Daily market key data review and trend analysis, produced by PANews.

1. Market Observation

Due to the U.S. market being closed for Martin Luther King Jr. Day, global market focus has shifted to geopolitical tensions. U.S. President Trump announced that to promote the acquisition of Greenland, he will impose a 10% tariff on Denmark, Norway, and six other European countries starting February 1, with plans to increase the rate to 25% on June 1. Trump stated that the tariffs will remain in effect until a "complete acquisition of Greenland" agreement is reached. This move has drawn strong condemnation from several European countries, labeling it as "extortion," and threatening retaliatory measures, leading to heightened market concerns over a new round of trade wars and a rapid increase in risk-averse sentiment. As a result, spot gold prices surged over 2% during the day, reaching a historic high of $4,690 per ounce; spot silver also rose more than 4%, setting a new record of $94 per ounce. Bank of America Chief Investment Strategist Michael Hartnett believes that Trump is driving global fiscal expansion, creating a "new world order = new world bull market," with gold and silver bull markets expected to continue, and a long-term gold target potentially breaking $6,000. However, the biggest risk lies in the rapid appreciation of the yen, won, and new Taiwan dollar, which could trigger global liquidity tightening. Looking ahead, the market's attention will be on the upcoming U.S. Senate vote on the cryptocurrency market structure bill and the Supreme Court's ruling on the legality of Trump's use of emergency powers to impose tariffs, both of which will be key variables affecting market direction.

Bitcoin has faced a continuous decline for five days after being blocked at $98,000, dropping below the $92,000 mark this morning, with a low of $91,910. Altcoin Sherpa noted that the macroeconomic environment has a significant negative impact on the crypto market, suggesting that Bitcoin could drop to the lower range of $85,000, and if a reversal does not occur in the coming days, the $80,000 range may become the next target. Doctor Profit insists that Bitcoin has entered a bear market since its peak of $115,000 to $125,000, and the current consolidation is merely a continuation of the decline, with the final target expected to be below $80,000. Mister Crypto warned that if the price drops to $77,000, it would trigger $1.8 billion in long liquidations.

However, on-chain data and technical analysts remain optimistic. Murphy pointed out that although the scale of short-term holders exiting at a loss is nearing panic levels, and long-term holders are increasing their transfers to exchanges, this may be preparing for the next round of upward movement. Cryptoquant analyst DarkFrost added that the selling pressure from OG holders has significantly weakened, with $101,000 being a key cost resistance level for long-term holders, while $81,700 serves as strong support. Technically, Astronomer believes that a higher low is forming around $92,200, maintaining a bullish logic; Sykodelic is going long around $92,300, targeting $100,000; Man of Bitcoin noted that as long as the key support area (such as $92,992) is held, Bitcoin can form another high, while World Of Charts believes that if it fails to hold, it will drop back to the $88,000-$89,000 range.

Ethereum followed the market down, breaking below $3,200, with market sentiment oscillating between bullish technicals and weak fundamentals. Ali Charts analysis indicated that ETH is at the end of a triangular consolidation on the daily chart and must hold the $3,085 support level; if it can break through $3,400, it is expected to rise to $3,660 or even $4,000. Glassnode data shows a rebound in on-chain activity, with active addresses doubling and ETFs accumulating approximately $520 million since the end of December. Etherealize co-founders Vivek Raman and Danny Ryan are bullish in the long term, predicting that ETH could reach $15,000 by the end of 2026. CyrilXBT also believes that the ETH/BTC exchange rate is bottoming out, with long-term support remaining effective. However, short-term risks still exist, as a Cointelegraph report shows that due to declining DApp activity and reduced fees, professional traders hold a neutral to bearish stance, with the derivatives market lacking bullish momentum.

