I. Outlook

1. Macroeconomic Summary and Future Predictions

Last week, the U.S. stock market showed overall strong fluctuations. The market interpreted "weakening manufacturing but not stalling + moderate cooling in employment" as favorable for a policy shift within the year. The technology and growth sectors performed relatively well, with the S&P 500 and Nasdaq recording slight increases, while cyclical and manufacturing-related sectors faced pressure.

Looking ahead, the U.S. economy is likely to operate within a "slowing but not recessionary" range. If subsequent data continues to confirm cooling employment and inflation does not rebound, expectations for easing will continue to support U.S. stock valuations. However, if the service industry and consumption strengthen again, and inflation expectations rise, the sensitivity of high U.S. stocks to data will significantly increase, leading to greater volatility risks.

2. Market Changes and Warnings in the Cryptocurrency Industry

Last week, the cryptocurrency market experienced a noticeable pullback after an initial rebound at the beginning of the year, indicating a concentrated release of selling pressure from above. Trading volume increased during the decline, with clear signs of capital withdrawal from risk assets, and ETF inflows slowed or even weakened temporarily. Altcoins and high-volatility varieties saw more severe pullbacks, with the previously high-performing MEME sector experiencing rapid declines, and some tokens recorded significant weekly losses, leading to a quick cooling of market risk appetite.

From a risk perspective, this round of pullback reflects that the current market still belongs to a rebalancing phase after a rebound, rather than the start of a trend-driven bull market. If Bitcoin cannot regain a stable position above $100,000 and form effective support, there is a possibility of further testing key support areas in the short term, with high-volatility sectors being the most affected. Additionally, with macro data returning intensively in January, if interest rates or inflation expectations show adverse changes, the magnitude of the pullback may be further amplified. Overall, the cryptocurrency market remains weak in the short term, and caution is needed to prevent the pullback from evolving into a deeper adjustment.

3. Industry and Sector Hotspots

A total of $447 million was raised, with JP Morgan and Nasdaq participating in the funding of Canton Network, a public Layer-1 blockchain launched by Digital Asset specifically designed for institutional finance; $1 million was raised, led by BIG BRAIN HOLDINGS, for Haiku, an AI-driven on-chain intent trading protocol and decentralized derivatives exchange based on Solana.

II. Market Hotspot Sectors and Potential Projects of the Week

1. Overview of Potential Projects

1.1. Analysis of the $447 Million Funding, with JP Morgan and Nasdaq Participating — Canton Network, an Institutional-Level Layer-1 Blockchain Focused on Need-to-Know Privacy and Cross-Application Atomic Interoperability

Introduction

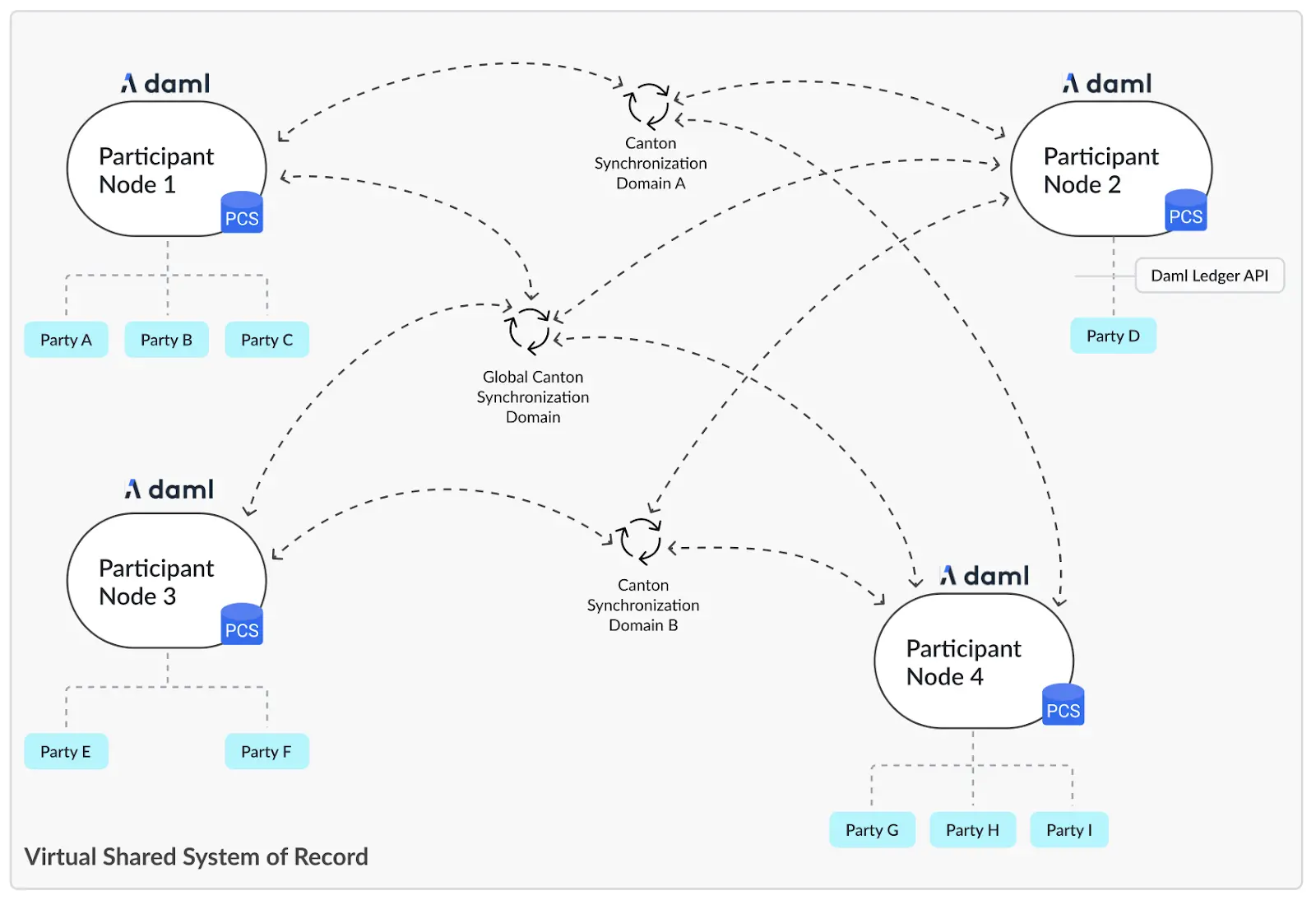

Canton Network is a public Layer-1 blockchain launched by Digital Asset, designed specifically for institutional finance, integrating privacy, interoperability, and high scalability. It is built on DAML smart contracts and employs a "need-to-know" privacy mechanism, ensuring that participants can only access transaction data relevant to themselves.

