Institutional entry, old rules no longer apply.

Author: Bruceai

Translation: Baihua Blockchain

I analyzed the outlook predictions for 2026 from the "Big Eight" in the crypto industry: @a16zcrypto, @Fidelity, @galaxyhq, @BitwiseInvest, @coinbase, @MessariCrypto, @Grayscale, and @21shares.

What is the conclusion? We are entering a "new paradigm." Here are the market opinions and core alpha.

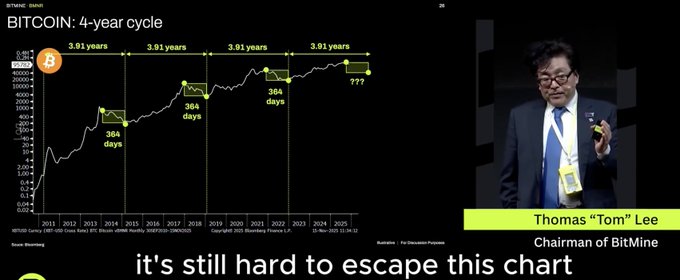

Opinion 1: The End of the Cycle

21Shares roars: "The four-year cycle of Bitcoin is broken!" Fidelity, Bitwise, and Grayscale indicate in between: Halving is no longer the core driving force.

Fidelity: We are shifting towards a "mainstream cycle" driven by sovereign nations and institutional adoption.

Bitwise: 2026 will break the historical trend of "post-halving crashes."

Key Point: Do not time 2026 based on experiences from 2017 or 2021; the market structure has changed.

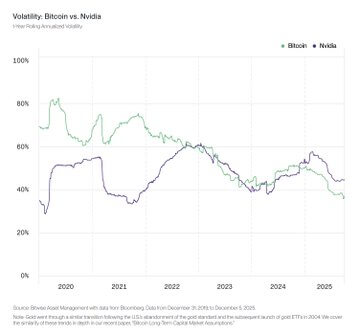

Volatility Reversal (Bitwise's Power Prediction)

Bitwise made a stunning prediction: by 2026, Bitcoin's volatility will be lower than Nvidia ($NVDA).

Bitcoin is graduating from a "risk-on tech asset" to a "monetary asset." Meanwhile, Fidelity believes Bitcoin is now the only hedge against fiat currency devaluation. Bitcoin is becoming the new safe haven.

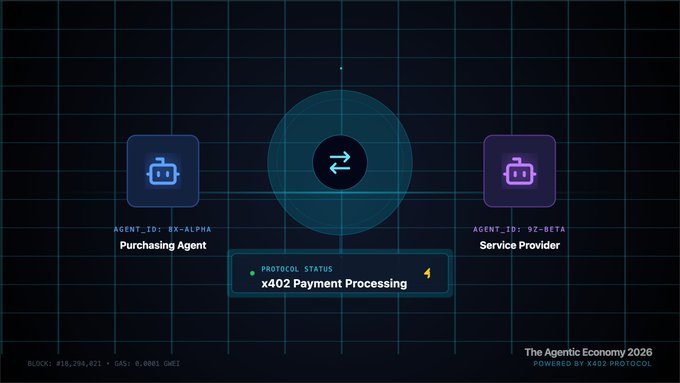

Consensus 2: Agency Economy (AI x Crypto)

This is the biggest technological breakthrough supported by a16z and Coinbase.

Coinbase: Unveiled the "x402" protocol and Google's "AP2" (Agent Payment Protocol).

Transformation: AI agents will directly purchase GPUs/data through on-chain payments, consuming banks.

a16z: "Agents are the new power users."

By 2026, robots will start splurging real money on-chain.

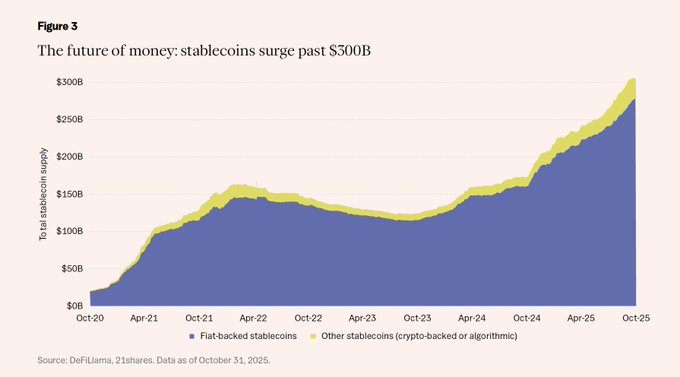

Consensus III: Stablecoins Will Dominate the World

21Shares: The market cap of stablecoins will reach $1 trillion.

Galaxy: Trading volume will exceed the ACH settlement network.

a16z: Stablecoins will become the "fundamental settlement layer" of the internet.

If you do not hold stablecoin infrastructure or PayFi protocols, you are missing out on the largest Total Addressable Market (TAM) in the cryptocurrency space.

Consensus IV: ETP Squeeze

21Shares: The assets under management (AUM) of global cryptocurrency ETPs (Exchange-Traded Products) will exceed $400 billion (enough to rival QQQ).

Bitwise: Institutional demand will absorb more than 100% of the new supply of Bitcoin, Ethereum, and Solana.

Increased Prediction: Bitwise predicts that 50% of Ivy League funds will enter the market.

The existing token supply fundamentally suppresses this demand.

Core Alpha (Closing Point): L2 Massacre

21Shares dropped a bombshell: "Most Ethereum L2s will not survive to 2026."

Liquidity is concentrated in the top three (Base, Arb, Sol). The rest will turn into "zombie chains." Galaxy's "Fat Application Theory": Value capture is shifting from infrastructure (L1) to applications.

