Author: Frank, PANews

One of the representatives in the privacy coin sector, XMR (Monero), reached an all-time high on January 13, with spot prices breaking through $690, reigniting discussions in the market about privacy coins.

From January 2025 to now, XMR has skyrocketed from around $200, with a maximum increase of 262%. In the current context where mainstream altcoins are generally weak, such an increase is extremely rare. What’s even more intriguing is that this round of price increase occurred against the backdrop of unprecedented global regulatory tightening.

Due to compliance pressures, mainstream centralized exchanges like Binance have long removed XMR from spot trading. On January 12, the Dubai Virtual Assets Regulatory Authority (VARA) officially announced a ban on the trading and custody of privacy tokens throughout Dubai and its free zones. However, this ban not only failed to cast a shadow over XMR but also ironically led to a new high, mocking the Dubai government.

In the midst of dwindling exchange liquidity and regulatory crackdowns, who is the real driving force behind XMR's rise? PANews peels back the surface to uncover the true demand behind this market trend.

Exchanges Are Not the Core Pricing Venue

Despite the hot market, this is not driven by funds within exchanges.

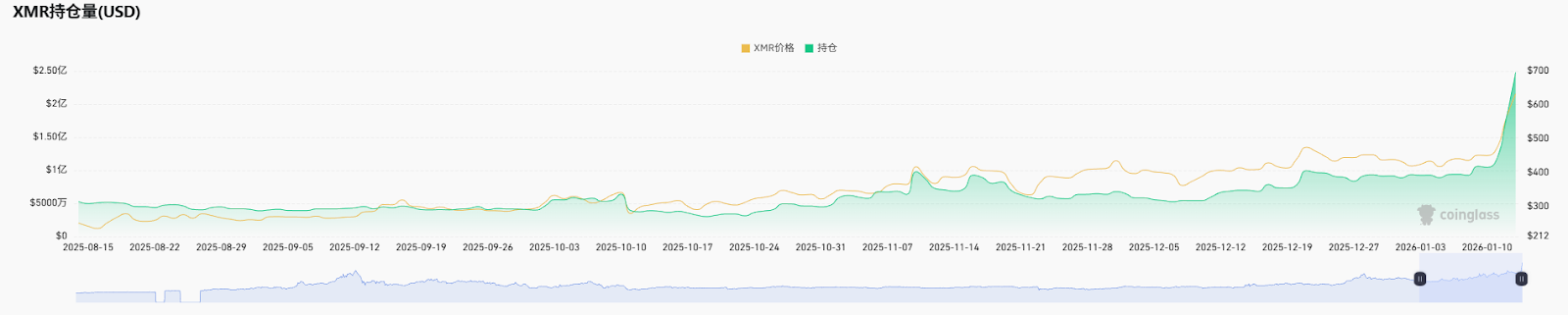

In terms of spot trading, while XMR's recent trading volume has increased with the price surge, it has mostly remained in the range of tens of millions to $200 million, without any particularly exaggerated increments. Historically, the true and significant peak in spot trading volume was created on November 10, reaching $410 million. This indicates that in this recent doubling trend, spot trading (or the spot buying within centralized exchanges) is not the main driving force.

