Author: Joseph Chee

Introduction

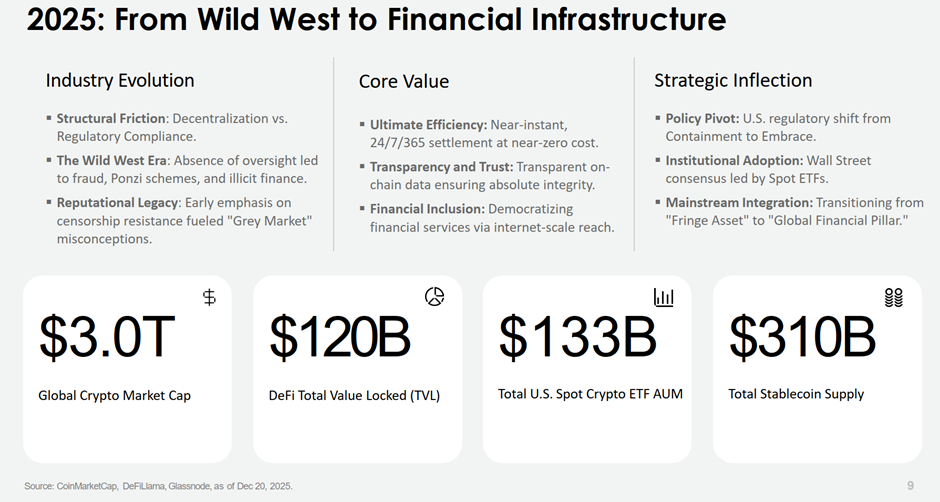

In 2025, with Trump promoting the implementation of the "GENIUS Act," blockchain finance received endorsement from the U.S. government and recognition from Wall Street. This year saw major players like BlackRock accelerating their entry into the market, alongside an explosion in the digitalization of real-world assets (RWA). The overseas crypto market is bidding farewell to its wild west era and moving towards a new generation of financial infrastructure that is critical and requires compliance. However, the sharp downturn in market conditions in the fourth quarter has once again raised cyclical concerns about the alternation between "prosperity and recession."

At the end of December, the Luohan Hall hosted a cutting-edge dialogue titled “The On-chain Future of the Financial System and the Intelligent Economy”. We invited several industry experts, investors, senior scholars, and policy advisors who are at the forefront of blockchain finance to examine and discuss the development history and prospects of this emerging field, as well as its potential opportunities and risks from multiple perspectives. For domestic observers, this was an excellent opportunity to gauge the trends in overseas fintech development. We will share insights and reflections from this event in due course.

In this wave of moving from the margins to the mainstream, the "Digital Asset Treasury" (DAT) companies are emerging as new conduits connecting traditional finance and blockchain assets, sprouting up like mushrooms after rain. As one of the representatives of DAT, Joseph Chee, the founder of Solana Company, has a particularly unique experience and perspective. He has spent over twenty years in traditional banking, then founded a venture capital fund, becoming one of the first licensed Asian institutions to invest in blockchain assets.

As an immigrant from traditional finance to the blockchain world, Joseph Chee shared three core judgments from an industry perspective during his speech:

The Inevitability of Financial Evolution: Compared to the disruption of the consumer end by the internet, innovation in the global financial backend is extremely lacking. He believes that blockchain is not merely a hype but a necessary upgrade to the outdated settlement system, with the ultimate goal of achieving 24/7 global asset flow.

Analogy with the Chinese Economy: He likens today's blockchain finance to China's economy when it first entered the WTO—huge growth potential but little known to the outside world. This lack of awareness is precisely the best window for institutional investors to enter.

Bridging the Old and New Worlds: To break down the barriers between traditional assets and the crypto economy, he focused on analyzing the two models of DAT and RWA. They serve as key conduits for capital introduction and asset "on-chain" processes, becoming financial innovations worth paying attention to in 2025.

The following is the full translation of Joseph Chee's speech:

Thank you to Luohan Hall for the invitation; I am pleased to participate in this very cutting-edge seminar.

First, let me introduce myself briefly. I currently serve as the chairman of Solana Company, a publicly listed company on NASDAQ. This is a "Digital Asset Treasury" (DAT) company, which ranks second in terms of the scale of digital assets held within the Solana blockchain ecosystem.

