

Private contracts

zk circuits

Characteristics:

Default provable

Strongly typed

Designed for privacy

Tron Comments

Aztec's core advantage lies in its "privacy-native" architecture: by placing private computations on the user's local device and delegating public execution to the network, while connecting the two with zero-knowledge proofs, it achieves default encrypted smart contracts, end-to-end privacy protection, and compliance-friendly optional disclosure, while still inheriting Ethereum's security and significantly reducing gas costs in privacy scenarios. However, its disadvantages are also evident—high technical complexity, steep development thresholds (Noir and provable programming require a completely new mindset), and client-side execution demands higher requirements for user devices and toolchains. The ecological maturity and general composability are currently weaker than mainstream EVM L2, making it more suitable for high-end DeFi and institutional applications with extremely high privacy, security, and compliance requirements, rather than the current low-threshold mass application scenarios.

1.2. Interpretation of Total Funding of $2.2 Million, Led by Robot Ventures, with Participation from Solana—Asgard, a Solana Credit Layer Infrastructure to Release DeFi Capital Efficiency through On-Chain Credit

Introduction

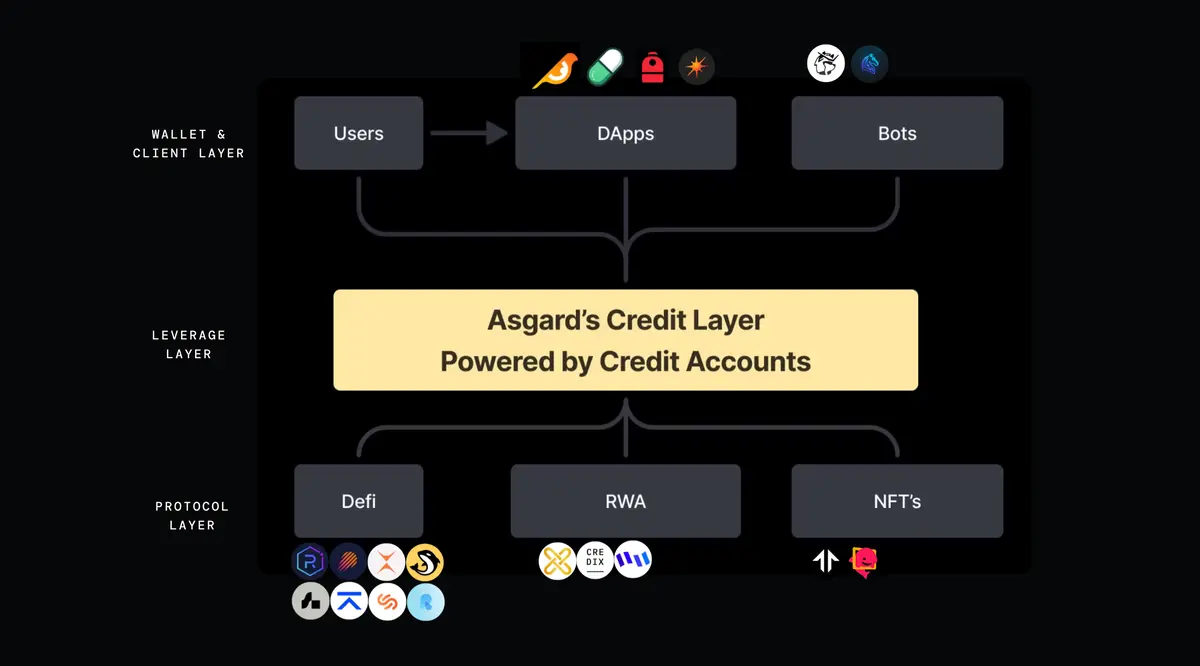

Asgard is a DeFi protocol built on Solana, aiming to become the "Credit Layer" of Solana DeFi by introducing composable credit mechanisms to enhance the capital efficiency of the entire Solana ecosystem.

Overview of Credit Layer Architecture

- Credit Synthesizer

Without altering the security of existing over-collateralized lending protocols, it synthesizes "quasi-credit" positions with higher capital efficiency, allowing users to achieve greater exposure with the same principal.

Core Idea

Traditional lending protocols follow an invariant: deposit X, and you can withdraw at most ≤ X in value. Asgard overlays leverage on this rule through structured operations, transforming X into a position with a value > X.

