Author: The Kobeissi Letter

Translated by: Jesse

This is an in-depth analysis from The Kobeissi Letter regarding the Greenland tariff incident and Trump's "tariff strategy."

Is the Trade War Resurrected by New Tariffs on Greenland?

Just now, President Trump announced new tariffs on the EU and confirmed his primary strategic goal: the acquisition of Greenland. This includes a new 10% tariff on Denmark, Norway, Sweden, France, Germany, the UK, the Netherlands, and Finland starting February 1.

Additionally, these tariffs will be raised to 25% on June 1 and will never be lifted before a Greenland agreement is reached. According to Trump, this deal must be a "complete and comprehensive purchase" of Greenland.

Before analyzing our precise strategy, it must first be pointed out that the trade war has become a "cyclical headwind." Tariffs always return when the market least expects it, only to gradually dissipate. This is a product of President Trump's "tariff strategy," which is carefully designed.

A recent case occurred on October 10, when President Trump threatened to impose a 100% tariff on China starting November 1 (just 21 days after the announcement). This timeline may sound familiar, as it is an integral part of the strategy manual. After the announcement, S&P 500 futures widened their decline to -3.5% before the weekend close.

October 10 - Trump threatens 100% tariffs on China

President Trump always begins with punitive and threatening messages as part of his negotiation tactics. Moreover, this tactic works well for him. In the October confrontation with China, it ultimately ended with the signing of a new trade agreement and China lifting restrictions on rare earth exports, which Trump stated were harming the U.S.

This time, the statement was released on Saturday, while the market futures would not open until Monday evening (as Monday is a federal holiday). The market's reaction may accompany a similar "emotional sell-off," but considering there is time to digest the news, the impact may be lighter.

All of this is part of President Trump's "tariff strategy," which we will detail below:

Tariff Strategy Manual

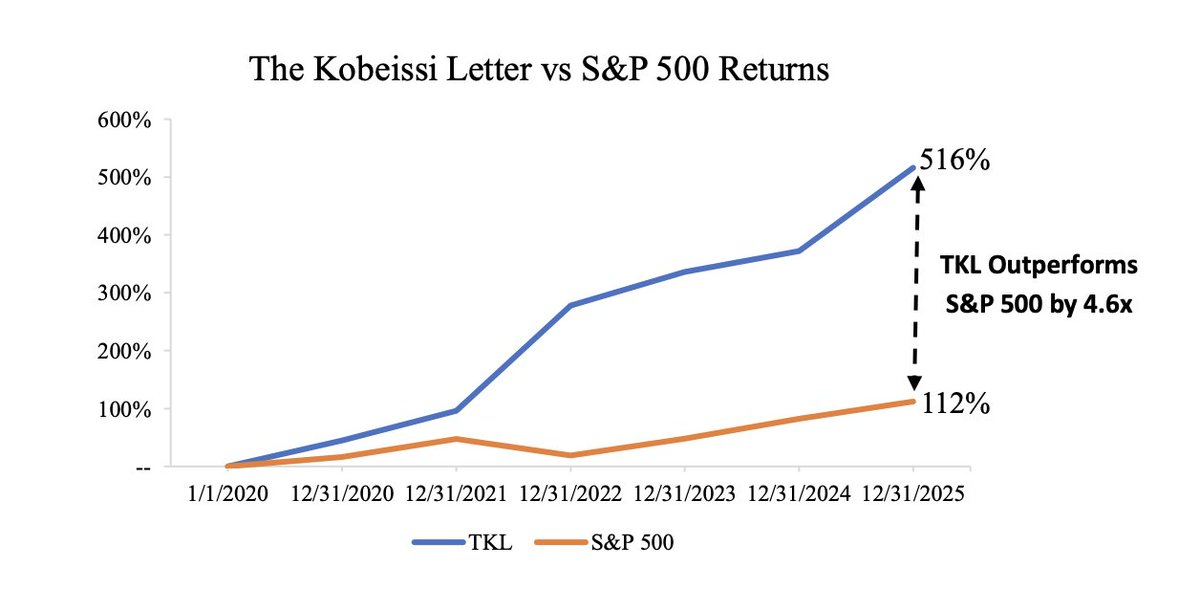

By 2025, our investment strategy returns were nearly double that of the S&P 500 index, largely because we capitalized early on the price fluctuations of assets during the trade war. Here are the specific response strategies we have consistently employed:

A comprehensive step-by-step guide to responding to Trump's trade war:

Friday: President Trump releases a vague message hinting at tariffs on specific countries or industries. As uncertainty increases, the market declines. This event began with Trump threatening tariffs on Denmark on Friday.

Later that day or shortly after (this time on Saturday): President Trump announces a massive new tariff, usually over 25%.

Saturday and Sunday: President Trump repeatedly escalates tariff threats during market closures to maximize psychological impact.

During the weekend: The targeted countries typically respond publicly or signal a willingness to negotiate.

Sunday at 6 PM EST (this time on Monday evening): Futures open, and the market reacts emotionally to the tariff headlines, causing futures prices to drop.

Monday and Tuesday: President Trump continues to publicly apply pressure, but investors begin to realize that the tariffs have not yet taken effect and that there are still weeks until implementation (e.g., February 1).

Wednesday of the same week: Bottom-fishing buyers step in, triggering a relief rally, but this trend often fades and leads to another wave of decline. This is usually when "smart money" starts to buy in.

The following weekend (about a week later): President Trump posts that negotiations are ongoing, and he is seeking solutions with the leaders of the targeted countries.

That weekend's Sunday at 6 PM: As optimism returns, futures open significantly higher, but the gains recede after the Monday spot market opens.

After Monday's opening: Senior government officials, including Treasury Secretary Bessent, appear on live television to reassure investors and emphasize progress in the agreement.

The next 2-4 weeks: Officials at various levels of the Trump administration continue to reveal progress on the trade agreement.

Ultimately: The trade agreement is officially announced, and the market reaches all-time highs.

Cycle: Repeat from step 1.

Of course, this is not a 100% guaranteed roadmap, but based on our experience, almost all trade war outbreaks since January 2025 have followed a roughly similar path.

Note: This time, President Trump's plan to acquire Greenland is undoubtedly a higher demand than asking China to reduce export controls. Therefore, the execution of this strategy may take longer, but it will follow a similar sequence of events.

Timing is Key

President Trump's entire negotiation strategy revolves around timing and pressure. He provides a 2-3 week buffer before tariffs take effect to reach an agreement. Trump's goal is to ensure that these tariffs never truly take effect; what he wants is a deal. This also explains why these announcements increasingly appear on weekends when the market is closed. He pushes the threats to the edge. That’s why they work: if they actually take effect and persist, they would have the power to shake the market and change the world.

In the last round of the trade war with China, President Trump announced a new trade agreement with China on November 1—exactly the day the 100% tariff was originally set to take effect.

Ultimately, those who can remain objective and follow the process during the fluctuations of the trade war are achieving the best trading environment ever.

As mentioned earlier, this objective, systematic approach has allowed our performance to surpass market benchmarks. As shown in the chart below, since 2020, our investment strategy's return rate is nearly five times that of the S&P 500 index.

Conclusion

This time, President Trump's plan to acquire Greenland is indeed a higher demand than previous requests. The market turmoil may last longer, but we want to emphasize the original point: the best traders are profiting from the asset price fluctuations triggered by trade war headlines.

Volatility is opportunity.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。