Author: Zen, PANews

As funds shift from broad net casting to targeted fishing, the market enters a phase driven by "quality" rather than "quantity." In this silent reshuffle of 2025, centralized finance (CeFi) returns to the center stage with massive financing, the narrative of the integration of Web3 and AI steadily advances, infrastructure and DeFi remain the backbone, while the once-glorious Web3 gaming sector fades away.

PANews has compiled 839 disclosed financing events in the primary market of the blockchain sector for 2025, following the flow of $23.7 billion in funds, revealing the choices of capital and tracking the rise of the next value high ground.

Overall Market Review: Doubling of Financing Scale Amidst Shrinking Number of Transactions

According to incomplete statistics from PANews, the primary market in the blockchain sector disclosed a total of 839 investment and financing events in 2025, with a total funding scale exceeding $23.7 billion. In terms of the number of financing events, the number of transactions announced in 2025 saw a significant decrease compared to 1,259 in 2024, a year-on-year decline of about 33.6%; however, in terms of funding scale, the inflow of funds into the investment and financing market in 2025 increased significantly, far exceeding the $9.3 billion of 2024.

Unlike the decline, caution, and rationality observed in the primary market from 2023 to 2024, 2025 overall showed a significant warming trend. The total number and scale of financing in that year also reached about half of the levels during the bull market of 2022—when there were a total of 1,660 investment and financing events, with total funds exceeding $34.8 billion.