Two Key Paths

- Recursive Deposits (Looping)

Collateralize assets

Borrow another asset

Exchange back to the original collateralized asset

Re-collateralize and repeat

Problem: cumbersome operations, high slippage, large fees, and extremely low manual execution efficiency

Flash Loans

Borrow precisely calculated temporary funds in one go

Complete collateralization, borrowing, and re-collateralization in a single atomic transaction

Immediately repay the flash loan with the borrowed funds

Advantages: one-click completion, efficient, low slippage, low friction

Key Breakthrough

Flash loans not only enhance capital efficiency but also expand the design space of lending

Not only can you "leverage buy tokens," but you can also:

Collateralize to purchase NFTs (e.g., Mad Lads)

Future support for tokenizable real-world assets (e.g., real estate)

The reason is: NFTs are non-fungible, while flash loans allow for "whole mortgage-style purchases" to be completed in a single transaction, which recursive deposits cannot achieve.

Phase Significance

The Credit Synthesizer lays the foundation for Asgard to build the Solana DeFi Credit Layer, marking the first step from "over-collateralization" to "structured credit."

2. Prime Brokerage

Building on Phase 1, it further expands the upper limit of decentralized "quasi-unsecured" credit, providing users with higher leverage and capital efficiency without sacrificing protocol security.

Core Concept: Borrowing in a Bubble

Asgard's core idea is to create a controlled lending environment:

Appears to be low collateral / quasi-unsecured

Technically always maintains over-collateralization

The ultimate control of assets remains with the protocol

It's like borrowing money in a "bubble":

You can operate freely within the bubble, but funds cannot escape the bubble.

TradFi Counterpart: Prime Brokerage

In traditional finance, a prime broker:

Provides clients with leverage and financing

Executes trades on behalf of clients

Strictly limits the use of funds and risk exposure

Asgard natively transfers this model on-chain:

The protocol does not directly transfer money to the user's wallet

Instead, it places it in a restricted on-chain account

All operations are executed within clearly defined rule boundaries

Algorithmic Security

Achieving security through code rather than trust:

Malicious exit is impossible: the code does not allow it

Funds cannot be transferred arbitrarily

Only permitted operations can be executed

The ultimate effect is:

The protocol remains controllable

Users still have a high degree of strategic freedom

Risks are confined to a calculable, manageable range

Result: Higher LTV → Higher Leverage → Higher Capital Efficiency

Key Components

- Credit Accounts

Restricted smart contract wallets

Hold both user collateral and borrowed funds

Prohibit arbitrary withdrawals or transfers to external wallets

- Whitelisted Protocols

Only allows interaction with selected DeFi protocols and assets

Balances yield opportunities with risk control

- Risk Assessment Engine

Real-time assessment of asset risk and strategy risk

Dynamically adjusts available leverage and position boundaries

- Liquidation Mechanisms

Automated liquidation processes

Ensures that from the protocol's perspective, it is always "over-collateralized"

Even if users experience a "quasi-unsecured experience"

Phase Significance

Phase 2 upgrades Asgard from a "leverage synthesizer" to a credit infrastructure on Solana:

Natively implements TradFi's Prime Brokerage

Safely releases higher leverage in DeFi

Lays the foundation for a true on-chain credit market

This is a key transitional phase for Asgard to become the Solana Credit Layer.

Tron Comments

Asgard's core advantage lies in its credit-centric design philosophy, providing users with high leverage and capital efficiency that approaches an unsecured experience through flash loans, recursive synthesis, and the Prime Brokerage model of "controlled accounts + algorithmic security," significantly expanding the design space of Solana DeFi, especially suitable for complex strategies and "mortgage-style" use of NFTs/non-standard assets;

However, its disadvantages are also evident—complex system structure, reliance on detailed risk assessment and whitelisting governance, and any deviation in parameter design or protocol integration could amplify systemic risks in extreme market conditions. Meanwhile, the "controlled environment" also somewhat limits the complete freedom of DeFi composability, posing a higher understanding and usage threshold for ordinary users.

2. Key Projects of the Week

2.1. Detailed Explanation of Total Funding of $52 Million, Led by Multicoin and CoinFund—One-Stop Cross-Chain Liquidity Routing and Asset Exchange Infrastructure LI.FI

Introduction

LI.FI is a cross-chain liquidity aggregation protocol that connects developers and users to various cross-chain bridges, DEXs, and decentralized liquidity sources through a unified API, SDK, or component (Widget). It supports the exchange and transfer of any asset to any asset across 30+ blockchains, finding the optimal price, lowest cost, and highest security path through smart routing between different bridges and exchanges. LI.FI completely abstracts the complexity of underlying cross-chain bridges and DEXs, allowing applications to provide users with a seamless one-stop cross-chain exchange and asset transfer experience at a very low integration cost.