I have over twenty years of experience in traditional banking. To make a long story short, my banking career can be described as "timely." I spent the first three years of my career on Wall Street in New York, followed by seventeen years at UBS Group in Asia, starting as a salesperson in the capital markets department and eventually rising to senior management responsible for UBS's entire investment banking business, overseeing the Asia-Pacific business for about three to four years before leaving to start my own venture.

At UBS, I spent ten years managing global capital markets business. The greatest value of this job was that it placed me at the center of the rise of the Chinese and broader Asia-Pacific economies. I witnessed many companies and industries grow from nothing to their current scale. Some outstanding companies transformed from obscurity to industry giants, successfully going public with market capitalizations reaching hundreds of millions of dollars. Therefore, I tend to view the world from the perspective of capital markets—this is a view driven by finance and capital markets.

I retired early in 2017 and founded Summer Capital. Initially, Summer Capital was a buyout fund focused on cross-industry investments. We began investing in digital currencies, blockchain technology, and related fintech companies from late 2017 to early 2018. We can say we got started relatively early, being one of the first funds in Hong Kong to obtain relevant licenses and possibly one of the earliest institutions in Asia to invest in the blockchain field.

Additionally, I serve as the vice chairman of AMINA Bank. Since its establishment in 2018, AMINA is a fully licensed bank registered in Switzerland, capable of conducting various businesses related to digital currencies and blockchain. Switzerland has only issued two such full licenses, and AMINA is one of them. Other banks are often limited by licensing scope, technical bottlenecks, or legal and regulatory issues, and can only conduct partial digital financial businesses.

Lack of Innovation in the Financial Industry

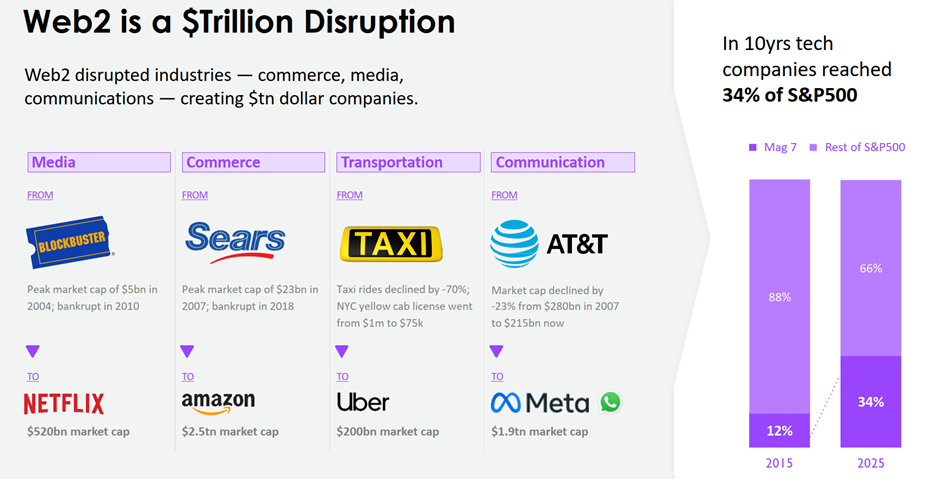

Looking back over the past twenty years, we all know that internet finance has brought tremendous disruption to many industries. Many who experienced the burst and revival of the internet bubble in the late 1990s and early 2000s still vividly remember that history. The development of e-commerce is a great example. In the early 2000s, many people were skeptical about online payments and did not trust e-wallets provided by e-commerce companies or payment companies, believing that e-commerce would not work. Twenty years later, e-commerce has become a reality and is popular worldwide, completely transforming retail and many other industries.