Canton supports atomic-level transactions across applications (such as settlements between tokenized bonds and cash) while maintaining asset isolation, privacy protection, and strict regulatory compliance controls.

Canton Network consists of all applications and users built and operated using Canton software, with these independent instances interconnected through the Canton protocol, forming a global interoperability system.

- Contract Instances and Smart Contract Templates

The core data unit managed and synchronized by Canton is the contract instance.

Each contract instance is based on a template, which defines the business logic and permission rules of the smart contract.

The choices in the template determine the executable state updates: archiving the old contract and creating a new contract in an atomic operation.

All templates and instances constitute a complete ledger.

- Parties and Ledger Ownership

Each contract belongs to one or more parties.

Each party connects to the network through its own validator and can only view contract data relevant to itself.

When multiple validators connect to different networks, the entire network forms a virtual global ledger not controlled by any single entity.

- Canton’s Infrastructure: Synchronizers and Validators

Validator: Executes and verifies transactions, managing the ledger state of its organization; does not open ports to the outside.

Synchronizer: Responsible for transaction ordering, buffering, and securely forwarding encrypted messages; cannot see transaction content.

A validator can connect to multiple synchronizers simultaneously, automatically forming a "network of networks."

- Transaction Execution Method

To complete cross-organization transactions, the relevant validators must connect to the same synchronizer.

Synchronizers are only responsible for transmission and ordering and do not understand business content.

Among them, the Global Synchronizer (https://sync.global) is the backbone node of the network.

- Stateless Synchronizers & Horizontal Network Expansion

Contracts are not bound to any specific synchronizer; synchronizers are also invisible to each other.

Validators can freely choose any connectable synchronizer for transactions.

This design allows Canton Network to horizontally scale like the internet by adding synchronizers and validators.

Overview of Canton Network Application Architecture

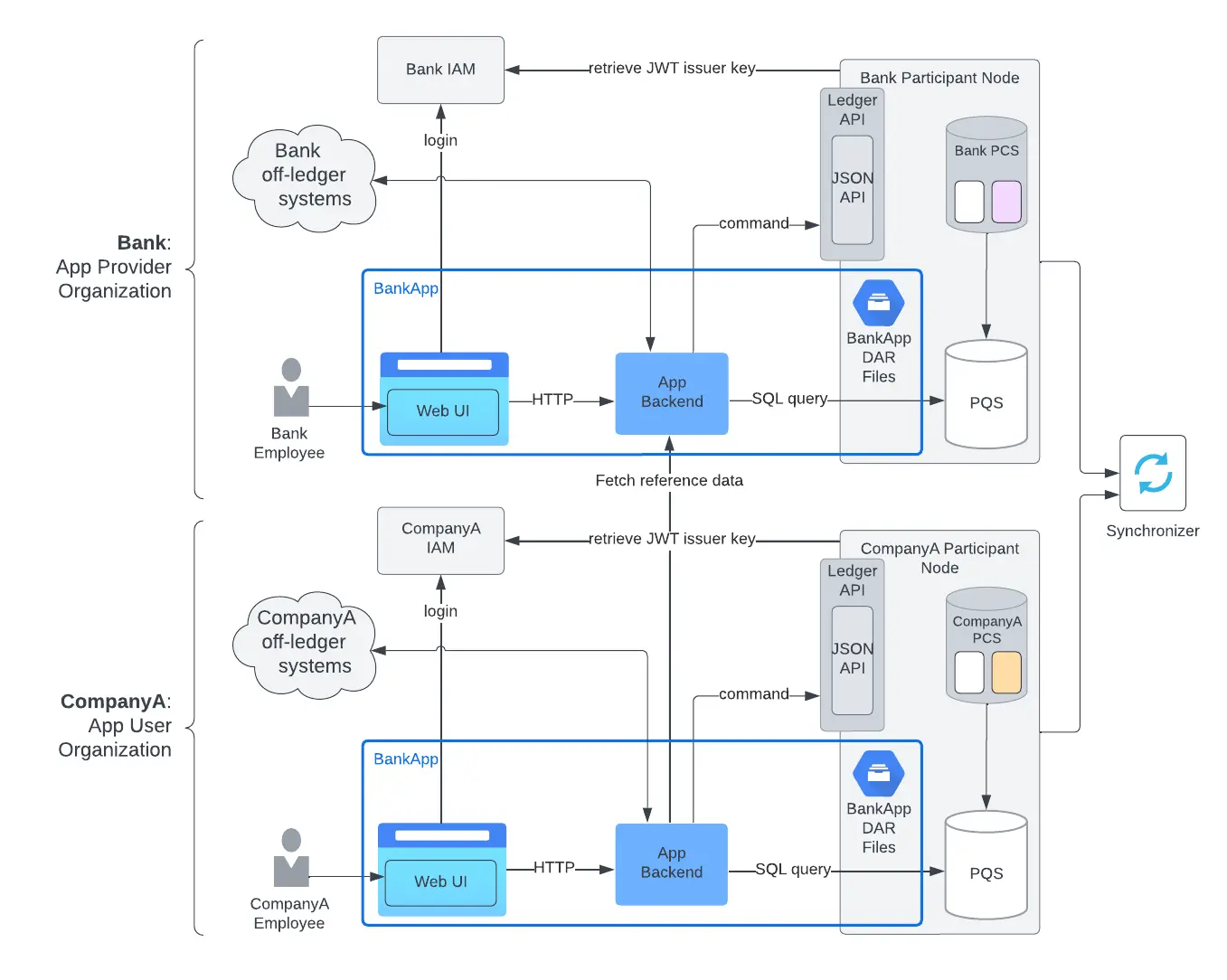

1. Frontend

The frontend is responsible for allowing end users to interact with the application business processes.