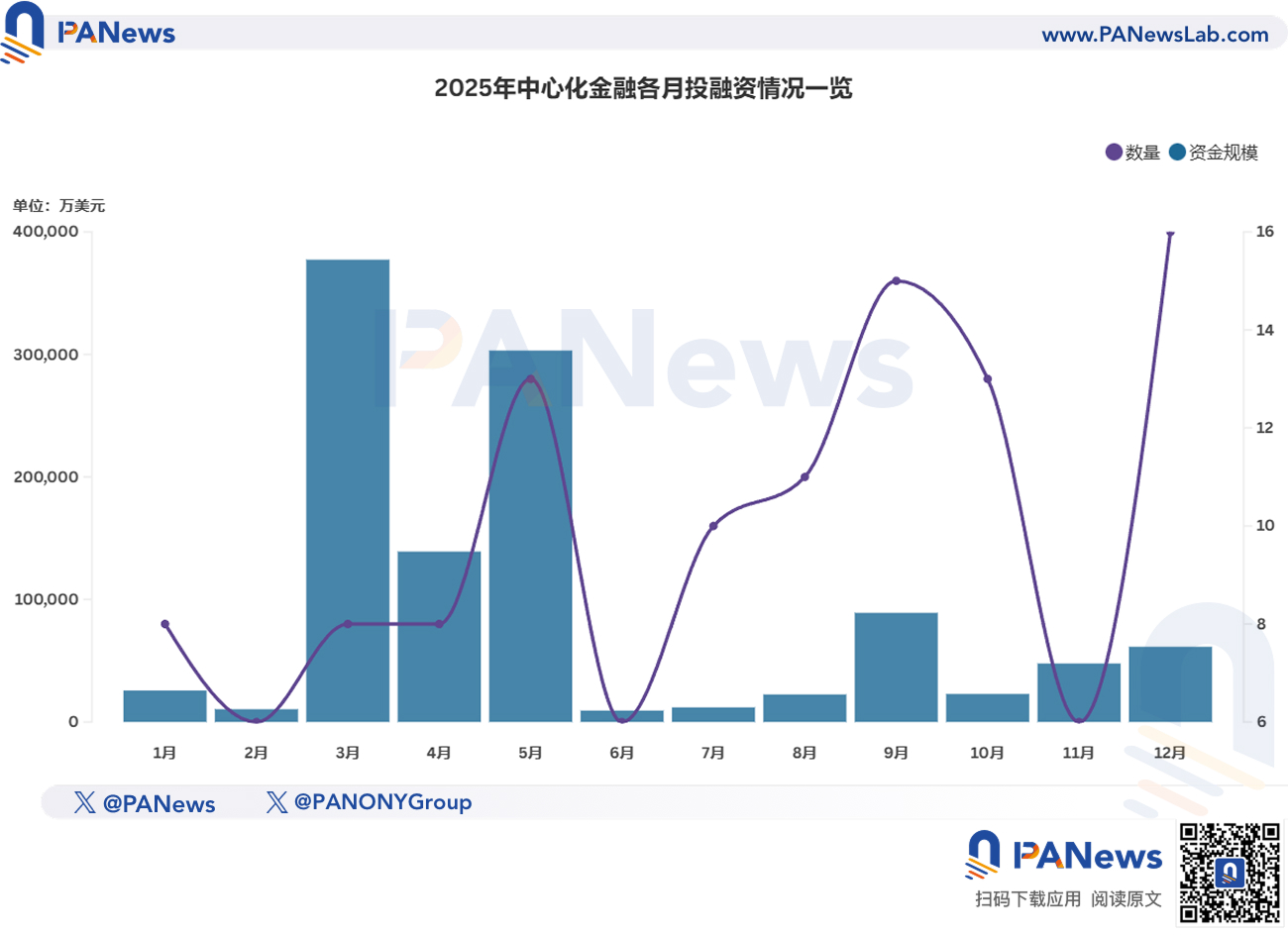

Although the overall market has significantly warmed, the trend of changes in the primary market remains largely the same as in 2023 and 2024, only more extreme—viewed from the perspective of capital inflow, 2025 still saw two explosive periods in the first and second halves of the year, concentrated in March-May and October-November.

This situation is mainly influenced by super-large financing events: In March, Abu Dhabi's MGX invested $2 billion in Binance for a minority stake; in October, the parent company of the New York Stock Exchange, ICE, made a $2 billion strategic investment in Polymarket at a post-investment valuation of $9 billion. The prediction market Kalshi raised over $300 million in a new round of financing, with a company valuation reaching $5 billion; in November, Kalshi completed another $1 billion financing, increasing its valuation to $11 billion.

Additionally, from March to May, Kraken acquired NinjaTrader for $1.5 billion, Ripple acquired Hidden Road for $1.25 billion, and Coinbase spent $2.9 billion to acquire Deribit, setting the largest transaction record in 2025.

Subsequently, at the end of the second quarter and during the third quarter of 2025, the market essentially replicated the trends of the past two years, returning to calm. As the fourth quarter began, the investment and financing market quickly welcomed the hottest month of the primary market in 2025: October. This month saw both volume and price rise, with 87 investment and financing events announced, and inflow funds exceeding $3.9 billion. Excluding the impact of super-large financing significantly increasing the total amount of funds, the number of financing transactions in that month was also the highest of the year.

After peaking in October, as the secondary market gradually weakened and the trend shifted from bull to bear, the publicly disclosed number of financing transactions plummeted to 52 in November, the lowest value among all months in 2025. However, the announcement of Kalshi completing $1 billion in financing and Ripple receiving a $500 million strategic investment in that month raised the financing scale, keeping the total monthly financing amount still at a high level.

From the perspective of industry development, the narrative themes favored by investment institutions mainly focus on centralized finance involving stablecoins and payment concepts, while exchanges and prediction markets are particularly prominent in their ability to attract capital.