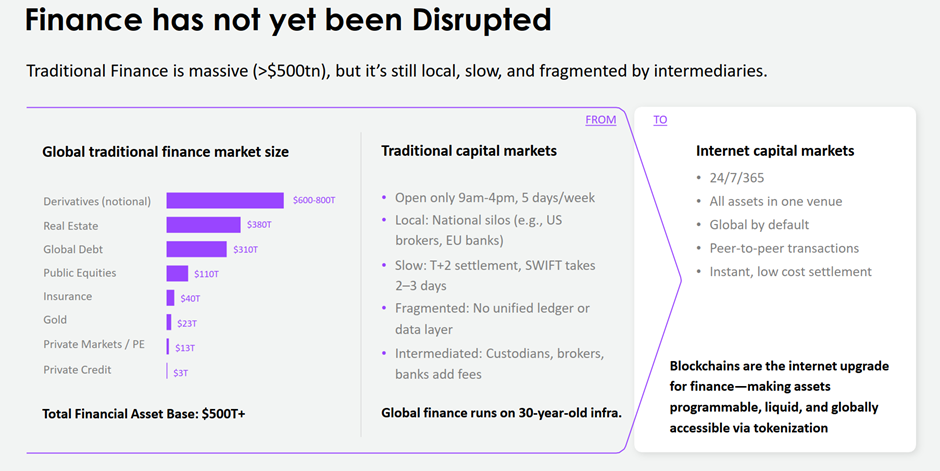

However, the financial industry itself has not experienced disruption. The reason I began to see the potential of blockchain technology around 2017 was that, as a seasoned banker, I witnessed the obsolescence and aging of the financial market system. Although capital markets provide various financing support for global innovation—from angel investments and VC to public market financing—the innovation within the financial industry itself is extremely lacking.

While many fintech companies have emerged over the past twenty years, a significant portion has focused on consumer-end solutions and has not brought much renewal or transformation to the infrastructure level of the financial system. Some exchanges in Europe still implement T+6 or T+7 settlement cycles and have only recently begun to move towards T+2. Even in Hong Kong, IPO settlements were still using T+5 until a few years ago, and have only recently been shortened to T+2 or T+3.

To be frank, whether in payments, settlements, or backend operations, many technologies in the existing financial system have not been updated or iterated for over ten or even twenty years. There may be several reasons why this traditional approach is difficult to change. On one hand, significant changes require lengthy negotiations with regulatory agencies, which is a very challenging task. On the other hand, some might say, "Since the existing system isn't broken, why fix it?" For example, Switzerland and Hong Kong still retain the habit of handwritten checks, and many companies are content with the status quo. Furthermore, behind traditional finance lies a complex web of vested interests. New technologies may encroach on the business of existing financial enterprises or service providers—such as exchanges that were originally monopolistic—so they naturally lack the motivation to change. This is also a reason why financial reform has been slow to occur.

From the perspective of capital markets, what is the ideal ultimate state? That is a market that operates 365 days a year, 7 days a week, 24 hours a day, where trading can occur anytime and anywhere, and all assets and all liquidity are interconnected, freely flowing between any region, industry, and commodity. Ideally, many transactions could even be conducted directly peer-to-peer without going through an exchange.

For capital markets, this is the ideal, the goal of practitioners, and the future. After gaining a preliminary understanding of blockchain, my first reaction was: Some technological prototypes needed for this ideal state have already emerged, marking the beginning of a revolution in the financial industry. Although there are many concerns regarding related regulations, taxation, fraud, and security issues, I believe this is the general direction for future development, which will make market operations more efficient and allow finance to become more inclusive, serving a broader range of groups.

Review of Blockchain Finance Development

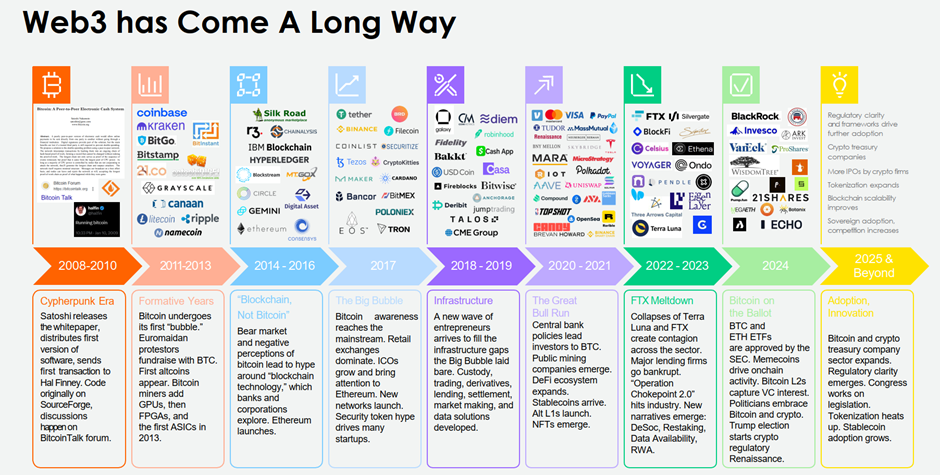

Of course, the development of blockchain finance did not happen overnight. In the early days, it did not attract much attention—I was no exception; as a busy senior banker, I completely missed its nascent period. I still remember during the 2008 financial crisis, I heard about the Bitcoin white paper, but at that time, I did not understand it well and did not take action. I thought it was just a very interesting but ultimately niche idea that could not be mainstreamed, and I did not pay much attention.