To ensure non-repudiation, all user operations must go through the backend of the organization to which the user belongs, submitted to the ledger via the organization’s Participant Node. Therefore, best practice is for each organization to independently host its own frontend and authenticate through their respective IAM systems. The frontend should not directly access the ledger but should call backend APIs, with the backend uniformly submitting commands.

2. Daml Model (Business Process and API Definition)

The Daml model defines the business logic, permission system, and operational modes shared across institutions. Its compiled product, the DAR file, must be deployed to all participating nodes.

The model should only express the current state and should not retain historical steps as long-term existing contracts to avoid infinite growth of ACS.

If historical records are needed, they should be queried through PQS event streams rather than maintaining active contracts in the model.

When cross-organization sharing of reference data is required, explicit disclosure is recommended to avoid performance overhead from numerous observers.

3. Backend (Core Backend)

The backend is responsible for:

3.1 Providing High-Level APIs

The backend abstracts the Ledger API, providing secure, scalable, and user-friendly interfaces for the frontend and external systems.

Read Path

Uses PQS (Participant Query Store) as the main query engine.

PQS supports SQL, historical event queries, and application-level indexing, suitable for building high-performance query services.

PQS does not impose access control, so the backend must implement fine-grained permission management on returned data.

PQS can serve various scenarios such as automation, integration, real-time UI, and analytical queries.

Write Path

Emphasizes reliability (retry mechanisms) and idempotency:

Failures must be safely retried.

Use contract consumption or command deduplication to ensure submissions do not take effect multiple times.

Provide unified encapsulation for the frontend and systems (e.g., "submit order," "update status," etc. business-level APIs).

4. Backend Automation and External System Integration

4.1 Automated On-Ledger Workflows

Workflows on the ledger do not advance automatically; all actions must be initiated by the backend.

The backend should break down automated work into retryable tasks, with each task being independent, side-effect-free, and always using the latest ledger state.

Automation sources include:

State-triggered: Polling new contracts through PQS (e.g., new approval requests).

Time-triggered: Scheduled tasks (e.g., regular reconciliations, event cancellations).

Note:

Commands submitted automatically must consume the contract that triggered the task to prevent infinite loops.

Retries should encompass the entire task process, not just retry the submission command part.

4.2 Integration with External Systems

The backend serves as a bridge between the ledger and the external world, allowing integration with:

KYC / AML systems

Market data sources

Accounting, clearing, and settlement systems

Order matching systems

Message queues

Integration methods are flexible, allowing data to be pushed to the ledger or pulled from the ledger or subscribed to events. It is strongly recommended that external systems do not directly access the Ledger API; all reads and writes should be managed uniformly through the backend to ensure permissions, idempotency, and data consistency.

Tron Comments

Canton's advantages lie in its "need-to-know" privacy model, cross-application atomic interoperability, and horizontally scalable architecture, which together create a compliant and high-performance blockchain infrastructure for institutional finance. Financial institutions can achieve cross-asset and cross-application collaboration while maintaining data isolation, privacy protection, and regulatory requirements, thus supporting the large-scale implementation of real-world financial applications. At the same time, the Canton network is governed collectively by global financial institutions, ensuring high security and credibility.

Its main disadvantage is the relatively high ecological threshold, requiring the use of DAML for development and necessitating institutions to deploy participant nodes, which results in a limited number of early developers, a lower degree of decentralization compared to public chains, and weaker accessibility for ordinary DeFi users.

1.2. Analysis of the $1 Million Funding, Led by BIG BRAIN HOLDINGS — Haiku, an AI Intent-Driven Ultra-Fast Perpetual Trading Layer on Solana

Introduction

Haiku is an AI-driven on-chain intent trading protocol and decentralized derivatives exchange based on Solana. It can convert any target trading state into a single unified on-chain transaction, abstracting away all DeFi complexities for users and integrators. Haiku offers ultra-fast, low-cost perpetual contract trading, along with deep liquidity, advanced risk management mechanisms, and modular AMM infrastructure.

