Written by: 0xjacobzhao

In our previous Crypto AI series reports, we have consistently emphasized the viewpoint that the most practically valuable scenarios in the current crypto space are primarily concentrated in stablecoin payments and DeFi, while Agent is the key interface of the AI industry facing users. Therefore, in the trend of the integration of Crypto and AI, the two most valuable paths are: AgentFi, based on existing mature DeFi protocols (basic strategies such as lending, liquidity mining, etc., as well as advanced strategies like Swap, Pendle PT, and funding rate arbitrage) in the short term, and Agent Payment, centered around stablecoin settlement and relying on protocols like ACP/AP2/x402/ERC-8004 in the medium to long term.

Prediction markets have become an industry trend that cannot be ignored by 2025, with annual total trading volume surging from approximately $9 billion in 2024 to over $40 billion in 2025, achieving over 400% year-on-year growth. This significant increase is driven by multiple factors: the uncertainty demand brought by macro-political events (such as the 2024 U.S. elections), the maturity of infrastructure and trading models, and the thawing of the regulatory environment (Kalshi's legal victory and Polymarket's return to the U.S.). Prediction Market Agents are expected to show early forms by early 2026 and may become an emerging product form in the agent field in the coming year.

I. Prediction Markets: From Betting Tools to "Global Truth Layer"

Prediction markets are a financial mechanism for trading around the outcomes of future events, where contract prices essentially reflect the market's collective judgment on the probability of an event occurring. Their effectiveness stems from the combination of collective intelligence and economic incentives: in an environment where anonymous, real-money betting occurs, dispersed information is quickly integrated into price signals weighted by capital willingness, significantly reducing noise and false judgments.

By the end of 2025, prediction markets have basically formed a duopoly dominated by Polymarket and Kalshi. According to Forbes, the total trading volume in 2025 is expected to reach approximately $44 billion, with Polymarket contributing about $21.5 billion and Kalshi around $17.1 billion. Kalshi has achieved rapid expansion due to its previous legal victory in the election contract case, its compliance first-mover advantage in the U.S. sports prediction market, and relatively clear regulatory expectations. Currently, the development paths of the two have shown clear differentiation:

- Polymarket adopts a hybrid CLOB architecture with "off-chain matching and on-chain settlement" and a decentralized settlement mechanism, building a global, non-custodial high-liquidity market, forming a "onshore + offshore" dual-track operational structure after compliance returns to the U.S.;

- Kalshi integrates into the traditional financial system by connecting with mainstream retail brokers through APIs, attracting Wall Street market makers to deeply participate in macro and data-driven contract trading, with products constrained by traditional regulatory processes, leading to relatively lagging long-tail demand and sudden events.

In addition to Polymarket and Kalshi, other competitive participants in the prediction market space mainly develop along two paths:

- One is the compliance distribution path, embedding event contracts into the existing account systems of brokers or large platforms, leveraging channel coverage, clearing capabilities, and institutional trust to establish advantages (e.g., ForecastTrader in collaboration with Interactive Brokers and FanDuel Predicts in collaboration with CME);

- The other is the on-chain performance and capital efficiency path, exemplified by the perpetual contract DEX Drift in the Solana ecosystem, which has added a prediction market module B.E.T (prediction markets) to its existing product line.

These two paths of traditional financial compliance entry and crypto-native performance advantages together form a diverse competitive landscape for the prediction market ecosystem.

On the surface, prediction markets resemble gambling and are essentially a zero-sum game, but the core difference between the two lies not in form but in whether they have positive externalities: by aggregating dispersed information through real-money transactions, they publicly price real events, forming a valuable signal layer. Despite limitations such as entertainment participation, the trend is shifting from gaming to a "global truth layer" — as institutions like CME and Bloomberg get involved, event probabilities have become decision metadata that can be directly invoked by financial and corporate systems, providing more timely and quantifiable market truths.

II. Prediction Agents: Architecture Design, Business Models, and Strategy Analysis

Currently, Prediction Market Agents are entering an early practical stage, where their value lies not in "AI predictions being more accurate," but in amplifying information processing and execution efficiency within prediction markets. Prediction markets are essentially information aggregation mechanisms, where prices reflect collective judgments on event probabilities; real-world market inefficiencies stem from information asymmetry, liquidity, and attention constraints. The reasonable positioning of prediction market agents is Executable Probabilistic Portfolio Management: transforming news, rule texts, and on-chain data into verifiable pricing deviations to execute strategies faster, more disciplined, and at lower costs, while capturing structural opportunities through cross-platform arbitrage and portfolio risk control.