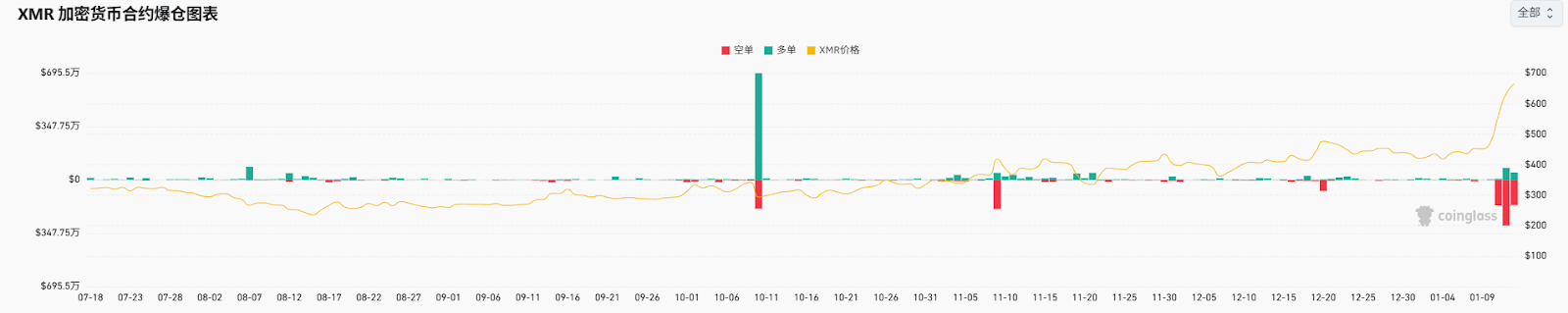

In terms of contracts, the situation is similar. The peak trading volume also occurred on November 10. Following that, until about a week ago, there was no significant surge in contract trading volume, and there were even signs of a slight decline. Observing the open interest data, the change curve in dollar terms almost completely overlaps with the price trend, indicating that the number of XMR positions in the market has not seen an abnormal surge; the increase in open interest is merely due to the rise in coin price, rather than a large influx of new capital entering the market.

Clearly, mainstream exchanges are not the core venues for XMR pricing at present.

Underlying Supply Dynamics: Restructuring Among Miners and Early Positioning

Since the "visible" funds are unremarkable, we need to turn to the "invisible" on-chain world. As the most privacy-focused network, XMR has very little information available for mining, but changes in mining difficulty and rewards can give us insight into capital's positioning on the supply side.

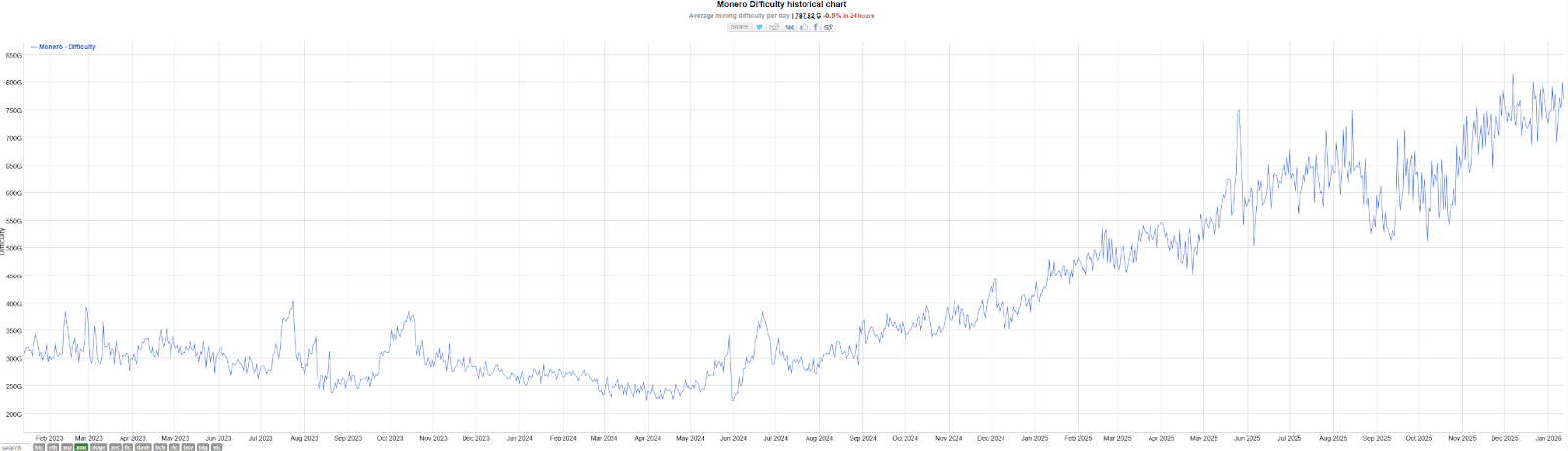

Mining difficulty typically represents the enthusiasm of capital participating in the network ecosystem. Data shows that XMR's mining difficulty began to rise rapidly at the end of 2024 and remained in a state of rapid growth throughout the first half of 2025. Although there were fluctuations from September to November, a new round of difficulty increase has begun recently.

An interesting episode must be mentioned: in September, the Qubic project claimed to control over 51% of the total XMR network hash rate and conducted a "demonstrative attack," leading to a chain reorganization of 18 blocks in the XMR network. This event sounded the alarm for the community, prompting many miners to migrate their hash power to the established mining pool SupportXMR. This turmoil was a major reason for the drastic fluctuations in mining difficulty at the end of 2025, but it also indirectly confirmed the activity and resilience of the hash power market.