Architecture Overview

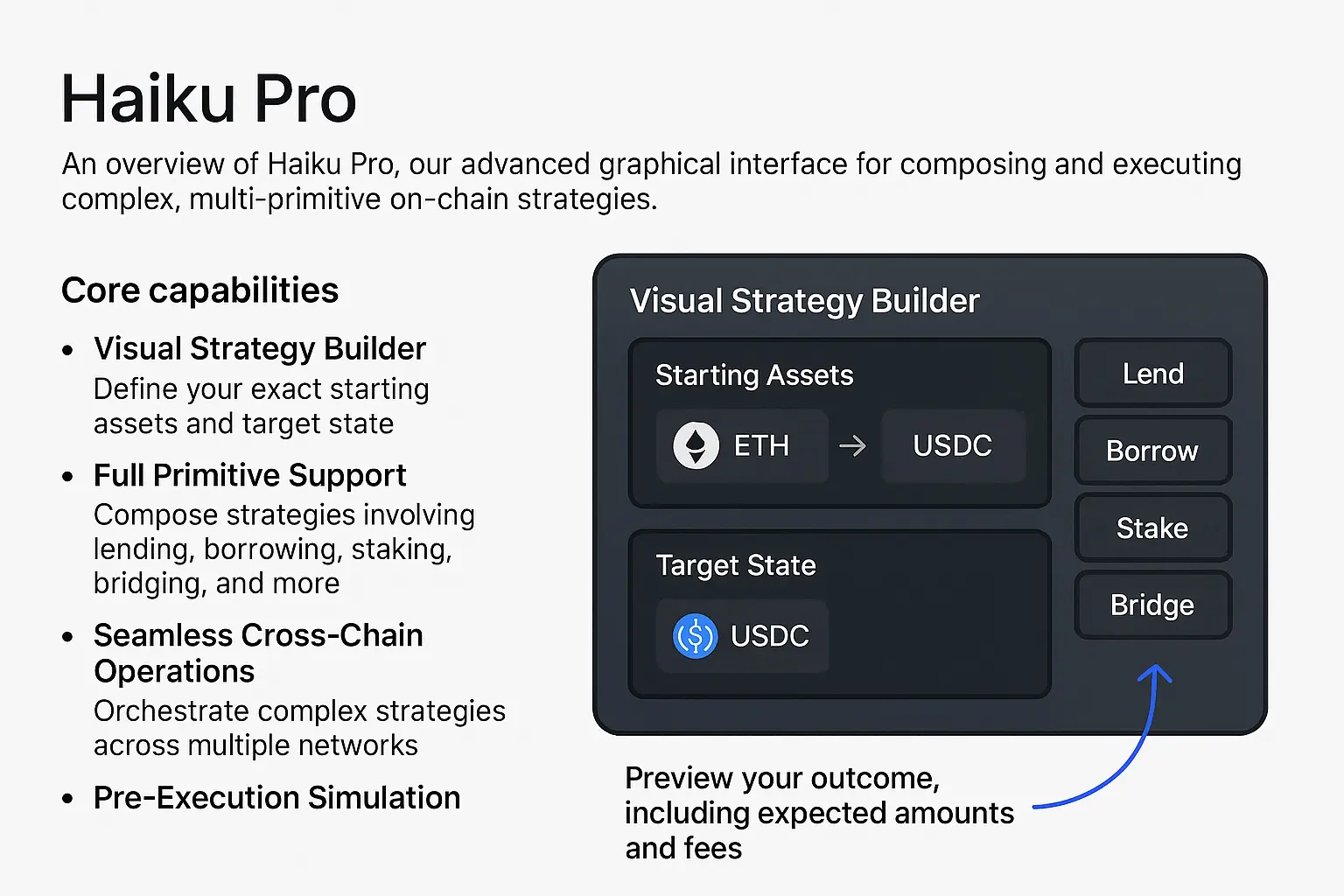

- Haiku Pro

Haiku Pro is an advanced graphical strategy interface aimed at professional traders, asset managers, and advanced DeFi users, allowing them to build and execute complex multi-step on-chain strategies visually without writing any code.

Traditional trading interfaces typically only allow for single operations, while Haiku Pro enables users to create all-in-one "All-or-Nothing" transactions composed of multiple DeFi primitives (lending, borrowing, staking, LP, bridging, etc.) through drag-and-drop combinations.

Core Capabilities

· Visual Strategy Builder

Users can set initial asset states and target states freely, combining complex strategies across any supported chain and asset.

· Full Primitive Support

Strategies are not limited to swaps but can natively combine lending, collateralization, staking, cross-chain, LP, and other types of operations.

· Seamless Cross-Chain Operations

Multi-step cross-chain transactions can be built in a single interface without the need for multiple interfaces or interactions.

· Pre-Execution Simulation

Provides a preview of transaction results before signing, including:

— Final asset quantity

— Transaction fees

— Slippage

— Execution path

Ensures user strategies are controllable, transparent, and predictable.

2. Haiku Agent

Haiku Agent is an interactive interface that executes complex DeFi strategies through natural language, allowing users to complete multi-step on-chain operations with a single sentence.

It serves as the conversational layer of our Declarative Transactions infrastructure, enabling users or AI agents to trigger complex on-chain strategies through simple text commands without needing to understand the underlying protocols or interface logic.

This product eliminates the final layer of complexity in DeFi—the interface itself. Users only need to describe the desired final state, and Haiku Agent allows both zero-background users and advanced on-chain AIs to utilize our execution engine.

How It Works

Haiku Agent is powered by a large language model (LLM) fine-tuned for DeFi protocols and financial primitives. The process is simple and smooth:

- Describe Your Strategy

Users or AI agents input goals in natural language, such as: "Leverage half of my ETH long, and deposit the other half into a lending pool to earn interest."

- Intelligent Parsing

The model understands the target state of the instruction and converts it into a structured execution request.

- Dynamic Execution

The execution engine calculates the most capital-efficient path based on the request and completes the entire strategy with a single All-or-Nothing transaction.

3. Haiku API

Haiku API is the core access layer for developers to our Declarative Transactions infrastructure.

It provides developers, protocol parties, and on-chain fund managers with a high-performance, unified, and programmable entry point for executing complex multi-step on-chain strategies in an All-or-Nothing manner.

By integrating Haiku API, you can completely delegate the entire execution lifecycle to our engine, eliminating the need to build and maintain fragile, complex underlying execution logic, allowing you to focus on product and user experience.

Core Value Proposition

- Abstract All Complexity

One integration provides access to 45+ protocols and 19 chains. Routing, cross-chain, swapping, and execution are all handled by Haiku, so you no longer need to worry about underlying interactions.

- Unlock Advanced Features

Provide your users with capabilities that traditional aggregators cannot achieve, such as:

True portfolio rebalancing

One-click cross-chain deposits

Leveraged positions and complex strategy combinations

Automated execution of multi-protocol, multi-step transactions

- All-or-Nothing Execution Assurance

All multi-step strategies will be packaged into a single unified transaction for execution:

Avoid partial execution failures

Prevent funds from being stuck between steps

Significantly enhance security and certainty

- High Performance and Stability

Haiku's execution engine can dynamically return complex strategy routes within 200 milliseconds and achieve a 99.7% API success rate in real production environments, ensuring institutional-level reliability.

Tron Comments

Haiku's advantage lies in its AI-driven intent execution and Declarative Transactions architecture, which abstracts multi-step on-chain operations into a single unified transaction, significantly lowering the complexity threshold of DeFi. With Haiku Pro, Haiku Agent, and Haiku API, users, AI agents, and developers can build and execute complex strategies across chains and protocols in a visual, natural language, or programming manner, enjoying ultra-fast low-cost execution, deep liquidity, and high composability, suitable for professional traders and institutional scenarios. At the same time, its All-or-Nothing execution model enhances the security and certainty of funds.

The disadvantage is that the high level of abstraction relies on the reliability and security of the underlying execution engine; any model misjudgment or routing error could lead to execution deviations. Additionally, the system has a strong dependency on external protocols, LLM reasoning, and cross-chain communication, which may face delays, failures, or risk amplification in extreme market conditions. Overall, Haiku brings revolutionary improvements to the on-chain trading experience but still needs to continuously strengthen risk control and infrastructure stability.