Strategy: Stop buying hollow infrastructure projects, buy income-generating applications.

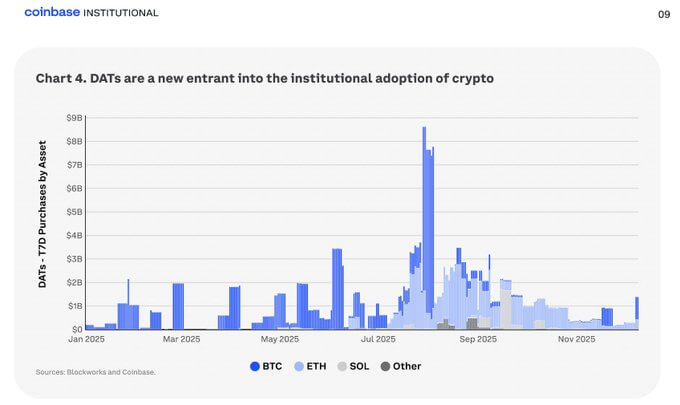

Reverse Investment Game: DAT Debate

There is a gradient regarding Digital Asset Treasury (DATs):

Bullish Side (21Shares): Predicts that as companies modify MicroStrategy, the scale of DATs will exceed $250 billion.

Bearish Side (Grayscale): Calls DAT a "red herring (false proposition)," believing its market-driving effect is far less than that of sovereign nation adoption.

Who is right? The market will provide the answer in 2026.

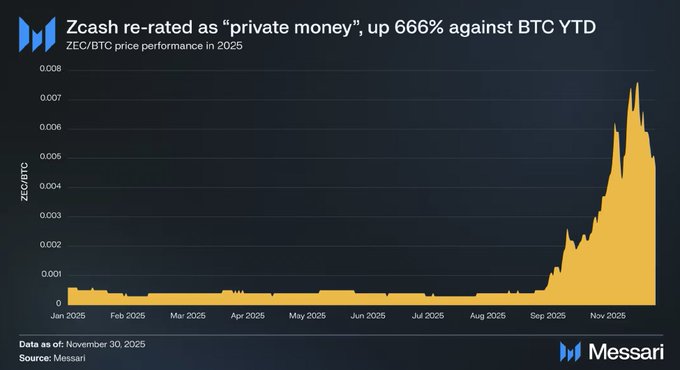

Dark Horse: The Return of Privacy Coins

While everyone is focused on AI, Messari is betting on @Zcash ($ZEC).

Argument: As regulations tighten and CBDCs (Central Bank Digital Currencies) approach, privacy coins will be repriced as "privacy as a service."

a16z adds: "Privacy is the moat for institutional adoption."

This is the ultimate non-consensus trade.

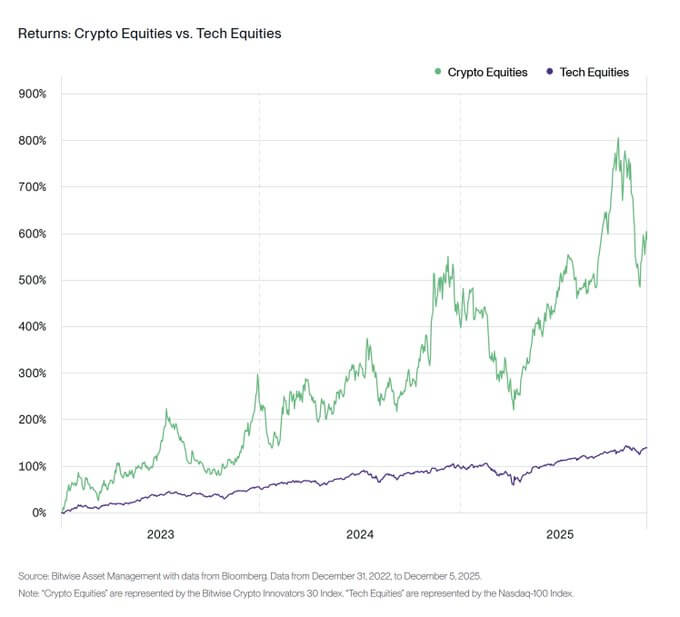

Crypto Stocks > Tech Stocks

Bitwise predicts: Crypto stocks (mining companies, Coinbase, Galaxy) will outperform the "Tech Seven."

They are a leveraged investment in the underlying assets, without the decay of futures contracts. If you can't buy coins directly, buy the companies building these rails.

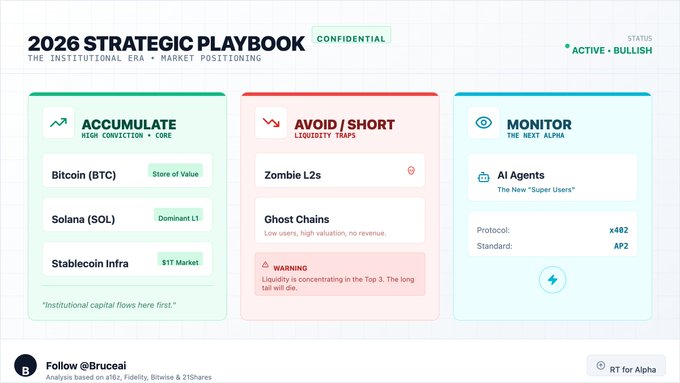

Summary: How to Position

The "simple model" is over; 2026 is the battlefield for professional players.

Go long leaders (BTC/SOL/stablecoins).

Short zombie L2s.

Focus on AI agents (x402/AP2 protocol).

If you find this article valuable, please retweet the first tweet and follow @Bruceai for more Alpha.

Article link: https://www.hellobtc.com/kp/du/12/6179.html

Source: https://x.com/Bruceai/status/2004552536540447224

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。