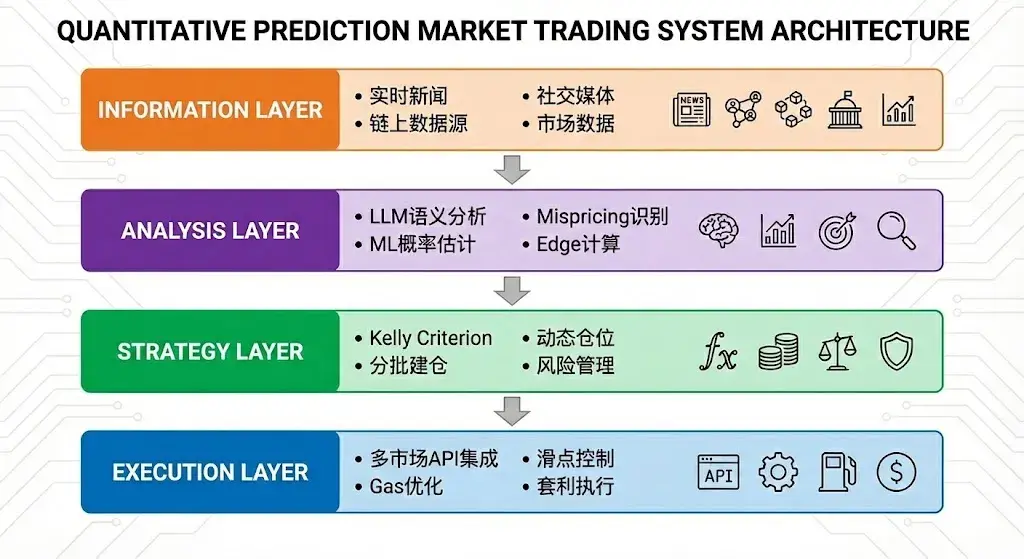

An ideal prediction market agent can be abstracted into a four-layer architecture:

- Information Layer gathers news, social, on-chain, and official data;

- Analysis Layer uses LLM and ML to identify mispricings and calculate Edge;

- Strategy Layer converts Edge into positions through the Kelly formula, batch building, and risk control;

- Execution Layer completes multi-market ordering, slippage and gas optimization, and arbitrage execution, forming an efficient automated closed loop.

The ideal business model design for prediction market agents explores different directions at various levels:

- Bottom Layer Infrastructure provides multi-source real-time data aggregation, Smart Money address databases, a unified prediction market execution engine, and backtesting tools, charging B2B/B2D for stable income unrelated to prediction accuracy;

- Middle Layer Strategy accumulates modular strategy components and community-contributed strategies in an open-source or token-gated manner, forming a combinable strategy ecosystem and achieving value capture;

- Top Layer Agent directly runs live trading through a managed Vault, with the ability to realize transparency on-chain records and 20-30% performance fees (plus a small management fee).

The ideal prediction market agent is closer to an AI-driven probabilistic asset management product, achieving returns through long-term disciplined execution and cross-market mispricing games, rather than relying on single prediction accuracy for profit. The core logic of the diversified income structure design of "infrastructure monetization + ecosystem expansion + performance participation" is that even if Alpha converges as the market matures, underlying capabilities such as execution, risk control, and settlement still hold long-term value, reducing dependence on the single assumption that "AI continuously outperforms the market."

Strategy Analysis of Prediction Market Agents:

Theoretically, agents possess advantages in high-speed, round-the-clock, and de-emotionalized execution, but in prediction markets, they often struggle to translate into sustained Alpha, with effective applications mainly limited to specific structures, such as automated market making, cross-platform mispricing capture, and information integration for long-tail events, which are scarce and constrained by liquidity and capital.

- Market Selection: Not all prediction markets have tradable value; participation value depends on five dimensions: settlement clarity, liquidity quality, information advantage, time structure, and manipulation risk. It is recommended to prioritize the early stages of new markets, long-tail events with few professional players, and temporary pricing windows caused by time zone differences; avoid high-heat political events, subjective settlement markets, and extremely low liquidity varieties.