The second phase of blockchain was probably from 2011 to 2013, when people began to see it as a technology. I was surprised that many of the current giants in this field—such as Grayscale and Coinbase—were established during those years. That can be considered an early start, and they have come a long way to where they are today.

The next phase was from 2014 to 2016, when the traditional financial industry began to pay attention to the potential benefits that blockchain technology could bring. This was followed by 2017, when digital currencies experienced a "wild west" period of frenzied expansion, with speculators and gamblers flocking in, and exchanges proliferating. At that time, the two largest exchanges monopolized 80% of the global Bitcoin trading volume, almost defining the blockchain market at that time.

During that period, many related startups emerged. Numerous on-chain funds clustered in Zug, Switzerland, which is thus referred to as Switzerland's—if not the world's—"Crypto Valley." The staunch belief in blockchain technology among its proponents began there. I started visiting Zug frequently from 2017 to 2018. I remember at the first blockchain finance conference I attended, the opening speaker, a guest with a ponytail and boots, shouted on stage: "We hate the state, we hate banks, we hate governments, we hate regulation; we want to draw a line with all of this." They asked me, "Mr. Chee, I heard you just founded your own company and started investing in crypto assets. What is your first step plan?" I replied, "I'm very sorry, but my first step is to establish a bank." So, it was evident that I was not very popular at that conference. I had to carefully explain to them: "At some stage of development in this field, you still need to stay grounded and require a bridge to the real world. And banks are that bridge."

From 2018 to 2020, people began to shift towards building the infrastructure of blockchain finance. True entrepreneurs—those with vision and motivation to create businesses and drive change—began to emerge. This gave rise to the first batch of blockchain finance infrastructure companies we know today, such as Bitwise in the United States, which was established during that time. Additionally, many traditional companies began to enter the space, such as Fidelity and the Chicago Mercantile Exchange (CME Group).

By 2020 and 2021, more Bitcoin companies were founded, and the ecosystem of blockchain finance grew increasingly robust. It was after frequently hearing reports about Bitcoin and Ethereum in Bloomberg News that I told the Summer Capital team: "Now, we must pay close attention to this sector and analyze it in depth. We need to invest heavily." This marked the beginning of our journey to where we are today.

Subsequently, stablecoins were born. Prior to this, converting crypto assets into fiat currency had always been the most challenging aspect. I remember around 2015-2016, some early investors in Ethereum (many of whom were from the Asia-Pacific region and were clients of UBS) attempted to convert part of their profits back into fiat for reinvestment; this process took about nine months. Although it was eventually completed, it was extremely arduous.

In overseas markets, stablecoins became an important medium of payment. Bitcoin was the initial payment currency but was gradually replaced by Ether, with everything on-chain priced in Ether. However, due to the high volatility of Bitcoin and Ether, they were not suitable as payment mediums. When stablecoins like USDT and USDC emerged, this sector rapidly exploded.

What followed was a downturn after the boom: between 2022 and 2023, scams and scandals like LUNA and FTX emerged. In fact, in a completely unregulated industry, such projects, which are clearly "pyramid schemes" from a traditional investment perspective, are bound to arise, and their collapse is inevitable.

After the FTX incident, many believed the industry was finished. But like any emerging industry, the cycles of boom and bust will eventually alternate. As long as a technology can solve real problems, it will rise again. And now, blockchain finance is making a strong comeback and becoming even more robust. Currently, the total market value of the global blockchain finance market is approximately $3-4 trillion, with a Total Value Locked (TVL) of about $120 billion. While this figure is not small, it is still a very young and rapidly growing sector compared to the entire global financial market. I believe it will not disappear but is still in its early growth stage.

