Author|Momir @IOSG

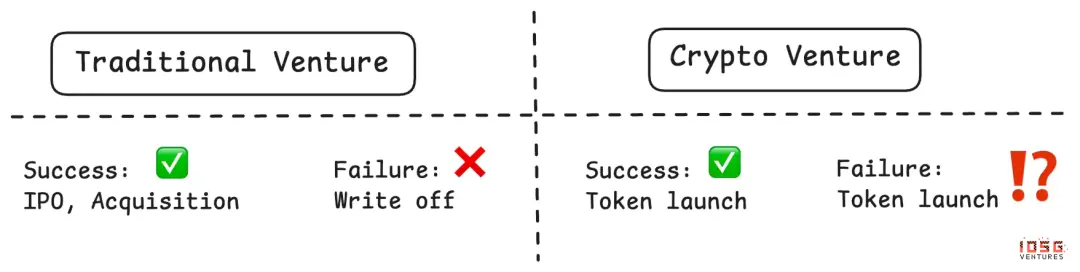

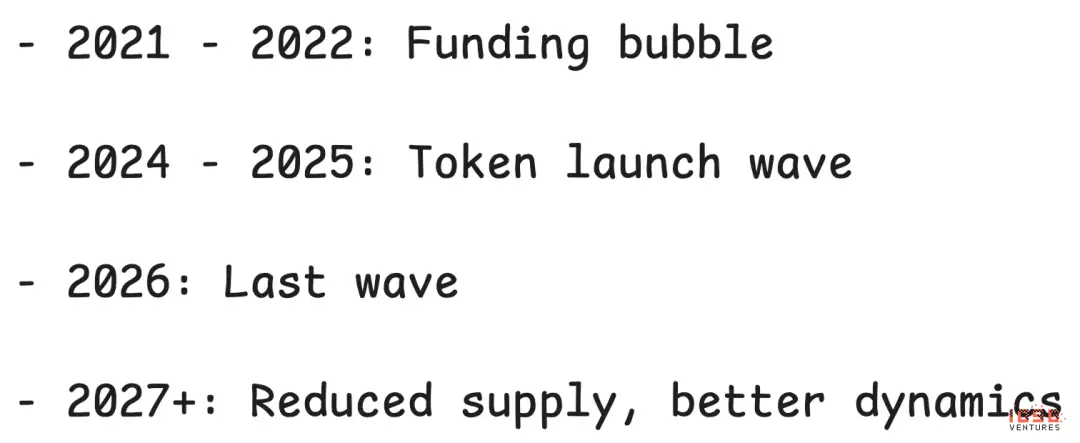

The altcoin market has experienced its most difficult period this year. To understand the reasons, we need to go back to decisions made a few years ago. The financing bubble of 2021-2022 gave rise to a batch of projects that raised significant funds, and now these projects are issuing tokens, leading to a fundamental problem: a massive supply is flooding the market, but demand is scarce.

The issue is not just oversupply; worse, the mechanisms that caused this problem have fundamentally remained unchanged. Projects continue to issue tokens regardless of whether there is a market for their products, treating token issuance as a necessary path rather than a strategic choice. As venture capital funds dry up and primary market investments shrink, many teams have turned token issuance into their only financing channel or a way to create exit opportunities for insiders.

This article will delve into the "four-loss dilemma" that is dismantling the altcoin market, examine why past repair mechanisms have failed, and propose possible rebalancing ideas.

1. Low Circulation Dilemma: A Four-Loss Game

Over the past three years, the entire industry has relied on a severely flawed mechanism: low circulation token issuance. When projects issue tokens, the circulation is extremely low, often only a single-digit percentage, artificially maintaining a high FDV (Fully Diluted Valuation). The logic seems reasonable: with less supply, prices remain stable.

However, low circulation cannot remain low indefinitely. As supply is gradually released, prices are bound to crash. Early supporters become the victims; data shows that most tokens have performed poorly since their launch.