- Order Strategy: Adopt strict systematic position management. The entry prerequisite is that one's probability judgment is significantly higher than the market's implied probability, and positions are determined based on the scored Kelly formula (usually 1/10–1/4 Kelly), with single event risk exposure not exceeding 15%, to achieve controlled risk, bearable drawdown, and compounding advantages for steady growth in the long term.

- Arbitrage Strategy: Arbitrage in prediction markets mainly manifests in four types: cross-platform price differences (be wary of settlement differences), Dutch Book arbitrage (high certainty but strict liquidity requirements), settlement arbitrage (dependent on execution speed), and related asset hedging (limited by structural mismatches). The key in practice is not to discover price differences but to strictly align contract definitions and settlement standards, avoiding pseudo-arbitrage caused by subtle differences in rules.

- Smart Money Following: On-chain "smart money" signals are not suitable as a primary strategy due to lag, inducement risks, and sample issues. A more reasonable use is as a confidence adjustment factor, assisting in core judgments based on information and pricing deviations.

III. Noya.ai: An Agent Network from Intelligence to Action

As an early exploration of prediction market agents, NOYA's core concept is "Intelligence That Acts." In on-chain markets, mere analysis and insights are insufficient to create value — although dashboards, data analysis, and research tools can help users understand "what might happen," there remains a significant amount of manual operations, cross-chain friction, and execution risks between insights and execution. NOYA is built on this pain point: compressing the complete link of "research → forming judgments → execution → continuous monitoring" in professional investment processes into a unified system, allowing intelligence to be directly transformed into on-chain actions.

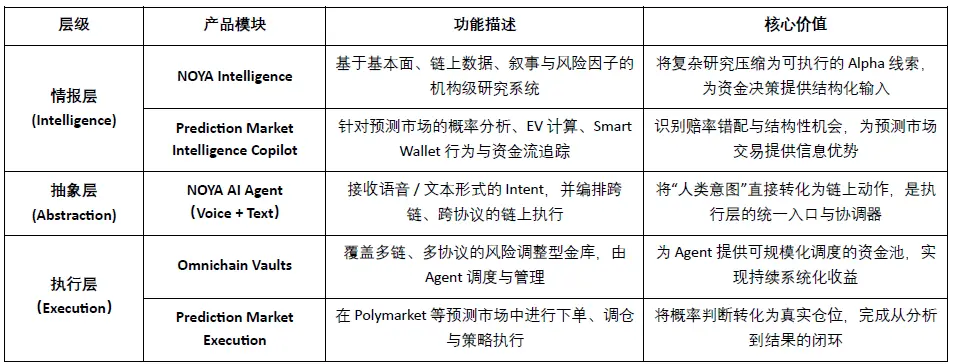

NOYA achieves this goal by integrating three core layers:

- Intelligence Layer: Aggregates market data, token analysis, and prediction market signals.

- Abstraction Layer: Hides complex cross-chain routing, allowing users to simply express intent.

- Execution Layer: AI Agents execute operations across chains and protocols based on user authorization.

In terms of product form, NOYA supports different participation methods for passive income users, active traders, and prediction market participants, and through designs such as Omnichain Execution, AI Agents & Intents, and Vault Abstraction, it modularizes and automates multi-chain liquidity management, complex strategy execution, and risk control.

The overall system forms a continuous closed loop: Intelligence → Intent → Execution → Monitoring, achieving efficient, verifiable, and low-friction transformation from insights to execution while ensuring that users always maintain control over their assets.