At the same time, this is also an industry that is often misunderstood. So you will see Jamie Dimon, CEO of JP Morgan Chase, making critical remarks about it, yet they have quickly become one of the fastest Wall Street bulge bracket firms to apply blockchain technology. Similarly, former UBS Chairman Alex Weber has also denounced it as a scam. If you visit regulatory agencies in various countries, many still believe that the entire industry is a scam, as there have indeed been too many speculations, frauds, and even illegal activities associated with it. For countries like China, Vietnam, and India, it serves as a convenient channel for capital flight.

Compared to artificial intelligence, the core value of blockchain technology may not seem as attractive or imaginative. As a competitive field for emerging technologies, AI has attracted a massive amount of attention, capital, and research power. If researchers had to choose between AI and blockchain, many would likely choose AI, as its future prospects seem limitless. In contrast, blockchain and digital currencies appear somewhat dull. However, if you examine its core value, you will find that it is the infrastructure for future financial markets.

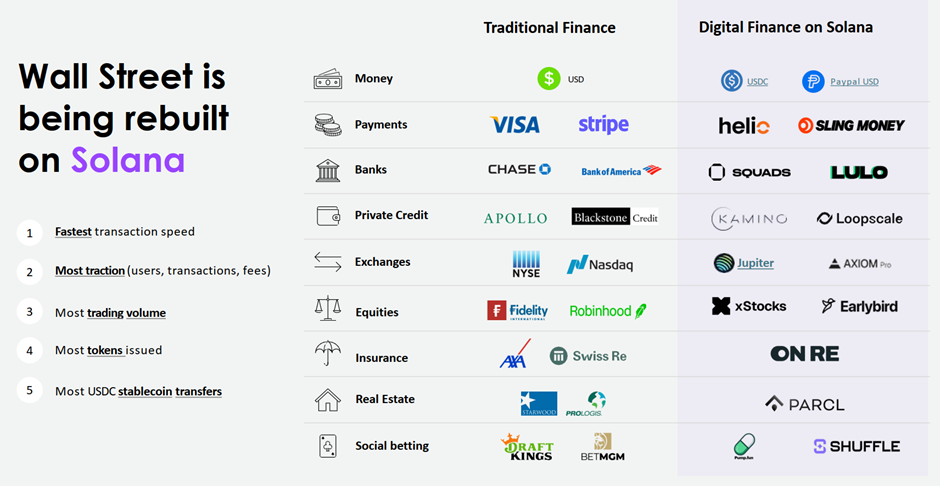

An important event in 2025—especially a series of supportive policies introduced after Trump won the election—marked the moment when this technology, once viewed as speculative and in a gray area, finally gained legitimacy in the United States. It is now recognized by Wall Street as the infrastructure for future financial services. Overnight, the application and popularization of this technology accelerated significantly. From my personal observation, at least in the United States, Wall Street investment banks and mainstream financial institutions are deploying blockchain technology at a speed of 120 miles per hour, putting assets and products on-chain. Progress in other parts of the world varies.

We can see that today’s blockchain finance map already has numerous sub-sectors and various companies. I often tell people, today's blockchain world is somewhat like China in the early 2000s. Back then, Western investors knew that the Chinese economy was growing rapidly; they flocked to Hong Kong, eager to invest in the mainland, but lacked timely and accurate information. At that time, mainland China did not have reliable third-party information providers, nor were there enough companies audited by the Big Four accounting firms or rated by Moody's or S&P, and there were no research reports issued by major banks. So what could they invest in? China National Petroleum, China Telecom, China Mobile.

Today’s blockchain world is no different. There are already many large and small enterprises here, as well as many good applications, but the outside world does not understand them, leading to significant information asymmetry. Therefore, Wall Street and mainstream capital will first start investing in leading companies like Bitcoin, Ethereum, and Solana. However, I believe the information gap will soon be filled, and in the next six months, they will discover that many companies in niche sectors will become more investable.

We see that financial institutions and investors from all sides are rushing to enter the market. Various institutions from traditional finance have come, especially American companies. With the approval of the Digital Asset Market Structure Act in the U.S., I believe even more traditional financial companies will flood in. Additionally, we can see that many digital finance companies that you may have never heard of are also actively entering the market. Some of these new players are significant, with billions of dollars in assets or revenues ranging from hundreds of millions to billions of dollars.