Architecture Overview

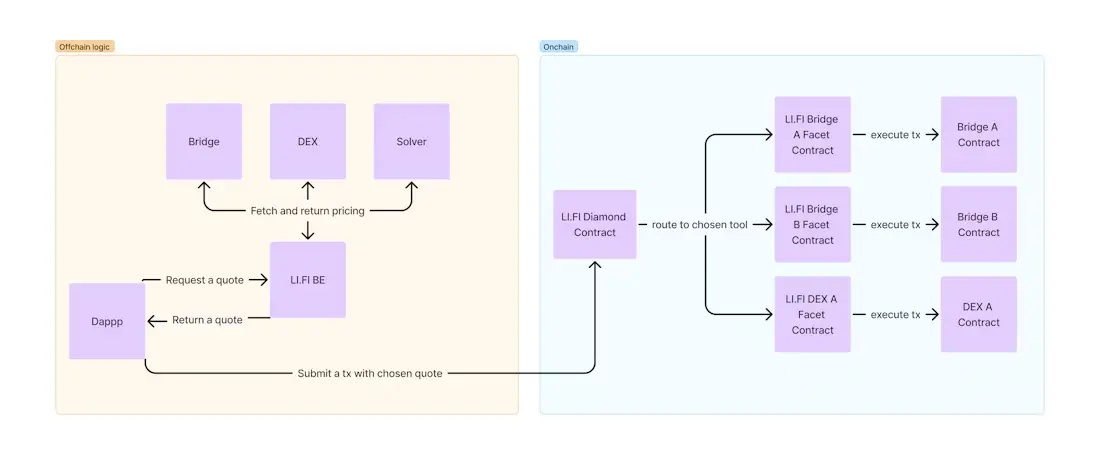

LI.FI is a multi-chain liquidity aggregation and smart routing layer that helps dApps and users complete optimal asset exchanges and cross-chain transfers across multiple chains through off-chain routing + on-chain modular execution.

Core Component Breakdown

- dApp Interface (Integration Party)

The front end that users interact with directly.

Initiates quote and path requests to the LI.FI API

After user confirmation, the dApp initiates the on-chain transaction

- LI.FI API (Off-Chain Aggregation and Routing Layer)

The brain of the system, responsible for "calculating routes."

Requests quotes from multiple bridges, DEXs, and Solvers

Compares prices, fees, and security

Returns the optimal trading path to the dApp

- LI.FI Diamond Contract (On-Chain Entry)

A unified entry for on-chain execution.

Receives transactions submitted by the dApp

Distributes transactions to corresponding modules (Facet) based on the path

Uses a Diamond structure for easy expansion and upgrades

- Facet Contracts (Functional Modules)

The adaptation layer for different types of liquidity:

Bridge Facet: Interfaces with cross-chain bridges

DEX Facet: Interfaces with single-chain DEXs

Solver Facet: Interfaces with market makers / advanced liquidity

- Underlying Liquidity Protocols

The bridge, DEX, or Solver contracts that ultimately execute the transactions.

Complete Transaction Process (End-to-End)

User initiates a request: requests cross-chain or single-chain exchange in the dApp

Path Calculation: LI.FI API aggregates multiple quotes and selects the optimal path

Submit Transaction: After user confirmation, the transaction is sent to the Diamond contract

On-Chain Execution: Diamond → Corresponding Facet → Actual Liquidity Protocol

Asset Arrival: Transaction completed, assets returned to the user

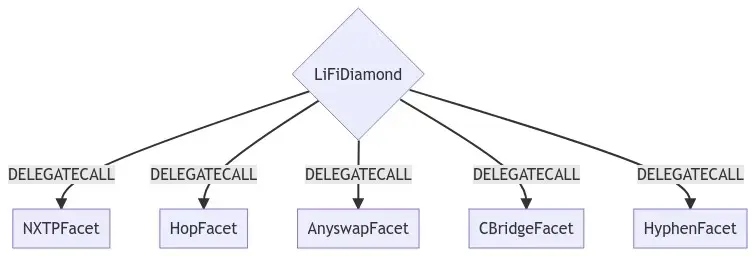

Smart Contract Architecture

LI.FI's on-chain contracts are built using the EIP-2535 (Diamond / Multi-Facet Proxy) standard, modularly executing different business logic through a unified entry contract.