IV. Noya.ai's Product System and Evolution Path

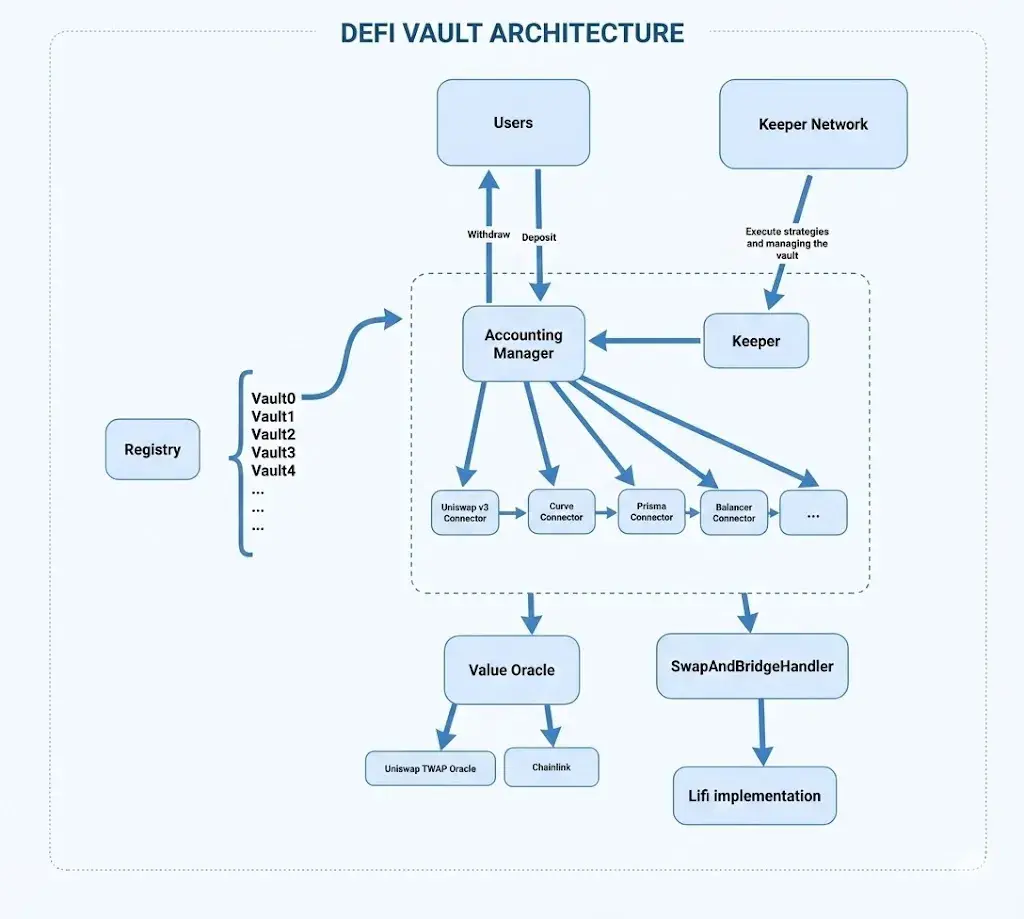

Core Foundation: Noya Omnichain Vaults

Omnivaults are the capital deployment layer of NOYA, providing cross-chain, risk-controlled automated yield strategies. Users can continuously operate their assets across multiple chains and protocols through simple deposit and withdrawal operations, without the need for manual rebalancing or monitoring, with the core goal of achieving stable risk-adjusted returns rather than short-term speculation.

Omnivaults cover strategies such as Standard Yield and Loop, clearly divided by asset and risk levels, and support optional binding incentive mechanisms. At the execution level, the system automatically completes cross-chain routing and optimization, and can introduce ZKML to provide verifiable proof for strategy decisions, enhancing the transparency and credibility of automated asset management. The overall design is centered on modularity and composability, supporting future access to more asset types and strategy forms.

The technical architecture of NOYA Vaults: Each vault is uniformly registered and managed through a Registry, with the AccountingManager responsible for user shares (ERC-20) and net asset pricing; the underlying layer connects to protocols like Aave and Uniswap through modular Connectors and calculates cross-protocol TVL, relying on Value Oracle (Chainlink + Uniswap v3 TWAP) to complete price routing and valuation; trading and cross-chain operations are executed by the Swap Handler (LiFi); finally, strategy execution is triggered by Keeper multi-signature, forming a composable and auditable execution closed loop.

Future Alpha: Prediction Market Agents

The most imaginative module of NOYA: the intelligence layer continuously tracks on-chain capital behavior and off-chain narrative changes, identifying news shocks, sentiment fluctuations, and odds mismatches; when probability deviations are discovered in prediction markets like Polymarket, the execution layer AI Agent can mobilize vault funds for arbitrage and rebalancing with user authorization. At the same time, Token Intelligence and Prediction Market Copilot provide users with structured token and prediction market analysis, directly transforming external information into executable trading decisions.

Prediction Market Intelligence Copilot

NOYA is committed to upgrading prediction markets from single-event betting to systematically manageable probabilistic assets. Its core module integrates diverse data such as market implied probabilities, liquidity structures, historical settlements, and on-chain smart money behavior, using expected value (EV) and scenario analysis to identify pricing deviations, and focuses on tracking position signals from high-win-rate wallets to distinguish information trading from market noise. Based on this, the Copilot supports cross-market and cross-event correlation analysis and transmits real-time signals to the AI Agent, driving automated execution of opening and rebalancing positions, achieving portfolio management and dynamic optimization in prediction markets.