What’s more noteworthy is the correlation between mining rewards and difficulty.

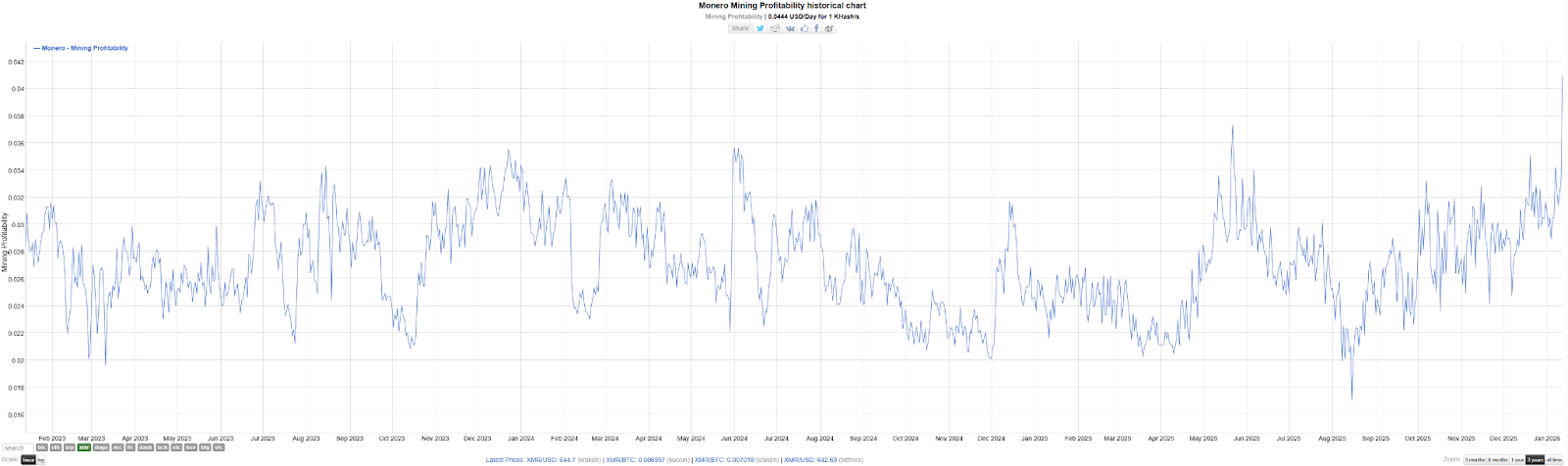

Before April 2025, Monero's mining rewards experienced a significant decline. Coupled with the difficulty chart at that time, hash power surged sharply while the coin price remained volatile. This divergence led to a dilution of rewards, potentially forcing some higher-cost small miners out of the market. Data shows that the mining difficulty did experience a pullback in April, confirming this hypothesis.

This is a typical case of "miner surrender" and "chip exchange." After this, as prices surged significantly, mining rewards and difficulty once again synchronized in their upward trend. From the data changes during this phase, it appears that as early as the beginning of 2025, some large mining enterprises or capital with strong risk resistance may have already started to position themselves in Monero token mining despite low rewards.