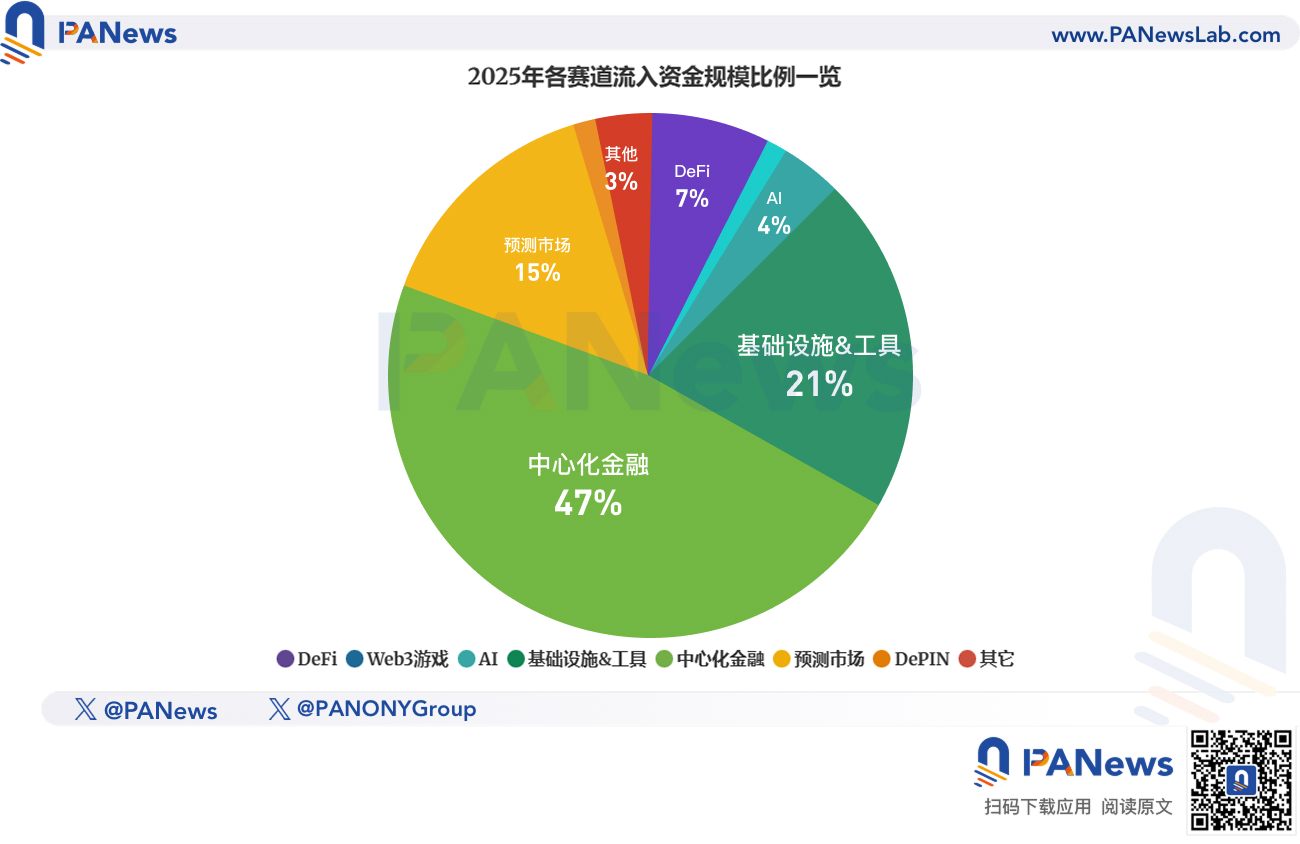

Based on market hotspots and continuity, PANews broadly categorizes projects into DeFi, Web3 gaming, infrastructure and tools, AI, centralized finance, and other Web3 applications including prediction markets, DePIN, social, and DeSci, and has compiled statistics on the investment and financing situation in each track.