2. Key Project Details of the Week

2.1. Detailed Analysis of the $2.75 Million Round, Led by Cyber Fund — Mellow, a Protocol That Enables Everyone to Build Professional-Level DeFi Strategies

Introduction

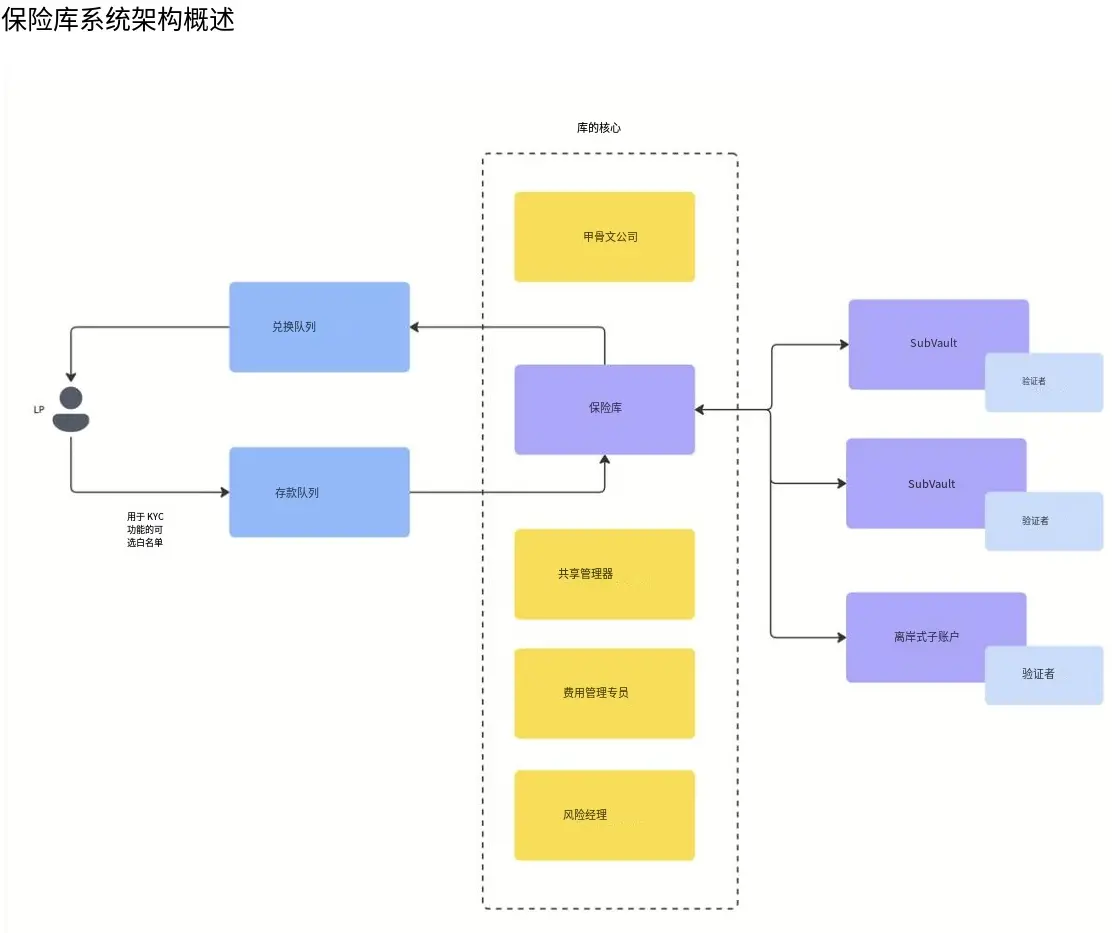

Mellow has built a composable liquidity treasury that allows for the completely permissionless creation of various types of vaults, including Simple LRT, MultiVaults, DVV, cross-ecosystem interoperable vaults, and more. This primitive consists of a set of vault smart contracts with customizable risk curves, managed by curators (strategy managers) responsible for strategy execution and risk parameter management. This manual includes the overall architecture of Mellow Vaults, contract details, audit information, user tutorials, API descriptions, and incentive mechanisms.

Mellow's ALM (Asset-Liability Management) module is responsible for constructing on-chain structured products that enhance DeFi capital efficiency, evolving from Mellow Permissionless Vaults—a fully permissionless, automated proactive liquidity management system.

Architecture Overview

Mellow's positioning is to productize, standardize, and make complex DeFi yield strategies composable, allowing professional asset managers and curators to design, deploy, and scale on-chain structured products in a modular manner.

- Mellow Core Vaults: Modular Structured Product Infrastructure

The architecture of Core Vaults is built around four principles: modularity, composability, auditability, and security, providing a unified execution framework for complex strategies.

Core functionalities include:

Custodial LP access modules (Deposit Queue & Redeem Queue)

Unified, configurable security oracle

Professional strategy execution units (Subvault + Verifier modules)

Yield recording and certificate management (Share Manager)

Four types of fee systems (Fee Manager)

Risk control system (Risk Manager)

Fine-grained role management (Mellow ACL)

Regardless of how complex the strategy is (LP, leverage, yield layering, CEX execution, restaking, Pendle, Aave, etc.), all strategy actions are executed through a standardized vault framework and strictly verified by the verifier, ensuring safety and transparency.

Core Architecture Modules

- Deposit Queue (Delayed Deposit)

Prevent front-running

Wait for oracle pricing before minting shares at the price

Optional whitelist (for compliance)

Prevent malicious user cancellations (avoid "redeem-cancel" harassment governance)

Allow curators to manage strategy liquidity asynchronously

- Signature Queues (Fast Track)

Signed by a trusted group (consensus group)

Instant minting or redemption without waiting for Oracle

Suitable for institutional-level needs or OTC-like functions

- Vault Control (Combining All Modules)

- Control asset inflows and outflows, fees, share logic, Oracle reports, etc.