Digital Asset Treasury (DAT) and Real World Asset Digitalization (RWA)

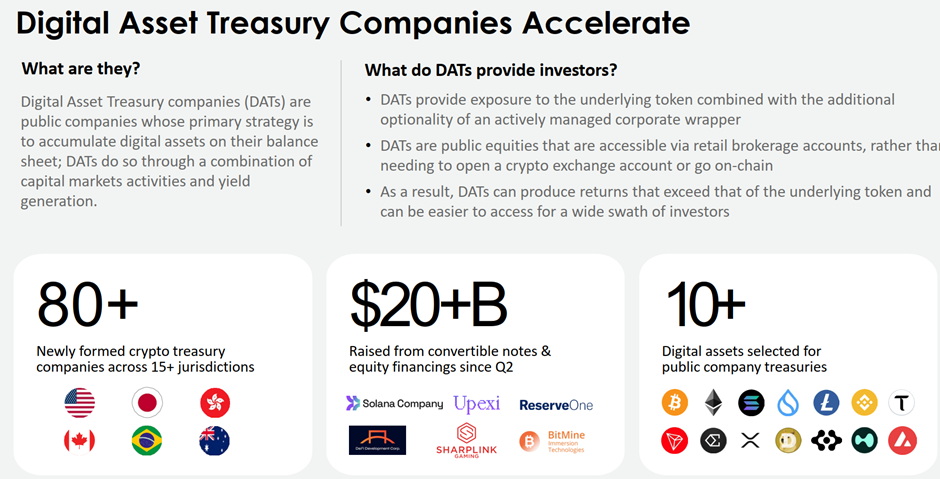

Here, I want to introduce two key concepts in the overseas market: Digital Asset Treasury (DAT) and Real World Asset (RWA) digitalization. They are the bridges connecting liquidity.

In overseas markets, DAT is essentially a publicly listed company established for holding digital assets. If we look at the total scale of global financial assets, it is approximately $900 trillion to $1,000 trillion. In contrast, the $3 trillion scale of blockchain finance is negligible. We know that to support the development of any emerging industry, the most likely source of capital that can obtain and further expand liquidity is the public stock market, which has a scale of about $120 trillion to $150 trillion. In the past, such investments were mainly made through private equity (PE), venture capital (VC), or investment banks, but their efficiency was relatively low. In contrast, hedge funds and large funds in the public market can commit hundreds of millions or even billions of dollars in a matter of hours.

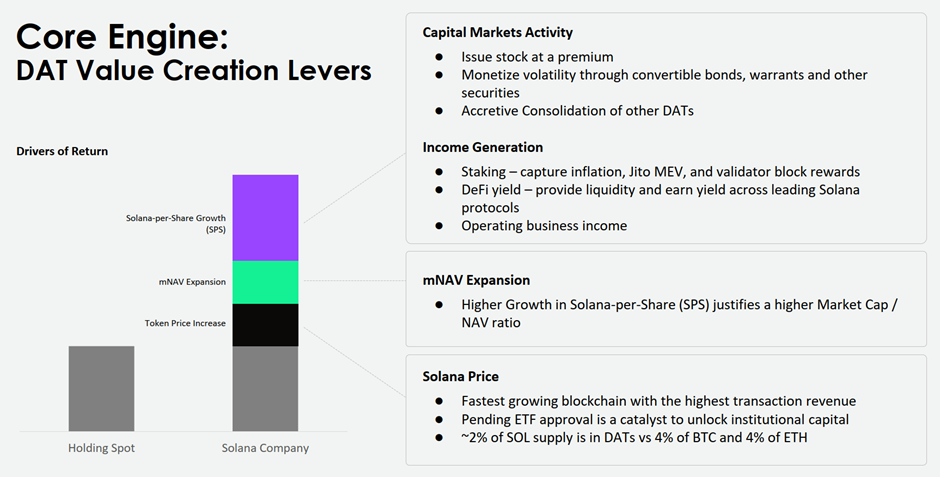

For blockchain finance to grow from $3 trillion to $10 trillion or even $100 trillion, it cannot do without funding support from traditional finance. DAT is one of the pathways to achieve this. Stock market investors can indirectly hold digital currency assets through the DAT model. Currently, there are about 80 pure DAT companies. If we count all publicly listed companies that hold digital assets, the number exceeds 200. The industry truly began to accelerate after April 2025. These DAT companies have recently raised $20 billion in funding. The number one focus is MicroStrategy, which has transformed into the largest treasury in the Bitcoin ecosystem by financing to purchase Bitcoin. This company pioneered the entire industry.