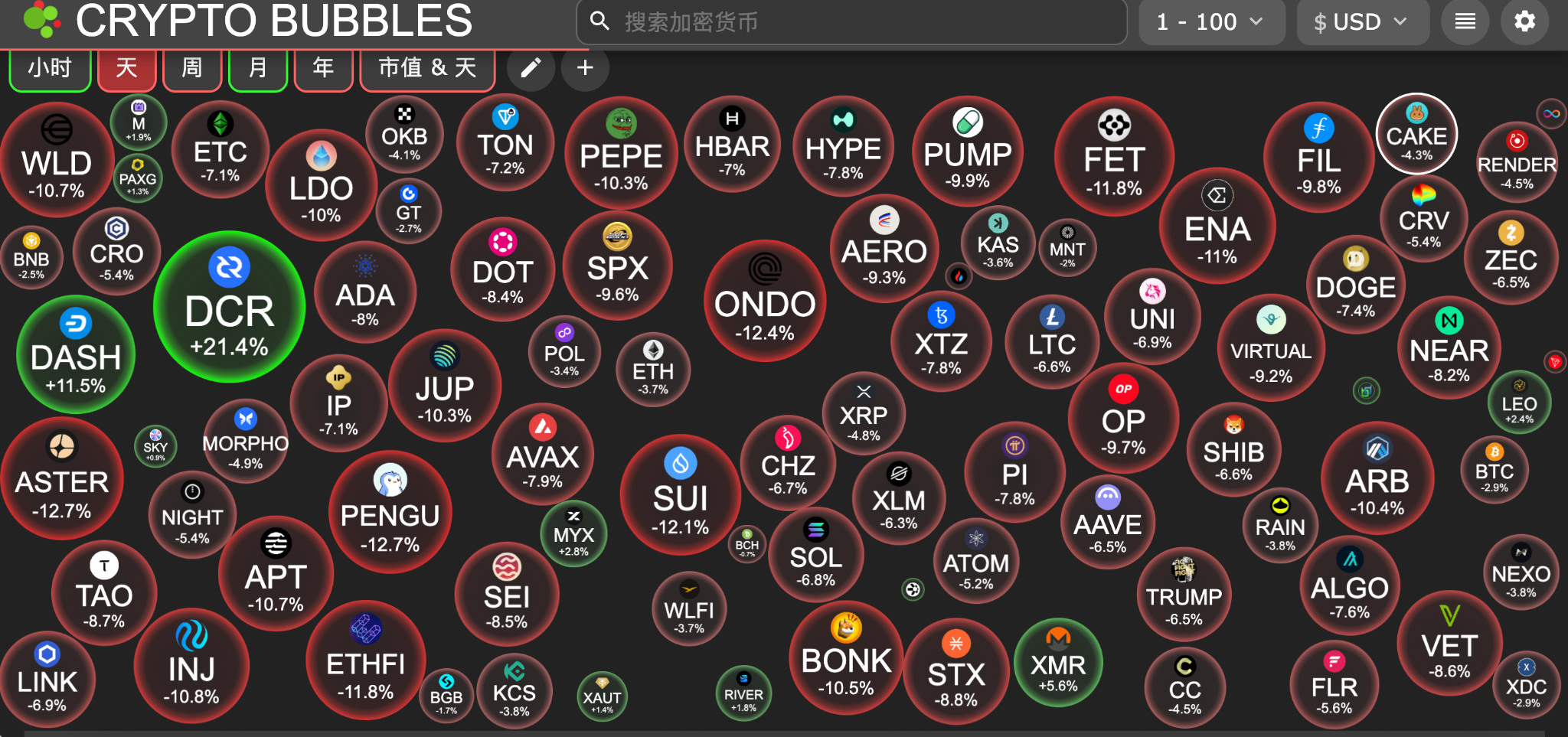

In the face of a complex market environment, well-known trader Eugene stated that he has liquidated his altcoin long positions and shifted to holding core Bitcoin positions and a large amount of cash. Although the altcoin market has seen widespread declines, the privacy sector continues to hold strong, with Monero (XMR) reaching a historic high of $800, DASH hitting a two-month high of $96, and DUSK surging over 70% in the past 24 hours, with a monthly increase of over 360%. Among DeFi projects, FXS gained attention after completing a 1:1 exchange for FRAX on January 15, with a 24-hour increase of over 30%. In the meme sector, the personal token FROG launched by the founder of Wagyu experienced a rollercoaster ride in market value, dropping from $220 million to $35 million, while claiming that Fwog.fun aims to surpass competitor Pump.fun.

2. Key Data (as of January 19, 13:00 HKT)

(Data source: CoinAnk, Upbit, SoSoValue, CoinMarketCap)

Bitcoin: $92,527.2 (YTD +5.5%), daily spot trading volume $37.33 billion

Ethereum: $3,280.38 (YTD +7.6%), daily spot trading volume $25.28 billion

Fear and Greed Index: 49 (Neutral)

Average GAS: BTC: 1.75 sat/vB, ETH: 0.02 Gwei

Market share: BTC 59.1%, ETH 12.4%

Upbit 24-hour trading volume ranking: XRP, AXS, BTC, BERA, ME

24-hour BTC long/short ratio: 48.80% / 51.20%

Sector performance: The crypto market saw widespread declines, with the GameFi sector dropping over 8%