Demand Side Validation: High Premium for Privacy Payments

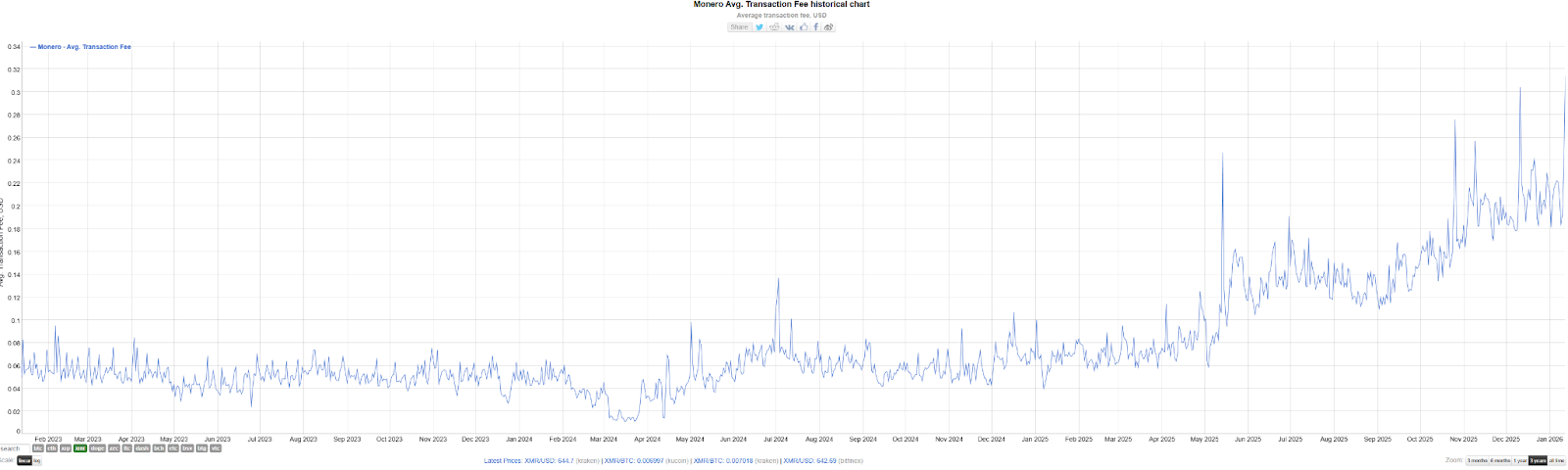

If miners represent confidence on the supply side, then average transaction fees most accurately reflect user demand.

From the charts, Monero's average transaction fees remained relatively stable below $0.1 before the first half of 2025. However, starting in June, a growth trend began to emerge; by December 11, the highest average fee reached over $0.3, more than three times the amount from six months prior.

Due to Monero's dynamic block expansion mechanism, the surge in fees indicates that a large number of users are attempting to send transactions quickly and are willing to pay high fees to compensate miners for expansion costs. This indirectly proves that starting in the second half of 2025, the real transaction demand on the Monero chain began to increase significantly.

However, we also discovered an interesting pattern: the surge in on-chain fees often synchronizes with price spikes.

For example, on April 28, XMR suddenly rose by 14%, and the average transaction fee surged to $0.125; during the subsequent slow price increase period, fees dropped back to the bottom (falling to $0.058 on May 4). This indicates that while market fluctuations can temporarily drive on-chain demand, once the volatility subsides, on-chain demand also returns to calm. Although sometimes the two do not move in sync (such as on May 14 when fees rose but prices did not move), overall, during this period of more than six months, price increases temporarily boosted on-chain demand, while real growth in on-chain demand in turn sparked optimism in the market for XMR, creating a mutually causal relationship.

The Truth of Black and White

In summary, the surge in XMR may have a "black and white" truth.

The so-called "white" represents the "anti-fragile" rebound of privacy demand under regulatory pressure.

The reverse driving effect of regulation is becoming increasingly evident. The VARA ban in Dubai not only failed to crush XMR but also made market participants realize: regulatory bodies can ban exchanges, but they cannot ban the protocol itself. As major exchanges withdraw from the XMR trading segment, the logic of pricing based on market makers and derivative contracts has been rewritten, XMR has returned to a model controlled by real users or certain heavyweight players. Detached from the exchange system, privacy coins have emerged with a completely different independent rhythm from the mainstream market.

The so-called "black" refers to the capital game under information asymmetry.

Behind this opacity, there may be a "whale" lurking beneath the surface. The "unremarkable" trading data (even on the record high of January 13, the contract open interest was only $240 million, with liquidation amounts just over $1 million) indicates that mainstream institutions have almost failed to predict and participate in this round of price increase in advance, only following along.

This information gap controlled by a few individuals leads to extreme price volatility. Especially when the market begins to focus on this rise, it often signals a short-term emotional overheating. Referring to the privacy coin ZEC in November, after a surge, it experienced a pullback of over 50%. Ultimately, in the market for privacy coins, there exists a significant amount of "information asymmetry," which places ordinary retail investors at an absolute disadvantage.

In the dramatic fluctuations of privacy coins, on-chain data may be our only reliable guide. However, in the depths of the opaque sea, the freedom of high premiums is always accompanied by unknown risks.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。