Core strategy mechanisms include:

- Multi-source Edge Information Capture: Integrating real-time odds from Polymarket, polling data, private and external information streams to cross-validate event implied probabilities, systematically mining information advantages that have not been fully priced.

- Cross-market and Cross-event Arbitrage: Constructing probabilistic and structural arbitrage strategies based on pricing differences between different markets, different contract structures, or similar events, capturing odds convergence returns while controlling directional risks.

- Odds-driven Dynamic Position Management: When odds significantly shift due to information, capital, or sentiment changes, the AI Agent automatically adjusts position size and direction, achieving continuous optimization in prediction markets rather than one-time bets.

NOYA Intelligence Token Reports

NOYA's institutional-level research and decision-making hub aims to automate professional crypto investment research processes and directly output decision-level signals that can be used for real asset allocation. This module presents clear investment positions, comprehensive ratings, core logic, key catalysts, and risk warnings in a standardized report structure, continuously updated with real-time market and on-chain data. Unlike traditional research tools, NOYA's intelligence does not stop at static analysis but can be invoked, compared, and questioned in natural language through the AI Agent, and directly delivered to the execution layer, driving subsequent cross-chain trading, capital allocation, and portfolio management, thus forming an integrated closed loop of "research—decision—execution," making Intelligence an active signal source in the automated capital operation system.

NOYA AI Agent (Voice and Natural Language Driven)

The NOYA AI Agent is the execution layer of the platform, with the core role of directly transforming user intent and market intelligence into authorized on-chain actions. Users can express their goals through text or voice, and the Agent is responsible for planning and executing cross-chain, cross-protocol operations, compressing research and execution into a continuous process. It is a key product form for NOYA to lower the operational threshold for DeFi and prediction markets.

Users do not need to understand the underlying links, protocols, or trading paths; they only need to express their goals in natural language or voice to trigger the AI Agent to automatically plan and execute multi-step on-chain operations, achieving "intent equals execution." Under the premise of user signatures and non-custodial operations, the Agent operates in a closed loop of "intent understanding → action planning → user confirmation → on-chain execution → result monitoring," not replacing decision-making but efficiently executing, significantly reducing the friction and threshold of complex financial operations.

Trust Moat: ZKML Verifiable Execution

Verifiable execution aims to build a fully verifiable closed loop for strategy, decision-making, and execution. NOYA introduces ZKML as a key mechanism to reduce trust assumptions: strategies are computed off-chain and generate verifiable proofs, which can only trigger corresponding capital operations after on-chain verification. This mechanism provides credibility for strategy outputs without disclosing model details and supports derivative capabilities such as verifiable backtesting. Currently, the relevant modules are still marked as "in development" in public documents, and engineering details await further disclosure and verification.

Future 6-Month Product Roadmap

- Advanced Order Capabilities for Prediction Markets: Enhancing strategy expression and execution accuracy to support agent-based trading.

- Expansion to Multiple Prediction Markets: Integrating more platforms beyond Polymarket to expand event coverage and liquidity.

- Multi-source Edge Information Collection: Cross-validating with market odds to systematically capture underpriced probability deviations.

- Clearer Token Signals and Advanced Reports: Outputting trading signals and in-depth on-chain analysis that can directly drive execution.

- More Advanced On-chain DeFi Strategy Combinations: Launching complex strategy structures to enhance capital efficiency, returns, and scalability.

V. Noya.ai's Ecosystem Growth and Incentive System

Currently, Omnichain Vaults are in the early stages of ecosystem development, with their cross-chain execution and multi-strategy framework already validated.

- Strategies and Coverage: The platform has integrated mainstream DeFi protocols such as Aave and Morpho, supporting cross-chain allocation of stablecoins, ETH, and their derivative assets, and has initially constructed layered risk strategies (e.g., basic yield vs. Loop strategies).

- Development Stage: The current TVL is limited, with the core goal being functional validation (MVP) and refinement of the risk control framework, with a strong composability in architectural design, reserving interfaces for the subsequent introduction of complex assets and advanced agent scheduling.

Incentive System: Kaito Interaction and Space Race Dual Drive

NOYA has built a set of mechanisms anchored in "real contributions," deeply binding content narratives with the growth flywheel of liquidity.