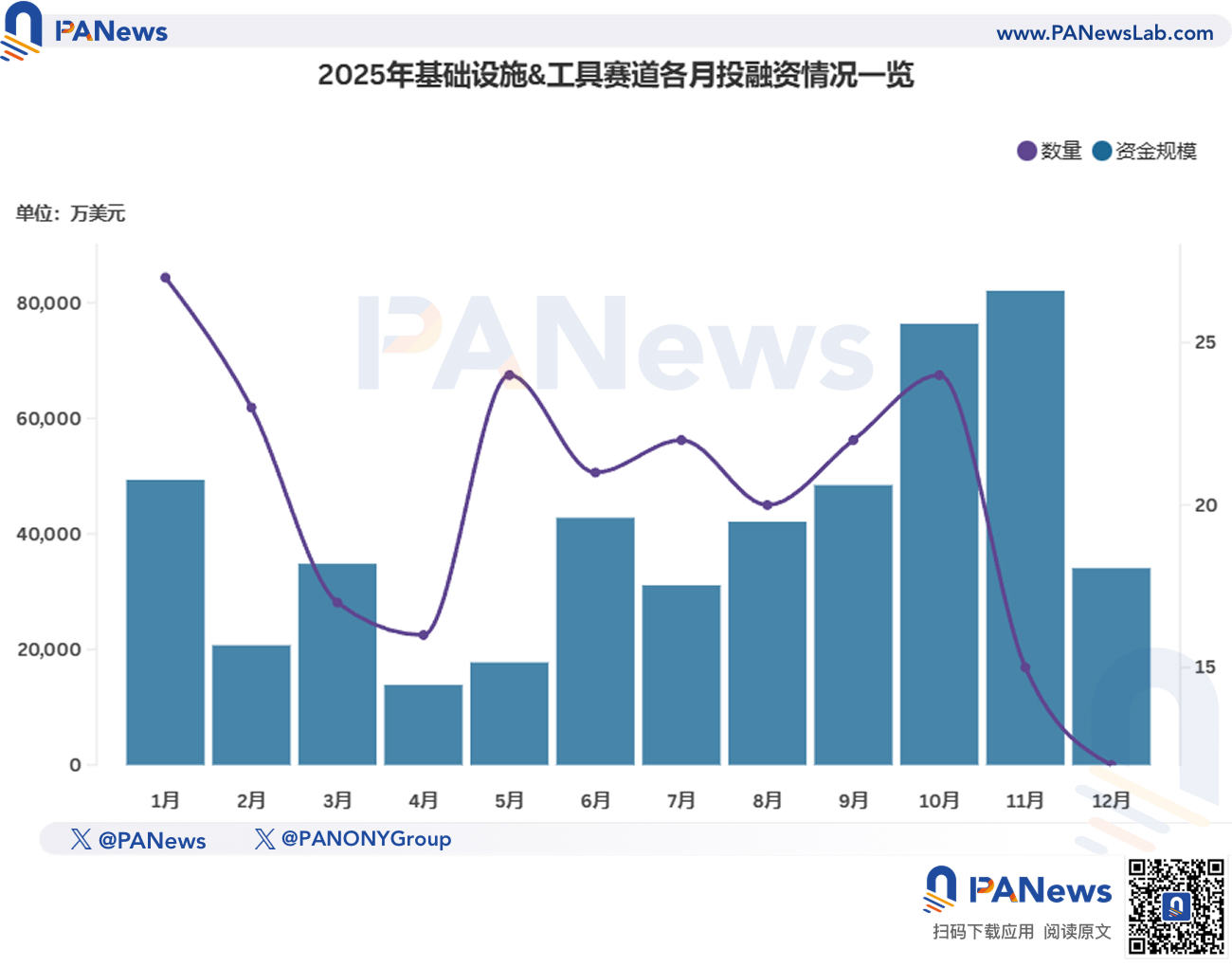

Infrastructure & Tools: Significant Increase in Large Financing Proportion, Favoring Payment and Settlement Fields

In 2025, the infrastructure and tools track disclosed a total of 243 investment and financing events, raising over $4.9 billion, with an average financing amount of about $20.3 million.

Among all financing events disclosed in 2025, about 28.96% belong to infrastructure & tools, which is basically on par with 2024; however, the amount raised in this track last year accounted for about 20.78% of the total, a significant decrease from 39.46% in 2024.

Nevertheless, the infrastructure & tools track still announced the most large financing news, with 101 investment and financing events at the million-dollar level or above, accounting for 41.56%, significantly higher than 27.82% in 2024; while there were 12 events reaching over $100 million, double that of last year.

In October 2025, the blockchain payment infrastructure project Tempo completed a $500 million Series A financing at a valuation of $5 billion, led by Thrive Capital and Greenoaks, with participation from Sequoia, Ribbit Capital, and others; in November, Ripple raised $500 million through institutional investors such as Fortress Investment and Citadel Securities, bringing its valuation to $40 billion. These two transactions were the largest financing amounts in this track last year, both focused on the infrastructure direction of crypto payments.