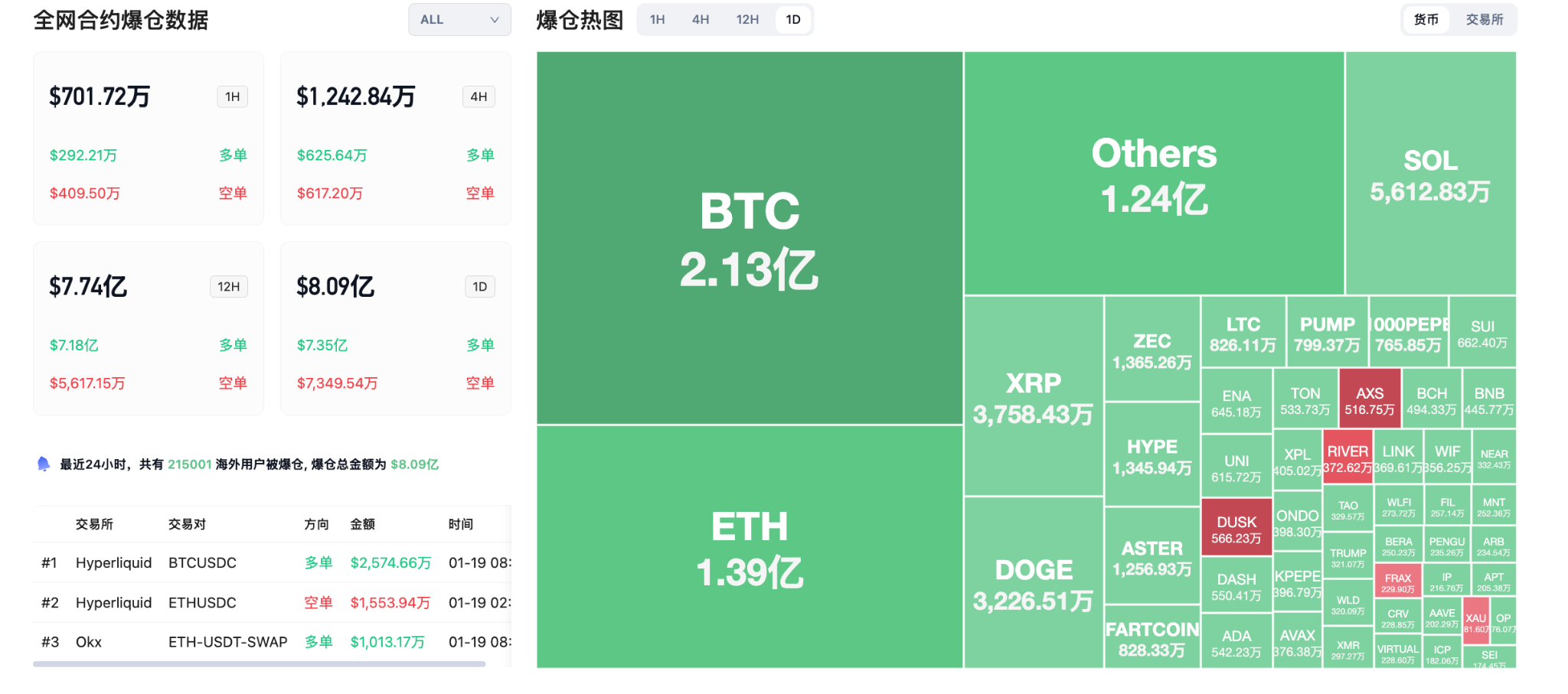

24-hour liquidation data: A total of 215,001 people were liquidated globally, with a total liquidation amount of $809 million, including $213 million in BTC liquidations, $139 million in ETH liquidations, and $37.58 million in XRP liquidations.

3. ETF Flows (as of January 16)

Bitcoin ETF: Net inflow of $1.42 billion last week,

Ethereum ETF: Net inflow of $479 million last week

XRP ETF: Net inflow of $56.83 million last week

SOL ETF: Net inflow of $46.88 million last week

4. Today's Outlook

Binance Wallet plans to launch the SENT Pre-TGE Prime Sale event on January 19

MANTRA: Token code change and 1:4 token split will take place on January 19

U.S. stock market closed on January 19 (Martin Luther King Jr. Day holiday)

LayerZero (ZRO) will unlock approximately 25.71 million tokens at 7 PM on January 20, with a circulation ratio of 6.36%, valued at approximately $44.5 million;

U.S. Q4 GDP (preliminary data) will be released

President Trump calls for a cap on credit card interest rates at 10% starting January 20, 2026, for one year

Today's top gainers among the top 100 cryptocurrencies by market cap: Decred up 21.4%, Dash up 11.5%, Monero up 5.6%, MYX Finance up 2.8%, LEO Token up 2.4%.

5. Hot News

Avalanche active addresses hit a new high, daily active users reached 1.71 million, a surge of 986%

Aster initiates an automatic buyback mechanism, repurchasing 20%-40% of daily income in $ASTER

Trump Token team deposits 381,000 TRUMP into Binance, valued at $2 million

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。