Core Design Philosophy

Single entry, multi-module execution

All user interactions enter the LI.FI Diamond contractModularization of business logic (Facet)

Different functions (cross-chain, DEX, Solver) are split into independent Facet contractsDelegatecall execution

The Diamond contract calls the logic in the Facet using DELEGATECALLScalable and upgradeable

Adding or replacing Facets does not require migrating the main contract or user assets

Contract Execution Process

Taking the use of Stargate for cross-chain as an example:

The user calls the LI.FI Diamond contract

The Diamond identifies the target Facet based on the function selector

Calls StargateV2Facet

StargateV2Facet further calls the official Stargate contract

Completes the cross-chain asset transfer

Users always interact only with the Diamond contract, and the underlying complexity is completely abstracted.

Facet Contracts (Business Modules)

All core business logic is written in src/Facets

Different Facets correspond to different liquidity sources or functions

Bridge Facet

DEX Facet

Solver Facet

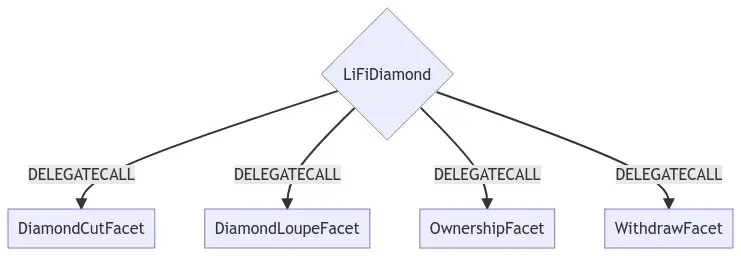

Diamond Helper Contracts

Deployed alongside the Diamond contract, used for:

Adding / upgrading / removing Facets

Managing method-to-Facet mappings

Contract ownership and permission control

Asset and fee extraction

These mechanisms all follow the EIP-2535 standard design.

Tron Comments

LI.FI's core advantage lies in its strong cross-chain abstraction and engineering capabilities: through a unified API and Diamond contract architecture, it aggregates a large number of bridges, DEXs, and Solvers, providing applications and users with optimal routing for any chain and any asset, significantly reducing the integration and usage costs of cross-chain and multi-step transactions, while maintaining high scalability and maintainability;

However, its disadvantages are also clear— the system is highly dependent on off-chain routing and pricing layers, has high architectural complexity, and requires a higher understanding cost and operational requirements from developers. Additionally, cross-chain itself still inherits the security risks of underlying bridges and external protocols; if any integrated component encounters issues, the overall experience and risk exposure may be affected.