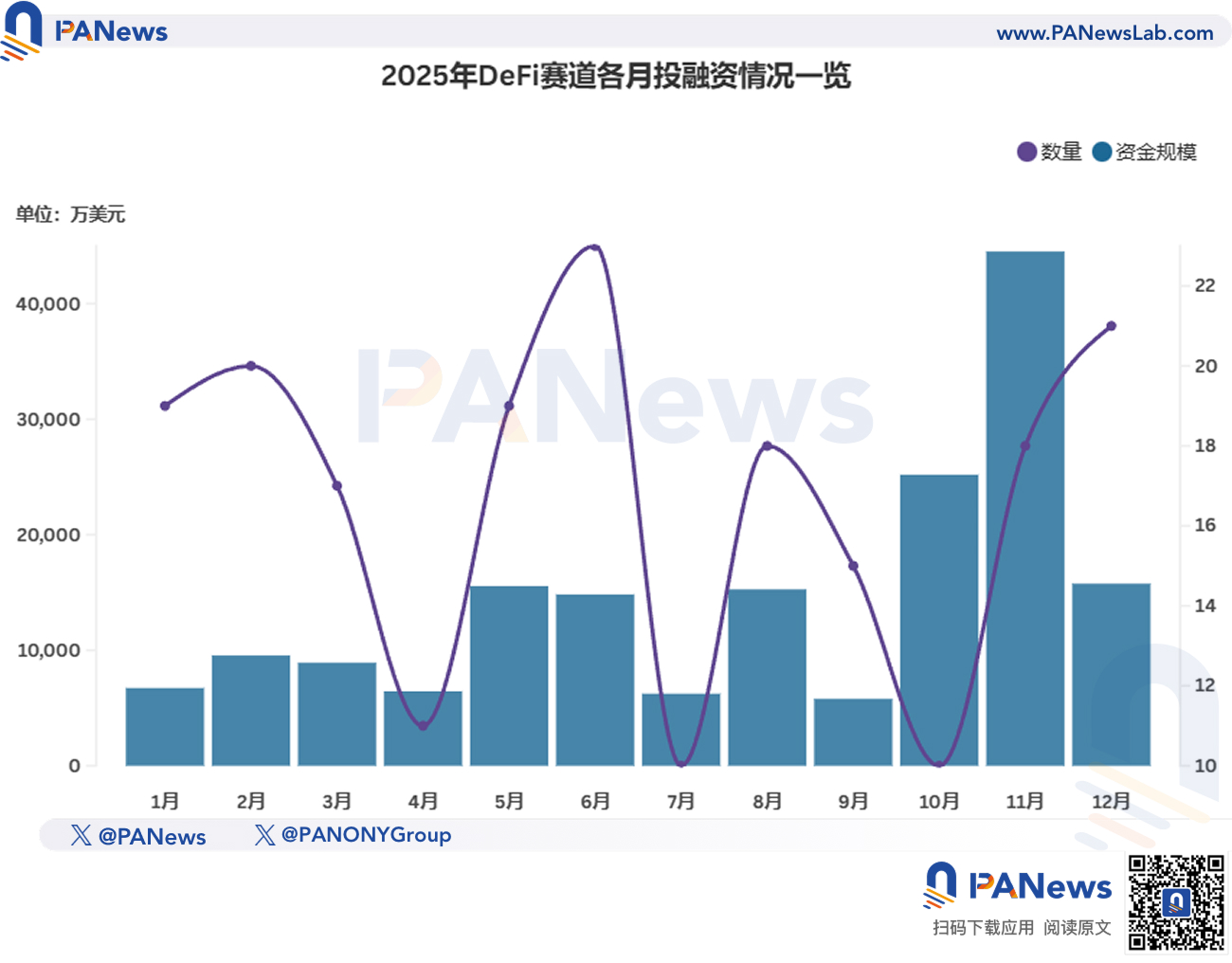

DeFi: Stable Base Maintained, Year-End Financing Activities Rise Against the Trend

In 2025, DeFi remained the most focused vertical field aside from infrastructure. This track disclosed a total of 201 investment and financing events throughout the year, with inflow funds exceeding $1.748 billion, accounting for 24.04% and 7.36% respectively, with the former being basically on par with 2024, while the latter significantly lower than 18.22% in 2024.

Among the financing news disclosed by DeFi projects, there were 41 events at the million-dollar level, accounting for 20.39%, exceeding 13.51% in 2024. However, in distribution, it still concentrated more in the range of several million dollars.

In November 2025, although the overall number of transactions in the primary market reached its lowest point, the DeFi track "suddenly rose," with the number of project financings rebounding to 18, exceeding the annual average of 16, and the inflow funds set a new record for the year, exceeding $445 million.

Additionally, among the top ten financing and mergers in the DeFi track in 2025, three occurred in November: the Bitcoin lending platform Lava raised $200 million in new funding, Paxos acquired the DeFi wallet startup Fordefi for over $100 million, and the decentralized trading protocol Lighter secured $68 million in financing.