- Ecosystem Collaboration (Kaito Yaps): NOYA lands on Kaito Leaderboards with a composite narrative of "AI × DeFi × Agent," configuring a non-locked incentive pool of 5% of total supply, with an additional 1% reserved for the Kaito ecosystem. Its mechanism deeply binds content creation (Yaps) with Vault deposits and Bond locking, converting users' weekly contributions into Stars that determine levels and multipliers, thereby synchronously reinforcing narrative consensus and long-term capital stickiness at the incentive level.

- Growth Engine (Space Race): Space Race constitutes NOYA's core growth flywheel, using Stars as long-term equity certificates to replace the traditional "capital scale priority" airdrop model. This mechanism integrates Bond locking bonuses, a two-way 10% referral incentive, and content dissemination into a weekly Points system, selecting highly engaged and consensus-driven long-term users, continuously optimizing community structure and token distribution.

- Community Building (Ambassador): NOYA adopts an invitation-based ambassador program, providing qualified participants with community round participation qualifications and performance rebates based on actual contributions (up to 10%).

Currently, Noya.ai has accumulated over 3,000 on-chain users, with X platform followers exceeding 41,000, ranking in the top five on the Kaito Mindshare leaderboard. This indicates that NOYA has secured a favorable attention ecological niche in the prediction market and agent track.

Additionally, Noya.ai's core contracts have undergone dual audits by Code4rena and Hacken, and have integrated Hacken Extractor.

VI. Token Economic Model Design and Governance

NOYA adopts a single-token ecosystem model, using $NOYA as the sole value carrier and governance vehicle.

NOYA employs a buyback and burn value capture mechanism, where the value generated at the protocol layer through products like AI Agents, Omnivaults, and prediction markets is realized through mechanisms such as staking, governance, access rights, and buyback and burn, forming a closed loop of usage → charging → buyback value, converting platform usage into long-term token value.

The project is based on the core principle of Fair Launch, without introducing angel rounds or VC investments, but instead completing distribution through a publicly valued community round (Launch-Raise) at a low valuation ($10M FDV), Space Race, and airdrops, deliberately reserving asymmetric upside potential for the community, making the chip structure more favorable to active users and long-term participants; team incentives mainly come from long-term locked token shares.

Token Distribution

Total Supply: 1 billion (1,000,000,000) NOYA

Initial Circulation (Low Float): Approximately 10%

Valuation and Financing (The Raise): Amount Raised: $1 million; Valuation (FDV): $10 million

VII. Competitive Analysis of Prediction Market Agents

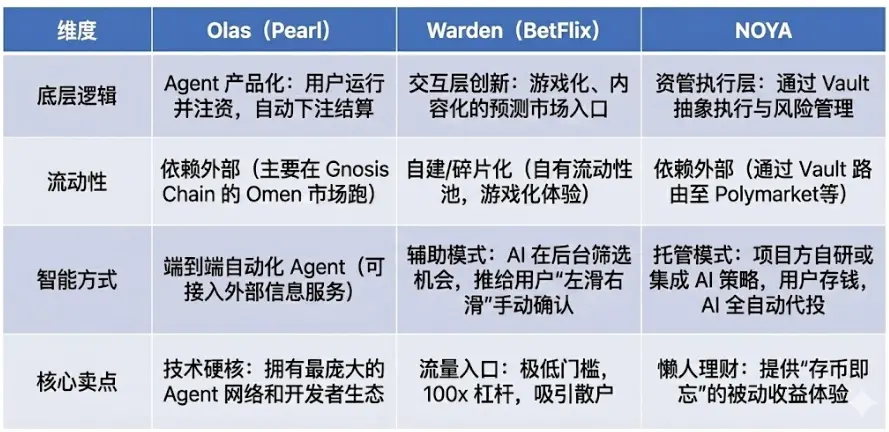

Currently, the Prediction Market Agent track is still in its early stages, with a limited number of projects, among which the more representative include Olas (Pearl Prediction Agents), Warden (BetFlix), and Noya.ai.

From the perspective of product form and user participation methods, they represent three paths currently in the prediction market agent track:

- 1) Olas (Pearl Prediction Agents): Agent productization and operational delivery, with participation through "running an automated prediction Agent," encapsulating prediction market trading into a runnable Agent: users deposit and run, and the system automatically completes information acquisition, probability judgment, betting, and settlement. The need for additional installation makes this participation method relatively less user-friendly for ordinary users.