- Subvault (Strategy Execution Unit)

One Subvault per strategy, can connect to any DeFi/CEX

Function calls are restricted by the Verifier module (security layer)

- Verifier (Strategy Whitelist System)

Ensures that strategy calls are always authorized

Can verify using Merkle, on-chain, or external verifiers

- Oracle (Trustless Pricing)

Supports deviation checks (absolute & relative deviation)

Can mark "suspicious prices" for administrator confirmation

Determines the final price for deposits/redemptions

- Share Manager (User Share Management)

Compliance features such as whitelisting, locking, pausing, and allocation

Supports precise accounting for "earned shares not claimed"

- Fee Manager (Fee System)

Deposit fee

Redemption fee

Performance fee

Protocol information fee

- Risk Manager (Risk Control)

Limitations on each Vault/Subvault

Audit pending assets/actual asset discrepancies

All limits calculated based on Oracle pricing

- ACL Permission System

Dynamic roles

Auditable, facilitating institutional governance

Supported Strategy Scenarios by Mellow

Through modular Subvaults, Mellow can support the most complex strategies across chains:

Pendle: Future yield splitting/yield enhancement

Aave / Morpho / Gearbox: Leverage & lending strategies

Uniswap / Curve: Stable and non-stable pool LP management

Cowswap: Limit order execution

Symbiotic / EigenLayer: Restaking yield management

CEX execution + off-chain market-making strategies

Core Vaults aim to become the most powerful underlying structured product on-chain.

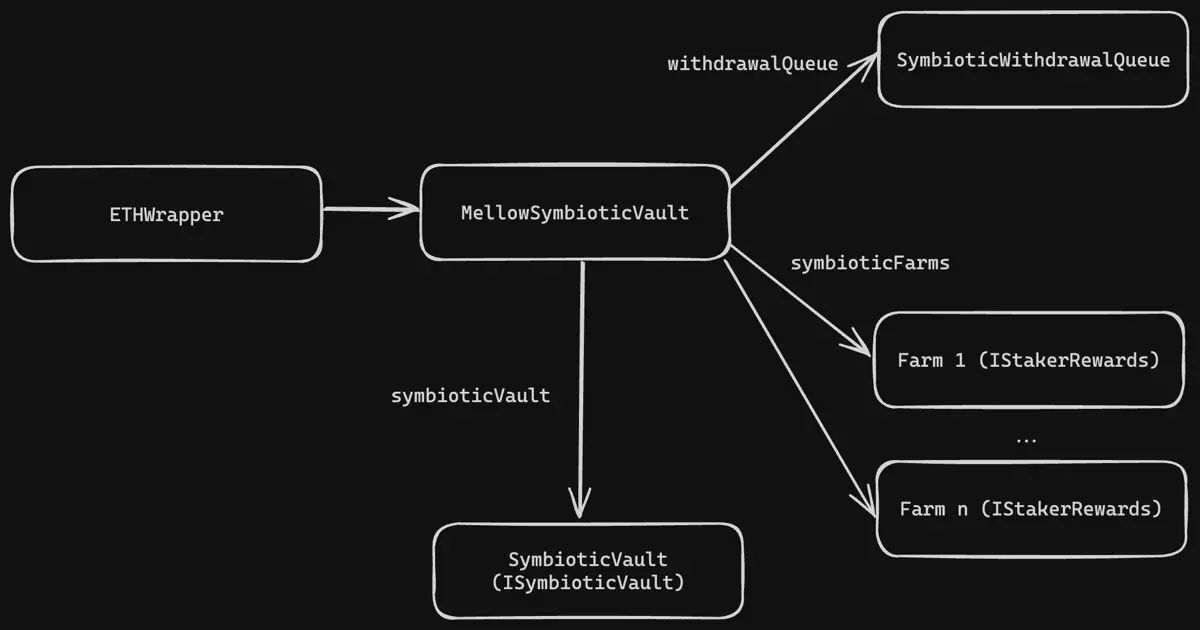

2. SimpleLRT Architecture

SimpleLRT is a modular Liquid Restaking primitive built on a set of composable vault (Vault) contracts, suitable for different risk configurations.

The system consists of the following key components:

MellowSymbioticVault (main vault logic, ERC-4626 style)

Assets (asset, such as wstETH) and corresponding DefaultCollateral

SymbioticVault (created through VaultConfigurator)

MellowSymbioticVault, as the core component, is responsible for:

ERC-4626 standard deposits and withdrawals (withdrawals are asynchronous)

Receiving rewards from the Symbiotic vault and distributing them to farms

Managing limits, pauses, whitelists, and other control logic

Key Features

The vault provides standardized asset management capabilities:

asset() / totalAssets() → Query underlying assets and TVL

convertToShares / convertToAssets → Conversion between assets and shares

preview*() → Estimate for deposits and withdrawals

getBalances() → Query user’s available/total assets and shares

Additionally, the system manages asynchronous withdrawals through an independent Withdrawal Queue, including:

pendingAssetsOf / claimableAssetsOf

claim() to complete the final claim

SimpleLRT standardizes Restaking, asynchronous withdrawals, reward distribution, and risk control into composable primitives through a modular Vault architecture, enabling permissionless creation of Liquid Restaking products with different risk preferences while being compatible with the underlying mechanisms of Symbiotic.