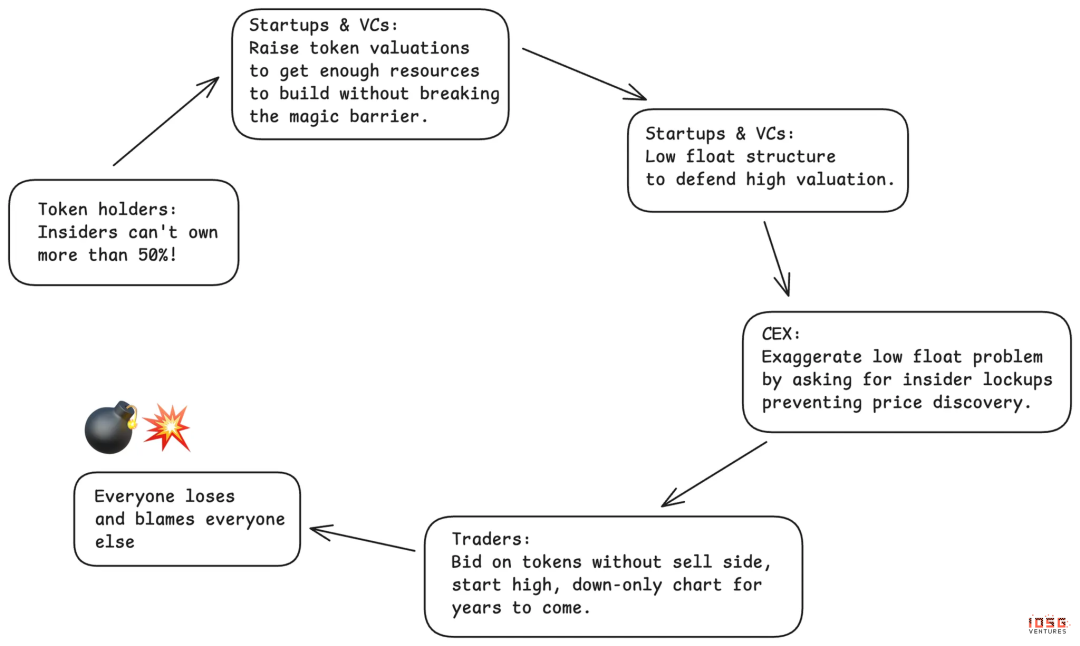

The most cunning aspect is that low circulation creates a situation where everyone feels they are benefiting, while in reality, everyone is losing:

- Centralized exchanges believe that by requiring low circulation and strengthening control, they can protect retail investors, but this results in community resentment and poor token price performance.

- Token holders thought that "low circulation" could prevent insiders from dumping, but ultimately, they did not see effective price discovery and were instead harmed by their early support. When the market demands that insiders hold no more than 50% of tokens, primary market valuations are pushed to distorted levels, forcing insiders to rely on low circulation strategies to maintain superficial stability.

- Project teams believed that manipulating low circulation could sustain high valuations and reduce dilution, but once this practice becomes a trend, it will destroy the entire industry's financing capability.

- Venture capitalists thought they could value their holdings based on the market cap of low circulation tokens and continue fundraising, but as the flaws in the strategy were exposed, mid- to long-term financing channels were cut off.

A perfect four-loss matrix. Everyone thinks they are playing a grand game, but the game itself is detrimental to all participants.

2. Market Response: Meme Coins and MetaDAO

The market has attempted to break the deadlock twice, and both attempts have exposed how complex token design is.