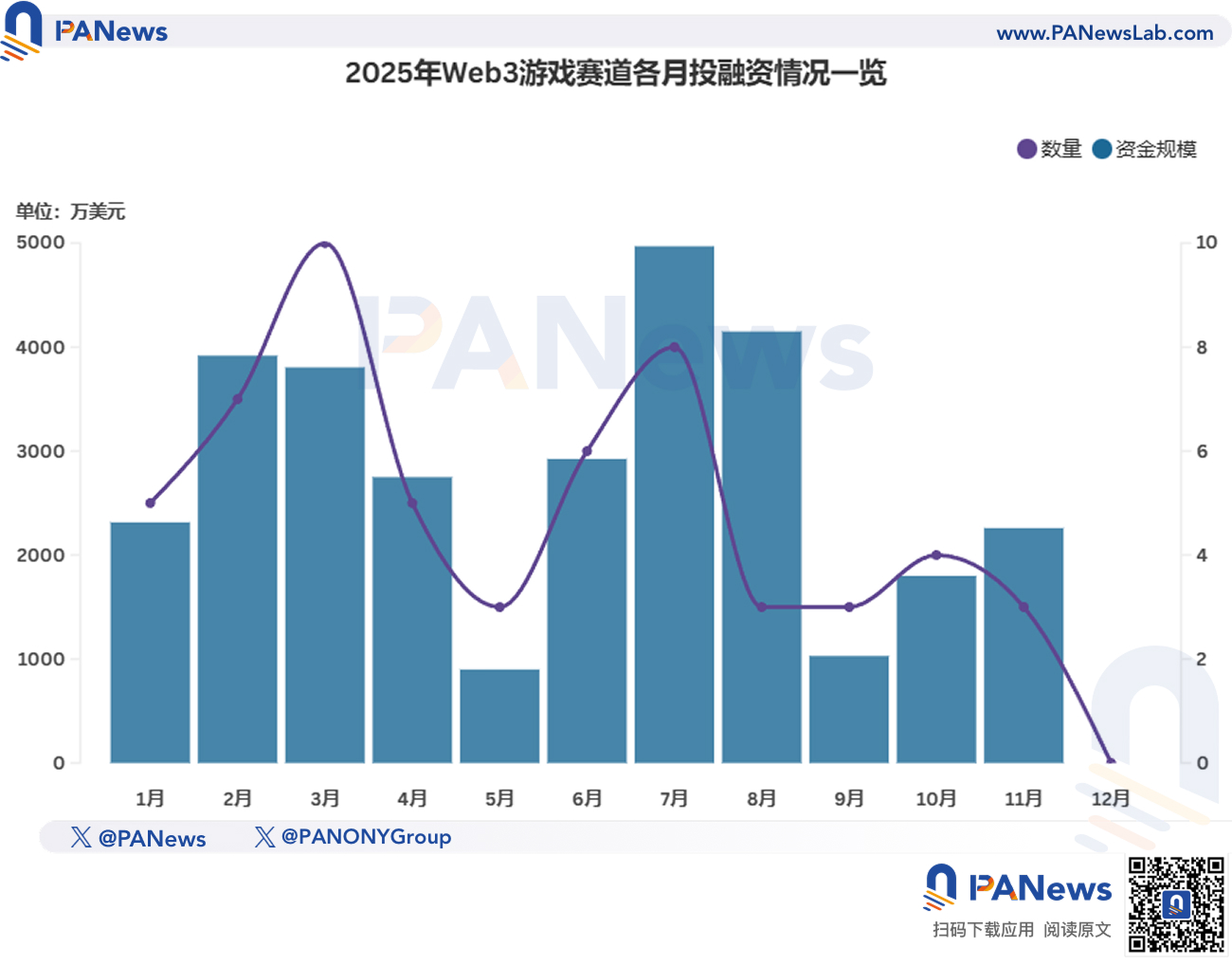

Web3 Gaming: Dramatic Decline in Popularity, Both Financing Scale and Quantity Halved

The Web3 gaming track continued to decline in 2025—this was already known before the official statistics. This track disclosed a total of 57 investment and financing events throughout the year, raising $308 million, while the data for 2024 was 178 events and $849 million. In terms of transaction quantity, Web3 gaming decreased by 67.98%; in terms of funding scale, the decline was 63.72%. From any perspective, the Web3 gaming track shows clear signs of decline.