Industry Data Analysis

1. Overall Market Performance

1.1. Spot BTC vs ETH Price Trends

BTC

ETH

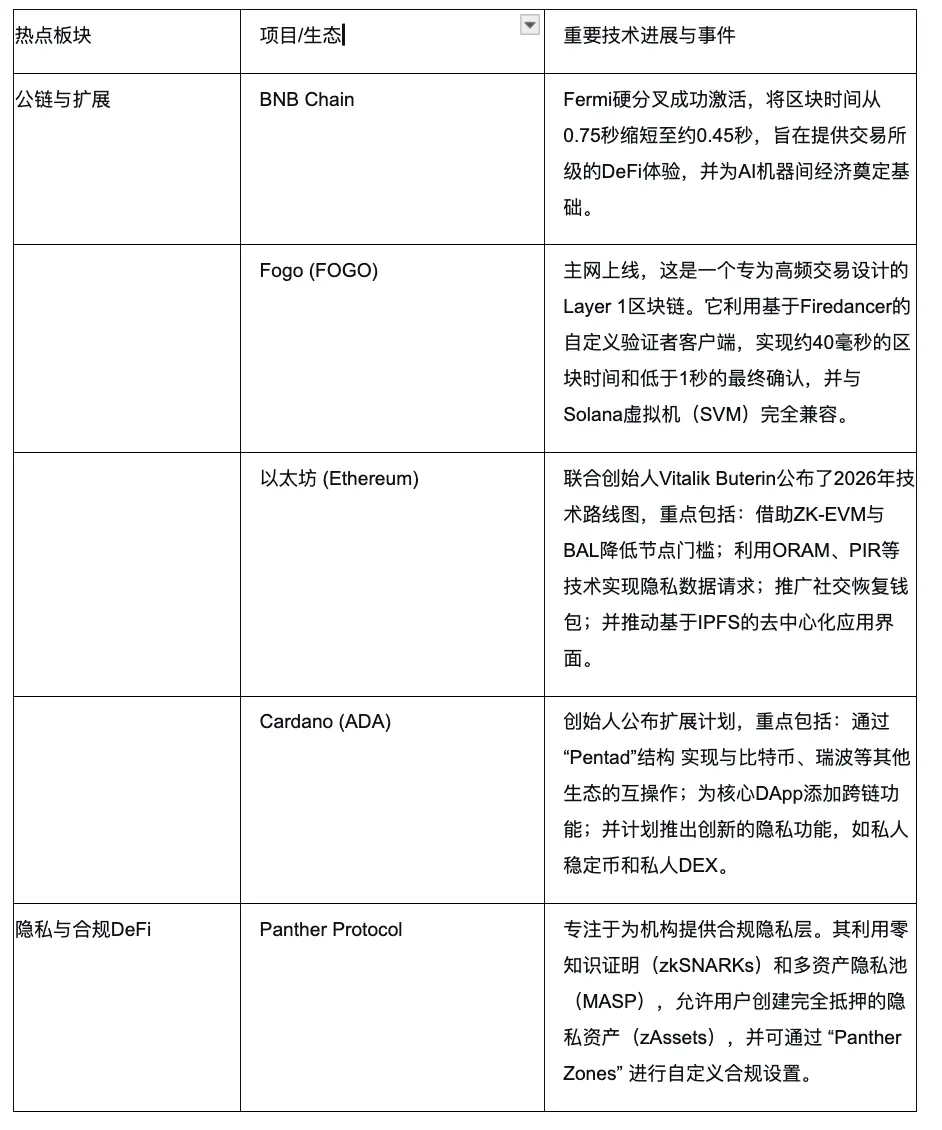

2. Summary of Hot Sectors

Macro Data Review and Key Data Release Nodes for Next Week

Last week, the U.S. December unadjusted CPI year-on-year data showed that inflation continues to exhibit a moderate decline but has not rapidly decreased. The overall CPI year-on-year rate further declined from the previous month, mainly dragged down by falling energy prices and ongoing weakness in goods inflation, indicating that the previous high inflation's transmission effect on the real economy is weakening. However, at the same time, housing and some service prices remain relatively resilient, making the path of inflation decline appear slow and uneven.

This result reinforces the market's judgment of "downward inflation trend but still sticky," and provides a basis for the Federal Reserve to maintain a wait-and-see approach, awaiting more confirmation signals—neither forcing it to quickly cut interest rates nor reducing the necessity to tighten policies again.

Regulatory Policies

United States: Key Legislation Enters Review Process

Core Progress: A legislative draft called the "Digital Asset Market Clarity Act" was published on January 12 and is scheduled for debate and revision by the Senate Banking Committee on January 15.

Key Points of the Bill: The bill aims to clarify regulatory responsibilities, specify when cryptocurrencies should be classified as securities or commodities, and plans to authorize the U.S. Commodity Futures Trading Commission (CFTC) to regulate the spot cryptocurrency market. The bill also addresses stablecoin regulation, proposing to prohibit companies from paying interest solely because customers hold stablecoins, but allowing rewards linked to specific activities such as payments and staking.

Market Impact: This move is seen as a key step towards seeking long-term regulatory certainty. However, due to changes in the political agenda of Congress, there remains uncertainty about whether the bill will ultimately pass.

France / European Union: Compliance Phase-Out Under MiCA Regulations

Regulatory Dynamics: As part of the EU's "Markets in Crypto-Assets" (MiCA) regulations, French regulators are intensifying the implementation of licensing requirements.

Specific Progress: Among approximately 90 cryptocurrency companies registered in France, 40% of unlicensed companies have not applied for MiCA licenses, and another 30% have not responded to regulatory inquiries. Regulators have warned that these non-compliant companies may be required to shut down by July 2026. This reflects that after unifying the EU market, MiCA regulations are entering a strict enforcement phase.

Kazakhstan: Signed Bill to Relax Regulations

Policy Direction: The president signed the "Law on Banks and Banking Activities" and the "Amendment on Financial Market Regulation and Development" on January 16.

Key Content: The new law aims to relax cryptocurrency trading rules and formally defines digital financial assets as new asset categories, including stablecoins and tokenized physical assets. In the future, the National Bank of Kazakhstan will be responsible for issuing exchange licenses and establishing a compliance token list.

Thailand: Plans to Strengthen Anti-Money Laundering Tracking

- Regulatory Plan: Reports indicate that Thailand plans to strengthen cryptocurrency reporting requirements, implement the Financial Action Task Force's "travel rule," and plans to establish a national data center to track illegal funds flowing between traditional finance and digital assets.

Nigeria: Incorporating Exchanges into Tax Reporting System

- Tax Reform: Nigeria has initiated tax reforms, incorporating cryptocurrency exchanges into an identity-based tax reporting system. This move aims to reshape the integration of digital assets with the traditional economy and strengthen tax regulation.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。