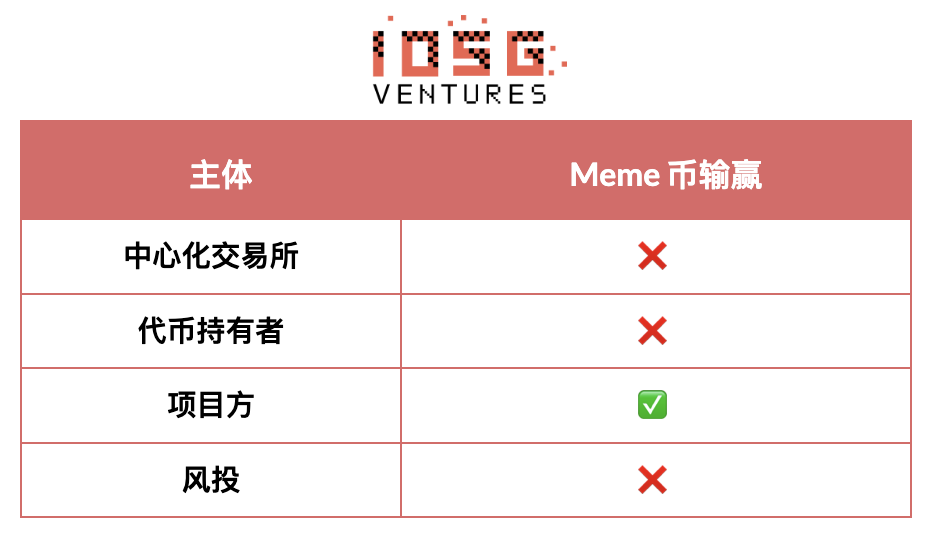

First Round: Meme Coin Experiment

Meme coins are a counterattack against venture capital's low circulation token issuance. The slogan is simple and enticing: 100% circulation on the first day, no venture capital, completely fair. Finally, retail investors won't be scammed in this game.

However, the reality is much darker. Without a filtering mechanism, the market is flooded with unfiltered tokens. Independent, anonymous operators have replaced venture capital teams, which not only failed to bring fairness but also created an environment where over 98% of participants lost money. Tokens became tools for exit scams, with holders being harvested clean within minutes or hours of launch.

Centralized exchanges find themselves in a dilemma. If they don't list meme coins, users will go directly to on-chain trading; if they do list meme coins and the prices crash, they take the blame. Token holders suffer the most. The real winners are only the token issuance teams and platforms like Pump.fun.

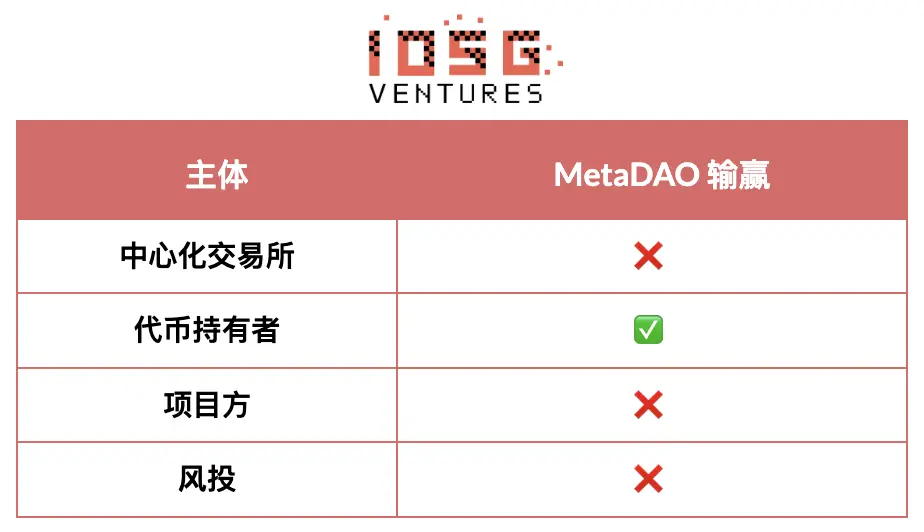

Second Round: MetaDAO Model

MetaDAO is the market's second major attempt, swinging to the other extreme—extremely protective of token holders.