According to trends, excluding the impact of the overall industry adjustment in May, the gaming track has been gradually declining over time. By the fourth quarter, it had fallen to its lowest point, with no financing news for any gaming projects announced in December. If this continues, Web3 gaming may find it difficult to form a specialized category with scale in statistics in 2026, similar to NFT and social tracks.

Moreover, the investment institutions active in this track are mostly limited to top gaming VCs focused on the gaming sector, such as Bitkraft Ventures, Griffin Gaming Partners, and Animoca Brands. Among them, Web3 VC Animoca Brands has invested in over 628 portfolio companies, about 200 of which are gaming projects.

Web3 + AI: Steady Progress in Narrative Integration

With the development of artificial intelligence, how to integrate it has become an important topic of interest in the tech industry, and the integration of AI with blockchain and cryptocurrency is also showing an upward trend. In 2025, the Web3 + AI track disclosed a total of 111 financings, with a funding scale of $884 million, both growing by over 20%.

Due to statistical criteria, considering that there are many blockchain projects that only integrate AI functions and applications rather than specifically focusing on AI, the actual funds involved in this field may be even more.

From the annual trend, the Web3 + AI track is the most stable direction. During the downturn in the market in the second and third quarters, it instead entered its "best period," with both the number of transactions and financing scale reaching their highest values in July.

In terms of funding scale, AI projects that received million-dollar funding in 2025 accounted for 26.12%, significantly exceeding 15.2% in 2024, showing a steady development trend. In August 2025, the AI compliance platform IVIX, which combats crypto financial crime, completed $60 million in Series B financing, setting the highest record for a single financing scale in this track.

Centralized Finance: A "Harvest Year" with Huge Financing and High Valuations Becoming the Norm

2025 is a "harvest" year for the centralized finance sector: a total of 120 investment and financing events were announced throughout the year, with a funding scale reaching $11.2 billion. Compared to 2024, the former doubled, while the latter increased nearly eightfold.

Centralized finance has always been the vertical field with the highest average financing amount in the entire industry, reaching $93.37 million in 2025. This is mainly due to large acquisition cases such as Coinbase's $2.9 billion acquisition of Deribit and Binance's single financing event of $2 billion, which significantly raised the funding scale. Even excluding these large transactions, the centralized finance sector still performed well overall: there were 73 financing events reaching the million-dollar level, accounting for as much as 60.83%, further improving from the already high 43.48% in 2024.

Additionally, compared to 2024, where only Hashkey's financing amount approached the $100 million level, there were seven financing events in 2025 that reached the billion-dollar scale. Among them, the established U.S. crypto exchange Kraken secured over $100 million in financing twice, while Citadel Securities made a single strategic investment of up to $200 million.

It is worth mentioning that South Korean tech giant Naver is acquiring Dunamu, the parent company of the cryptocurrency exchange Upbit, for $10.3 billion. This transaction is a full stock merger and is expected to be completed in June 2026, so it will not be included in the 2025 annual statistics.