Why does the DAT model work? First, it reduces operational risk. Most fund management companies do not want fund managers or employees to directly manage digital wallets, transferring large amounts of funds in and out, and bearing the associated operational risks. Secondly, there are authorization issues. Not all funds are authorized to invest in digital asset-related ETFs. Even if they have such authorization, the fund manager's responsibility is to select excellent management teams and companies; if they invest heavily in ETFs, the fund management fees would be unearned. Additionally, DAT can bypass entry restrictions. In some regions, regulators prohibit retail investors from directly purchasing digital currencies, but they can invest indirectly through publicly listed companies like DAT.

The business logic of DAT companies is not complicated. They raise low-cost financing through issuing convertible bonds, selling options, etc., and then use the funds to purchase digital currencies. When market sentiment is high, they also issue stocks at high prices, continuously increasing the average number of digital currencies held per share. This is their core logic. This is also why MicroStrategy's performance during the same period can outperform Bitcoin itself, even reaching more than three times that of Bitcoin. Another important point is that, unlike Bitcoin, other digital currencies on blockchains (like Solana) can also "earn interest," thus generating additional returns.

Currently, the DAT sector is experiencing a boom-and-bust cycle, with too many DAT companies desperately trying to absorb all possible liquidity. However, I believe this industry has found its business model. In the future, we will see more DATs emerge as mainstream holders of digital assets, which is worth paying close attention to.

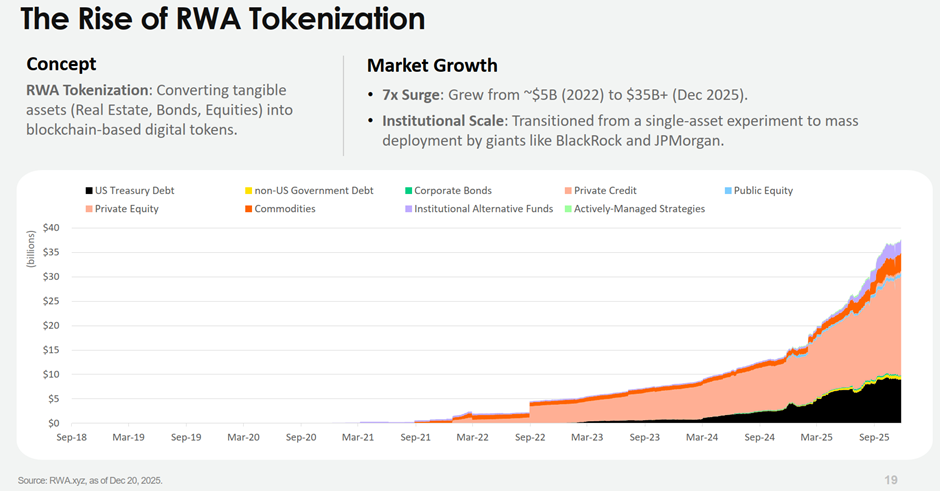

In contrast, RWA is still in an earlier stage of development. RWA refers to the digitization of traditional real-world assets and their introduction onto the blockchain, thereby increasing the liquidity of these assets. Because blockchain finance is an emerging market, assets here can achieve higher risk-free yields. This is somewhat akin to depositing dollars in Cambodia, where you would receive a higher deposit interest rate. We see that RWA based on private credit is growing the fastest. However, RWAs based on safer instruments like U.S. Treasury bonds are also performing well, as more digital asset investors are willing to forgo a portion of their returns to diversify their investments and reduce risk. This is also a reason for the accelerated growth of RWA in recent years.

RWA is technically ready, and the operational processes are not complex, but the key lies in regulation and liquidity. Since different assets are at different stages of their lifecycle, the task is to find the appropriate asset types, digitize them, gain liquidity, and ensure their feasibility and success. This also depends on the type of asset itself. In the United States, if an asset is classified as a "security," then its compliance requirements are relatively high. With the rise of asset digitization, I believe standardized products and highly liquid products will take the lead in going on-chain, followed closely by those large asset classes that require liquidity and are widely recognized. All of this is happening, and we will wait and see.

That's all for my sharing. Thank you, everyone.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。