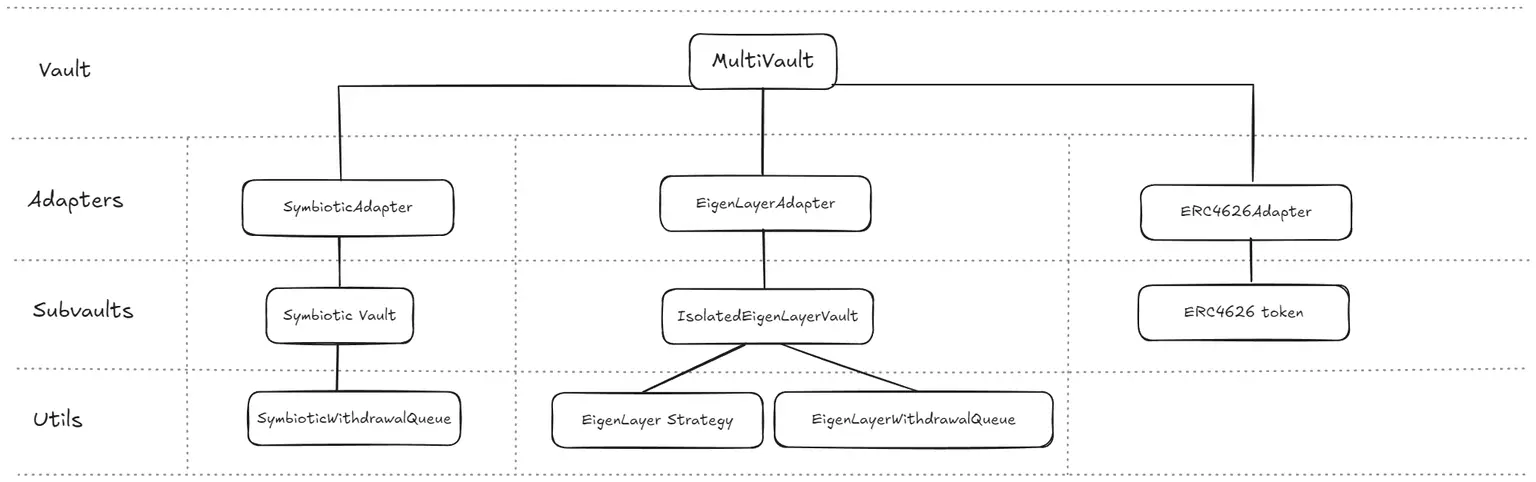

3. MultiVault Architecture

MultiVault is an asset aggregation vault aimed at multi-source yield and restaking scenarios, managing yields, restaking, and liquidity from different protocols through modular design. The system is based on an extended ERC4626, implementing advanced features such as limits, whitelists, and locking.

Core Features

Single asset entry, with MultiVault distributing and scheduling across multiple Subvaults.

Subvault supports multi-protocol combinations, such as Symbiotic, EigenLayer, and standard ERC4626, to maximize yields and abstract underlying complexities.

Unified protocol adaptation layer (Adapters):

SymbioticAdapter

EigenLayerAdapter

EigenLayerWstETHAdapter

ERC4626Adapter

Subvault Types

Currently, three types of Subvaults are supported:

SYMBIOTIC

EIGEN_LAYER

ERC4626

Excess assets revert to Symbiotic's DefaultCollateral to enhance utilization efficiency.

Asset Management Strategy (RatiosStrategy)

The strategy controls the target asset allocation range for each Subvault through minRatioD18 / maxRatioD18 and executes asset distribution during deposits, withdrawals, and rebalancing.

MultiVault abstracts multi-protocol restaking and yield sources into a unified vault system, achieving flexible, scalable, and highly secure yield aggregation and asset scheduling through Ratio strategies, adapter layers, and asynchronous withdrawal queues.

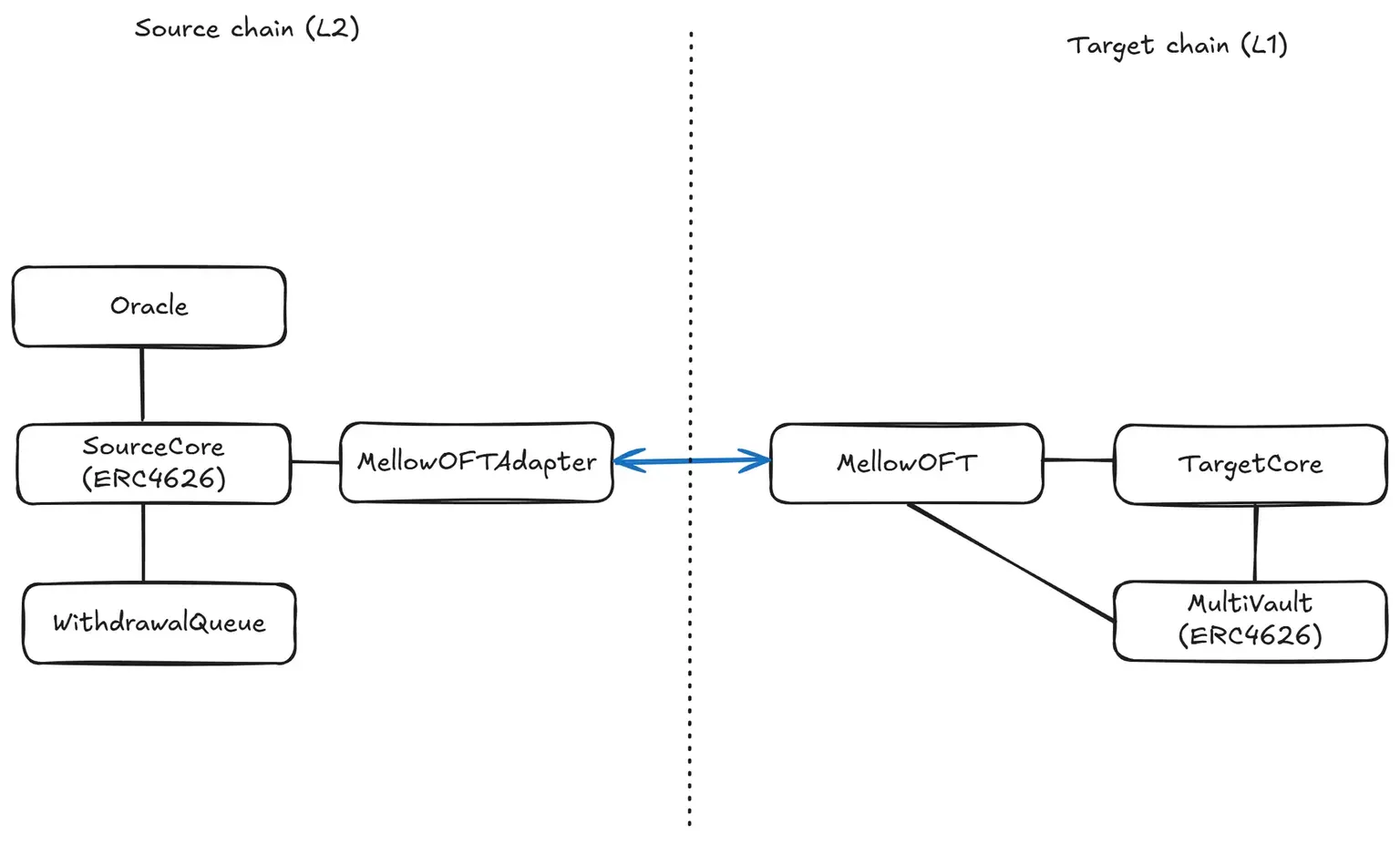

4. Interoperable Vaults

Interoperable Vaults aim to allow users to deposit assets on L2 without transferring real assets across chains, enabling restaking on L1 to obtain cross-chain yields and multi-network rewards.