- 2) Warden (BetFlix): An interactive distribution and consumer-grade platform that attracts user participation through low barriers and strong entertainment value, adopting an interactive and distribution-oriented path to lower participation costs through gamification and content-driven front ends, emphasizing the consumption and entertainment attributes of prediction markets. Its competitive advantage mainly comes from user growth and distribution efficiency, rather than depth in strategy or execution.

- 3) NOYA.ai: Centered on "fund custody + strategy execution," it abstracts prediction market and DeFi execution into asset management products through Vaults, providing a low-operation, low-mental-burden participation method. If the Prediction Market Intelligence and Agent execution modules are added later, it is expected to form an integrated workflow of "research—execution—monitoring."

Compared to AgentFi projects like Giza and Almanak that have achieved clear product delivery, NOYA's DeFi Agent is still in a relatively early stage. However, NOYA's differentiation lies in its positioning and entry level: it enters the same execution and asset management narrative track with a fair launch valuation of approximately $10M FDV, possessing significant valuation discount and growth potential at this stage.

- NOYA: An asset management encapsulated AgentFi project centered on Omnichain Vaults, currently focusing on foundational infrastructure such as cross-chain execution and risk control, while the upper-level Agent execution, prediction market capabilities, and ZKML-related mechanisms are still in development and validation stages.

- Giza: Can directly run asset management strategies (ARMA, Pulse), currently has the highest completion of AgentFi products.

- Almanak: Positioned as AI Quant for DeFi, outputs strategies and risk signals through models and quantitative frameworks, mainly targeting professional capital and strategy management needs, emphasizing the systematic nature of methodology and reproducibility of results.

- Theoriq: A strategy and execution framework centered on multi-agent collaboration (Agent Swarms), emphasizing a scalable Agent collaboration system and mid-to-long-term infrastructure narrative, leaning more towards foundational capability building.

- Infinit: An execution-layer Agentic DeFi terminal that significantly reduces the execution threshold for complex DeFi operations through the process orchestration of "intent → multi-step on-chain operations," making users' perception of product value relatively direct.

VIII. Conclusion: Business Logic, Engineering Implementation, and Potential Risks

Business Logic:

NOYA is a relatively rare subject in the current market, combining AI Agent × Prediction Market × ZKML multiple narratives, further integrating the product direction of Intent-driven execution. In terms of asset pricing, it starts with an approximate $10M FDV, significantly lower than the common valuation range of $75M–$100M for similar AI / DeFAI / Prediction-related projects, forming a certain structural price difference.

From a design perspective, NOYA attempts to unify strategy execution (Vault / Agent) and information advantage (Prediction Market Intelligence) into the same execution framework, establishing a value capture closed loop through protocol revenue return (fees → buyback & burn). Although the project is still in its early stages, the combined effect of multiple narratives and a low valuation starting point makes its risk-reward structure closer to a high-odds, asymmetric game subject.

Engineering Implementation: In terms of verifiable delivery, NOYA's currently launched core functionality is Omnichain Vaults, providing cross-chain asset scheduling, yield strategy execution, and delayed settlement mechanisms, with relatively basic engineering implementation. The emphasized Prediction Market Intelligence (Copilot), NOYA AI Agent, and ZKML driven verifiable execution are still in development stages and have not yet formed a complete closed loop on the mainnet. At this stage, it is not a mature DeFAI platform.

Potential Risks and Points of Concern

- Delivery Uncertainty: The technical span from "basic Vault" to "fully functional Agent" is vast, and there is a need to be cautious of risks such as roadmap delays or ZKML implementation falling short of expectations.

- Potential System Risks: Including contract security, cross-chain bridge failures, and the unique oracle disputes of prediction markets (such as ambiguous rules leading to inability to adjudicate), any single point of failure could result in capital loss.

Disclaimer: This article utilized AI tools such as ChatGPT-5.2, Gemini 3, and Claude Opus 4.5 during its creation. The author has made efforts to proofread and ensure the information is true and accurate, but some omissions may still exist. It should be noted that the cryptocurrency asset market generally experiences a divergence between project fundamentals and secondary market price performance. The content of this article is for information integration and academic/research exchange only, does not constitute any investment advice, and should not be viewed as a recommendation for buying or selling any tokens.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。