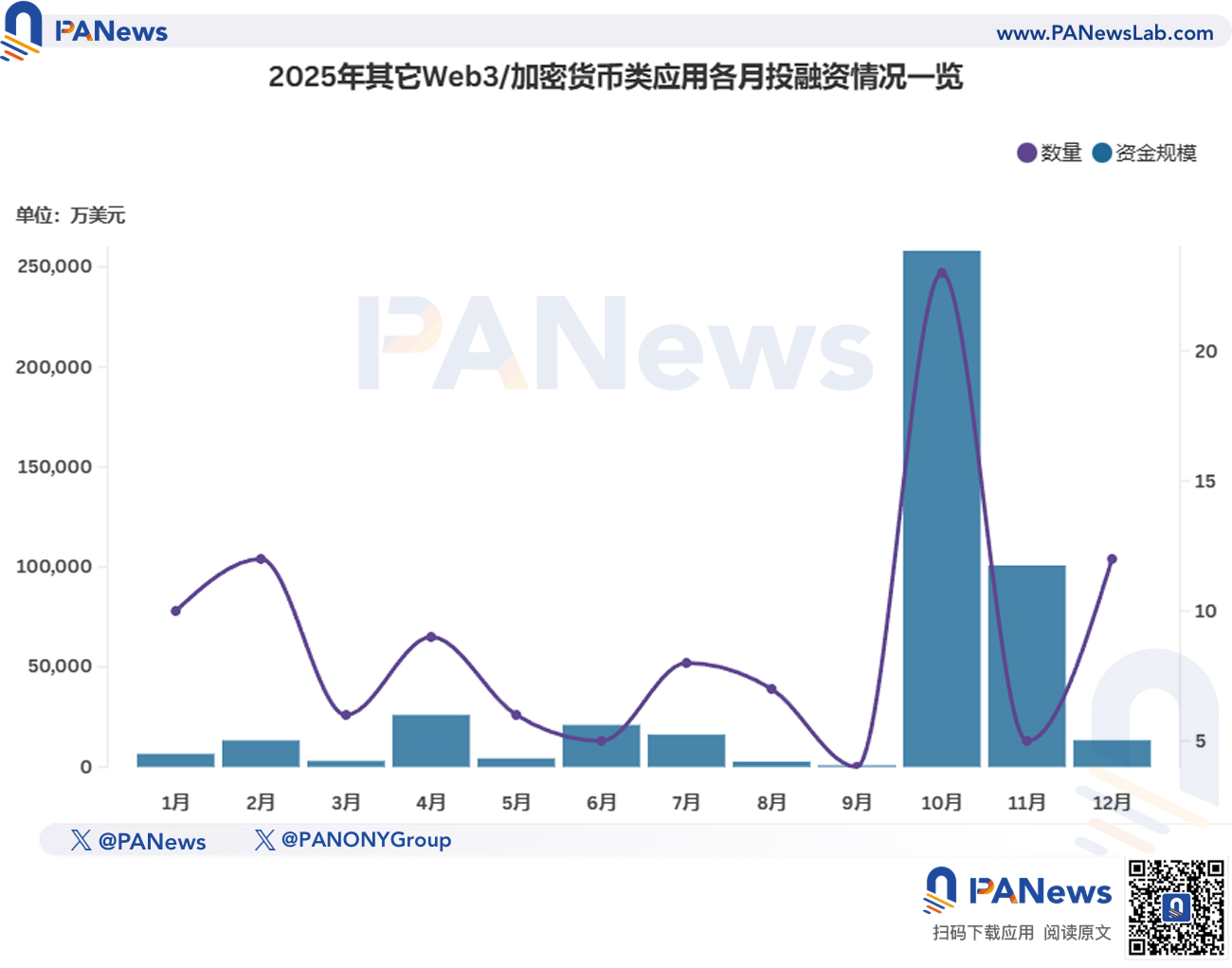

Others: Prediction Markets Lead the Hot Topics

The "Others" category includes blockchain application directions such as prediction markets, DePIN, crypto mining, DAOs, DeSci, and social platforms. It should be noted that while prediction markets are undoubtedly the hottest topic in 2025, due to their lack of continuity and the fact that funding is almost entirely concentrated in the two giants Polymarket and Kalshi, they are categorized under "Others."

In 2025, this track disclosed a total of 107 investment and financing events, with a funding scale of $4.376 billion. Among them, the total financing amount for prediction markets reached $3.561 billion—Polymarket secured $2 billion in a single financing, while Kalshi quickly followed suit, completing three rounds of financing within a few months starting from mid-year, raising a total of $1.485 billion.

In terms of funding scale, aside from prediction markets, crypto mining, DePIN projects, and consumer projects also secured large financing amounts. Among them, U.S. Bitcoin mining manufacturer Auradine completed a $153 million financing round, with participation from StepStone Group, Samsung, Qualcomm, Premji Invest, and others.

Investment Institutions: Focusing on Quality Over Quantity, Family Office Funds Emerge

According to incomplete statistics from PANews, 36 crypto investment funds were launched in 2025, a decrease from 47 in 2024; the total scale reached $5.082 billion, exceeding the $4.34 billion of 2024.

As the cycle turns and the sands of time sift, many crypto VCs have gradually faded away. In 2025, the investment institution sector continued to evolve towards a "focus on quality over quantity" direction. Among the VCs that launched crypto investment funds in 2025, 20 funds raised over $100 million, accounting for 55.5%, which is double that of 2024.

In October 2025, the former Binance Labs, now transformed into a family office, YZi Labs, established a $1 billion fund to support the construction of the BNB ecosystem, making it the largest fund by scale in 2025.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。