There are indeed benefits:

- Token holders gain control, making capital deployment more attractive.

- Insiders can only cash out if they meet specific KPIs.

- It opens up new financing methods in a capital-constrained environment.

- Initial valuations are relatively low, making access fairer.

But MetaDAO overcorrects, bringing new problems:

- Founders lose too much control too early. This creates a "founder lemon market"—capable and selective teams avoid this model, leaving only desperate teams to accept it.

Tokens still launch very early, with huge volatility, but the filtering mechanism is even less than that of venture capital cycles.

- The infinite issuance mechanism makes it nearly impossible for top-tier exchanges to list. MetaDAO and centralized exchanges that control the majority of liquidity fundamentally do not align. If tokens cannot be listed on centralized exchanges, they become trapped in a market with depleted liquidity.

Each iteration aims to solve problems for one party but proves that the market has self-regulating capabilities. However, we are still searching for a balanced solution that considers the interests of all key participants: exchanges, token holders, project teams, and capital providers.

Evolution continues, and there will be no sustainable model until a balance is found. This balance is not about pleasing everyone but about drawing a line between harmful practices and reasonable rights.

3. What Should a Balanced Solution Look Like

Centralized Exchanges

What should stop: Requiring extended lock-up periods to hinder normal price discovery. These extended lock-ups seem protective but actually impede the market from finding a reasonable price.

What should be required: Predictability of token release schedules and effective accountability mechanisms. The focus should shift from arbitrary time locks to KPI-based unlocks, with shorter, more frequent release cycles tied to actual progress.

Token Holders

What should stop: Overcorrecting due to historical lack of rights, excessively controlling and scaring away the best talent, exchanges, and venture capital. Not all insiders are the same; demanding uniform long-term lock-ups while ignoring the differences among roles also hinders reasonable price discovery. Insisting on a so-called magical holding threshold ("insiders cannot exceed 50%") creates the very soil for low circulation manipulation.

What should be required: Strong information rights and operational transparency. Token holders should be clear about the business operations behind the tokens, regularly updated on progress and challenges, and aware of the true state of reserves and resource allocation. They have the right to ensure that value is not lost through opaque operations or alternative structures, and tokens should be the primary IP holders, ensuring that the created value belongs to the token holders. Finally, token holders should have reasonable control over budget allocation, especially for significant expenditures, but should not micromanage daily operations.

Project Teams

What should stop: Issuing tokens without clear product-market fit signals or actual token utility. Too many teams treat tokens as a less favorable form of equity—worse than risk equity, yet without legal protection. Token issuance should not be merely because "all crypto projects do this" or because funds are running low.

What should be required: The ability to make strategic decisions, take bold bets, and manage daily operations without needing DAO approval for everything. If they are to be held accountable for results, they must have the power to execute.

Venture Capitalists

What should stop: Forcing every invested project to issue tokens, regardless of whether it makes sense. Not every crypto company needs a token; forcing token issuance to mark holdings or create exit opportunities has already flooded the market with low-quality projects. Venture capitalists should be stricter and realistically assess which companies are truly suited for a token model.

What should be required: The right to receive corresponding returns for taking extreme risks in early-stage crypto projects. High-risk capital should expect high returns when locked up. This means reasonable ownership ratios, fair release plans reflecting contributions and risks, and the right to not be demonized when successfully exiting investments.

Even if a balanced path is found, timing is crucial. The short-term outlook remains grim.

4. The Next 12 Months: The Last Wave of Supply Shock

The next 12 months are likely to be the last wave of supply excess from the previous venture capital hype cycle.

If we survive this digestion period, the situation should improve:

- By the end of 2026, projects from the last round will either have issued their tokens or gone bankrupt.

- Financing costs remain high, and the formation of new projects is limited. The number of venture capital projects waiting to issue tokens has noticeably decreased.

- Primary market valuations will return to rationality, alleviating the pressure of maintaining high valuations through low circulation.