The system relies on LayerZero's OFT (Omnichain Fungible Token) standard to achieve cross-chain mapping of assets, managed by Mellow's MultiVault for scheduling and managing restaking yields on L1.

Core Process

Users deposit assets on L2 and receive receipt tokens.

Assets are locked in place on L2, not moving across chains.

The system mints corresponding OFT "shadow assets" on L1.

OFT is used on L1 for restaking (Symbiotic / EigenLayer) to earn rewards.

Users receive dual yields: L2 incentives + L1 restaking yields.

In the event of slashing, OFT is proportionally reduced, but the remaining portion can still be redeemed on L2.

Two Major Sources of Yield

① L2 Yield

L2 incentives

L2 DeFi strategy yields

Ecological rewards for receipt tokens

② L1 Restaking Yield

Symbiotic / EigenLayer rewards

Network points

OFT is treated as equivalent to native assets, eligible for full rewards

Architecture Essentials

L2 (Source Chain)

Users deposit & receive shares

Assets are locked

L2 yield sources

L1 (Target Chain)

Mint OFT

MultiVault allocates to restaking protocols

Generate L1 yields

Cross-Chain Communication

Uses LayerZero OFT

Only SourceCore is allowed to initiate cross-chain operations

Real assets do not move, only cross-chain mapping

Tron Comments

Mellow's advantages lie in its highly modular and composable vault infrastructure, supporting permissionless creation of various structured products such as LRT, MultiVault, and cross-chain vaults. It can connect to multiple ecosystems including Symbiotic, EigenLayer, and DeFi, meeting institutional-level ALM, yield management, and restaking needs. Its modules for strategy, risk control, queues, permissions, and oracles are clearly separated, enhancing security, transparency, and scalability, while allowing curators to flexibly construct complex strategies. It is currently one of the most comprehensive on-chain structured yield frameworks.

The disadvantages include the system's relative complexity, relying on multi-layer queues and cross-chain components, which presents a higher understanding threshold for ordinary users. Additionally, the combination of multiple protocols, cross-chain operations, and restaking increases operational risk, with strong dependencies on oracles, permission management, and the stability of external protocols. The curator role may also introduce certain trust assumptions and operational risks.

1. Overall Market Performance

1.1. Spot BTC vs ETH Price Trends

BTC

ETH

2. Public Chain Data

Macroeconomic Data Review and Key Data Release Points for Next Week

The non-farm payroll and unemployment rate data released last week for December overall signaled "employment continues to cool but has not yet stalled." The number of new non-farm jobs added in December was significantly below the average level for the year, indicating a further slowdown in companies' hiring intentions and a weakening of employment expansion momentum. Meanwhile, the unemployment rate rose slightly, reflecting that the labor market is transitioning from a previously tight balance to a more relaxed state. This set of data reinforces the judgment that "the lagging impact of high interest rates on employment is becoming evident," and supports market expectations that the Federal Reserve's subsequent policies will lean more towards a wait-and-see approach, reserving space for interest rate cuts within the year. Overall, the employment data did not trigger a recession alarm but clearly pointed towards an economic slowdown.

Important data releases this week:

January 13: U.S. December unadjusted CPI year-on-year

Regulatory Policies

China: Reaffirming Strict Regulation and Promoting Digital RMB

Regulatory Tone: The People's Bank of China held a work meeting from January 5 to 6, clearly stating that it will further tighten regulations on virtual currency "mining" and trading activities by 2026 and increase efforts to combat related illegal financial activities.

Payment Monitoring: The meeting required commercial banks and payment institutions to continuously strengthen monitoring of fund flows related to cryptocurrency transactions to prevent risk transmission.

Digital Currency: The meeting reiterated the cautious and steady advancement of the research and pilot of the digital RMB (e-CNY), expanding its application scenarios and ecosystem construction.

United States: Key Legislative Process Enters Sprint Stage

Legislative Process: The Senate Banking Committee is officially scheduled to review and vote on the "Digital Asset Market Structure Act" (CLARITY Act) on January 15. This is a critical step for the bill to enter a full Senate vote and ultimately become law.

Clause Controversy: In the negotiations over the final text of the bill, bipartisan lawmakers have proposed specific amendments:

Democratic Senator Angela Alsobrooks proposed allowing exchanges to pay rewards for active trading involving USD stablecoins but prohibiting interest payments on stablecoins merely held in wallets to prevent unregulated "bank-like" products.

Republicans proposed amending the Bank Secrecy Act to explicitly include intermediary service providers for digital commodities (such as Bitcoin) within the definition of "financial institutions" under the law to strengthen anti-money laundering obligations.

Industry Action: As the review date approaches, U.S. cryptocurrency industry organizations are ramping up lobbying efforts to secure a more favorable regulatory environment in the final terms.

International Organization (OECD): A Key Step Towards Global Tax Transparency

Framework Effectiveness: The "Crypto Asset Reporting Framework" (CARF) developed by the Organization for Economic Cooperation and Development (OECD) will officially take effect on January 1, 2026.

Core Requirements: The framework requires crypto asset service providers (such as exchanges and custodians) in participating jurisdictions to collect transaction information of their clients (including individuals and entities) and automatically report it to their national tax authorities.

Participation Scope: The first batch includes 48 jurisdictions joining the framework, including all EU member states, the UK, Brazil, Japan, South Korea, Australia, and others. The automatic information exchange plan between jurisdictions will begin implementation in 2027.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。