Decisions made three years ago have shaped today's market landscape. Today's decisions will determine the market direction two to three years from now.

However, beyond the supply cycle, the entire token model faces deeper threats.

5. Existential Crisis: Lemon Market

The biggest long-term threat is that altcoins become a "lemon market"—high-quality participants are kept out, and only those with no other options come in.

Possible evolutionary paths:

- Failed projects continue to issue tokens to gain liquidity or prolong their existence, even if their products have no market fit. As long as projects are expected to issue tokens, regardless of success or failure, failed projects will continue to flood the market.

- Successful projects choose to exit upon seeing the dire situation. When excellent teams observe the overall poor performance of tokens, they may turn to traditional equity structures. If they can succeed as equity companies, why endure the torment of the token market? Many projects lack convincing reasons to issue tokens; for most application-layer projects, tokens are shifting from a necessity to an option.

If this trend continues, the token market will be dominated by those failed projects with no other choice—unwanted "lemons."

Despite the risks, I remain optimistic.

6. Why Tokens Can Still Win

Although there are many challenges, I still believe that the worst-case lemon market will not come true. The unique game-theoretic mechanisms that tokens provide are fundamentally unattainable through equity structures.

Accelerating growth through ownership distribution. Tokens can achieve precise distribution strategies and growth flywheels that traditional equity cannot. Ethena's token-driven mechanism rapidly guides user growth, creating a sustainable protocol economic model, which is the best proof.

Creating passionate, loyal communities with moats. When done right, tokens can build truly vested communities—participants become highly engaged and loyal ecosystem advocates. Hyperliquid is an example: their trader community has become deeply involved, creating network effects and loyalty that would be impossible to replicate without tokens.

Tokens can enable growth to be much faster than equity models, while also opening up vast spaces for game-theoretic design. When done right, they can unlock tremendous opportunities. When these mechanisms truly operate, they can indeed be transformative.

7. Signs of Self-Correction

Despite numerous challenges, the market is showing signs of adjustment:

Top-tier exchanges have become extremely selective. The requirements for token issuance and listing have tightened significantly. Exchanges are strengthening quality control, and the evaluation of new tokens is becoming more rigorous.

Investor protection mechanisms are evolving. Innovations in MetaDAO, DAO ownership of IP rights (referencing governance disputes in Uniswap and Aave), and other governance innovations indicate that the community is actively trying to establish better frameworks.

The market is learning; although slowly and painfully, it is indeed learning.

Recognizing the Cycle Position

The crypto market is highly cyclical, and we are currently at the bottom. We are digesting the negative consequences brought about by the venture capital bull market, hype cycles, over-investment, and misaligned structures from 2021-2022.

But cycles always turn. Two years from now, once the projects from 2021-2022 are fully digested, as new token supply decreases due to funding constraints, and as better standards emerge from trial and error—the market dynamics should significantly improve.

The key question is whether successful projects will return to the token model or permanently shift to equity structures. The answer depends on whether the industry can resolve issues of interest alignment and project selection.

8. Path to Breakthrough

The altcoin market stands at a crossroads. The four-loss dilemma—exchanges, token holders, project teams, and venture capitalists are all losing—has created an unsustainable market condition, but this is not a deadlock.

The next 12 months will be painful, as the last wave of supply from 2021-2022 is about to arrive. However, after the digestion period, three things may drive recovery: better standards formed from painful trial and error, an interest adjustment mechanism acceptable to all parties, and selective token issuance—only issuing tokens when real value is added.

The answer depends on today's choices. Three years from now, when we look back at 2026, it will be similar to how we look back at 2021-2022 today—what are we building?

To learn more about investment news and the movements of the IOSG Ventures portfolio, please click on the next article.

Due to adjustments in the public account push logic, if you enjoy our content, please star the IOSG public account; otherwise, you may not receive the latest article updates.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。